Key Insights

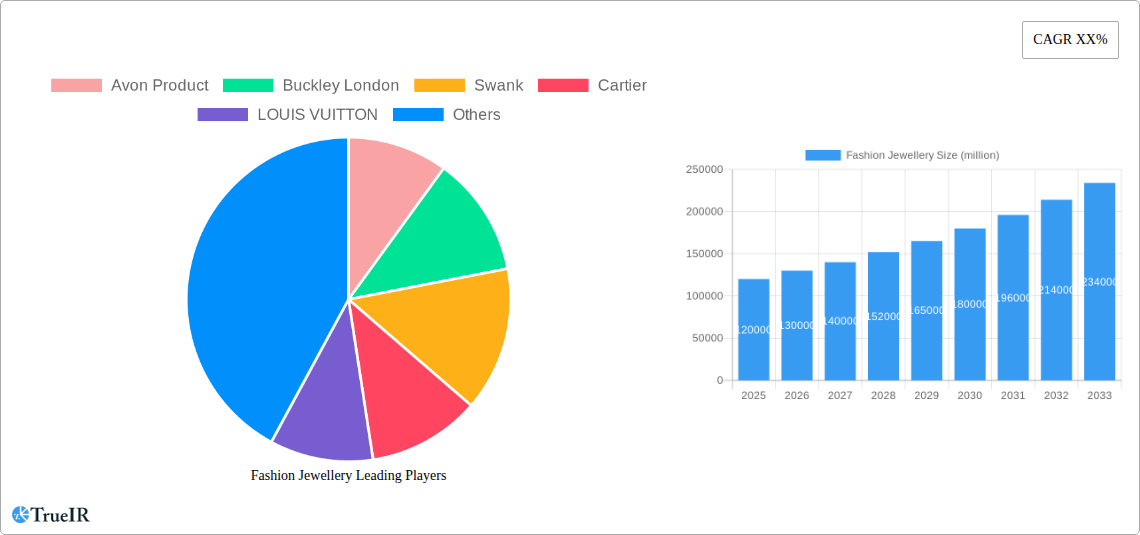

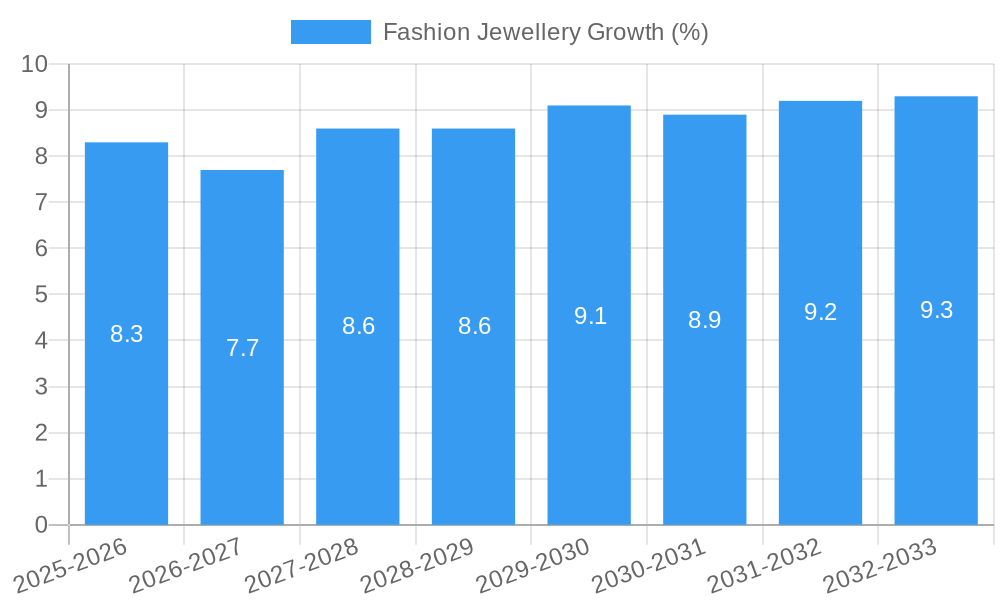

The global fashion jewellery market is poised for significant expansion, projected to reach approximately $120 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated throughout the forecast period of 2025-2033. This impressive growth is propelled by a confluence of factors, including the increasing disposable incomes in emerging economies, a growing consumer preference for trendy and affordable accessories, and the pervasive influence of social media and celebrity endorsements that drive demand for statement pieces. The market is also benefiting from the expanding reach of e-commerce platforms, which have democratized access to a diverse range of fashion jewellery, making it more accessible to a broader consumer base. Furthermore, the industry is witnessing a surge in demand for personalized and customizable jewellery, catering to individual tastes and evolving fashion sensibilities.

The fashion jewellery landscape is characterized by dynamic trends and strategic segmentation. Offline channels continue to hold a substantial market share, driven by the experiential nature of in-store shopping and the immediate gratification it offers. However, the Online segment is exhibiting accelerated growth, fueled by convenience, wider product selection, and competitive pricing. Within product types, Necklaces & Chains, Earrings, and Rings are anticipated to remain dominant categories, accounting for the largest share. The market is also witnessing increasing innovation in materials and designs, with a focus on sustainable and ethically sourced components gaining traction. Key players such as PANDORA A/S, Swarovski Group, and Louis Vuitton are actively shaping market dynamics through product innovation, strategic partnerships, and expansive global reach. Restraints such as fluctuating raw material costs and intense competition are being navigated through efficient supply chain management and product differentiation strategies.

Fashion Jewellery Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global fashion jewellery market, covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033. Leveraging extensive market research and high-volume SEO keywords, this report is designed to provide unparalleled insights for industry stakeholders, investors, and decision-makers. The study examines market structure, competitive landscape, emerging trends, dominant segments, product innovations, key drivers, critical challenges, and the future outlook for this dynamic industry.

Fashion Jewellery Market Structure & Competitive Landscape

The fashion jewellery market, while exhibiting a moderate concentration ratio, is characterized by a vibrant competitive landscape where innovation and brand differentiation play pivotal roles. Key industry developments are shaped by evolving consumer preferences, rapid technological advancements, and an increasingly stringent regulatory environment. Product substitutes, ranging from high-end fine jewellery to affordable imitation pieces, present a constant challenge, compelling market players to focus on unique designs, material innovation, and superior customer experiences. End-user segmentation is becoming increasingly granular, with a growing emphasis on personalized offerings and niche market catering. Mergers and acquisitions (M&A) activity, while not at the extreme highs seen in more consolidated industries, is a consistent feature, driven by the pursuit of market share expansion, technological integration, and brand portfolio diversification. The volume of M&A deals is estimated in the hundreds of millions annually, reflecting strategic consolidation and the acquisition of innovative startups. Regulatory impacts, particularly concerning material sourcing, ethical production, and e-commerce compliance, are significant factors influencing market entry and operational strategies, necessitating a proactive approach to sustainability and corporate responsibility.

Fashion Jewellery Market Trends & Opportunities

The global fashion jewellery market is poised for significant expansion, driven by a confluence of evolving consumer tastes, technological innovation, and shifting retail paradigms. The market size is projected to grow at a compound annual growth rate (CAGR) of approximately xx% from 2025 to 2033, reaching a valuation exceeding one million million dollars. This growth is underpinned by a discernible shift in consumer preferences towards personalized, ethically sourced, and sustainable fashion accessories. The proliferation of online retail channels, coupled with the rise of social media marketing and influencer collaborations, has democratized access to a wider array of brands and designs, significantly increasing market penetration rates.

Technological shifts are profoundly impacting the industry, from advancements in material science enabling the creation of more durable and aesthetically pleasing imitation stones to the integration of augmented reality (AR) for virtual try-on experiences, enhancing online shopping convenience. 3D printing technology is also revolutionizing design and production, allowing for rapid prototyping and the creation of intricate, bespoke pieces.

Competitive dynamics are intensifying, with both established luxury brands and agile direct-to-consumer (DTC) startups vying for market share. Strategic collaborations between fashion apparel brands and jewellery designers are becoming more common, creating synergistic opportunities and expanding reach. The increasing demand for unique, limited-edition pieces and artisanal craftsmanship presents a niche opportunity for smaller players to carve out significant market presence. Furthermore, the growing awareness of ethical sourcing and sustainable practices is creating a strong demand for eco-friendly jewellery, presenting a substantial opportunity for brands that can authentically integrate these values into their product offerings and supply chains. The market penetration of sustainable fashion jewellery is predicted to reach xx% by 2033, highlighting a key growth area. The report will delve into specific regional market penetrations and segment-wise growth projections, offering a nuanced view of the evolving landscape.

Dominant Markets & Segments in Fashion Jewellery

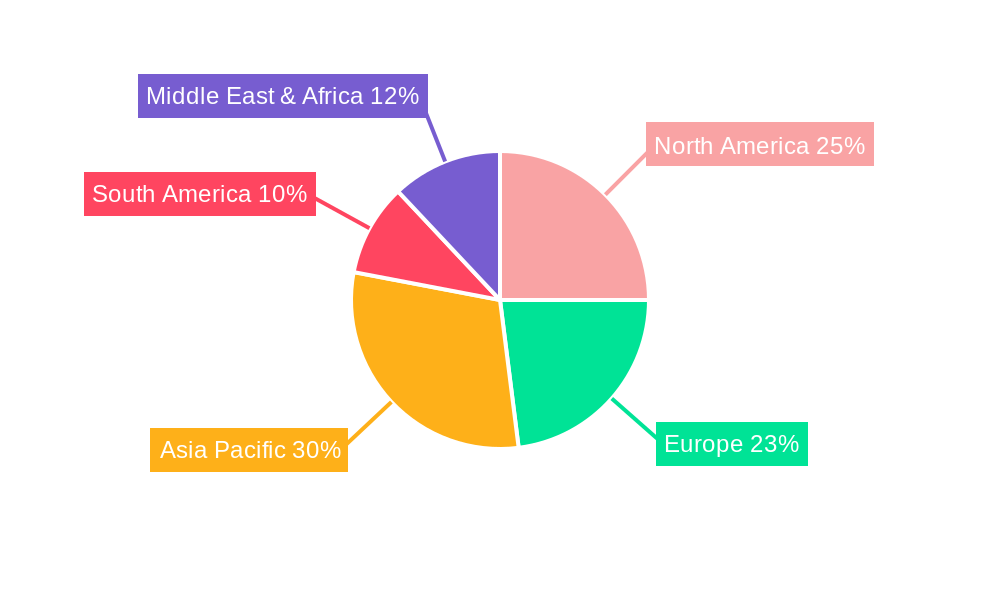

The fashion jewellery market exhibits distinct regional dominance and segment-specific growth trajectories. The Online application segment is emerging as a dominant force, projected to account for over one million million dollars in market share by 2033. This surge is fueled by increasing internet penetration, the convenience of e-commerce, and the ability of online platforms to reach a global audience. Key growth drivers for the online segment include enhanced digital marketing strategies, personalized customer experiences through AI-driven recommendations, and the seamless integration of social commerce. Policies supporting digital infrastructure development and cross-border e-commerce further bolster this segment's expansion.

Within product types, Earrings and Necklaces & Chains are consistently leading segments, collectively estimated to contribute one million million dollars to the market value by 2033. The enduring popularity of earrings for everyday wear and special occasions, coupled with the versatility and expressive nature of necklaces, drives sustained demand. Growth in these segments is propelled by:

- Innovative Designs: Continuous introduction of contemporary and classic designs catering to diverse aesthetic preferences.

- Material Affordability: Availability of a wide range of affordable yet attractive materials, including plated metals and synthetic gemstones.

- Celebrity Endorsements & Social Media Trends: The influence of social media and celebrity style drives demand for trending earring and necklace styles.

- Customization Options: Increasing availability of personalized necklaces and earrings, allowing consumers to express individuality.

The Bracelets segment also demonstrates robust growth, driven by stackable styles, charm bracelets, and fitness tracker integration. Rings, while historically a cornerstone of the jewellery market, are seeing a resurgence in the fashion jewellery category with trend-driven designs and affordable alternatives to precious metals. The Others segment, encompassing brooches, anklets, and hair accessories, is expected to grow at a steady pace, driven by emerging fashion trends and niche market demands. Regional analysis indicates Asia-Pacific as a rapidly expanding market due to its large consumer base and increasing disposable incomes, while North America and Europe continue to be mature but significant markets with a strong emphasis on premium fashion jewellery.

Fashion Jewellery Product Analysis

Fashion jewellery product innovation is characterized by the rapid iteration of designs, the exploration of novel materials, and a focus on enhancing wearability and aesthetic appeal. Competitive advantages are being carved out through unique styling, celebrity collaborations, and the integration of sustainable and ethically sourced materials. Technological advancements, such as improved plating techniques and the development of high-quality imitation gemstones, are enabling manufacturers to offer visually striking pieces at accessible price points. The market fit for these products is increasingly driven by fast fashion cycles and the desire for accessories that complement evolving wardrobes.

Key Drivers, Barriers & Challenges in Fashion Jewellery

Key Drivers: The fashion jewellery market is propelled by several key drivers. Technological advancements in design software and manufacturing processes allow for greater creativity and faster production cycles. Economic growth and rising disposable incomes in emerging economies create a larger consumer base with increased purchasing power for discretionary items like fashion jewellery. Furthermore, evolving consumer preferences towards self-expression and personal style, amplified by social media trends, significantly boost demand. Policy support for small and medium-sized enterprises (SMEs) in the fashion sector and the increasing focus on ethical and sustainable sourcing are also emerging as important drivers.

Barriers & Challenges: Supply chain disruptions, particularly those impacting the availability and cost of raw materials like base metals and plating solutions, pose a significant challenge. Regulatory hurdles related to material content disclosure, import/export regulations, and environmental standards can also create complexities. Intense competitive pressures from both global brands and numerous smaller players often lead to price wars and compressed profit margins. The inherent seasonality of fashion trends and the rapid obsolescence of certain styles necessitate agile inventory management and quick adaptation to market demands.

Growth Drivers in the Fashion Jewellery Market

The fashion jewellery market's growth is significantly influenced by technological innovation, which allows for more intricate designs and cost-effective production through methods like advanced plating and 3D printing. Economic factors, including rising disposable incomes and a growing middle class in developing regions, are expanding the potential consumer base. Furthermore, supportive government policies aimed at promoting the fashion and retail sectors, alongside increased consumer focus on personal branding and self-expression through accessories, are crucial growth catalysts. The influence of social media and celebrity endorsements continues to drive trends and create aspirational demand.

Challenges Impacting Fashion Jewellery Growth

Several challenges can impede the growth of the fashion jewellery market. Regulatory complexities, including evolving standards for material sourcing, ethical manufacturing, and consumer safety, can create compliance burdens. Supply chain issues, such as the volatility of raw material prices and geopolitical disruptions, can impact production costs and lead times. Intense competitive pressures from a vast number of players, ranging from global conglomerates to independent designers, often result in price sensitivity and a need for continuous differentiation. The fast-paced nature of fashion also means that trends can shift rapidly, posing a challenge for inventory management and product development.

Key Players Shaping the Fashion Jewellery Market

- Avon Product

- Buckley London

- Swank

- Cartier

- LOUIS VUITTON

- DCK Concessions

- Billig Jewelers

- BaubleBar

- Giorgio Armani

- Stuller

- The Colibri Group

- H. Stern

- Channel

- Yurman Design

- Gianni Versace

- Gucci Group NV

- Swarovski Group

- PANDORA A/S

- H & M

- Zara

- PRADA

Significant Fashion Jewellery Industry Milestones

- 2019: Increased adoption of online direct-to-consumer (DTC) models by fashion jewellery brands, leading to greater brand accessibility and customer engagement.

- 2020: Surge in demand for personalized and customizable jewellery pieces, fueled by a growing desire for unique self-expression during a period of increased introspection.

- 2021: Growing emphasis on sustainable and ethically sourced materials, with brands beginning to highlight their commitment to responsible production practices.

- 2022: Integration of augmented reality (AR) for virtual try-on experiences in online retail, enhancing customer confidence and reducing return rates.

- 2023: Rise of minimalist and eco-conscious jewellery designs, reflecting broader societal shifts towards mindful consumption.

- 2024: Expansion of inclusive sizing and diverse representation in fashion jewellery marketing campaigns, catering to a broader range of consumers.

Future Outlook for Fashion Jewellery Market

The future outlook for the fashion jewellery market is exceptionally bright, driven by persistent innovation and evolving consumer dynamics. Strategic opportunities lie in the continued expansion of e-commerce, the development of sustainable and ethically produced lines, and the leveraging of AI for personalized customer experiences and trend forecasting. The increasing demand for unique, artisanal, and customizable pieces presents a significant avenue for growth for both established players and emerging brands. Furthermore, the integration of smart technology into jewellery and the exploration of novel material combinations will likely shape future product development, ensuring the market's continued vitality and expansion, with projections indicating sustained growth exceeding one million million dollars in market value by the end of the forecast period.

Fashion Jewellery Segmentation

-

1. Application

- 1.1. Offline

- 1.2. Online

-

2. Types

- 2.1. Necklaces & Chains

- 2.2. Earrings

- 2.3. Rings

- 2.4. Bracelets

- 2.5. Others

Fashion Jewellery Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fashion Jewellery REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Necklaces & Chains

- 5.2.2. Earrings

- 5.2.3. Rings

- 5.2.4. Bracelets

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Offline

- 6.1.2. Online

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Necklaces & Chains

- 6.2.2. Earrings

- 6.2.3. Rings

- 6.2.4. Bracelets

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Offline

- 7.1.2. Online

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Necklaces & Chains

- 7.2.2. Earrings

- 7.2.3. Rings

- 7.2.4. Bracelets

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Offline

- 8.1.2. Online

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Necklaces & Chains

- 8.2.2. Earrings

- 8.2.3. Rings

- 8.2.4. Bracelets

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Offline

- 9.1.2. Online

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Necklaces & Chains

- 9.2.2. Earrings

- 9.2.3. Rings

- 9.2.4. Bracelets

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fashion Jewellery Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Offline

- 10.1.2. Online

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Necklaces & Chains

- 10.2.2. Earrings

- 10.2.3. Rings

- 10.2.4. Bracelets

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Avon Product

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Buckley London

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Swank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cartier

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LOUIS VUITTON

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DCK Concessions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Billig Jewelers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BaubleBar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Giorgio Armani

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stuller

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Colibri Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 H. Stern

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Channel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yurman Design

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Gianni Versace

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Gucci Group NV

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Swarovski Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 PANDORA A/S

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 H & M

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Zara

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 PRADA

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Avon Product

List of Figures

- Figure 1: Global Fashion Jewellery Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fashion Jewellery Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fashion Jewellery Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fashion Jewellery Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fashion Jewellery Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fashion Jewellery Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fashion Jewellery Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fashion Jewellery Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fashion Jewellery Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fashion Jewellery Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fashion Jewellery Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fashion Jewellery Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fashion Jewellery Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fashion Jewellery Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fashion Jewellery Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fashion Jewellery Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fashion Jewellery Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fashion Jewellery Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fashion Jewellery Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fashion Jewellery Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fashion Jewellery Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fashion Jewellery Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fashion Jewellery Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fashion Jewellery Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fashion Jewellery Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fashion Jewellery Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fashion Jewellery Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fashion Jewellery Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fashion Jewellery Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fashion Jewellery Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fashion Jewellery Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fashion Jewellery Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fashion Jewellery Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fashion Jewellery Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fashion Jewellery Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fashion Jewellery Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fashion Jewellery Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fashion Jewellery Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fashion Jewellery Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fashion Jewellery Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fashion Jewellery Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fashion Jewellery?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fashion Jewellery?

Key companies in the market include Avon Product, Buckley London, Swank, Cartier, LOUIS VUITTON, DCK Concessions, Billig Jewelers, BaubleBar, Giorgio Armani, Stuller, The Colibri Group, H. Stern, Channel, Yurman Design, Gianni Versace, Gucci Group NV, Swarovski Group, PANDORA A/S, H & M, Zara, PRADA.

3. What are the main segments of the Fashion Jewellery?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fashion Jewellery," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fashion Jewellery report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fashion Jewellery?

To stay informed about further developments, trends, and reports in the Fashion Jewellery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence