Key Insights

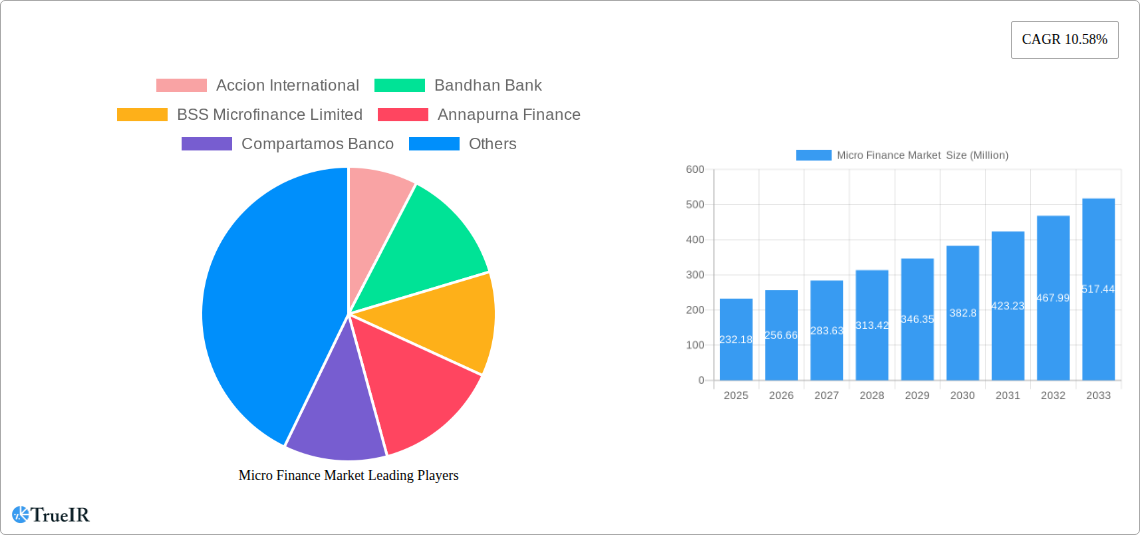

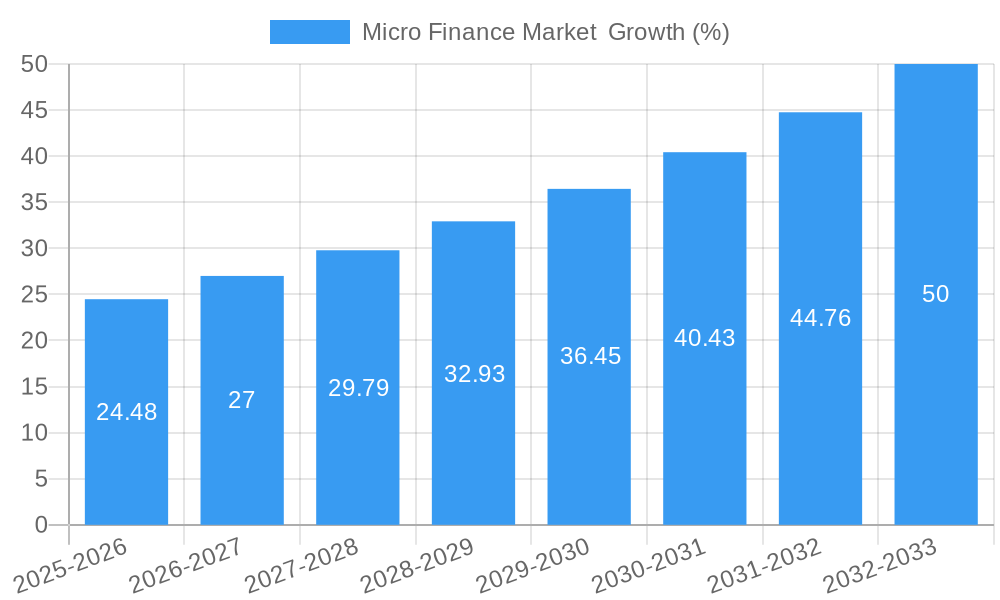

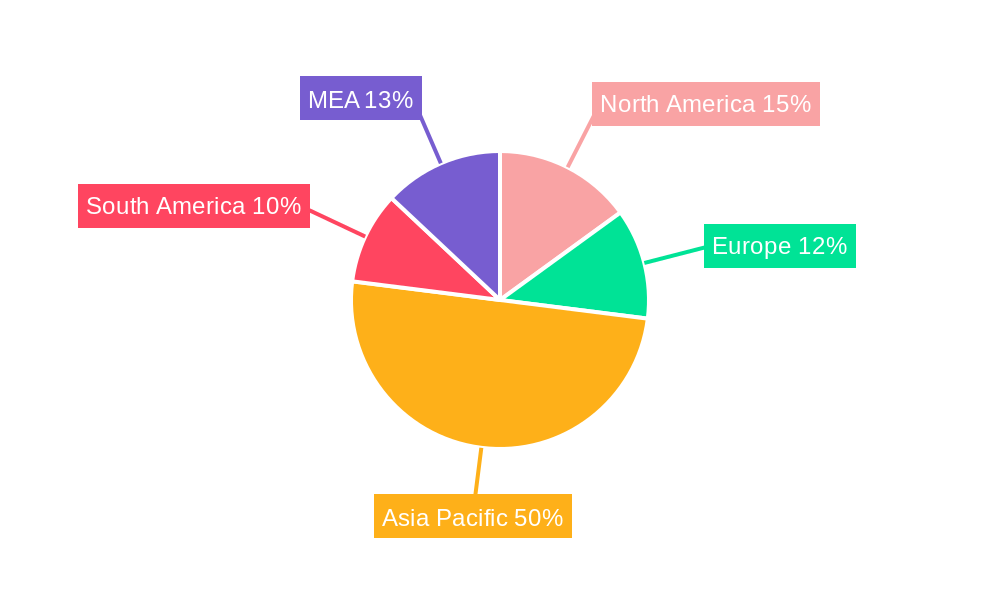

The global microfinance market, valued at $232.18 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.58% from 2025 to 2033. This expansion is driven by several key factors. Increasing financial inclusion initiatives by governments and NGOs in developing economies are creating a larger pool of potential borrowers. Furthermore, the rising number of micro, small, and medium-sized enterprises (MSMEs) seeking access to credit fuels demand for microfinance services. Technological advancements, such as mobile banking and digital lending platforms, are streamlining loan disbursement and collection processes, boosting market efficiency and reach. The diversification of microfinance products beyond traditional lending, including savings accounts and insurance products, also contributes to market growth. However, challenges remain, including high operational costs in reaching remote populations, concerns about over-indebtedness among borrowers, and regulatory hurdles in some regions. The market segmentation, encompassing various financial institutions (banks, MFIs, NBFCs) serving diverse end-users (small enterprises, solo and micro-entrepreneurs), presents opportunities for specialized service providers to cater to specific niches. Regional variations in market penetration and regulatory environments will significantly influence future growth patterns, with Asia-Pacific and South America expected to be significant growth drivers due to high population density and evolving entrepreneurial landscapes.

The competitive landscape is characterized by a mix of established players and emerging fintech companies. Large international organizations like Accion International and Grameen Bank operate alongside regional microfinance institutions and local banks. The increasing adoption of technology and innovative financial products will likely reshape the competitive dynamics, favoring players adept at leveraging digital technologies and data analytics to improve risk management and customer service. The market's future trajectory will depend on effective regulation that balances financial inclusion goals with responsible lending practices, sustained economic growth in developing regions, and the continued innovation of financial products tailored to the specific needs of micro-entrepreneurs and SMEs. Stringent risk management and robust client protection frameworks will be crucial to ensuring the long-term sustainability and social impact of the microfinance sector.

Microfinance Market Report: 2019-2033 - A Comprehensive Analysis

This dynamic report provides a detailed analysis of the global microfinance market, offering invaluable insights for investors, industry players, and researchers. Covering the period 2019-2033, with a focus on 2025, this study examines market size, growth drivers, challenges, competitive landscape, and future outlook. The report utilizes high-volume keywords to maximize search engine optimization, ensuring accessibility to a wide audience. Key players such as Accion International, Bandhan Bank, and Grameen Bank are analyzed, alongside emerging trends and opportunities within this vital sector. The market is expected to reach xx Million by 2033.

Micro Finance Market Market Structure & Competitive Landscape

The microfinance market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller MFIs and NBFCs compete within specific geographic regions or niche segments. The market’s competitive intensity is driven by factors such as varying interest rates, product innovation (e.g., mobile-based lending platforms), and customer service levels. Regulatory changes significantly impact market dynamics, with compliance costs and licensing requirements affecting profitability and entry barriers. Product substitutes, such as informal lending circles and pawn shops, exist but often lack the scale, transparency, and regulatory oversight of formal microfinance institutions.

The end-user segmentation is crucial: small enterprises, solo entrepreneurs, and micro-entrepreneurs each have unique financial needs and risk profiles. Mergers and acquisitions (M&A) activity in the microfinance sector has been steady, primarily driven by consolidation among regional players aiming for greater market reach and operational efficiency. The estimated M&A volume for the period 2019-2024 was xx Million, with an anticipated increase in the forecast period (2025-2033) to xx Million driven by larger organizations seeking to expand market share. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was xx, indicating a moderately concentrated market.

Micro Finance Market Market Trends & Opportunities

The global microfinance market is experiencing robust growth, driven by several key trends. The market size reached xx Million in 2024 and is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by increasing financial inclusion initiatives, rising entrepreneurship among low-income populations, and the expanding adoption of fintech solutions that facilitate access to credit for underserved communities.

Technological advancements, such as mobile money and digital lending platforms, are revolutionizing the industry, reducing transaction costs, expanding reach, and improving efficiency. Consumer preferences are shifting towards greater transparency, convenience, and personalized financial services. The competitive landscape is characterized by both established players and new entrants vying for market share, leading to increased product innovation and improved service offerings. Market penetration rates vary significantly across regions, with higher penetration observed in areas with strong regulatory support and advanced digital infrastructure.

Dominant Markets & Segments in Micro Finance Market

While precise market share data for each segment is proprietary, the following are observations:

Leading Region/Country: India currently holds a significant share of the global microfinance market, followed by other regions in Asia and parts of Africa. Its large population of underserved individuals and government support contributes to its dominance.

Dominant Segment (By Type): MFIs (Microfinance Institutions) typically comprise the largest segment due to their historical dominance and widespread network. However, NBFCs (Non-Banking Financial Companies) are demonstrating significant growth, leveraging technological advancements to reach a broader customer base. Banks are also increasingly involved in providing microfinance products, leveraging their existing infrastructure.

Dominant Segment (By End-User): Solo entrepreneurs and micro-entrepreneurs constitute the largest portion of the end-user market owing to the substantial need for capital in those sectors. However, small enterprises also represent a considerable market segment, with larger financing needs for expansion and growth.

Key Growth Drivers:

Supportive Government Policies: Government initiatives focused on financial inclusion are a significant catalyst for growth. Examples include subsidies, loan guarantees, and regulatory frameworks that encourage responsible lending practices.

Infrastructure Development: Improvements in digital infrastructure, particularly mobile network penetration and internet access, are crucial for expanding the reach of microfinance services to remote areas.

Financial Literacy Programs: Increased awareness of financial products and responsible borrowing practices among target populations significantly enhances market penetration.

Micro Finance Market Product Analysis

Product innovation is a key aspect of the microfinance market. Mobile-based lending platforms, digital savings accounts, and insurance products tailored to micro-entrepreneurs' needs are transforming the industry. These products often come with value-added services like financial literacy training and business development support. Competitive advantages are derived from superior technology, customer service, strong risk management practices, and innovative product offerings catering to the specific requirements of various end-user segments.

Key Drivers, Barriers & Challenges in Micro Finance Market

Key Drivers:

The market is driven by the growing need for financial services among underserved populations, increasing adoption of digital technologies, and supportive government policies promoting financial inclusion. Economic growth in emerging markets also fuels demand for microfinance products.

Key Challenges and Restraints:

The microfinance industry faces challenges such as high operational costs in reaching remote areas, stringent regulatory requirements, and risks associated with loan defaults. Competition from informal lenders and the need for effective risk mitigation strategies also pose significant hurdles. The impact of loan defaults on the market’s profitability is estimated to be xx Million annually.

Growth Drivers in the Micro Finance Market Market

The expansion of mobile technology, government-led financial inclusion initiatives, and the burgeoning number of micro and small businesses globally are key drivers of growth in the microfinance market. Furthermore, the development of innovative financial products tailored to the unique needs of this market segment further supports this expansion.

Challenges Impacting Micro Finance Market Growth

Regulatory complexities, coupled with operational challenges in reaching remote and underserved populations, create hurdles for growth. Additionally, managing loan defaults and combating competition from informal lending sources are significant concerns for the sector.

Key Players Shaping the Micro Finance Market Market

- Accion International

- Bandhan Bank

- BSS Microfinance Limited

- Annapurna Finance

- Compartamos Banco

- Grameen Bank

- CreditAccess Grameen Limited

- Kiva

- ASA International

- Asirvad Microfinance Limited

Significant Micro Finance Market Industry Milestones

- November 2023: The microfinance industry in India expanded its outreach by including 80,000 additional female clients, bringing the total to 6.64 crore low-income women clients across 729 districts.

- September 2023: Almun Microfinance Foundation secured a EGP 120 million (USD 4.84 million) loan agreement with First Abu Dhabi Bank, Egypt, to broaden financial offerings to more women-owned microenterprises.

Future Outlook for Micro Finance Market Market

The future of the microfinance market is bright, driven by the continued expansion of digital technologies, increasing financial inclusion efforts, and the growing demand for financial services among underserved populations. Strategic partnerships between microfinance institutions and fintech companies will play a crucial role in shaping the industry's future trajectory. The market is poised for significant growth, particularly in underserved regions with expanding mobile network coverage and supportive government policies.

Micro Finance Market Segmentation

-

1. Type

- 1.1. Banks

- 1.2. Micro Finance Institute (MFI)

- 1.3. NBFC (Non-Banking Financial Institutions)

-

2. End-User

- 2.1. Small Enterprises

- 2.2. Solo Entrepreneurs

- 2.3. Micro Entrepreneurs

Micro Finance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Micro Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Advanced Technology in the Micro Finance Sector in Developing Countries; Funding Needs from Small and Medium-Sized Enterprises Boosts Market Growth

- 3.3. Market Restrains

- 3.3.1. Legislation and Regulatory Compliance Impedes Market Growth; Lack of Knowledge About Financial Services Within the Economy

- 3.4. Market Trends

- 3.4.1. Growing Importance of Digitalization for Traditional Microfinance Institutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Banks

- 5.1.2. Micro Finance Institute (MFI)

- 5.1.3. NBFC (Non-Banking Financial Institutions)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Small Enterprises

- 5.2.2. Solo Entrepreneurs

- 5.2.3. Micro Entrepreneurs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Banks

- 6.1.2. Micro Finance Institute (MFI)

- 6.1.3. NBFC (Non-Banking Financial Institutions)

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Small Enterprises

- 6.2.2. Solo Entrepreneurs

- 6.2.3. Micro Entrepreneurs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Banks

- 7.1.2. Micro Finance Institute (MFI)

- 7.1.3. NBFC (Non-Banking Financial Institutions)

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Small Enterprises

- 7.2.2. Solo Entrepreneurs

- 7.2.3. Micro Entrepreneurs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Banks

- 8.1.2. Micro Finance Institute (MFI)

- 8.1.3. NBFC (Non-Banking Financial Institutions)

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Small Enterprises

- 8.2.2. Solo Entrepreneurs

- 8.2.3. Micro Entrepreneurs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Banks

- 9.1.2. Micro Finance Institute (MFI)

- 9.1.3. NBFC (Non-Banking Financial Institutions)

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Small Enterprises

- 9.2.2. Solo Entrepreneurs

- 9.2.3. Micro Entrepreneurs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Banks

- 10.1.2. Micro Finance Institute (MFI)

- 10.1.3. NBFC (Non-Banking Financial Institutions)

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Small Enterprises

- 10.2.2. Solo Entrepreneurs

- 10.2.3. Micro Entrepreneurs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Micro Finance Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Accion International

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Bandhan Bank

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 BSS Microfinance Limited

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Annapurna Finance

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Compartamos Banco

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Grameen Bank

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 CreditAccess Grameen Limited

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Kiva

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 ASA International**List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Asirvad Microfinance Limited

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Accion International

List of Figures

- Figure 1: Global Micro Finance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Micro Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Micro Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Micro Finance Market Revenue (Million), by End-User 2024 & 2032

- Figure 17: North America Micro Finance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 18: North America Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Micro Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Micro Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Micro Finance Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe Micro Finance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Micro Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Micro Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Micro Finance Market Revenue (Million), by End-User 2024 & 2032

- Figure 29: Asia Pacific Micro Finance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 30: Asia Pacific Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East and Africa Micro Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East and Africa Micro Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East and Africa Micro Finance Market Revenue (Million), by End-User 2024 & 2032

- Figure 35: Middle East and Africa Micro Finance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 36: Middle East and Africa Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa Micro Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: South America Micro Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 39: South America Micro Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: South America Micro Finance Market Revenue (Million), by End-User 2024 & 2032

- Figure 41: South America Micro Finance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: South America Micro Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 43: South America Micro Finance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Micro Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Micro Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Micro Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 52: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 55: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 58: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 61: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Micro Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Micro Finance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 64: Global Micro Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Finance Market ?

The projected CAGR is approximately 10.58%.

2. Which companies are prominent players in the Micro Finance Market ?

Key companies in the market include Accion International, Bandhan Bank, BSS Microfinance Limited, Annapurna Finance, Compartamos Banco, Grameen Bank, CreditAccess Grameen Limited, Kiva, ASA International**List Not Exhaustive, Asirvad Microfinance Limited.

3. What are the main segments of the Micro Finance Market ?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 232.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Advanced Technology in the Micro Finance Sector in Developing Countries; Funding Needs from Small and Medium-Sized Enterprises Boosts Market Growth.

6. What are the notable trends driving market growth?

Growing Importance of Digitalization for Traditional Microfinance Institutions.

7. Are there any restraints impacting market growth?

Legislation and Regulatory Compliance Impedes Market Growth; Lack of Knowledge About Financial Services Within the Economy.

8. Can you provide examples of recent developments in the market?

November 2023 - In 2022-23, the microfinance industry in India increased its outreach by incorporating 80,000 more female clients, resulting in a total of 6.64 crore low-income women clients spread across 729 districts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Finance Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Finance Market ?

To stay informed about further developments, trends, and reports in the Micro Finance Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence