Key Insights

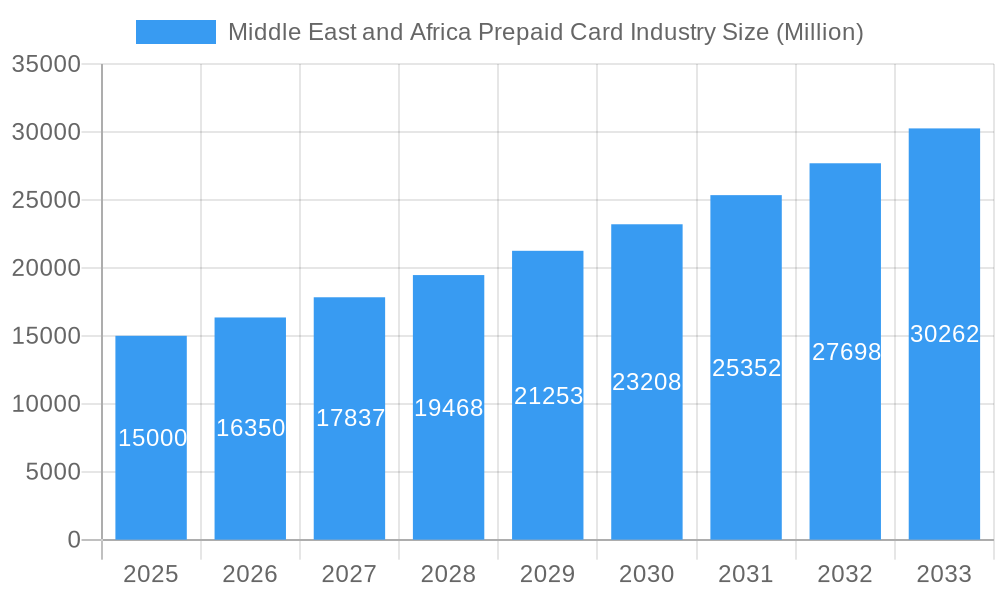

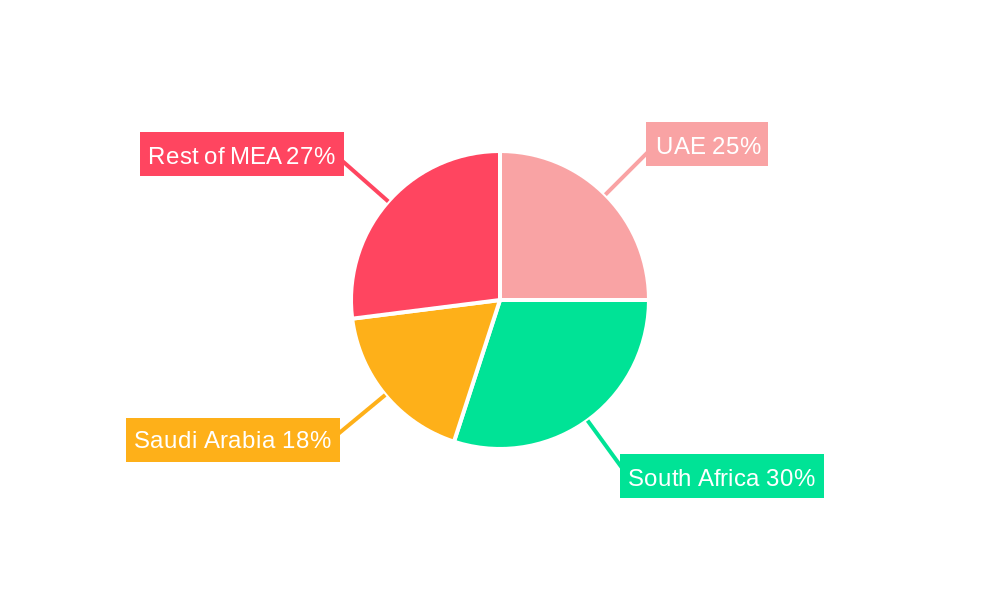

The Middle East and Africa (MEA) prepaid card market is projected for substantial expansion, fueled by robust financial inclusion efforts, a thriving e-commerce landscape, and a growing preference for digital payments. A significant Compound Annual Growth Rate (CAGR) of 11.3% is anticipated between 2025 and 2033. The market is diversified across offering types (general purpose, gift, government, incentive/payroll, and others), card types (closed-loop and open-loop), and end-users (retail, corporate, and government). Notable growth is observed in gift cards, driven by consumer demand for convenient gifting solutions, and government initiatives promoting digital payment adoption for social welfare programs. Leading entities, including Amazon, Visa, and prominent regional financial institutions, are actively innovating within this dynamic sector. Enhanced smartphone penetration and internet accessibility across the MEA region further bolster market growth. South Africa and the UAE currently lead regional adoption due to their advanced digital and financial infrastructures, while other MEA nations present significant untapped growth prospects.

Middle East and Africa Prepaid Card Industry Market Size (In Billion)

The forecast period from 2025 to 2033 indicates sustained market development, potentially at a more stabilized rate as market penetration deepens. Emerging regulatory shifts and economic variances may influence market dynamics. Despite ongoing challenges, such as addressing infrastructural limitations in select areas and enhancing financial literacy, the MEA prepaid card market maintains a positive outlook. Intensified competition among established and new participants is driving innovation in product features, pricing strategies, and distribution networks, thereby benefiting consumers with a wider array of choices.

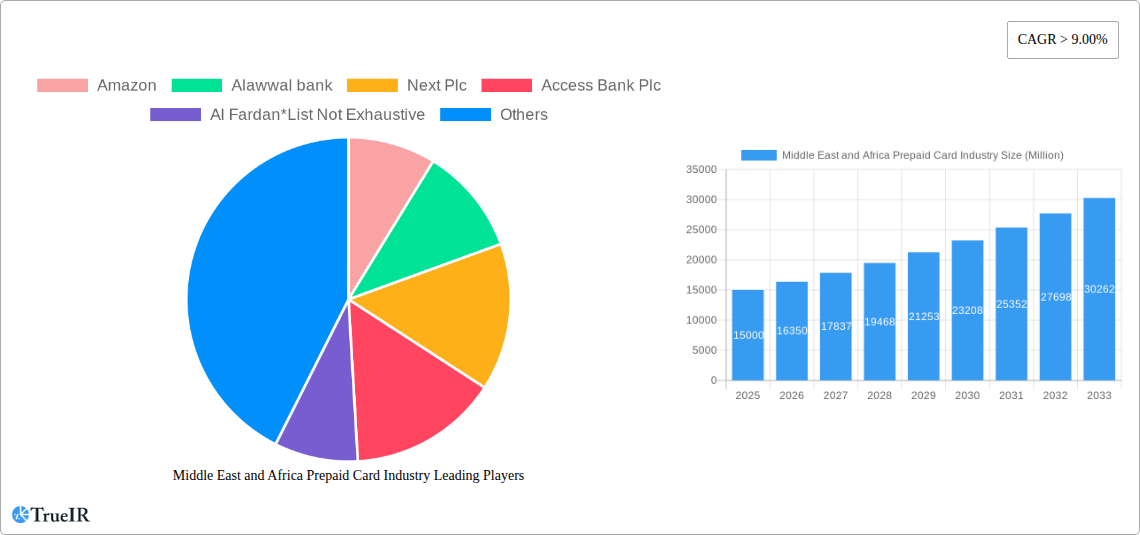

Middle East and Africa Prepaid Card Industry Company Market Share

The MEA prepaid card market is estimated at $44 billion in 2025 and is projected to reach considerable heights by 2033, demonstrating its strong growth trajectory.

Middle East and Africa Prepaid Card Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the Middle East and Africa prepaid card industry, offering invaluable insights for businesses, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to paint a comprehensive picture of this rapidly evolving market. The report projects a market valued at xx Million in 2025, experiencing significant growth throughout the forecast period.

Middle East and Africa Prepaid Card Industry Market Structure & Competitive Landscape

The Middle East and Africa prepaid card market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. Key drivers of innovation include the rising adoption of mobile technology, the increasing demand for financial inclusion, and the expansion of e-commerce. Regulatory impacts vary significantly across the region, with some countries exhibiting more favorable regulatory environments than others. Product substitutes, such as mobile money and other digital payment methods, pose a competitive threat, although prepaid cards retain significant advantages in terms of convenience and security.

End-user segmentation is dominated by the retail sector, which accounts for approximately xx% of the market. Corporate and government segments are also experiencing significant growth, driven by the increasing demand for employee benefits and government disbursement programs. M&A activity has been relatively modest in recent years, with a total transaction value of approximately xx Million recorded between 2019 and 2024. However, increasing industry consolidation is expected in the coming years.

- Market Concentration: HHI of xx in 2024.

- Innovation Drivers: Mobile technology adoption, financial inclusion, e-commerce growth.

- Regulatory Impacts: Vary significantly across countries.

- Product Substitutes: Mobile money, other digital payment methods.

- End-User Segmentation: Retail (xx%), Corporate (xx%), Government (xx%).

- M&A Activity: Total transaction value of xx Million (2019-2024).

Middle East and Africa Prepaid Card Industry Market Trends & Opportunities

The Middle East and Africa prepaid card market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by several factors, including the rapid adoption of smartphones and mobile internet, increasing financial inclusion initiatives by governments across the region, and the rise of e-commerce and digital transactions. Market penetration rates remain relatively low in several key markets, presenting substantial untapped potential. The shift towards digital payments and the integration of fintech solutions are further accelerating market growth. Consumer preferences are leaning towards cards that offer enhanced security features, user-friendly interfaces, and wider acceptance at merchants. Competitive dynamics are characterized by increasing competition from both established players and emerging fintech companies. New entrants are focused on delivering innovative products and services to capture market share.

Dominant Markets & Segments in Middle East and Africa Prepaid Card Industry

The report identifies [Country X] as the leading market within the Middle East and Africa region, primarily driven by its robust economic growth and supportive regulatory environment. Within the segments, the General Purpose prepaid card remains the dominant offering, accounting for xx% of the market share in 2024.

- Key Growth Drivers for [Country X]:

- Rapid economic growth.

- Favorable regulatory environment.

- Strong mobile penetration.

- Key Growth Drivers for General Purpose Cards:

- Versatility and widespread acceptance.

- Convenience for everyday transactions.

- Increasing financial inclusion initiatives.

The Open-Loop card type holds a larger market share compared to Closed-Loop cards due to its broader acceptance and utility. The Retail end-user segment shows strong growth, driven by increasing consumer spending and the expansion of e-commerce platforms.

Middle East and Africa Prepaid Card Industry Product Analysis

Recent product innovations in the Middle East and Africa prepaid card market have focused on enhancing security features, such as biometric authentication and tokenization, and integrating with mobile wallets and other digital payment platforms. These innovations aim to improve user experience, enhance security, and broaden acceptance. The market is also witnessing the rise of prepaid cards tailored to specific segments, such as government-sponsored programs and corporate employee benefits. This specialization is enhancing market fit by addressing niche customer needs and providing targeted value propositions.

Key Drivers, Barriers & Challenges in Middle East and Africa Prepaid Card Industry

Key Drivers: Technological advancements (e.g., mobile payment platforms), economic growth in key markets, and supportive government regulations fostering financial inclusion are primary drivers. For example, the rising adoption of smartphones and mobile internet across the region is expanding the potential customer base for prepaid cards.

Key Challenges: Regulatory complexities and varying standards across different countries create hurdles for market expansion. Supply chain disruptions and the need to invest in robust security infrastructure represent significant challenges. Furthermore, increasing competition from alternative payment methods like mobile money poses a threat. The impact of these challenges could translate to a potential reduction in market growth by xx% if not effectively addressed.

Growth Drivers in the Middle East and Africa Prepaid Card Industry Market

Several factors are propelling growth, including the increasing adoption of mobile technology, government initiatives promoting financial inclusion, and the expanding e-commerce sector. For instance, the launch of mobile money platforms and the proliferation of digital wallets are expanding the reach of prepaid cards. Economic growth in several key markets also contributes to increased spending and demand for convenient payment solutions.

Challenges Impacting Middle East and Africa Prepaid Card Industry Growth

Significant challenges include regulatory hurdles in certain markets, which may hinder market entry and expansion. Supply chain disruptions can impact the availability and timely distribution of prepaid cards, while intense competition from other digital payment methods necessitates continuous innovation and investment.

Key Players Shaping the Middle East and Africa Prepaid Card Industry Market

- Amazon

- Alawwal bank

- Next Plc

- Access Bank Plc

- Al Fardan

- Capitec Bank

- Wal-mart Stores Inc

- Equity Bank

- First Abu Dhabi Bank

- Visa

- American Express

Significant Middle East and Africa Prepaid Card Industry Industry Milestones

- September 2022: Launch of Telda prepaid cards in Egypt, powered by Mastercard, marking a significant partnership between a fintech startup and a major bank.

- April 2022: OPay Egypt receives approval from the Central Bank of Egypt to issue prepaid cards through its app, signifying regulatory support for fintech innovation.

Future Outlook for Middle East and Africa Prepaid Card Industry Market

The future outlook for the Middle East and Africa prepaid card industry is positive, driven by continued technological advancements, supportive government policies, and expanding financial inclusion. Strategic opportunities exist in developing innovative card products tailored to specific market segments and strengthening partnerships with mobile network operators and fintech companies. The market's potential for growth remains considerable, particularly in under-banked regions where prepaid cards offer convenient access to financial services.

Middle East and Africa Prepaid Card Industry Segmentation

-

1. Offering

- 1.1. General Purpose

- 1.2. Gift Card

- 1.3. Government Card

- 1.4. Incentive/ Payroll

- 1.5. Others

-

2. Card Type

- 2.1. Closed- Loop Card

- 2.2. Open- Loop Card

-

3. End- User

- 3.1. Retail

- 3.2. Corporate

- 3.3. Government

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Regional Market Share

Geographic Coverage of Middle East and Africa Prepaid Card Industry

Middle East and Africa Prepaid Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Digital and Mobile Banking is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. General Purpose

- 5.1.2. Gift Card

- 5.1.3. Government Card

- 5.1.4. Incentive/ Payroll

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Card Type

- 5.2.1. Closed- Loop Card

- 5.2.2. Open- Loop Card

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Retail

- 5.3.2. Corporate

- 5.3.3. Government

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of the Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. South Africa

- 5.5.4. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Saudi Arabia Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. General Purpose

- 6.1.2. Gift Card

- 6.1.3. Government Card

- 6.1.4. Incentive/ Payroll

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Card Type

- 6.2.1. Closed- Loop Card

- 6.2.2. Open- Loop Card

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Retail

- 6.3.2. Corporate

- 6.3.3. Government

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. South Africa

- 6.4.4. Rest of the Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. United Arab Emirates Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. General Purpose

- 7.1.2. Gift Card

- 7.1.3. Government Card

- 7.1.4. Incentive/ Payroll

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Card Type

- 7.2.1. Closed- Loop Card

- 7.2.2. Open- Loop Card

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Retail

- 7.3.2. Corporate

- 7.3.3. Government

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. South Africa

- 7.4.4. Rest of the Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. South Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. General Purpose

- 8.1.2. Gift Card

- 8.1.3. Government Card

- 8.1.4. Incentive/ Payroll

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Card Type

- 8.2.1. Closed- Loop Card

- 8.2.2. Open- Loop Card

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Retail

- 8.3.2. Corporate

- 8.3.3. Government

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. South Africa

- 8.4.4. Rest of the Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the Middle East and Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. General Purpose

- 9.1.2. Gift Card

- 9.1.3. Government Card

- 9.1.4. Incentive/ Payroll

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Card Type

- 9.2.1. Closed- Loop Card

- 9.2.2. Open- Loop Card

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Retail

- 9.3.2. Corporate

- 9.3.3. Government

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. South Africa

- 9.4.4. Rest of the Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Amazon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alawwal bank

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Next Plc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Access Bank Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Fardan*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Capitec Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wal-mart Stores Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Equity Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 First Abu Dhabi Bank

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Visa

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 American Express

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Amazon

List of Figures

- Figure 1: Middle East and Africa Prepaid Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Prepaid Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 3: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 8: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 9: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 12: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 13: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 14: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 17: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 18: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 19: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 22: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 23: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 24: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Prepaid Card Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the Middle East and Africa Prepaid Card Industry?

Key companies in the market include Amazon, Alawwal bank, Next Plc, Access Bank Plc, Al Fardan*List Not Exhaustive, Capitec Bank, Wal-mart Stores Inc, Equity Bank, First Abu Dhabi Bank, Visa, American Express.

3. What are the main segments of the Middle East and Africa Prepaid Card Industry?

The market segments include Offering, Card Type, End- User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Digital and Mobile Banking is Driving the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

In September 2022, One of Egypt's leading banks and a fintech company jointly created Telda prepaid cards, which were powered by Mastercard's debut. The ground-breaking payment solution is the result of a fruitful partnership between Telda, a rapidly expanding Egyptian fintech start-up, and Banque du Caire, one of the nation's top financial institutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Prepaid Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Prepaid Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Prepaid Card Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Prepaid Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence