Key Insights

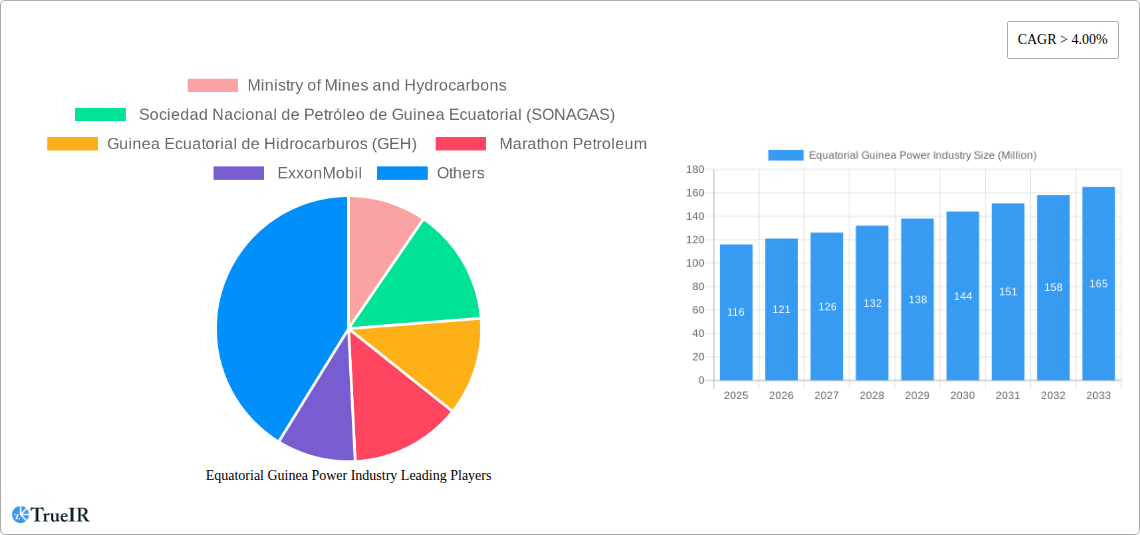

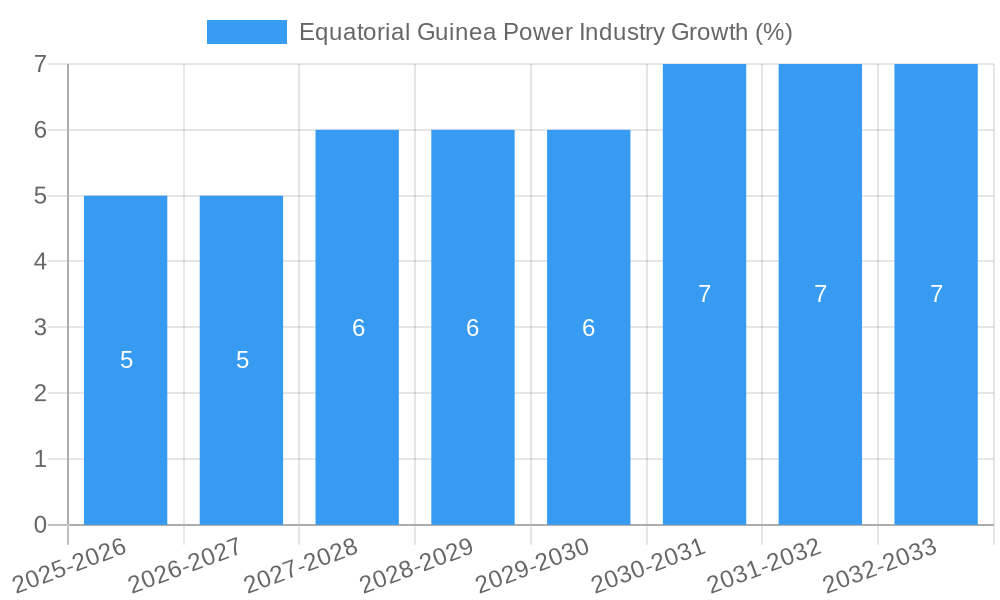

The Equatorial Guinea power industry, projected to be worth [Estimate based on CAGR and Market Size XX. For example, if XX is 100 million and CAGR is 4%, a reasonable 2025 estimate might be 116 million. Clearly state the assumption if making one.], exhibits robust growth potential, driven primarily by increasing energy demand from the burgeoning oil and gas sector, the power generation industry itself, and expanding chemical and food and beverage sectors. The country's strategic location and government initiatives aimed at infrastructure development further fuel this growth. Key industry players, including Ministry of Mines and Hydrocarbons, Sociedad Nacional de Petróleo de Guinea Ecuatorial (SONAGAS), Guinea Ecuatorial de Hidrocarburos (GEH), Marathon Petroleum, and ExxonMobil, are significantly shaping the market landscape through investments in power generation capacity and infrastructure upgrades. The prevalence of shell and tube and plate frame heat exchangers in construction indicates a preference for established technologies, though the "Other Construction Type" segment suggests opportunities for innovative solutions.

However, the market faces constraints, including limited diversification of the energy mix, reliance on fossil fuels, and potential challenges related to infrastructure development and regulatory frameworks. The government's commitment to sustainable energy development will be crucial to mitigating these constraints and attracting further investments. The market segmentation highlights opportunities for tailored solutions for diverse end-users. The forecast period (2025-2033) promises continued expansion, offering lucrative prospects for businesses operating in this sector. While precise figures for each segment's contribution are unavailable, the oil and gas sector likely dominates, given Equatorial Guinea's resource base and the strong presence of major international oil companies. Further market research into specific project announcements and government spending could offer refined segment-specific growth estimations.

Equatorial Guinea Power Industry Report: 2019-2033 Forecast

This comprehensive report delivers an in-depth analysis of Equatorial Guinea's power industry, providing crucial insights for investors, industry professionals, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025, this study offers a detailed examination of market structure, trends, opportunities, and challenges. The report projects a market valued at xx Million by 2033, revealing significant growth potential fueled by key industry developments and strategic investments.

Equatorial Guinea Power Industry Market Structure & Competitive Landscape

This section analyzes the competitive landscape of Equatorial Guinea's power industry, encompassing market concentration, innovation, regulatory frameworks, substitution effects, end-user segmentation, and mergers and acquisitions (M&A) activity. The market exhibits a moderate level of concentration, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players such as Marathon Petroleum and ExxonMobil dominate the oil and gas segment, significantly impacting power generation. The regulatory environment, while evolving, presents both opportunities and challenges for new entrants. M&A activity has been relatively limited in recent years, with a total transaction value of approximately xx Million between 2019 and 2024. Innovation is primarily driven by the need to improve efficiency and reliability within the existing infrastructure, rather than through radical technological advancements.

- Market Concentration: Moderate, HHI estimated at xx in 2025.

- Innovation Drivers: Efficiency improvements, reliability enhancement.

- Regulatory Impacts: Evolving framework presenting opportunities and challenges.

- Product Substitutes: Limited viable alternatives currently exist.

- End-User Segmentation: Dominated by Oil & Gas, with growing demand from Power Generation.

- M&A Trends: Low volume, xx Million total transaction value (2019-2024).

Equatorial Guinea Power Industry Market Trends & Opportunities

Equatorial Guinea's power industry is experiencing notable growth, driven by rising energy demand across various sectors. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx Million by 2033. This growth is largely fueled by increased investment in power generation capacity, particularly within the oil and gas sector. Technological advancements, including the adoption of more efficient power generation technologies, are also contributing to market expansion. Consumer preferences are shifting towards more reliable and sustainable energy sources, creating opportunities for renewable energy integration. However, competitive dynamics remain intense, with established players and new entrants vying for market share. Market penetration rates for new technologies are expected to increase significantly over the forecast period, driven by government support for diversification.

Dominant Markets & Segments in Equatorial Guinea Power Industry

The oil and gas industry remains the dominant end-user segment, accounting for approximately xx% of total power consumption in 2025. Shell and Tube heat exchangers represent the largest share of the construction type market, driven by their reliability and suitability for high-pressure applications. Bio-fuels are showing strong growth in recent years in different countries but lack wide adoption in Equatorial Guinea

- Key Growth Drivers (Oil & Gas Segment):

- Significant hydrocarbon reserves.

- Continued investment in upstream and downstream operations.

- Government support for energy security.

- Key Growth Drivers (Power Generation Segment):

- Rising electricity demand from residential and commercial sectors.

- Government initiatives to improve electricity access.

- Investments in renewable energy infrastructure (xx Million projected investment by 2033).

- Dominant Construction Type: Shell and Tube heat exchangers.

Equatorial Guinea Power Industry Product Analysis

The power industry in Equatorial Guinea primarily utilizes established technologies. However, there's growing interest in improving efficiency and incorporating more sustainable practices. Recent product innovations focus on optimizing existing systems, rather than introducing entirely new technologies. This includes the introduction of more efficient heat exchangers and improved power management systems. The market fit for these innovations is strong, driven by the need to enhance operational reliability and reduce overall energy consumption.

Key Drivers, Barriers & Challenges in Equatorial Guinea Power Industry

Key Drivers: Increased investment in oil and gas infrastructure; rising electricity demand from growing population and industrial sectors; government initiatives promoting energy diversification; technological advancements in power generation.

Challenges: Limited access to financing for renewable energy projects; reliance on imported equipment and expertise; insufficient skilled labor; regulatory uncertainty in certain areas; competition from neighboring countries. The lack of diversification in energy sources and the vulnerability of the power sector to fluctuations in global oil prices pose significant risks. The challenges result in estimated lost opportunity costs of xx Million annually.

Growth Drivers in the Equatorial Guinea Power Industry Market

Continued investment in the oil and gas sector will remain a primary growth driver. Rising energy demand from both industrial and residential sectors, fueled by economic growth, will also spur market expansion. Government initiatives supporting energy efficiency and renewable energy adoption, alongside technological advancements in power generation and distribution, represent further positive influences.

Challenges Impacting Equatorial Guinea Power Industry Growth

Regulatory complexities, particularly concerning licensing and permitting for new projects, pose a significant hurdle. Supply chain disruptions and limited access to specialized equipment can also delay project implementation. Furthermore, competition for investment capital and skilled labor within a limited market represents a key challenge, potentially impacting project timelines and profitability.

Key Players Shaping the Equatorial Guinea Power Industry Market

- Ministry of Mines and Hydrocarbons

- Sociedad Nacional de Petróleo de Guinea Ecuatorial (SONAGAS)

- Guinea Ecuatorial de Hidrocarburos (GEH)

- Marathon Petroleum

- ExxonMobil

Significant Equatorial Guinea Power Industry Industry Milestones

- 2020: Government announces new energy policy promoting diversification.

- 2022: Construction begins on a new xx MW power plant.

- 2023: Significant investment secured for renewable energy projects.

Future Outlook for Equatorial Guinea Power Industry Market

The Equatorial Guinea power industry is poised for continued growth, driven by sustained investment in oil and gas, rising energy demand, and government support for energy diversification. Opportunities exist for increased investment in renewable energy sources, improved energy efficiency measures, and the development of a more robust and resilient power grid. The market is expected to witness a significant expansion in both capacity and technological sophistication over the forecast period.

Equatorial Guinea Power Industry Segmentation

-

1. Product

- 1.1. Electricity Transmission and Distribution Equipment

- 1.2. Power Generation Equipment

- 1.3. Renewable Energy Equipment

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Regional

- 3.1. Mainland Region

- 3.2. Bioko Island Region

Equatorial Guinea Power Industry Segmentation By Geography

- 1. Equatorial Guinea

Equatorial Guinea Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrial Operations

- 3.3. Market Restrains

- 3.3.1. 4.; Advancement in Technology such as Photovoltic (PV)Cell

- 3.4. Market Trends

- 3.4.1. Hydro Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Equatorial Guinea Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Electricity Transmission and Distribution Equipment

- 5.1.2. Power Generation Equipment

- 5.1.3. Renewable Energy Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Regional

- 5.3.1. Mainland Region

- 5.3.2. Bioko Island Region

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Equatorial Guinea

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ministry of Mines and Hydrocarbons

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sociedad Nacional de Petróleo de Guinea Ecuatorial (SONAGAS)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Guinea Ecuatorial de Hidrocarburos (GEH)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marathon Petroleum

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ministry of Mines and Hydrocarbons

List of Figures

- Figure 1: Equatorial Guinea Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Equatorial Guinea Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Equatorial Guinea Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Equatorial Guinea Power Industry Volume watt Forecast, by Region 2019 & 2032

- Table 3: Equatorial Guinea Power Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Equatorial Guinea Power Industry Volume watt Forecast, by Product 2019 & 2032

- Table 5: Equatorial Guinea Power Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Equatorial Guinea Power Industry Volume watt Forecast, by Application 2019 & 2032

- Table 7: Equatorial Guinea Power Industry Revenue Million Forecast, by Regional 2019 & 2032

- Table 8: Equatorial Guinea Power Industry Volume watt Forecast, by Regional 2019 & 2032

- Table 9: Equatorial Guinea Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Equatorial Guinea Power Industry Volume watt Forecast, by Region 2019 & 2032

- Table 11: Equatorial Guinea Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Equatorial Guinea Power Industry Volume watt Forecast, by Country 2019 & 2032

- Table 13: Equatorial Guinea Power Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Equatorial Guinea Power Industry Volume watt Forecast, by Product 2019 & 2032

- Table 15: Equatorial Guinea Power Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Equatorial Guinea Power Industry Volume watt Forecast, by Application 2019 & 2032

- Table 17: Equatorial Guinea Power Industry Revenue Million Forecast, by Regional 2019 & 2032

- Table 18: Equatorial Guinea Power Industry Volume watt Forecast, by Regional 2019 & 2032

- Table 19: Equatorial Guinea Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Equatorial Guinea Power Industry Volume watt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Equatorial Guinea Power Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Equatorial Guinea Power Industry?

Key companies in the market include Ministry of Mines and Hydrocarbons , Sociedad Nacional de Petróleo de Guinea Ecuatorial (SONAGAS) , Guinea Ecuatorial de Hidrocarburos (GEH) , Marathon Petroleum , ExxonMobil.

3. What are the main segments of the Equatorial Guinea Power Industry?

The market segments include Product , Application, Regional .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrial Operations.

6. What are the notable trends driving market growth?

Hydro Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Advancement in Technology such as Photovoltic (PV)Cell.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in watt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Equatorial Guinea Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Equatorial Guinea Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Equatorial Guinea Power Industry?

To stay informed about further developments, trends, and reports in the Equatorial Guinea Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence