Key Insights

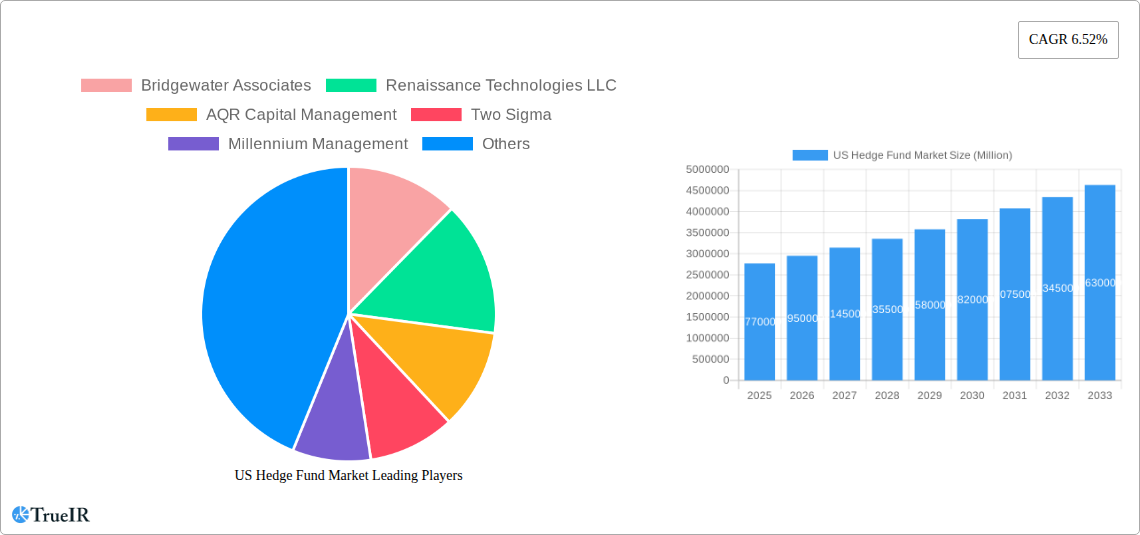

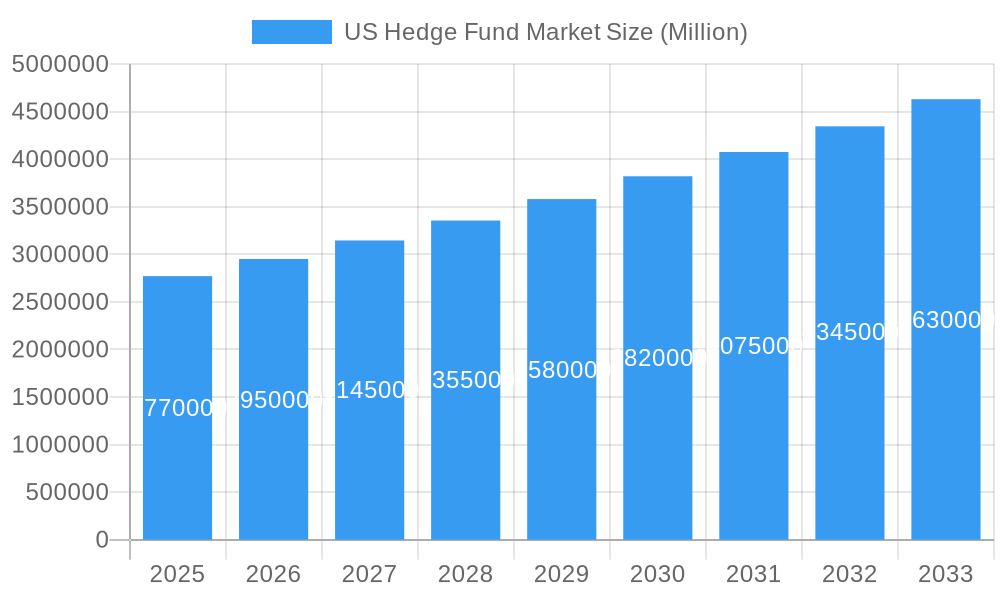

The US hedge fund market, currently valued at $2.77 trillion (2025), is projected to experience robust growth, driven by increasing investor interest in alternative investment strategies and the pursuit of higher returns compared to traditional asset classes. A compound annual growth rate (CAGR) of 6.52% from 2025 to 2033 suggests a significant expansion in market size over the forecast period. This growth is fueled by several factors. The persistent low-interest-rate environment continues to incentivize investors to seek higher-yielding investments, and sophisticated quantitative strategies employed by many firms are attracting significant capital inflows. Furthermore, the increasing complexity of global financial markets demands specialized expertise offered by hedge fund managers, further bolstering demand. However, regulatory scrutiny and the potential for increased fees remain challenges. Competition among firms is intense, with established players like Bridgewater Associates, Renaissance Technologies, and BlackRock vying for market share alongside emerging managers who leverage innovative strategies and technologies. The market’s segmentation, while not explicitly detailed, likely reflects the diverse investment strategies employed, including long/short equity, global macro, and event-driven strategies, each exhibiting varying growth trajectories. The geographic concentration is likely heavily skewed towards major financial centers within the US, such as New York and Connecticut.

US Hedge Fund Market Market Size (In Million)

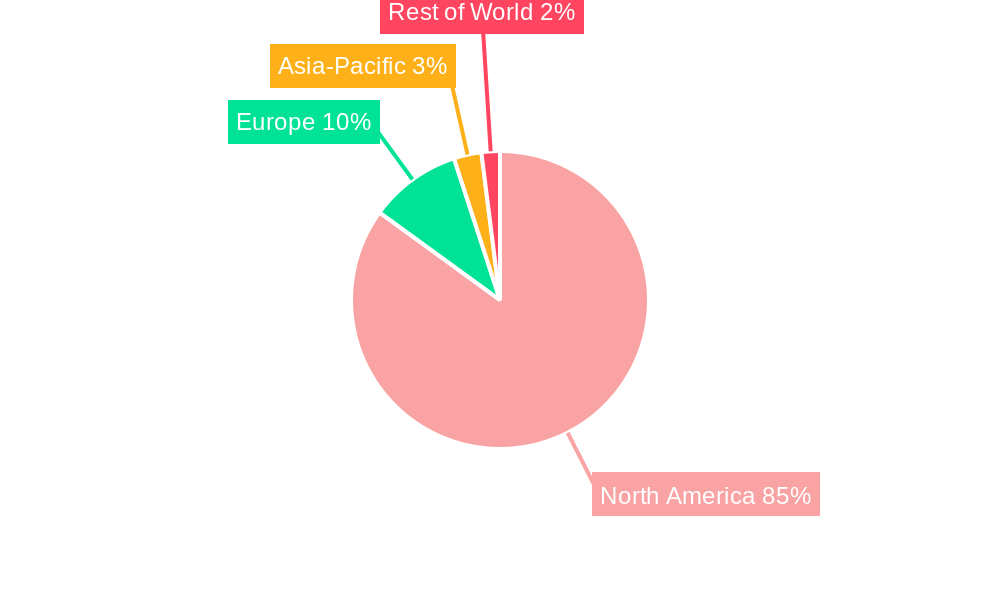

The projected CAGR of 6.52% translates to substantial growth throughout the forecast period. While precise regional breakdowns are unavailable, it's reasonable to anticipate a continued concentration of assets in North America, given the dominance of US-based hedge funds. However, the global nature of many hedge fund investments will likely lead to some growth in other regions, but at a likely slower pace than the US market. Future market performance will hinge on macroeconomic conditions, investor sentiment, and the ability of hedge fund managers to consistently deliver alpha, exceeding benchmark returns. Regulation and evolving investor preferences will also play a significant role in shaping the landscape of the US hedge fund market over the coming decade.

US Hedge Fund Market Company Market Share

US Hedge Fund Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the US Hedge Fund Market, covering market structure, competitive dynamics, growth trends, and future outlook from 2019 to 2033. The study incorporates detailed financial data, industry insights, and expert analysis to offer a complete picture of this dynamic sector. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an invaluable resource for investors, industry professionals, and anyone seeking to understand the intricacies of the US hedge fund landscape.

US Hedge Fund Market Market Structure & Competitive Landscape

The US hedge fund market is characterized by a highly concentrated structure, with a few dominant players controlling a significant share of assets under management (AUM). While precise concentration ratios fluctuate, it's estimated that the top 10 firms control upwards of 40% of the total AUM, exceeding xx Million. This concentration is driven by economies of scale, access to superior talent and technology, and established network effects.

Innovation within the sector is heavily influenced by technological advancements, particularly in areas like artificial intelligence (AI), machine learning (ML), and high-frequency trading (HFT). Regulatory changes, such as increased scrutiny of fees and risk management practices, also play a significant role in shaping the market. Product substitutes are limited, mainly consisting of other alternative investment strategies like private equity or venture capital. End-user segmentation comprises high-net-worth individuals, institutional investors (pension funds, endowments), and family offices. M&A activity is moderately high but varies across economic cycles. The historical period (2019-2024) saw approximately xx M&A deals, with a noticeable increase in consolidation among smaller firms seeking to enhance scale and capabilities. This trend is projected to continue, though possibly at a slower rate than previously seen.

US Hedge Fund Market Market Trends & Opportunities

The US hedge fund market experienced significant growth throughout the historical period (2019-2024), with the total AUM expanding to an estimated xx Million by 2024. This growth is attributed to several factors: a favorable regulatory environment (relative to other markets), consistent demand from institutional investors seeking diversification and higher returns, and ongoing innovation in investment strategies and technologies. The projected Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated at xx%, driven by increasing institutional investor participation and the continuing exploration of alternative investment strategies to mitigate risk within traditional portfolios. Market penetration, while high in certain segments (e.g., institutional investors), still presents opportunities for expansion into newer markets, including retail investors (albeit with significant regulatory hurdles). The increasing integration of technology, particularly AI and ML, presents substantial opportunities for enhancing risk management, improving portfolio allocation, and optimizing trading strategies. However, this technological advancement also creates a competitive landscape where firms must continuously adapt and invest to maintain their edge.

Dominant Markets & Segments in US Hedge Fund Market

The US hedge fund market is largely dominated by geographically concentrated hubs such as New York City, Connecticut, and California, which account for an estimated xx% of total AUM. These regions benefit from a concentration of skilled labor, established financial infrastructure, and access to capital.

- Key Growth Drivers in Dominant Regions:

- Access to a large pool of highly skilled professionals.

- Established financial infrastructure and regulatory framework.

- Proximity to major institutional investors.

- Strong networks and relationships within the financial community.

- Supportive government policies encouraging financial innovation.

The dominance of these regions is expected to continue during the forecast period, although some growth is anticipated in other regions with burgeoning financial technology and innovation ecosystems, such as Texas. However, the geographic concentration of AUM poses challenges to those firms who are not headquartered in those hubs.

US Hedge Fund Market Product Analysis

Product innovation in the US hedge fund market is primarily driven by the adoption of advanced technological tools, including quantitative and qualitative models, AI, and ML, for portfolio management and trading. These tools allow for improved risk assessment, algorithmic trading, and the development of sophisticated investment strategies tailored to specific market conditions. The successful implementation of these technological advancements hinges on effective integration with existing infrastructure and the development of skilled teams capable of utilizing these complex tools. Competitive advantages increasingly stem from data analytics capabilities and the ability to adapt quickly to rapidly changing market dynamics.

Key Drivers, Barriers & Challenges in US Hedge Fund Market

Key Drivers: The primary drivers propelling the US hedge fund market include increasing demand for alternative investment strategies, technological advancements, and a relatively supportive regulatory environment (compared to some other countries). The growing sophistication of quantitative strategies and the increased use of data analytics contribute significantly. Institutional investors, looking to diversify their portfolios and secure higher risk-adjusted returns, represent a substantial growth engine.

Challenges: The key challenges include regulatory scrutiny, increasing competitive pressure, and the complexity of managing substantial AUM across diverse investment strategies. Regulatory changes, such as stricter reporting requirements and increased compliance costs, present ongoing obstacles. Furthermore, the highly competitive nature of the market necessitates continual innovation and a commitment to attracting and retaining top talent to remain competitive. Supply chain disruptions, while not directly impacting the core hedge fund business model, can indirectly affect performance via reduced market liquidity.

Growth Drivers in the US Hedge Fund Market Market

Technological advancements, particularly in AI and machine learning, are key drivers, enabling enhanced risk management, algorithmic trading, and the development of sophisticated investment strategies. Increased institutional investor participation and the search for higher-yielding investments contribute significantly. A relatively supportive regulatory environment (compared to some international markets) helps foster growth. Growing demand from high-net-worth individuals also fuels market expansion.

Challenges Impacting US Hedge Fund Market Growth

Regulatory complexities and evolving compliance requirements present significant hurdles, increasing operational costs and potentially hindering innovation. Intense competition among established players and new entrants necessitates continuous adaptation and investment in talent and technology to maintain a competitive edge. Supply chain issues indirectly impact performance through market volatility and liquidity constraints.

Key Players Shaping the US Hedge Fund Market Market

Significant US Hedge Fund Market Industry Milestones

- October 2022: Divya Nettimi launched a hedge fund with over USD 1 Billion in commitments, marking a significant milestone for women in the industry. This event highlighted the growing importance of diversity and inclusion within the hedge fund sector.

- January 2024: The partnership between the Palm Beach Hedge Fund Association (PBHFA) and Entoro aims to enhance deal flow and distribution for hedge funds operating in South Florida. This collaboration signals a trend toward increased cooperation and synergy within the industry.

Future Outlook for US Hedge Fund Market Market

The US hedge fund market is poised for continued growth, driven by persistent demand from institutional investors, technological innovation, and a relatively stable regulatory environment. Strategic opportunities exist in areas such as AI-driven investment strategies, sustainable investing, and the exploration of new asset classes. The market's potential is substantial, with the potential for expansion into new geographic areas and the continued diversification of investment strategies.

US Hedge Fund Market Segmentation

-

1. Core Investment Strategies

- 1.1. Equity Strategies

- 1.2. Macro Strategies

- 1.3. Event Driven Strategies

- 1.4. Credit Strategies

- 1.5. Relative Value Strategies

- 1.6. Niche Strategies

- 1.7. Multi-Strategy

- 1.8. Managed Futures/CTA Strategies

US Hedge Fund Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Hedge Fund Market Regional Market Share

Geographic Coverage of US Hedge Fund Market

US Hedge Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Positive Trends in Equity Market is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Positive Trends in Equity Market is Driving the Market

- 3.4. Market Trends

- 3.4.1. Rise of the Crypto Hedge Funds in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 5.1.1. Equity Strategies

- 5.1.2. Macro Strategies

- 5.1.3. Event Driven Strategies

- 5.1.4. Credit Strategies

- 5.1.5. Relative Value Strategies

- 5.1.6. Niche Strategies

- 5.1.7. Multi-Strategy

- 5.1.8. Managed Futures/CTA Strategies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6. North America US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6.1.1. Equity Strategies

- 6.1.2. Macro Strategies

- 6.1.3. Event Driven Strategies

- 6.1.4. Credit Strategies

- 6.1.5. Relative Value Strategies

- 6.1.6. Niche Strategies

- 6.1.7. Multi-Strategy

- 6.1.8. Managed Futures/CTA Strategies

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7. South America US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7.1.1. Equity Strategies

- 7.1.2. Macro Strategies

- 7.1.3. Event Driven Strategies

- 7.1.4. Credit Strategies

- 7.1.5. Relative Value Strategies

- 7.1.6. Niche Strategies

- 7.1.7. Multi-Strategy

- 7.1.8. Managed Futures/CTA Strategies

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8. Europe US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8.1.1. Equity Strategies

- 8.1.2. Macro Strategies

- 8.1.3. Event Driven Strategies

- 8.1.4. Credit Strategies

- 8.1.5. Relative Value Strategies

- 8.1.6. Niche Strategies

- 8.1.7. Multi-Strategy

- 8.1.8. Managed Futures/CTA Strategies

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9. Middle East & Africa US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9.1.1. Equity Strategies

- 9.1.2. Macro Strategies

- 9.1.3. Event Driven Strategies

- 9.1.4. Credit Strategies

- 9.1.5. Relative Value Strategies

- 9.1.6. Niche Strategies

- 9.1.7. Multi-Strategy

- 9.1.8. Managed Futures/CTA Strategies

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10. Asia Pacific US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10.1.1. Equity Strategies

- 10.1.2. Macro Strategies

- 10.1.3. Event Driven Strategies

- 10.1.4. Credit Strategies

- 10.1.5. Relative Value Strategies

- 10.1.6. Niche Strategies

- 10.1.7. Multi-Strategy

- 10.1.8. Managed Futures/CTA Strategies

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bridgewater Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renaissance Technologies LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AQR Capital Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Two Sigma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Millennium Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elliott Investment Management

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BlackRock Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Citadel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Davidson Kempner Capital Management

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 D E Shaw & Co **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bridgewater Associates

List of Figures

- Figure 1: Global US Hedge Fund Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Hedge Fund Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 4: North America US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 5: North America US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 6: North America US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 7: North America US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 9: North America US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 12: South America US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 13: South America US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 14: South America US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 15: South America US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: South America US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 20: Europe US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 21: Europe US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 22: Europe US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 23: Europe US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 28: Middle East & Africa US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 29: Middle East & Africa US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 30: Middle East & Africa US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 31: Middle East & Africa US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 36: Asia Pacific US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 37: Asia Pacific US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 38: Asia Pacific US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 39: Asia Pacific US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 2: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 3: Global US Hedge Fund Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Hedge Fund Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 6: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 7: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 9: United States US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 11: Canada US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 16: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 17: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Argentina US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 26: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 27: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Germany US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: France US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Italy US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Spain US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Russia US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Benelux US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Nordics US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 48: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 49: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 51: Turkey US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Israel US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: GCC US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: North Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: South Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 64: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 65: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 67: China US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: India US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Japan US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: South Korea US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: Oceania US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Hedge Fund Market?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the US Hedge Fund Market?

Key companies in the market include Bridgewater Associates, Renaissance Technologies LLC, AQR Capital Management, Two Sigma, Millennium Management, Elliott Investment Management, BlackRock Inc, Citadel, Davidson Kempner Capital Management, D E Shaw & Co **List Not Exhaustive.

3. What are the main segments of the US Hedge Fund Market?

The market segments include Core Investment Strategies.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Positive Trends in Equity Market is Driving the Market.

6. What are the notable trends driving market growth?

Rise of the Crypto Hedge Funds in United States.

7. Are there any restraints impacting market growth?

Positive Trends in Equity Market is Driving the Market.

8. Can you provide examples of recent developments in the market?

January 2024: The Palm Beach Hedge Fund Association (PBHFA), the premier trade association for investors and financial professionals in South Florida, and Entoro, a leading boutique finance and investment banking group, announced a strategic partnership to improve deal distribution for hedge funds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Hedge Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Hedge Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Hedge Fund Market?

To stay informed about further developments, trends, and reports in the US Hedge Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence