Key Insights

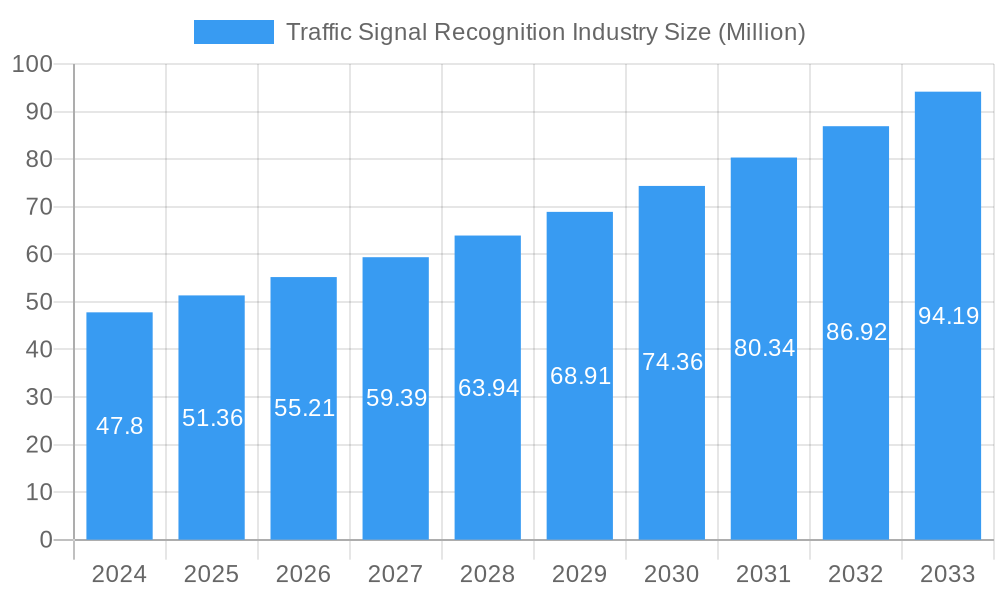

The global Traffic Signal Recognition market is poised for significant expansion, projected to reach $47.8 million in 2024 and exhibit a robust CAGR of 7.5% throughout the forecast period of 2025-2033. This growth is primarily fueled by the escalating adoption of Advanced Driver-Assistance Systems (ADAS) and the increasing demand for autonomous driving technologies. Governments worldwide are also implementing stricter road safety regulations, further accelerating the integration of intelligent traffic management solutions. Key drivers include the ongoing technological advancements in computer vision and artificial intelligence, leading to more accurate and reliable traffic signal detection systems. The increasing prevalence of connected vehicles and the development of smart city initiatives are also contributing to this upward trajectory. The market is segmented into sophisticated traffic signal detection methods such as color-based, shape-based, and feature-based detection, catering to diverse environmental conditions and complexities. Additionally, the segmentation by vehicle type, encompassing passenger cars and commercial vehicles, highlights the broad applicability of this technology.

Traffic Signal Recognition Industry Market Size (In Million)

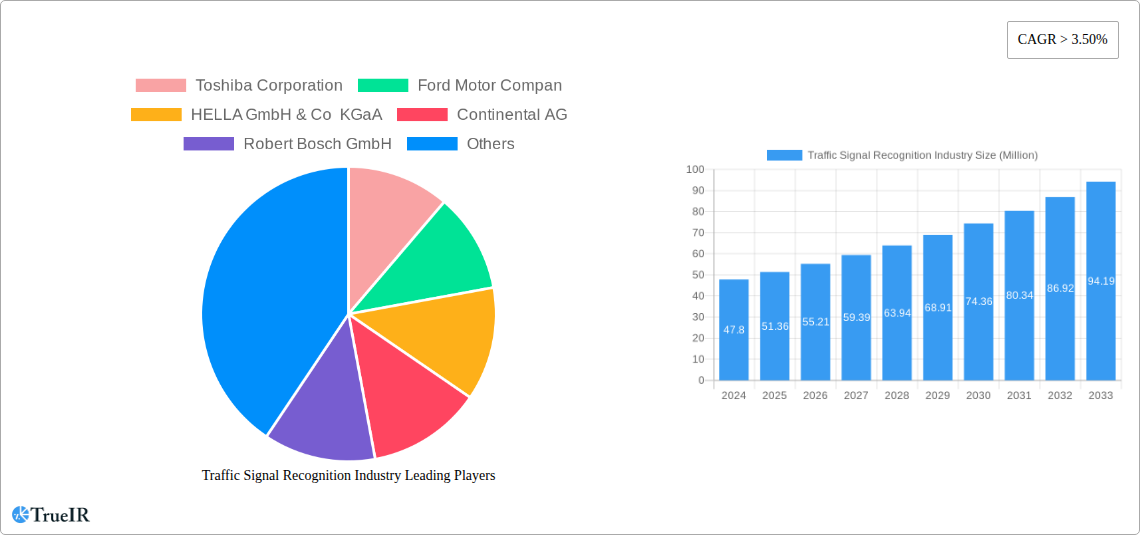

Emerging trends such as the integration of 5G technology for real-time data transmission and the development of V2X (Vehicle-to-Everything) communication are expected to revolutionize traffic signal recognition. These advancements will enable vehicles to not only detect signals but also communicate with them, leading to enhanced traffic flow optimization and accident prevention. Despite the promising outlook, certain restraints might impede market growth, including the high initial investment costs for implementing these advanced systems and the challenges associated with integrating them into existing infrastructure. Cybersecurity concerns regarding the sensitive data processed by these systems also present a hurdle. However, ongoing research and development efforts are focused on addressing these challenges, paving the way for a more efficient, safer, and automated future for road transportation. Major industry players like Toshiba Corporation, Ford Motor Company, HELLA GmbH & Co KGaA, Continental AG, Robert Bosch GmbH, Mobileye Corporation, and DENSO Corporation are actively investing in innovation to capture a significant share of this burgeoning market.

Traffic Signal Recognition Industry Company Market Share

Traffic Signal Recognition Industry Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Traffic Signal Recognition Industry, forecasting market dynamics from 2025 to 2033. Leveraging high-volume SEO keywords, this report is designed to capture the attention of industry professionals, investors, and stakeholders seeking critical insights into this rapidly evolving sector. The study encompasses a historical period of 2019–2024 and a base year of 2025, with an estimated year also set for 2025.

Traffic Signal Recognition Industry Market Structure & Competitive Landscape

The Traffic Signal Recognition Industry exhibits a moderately concentrated market structure, with key players like Toshiba Corporation, Ford Motor Company, HELLA GmbH & Co KGaA, Continental AG, Robert Bosch GmbH, Mobileye Corporation, and DENSO Corporation dominating significant market share. Innovation drivers are primarily fueled by advancements in artificial intelligence (AI), machine learning (ML), and computer vision technologies, pushing the boundaries of accuracy and real-time processing for traffic signal detection. Regulatory impacts are becoming increasingly influential, with governments worldwide mandating enhanced road safety features in vehicles, thereby driving adoption of traffic signal recognition systems. Product substitutes, while nascent, are emerging in the form of more generalized sensor fusion technologies. End-user segmentation reveals a strong focus on passenger cars, with commercial vehicles also representing a growing segment due to fleet safety initiatives. Merger and acquisition (M&A) trends are a key feature of the competitive landscape. Over the historical period (2019-2024), an estimated 30 significant M&A activities were recorded, indicating a consolidation phase as larger players acquire innovative startups to bolster their technological portfolios. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around 0.25, suggesting moderate concentration. Key areas of competitive advantage lie in algorithm efficiency, robustness to varying environmental conditions, and seamless integration with existing automotive systems.

Traffic Signal Recognition Industry Market Trends & Opportunities

The global Traffic Signal Recognition Industry is poised for substantial growth, driven by a confluence of technological advancements, increasing automotive safety regulations, and evolving consumer preferences for intelligent vehicle features. The market size is projected to expand from an estimated $3.5 million in 2025 to over $12 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period (2025–2033). This remarkable growth is underpinned by significant technological shifts. The increasing sophistication of AI algorithms and the development of deep learning models are enabling higher accuracy rates in identifying traffic signals under diverse lighting conditions, weather, and occlusion scenarios. Furthermore, the integration of these recognition systems with Vehicle-to-Everything (V2X) communication technologies presents a significant opportunity for enhanced traffic management and accident prevention. Consumer preferences are increasingly leaning towards vehicles equipped with advanced driver-assistance systems (ADAS), including traffic signal recognition, as awareness of their safety benefits grows. This heightened consumer demand, coupled with stringent regulatory mandates for safety features in new vehicle models across major automotive markets, is a primary growth catalyst. Competitive dynamics are intensifying, with established automotive suppliers and technology giants investing heavily in R&D to develop more accurate, cost-effective, and scalable solutions. Opportunities also lie in the development of specialized traffic signal recognition systems for autonomous driving applications, where precise and immediate recognition is paramount. The market penetration rate for basic traffic signal recognition features is expected to surge from approximately 30% in 2025 to over 75% by 2033. Emerging markets in Asia-Pacific and Latin America, driven by rapid automotive sales growth and increasing government focus on road safety, represent significant untapped potential. The continuous refinement of sensor fusion techniques, combining camera data with radar and lidar, will further enhance the reliability and scope of these systems, opening new avenues for market expansion.

Dominant Markets & Segments in Traffic Signal Recognition Industry

The Traffic Signal Recognition Industry is experiencing robust growth across various regions and segments, with North America and Europe currently leading in terms of market dominance. This leadership is attributed to a combination of factors, including stringent automotive safety regulations, high consumer adoption rates for ADAS features, and a mature automotive manufacturing ecosystem. Within these dominant regions, Passenger Cars represent the largest vehicle type segment, driven by their widespread ownership and the increasing integration of traffic signal recognition as a standard or optional feature in new vehicle models. The Traffic Sign Detection segment, a critical component of traffic signal recognition, is further dissected into specialized areas, with Feature-based Detection emerging as the most dominant and technologically advanced approach. This method leverages a wider array of sophisticated algorithms to analyze complex visual cues, including shape, color, texture, and context, leading to higher accuracy and robustness compared to solely color-based or shape-based detection methods.

Key growth drivers contributing to this dominance include:

- Infrastructure Development: Investments in smart city initiatives and intelligent transportation systems (ITS) are creating an environment where sophisticated road sign and signal recognition technologies are increasingly valued and integrated.

- Government Policies & Regulations: Mandates for advanced safety features, such as automatic emergency braking (AEB) and traffic sign recognition systems, in new vehicles are a significant policy-driven catalyst.

- Technological Advancements: Continuous improvements in AI, machine learning, and computer vision algorithms are enhancing the performance and reliability of traffic signal recognition systems, making them more viable for widespread adoption.

In the Traffic Sign Detection segment, while Color-based Detection and Shape-based Detection offer foundational capabilities, Feature-based Detection offers superior performance in challenging conditions like low light, adverse weather, and partially obscured signs. This advanced approach allows systems to interpret a wider variety of traffic signals and signs with greater accuracy. Consequently, the market is shifting towards systems that employ comprehensive feature extraction and analysis.

For Vehicle Type, Passenger Cars continue to be the primary driver due to their high sales volumes and the growing consumer demand for advanced safety and convenience features. However, the Commercial Vehicle segment is exhibiting a particularly strong growth trajectory. This is fueled by the increasing focus on fleet safety, regulatory pressures to reduce accidents involving trucks and buses, and the potential for significant operational cost savings through enhanced driver assistance. The implementation of traffic signal recognition in commercial vehicles can lead to fewer accidents, reduced insurance premiums, and improved delivery efficiency.

Traffic Signal Recognition Industry Product Analysis

The Traffic Signal Recognition Industry is characterized by continuous product innovation, driven by the pursuit of enhanced accuracy, robustness, and integration capabilities. Products range from sophisticated camera-based systems leveraging AI and deep learning for precise traffic signal identification to integrated ADAS modules that incorporate this functionality alongside other safety features. Key competitive advantages are derived from algorithm efficiency in processing complex visual data, resistance to adverse weather and lighting conditions, and seamless integration with vehicle infotainment and control systems. Applications are expanding beyond basic driver alerts to encompass predictive driving assistance and enhanced autonomous driving functionalities, marking a significant leap in automotive safety and intelligence.

Key Drivers, Barriers & Challenges in Traffic Signal Recognition Industry

Key Drivers:

- Technological Advancements: The relentless progress in AI, machine learning, and computer vision algorithms is enhancing the accuracy and reliability of traffic signal recognition systems, making them more effective in real-world driving scenarios.

- Stringent Automotive Safety Regulations: Government mandates and increasing consumer demand for ADAS features are compelling automakers to integrate advanced safety technologies, including traffic signal recognition, into their vehicle lineups.

- Growing Adoption of Intelligent Transportation Systems (ITS): Investments in smart city infrastructure and connected vehicle technologies create a conducive environment for the widespread deployment and utilization of traffic signal recognition.

Barriers & Challenges:

- Regulatory Complexities and Standardization: While regulations are a driver, the lack of universal standardization for traffic signals and signs across different regions can pose challenges for global deployment and system development. Harmonizing these standards is crucial for widespread adoption.

- Supply Chain Issues and Component Availability: The reliance on advanced sensors and processing units can make the industry susceptible to supply chain disruptions and fluctuations in component availability, impacting production timelines and costs.

- Competitive Pressures and Cost Sensitivity: Intense competition among technology providers and automotive manufacturers leads to price pressures, requiring continuous innovation to balance performance with affordability for mass-market adoption. The cost of implementation for smaller vehicle segments or emerging markets can be a significant barrier.

- Data Scarcity and Quality for Training: Developing highly accurate and robust AI models requires vast amounts of diverse and high-quality training data, which can be challenging and expensive to acquire and curate, especially for rare or unusual traffic signal scenarios.

Growth Drivers in the Traffic Signal Recognition Industry Market

The Traffic Signal Recognition Industry is experiencing robust growth primarily driven by technological advancements in AI and computer vision, leading to more accurate and reliable detection systems. Stringent automotive safety regulations worldwide, mandating the inclusion of ADAS features, serve as a significant impetus for market expansion. The increasing consumer demand for enhanced vehicle safety and convenience further fuels adoption. Furthermore, the growing implementation of intelligent transportation systems (ITS) and smart city initiatives creates an ecosystem ripe for the integration of sophisticated traffic management technologies. The continuous push towards autonomous driving also necessitates highly advanced and precise traffic signal recognition capabilities.

Challenges Impacting Traffic Signal Recognition Industry Growth

Despite the promising growth trajectory, the Traffic Signal Recognition Industry faces several challenges. Regulatory fragmentation and the lack of universal standardization for traffic signals across different countries and even within regions can hinder global scalability. Supply chain vulnerabilities, particularly concerning specialized semiconductor components and sensors, can lead to production delays and increased costs. Intense competition among technology providers exerts significant pricing pressure, requiring a delicate balance between innovation and affordability. Furthermore, the continuous need for extensive and diverse training data to ensure system accuracy under all possible real-world conditions presents an ongoing challenge in terms of data acquisition, annotation, and processing.

Key Players Shaping the Traffic Signal Recognition Industry Market

- Toshiba Corporation

- Ford Motor Company

- HELLA GmbH & Co KGaA

- Continental AG

- Robert Bosch GmbH

- Mobileye Corporation

- DENSO Corporation

Significant Traffic Signal Recognition Industry Industry Milestones

- 2019: Introduction of enhanced AI-powered traffic sign recognition algorithms by Mobileye, significantly improving accuracy in challenging conditions.

- 2020: HELLA GmbH & Co KGaA launches advanced camera-based ADAS systems incorporating sophisticated traffic signal recognition capabilities for premium vehicle segments.

- 2021: Continental AG announces strategic partnerships to integrate its traffic signal recognition technology with emerging V2X communication platforms.

- 2022: DENSO Corporation invests heavily in R&D for next-generation traffic signal recognition, focusing on low-light performance and wider detection angles.

- 2023: Robert Bosch GmbH unveils its latest generation of automotive sensors and software optimized for real-time traffic signal identification, targeting mass-market adoption.

- 2024: Toshiba Corporation showcases advancements in edge computing for traffic signal recognition, enabling faster on-board processing and reduced reliance on cloud connectivity.

Future Outlook for Traffic Signal Recognition Industry Market

The future outlook for the Traffic Signal Recognition Industry is exceptionally bright, with continued expansion driven by the relentless pursuit of automotive safety and autonomy. Strategic opportunities lie in the development of more integrated and context-aware recognition systems that can not only identify signals but also predict their status and interact with other intelligent infrastructure. The increasing sophistication of AI models and the convergence of sensor technologies will lead to near-perfect accuracy rates, paving the way for wider adoption in fully autonomous vehicles. Emerging markets represent a significant untapped potential, and localized solutions tailored to regional traffic signal variations will be crucial for market penetration. The industry is poised for sustained innovation, offering enhanced safety, efficiency, and a glimpse into the future of intelligent mobility.

Traffic Signal Recognition Industry Segmentation

-

1. Traffic Sign Detection

- 1.1. Color-based Detection

- 1.2. Shape-based Detection

- 1.3. Feature-based Detection

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

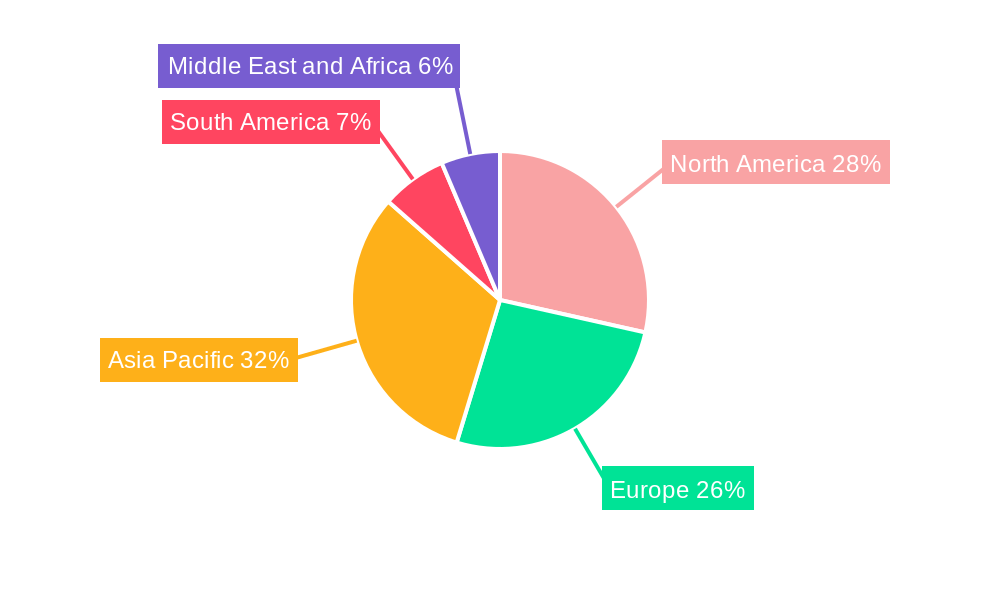

Traffic Signal Recognition Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Traffic Signal Recognition Industry Regional Market Share

Geographic Coverage of Traffic Signal Recognition Industry

Traffic Signal Recognition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Enhanced Ride Comfort

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost of Advanced Suspension Systems

- 3.4. Market Trends

- 3.4.1. Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 5.1.1. Color-based Detection

- 5.1.2. Shape-based Detection

- 5.1.3. Feature-based Detection

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6. North America Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6.1.1. Color-based Detection

- 6.1.2. Shape-based Detection

- 6.1.3. Feature-based Detection

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 7. Europe Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 7.1.1. Color-based Detection

- 7.1.2. Shape-based Detection

- 7.1.3. Feature-based Detection

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 8. Asia Pacific Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 8.1.1. Color-based Detection

- 8.1.2. Shape-based Detection

- 8.1.3. Feature-based Detection

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 9. South America Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 9.1.1. Color-based Detection

- 9.1.2. Shape-based Detection

- 9.1.3. Feature-based Detection

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 10. Middle East and Africa Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 10.1.1. Color-based Detection

- 10.1.2. Shape-based Detection

- 10.1.3. Feature-based Detection

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toshiba Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ford Motor Compan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HELLA GmbH & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Continental AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robert Bosch GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mobileye Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DENSO Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Toshiba Corporation

List of Figures

- Figure 1: Global Traffic Signal Recognition Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 3: North America Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 4: North America Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 9: Europe Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 10: Europe Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: Europe Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 15: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 16: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 21: South America Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 22: South America Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 23: South America Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 27: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 28: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 2: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 5: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 8: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 11: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 14: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 17: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Traffic Signal Recognition Industry?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Traffic Signal Recognition Industry?

Key companies in the market include Toshiba Corporation, Ford Motor Compan, HELLA GmbH & Co KGaA, Continental AG, Robert Bosch GmbH, Mobileye Corporation, DENSO Corporation.

3. What are the main segments of the Traffic Signal Recognition Industry?

The market segments include Traffic Sign Detection, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Enhanced Ride Comfort.

6. What are the notable trends driving market growth?

Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

High Upfront Cost of Advanced Suspension Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Traffic Signal Recognition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Traffic Signal Recognition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Traffic Signal Recognition Industry?

To stay informed about further developments, trends, and reports in the Traffic Signal Recognition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence