Key Insights

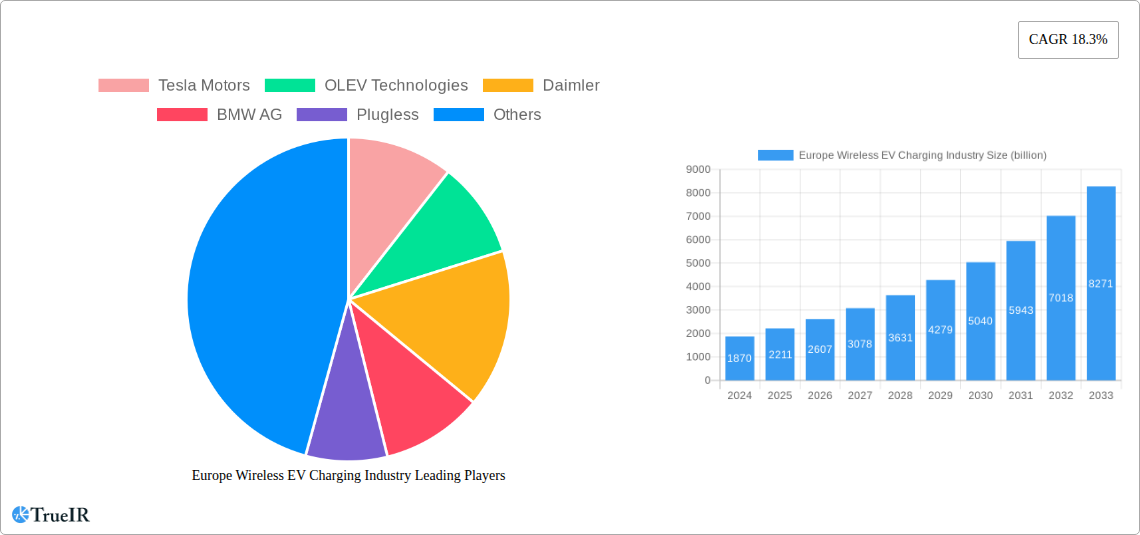

The European Wireless EV Charging industry is poised for exceptional growth, with an estimated market size of $1.87 billion in 2024. This robust expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 18.3% over the forecast period (2025-2033), indicating a dynamic and rapidly evolving market. The primary catalysts for this surge include increasing government initiatives to promote EV adoption, particularly in key European nations like Germany, France, and the UK, which are actively investing in charging infrastructure. Furthermore, the growing consumer demand for convenient and user-friendly charging solutions, coupled with advancements in wireless charging technology making it more efficient and accessible, are significant drivers. The industry is also benefiting from the expanding electric vehicle parc, as more Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) hit the roads, necessitating advanced charging capabilities. Key players like Tesla Motors, BMW AG, and Nissan are actively investing in and rolling out wireless charging solutions, further accelerating market penetration.

Europe Wireless EV Charging Industry Market Size (In Billion)

The wireless EV charging market in Europe is characterized by a strong focus on technological innovation, with companies actively developing higher power transfer capabilities, improved alignment mechanisms, and enhanced safety features. Emerging trends include the integration of wireless charging into public parking spaces, fleet management solutions, and even residential garages, offering unparalleled convenience. The growing environmental consciousness among European consumers and stricter emissions regulations are further propelling the adoption of electric vehicles, directly benefiting the wireless charging infrastructure. While the initial cost of implementing wireless charging systems and the need for standardization across different vehicle models and charging pads present certain restraints, the long-term benefits of reduced maintenance, increased charging accessibility, and a more seamless EV ownership experience are expected to outweigh these challenges. The forecast period anticipates significant advancements in inductive and resonant charging technologies, making wireless charging a mainstream solution for electric mobility across Europe.

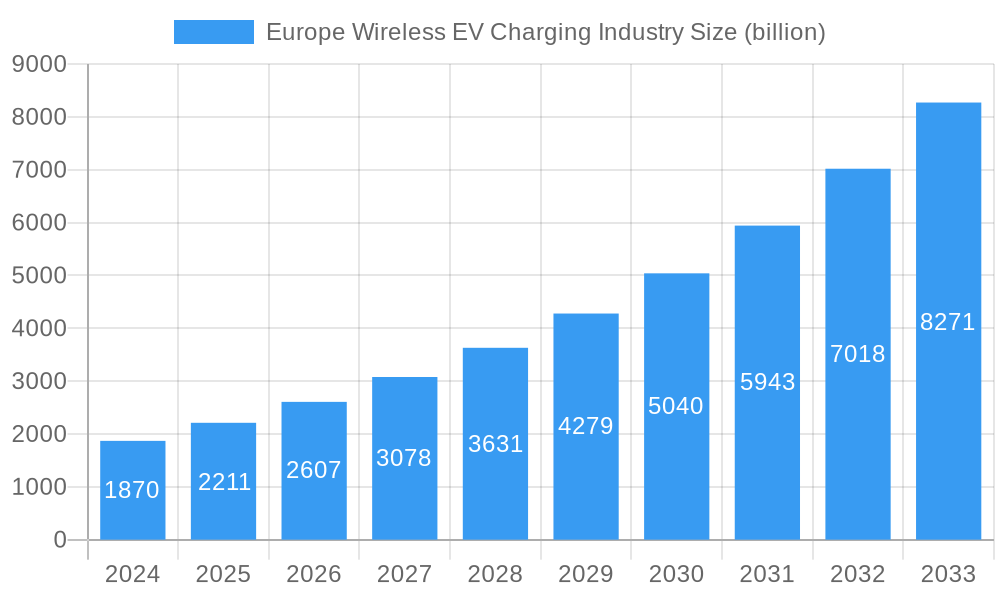

Europe Wireless EV Charging Industry Company Market Share

Europe Wireless EV Charging Industry: Unlocking the Future of Electric Mobility

This comprehensive report delves into the dynamic Europe wireless EV charging industry, a rapidly expanding sector poised for unprecedented growth. Covering the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this analysis provides deep insights into market structure, key trends, dominant segments, product innovations, and the crucial drivers and challenges shaping the future of wireless electric vehicle charging. With an estimated market size in billions, this report navigates the competitive landscape featuring giants like Tesla Motors, OLEV Technologies, Daimler, BMW AG, Nissan, and emerging innovators. We dissect the market for Battery Electric Vehicle (BEV) and Plug-in Hybrid Vehicle (PHEV) segments, exploring significant industry developments such as the Jaguar collaboration for electric taxi charging in Oslo, HEVO's US manufacturing plans, and Electreon's groundbreaking dynamic wireless charging for trucks. This report is essential for stakeholders seeking to capitalize on the billions in opportunity within the European wireless charging market and understand the trajectory of EV infrastructure development.

Europe Wireless EV Charging Industry Market Structure & Competitive Landscape

The Europe wireless EV charging industry is characterized by a moderately concentrated market structure, driven by significant R&D investments and the emergence of specialized technology providers. Key innovation drivers include the pursuit of higher charging efficiencies, increased power transfer rates, and seamless integration into urban environments. Regulatory impacts are increasingly positive, with governments across Europe actively promoting electric vehicle adoption and charging infrastructure deployment, creating a fertile ground for wireless solutions. Product substitutes, primarily conventional wired charging solutions, still hold a substantial market share but are gradually losing ground to the convenience and aesthetics of wireless technology. End-user segmentation reveals strong demand from both private consumers seeking hassle-free charging and fleet operators prioritizing operational efficiency. Merger and acquisition (M&A) trends are beginning to surface as larger automotive players and energy companies seek to acquire nascent wireless charging technologies and expand their EV charging networks. We estimate the M&A volume to be in the hundreds of millions of Euros annually. Concentration ratios, while not yet at oligopolistic levels, are expected to increase as early market leaders consolidate their positions. The competitive advantage lies in patented technologies, strategic partnerships with automotive manufacturers, and the ability to scale production to meet growing demand for wireless EV charging solutions.

Europe Wireless EV Charging Industry Market Trends & Opportunities

The Europe wireless EV charging industry is experiencing robust market size growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive governmental policies. The market is projected to reach several billions in value by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of over 25%. This rapid expansion is fueled by significant technological shifts, including improvements in inductive and resonant charging technologies, leading to higher power outputs and greater spatial flexibility. The transition towards autonomous vehicles also presents a compelling case for wireless charging, eliminating the need for manual connection and enhancing the user experience. Consumer preferences are increasingly leaning towards convenience and aesthetics, with wireless charging offering a cleaner, more integrated solution compared to traditional plug-in methods. This shift is evident in rising adoption rates for EVs and a growing demand for smart charging solutions. Competitive dynamics are intensifying, with established automotive giants like BMW AG and Toyota investing heavily in research and development, while innovative startups like WiTricity and HEVO Power are carving out significant niches. Market penetration rates for wireless charging are still in their nascent stages, estimated to be below 5% of the total EV charging market, indicating substantial untapped potential. The development of dynamic wireless charging capabilities, allowing vehicles to charge while in motion, represents a major disruptive trend, promising to revolutionize long-haul transport and public transportation. The ongoing expansion of charging infrastructure in public spaces, workplaces, and residential areas is a critical factor supporting market growth. The increasing availability of higher kilowatt-rated wireless chargers is also crucial for reducing charging times and making wireless technology more competitive with fast wired charging. Furthermore, the integration of wireless charging with smart grids and vehicle-to-grid (V2G) technologies opens up new revenue streams and enhances grid stability, further boosting market adoption. The billions in investment being poured into EV battery technology and charging solutions underscores the strategic importance of wireless charging in the future of mobility.

Dominant Markets & Segments in Europe Wireless EV Charging Industry

The Battery Electric Vehicle (BEV) segment is currently the dominant force within the Europe wireless EV charging industry, accounting for over 70% of the market share. This dominance is attributed to the accelerating adoption of BEVs across European nations, driven by stricter emissions regulations and a growing consumer consciousness regarding environmental sustainability. Key growth drivers for the BEV segment include the increasing range of electric vehicles, coupled with a burgeoning network of charging stations, both static and increasingly, wireless. Countries like Norway, Sweden, and the Netherlands are leading the charge in BEV penetration and the deployment of advanced wireless EV charging infrastructure.

The Plug-in Hybrid Vehicle (PHEV) segment, while smaller, is also exhibiting significant growth. PHEVs offer a transitional solution for consumers apprehensive about the range limitations of pure BEVs, providing the flexibility of electric power for shorter commutes and the assurance of a gasoline engine for longer journeys. The growth of the PHEV segment is bolstered by government incentives and the wider availability of charging options, including wireless solutions.

Regionally, Northern European countries are at the forefront of wireless EV charging adoption. Germany, as a major automotive manufacturing hub, is investing heavily in wireless charging technology research and development, positioning itself as a key market. France and the UK are also witnessing substantial growth, supported by ambitious EV infrastructure targets and increasing consumer interest in wireless charging solutions. The expansion of charging infrastructure in urban centers, particularly for taxis and ride-sharing services, is a critical factor in market dominance. For instance, the Jaguar collaboration in Oslo demonstrates the potential of wireless charging for electrifying taxi fleets, a segment with high utilization rates. Furthermore, the development of dynamic wireless charging for public transport and commercial fleets, as showcased by Electreon's testing in Sweden, signifies a paradigm shift towards seamless, on-the-go charging, further solidifying the dominance of electric mobility solutions. The market size for wireless EV charging infrastructure is anticipated to reach billions in the coming years, driven by these expanding segments and regions.

Europe Wireless EV Charging Industry Product Analysis

Product innovations in the Europe wireless EV charging industry are centered on enhancing charging speed, efficiency, and user convenience. Significant advancements are being made in both inductive and resonant charging technologies, leading to higher power transfer rates, enabling faster charging times comparable to high-power wired chargers. Competitive advantages are increasingly derived from miniaturization of components, improved foreign object detection (FOD) for safety, and the development of robust weather-resistant designs for outdoor applications. The integration of wireless EV charging into parking spots, road infrastructure for dynamic charging, and even residential garages offers diverse applications. Companies like Qualcomm are contributing with advanced chipsets, while others focus on the complete charging system design and manufacturing. The market fit is strong for premium vehicles and fleet operators prioritizing ease of use and a modern aesthetic, driving demand for these cutting-edge wireless charging solutions.

Key Drivers, Barriers & Challenges in Europe Wireless EV Charging Industry

Key Drivers, Barriers & Challenges in Europe Wireless EV Charging Industry

The Europe wireless EV charging industry is propelled by several key drivers. Technological advancements in inductive and resonant charging systems are increasing efficiency and power output. Government incentives and supportive regulations for EV adoption and charging infrastructure play a crucial role. The growing consumer demand for convenience and a seamless charging experience is a significant market pull. Furthermore, the increasing electrification of fleets, particularly for public transportation and ride-sharing services, presents substantial opportunities. The prospect of billions in market growth is attracting considerable investment.

However, significant barriers and challenges exist. High initial implementation costs for wireless charging infrastructure remain a concern, impacting widespread adoption, especially in comparison to established wired solutions. Standardization issues across different manufacturers and charging protocols can hinder interoperability. Public perception and awareness regarding the safety and efficiency of wireless charging need continuous effort to overcome. Supply chain complexities for specialized components can lead to production bottlenecks, and the long lifespan of existing wired charging infrastructure presents a competitive hurdle. Regulatory approvals for new charging technologies can also be a lengthy process, impacting the speed of market penetration.

Growth Drivers in the Europe Wireless EV Charging Industry Market

Key growth drivers in the Europe wireless EV charging industry market are multi-faceted. Technological innovation, particularly in higher power transfer and greater coil alignment tolerances, is making wireless charging more practical and efficient for a wider range of EVs. Supportive government policies, including subsidies for EV purchases and mandates for charging infrastructure development, are accelerating market adoption. The increasing environmental consciousness among consumers and the rising global fuel prices are further encouraging the switch to electric mobility. Strategic partnerships between automotive manufacturers, technology providers like WiTricity, and energy companies are essential for building robust wireless charging networks and driving economies of scale, projected to unlock billions in future revenue.

Challenges Impacting Europe Wireless EV Charging Industry Growth

Challenges impacting Europe wireless EV charging industry growth include the substantial upfront investment required for establishing widespread wireless charging infrastructure, which currently poses a higher barrier than traditional wired solutions. Regulatory hurdles related to safety, efficiency standards, and grid integration can slow down the deployment of new technologies. Supply chain vulnerabilities for specialized components, coupled with the need for ongoing research and development to improve performance and reduce costs, present persistent obstacles. Furthermore, intense competition from rapidly evolving and more established wired charging solutions necessitates continuous innovation and cost optimization to maintain market competitiveness, limiting the immediate realization of billions in market potential.

Key Players Shaping the Europe Wireless EV Charging Industry Market

- Tesla Motors

- OLEV Technologies

- Daimler

- BMW AG

- Plugless

- Bombardier

- Nissan

- HEVO Power

- WiTricity

- Qualcomm

- Hella Aglaia Mobile Vision

- Toyota

Significant Europe Wireless EV Charging Industry Industry Milestones

- June 2020: Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital, a significant step towards electrifying urban transportation fleets.

- May 2020: HEVO announced plans to launch US manufacturing for Wireless Electric Vehicle Chargers by 2024, indicating a growing global demand and a commitment to scaling production for wireless EV charging solutions.

- March 2020: Electreon announced the successful completion of testing a dynamic wireless charging of a 40-ton long-haul electric truck in Sweden. This marked the world's first truck operations on a public wireless electric road, demonstrating the transformative potential of dynamic wireless charging for commercial transport.

Future Outlook for Europe Wireless EV Charging Industry Market

The future outlook for the Europe wireless EV charging industry market is exceptionally bright, poised for substantial growth and innovation. Strategic opportunities lie in the further development and widespread adoption of dynamic wireless charging, which promises to revolutionize how electric vehicles are powered, especially for public transport and commercial fleets, potentially unlocking billions in new markets. Increased investment in R&D will lead to more efficient, affordable, and user-friendly wireless charging systems, driving broader consumer acceptance. The integration of wireless charging with smart grid technologies and autonomous driving systems will create a more connected and seamless electric mobility ecosystem. As regulatory frameworks become more harmonized and supportive, and as economies of scale drive down costs, wireless EV charging is set to become an indispensable component of the future electric vehicle landscape in Europe.

Europe Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Vehicle

- 1.2. Plug-in Hybrid Vehicle

Europe Wireless EV Charging Industry Segmentation By Geography

-

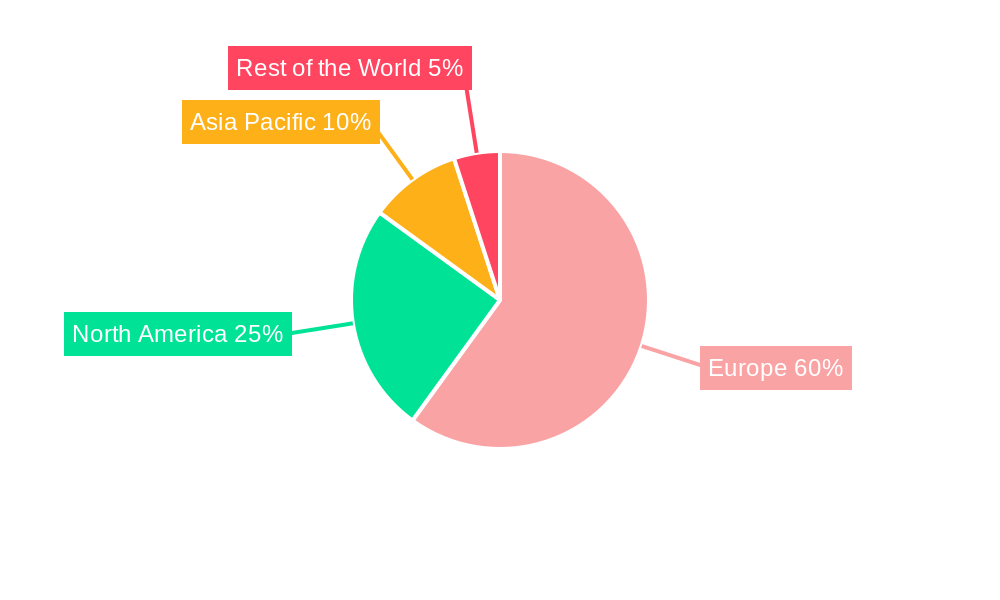

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Europe Wireless EV Charging Industry

Europe Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tesla Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OLEV Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plugless

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bombardier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HEVO Powe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WiTricity

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qualcomm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hella Aglaia Mobile Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toyota

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tesla Motors

List of Figures

- Figure 1: Europe Wireless EV Charging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Wireless EV Charging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Wireless EV Charging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Wireless EV Charging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless EV Charging Industry?

The projected CAGR is approximately 18.3%.

2. Which companies are prominent players in the Europe Wireless EV Charging Industry?

Key companies in the market include Tesla Motors, OLEV Technologies, Daimler, BMW AG, Plugless, Bombardier, Nissan, HEVO Powe, WiTricity, Qualcomm, Hella Aglaia Mobile Vision, Toyota.

3. What are the main segments of the Europe Wireless EV Charging Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

In June 2020, Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence