Key Insights

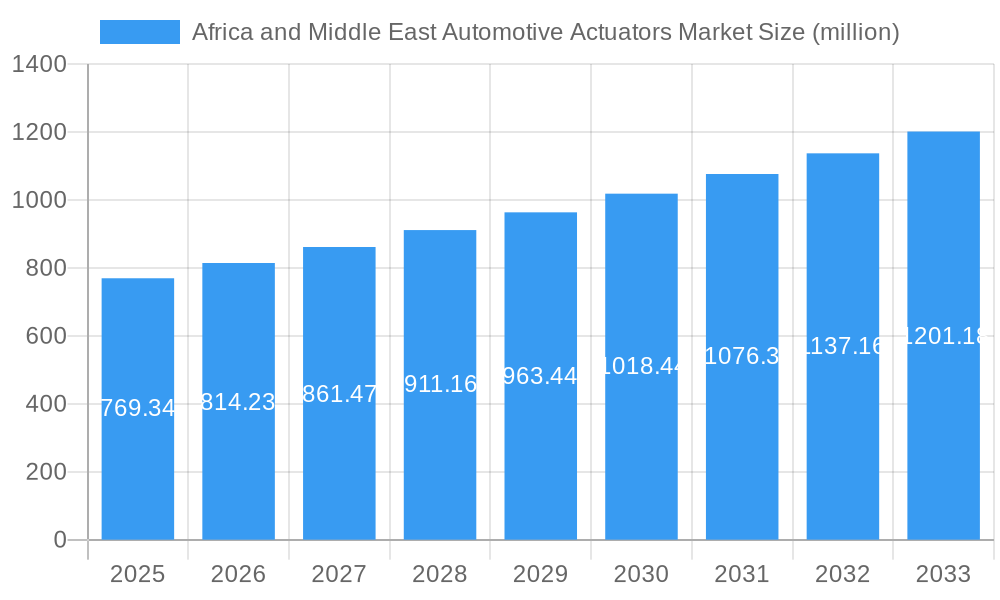

The Africa and Middle East automotive actuators market is poised for significant expansion, projected to reach $769.34 million in 2025, driven by a robust compound annual growth rate (CAGR) of 5.6% over the forecast period of 2025-2033. This growth is fundamentally fueled by the increasing demand for advanced automotive technologies aimed at enhancing fuel efficiency, safety, and performance. Key drivers include the rising adoption of sophisticated engine management systems, particularly electronic throttle control and direct fuel injection technologies, which are becoming standard in modern vehicles across passenger cars and commercial segments. Furthermore, the growing emphasis on vehicle safety features, such as advanced braking systems and electronic stability control, directly translates into a higher demand for specialized brake actuators. The region's expanding automotive manufacturing base and the subsequent integration of automated production processes further contribute to this market's upward trajectory. Emerging economies within Africa and the Middle East are witnessing a surge in vehicle ownership, propelled by a growing middle class and improving economic conditions, which in turn stimulates the demand for automotive components like actuators.

Africa and Middle East Automotive Actuators Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of trends and challenges. A significant trend is the shift towards electric and hybrid vehicles, which necessitates specialized actuators for powertrains and regenerative braking systems, opening new avenues for market players. The increasing integration of intelligent systems, including adaptive cruise control and autonomous driving features, also amplifies the need for precise and responsive actuators. However, the market faces restraints such as the high cost of advanced actuator technologies and the need for skilled labor for their installation and maintenance. Fluctuations in raw material prices and the presence of established global players with strong R&D capabilities also present competitive hurdles. Despite these challenges, the increasing regulatory push for stricter emission standards and improved vehicle safety across both Africa and the Middle East is expected to maintain a strong demand for innovative actuator solutions, ensuring sustained market growth. The key application segments of throttle, fuel injection, and brake actuators are anticipated to witness substantial growth, with potential for diversification into other emerging areas within the automotive ecosystem.

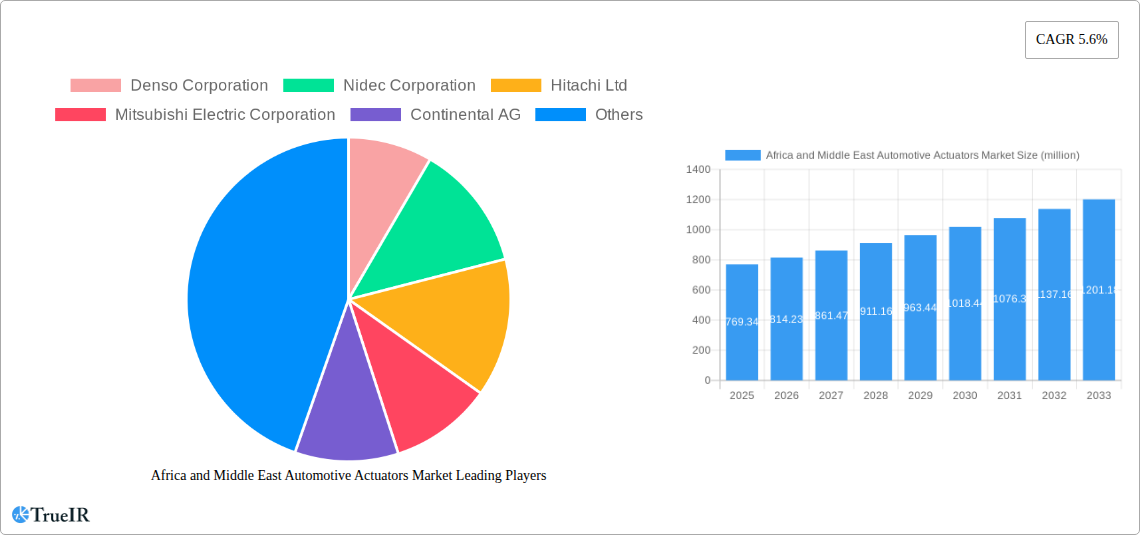

Africa and Middle East Automotive Actuators Market Company Market Share

This in-depth report delivers a dynamic, SEO-optimized analysis of the Africa and Middle East Automotive Actuators Market, a crucial segment within the global automotive industry. Leveraging high-volume keywords and detailed insights, this report is designed for industry stakeholders seeking to understand market dynamics, competitive landscapes, and future growth trajectories. Our comprehensive study covers the period from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period extending from 2025 to 2033. This report requires no further modification and is ready for immediate use.

Africa and Middle East Automotive Actuators Market Market Structure & Competitive Landscape

The Africa and Middle East Automotive Actuators Market is characterized by a moderate to high level of concentration, with a few major global players dominating market share. Innovation is a key driver, fueled by increasing demand for advanced automotive technologies, enhanced fuel efficiency, and stringent emission regulations across the region. Regulatory impacts, while varying across countries, are increasingly pushing for the adoption of more sophisticated actuator systems. Product substitutes, such as mechanical linkages, are gradually being phased out in favor of electronic and electromechanical actuators due to performance and efficiency advantages. End-user segmentation clearly favors Passenger Cars due to their higher sales volumes, although the growing commercial vehicle segment in the Middle East presents a significant opportunity. Mergers and Acquisitions (M&A) remain a strategic tool for market consolidation and expansion. In the historical period (2019-2024), an estimated 25 significant M&A deals were observed, contributing to the evolving competitive landscape. Key industry players are actively investing in R&D to develop next-generation actuators that offer improved precision, reliability, and cost-effectiveness.

Africa and Middle East Automotive Actuators Market Market Trends & Opportunities

The Africa and Middle East Automotive Actuators Market is poised for substantial growth, driven by an upward trajectory in vehicle production and sales across both continents. The market size is projected to reach an estimated $X,XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.XX% during the forecast period (2025-2033). This expansion is underpinned by a confluence of technological shifts, evolving consumer preferences, and dynamic competitive forces. The increasing adoption of advanced driver-assistance systems (ADAS) and the nascent but growing interest in electric vehicles (EVs) are creating new avenues for specialized actuator solutions, particularly in areas like electronic braking and advanced steering systems. Consumer preferences are increasingly leaning towards vehicles that offer enhanced safety, comfort, and fuel economy, directly translating into a demand for more sophisticated actuator technologies.

Technological advancements in electromobility and autonomous driving are reshaping the actuator landscape. This includes a shift from hydraulic and pneumatic actuators to more precise and energy-efficient electromechanical and electronic actuators. The drive for improved fuel efficiency and reduced emissions underpins the growth of throttle actuators and fuel injection actuators. Furthermore, the burgeoning automotive manufacturing capabilities in countries like South Africa, Egypt, and the UAE are creating localized demand for a wide range of automotive actuators.

Opportunities abound for manufacturers capable of delivering high-quality, cost-competitive solutions tailored to the specific needs of the African and Middle Eastern automotive markets. This includes developing robust actuators that can withstand the diverse and often challenging environmental conditions prevalent in some parts of the region. The growing aftermarket for automotive components also presents a significant, albeit fragmented, opportunity. The competitive dynamics are characterized by intense rivalry among global Tier-1 suppliers and a growing number of local and regional players aiming to capture market share through strategic partnerships and localized production. The penetration rate of advanced actuators is expected to increase significantly as vehicle technologies become more standardized across the region.

Dominant Markets & Segments in Africa and Middle East Automotive Actuators Market

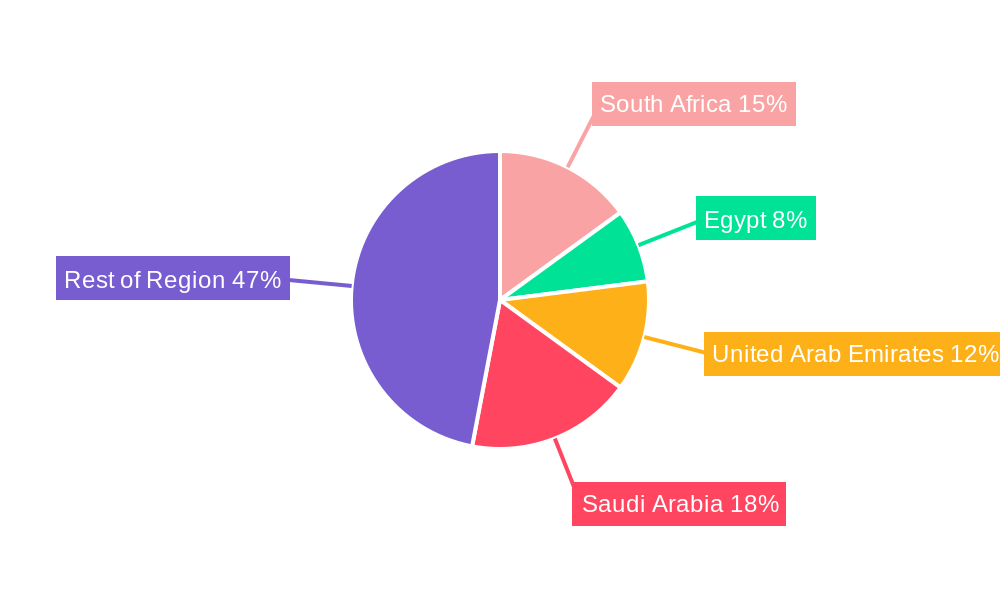

The Africa and Middle East Automotive Actuators Market exhibits distinct dominance patterns across its geographical and product segments. Passenger Cars represent the largest and most dominant vehicle type segment, driven by their widespread popularity and higher sales volumes across key markets like Saudi Arabia, UAE, Egypt, and South Africa. The growing middle class and increasing disposable incomes in these regions are fueling demand for new vehicles equipped with advanced actuator technologies.

Within the application type segments, the Throttle Actuator segment holds a significant market share due to its integral role in engine management for both internal combustion engines and its evolving application in hybrid and electric powertrains. The Fuel Injection Actuator segment also commands substantial importance, directly linked to the need for precise fuel delivery for optimal engine performance and emission control. The Brake Actuator segment is experiencing robust growth, propelled by the increasing adoption of advanced braking systems, including Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC), which are becoming standard safety features.

Geographically, the Middle East, particularly the GCC countries (Saudi Arabia, UAE, Qatar), is a dominant market due to higher vehicle purchasing power, significant investments in automotive infrastructure, and a strong preference for premium and technologically advanced vehicles. The presence of major automotive hubs and extensive road networks further bolsters demand. In Africa, South Africa stands out as a dominant market due to its established automotive manufacturing base and significant vehicle parc. Egypt is also emerging as a key growth region due to its expanding automotive sector and a large population.

Key growth drivers for dominance include:

- Infrastructure Development: Investments in road networks and urban mobility projects in the Middle East are spurring vehicle sales.

- Favorable Economic Conditions: Strong economic growth and high disposable incomes in GCC countries support vehicle purchases.

- Increasing Vehicle Production: Local manufacturing hubs in South Africa and Egypt contribute to the demand for automotive components.

- Regulatory Push for Safety and Emissions: Stricter safety standards and emission norms are driving the adoption of advanced actuators.

- Consumer Demand for Advanced Features: Growing consumer awareness and preference for modern automotive technologies.

Africa and Middle East Automotive Actuators Market Product Analysis

The Africa and Middle East Automotive Actuators Market is witnessing a surge in product innovation centered around enhanced precision, efficiency, and integration with advanced automotive systems. Key innovations include the development of highly responsive and compact electric throttle bodies, advanced solenoid-based fuel injection actuators for greater fuel atomization and control, and sophisticated electromechanical brake actuators enabling precise braking force distribution and faster response times. The trend towards miniaturization and increased power density allows for easier integration into increasingly complex vehicle architectures. These advancements are critical for meeting evolving demands for improved fuel economy, reduced emissions, and the implementation of sophisticated safety and driver-assistance features across a wide range of vehicle types.

Key Drivers, Barriers & Challenges in Africa and Middle East Automotive Actuators Market

Key Drivers: The Africa and Middle East Automotive Actuators Market is primarily propelled by the increasing vehicle production and sales volumes across the region, particularly in the passenger car segment. The growing adoption of advanced automotive technologies, including ADAS and emission control systems, directly fuels demand for sophisticated actuators. Regulatory mandates for improved safety standards and stricter emission norms are also significant growth catalysts. Economic growth in key Middle Eastern countries and emerging manufacturing capabilities in parts of Africa contribute to market expansion.

Barriers & Challenges: Supply chain complexities and logistics challenges in reaching remote or underdeveloped regions of Africa pose a significant restraint. The volatile economic conditions and fluctuating currency values in some African nations can impact vehicle sales and investment. Regulatory fragmentation across different countries, with varying standards and approval processes, can create hurdles for market entry and expansion. Intense competition from established global players and the emergence of local manufacturers can lead to pricing pressures. Furthermore, the slow pace of EV adoption in certain parts of the region, compared to global leaders, can temper the demand for specialized actuators for electric powertrains.

Growth Drivers in the Africa and Middle East Automotive Actuators Market Market

Key growth drivers in the Africa and Middle East Automotive Actuators Market include the expanding automotive manufacturing base in countries like South Africa and Egypt, which is boosting local demand for components. The rising disposable incomes and growing middle class in Middle Eastern nations are leading to increased passenger car sales, thereby escalating the demand for various actuators. Furthermore, the global push for enhanced vehicle safety and stringent emission regulations are driving the adoption of advanced actuator technologies for systems like ABS, ESC, and efficient fuel injection. The increasing integration of electronic components in vehicles to support features such as electronic power steering and adaptive cruise control is also a significant contributor to market growth.

Challenges Impacting Africa and Middle East Automotive Actuators Market Growth

Challenges impacting the Africa and Middle East Automotive Actuators Market growth include the significant logistical and supply chain hurdles present in vast and sometimes underdeveloped regions of Africa. Economic instability and currency fluctuations in several African countries can dampen consumer spending on vehicles. The fragmented regulatory landscape across different nations, with varying standards and certification requirements, complicates market entry for manufacturers. Intense price competition from both global and emerging local players also exerts pressure on profit margins. Moreover, the relatively slow pace of electric vehicle adoption in many parts of the region limits the immediate demand for specialized actuators associated with EV powertrains.

Key Players Shaping the Africa and Middle East Automotive Actuators Market Market

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- Johnson Electric

- Far Hydraulics

- Robert Bosch GmbH

- Hella KGaA Hueck & Co

- Magneti Marelli S P

Significant Africa and Middle East Automotive Actuators Market Industry Milestones

- 2023: Launch of advanced, high-efficiency electric throttle actuators by major players, catering to stricter emission norms.

- 2022: Increased investment in localized R&D and manufacturing facilities by global automotive component suppliers in South Africa and UAE.

- 2021: Introduction of next-generation brake-by-wire actuators, paving the way for advanced autonomous driving features.

- 2020: Growing adoption of electro-mechanical actuators for fuel injection systems to enhance engine performance and fuel economy.

- 2019: Significant mergers and acquisitions activity as key players consolidated their market positions in response to evolving automotive trends.

Future Outlook for Africa and Middle East Automotive Actuators Market Market

The future outlook for the Africa and Middle East Automotive Actuators Market is exceptionally promising, driven by sustained growth in vehicle production and the accelerating adoption of advanced automotive technologies. Strategic opportunities lie in developing cost-effective and robust actuator solutions tailored to the specific climatic and operational conditions of the region. The increasing integration of ADAS, electrification of powertrains, and demand for enhanced safety features will be key growth catalysts. Manufacturers focusing on localized production, robust supply chains, and innovative product development are poised to capture significant market share, further solidifying the region's role in the global automotive supply chain.

Africa and Middle East Automotive Actuators Market Segmentation

-

1. Application Type

- 1.1. Throttle actuator

- 1.2. Fuel Injection Actuator

- 1.3. Brake Actuator

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Africa and Middle East Automotive Actuators Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. United Arab Emirates

- 4. Saudi Arabia

- 5. Rest of Region

Africa and Middle East Automotive Actuators Market Regional Market Share

Geographic Coverage of Africa and Middle East Automotive Actuators Market

Africa and Middle East Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Seat Adjustment to Witness Faster Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle actuator

- 5.1.2. Fuel Injection Actuator

- 5.1.3. Brake Actuator

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. United Arab Emirates

- 5.3.4. Saudi Arabia

- 5.3.5. Rest of Region

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. South Africa Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Throttle actuator

- 6.1.2. Fuel Injection Actuator

- 6.1.3. Brake Actuator

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Egypt Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Throttle actuator

- 7.1.2. Fuel Injection Actuator

- 7.1.3. Brake Actuator

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. United Arab Emirates Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Throttle actuator

- 8.1.2. Fuel Injection Actuator

- 8.1.3. Brake Actuator

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Saudi Arabia Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Throttle actuator

- 9.1.2. Fuel Injection Actuator

- 9.1.3. Brake Actuator

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Rest of Region Africa and Middle East Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Throttle actuator

- 10.1.2. Fuel Injection Actuator

- 10.1.3. Brake Actuator

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nidec Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johnson Electric

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Far Hydraulics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robert Bosch GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hella KGaA Hueck & Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Magneti Marelli S P

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Africa and Middle East Automotive Actuators Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa and Middle East Automotive Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 2: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 5: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 11: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 17: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Africa and Middle East Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa and Middle East Automotive Actuators Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Africa and Middle East Automotive Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, Johnson Electric, Far Hydraulics, Robert Bosch GmbH, Hella KGaA Hueck & Co, Magneti Marelli S P.

3. What are the main segments of the Africa and Middle East Automotive Actuators Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 769.34 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Seat Adjustment to Witness Faster Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa and Middle East Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa and Middle East Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa and Middle East Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the Africa and Middle East Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence