Key Insights

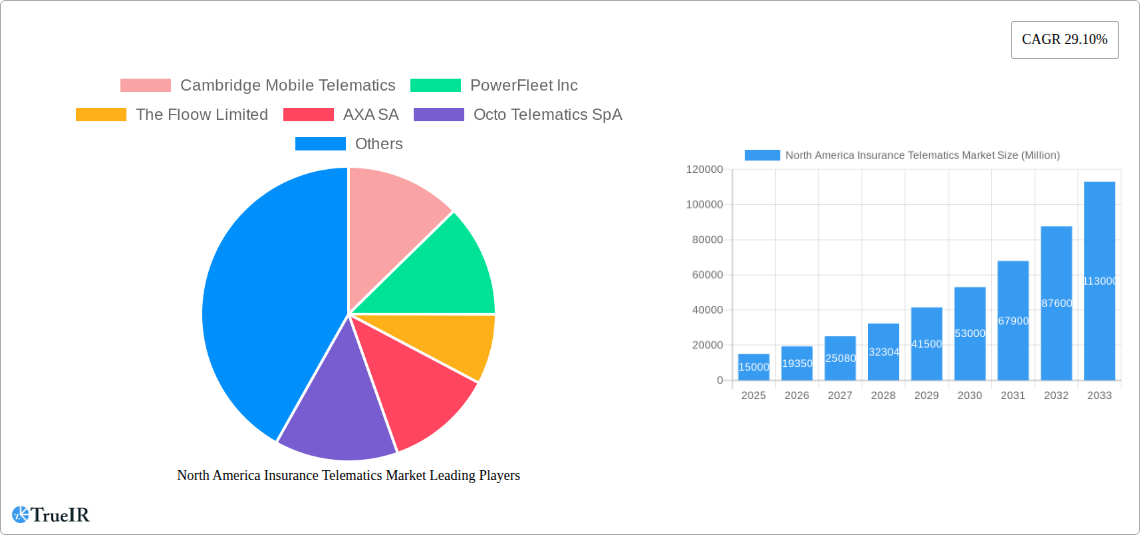

The North American insurance telematics market is experiencing robust growth, driven by the increasing adoption of connected car technologies and a rising demand for usage-based insurance (UBI) programs. The market's Compound Annual Growth Rate (CAGR) of 29.10% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several factors, including the increasing affordability of telematics devices, improved data analytics capabilities leading to more accurate risk assessments, and a growing consumer awareness of the potential cost savings associated with UBI. Major players like Cambridge Mobile Telematics, PowerFleet Inc., and Octo Telematics are actively contributing to market expansion through innovative product offerings and strategic partnerships with insurance providers. The market segmentation by country (United States and Canada) reflects the higher concentration of telematics adoption in these regions, driven by advanced infrastructure and a receptive regulatory environment. Furthermore, the increasing integration of telematics data with other data sources, such as driver behavior analytics and claims data, is leading to the development of more sophisticated risk models, further propelling market growth.

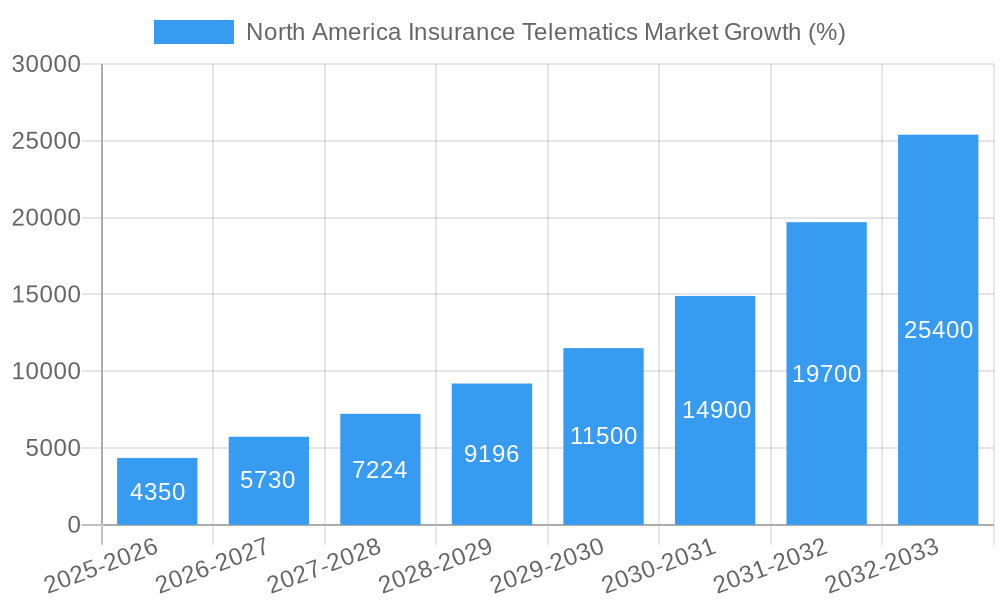

Looking ahead, the forecast period (2025-2033) promises continued expansion, albeit potentially at a slightly moderated pace. The market is expected to mature, with increased competition among established players and the emergence of new entrants. However, ongoing technological advancements, including the integration of artificial intelligence and machine learning in risk assessment and fraud detection, will continue to stimulate market growth. The expansion of UBI programs into new market segments, such as commercial fleets and motorcycle insurance, presents substantial growth opportunities. Government regulations promoting road safety and the adoption of connected car technologies will also play a pivotal role in shaping the future of the North American insurance telematics market. While challenges exist, such as data privacy concerns and the need for robust cybersecurity measures, the overall outlook remains positive for sustained expansion throughout the forecast period.

This comprehensive report provides an in-depth analysis of the North America insurance telematics market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, competitive landscapes, growth drivers, and future trends, equipping stakeholders with the knowledge needed to navigate this rapidly evolving sector. The report leverages extensive data analysis and incorporates recent industry developments to offer a robust and actionable forecast. The market is projected to reach xx Million by 2033.

North America Insurance Telematics Market Structure & Competitive Landscape

The North American insurance telematics market exhibits a moderately concentrated structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 was estimated at xx, indicating a moderately competitive landscape. Innovation is a crucial driver, with companies continuously developing advanced features such as driver behavior analysis, predictive modeling, and integration with connected car ecosystems. Regulatory frameworks, including data privacy regulations and insurance guidelines, significantly impact market operations. Product substitutes, such as traditional insurance models, pose a competitive threat, albeit decreasingly so as the advantages of telematics become more widely recognized.

The market is segmented by end-user, including personal vehicle insurance, commercial vehicle insurance, and fleet management. M&A activity has been relatively robust in recent years, with xx major mergers and acquisitions recorded between 2019 and 2024. This consolidation reflects the strategic importance of telematics technology and the drive for scale within the industry.

- Market Concentration: HHI (2024): xx

- Key Innovation Drivers: Advanced analytics, AI, IoT integration.

- Regulatory Impacts: Data privacy (e.g., CCPA, GDPR implications), insurance regulations.

- Product Substitutes: Traditional insurance models.

- End-User Segmentation: Personal vehicles, commercial vehicles, fleet management.

- M&A Trends: xx major M&A deals (2019-2024).

North America Insurance Telematics Market Trends & Opportunities

The North American insurance telematics market is experiencing significant growth, driven by several key trends. The market size, which stood at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by increasing consumer adoption of connected car technology, the growing popularity of usage-based insurance (UBI) programs, and the continuous development of sophisticated telematics solutions. Market penetration rates, currently at approximately xx%, are expected to rise steadily to xx% by 2033, reflecting the expanding reach of telematics-based insurance offerings.

Technological advancements, such as the adoption of AI and machine learning for risk assessment and fraud detection, further propel market growth. Shifting consumer preferences towards personalized insurance solutions and data-driven pricing models also contribute to the market's expansion. Intensifying competition among established players and new entrants drives innovation and efficiency within the market.

Dominant Markets & Segments in North America Insurance Telematics Market

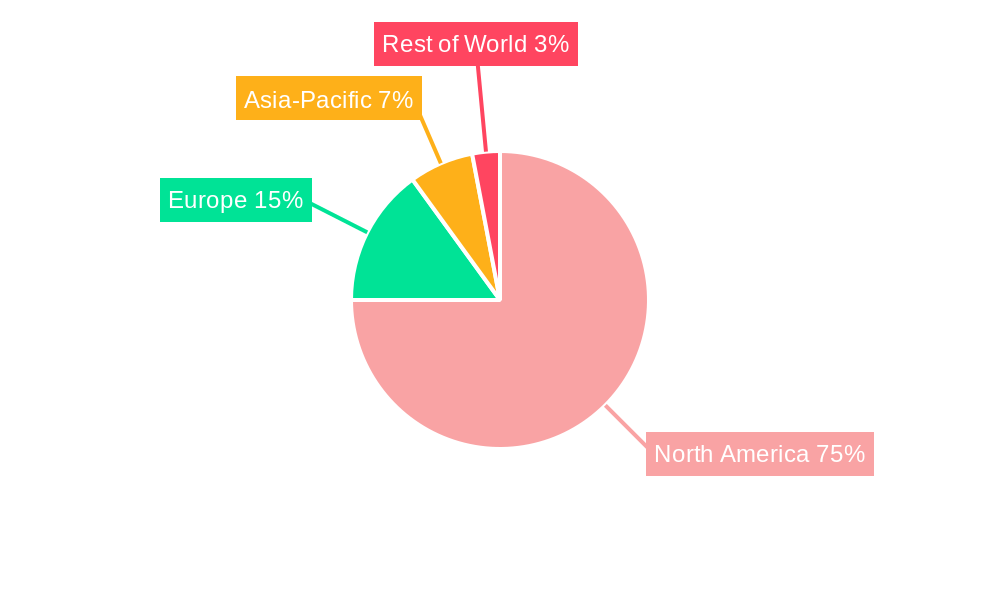

The United States dominates the North America insurance telematics market, accounting for approximately xx% of the total market share in 2024. This dominance stems from the large and technologically advanced automotive sector in the US, combined with higher adoption rates of connected car technologies and UBI programs. Canada represents a significantly smaller but growing segment of the market.

United States:

- Key Growth Drivers: High vehicle ownership rates, advanced technological infrastructure, established insurance market, strong consumer adoption of UBI.

Canada:

- Key Growth Drivers: Rising adoption of connected car technology, government initiatives promoting telematics usage, favorable regulatory environment (despite being smaller than the US market).

North America Insurance Telematics Market Product Analysis

The insurance telematics market offers a range of products, including smartphone-based apps, OBD-II plug-in devices, and integrated telematics systems within vehicles. These solutions offer features such as driver behavior monitoring, vehicle diagnostics, accident detection, and stolen vehicle tracking. The competitive advantage lies in the accuracy and comprehensiveness of data analysis, the user-friendliness of the interface, and the effectiveness of risk mitigation strategies offered to insurers. Recent technological advancements, such as advanced analytics and AI-powered risk assessment, are driving product innovation and differentiation.

Key Drivers, Barriers & Challenges in North America Insurance Telematics Market

Key Drivers:

- Technological advancements: AI-powered risk assessment, improved data analytics, and IoT integration.

- Increased consumer demand: Personalized insurance options and cost savings through UBI.

- Government support: Regulatory incentives for telematics adoption in certain regions.

Challenges and Restraints:

- Data privacy concerns: Balancing data collection with consumer privacy regulations.

- Cybersecurity risks: Protecting sensitive data from cyber threats.

- High initial investment costs: Implementation costs for insurers and integration challenges with legacy systems.

- Consumer adoption barriers: Lack of awareness or trust in telematics-based insurance.

Growth Drivers in the North America Insurance Telematics Market Market

Technological advancements like AI and IoT are central to the market's growth. The increasing demand for personalized insurance solutions and the cost-saving potential of UBI are strong incentives for both consumers and insurers. Government initiatives promoting telematics also create a favorable regulatory environment.

Challenges Impacting North America Insurance Telematics Market Growth

Data privacy concerns and the need to address cybersecurity risks remain significant hurdles. The potentially high initial investment costs can deter smaller insurers, and overcoming consumer skepticism regarding data privacy is crucial for broader adoption.

Key Players Shaping the North America Insurance Telematics Market Market

- Cambridge Mobile Telematics

- PowerFleet Inc

- The Floow Limited

- AXA SA

- Octo Telematics SpA

- IMERTIK Global Inc

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- GEICO (Berkshire Hathaway Inc)

- LexisNexis Risk Solutions (RELX Group)

Significant North America Insurance Telematics Market Industry Milestones

- September 2023: OCTO launched its "Digital Driver, Try Before You Buy" solution, offering a more objective risk assessment based on driving behavior.

- September 2023: The Floow Limited partnered with Definity and Munich Re to launch Sonnet Shift, Canada's first UBI product with quarterly price adjustments based on driving scores.

Future Outlook for North America Insurance Telematics Market Market

The North American insurance telematics market is poised for continued expansion, driven by ongoing technological innovation, increased consumer adoption of UBI, and favorable regulatory environments. Strategic opportunities exist for companies focusing on advanced analytics, AI-powered solutions, and seamless integration with connected car ecosystems. The market's potential for growth remains substantial, with significant opportunities for market entrants and established players alike.

North America Insurance Telematics Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Insurance Telematics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Insurance Telematics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Usage-based Insurance by Insurance Companies; Increase in Innovation in the Automotive Industry Across the Region to Witness the Growth

- 3.3. Market Restrains

- 3.3.1. Installation Complexities

- 3.4. Market Trends

- 3.4.1. Increase in Innovation in the Automotive Industry Across the Region to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insurance Telematics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Insurance Telematics Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Insurance Telematics Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Insurance Telematics Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Insurance Telematics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Cambridge Mobile Telematics

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PowerFleet Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Floow Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AXA SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Octo Telematics SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IMERTIK Global Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nationwide Mutual Insurance Compan

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 State Farm Mutual Automobile Insurance Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GEICO (Berkshire Hathaway Inc )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LexisNexis Risks Solutions (RELX Group)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cambridge Mobile Telematics

List of Figures

- Figure 1: North America Insurance Telematics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Insurance Telematics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Insurance Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Insurance Telematics Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: North America Insurance Telematics Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: North America Insurance Telematics Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 5: North America Insurance Telematics Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: North America Insurance Telematics Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 7: North America Insurance Telematics Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: North America Insurance Telematics Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: North America Insurance Telematics Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: North America Insurance Telematics Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: North America Insurance Telematics Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: North America Insurance Telematics Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: North America Insurance Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Insurance Telematics Market Volume Million Forecast, by Region 2019 & 2032

- Table 15: North America Insurance Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Insurance Telematics Market Volume Million Forecast, by Country 2019 & 2032

- Table 17: United States North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: North America Insurance Telematics Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: North America Insurance Telematics Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 27: North America Insurance Telematics Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: North America Insurance Telematics Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 29: North America Insurance Telematics Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: North America Insurance Telematics Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: North America Insurance Telematics Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: North America Insurance Telematics Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: North America Insurance Telematics Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: North America Insurance Telematics Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: North America Insurance Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Insurance Telematics Market Volume Million Forecast, by Country 2019 & 2032

- Table 37: United States North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United States North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 41: Mexico North America Insurance Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico North America Insurance Telematics Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insurance Telematics Market?

The projected CAGR is approximately 29.10%.

2. Which companies are prominent players in the North America Insurance Telematics Market?

Key companies in the market include Cambridge Mobile Telematics, PowerFleet Inc, The Floow Limited, AXA SA, Octo Telematics SpA, IMERTIK Global Inc, Nationwide Mutual Insurance Compan, State Farm Mutual Automobile Insurance Company, GEICO (Berkshire Hathaway Inc ), LexisNexis Risks Solutions (RELX Group).

3. What are the main segments of the North America Insurance Telematics Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Usage-based Insurance by Insurance Companies; Increase in Innovation in the Automotive Industry Across the Region to Witness the Growth.

6. What are the notable trends driving market growth?

Increase in Innovation in the Automotive Industry Across the Region to Witness Growth.

7. Are there any restraints impacting market growth?

Installation Complexities.

8. Can you provide examples of recent developments in the market?

September 2023 - OCTO announced the launch of the Digital Driver, Try Before You Buy solution, available through an App dedicated to drivers and designed to encourage a more objective risk assessment based on driving style. The exclusive monitoring features of Try Before You Buy allow the insurance company to accurately define customer pricing through a more transparent relationship based on actual driving behavior data that goes far beyond the traditional use of demographic factors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insurance Telematics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insurance Telematics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insurance Telematics Market?

To stay informed about further developments, trends, and reports in the North America Insurance Telematics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence