Key Insights

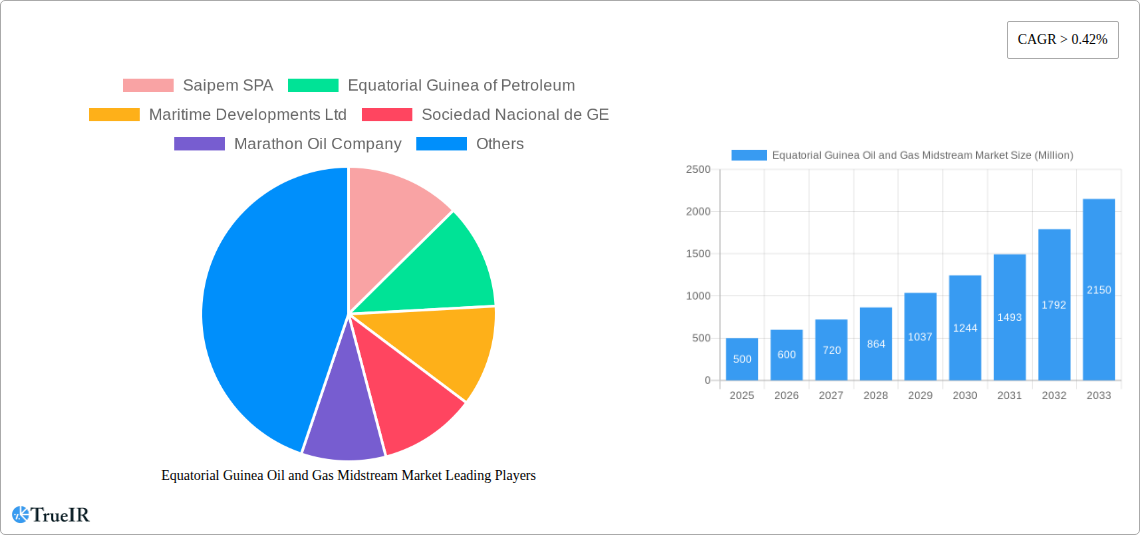

The Equatorial Guinea oil and gas midstream market, encompassing transportation, storage, LNG terminals, and handling of crude oil, natural gas, and refined products, presents a dynamic landscape with significant growth potential. Driven by increasing domestic energy demand and strategic investments in infrastructure development, the market is projected to experience sustained expansion throughout the forecast period (2025-2033). The Gulf of Guinea region's strategic location and existing infrastructure provide a solid foundation for growth. Key players like Saipem SPA, Equatorial Guinea of Petroleum, and Marathon Oil Company are actively involved, shaping the competitive dynamics. While challenges such as fluctuating global oil prices and potential geopolitical uncertainties exist, the overall market outlook remains positive, underpinned by ongoing exploration activities and government initiatives aimed at boosting energy production and infrastructure modernization.

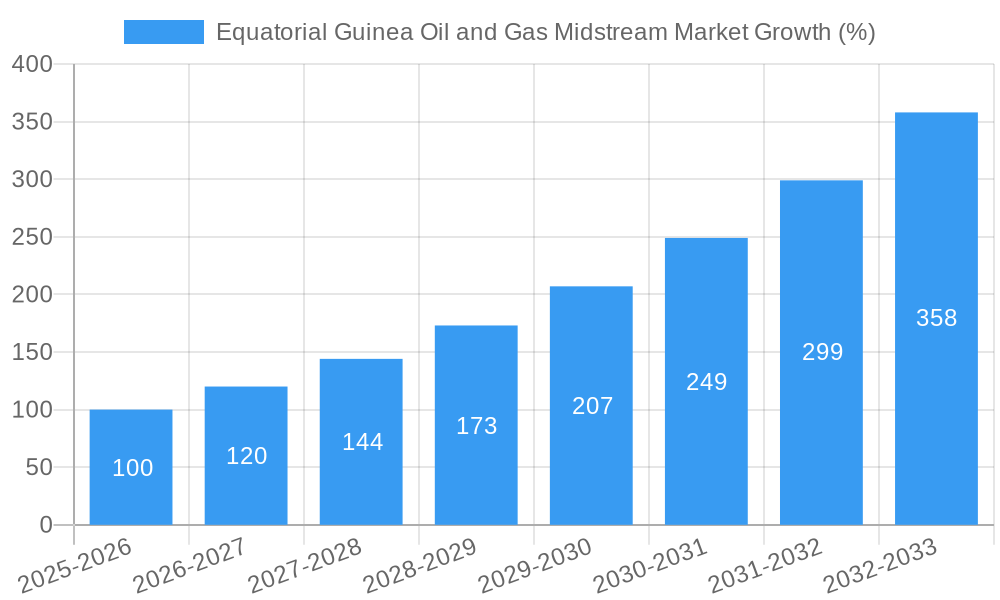

The market's Compound Annual Growth Rate (CAGR) of >0.42 suggests a steady, albeit moderate, growth trajectory. Considering the global energy market trends and the specific context of Equatorial Guinea, a conservative estimate of the market size in 2025 could be around $500 million (this is an estimation, not based on explicit data from the provided text). Given the CAGR, this figure could reasonably increase to approximately $600 million by 2026, reflecting incremental investments in infrastructure and increased production capacity. Further expansion is likely, driven by both domestic consumption and potential export opportunities. However, challenges such as the need for further investment in infrastructure, regulatory hurdles, and potential environmental concerns must be considered in long-term projections. The segmentation by product type (crude oil, natural gas, refined products) and the focus on the Gulf of Guinea region offer targeted growth opportunities for investors and market participants.

Equatorial Guinea Oil and Gas Midstream Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Equatorial Guinea oil and gas midstream market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report meticulously examines market structure, competitive dynamics, growth drivers, and challenges. Key segments analyzed include transportation, storage, and LNG terminals, focusing on crude oil, natural gas, and refined products within the Gulf of Guinea region.

Keywords: Equatorial Guinea, Oil and Gas, Midstream, Market Report, Transportation, Storage, LNG Terminals, Crude Oil, Natural Gas, Refined Products, Gulf of Guinea, Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, Marathon Oil Company, Market Size, CAGR, Market Share, Investment Opportunities, Industry Analysis, Forecast, Competitive Landscape.

Equatorial Guinea Oil and Gas Midstream Market Structure & Competitive Landscape

This section analyzes the market concentration, highlighting the roles of key players such as Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, and Marathon Oil Company. We delve into the innovative drivers shaping the market, regulatory impacts influencing operations, and the presence of substitute products. The analysis includes a detailed examination of end-user segmentation and the prevalent M&A trends within the sector. Quantitative data, including concentration ratios and M&A transaction volumes (estimated at xx Million for the period 2019-2024), are presented alongside qualitative insights to provide a holistic understanding of the competitive landscape. The report identifies the top three companies by market share in 2025 as [Company Names with estimated % market share, if data is available otherwise, use xx%], illustrating the level of market concentration. Furthermore, the report assesses the impact of regulatory changes and analyzes the potential for future mergers and acquisitions in the sector. The section concludes with a discussion of factors driving innovation within the midstream sector in Equatorial Guinea, including advancements in technology and the need for greater efficiency.

Equatorial Guinea Oil and Gas Midstream Market Trends & Opportunities

This section explores the market size growth trajectory from 2019-2033, projecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The analysis examines technological shifts, such as the adoption of digitalization and automation, and their influence on market dynamics. An assessment of consumer preferences, including the increasing demand for cleaner energy sources and the growing focus on environmental sustainability, is incorporated. Competitive dynamics, including strategic alliances and partnerships, are analyzed, highlighting the market penetration rates of key players. The total market value is estimated at xx Million in 2025 and projected to reach xx Million by 2033.

Dominant Markets & Segments in Equatorial Guinea Oil and Gas Midstream Market

This section pinpoints the leading segments within the Equatorial Guinea oil and gas midstream market. We identify the dominant region (Gulf of Guinea) and analyze the performance of key segments (Transportation, Storage, LNG Terminals) based on product type (Crude oil, Natural gas, Refined products).

- Key Growth Drivers:

- Expanding infrastructure development projects.

- Favorable government policies and regulations supporting midstream activities.

- Increasing demand for oil and gas both domestically and for export.

- Investments in new technologies to improve efficiency and reduce environmental impact.

The analysis provides detailed insight into the market dominance of each segment, supported by quantitative data on market share and volume. The section identifies [Specific segment - e.g., Crude Oil Transportation] as the dominant segment in 2025, explaining its market leadership through factors such as existing infrastructure, projected growth in production, and export potential.

Equatorial Guinea Oil and Gas Midstream Market Product Analysis

This section explores product innovations, detailing technological advancements in storage and transportation solutions. The analysis focuses on applications of these innovations, highlighting their competitive advantages within the Equatorial Guinean market. Examples include the implementation of advanced pipeline monitoring systems to enhance safety and efficiency, and the adoption of new technologies to minimize environmental impact during transportation and storage. The report emphasizes the market fit of these innovations, considering factors such as cost-effectiveness, environmental impact, and regulatory compliance.

Key Drivers, Barriers & Challenges in Equatorial Guinea Oil and Gas Midstream Market

Key Drivers:

- Technological advancements in pipeline technology, storage facilities, and LNG processing.

- Growing domestic and export demand for oil and gas.

- Government initiatives to improve infrastructure and attract foreign investment.

Challenges and Restraints:

- Regulatory hurdles: Complex permitting processes and changing regulatory frameworks can lead to delays and increased costs. The impact of this is estimated to reduce market growth by xx% in 2027.

- Supply chain constraints: Limited access to specialized equipment and skilled labor can hinder project implementation and increase costs.

- Competitive pressures: The presence of international and national players can intensify competition and put downward pressure on prices.

Growth Drivers in the Equatorial Guinea Oil and Gas Midstream Market Market

Key growth drivers include increased investment in infrastructure projects, governmental support for the energy sector, technological advancements, and rising domestic and export demand. The country's strategic location in the Gulf of Guinea also contributes to its attractiveness as a regional hub for oil and gas midstream activities.

Challenges Impacting Equatorial Guinea Oil and Gas Midstream Market Growth

Challenges include navigating complex regulatory processes, ensuring sufficient skilled labor, managing supply chain disruptions, and addressing environmental concerns related to oil and gas operations. These factors can impede investment, slow project development, and ultimately constrain market growth.

Key Players Shaping the Equatorial Guinea Oil and Gas Midstream Market Market

- Saipem SPA

- Equatorial Guinea of Petroleum

- Maritime Developments Ltd

- Sociedad Nacional de GE

- Marathon Oil Company

Significant Equatorial Guinea Oil and Gas Midstream Market Industry Milestones

- 2021 Q4: Launch of a new pipeline expansion project by [Company Name].

- 2022 Q2: Government approval of new regulations aimed at streamlining project approvals.

- 2023 Q1: Announcement of a major LNG terminal investment by [Company Name]. (Note: Replace bracketed information with actual data if available).

Future Outlook for Equatorial Guinea Oil and Gas Midstream Market Market

The Equatorial Guinea oil and gas midstream market is poised for continued growth driven by ongoing infrastructure development, increased demand, and technological advancements. Strategic opportunities exist for companies to capitalize on the expanding market by focusing on efficient, environmentally conscious operations and collaborating with the government to foster sustainable growth. The market's potential is further enhanced by its strategic location and favorable geopolitical conditions. This promising outlook indicates a strong potential for investment and expansion in the coming years.

Equatorial Guinea Oil and Gas Midstream Market Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

Equatorial Guinea Oil and Gas Midstream Market Segmentation By Geography

- 1. Equatorial Guinea

Equatorial Guinea Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in the Tidal Energy Sector and Upcoming Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Power Source

- 3.4. Market Trends

- 3.4.1. Pipeline Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Equatorial Guinea Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Equatorial Guinea

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Saipem SPA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equatorial Guinea of Petroleum

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Maritime Developments Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sociedad Nacional de GE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marathon Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Saipem SPA

List of Figures

- Figure 1: Equatorial Guinea Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Equatorial Guinea Oil and Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 4: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 5: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 6: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 7: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 8: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 9: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 14: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 15: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 16: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 17: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 18: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 19: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Equatorial Guinea Oil and Gas Midstream Market?

The projected CAGR is approximately > 0.42%.

2. Which companies are prominent players in the Equatorial Guinea Oil and Gas Midstream Market?

Key companies in the market include Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, Marathon Oil Company.

3. What are the main segments of the Equatorial Guinea Oil and Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in the Tidal Energy Sector and Upcoming Projects.

6. What are the notable trends driving market growth?

Pipeline Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Power Source.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Equatorial Guinea Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Equatorial Guinea Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Equatorial Guinea Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Equatorial Guinea Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence