Key Insights

The European casino gambling market is poised for significant expansion, propelled by the escalating adoption of online platforms and mobile accessibility. Innovations in virtual and augmented reality are enhancing player immersion and driving engagement. Favorable regulatory frameworks across European nations are fostering a more secure and competitive environment, encouraging investment and innovation. Increased disposable income among younger demographics, coupled with strategic marketing efforts, further contributes to market momentum. While regulatory complexities and responsible gambling initiatives present ongoing considerations, the market exhibits a strong upward trajectory.

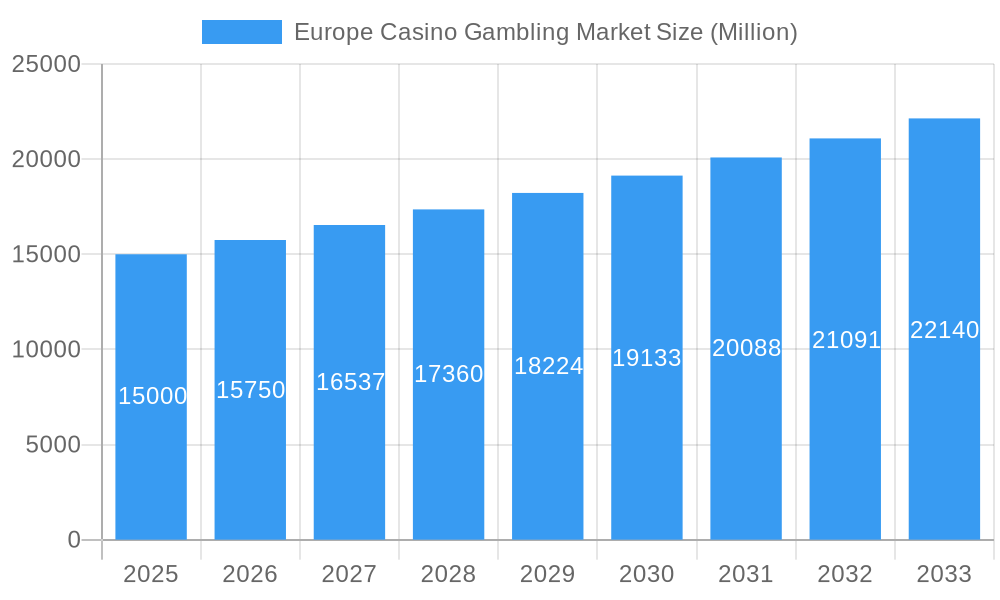

Europe Casino Gambling Market Market Size (In Billion)

Key growth drivers for the European casino gambling market include increasing disposable incomes, technological advancements, and the growing preference for online and mobile gaming. The projected Compound Annual Growth Rate (CAGR) is estimated at 14.18%. The market size was valued at $80.13 billion in the base year 2025 and is expected to reach significant future valuation. However, stringent regulatory requirements and the imperative for responsible gaming practices may pose challenges. Intense industry competition and economic volatility also influence market performance. Despite these factors, the outlook remains robust, driven by technological integration and novel gaming experiences.

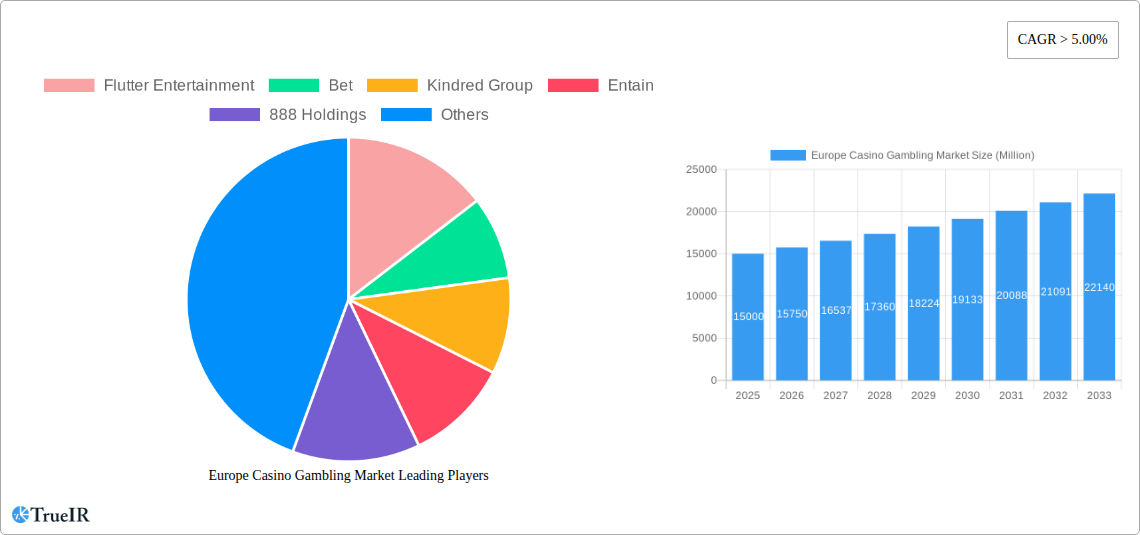

Europe Casino Gambling Market Company Market Share

Europe Casino Gambling Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the European casino gambling market, offering invaluable insights for investors, industry professionals, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines market size, trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis and incorporates recent industry developments to paint a comprehensive picture of this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting a compelling CAGR of xx%.

Europe Casino Gambling Market Market Structure & Competitive Landscape

The European casino gambling market is characterized by a complex interplay of established giants and emerging players. Market concentration is moderate, with a few dominant players holding significant market share, but with increasing fragmentation due to the rise of niche online operators and the expansion of mobile gaming. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2025, indicating a moderately concentrated market. Innovation is a key driver, with companies continuously developing new games, platforms, and technologies to enhance the player experience. Regulatory landscapes vary significantly across European countries, creating both opportunities and challenges. The market also faces pressure from substitute forms of entertainment, such as online video games and social media. The end-user segment is diverse, ranging from casual players to high-rollers, each with different preferences and spending habits.

Mergers and acquisitions (M&A) activity is frequent, reflecting the industry's consolidation trends. The volume of M&A deals in the European casino gambling market totaled approximately xx Million in 2024, with a significant portion driven by online gaming companies seeking to expand their geographical reach and product portfolios. Key M&A trends include:

- Consolidation among online gaming operators.

- Acquisition of smaller regional operators by larger multinational companies.

- Strategic partnerships to leverage technological expertise and distribution networks.

Europe Casino Gambling Market Market Trends & Opportunities

The European casino gambling market is witnessing significant growth, driven by several key trends. The market size, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%. Technological advancements, particularly the proliferation of mobile gaming and the adoption of virtual reality (VR) and augmented reality (AR) technologies, are transforming the player experience. Consumer preferences are shifting towards more personalized and immersive gaming experiences. The rise of esports and the integration of gaming into social platforms are also creating new opportunities. Competitive dynamics are intensifying, with companies investing heavily in marketing, product development, and technological innovation to gain a competitive edge. Market penetration rates for online casino gaming are rising steadily across most European countries, reflecting the growing acceptance and adoption of online gambling platforms. This growth, however, is tempered by increasing regulatory scrutiny and the need for responsible gambling initiatives.

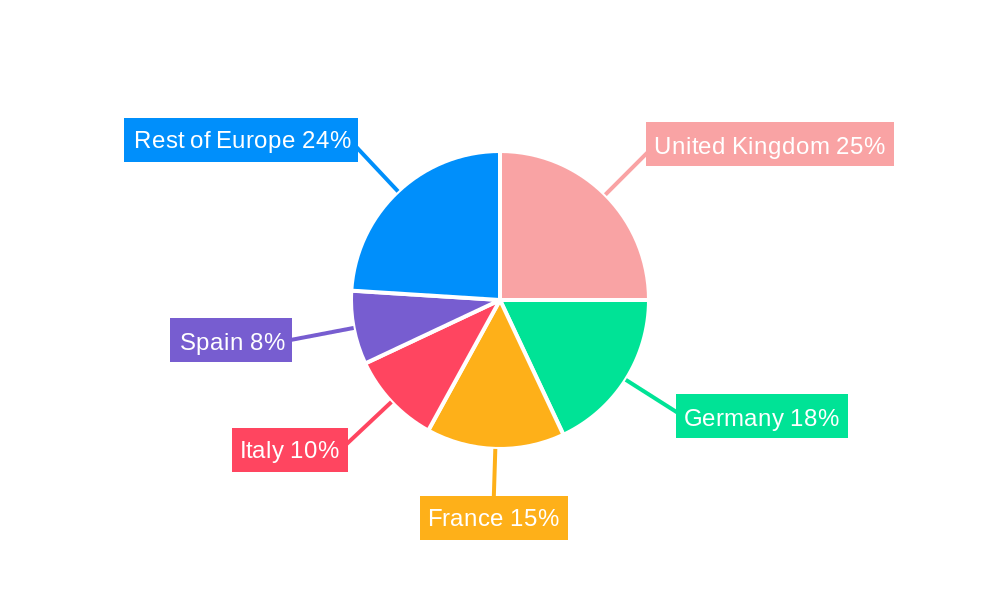

Dominant Markets & Segments in Europe Casino Gambling Market

The United Kingdom remains a dominant market, accounting for xx% of the total European market revenue in 2025, followed by Germany and France. This dominance is fueled by a combination of factors:

- Mature regulatory framework: Established legal and regulatory frameworks provide a stable environment for the industry's development.

- High internet and mobile penetration: High rates of internet and smartphone usage among the population facilitate online gambling participation.

- Strong consumer spending: A relatively higher disposable income contributes to higher spending on entertainment, including gambling.

Other key markets experiencing substantial growth include Spain, Italy, and Sweden, driven by similar factors. The online segment dominates the market, capturing xx% of the total revenue in 2025, significantly surpassing the land-based segment.

Europe Casino Gambling Market Product Analysis

The market offers a diverse range of products, including slots, table games (poker, blackjack, roulette), and live dealer games. Technological advancements such as enhanced graphics, immersive sound effects, and sophisticated game mechanics are driving product innovation. The integration of mobile gaming, social features, and loyalty programs enhances user engagement. The competitive advantage lies in offering a compelling combination of game selection, user experience, and responsible gambling features.

Key Drivers, Barriers & Challenges in Europe Casino Gambling Market

Key Drivers: The increasing adoption of online and mobile gaming platforms, coupled with the growing popularity of esports and the introduction of innovative game formats are key growth drivers. Favorable regulatory changes in some European countries, coupled with advancements in technology (AI, VR/AR) are further fueling this growth.

Challenges: Stringent regulatory requirements and licensing processes across different jurisdictions present significant hurdles. The need for robust anti-money laundering and responsible gambling measures also creates operational complexities. Intense competition, coupled with fluctuating economic conditions, is another factor impacting market stability. Supply chain disruptions, particularly in the production of hardware and software components, may hinder growth.

Growth Drivers in the Europe Casino Gambling Market Market

The rising popularity of online gaming, particularly on mobile devices, is a significant driver. Technological innovations, such as virtual reality (VR) and augmented reality (AR), enhance user experience, attracting new players. Easing of regulations in some markets creates new opportunities for expansion, further accelerating market growth.

Challenges Impacting Europe Casino Gambling Market Growth

Regulatory hurdles vary significantly across different European countries, creating complexities for operators seeking to expand. Stringent responsible gambling regulations increase compliance costs and may limit market growth. Intense competition from existing and new entrants creates price pressures and reduces profit margins.

Key Players Shaping the Europe Casino Gambling Market Market

- Flutter Entertainment

- Bet

- Kindred Group

- Entain

- 888 Holdings

- MyStake

- PlayOJO

- Spin Casino

- Evolution Gaming

- International Game Technology

- Aristocrat

- Draft Kings

Significant Europe Casino Gambling Market Industry Milestones

- September 2023: Flutter Entertainment acquired a 51% stake in MaxBet for €141 Million, expanding its reach into Serbia and potentially other fast-growing markets.

- July 2023: Bet365 extended its sponsorship agreement with UFC, strengthening its brand presence and enhancing its betting experience in several key European markets.

Future Outlook for Europe Casino Gambling Market Market

The European casino gambling market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic acquisitions. Opportunities exist in expanding into new markets, developing innovative gaming products, and leveraging data analytics to personalize the player experience. Responsible gambling initiatives will play a crucial role in shaping the industry’s future trajectory and ensuring sustainable growth.

Europe Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Other Types

-

2. Application

- 2.1. Online

- 2.2. Offline

Europe Casino Gambling Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Casino Gambling Market Regional Market Share

Geographic Coverage of Europe Casino Gambling Market

Europe Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Internet Penetration is Driving the Market

- 3.4. Market Trends

- 3.4.1. Online Casino Gambling is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flutter Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kindred Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Entain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 888 Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MyStake

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PlayOJO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spin Casino

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evolution Gaming

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Game Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aristocrat

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Draft Kings**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Flutter Entertainment

List of Figures

- Figure 1: Global Europe Casino Gambling Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Germany Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Germany Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Germany Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Germany Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 9: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: United Kingdom Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 11: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: United Kingdom Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 15: France Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: France Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 17: France Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: France Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Italy Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Italy Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Italy Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Italy Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Europe Casino Gambling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Casino Gambling Market?

The projected CAGR is approximately 14.18%.

2. Which companies are prominent players in the Europe Casino Gambling Market?

Key companies in the market include Flutter Entertainment, Bet, Kindred Group, Entain, 888 Holdings, MyStake, PlayOJO, Spin Casino, Evolution Gaming, International Game Technology, Aristocrat, Draft Kings**List Not Exhaustive.

3. What are the main segments of the Europe Casino Gambling Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 80.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Casino Gambling is Driving the Market.

7. Are there any restraints impacting market growth?

Internet Penetration is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Flutter made the acquisition of an initial 51% stake in MaxBet, Serbia's omni-channel sports betting and gaming operator, for a cash consideration of euros 141 million. MaxBet will likely provide Flutter with the platform to access fast-growing markets via a podium brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Europe Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence