Key Insights

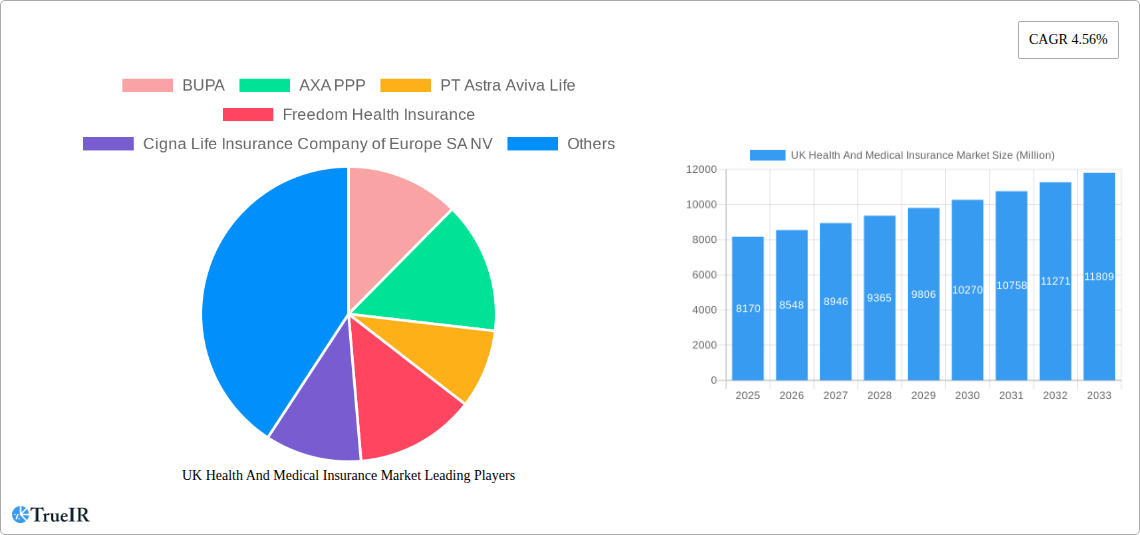

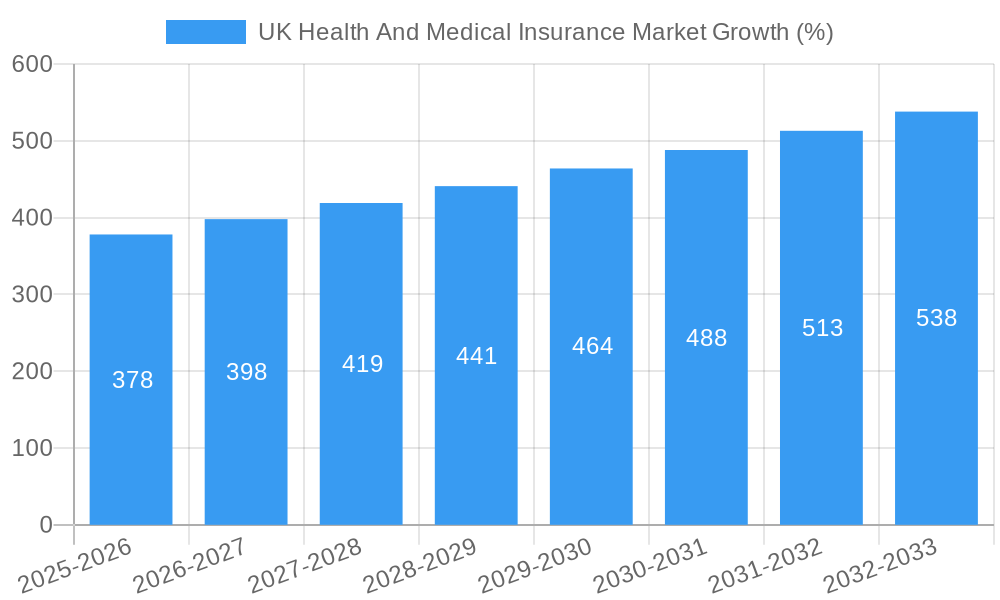

The UK health and medical insurance market, valued at £8.17 billion in 2025, is projected to experience robust growth, driven by several key factors. An aging population necessitates increased healthcare needs, fueling demand for supplemental insurance coverage. Rising healthcare costs, coupled with a growing awareness of the benefits of private medical care, further stimulate market expansion. Technological advancements, such as telemedicine and digital health platforms, are enhancing accessibility and efficiency within the industry, contributing to its positive trajectory. Increased government initiatives promoting preventative healthcare and wellness programs also indirectly support market growth by fostering a healthier population that, while ideally needing less acute care, still values supplemental insurance for specialized treatments and faster access to services. The competitive landscape is shaped by a mix of established multinational players like Bupa, AXA PPP, and Cigna, alongside regional providers and specialized insurers catering to niche demographics. This competition fosters innovation and drives down prices in certain sectors.

However, market expansion faces certain constraints. The economic climate significantly influences consumer spending on non-essential health insurance, with periods of economic downturn potentially impacting uptake. Stringent regulatory frameworks and evolving government policies also present challenges for insurers, requiring continuous adaptation. Furthermore, the rising cost of medical treatments and procedures, while a driver for the market, also presents a financial pressure that affects profitability and potentially influences premium pricing. Nevertheless, the projected Compound Annual Growth Rate (CAGR) of 4.56% from 2025 to 2033 indicates a consistently expanding market, with significant opportunities for both established players and new entrants focused on specific market segments and innovative service offerings.

UK Health & Medical Insurance Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the UK health and medical insurance market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this study unveils market trends, competitive dynamics, and future growth prospects. The report leverages extensive data analysis and expert insights to offer a robust understanding of this dynamic sector.

UK Health And Medical Insurance Market Market Structure & Competitive Landscape

The UK health and medical insurance market exhibits a moderately concentrated structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation is driven by technological advancements, such as telehealth and digital health platforms, alongside regulatory pressures to enhance accessibility and affordability. Product substitutes include self-insurance and government-funded healthcare schemes, impacting market penetration. The market is segmented by coverage type (individual, family, group), customer demographics (age, income), and service offerings (hospitalization, outpatient care, chronic disease management). Significant M&A activity has been observed in recent years, with xx deals recorded between 2019 and 2024, mostly focused on expanding market reach and service offerings. This activity reflects both consolidation within the sector and an ongoing trend towards diversification.

- Concentration Ratio (CR4): xx% (2024)

- M&A Deal Volume (2019-2024): xx

- Key Innovation Drivers: Telehealth, AI-driven diagnostics, personalized medicine.

- Regulatory Impacts: Increasing focus on transparency and consumer protection.

UK Health And Medical Insurance Market Market Trends & Opportunities

The UK health and medical insurance market is experiencing robust growth, driven by factors such as an aging population, rising healthcare costs, and increasing awareness of health insurance benefits. The market size in 2024 was estimated at £xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration remains relatively low compared to other developed nations, presenting significant untapped potential. Technological advancements, particularly in telehealth and digital health solutions, are reshaping consumer preferences, driving demand for convenient and accessible healthcare services. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and services. Market players are increasingly focusing on value-added services, personalized care plans, and preventive healthcare offerings to attract and retain customers.

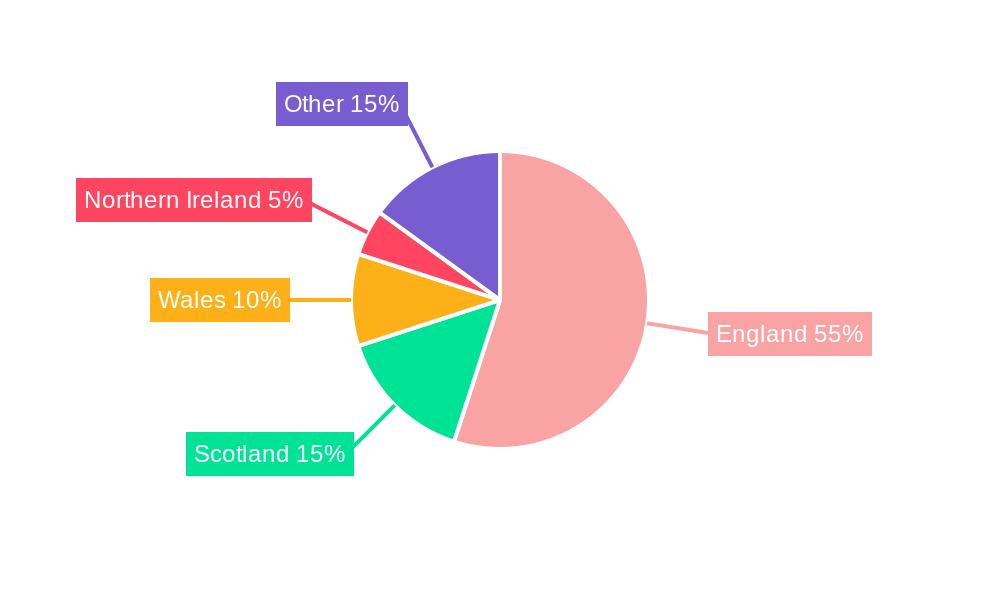

Dominant Markets & Segments in UK Health And Medical Insurance Market

The private health insurance market in England is the largest segment, accounting for the majority of the UK's private health insurance market. This is largely due to higher disposable incomes, greater awareness of private healthcare, and significant investment in private healthcare infrastructure. Scotland, Wales and Northern Ireland each possess their unique markets, demonstrating lower penetration rates than England but exhibiting gradual growth.

- Key Growth Drivers in England:

- Higher disposable incomes.

- Increased awareness of private healthcare options.

- Significant private hospital investment.

- Key Growth Drivers in Other Regions:

- Growing government support for private healthcare.

- Rising incidence of chronic diseases.

- Increasing demand for specialized medical care.

UK Health And Medical Insurance Market Product Analysis

Product innovation is focused on enhancing customer experience and access to care through technological advancements. Digital platforms offering online consultations, virtual care management, and personalized health recommendations are gaining traction. These offerings aim to provide convenience, affordability, and improved access to healthcare services. The competitive advantage lies in providing comprehensive coverage, exceptional customer service, and utilizing technology effectively to enhance the overall healthcare experience.

Key Drivers, Barriers & Challenges in UK Health And Medical Insurance Market

Key Drivers:

- Aging Population: The increasing proportion of older individuals drives demand for health insurance.

- Rising Healthcare Costs: Escalating medical expenses make insurance more appealing.

- Technological Advancements: Telehealth and digital health solutions enhance access and convenience.

Key Challenges:

- Regulatory Complexity: Stringent regulations and compliance requirements increase operating costs.

- Competitive Pressures: Intense competition among insurers limits pricing power.

- Supply Chain Issues: Shortages of healthcare professionals and resources can impact service delivery.

Growth Drivers in the UK Health And Medical Insurance Market Market

The market is propelled by an aging population, rising healthcare costs, and technological innovations like telehealth. Government policies encouraging private healthcare participation also contribute.

Challenges Impacting UK Health And Medical Insurance Market Growth

Regulatory hurdles, competition from other healthcare providers, and managing healthcare costs restrain growth.

Key Players Shaping the UK Health And Medical Insurance Market Market

- BUPA

- AXA PPP

- PT Astra Aviva Life

- Freedom Health Insurance

- Cigna Life Insurance Company of Europe SA NV

- Simplyhealth Group Ltd

- WPA - Western Provident Association

- Vitality Health

- Aviva

- SAGA

- List Not Exhaustive

Significant UK Health And Medical Insurance Market Industry Milestones

- November 2022: Bupa partners with JAAQ for a six-month trial to improve access to online health advice. This enhances Bupa's existing mental health support services.

- February 2022: AXA UK&I acquires renewable rights to Ageas UK's commercial business for £47.5 Million, strengthening its position in the SME and Schemes market segments.

Future Outlook for UK Health And Medical Insurance Market Market

The UK health and medical insurance market is poised for continued growth, driven by an aging population, rising healthcare costs, and technological advancements. Strategic opportunities exist in expanding telehealth offerings, personalizing healthcare plans, and leveraging data analytics to improve risk management and service delivery. The market's potential is substantial, offering significant growth prospects for insurers who can adapt to evolving customer needs and technological disruptions.

UK Health And Medical Insurance Market Segmentation

-

1. Product Type

-

1.1. Private Medical Insurance

- 1.1.1. Individual Policy Coverage

- 1.1.2. Group Policy Coverage

- 1.2. Healthcare Cash Plans

- 1.3. Dental Insurance Plans

-

1.1. Private Medical Insurance

-

2. Procurement type

- 2.1. Self-pay Health Coverage

- 2.2. Employee Sponsored Health Coverage

UK Health And Medical Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Health And Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Global Economic Slowdown and Better Government Insurance Services Affecting the United Kingdom Health and Medical Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Private Medical Insurance

- 5.1.1.1. Individual Policy Coverage

- 5.1.1.2. Group Policy Coverage

- 5.1.2. Healthcare Cash Plans

- 5.1.3. Dental Insurance Plans

- 5.1.1. Private Medical Insurance

- 5.2. Market Analysis, Insights and Forecast - by Procurement type

- 5.2.1. Self-pay Health Coverage

- 5.2.2. Employee Sponsored Health Coverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Private Medical Insurance

- 6.1.1.1. Individual Policy Coverage

- 6.1.1.2. Group Policy Coverage

- 6.1.2. Healthcare Cash Plans

- 6.1.3. Dental Insurance Plans

- 6.1.1. Private Medical Insurance

- 6.2. Market Analysis, Insights and Forecast - by Procurement type

- 6.2.1. Self-pay Health Coverage

- 6.2.2. Employee Sponsored Health Coverage

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Private Medical Insurance

- 7.1.1.1. Individual Policy Coverage

- 7.1.1.2. Group Policy Coverage

- 7.1.2. Healthcare Cash Plans

- 7.1.3. Dental Insurance Plans

- 7.1.1. Private Medical Insurance

- 7.2. Market Analysis, Insights and Forecast - by Procurement type

- 7.2.1. Self-pay Health Coverage

- 7.2.2. Employee Sponsored Health Coverage

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Private Medical Insurance

- 8.1.1.1. Individual Policy Coverage

- 8.1.1.2. Group Policy Coverage

- 8.1.2. Healthcare Cash Plans

- 8.1.3. Dental Insurance Plans

- 8.1.1. Private Medical Insurance

- 8.2. Market Analysis, Insights and Forecast - by Procurement type

- 8.2.1. Self-pay Health Coverage

- 8.2.2. Employee Sponsored Health Coverage

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Private Medical Insurance

- 9.1.1.1. Individual Policy Coverage

- 9.1.1.2. Group Policy Coverage

- 9.1.2. Healthcare Cash Plans

- 9.1.3. Dental Insurance Plans

- 9.1.1. Private Medical Insurance

- 9.2. Market Analysis, Insights and Forecast - by Procurement type

- 9.2.1. Self-pay Health Coverage

- 9.2.2. Employee Sponsored Health Coverage

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Private Medical Insurance

- 10.1.1.1. Individual Policy Coverage

- 10.1.1.2. Group Policy Coverage

- 10.1.2. Healthcare Cash Plans

- 10.1.3. Dental Insurance Plans

- 10.1.1. Private Medical Insurance

- 10.2. Market Analysis, Insights and Forecast - by Procurement type

- 10.2.1. Self-pay Health Coverage

- 10.2.2. Employee Sponsored Health Coverage

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BUPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AXA PPP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Astra Aviva Life

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Freedom Health Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cigna Life Insurance Company of Europe SA NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Simplyhealth Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WPA - Western Provident Association

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vitality Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviva

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAGA**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BUPA

List of Figures

- Figure 1: Global UK Health And Medical Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global UK Health And Medical Insurance Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America UK Health And Medical Insurance Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America UK Health And Medical Insurance Market Volume (Billion), by Product Type 2024 & 2032

- Figure 5: North America UK Health And Medical Insurance Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America UK Health And Medical Insurance Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America UK Health And Medical Insurance Market Revenue (Million), by Procurement type 2024 & 2032

- Figure 8: North America UK Health And Medical Insurance Market Volume (Billion), by Procurement type 2024 & 2032

- Figure 9: North America UK Health And Medical Insurance Market Revenue Share (%), by Procurement type 2024 & 2032

- Figure 10: North America UK Health And Medical Insurance Market Volume Share (%), by Procurement type 2024 & 2032

- Figure 11: North America UK Health And Medical Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America UK Health And Medical Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America UK Health And Medical Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America UK Health And Medical Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America UK Health And Medical Insurance Market Revenue (Million), by Product Type 2024 & 2032

- Figure 16: South America UK Health And Medical Insurance Market Volume (Billion), by Product Type 2024 & 2032

- Figure 17: South America UK Health And Medical Insurance Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: South America UK Health And Medical Insurance Market Volume Share (%), by Product Type 2024 & 2032

- Figure 19: South America UK Health And Medical Insurance Market Revenue (Million), by Procurement type 2024 & 2032

- Figure 20: South America UK Health And Medical Insurance Market Volume (Billion), by Procurement type 2024 & 2032

- Figure 21: South America UK Health And Medical Insurance Market Revenue Share (%), by Procurement type 2024 & 2032

- Figure 22: South America UK Health And Medical Insurance Market Volume Share (%), by Procurement type 2024 & 2032

- Figure 23: South America UK Health And Medical Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 24: South America UK Health And Medical Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 25: South America UK Health And Medical Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America UK Health And Medical Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe UK Health And Medical Insurance Market Revenue (Million), by Product Type 2024 & 2032

- Figure 28: Europe UK Health And Medical Insurance Market Volume (Billion), by Product Type 2024 & 2032

- Figure 29: Europe UK Health And Medical Insurance Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Europe UK Health And Medical Insurance Market Volume Share (%), by Product Type 2024 & 2032

- Figure 31: Europe UK Health And Medical Insurance Market Revenue (Million), by Procurement type 2024 & 2032

- Figure 32: Europe UK Health And Medical Insurance Market Volume (Billion), by Procurement type 2024 & 2032

- Figure 33: Europe UK Health And Medical Insurance Market Revenue Share (%), by Procurement type 2024 & 2032

- Figure 34: Europe UK Health And Medical Insurance Market Volume Share (%), by Procurement type 2024 & 2032

- Figure 35: Europe UK Health And Medical Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Europe UK Health And Medical Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Europe UK Health And Medical Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe UK Health And Medical Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa UK Health And Medical Insurance Market Revenue (Million), by Product Type 2024 & 2032

- Figure 40: Middle East & Africa UK Health And Medical Insurance Market Volume (Billion), by Product Type 2024 & 2032

- Figure 41: Middle East & Africa UK Health And Medical Insurance Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 42: Middle East & Africa UK Health And Medical Insurance Market Volume Share (%), by Product Type 2024 & 2032

- Figure 43: Middle East & Africa UK Health And Medical Insurance Market Revenue (Million), by Procurement type 2024 & 2032

- Figure 44: Middle East & Africa UK Health And Medical Insurance Market Volume (Billion), by Procurement type 2024 & 2032

- Figure 45: Middle East & Africa UK Health And Medical Insurance Market Revenue Share (%), by Procurement type 2024 & 2032

- Figure 46: Middle East & Africa UK Health And Medical Insurance Market Volume Share (%), by Procurement type 2024 & 2032

- Figure 47: Middle East & Africa UK Health And Medical Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Middle East & Africa UK Health And Medical Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Middle East & Africa UK Health And Medical Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa UK Health And Medical Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific UK Health And Medical Insurance Market Revenue (Million), by Product Type 2024 & 2032

- Figure 52: Asia Pacific UK Health And Medical Insurance Market Volume (Billion), by Product Type 2024 & 2032

- Figure 53: Asia Pacific UK Health And Medical Insurance Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Asia Pacific UK Health And Medical Insurance Market Volume Share (%), by Product Type 2024 & 2032

- Figure 55: Asia Pacific UK Health And Medical Insurance Market Revenue (Million), by Procurement type 2024 & 2032

- Figure 56: Asia Pacific UK Health And Medical Insurance Market Volume (Billion), by Procurement type 2024 & 2032

- Figure 57: Asia Pacific UK Health And Medical Insurance Market Revenue Share (%), by Procurement type 2024 & 2032

- Figure 58: Asia Pacific UK Health And Medical Insurance Market Volume Share (%), by Procurement type 2024 & 2032

- Figure 59: Asia Pacific UK Health And Medical Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific UK Health And Medical Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Asia Pacific UK Health And Medical Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific UK Health And Medical Insurance Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 6: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 7: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 12: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 13: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 23: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 24: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 25: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Brazil UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Argentina UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 35: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 36: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 37: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: United Kingdom UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Germany UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: France UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Italy UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Spain UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: Russia UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Russia UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Benelux UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Benelux UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Nordics UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Nordics UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 59: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 60: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 61: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 63: Turkey UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Turkey UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Israel UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Israel UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 67: GCC UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: GCC UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 69: North Africa UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: North Africa UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 71: South Africa UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Africa UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 75: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 76: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 77: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Procurement type 2019 & 2032

- Table 78: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Procurement type 2019 & 2032

- Table 79: Global UK Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: Global UK Health And Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 81: China UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: China UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 83: India UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: India UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 85: Japan UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Japan UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 87: South Korea UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: South Korea UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 89: ASEAN UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 91: Oceania UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Oceania UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific UK Health And Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific UK Health And Medical Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Health And Medical Insurance Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the UK Health And Medical Insurance Market?

Key companies in the market include BUPA, AXA PPP, PT Astra Aviva Life, Freedom Health Insurance, Cigna Life Insurance Company of Europe SA NV, Simplyhealth Group Ltd, WPA - Western Provident Association, Vitality Health, Aviva, SAGA**List Not Exhaustive.

3. What are the main segments of the UK Health And Medical Insurance Market?

The market segments include Product Type, Procurement type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Global Economic Slowdown and Better Government Insurance Services Affecting the United Kingdom Health and Medical Insurance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On November 2022, in partnership with online platform JAAQ in a six-month trial for boosting access to personalised expert-led health advice online. This adds to Bupa's mental health support which provides ongoing, around-the-clock support for a wealth of mental health conditions, such as anxiety, depression and addiction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Health And Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Health And Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Health And Medical Insurance Market?

To stay informed about further developments, trends, and reports in the UK Health And Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence