Key Insights

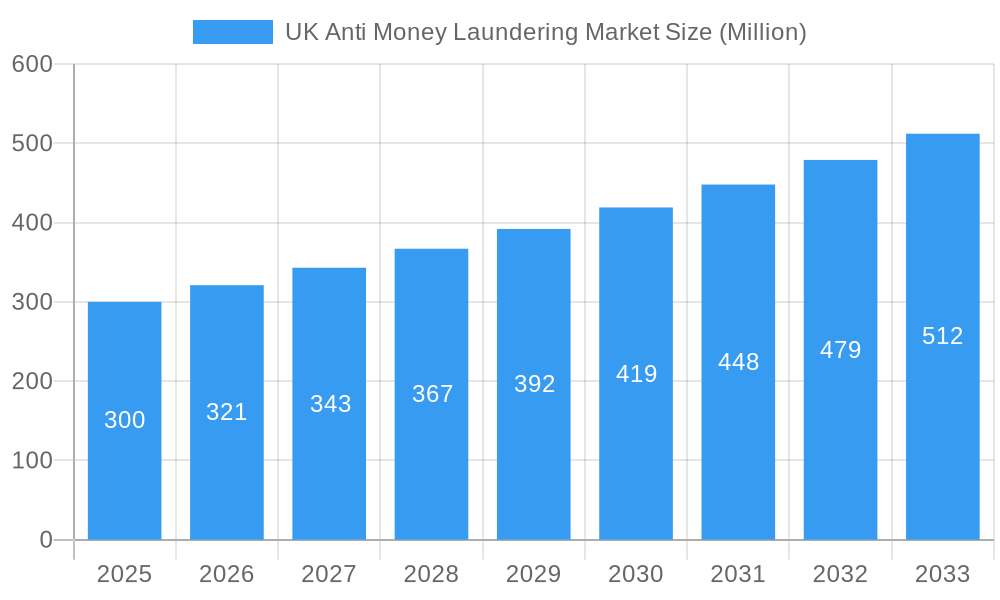

The UK Anti-Money Laundering (AML) market is poised for substantial growth, driven by intensified regulatory scrutiny, the increasing sophistication of financial crimes, and a critical need for robust compliance solutions. The UK AML market is projected to reach a size of £4.13 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 17.8%, and is expected to continue this upward trajectory through 2033. Key growth catalysts include the rising incidence of financial crimes such as fraud and terrorist financing, the strengthening of regulatory frameworks like the Fifth Anti-Money Laundering Directive (5AMLD), and the increasing adoption of advanced technologies, including artificial intelligence and machine learning, to enhance AML detection capabilities. Emerging trends such as a greater emphasis on risk-based AML compliance, the integration of AML solutions with other Regulatory Technology (RegTech) offerings, and the demand for comprehensive, end-to-end solutions across the customer lifecycle are further shaping market dynamics.

UK Anti Money Laundering Market Market Size (In Billion)

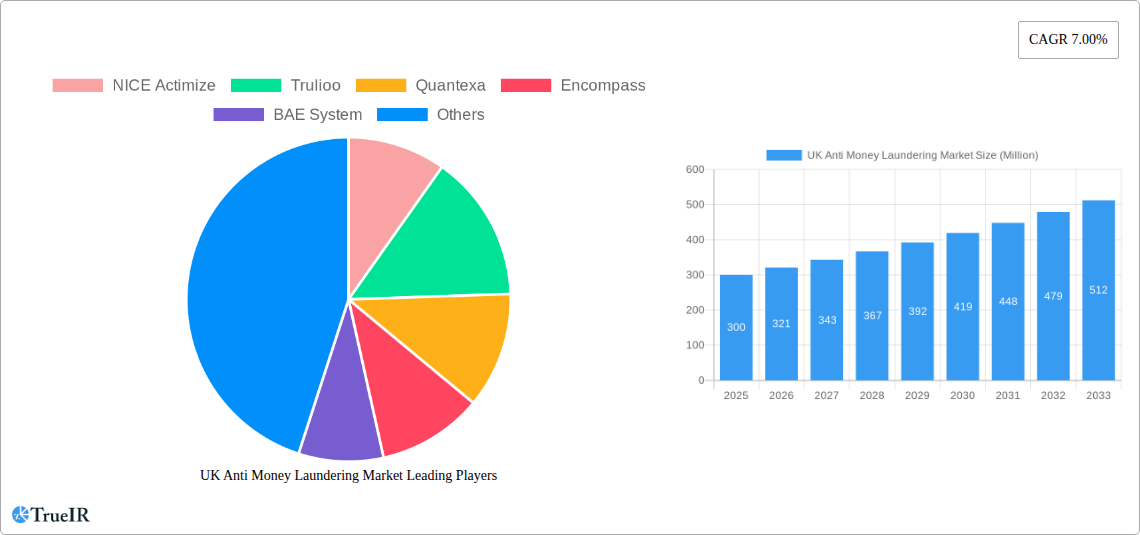

Despite significant growth potential, several factors may present challenges. These include the substantial costs associated with implementing and maintaining AML compliance systems, the complexities of integrating disparate systems and technologies, and the continuous challenge of adapting to evolving criminal tactics and regulatory mandates. Furthermore, a shortage of skilled professionals in compliance and data analytics poses a notable impediment to effective AML implementation. The market is segmented by solution type (e.g., transaction monitoring, customer due diligence, sanctions screening), deployment model (cloud, on-premise), and end-user (banks, financial institutions, and other regulated entities). Prominent players in this competitive landscape include NICE Actimize, Trulioo, Quantexa, Encompass, BAE Systems, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, and FullCircle, alongside a host of specialized providers catering to niche requirements. The ongoing evolution of financial crime and regulatory responses ensures sustained demand for AML solutions in the UK throughout the forecast period (2025-2033).

UK Anti Money Laundering Market Company Market Share

UK Anti-Money Laundering (AML) Market Analysis and Forecast: 2025-2033

This comprehensive report delivers a detailed analysis of the UK Anti-Money Laundering market, offering critical insights for businesses, investors, and policymakers. With a forecast period from 2025 to 2033 and a base year of 2025, this study utilizes historical data (2019-2024) to project future market trends and identify growth opportunities. The UK AML market size was valued at £4.13 billion in the base year 2025 and is anticipated to grow to £15.5 billion by 2033, exhibiting a CAGR of 17.8%. This in-depth study examines key market segments, competitive landscapes, and significant growth drivers.

UK Anti Money Laundering Market Market Structure & Competitive Landscape

The UK AML market is characterized by a moderately concentrated structure, with a few major players dominating alongside several smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, suggesting a moderately competitive landscape. Innovation is a key driver, with companies continuously developing advanced technologies like AI and machine learning to improve AML detection and prevention. Stringent regulations, such as those imposed by the Financial Conduct Authority (FCA), significantly impact market dynamics, forcing companies to invest in compliance solutions. Product substitutes are limited, as AML solutions are often tailored to specific industry needs. The market exhibits clear end-user segmentation, including financial institutions, government agencies, and other regulated sectors. M&A activity has been moderate in recent years, with xx transactions recorded between 2019 and 2024, valued at approximately £xx Million.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx.

- Innovation Drivers: AI, machine learning, and advanced analytics.

- Regulatory Impacts: Significant influence from the FCA and other regulatory bodies.

- Product Substitutes: Limited due to specialized nature of AML solutions.

- End-User Segmentation: Financial institutions, government agencies, and other regulated sectors.

- M&A Trends: Moderate activity, with xx transactions totaling approximately £xx Million (2019-2024).

UK Anti Money Laundering Market Market Trends & Opportunities

The UK AML market is experiencing robust growth, driven by increasing regulatory scrutiny, rising cybercrime, and the evolving sophistication of money laundering techniques. The market size is projected to expand significantly over the forecast period, fueled by rising adoption of advanced technologies and increasing awareness of AML risks across various sectors. Technological advancements, such as AI-powered solutions, are transforming the market, enabling faster and more accurate detection of suspicious activities. Consumer preference is shifting towards comprehensive, integrated AML solutions that offer improved efficiency and compliance. Competitive dynamics are shaped by technological innovation, strategic partnerships, and regulatory compliance pressures.

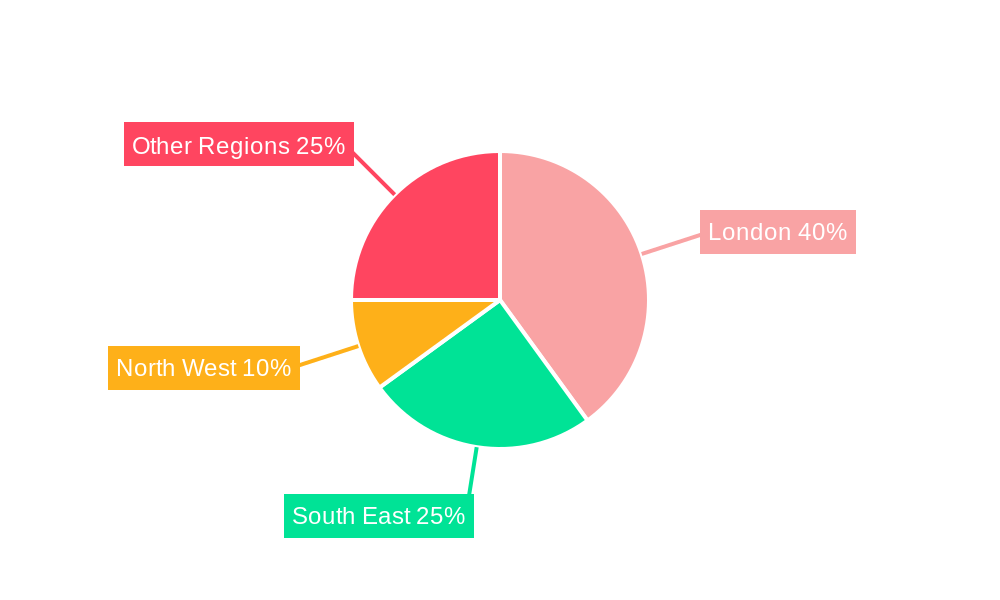

Dominant Markets & Segments in UK Anti Money Laundering Market

The financial services sector constitutes the largest segment of the UK AML market, driven by stringent regulatory requirements and the high volume of financial transactions. London, as a global financial hub, represents a key geographic market. Other significant sectors include gaming, real estate, and professional services.

- Key Growth Drivers in the Financial Services Sector:

- Stringent regulatory compliance requirements from the FCA.

- High transaction volumes and associated risk of money laundering.

- Increased adoption of digital technologies and financial instruments.

- Key Growth Drivers in London:

- Concentration of financial institutions and global businesses.

- Strong regulatory framework and enforcement.

- Access to a skilled workforce and technological infrastructure.

UK Anti Money Laundering Market Product Analysis

The UK AML market offers a range of solutions, including transaction monitoring systems, KYC/KYB solutions, sanctions screening tools, and consulting services. Technological advancements are leading to the development of more sophisticated solutions that leverage AI, machine learning, and big data analytics to improve accuracy and efficiency. These solutions are designed to meet the evolving needs of businesses operating in a high-risk environment, ensuring compliance with increasingly complex regulations.

Key Drivers, Barriers & Challenges in UK Anti Money Laundering Market

Key Drivers: Increased regulatory scrutiny, rising cybercrime, growing awareness of AML risks, and technological advancements (AI, machine learning).

Challenges: Regulatory complexity and evolving compliance requirements present significant hurdles. Supply chain disruptions can impact the availability and affordability of AML solutions. Intense competition from both established and emerging players creates pressure on pricing and margins. The market faces challenges in keeping pace with the ever-evolving tactics of financial criminals.

Growth Drivers in the UK Anti Money Laundering Market Market

The market is propelled by a combination of factors: stringent regulations emphasizing proactive AML compliance, the escalating sophistication of money laundering techniques demanding advanced technology, and the increasing adoption of digital financial services expanding the attack surface. Government initiatives promoting financial crime prevention further fuel market growth.

Challenges Impacting UK Anti Money Laundering Market Growth

High implementation costs, the complexity of integrating AML solutions into existing systems, and the ongoing need for skilled professionals to manage and interpret data are key obstacles. The market also faces the constant challenge of adapting to rapidly evolving money laundering schemes, demanding ongoing upgrades and investment in new technologies.

Key Players Shaping the UK Anti Money Laundering Market Market

- NICE Actimize

- Trulioo

- Quantexa

- Encompass

- BAE Systems

- LexisNexis Risk Solutions

- Passfort

- Refinitiv

- Sanctionscanner

- FullCircl

List Not Exhaustive

Significant UK Anti Money Laundering Market Industry Milestones

- April 2022: NICE Actimize partners with Deutsche Telekom Global Business to expand its CXone portfolio across Europe.

- January 2022: PassFort partners with Trulioo to enhance KYC/KYB processes for regulated enterprises.

Future Outlook for UK Anti Money Laundering Market Market

The UK AML market is poised for continued growth, driven by increasing regulatory pressure, technological advancements, and the evolving landscape of financial crime. Strategic partnerships and investments in innovative solutions will be crucial for companies seeking to capitalize on emerging opportunities. The market’s future will be defined by its ability to adapt to emerging threats and leverage cutting-edge technology to effectively combat money laundering.

UK Anti Money Laundering Market Segmentation

-

1. Solutions

- 1.1. Know Your Customer (KYC) Systems

- 1.2. Compliance Reporting

- 1.3. Transactions Monitoring

- 1.4. Auditing

-

2. Type

- 2.1. Softwares

- 2.2. Solutions

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

-

4. End-User

- 4.1. BFSI's

- 4.2. Government

- 4.3. IT & Telecom

- 4.4. Others

UK Anti Money Laundering Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Anti Money Laundering Market Regional Market Share

Geographic Coverage of UK Anti Money Laundering Market

UK Anti Money Laundering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. UK Ranks in Top for Global Money Laundering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Know Your Customer (KYC) Systems

- 5.1.2. Compliance Reporting

- 5.1.3. Transactions Monitoring

- 5.1.4. Auditing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Softwares

- 5.2.2. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI's

- 5.4.2. Government

- 5.4.3. IT & Telecom

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. North America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 6.1.1. Know Your Customer (KYC) Systems

- 6.1.2. Compliance Reporting

- 6.1.3. Transactions Monitoring

- 6.1.4. Auditing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Softwares

- 6.2.2. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI's

- 6.4.2. Government

- 6.4.3. IT & Telecom

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 7. South America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 7.1.1. Know Your Customer (KYC) Systems

- 7.1.2. Compliance Reporting

- 7.1.3. Transactions Monitoring

- 7.1.4. Auditing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Softwares

- 7.2.2. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI's

- 7.4.2. Government

- 7.4.3. IT & Telecom

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 8. Europe UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 8.1.1. Know Your Customer (KYC) Systems

- 8.1.2. Compliance Reporting

- 8.1.3. Transactions Monitoring

- 8.1.4. Auditing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Softwares

- 8.2.2. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI's

- 8.4.2. Government

- 8.4.3. IT & Telecom

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 9. Middle East & Africa UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 9.1.1. Know Your Customer (KYC) Systems

- 9.1.2. Compliance Reporting

- 9.1.3. Transactions Monitoring

- 9.1.4. Auditing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Softwares

- 9.2.2. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI's

- 9.4.2. Government

- 9.4.3. IT & Telecom

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 10. Asia Pacific UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 10.1.1. Know Your Customer (KYC) Systems

- 10.1.2. Compliance Reporting

- 10.1.3. Transactions Monitoring

- 10.1.4. Auditing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Softwares

- 10.2.2. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. BFSI's

- 10.4.2. Government

- 10.4.3. IT & Telecom

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NICE Actimize

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trulioo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quantexa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Encompass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE System

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LexisNexis Risk Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Passfort

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Refinitive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sanctionscanner

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FullCircl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NICE Actimize

List of Figures

- Figure 1: Global UK Anti Money Laundering Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 3: North America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 4: North America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 7: North America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 13: South America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 14: South America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 15: South America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 17: South America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 18: South America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 23: Europe UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 24: Europe UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 25: Europe UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 27: Europe UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 28: Europe UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 33: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 34: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 37: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 43: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 44: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 45: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 47: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 48: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 2: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 4: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global UK Anti Money Laundering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 7: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 9: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 15: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 17: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 23: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 25: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 37: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 39: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 48: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 49: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 50: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Anti Money Laundering Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the UK Anti Money Laundering Market?

Key companies in the market include NICE Actimize, Trulioo, Quantexa, Encompass, BAE System, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, FullCircl**List Not Exhaustive.

3. What are the main segments of the UK Anti Money Laundering Market?

The market segments include Solutions, Type, Deployment Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

UK Ranks in Top for Global Money Laundering.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, NICE established cooperation with Deutsche Telekom Global Business, a subsidiary of Deutsche Telekom that provides telecommunications and connectivity services to businesses of all kinds, including the government. Deutsche Telekom Global Business is now delivering the CXone portfolio of industry-leading digital and agent-assisted CX solutions across Europe as part of the partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Anti Money Laundering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Anti Money Laundering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Anti Money Laundering Market?

To stay informed about further developments, trends, and reports in the UK Anti Money Laundering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence