Key Insights

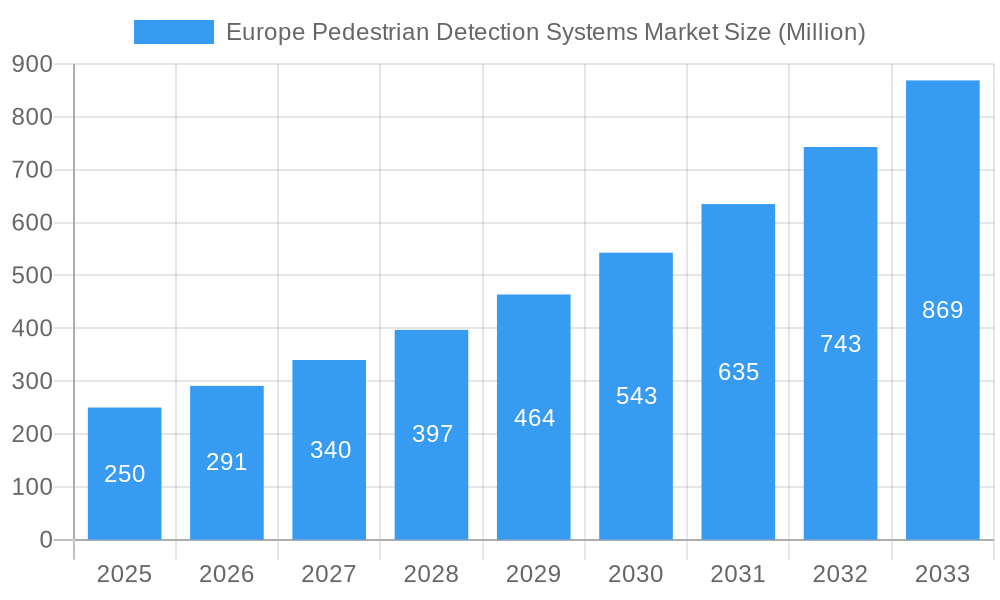

The European pedestrian detection systems market is poised for significant expansion, driven by enhanced road safety imperatives and rapid advancements in sensor and AI technologies. Projected to grow at a Compound Annual Growth Rate (CAGR) of 7.15% from 2025 to 2033, the market is estimated to reach $15.46 billion by the end of the forecast period. Stringent regulatory mandates across Europe, requiring advanced driver-assistance systems (ADAS) with integrated pedestrian detection in new vehicles, are primary growth catalysts. The escalating adoption of autonomous vehicles (AVs), where robust pedestrian detection is paramount for safe operation, further fuels this expansion. Innovations in sensor fusion, combining radar, cameras, and infrared technologies, are continuously improving system accuracy and reliability, boosting market demand. Segmentation by system type, including video-based, infrared, and hybrid solutions, highlights diverse market applications. Germany, France, the UK, and Italy represent key markets due to their established automotive sectors and proactive regulatory environments.

Europe Pedestrian Detection Systems Market Market Size (In Billion)

Challenges to market growth include the substantial initial investment required for advanced system implementation, potentially impacting smaller automotive manufacturers. The intricate integration of diverse sensor technologies and seamless data fusion also presents a technical hurdle. Additionally, addressing data privacy and cybersecurity concerns associated with pedestrian data collection is crucial for broader market acceptance. Despite these obstacles, the unwavering focus on improving road safety and ongoing technological evolution in pedestrian detection systems are expected to drive considerable market growth. The future trajectory will be shaped by effective mitigation of these challenges and the development of more advanced, cost-efficient, and dependable solutions.

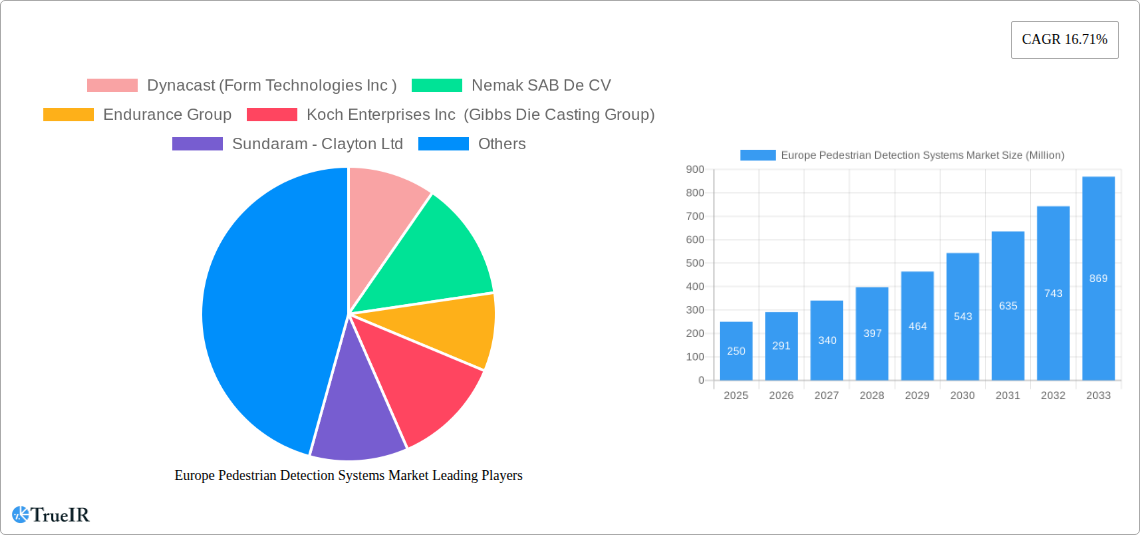

Europe Pedestrian Detection Systems Market Company Market Share

Europe Pedestrian Detection Systems Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Europe Pedestrian Detection Systems Market, offering invaluable insights for industry stakeholders. From market sizing and segmentation to competitive landscapes and future projections, this comprehensive study unravels the key trends shaping this crucial sector. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033.

Europe Pedestrian Detection Systems Market Market Structure & Competitive Landscape

The Europe Pedestrian Detection Systems Market is characterized by a moderately concentrated competitive landscape, with a few major players holding significant market share, but with a number of smaller, more specialized companies also contributing. The market concentration ratio (CR4) is estimated at xx%, indicating moderate competition. Innovation plays a pivotal role, driven by advancements in sensor technology, AI-powered algorithms, and the demand for enhanced safety features in vehicles. Stringent regulations regarding pedestrian safety in Europe significantly influence market dynamics, pushing for the adoption of advanced pedestrian detection systems. Product substitutes are limited, primarily consisting of traditional driver-based observation, which is less reliable and effective. The end-user segment is predominantly comprised of automotive manufacturers, with a growing contribution from fleet operators and infrastructure developers. M&A activity in the sector has been moderate, with approximately xx deals recorded in the past five years, largely focused on consolidating smaller players and gaining access to specialized technologies.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: Advancements in sensor technology, AI, and improved safety regulations.

- Regulatory Impacts: Stringent European safety standards driving adoption.

- Product Substitutes: Limited, primarily relying on driver observation.

- End-User Segmentation: Automotive manufacturers, fleet operators, infrastructure developers.

- M&A Trends: Moderate activity, focused on consolidation and technology acquisition.

Europe Pedestrian Detection Systems Market Market Trends & Opportunities

The Europe Pedestrian Detection Systems Market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Market size is expected to reach xx Million by 2033 from xx Million in 2025. This growth is primarily fuelled by increasing urbanization, rising concerns over pedestrian safety, and the mandatory implementation of advanced driver-assistance systems (ADAS) in new vehicles across Europe. Technological advancements, such as the integration of AI and machine learning into pedestrian detection systems, are enhancing accuracy and reliability, further driving adoption. Consumer preference is shifting towards vehicles equipped with advanced safety features, creating a strong demand for effective pedestrian detection systems. Intense competition is driving innovation and pricing pressures, resulting in a diverse range of solutions catering to different price points and performance requirements. Market penetration remains relatively high in major European countries, but considerable untapped potential exists in smaller markets and among older vehicle fleets.

Dominant Markets & Segments in Europe Pedestrian Detection Systems Market

Germany, France, and the UK are the dominant markets within Europe, representing a combined xx% of the total market share in 2025. The strong automotive industry in these countries, coupled with stringent safety regulations, fuels significant demand.

- Leading Regions: Germany, France, UK

- Leading Segment (Type): Video-based systems hold the largest market share due to their relatively lower cost and established technology. Infrared systems show the fastest growth, due to better performance in low-light conditions.

- Leading Segment (Component Type): Cameras represent the largest segment, followed by radar systems, with sensors growing at a faster rate driven by increasing demand for more advanced and accurate systems.

Growth Drivers:

- Stringent Safety Regulations: EU regulations mandating ADAS features drive adoption.

- Infrastructure Development: Smart city initiatives and investments in pedestrian safety infrastructure promote market growth.

- Technological Advancements: AI and machine learning improve detection accuracy and reliability.

- Rising Urbanization: Increased pedestrian traffic in urban areas necessitates better safety measures.

Europe Pedestrian Detection Systems Market Product Analysis

The market offers a wide range of pedestrian detection systems, categorized by type (video, infrared, hybrid, other) and component (sensors, radars, cameras, other). Technological advancements are focused on improving accuracy and reliability in challenging conditions (e.g., poor visibility, adverse weather). AI and machine learning are key differentiators, enabling systems to adapt to varying environments and pedestrian behaviours. The market is witnessing a shift towards hybrid systems combining different technologies for optimal performance, offering competitive advantages in terms of robustness and accuracy. The focus is on seamless integration with existing vehicle systems and offering user-friendly interfaces.

Key Drivers, Barriers & Challenges in Europe Pedestrian Detection Systems Market

Key Drivers:

- Growing concerns about pedestrian safety.

- Stringent government regulations and mandates.

- Advancements in sensor technology and AI.

- Rising adoption of ADAS in new vehicles.

Challenges and Restraints:

- High initial investment costs for advanced systems.

- Potential for false positives and negative impacts on driver confidence.

- Supply chain disruptions affecting component availability.

- Competition from established and emerging players.

- Data privacy concerns related to the use of cameras and AI.

Growth Drivers in the Europe Pedestrian Detection Systems Market Market

The market's growth is fueled by increasing safety regulations, technological advancements offering better accuracy and reliability, and rising consumer demand for enhanced safety features. The expansion of smart city initiatives further supports market growth, creating a need for integrated pedestrian detection systems.

Challenges Impacting Europe Pedestrian Detection Systems Market Growth

High upfront costs for advanced systems, concerns about data privacy, and potential supply chain disruptions pose significant challenges. The complex regulatory landscape across different European countries also creates hurdles for market expansion. Intense competition necessitates constant innovation to maintain a competitive edge.

Key Players Shaping the Europe Pedestrian Detection Systems Market Market

- Dynacast (Form Technologies Inc)

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Significant Europe Pedestrian Detection Systems Market Industry Milestones

- July 2022: Volvo Trucks launched its Side Collision Avoidance Support system, using twin radars to detect cyclists and pedestrians in blind spots. This highlights the increasing focus on proactive safety measures.

- February 2022: Skoda Auto announced conducting over 200 pedestrian safety tests during vehicle development, showcasing commitment to improving pedestrian protection. This demonstrates the rigorous testing standards being adopted by manufacturers.

- January 2022: Ficosa's plan to replace front mirrors with camera systems in MAN commercial vehicles demonstrates a shift towards camera-based solutions and improved visibility around the vehicle. This illustrates the adoption of innovative technologies to improve pedestrian safety.

Future Outlook for Europe Pedestrian Detection Systems Market Market

The Europe Pedestrian Detection Systems Market is poised for continued growth, driven by ongoing technological advancements, stricter safety regulations, and increasing consumer awareness. Opportunities lie in developing more sophisticated, cost-effective systems that seamlessly integrate with other ADAS features and address data privacy concerns. The market will continue to see innovation in areas such as AI-powered object recognition, improved sensor fusion techniques, and better integration with smart city infrastructure. The focus will be on improving both the accuracy and reliability of pedestrian detection systems, as well as lowering costs to expand market penetration.

Europe Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

-

2. Component Type

- 2.1. Sensors

- 2.2. Radars

- 2.3. Cameras

- 2.4. Other Component Types

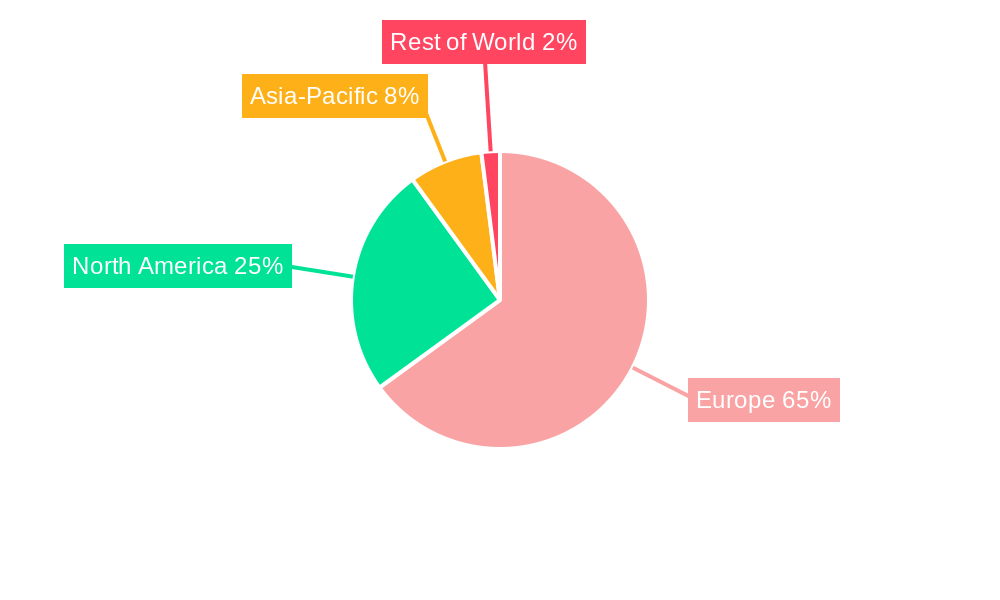

Europe Pedestrian Detection Systems Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Europe Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of Europe Pedestrian Detection Systems Market

Europe Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of ADAS Systems Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ADAS Systems Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Sensors

- 5.2.2. Radars

- 5.2.3. Cameras

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Infrared

- 6.1.3. Hybrid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Sensors

- 6.2.2. Radars

- 6.2.3. Cameras

- 6.2.4. Other Component Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Infrared

- 7.1.3. Hybrid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Sensors

- 7.2.2. Radars

- 7.2.3. Cameras

- 7.2.4. Other Component Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Infrared

- 8.1.3. Hybrid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Sensors

- 8.2.2. Radars

- 8.2.3. Cameras

- 8.2.4. Other Component Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Infrared

- 9.1.3. Hybrid

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Sensors

- 9.2.2. Radars

- 9.2.3. Cameras

- 9.2.4. Other Component Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Video

- 10.1.2. Infrared

- 10.1.3. Hybrid

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Sensors

- 10.2.2. Radars

- 10.2.3. Cameras

- 10.2.4. Other Component Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Video

- 11.1.2. Infrared

- 11.1.3. Hybrid

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Sensors

- 11.2.2. Radars

- 11.2.3. Cameras

- 11.2.4. Other Component Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Video

- 12.1.2. Infrared

- 12.1.3. Hybrid

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Component Type

- 12.2.1. Sensors

- 12.2.2. Radars

- 12.2.3. Cameras

- 12.2.4. Other Component Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dynacast (Form Technologies Inc )

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nemak SAB De CV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Endurance Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sundaram - Clayton Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Georg Fischer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ryobi Die Casting Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Officine Meccaniche Rezzatesi SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockman Industries

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Engtek Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Shiloh Industries Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Europe Pedestrian Detection Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 9: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 12: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 15: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 21: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 24: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pedestrian Detection Systems Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Europe Pedestrian Detection Systems Market?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the Europe Pedestrian Detection Systems Market?

The market segments include Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of ADAS Systems Driving the Market.

6. What are the notable trends driving market growth?

Increasing Adoption of ADAS Systems Driving the Market.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

July 2022: Volvo Trucks announced the launch of a new safety technology aimed at improving road safety. The device utilizes twin radars on each side of the truck to recognize when other road users, such as bicycles, enter the danger zone. Known as the Side Collision Avoidance Support system, it alerts the driver by flashing a red light on the appropriate side mirror when something is in the blind spot area. If the driver signals a lane change with the turn signal, the red light starts to flash, and an audible warning sound is emitted from the side of the potential accident. This provides the driver with timely information and the option to apply the brakes, allowing, for example, a bike to safely pass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the Europe Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence