Key Insights

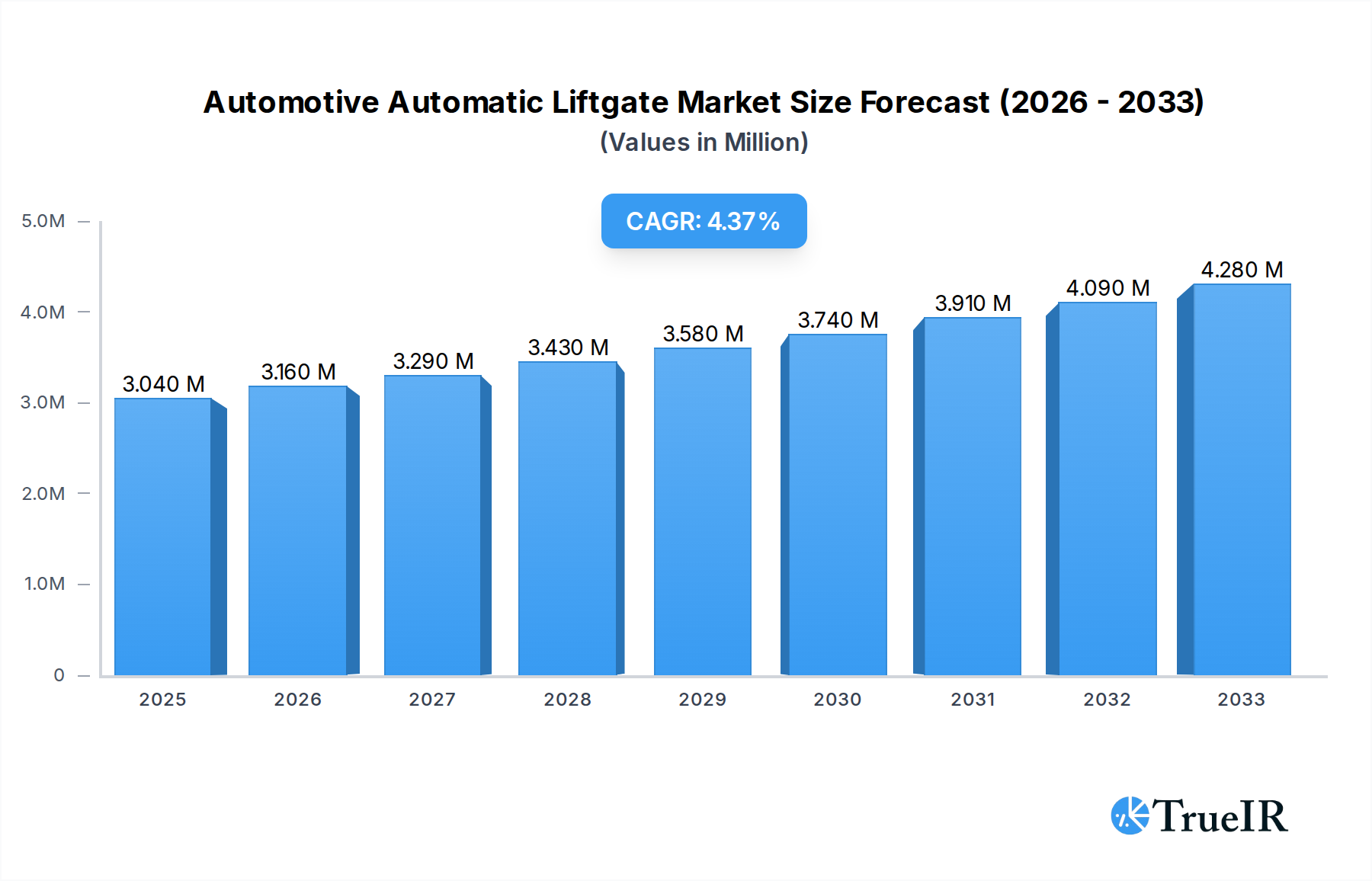

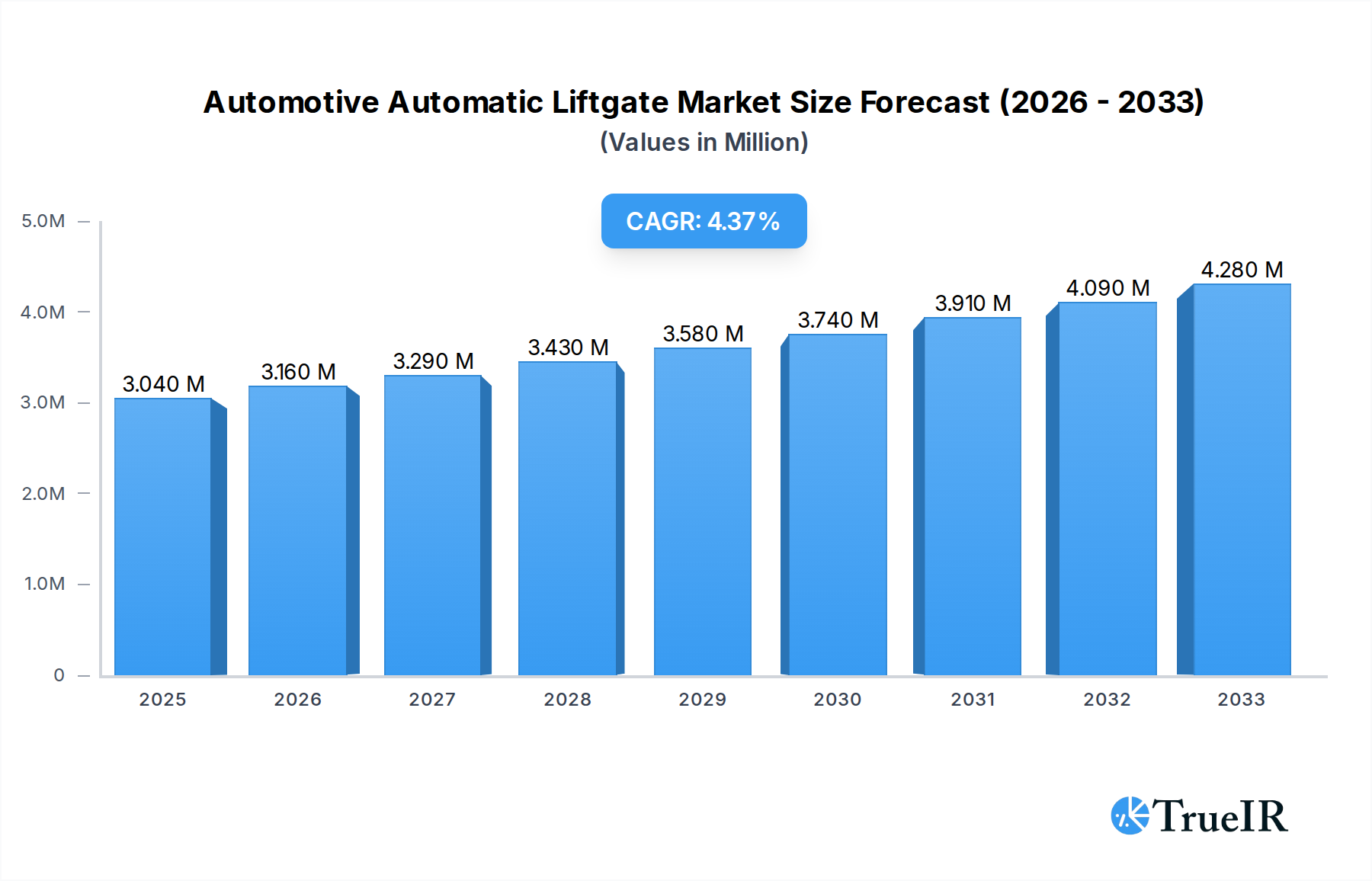

The global Automotive Automatic Liftgate Market is poised for robust expansion, projected to reach $3.04 Million in 2025 and exhibit a CAGR of 4.20% during the forecast period of 2025-2033. This significant growth is driven by an increasing consumer demand for enhanced convenience and premium features in vehicles, coupled with the continuous technological advancements in automotive electronics. The integration of automatic liftgate systems, offering hands-free operation and sophisticated sensor technologies, is becoming a key differentiator for automakers seeking to attract a discerning customer base. Furthermore, the rising production of SUVs and premium sedans, which often feature these advanced functionalities as standard or optional equipment, directly fuels market expansion. The evolving automotive landscape, with a strong emphasis on driver and passenger comfort, positions automatic liftgate systems as an integral component of modern vehicle design, contributing to their widespread adoption across various vehicle segments.

Automotive Automatic Liftgate Market Market Size (In Million)

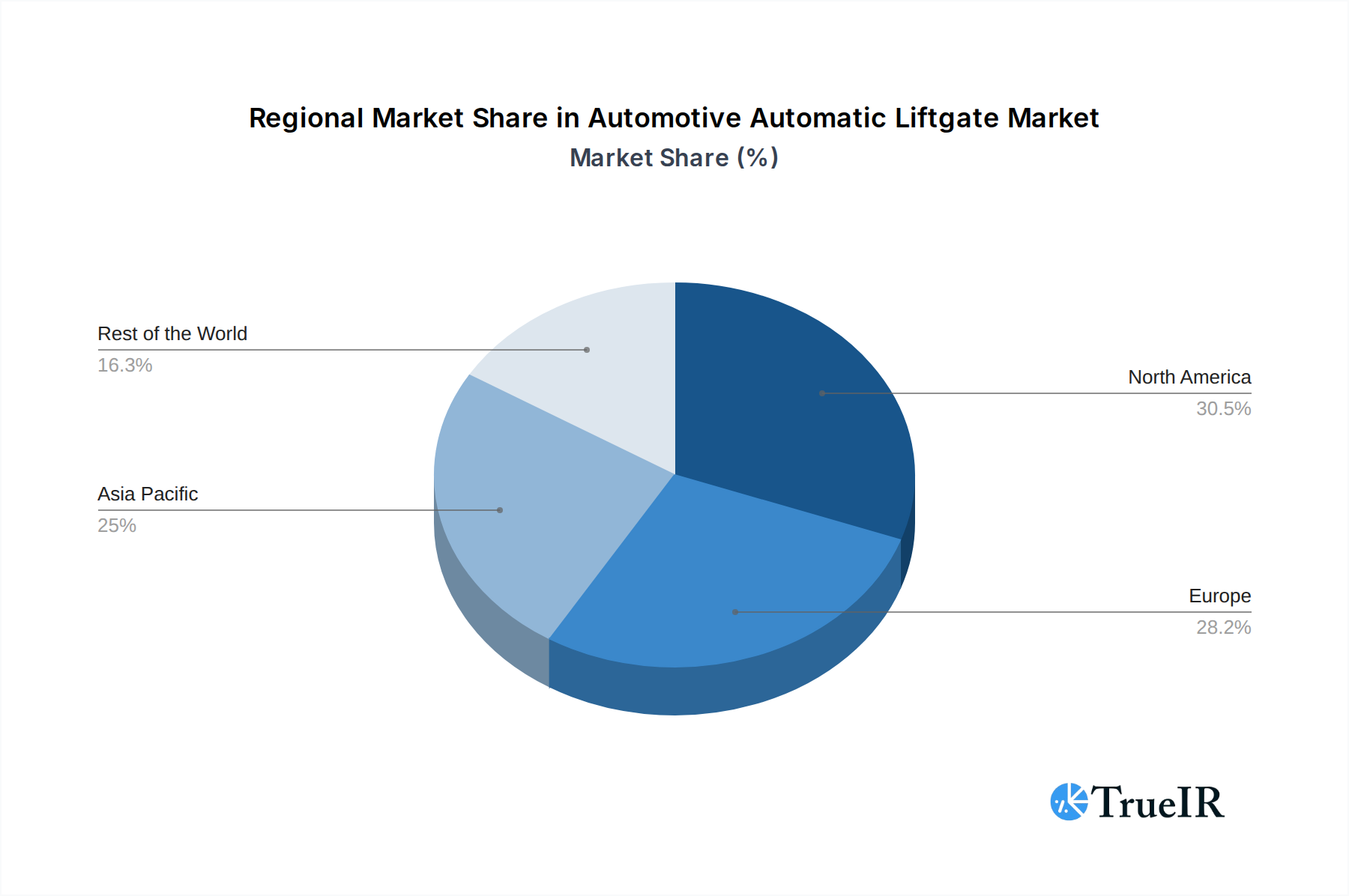

The market is segmented across diverse vehicle types, with Hatchbacks, Sports Utility Vehicles (SUVs), and Sedans representing key adoption categories. The prevalent use of Metal and Composite materials in the construction of these liftgates, optimized for durability and weight, underscores the technical sophistication of this market. Sales channels are dominated by Original Equipment Manufacturers (OEMs), reflecting the integration of these systems during vehicle production, while the aftermarket segment also presents a growing opportunity. Geographically, North America and Europe are leading markets, driven by high disposable incomes and a mature automotive industry that readily embraces new technologies. However, the Asia Pacific region, particularly China and India, is expected to witness substantial growth due to the rapid expansion of the automotive sector and increasing consumer interest in advanced vehicle features. Key players like Magna International Inc., Continental AG, and Huf Hulsbeck & First GmbH & Co KG are actively innovating and expanding their presence to capitalize on these burgeoning opportunities.

Automotive Automatic Liftgate Market Company Market Share

Unlock the Future of Vehicle Convenience: Automotive Automatic Liftgate Market Analysis (2019-2033)

Dive deep into the rapidly evolving Automotive Automatic Liftgate Market with this comprehensive, SEO-optimized report. Explore the burgeoning demand for hands-free vehicle access, driven by innovation, convenience, and premium features across all vehicle segments. This report provides critical insights for manufacturers, suppliers, and investors navigating the dynamics of this high-growth automotive technology sector. The study spans from 2019 to 2033, with 2025 serving as both the base and estimated year, and the forecast period extending from 2025 to 2033, building upon historical data from 2019 to 2024. The projected market value is estimated to reach $3,500 Million by 2033, with a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period.

Automotive Automatic Liftgate Market Market Structure & Competitive Landscape

The Automotive Automatic Liftgate Market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive innovation in areas such as sensor technology, motor efficiency, and smart integration with vehicle infotainment systems. Regulatory impacts are minimal at present, primarily focusing on safety standards. Product substitutes are limited, with manual liftgates being the primary alternative, but the convenience and premium appeal of automatic systems are rapidly diminishing this. End-user segmentation reveals a strong preference for automatic liftgates in Sports Utility Vehicles (SUVs), followed by Hatchbacks and Sedans. Mergers and acquisitions (M&A) activity is moderate, with larger Tier-1 suppliers acquiring smaller technology firms to enhance their product portfolios and market reach. For instance, M&A volumes in the past two years have been estimated at $150 Million, indicating a strategic consolidation trend. Concentration ratios for the top 5 players are estimated at 55%.

- Innovation Drivers: Advanced sensor arrays, voice command integration, gesture control, improved motor torque and speed, battery efficiency.

- Regulatory Impacts: Emphasis on pedestrian safety, pinch protection mechanisms, and electromagnetic compatibility.

- Product Substitutes: Manual liftgates, aftermarket manual-to-automatic conversion kits.

- End-User Segmentation: SUVs leading adoption, followed by premium sedans and increasingly hatchbacks.

- M&A Trends: Acquisition of specialized sensor and software companies by established automotive suppliers.

Automotive Automatic Liftgate Market Market Trends & Opportunities

The Automotive Automatic Liftgate Market is experiencing robust growth, driven by increasing consumer demand for convenience and the integration of advanced features in new vehicle models. The market size is projected to expand from approximately $1,500 Million in 2025 to an impressive $3,500 Million by 2033, with an estimated CAGR of 8.5%. Technological shifts are a significant trend, with the evolution from simple motorized opening to sophisticated hands-free, gesture-controlled, and even voice-activated systems. Consumer preferences are increasingly leaning towards premium features that enhance the driving experience, making automatic liftgates a desirable attribute for car buyers, particularly in the SUV segment where cargo access is paramount. Competitive dynamics are characterized by intense innovation and strategic partnerships between automotive OEMs and Tier-1 suppliers. The market penetration rate for automatic liftgates in new vehicle sales is projected to reach 40% by 2030, up from an estimated 25% in 2024. Opportunities abound for suppliers offering cost-effective solutions, enhanced safety features, and seamless integration with existing vehicle architectures. The increasing focus on electrification also presents an opportunity, as electric vehicles (EVs) often have dedicated space for liftgate mechanisms and can benefit from the energy efficiency of advanced motor designs. Furthermore, the growing trend of connected car technology allows for remote liftgate operation via smartphone apps, adding another layer of convenience and driving adoption. The development of lighter and more durable composite materials also presents an opportunity to reduce the weight of liftgate systems, improving vehicle efficiency.

Dominant Markets & Segments in Automotive Automatic Liftgate Market

The Automotive Automatic Liftgate Market is dominated by the Sports Utility Vehicle (SUV) segment, which accounts for an estimated 60% of the total market share in 2025. This dominance is fueled by the inherent need for easy cargo access in larger vehicles and the premium positioning of SUVs in most global automotive markets. Within vehicle types, the SUV segment is projected to grow at a CAGR of 9.2% through 2033. The Metal material type currently holds the largest market share due to its durability and cost-effectiveness, representing approximately 70% of the market. However, the Composite segment is experiencing faster growth, with an estimated CAGR of 10.5%, driven by the demand for lighter and more fuel-efficient vehicles. In terms of sales channels, Original Equipment Manufacturers (OEMs) are the primary drivers of the market, accounting for around 85% of sales, with the aftermarket segment projected to grow at a CAGR of 7.0%. Geographically, North America and Europe are the leading markets, driven by high disposable incomes and a strong preference for SUVs and premium vehicles. The Asia-Pacific region is emerging as a significant growth market, with increasing vehicle production and rising consumer awareness of convenience features.

- Leading Region: North America, followed closely by Europe.

- Leading Country: United States, due to its large SUV market.

- Dominant Vehicle Type: Sports Utility Vehicle (SUV).

- Key Growth Drivers: Increased adoption in mid-size and compact SUV segments, demand for enhanced cargo utility, premium feature expectations.

- Dominant Material Type: Metal.

- Key Growth Drivers: Established manufacturing processes, cost-efficiency, robust performance.

- Emerging Material Type: Composite.

- Key Growth Drivers: Weight reduction for fuel efficiency, design flexibility, increasing adoption in premium EVs.

- Dominant Sales Channel: Original Equipment Manufacturers (OEMs).

- Key Growth Drivers: Factory integration, warranty benefits, economies of scale in production.

- Growing Sales Channel: Aftermarket.

- Key Growth Drivers: Retrofitting older vehicles, customization options, competitive pricing for upgrades.

Automotive Automatic Liftgate Market Product Analysis

The Automotive Automatic Liftgate Market is characterized by continuous product innovation, focusing on enhancing user experience and vehicle integration. Key product advancements include the development of smarter sensor systems that accurately detect obstacles and user presence, enabling hands-free operation through gestures or foot sweeps. Motor technology is evolving towards more compact, energy-efficient, and quieter actuators that provide smooth and swift opening and closing. Competitive advantages are being carved out through features like programmable liftgate heights, integrated anti-pinch mechanisms for safety, and seamless connectivity with smartphone applications for remote operation. The market fit is strong as automatic liftgates are increasingly becoming a standard or optional feature in mid-to-high-end vehicles, fulfilling consumer demand for convenience and a premium feel.

Key Drivers, Barriers & Challenges in Automotive Automatic Liftgate Market

Key Drivers:

- Increasing demand for convenience and comfort: Consumers are prioritizing features that simplify daily tasks.

- Growth in the SUV segment: SUVs, with their larger cargo spaces, benefit most from automatic liftgate functionality.

- Technological advancements: Innovations in sensor technology, motor efficiency, and smart connectivity.

- Rising disposable incomes: Enabling consumers to opt for vehicles with premium features.

- Electrification of vehicles: EVs often have design advantages for integrating automatic liftgate systems.

Barriers & Challenges:

- Cost of implementation: Automatic liftgate systems add to the overall vehicle cost, potentially limiting adoption in entry-level segments.

- Complexity of integration: Ensuring seamless integration with diverse vehicle electrical systems and software.

- Supply chain disruptions: Potential for component shortages impacting production volumes.

- Perceived necessity versus desirability: Convincing budget-conscious consumers of the value proposition.

- Weight implications: While composites offer solutions, metal components can add weight, impacting fuel efficiency.

Growth Drivers in the Automotive Automatic Liftgate Market Market

The Automotive Automatic Liftgate Market is propelled by several key growth drivers. Technological advancements in sensor technology, including proximity and gesture recognition, are making hands-free operation more intuitive and reliable. The escalating consumer demand for enhanced convenience and luxury in vehicles is a significant catalyst, especially with the robust growth of the SUV market. Furthermore, the electrification trend in the automotive industry presents an opportunity, as EVs often have dedicated space for liftgate mechanisms and can leverage their advanced power systems for efficient operation. Policy-driven incentives for adopting advanced safety and convenience features could also indirectly boost market growth.

Challenges Impacting Automotive Automatic Liftgate Market Growth

Challenges impacting the growth of the Automotive Automatic Liftgate Market include the inherent cost associated with these sophisticated systems, which can be a barrier for budget-conscious consumers and lower-segment vehicles. Regulatory complexities surrounding safety standards and electromagnetic compatibility require continuous compliance efforts from manufacturers. Supply chain issues, such as the availability of specialized electronic components and motors, can lead to production delays and increased costs. Intense competitive pressures among established players and emerging market entrants also necessitate constant innovation and cost optimization to maintain market share.

Key Players Shaping the Automotive Automatic Liftgate Market Market

- Huf Hulsbeck & First GmbH & Co KG

- Magna International Inc

- Stabilus SE

- Brose Fahrzeugteile SE & Co KG

- Johnson Electric Holdings Limited

- STMicroelectronics N V

- Aisin Seiki Co Ltd

- Continental AG

- Plastic Omnium SE

- Autoease Technology

- Faurecia SE

Significant Automotive Automatic Liftgate Market Industry Milestones

- November 2023: Hyundai Motor Company introduced the Santa Fe with a development concept centered around its new liftgate opening that is six inches wider than the previous generation, enhancing cargo access and user convenience.

- October 2023: Honda Motor Co. Ltd introduced the Honda Passport, a mid-size SUV in the United States. The Honda Passport model features a remote-controlled power liftgate, offering enhanced practicality for consumers.

Future Outlook for Automotive Automatic Liftgate Market Market

The future outlook for the Automotive Automatic Liftgate Market is exceptionally bright, driven by an ongoing consumer quest for convenience and premium vehicle features. Strategic opportunities lie in the continued integration of AI-powered smart functionalities, such as predictive opening based on driver behavior and advanced obstacle detection. The expansion of the EV market will further fuel demand, as battery-powered vehicles are more amenable to sophisticated electronic systems. Market potential is immense, with an increasing number of automotive OEMs adopting automatic liftgates as standard across a wider range of vehicle models and segments, solidifying its position as a must-have automotive convenience feature. The projected market size of $3,500 Million by 2033 underscores the substantial growth trajectory and investment potential within this dynamic sector.

Automotive Automatic Liftgate Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sports Utility vehicle

- 1.3. Sedan

- 1.4. Other Vehicle Types

-

2. Material Type

- 2.1. Metal

- 2.2. Composite

-

3. Sales Channel Type

- 3.1. Original Equipment Manufacturers (OEM)

- 3.2. Aftermarket

Automotive Automatic Liftgate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Automatic Liftgate Market Regional Market Share

Geographic Coverage of Automotive Automatic Liftgate Market

Automotive Automatic Liftgate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sale of Luxury Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With the System

- 3.4. Market Trends

- 3.4.1. SUV Will Fuel The Growth Of The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sports Utility vehicle

- 5.1.3. Sedan

- 5.1.4. Other Vehicle Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Composite

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. Original Equipment Manufacturers (OEM)

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchback

- 6.1.2. Sports Utility vehicle

- 6.1.3. Sedan

- 6.1.4. Other Vehicle Types

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Metal

- 6.2.2. Composite

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 6.3.1. Original Equipment Manufacturers (OEM)

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchback

- 7.1.2. Sports Utility vehicle

- 7.1.3. Sedan

- 7.1.4. Other Vehicle Types

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Metal

- 7.2.2. Composite

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 7.3.1. Original Equipment Manufacturers (OEM)

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchback

- 8.1.2. Sports Utility vehicle

- 8.1.3. Sedan

- 8.1.4. Other Vehicle Types

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Metal

- 8.2.2. Composite

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 8.3.1. Original Equipment Manufacturers (OEM)

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Automatic Liftgate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchback

- 9.1.2. Sports Utility vehicle

- 9.1.3. Sedan

- 9.1.4. Other Vehicle Types

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Metal

- 9.2.2. Composite

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 9.3.1. Original Equipment Manufacturers (OEM)

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Huf Hulsbeck & First GmbH & Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Magna International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stabilus SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Brose Fahrzeugteile SE & Co KG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson Electric Holdings Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aisin Seiki Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Continental AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Plastic Omnium SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Autoease Technology

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Faurecia SE

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Huf Hulsbeck & First GmbH & Co KG

List of Figures

- Figure 1: Global Automotive Automatic Liftgate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 7: North America Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 8: North America Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 15: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 16: Europe Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Sales Channel Type 2025 & 2033

- Figure 31: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Sales Channel Type 2025 & 2033

- Figure 32: Rest of the World Automotive Automatic Liftgate Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Automatic Liftgate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 14: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 15: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 24: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 32: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 33: Global Automotive Automatic Liftgate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Automatic Liftgate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Automatic Liftgate Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Automotive Automatic Liftgate Market?

Key companies in the market include Huf Hulsbeck & First GmbH & Co KG, Magna International Inc, Stabilus SE, Brose Fahrzeugteile SE & Co KG, Johnson Electric Holdings Limited, STMicroelectronics N V, Aisin Seiki Co Ltd, Continental AG, Plastic Omnium SE, Autoease Technology, Faurecia SE.

3. What are the main segments of the Automotive Automatic Liftgate Market?

The market segments include Vehicle Type, Material Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sale of Luxury Vehicles.

6. What are the notable trends driving market growth?

SUV Will Fuel The Growth Of The Market.

7. Are there any restraints impacting market growth?

High Costs Associated With the System.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Motor Company introduced Santa Fe with a development concept centered around its new liftgate opening that is six inches wider than the previous generation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Automatic Liftgate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Automatic Liftgate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Automatic Liftgate Market?

To stay informed about further developments, trends, and reports in the Automotive Automatic Liftgate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence