Key Insights

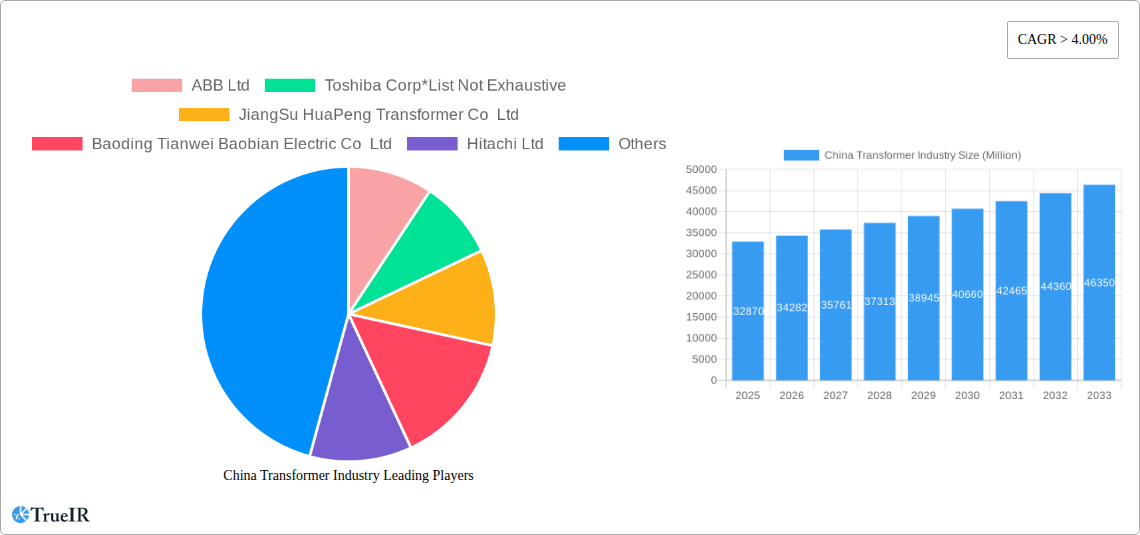

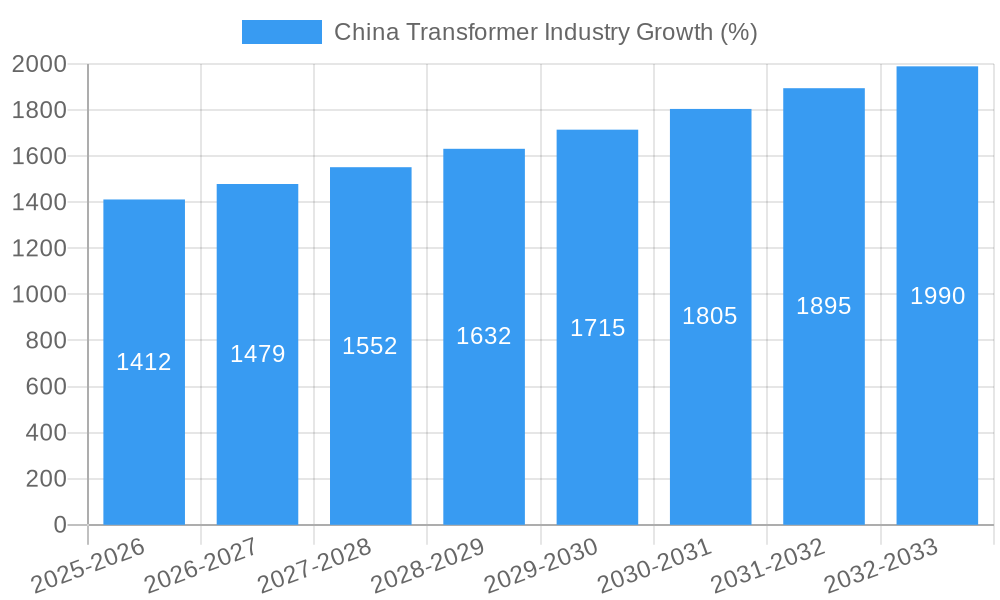

The China transformer industry, valued at $32.87 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, China's ongoing investments in infrastructure development, particularly in its power grid modernization and expansion of renewable energy sources, are creating significant demand for transformers. The increasing adoption of smart grids and the electrification of transportation and industries further contribute to this demand. Secondly, technological advancements in transformer design, including the development of more efficient and compact models, are driving market growth. The shift towards energy-efficient solutions, driven by environmental concerns and government regulations, is also a major impetus. Segmentation within the market reveals strong demand across various power ratings (small, medium, and large), cooling types (air-cooled and oil-cooled), and transformer types (power and distribution). Leading players like ABB, Toshiba, Hitachi, and Siemens are actively competing in this dynamic market, leveraging their technological expertise and established distribution networks to capture market share.

However, the industry also faces certain challenges. Rising raw material costs, particularly for copper and steel, pose a significant constraint on profitability. Intense competition among domestic and international manufacturers necessitates continuous innovation and cost optimization strategies. Furthermore, stringent environmental regulations regarding the disposal of used transformers require manufacturers to adopt sustainable practices and invest in recycling technologies. Despite these challenges, the long-term outlook for the China transformer industry remains positive, driven by the country's continued economic growth, its commitment to renewable energy, and the ongoing modernization of its power infrastructure. The market's resilience and growth potential are likely to attract further investment and innovation in the coming years.

China Transformer Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the booming China transformer industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive market research and data analysis covering the period 2019-2033, this report unveils the key trends, opportunities, and challenges shaping this multi-billion dollar market. We project a xx Million market value in 2025, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

China Transformer Industry Market Structure & Competitive Landscape

The China transformer industry exhibits a moderately concentrated market structure, with a few major global players and numerous domestic manufacturers vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies investing heavily in R&D to develop energy-efficient, smart transformers and advanced materials. Regulatory policies, including energy efficiency standards and grid modernization initiatives, significantly influence market dynamics. Product substitutes, such as advanced power electronics, pose a moderate threat, while mergers and acquisitions (M&A) activity remains relatively high, with an estimated xx Million in M&A volume in 2024. End-user segmentation includes power generation, transmission & distribution, and industrial sectors.

- Market Concentration: Moderately concentrated, with a HHI of xx in 2024.

- Innovation Drivers: R&D in energy efficiency, smart grids, and advanced materials.

- Regulatory Impacts: Stringent energy efficiency standards and grid modernization plans.

- Product Substitutes: Emerging technologies like advanced power electronics.

- M&A Activity: Significant, with approximately xx Million in M&A volume in 2024.

- End-User Segmentation: Power generation, transmission & distribution, industrial sectors.

China Transformer Industry Market Trends & Opportunities

The China transformer market is experiencing robust growth fueled by large-scale infrastructure development, urbanization, and the increasing demand for electricity. Technological advancements, such as the adoption of smart grid technologies and the development of more efficient transformer designs, are driving market expansion. Consumer preferences are shifting towards energy-efficient and environmentally friendly transformers, creating significant opportunities for manufacturers. The market's competitive dynamics are marked by both intense domestic competition and the presence of major international players. Market penetration rates for advanced transformer technologies remain relatively low, presenting opportunities for growth.

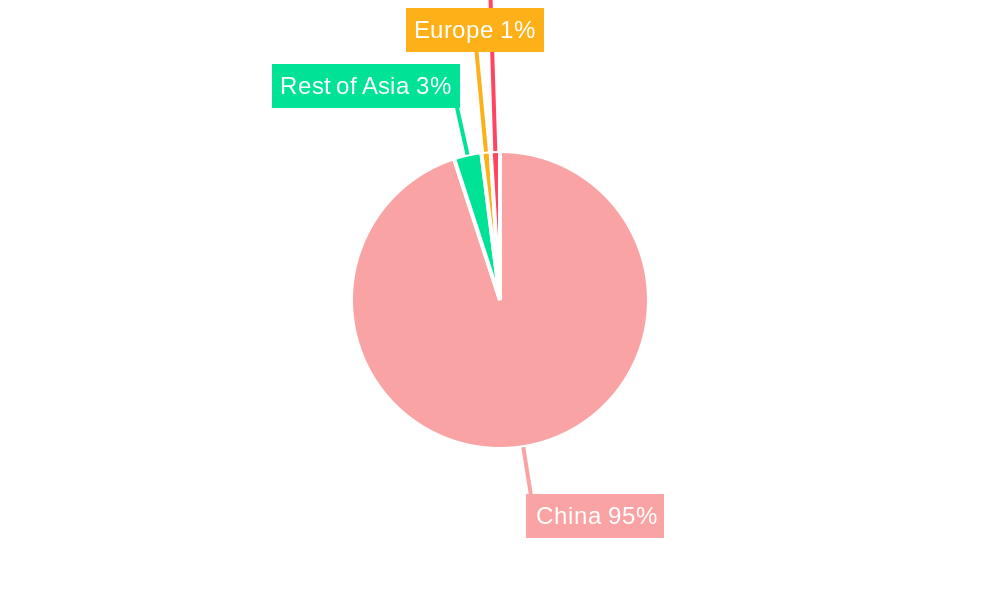

Dominant Markets & Segments in China Transformer Industry

The market is dominated by the Eastern region of China due to rapid urbanization and industrial expansion. Within the various segments, the Large power rating segment exhibits the fastest growth, driven by the expanding power transmission and distribution infrastructure. Oil-cooled transformers retain a significant market share due to their established reliability, although air-cooled transformers are witnessing increased adoption owing to their higher efficiency and environmental benefits. Power transformers command a larger market share compared to distribution transformers, reflecting the substantial investments in high-voltage transmission lines.

- Leading Region: Eastern China

- Fastest-Growing Segment (Power Rating): Large

- Largest Market Share (Cooling Type): Oil-cooled

- Largest Market Share (Transformer Type): Power Transformer

- Key Growth Drivers: Infrastructure development, urbanization, and grid modernization.

China Transformer Industry Product Analysis

Technological advancements are driving innovation in the China transformer industry. Manufacturers are focusing on energy-efficient designs, enhanced reliability, and smart grid integration. Key product innovations include the integration of digital technologies, advanced cooling systems, and the use of high-strength materials. This focus on improved efficiency, reliability, and smart grid compatibility ensures better market fit, driving demand across diverse industrial and utility applications.

Key Drivers, Barriers & Challenges in China Transformer Industry

Key Drivers:

- Government initiatives promoting grid modernization and renewable energy integration.

- Rapid urbanization and industrial expansion driving electricity demand.

- Technological advancements leading to higher efficiency and reliability.

Challenges:

- Intense competition from domestic and international players.

- Supply chain disruptions impacting raw material availability and production costs (estimated impact: xx Million in 2024).

- Stringent environmental regulations impacting production processes.

Growth Drivers in the China Transformer Industry Market

Key growth drivers include significant investments in grid infrastructure modernization, expanding renewable energy integration projects, and the increasing adoption of smart grid technologies. Government support for technological innovation and energy efficiency further fuels market expansion.

Challenges Impacting China Transformer Industry Growth

Challenges include the intense competition among domestic and international players, potential supply chain disruptions impacting production costs, and the need to comply with stringent environmental regulations.

Key Players Shaping the China Transformer Industry Market

- ABB Ltd

- Toshiba Corp

- Jiangsu HuaPeng Transformer Co Ltd

- Baoding Tianwei Baobian Electric Co Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Panasonic Corporation

Significant China Transformer Industry Industry Milestones

- November 2022: Successful installation of the first domestically-built converter transformer with on-load tap changers in a major west-to-east power transmission project in Guangdong Province. This breakthrough demonstrates China's mastery of key high-end electric equipment technologies.

- March 2022: The State Grid Corporation of China (SGCC) ordered two 110 kV, 63 MVA EconiQ™ power transformers from Hitachi Energy for a sustainable substation project in Jiangsu Province, highlighting the growing adoption of eco-friendly technologies.

Future Outlook for China Transformer Industry Market

The China transformer market is poised for continued robust growth driven by sustained infrastructure investment, expanding renewable energy capacity, and the ongoing modernization of the national power grid. Strategic opportunities exist for manufacturers who can develop and deliver energy-efficient, technologically advanced, and cost-competitive transformers. The market's potential is significant, with projected growth exceeding xx Million by 2033.

China Transformer Industry Segmentation

-

1. Power Rating

- 1.1. Small

- 1.2. Large

- 1.3. Medium

-

2. Cooling Type

- 2.1. Air-Cooled

- 2.2. Oil-Cooled

-

3. Transformer Type

- 3.1. Power Transformer

- 3.2. Distribution Transformer

China Transformer Industry Segmentation By Geography

- 1. China

China Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Distribution Transformer Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Small

- 5.1.2. Large

- 5.1.3. Medium

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air-Cooled

- 5.2.2. Oil-Cooled

- 5.3. Market Analysis, Insights and Forecast - by Transformer Type

- 5.3.1. Power Transformer

- 5.3.2. Distribution Transformer

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corp*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JiangSu HuaPeng Transformer Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Baoding Tianwei Baobian Electric Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: China Transformer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Transformer Industry Share (%) by Company 2024

List of Tables

- Table 1: China Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Transformer Industry Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 3: China Transformer Industry Revenue Million Forecast, by Cooling Type 2019 & 2032

- Table 4: China Transformer Industry Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 5: China Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Transformer Industry Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 8: China Transformer Industry Revenue Million Forecast, by Cooling Type 2019 & 2032

- Table 9: China Transformer Industry Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 10: China Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Transformer Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the China Transformer Industry?

Key companies in the market include ABB Ltd, Toshiba Corp*List Not Exhaustive, JiangSu HuaPeng Transformer Co Ltd, Baoding Tianwei Baobian Electric Co Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, General Electric Company, Panasonic Corporation.

3. What are the main segments of the China Transformer Industry?

The market segments include Power Rating, Cooling Type, Transformer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.87 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Distribution Transformer Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

November 2022: An major west-to-east power transmission project in Guangdong Province, South China, successfully installed the first convertor transformer using on-load tap changers built in China. This signifies that China has successfully overcome the limitations imposed by this key technology in high-end electric equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Transformer Industry?

To stay informed about further developments, trends, and reports in the China Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence