Key Insights

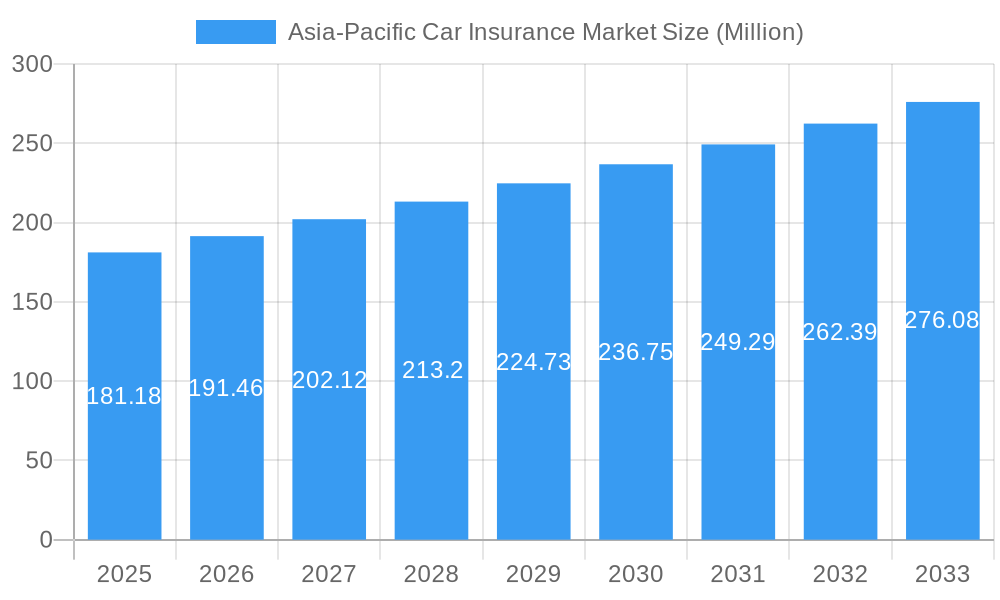

The Asia-Pacific car insurance market, valued at $181.18 million in 2025, is projected to experience robust growth, driven by a rising number of vehicles, increasing urbanization, and stricter government regulations mandating insurance coverage. A compound annual growth rate (CAGR) of 5.45% from 2025 to 2033 indicates a significant expansion, with the market expected to exceed $280 million by 2033. This growth is fueled by several key factors. Firstly, the burgeoning middle class in countries like China, India, and South Korea is leading to increased car ownership, directly boosting insurance demand. Secondly, evolving consumer preferences are shifting towards comprehensive coverage, including collision and other optional add-ons, rather than solely relying on third-party liability. This trend is further amplified by government initiatives promoting road safety and financial protection for vehicle owners. Finally, the expansion of online distribution channels and the adoption of innovative insurance technologies are streamlining the buying process and increasing accessibility, contributing to market expansion.

Asia-Pacific Car Insurance Market Market Size (In Million)

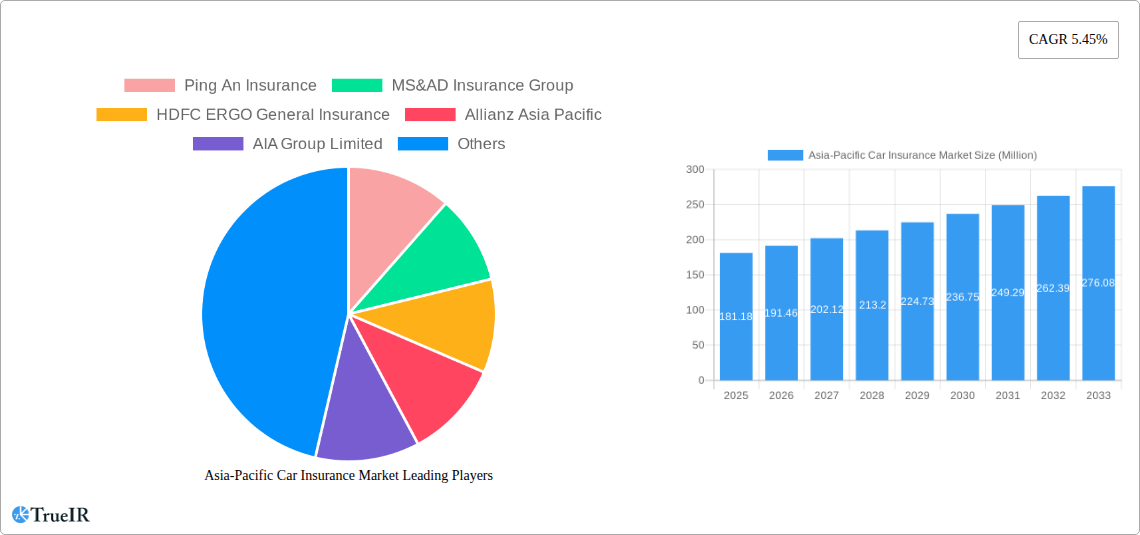

However, several challenges exist. Competitive intensity among established players and new entrants necessitates strategic pricing and product differentiation. Furthermore, fluctuating fuel prices and economic uncertainties can impact consumer spending on insurance. Geographic variations in insurance penetration rates across the Asia-Pacific region also present both opportunities and hurdles for insurers, requiring targeted strategies tailored to individual markets. Key segments driving growth include personal vehicle insurance, followed by commercial vehicles, with online distribution channels witnessing significant uptake. China, Japan, and India are the major market contributors, offering considerable growth potential. The leading players, such as Ping An Insurance, MS&AD Insurance Group, and HDFC ERGO, are strategically investing in digitalization and expanding their product offerings to maintain their competitive edge in this dynamic market.

Asia-Pacific Car Insurance Market Company Market Share

Asia-Pacific Car Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific car insurance market, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for industry stakeholders seeking to navigate this dynamic market. The report leverages extensive data analysis and qualitative insights to deliver actionable intelligence for strategic decision-making. The market is segmented by application (personal and commercial vehicles), distribution channel (direct sales, agents, brokers, banks, online, and others), country (China, Japan, India, South Korea, and Rest of Asia-Pacific), and coverage type (third-party liability and collision/comprehensive).

Asia-Pacific Car Insurance Market Structure & Competitive Landscape

The Asia-Pacific car insurance market exhibits a moderately concentrated structure, with several large players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies investing heavily in telematics, data analytics, and digital distribution channels to enhance customer experience and operational efficiency. Regulatory changes, including those related to data privacy and insurance pricing, significantly impact market dynamics. Product substitutes, such as self-insurance schemes for low-risk drivers, are emerging but have limited market penetration currently at xx%. The market is largely segmented by the type of vehicle (personal or commercial), with a greater emphasis on the personal vehicle segment (xx% of market share in 2024). M&A activity has been significant in recent years, with xx major deals recorded between 2019 and 2024, driven by the consolidation efforts of insurance companies to gain a competitive advantage. These mergers and acquisitions have been primarily aimed at expanding geographic reach, strengthening product portfolios, and accessing new technologies.

- Market Concentration: Moderately concentrated, HHI (2024): xx

- Innovation Drivers: Telematics, data analytics, digital distribution

- Regulatory Impacts: Data privacy, insurance pricing regulations

- Product Substitutes: Self-insurance schemes (limited penetration)

- End-User Segmentation: Primarily personal vehicles (xx% market share in 2024), followed by commercial vehicles

- M&A Trends: xx major deals (2019-2024), driven by geographic expansion, portfolio diversification, and technological access

Asia-Pacific Car Insurance Market Trends & Opportunities

The Asia-Pacific car insurance market is experiencing robust growth, driven by factors such as rising vehicle ownership, increasing urbanization, and the expansion of the middle class. The market size, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in telematics and AI-powered risk assessment, are transforming the industry. Consumer preferences are shifting towards digital channels, personalized services, and value-added benefits. Intense competition is forcing insurers to adopt innovative strategies to improve customer acquisition and retention. Market penetration rates vary significantly across countries, with higher rates observed in developed economies like Japan and South Korea compared to emerging markets. The increasing adoption of connected cars and the availability of real-time data present significant opportunities for insurers to develop more accurate risk models and offer customized insurance products. This includes the growing use of usage-based insurance (UBI) and pay-per-mile programs.

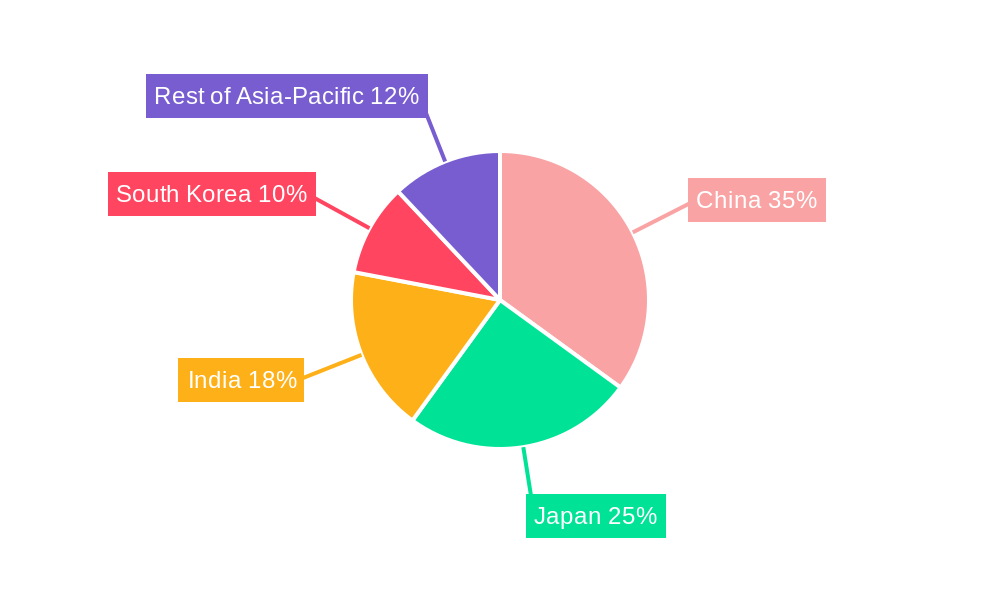

Dominant Markets & Segments in Asia-Pacific Car Insurance Market

China currently dominates the Asia-Pacific car insurance market, accounting for xx% of the total market value in 2024, followed by Japan and India. The personal vehicle segment holds the largest market share, driven by high demand from individuals and rising vehicle ownership. Online distribution channels are witnessing significant growth, indicating a clear shift in consumer preference toward convenience and digital interaction.

- Leading Region: China (xx% of market value in 2024)

- Leading Country: China

- Leading Segment (Application): Personal Vehicles

- Leading Segment (Distribution): Online (growing rapidly)

Key Growth Drivers:

- China: Rapid economic growth, increasing vehicle ownership, improving infrastructure.

- Japan: High vehicle ownership rates, well-developed insurance infrastructure.

- India: Expanding middle class, rising vehicle sales, government initiatives.

- Online: Consumer preference for convenience, accessibility, and cost-effectiveness.

Asia-Pacific Car Insurance Market Product Analysis

Product innovations are focused on enhancing customer experience, improving risk assessment accuracy, and offering more personalized and affordable insurance products. Telematics-based insurance, usage-based insurance (UBI), and AI-powered risk assessment are key areas of innovation. These advancements enable insurers to offer dynamic pricing, real-time monitoring, and personalized services, improving customer satisfaction and reducing operational costs. The competitive advantage lies in offering innovative products, superior customer service, and efficient distribution channels, such as through digital platforms and partnerships with automotive manufacturers.

Key Drivers, Barriers & Challenges in Asia-Pacific Car Insurance Market

Key Drivers:

- Rising vehicle ownership and urbanization.

- Expanding middle class and increased disposable incomes.

- Technological advancements in telematics and data analytics.

- Government regulations promoting insurance penetration.

Challenges:

- Intense competition among established and new market entrants.

- Regulatory hurdles and variations across different countries.

- Supply chain disruptions impacting the availability of essential resources.

- Fraudulent claims and rising claims costs. The cost of claims has increased by xx% from 2019 to 2024.

Growth Drivers in the Asia-Pacific Car Insurance Market Market

The Asia-Pacific car insurance market is driven by factors such as rapid economic growth in several countries, expanding middle class, rising vehicle ownership, and advancements in telematics and data analytics. Government initiatives promoting insurance penetration and infrastructure development also contribute to market growth.

Challenges Impacting Asia-Pacific Car Insurance Market Growth

Challenges include intense competition, varying regulatory landscapes across countries, and operational complexities related to claim processing and fraud management. Supply chain disruptions and the increasing cost of claims also pose significant hurdles.

Key Players Shaping the Asia-Pacific Car Insurance Market Market

- Ping An Insurance

- MS&AD Insurance Group

- HDFC ERGO General Insurance

- Allianz Asia Pacific

- AIA Group Limited

- Zurich Insurance Group

- PICC

- Tokio Marine

- Sompo Japan Nipponkoa Insurance

- National Insurance Company

- TATA AIG General Insurance

- Bajaj Allianz General Insurance

- SBI General Insurance

- IAG (Insurance Australia Group)

Significant Asia-Pacific Car Insurance Market Industry Milestones

- July 2022: Edelweiss General Insurance launched 'Switch,' a fully digital, telematics-based motor insurance policy, expanding real-time driving score and dynamic premium calculation services.

- July 2023: Lexasure Financial Group partnered with My Car Consultant Pte. Ltd. to offer data-driven, self-insured car insurance in South and Southeast Asia.

Future Outlook for Asia-Pacific Car Insurance Market Market

The Asia-Pacific car insurance market is poised for continued growth, driven by factors such as increasing vehicle ownership, technological advancements, and favorable government policies. Strategic opportunities exist for insurers who can leverage data analytics, personalize offerings, and enhance customer experience through digital channels. The market presents significant potential for companies that can successfully navigate the challenges and capitalize on the emerging trends.

Asia-Pacific Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Asia-Pacific Car Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Car Insurance Market Regional Market Share

Geographic Coverage of Asia-Pacific Car Insurance Market

Asia-Pacific Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events

- 3.3. Market Restrains

- 3.3.1. Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations

- 3.4. Market Trends

- 3.4.1. China Leading the Asia Pacific Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ping An Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MS&AD Insurance Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC ERGO General Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allianz Asia Pacific

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AIA Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zurich Insurance Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PICC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokio Marine

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sompo Japan Nipponkoa Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 National Insurance Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TATA AIG General Insurance**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bajaj Allianz General Insurance

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SBI General Insurance

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 IAG (Insurance Australia Group)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Ping An Insurance

List of Figures

- Figure 1: Asia-Pacific Car Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Car Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 6: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Car Insurance Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Car Insurance Market?

Key companies in the market include Ping An Insurance, MS&AD Insurance Group, HDFC ERGO General Insurance, Allianz Asia Pacific, AIA Group Limited, Zurich Insurance Group, PICC, Tokio Marine, Sompo Japan Nipponkoa Insurance, National Insurance Company, TATA AIG General Insurance**List Not Exhaustive, Bajaj Allianz General Insurance, SBI General Insurance, IAG (Insurance Australia Group).

3. What are the main segments of the Asia-Pacific Car Insurance Market?

The market segments include Coverage, Application , Distribution Channel .

4. Can you provide details about the market size?

The market size is estimated to be USD 181.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events.

6. What are the notable trends driving market growth?

China Leading the Asia Pacific Market.

7. Are there any restraints impacting market growth?

Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: Edelweiss General Insurance launched a comprehensive motor insurance product named 'Switch' which exists as a fully digital, mobile telematics-based motor policy that detects motion and automatically activates insurance when the vehicle is driven. This resulted in further expansion toward real-time driving scores and dynamically calculated premium-based car insurance services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Car Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence