Key Insights

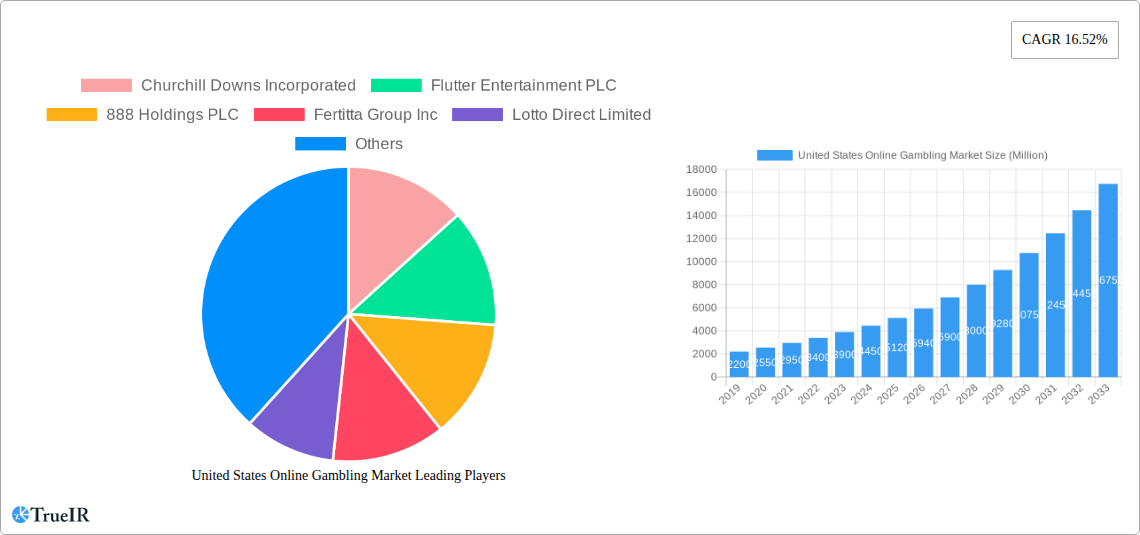

The United States online gambling market is poised for remarkable expansion, projected to reach a substantial USD 5.12 billion in 2025. This growth is propelled by an impressive Compound Annual Growth Rate (CAGR) of 16.52%, indicating a dynamic and rapidly evolving industry. The primary drivers fueling this surge include the increasing legalization and regulation of online gambling across various states, coupled with the widespread adoption of mobile devices, which facilitate convenient and accessible gaming experiences. Consumers are increasingly embracing online platforms for their sports betting and casino game offerings, including live casino, slots, baccarat, blackjack, and poker. The shift from traditional brick-and-mortar establishments to digital alternatives is a significant trend, driven by technological advancements, enhanced user interfaces, and the appeal of a wider variety of games and betting options.

United States Online Gambling Market Market Size (In Billion)

While the market exhibits robust growth, certain restraints could potentially moderate its pace. These may include stringent regulatory hurdles in some jurisdictions, concerns over responsible gambling practices, and the ongoing competition from established land-based casinos. Despite these challenges, the forecast period (2025-2033) is expected to witness sustained momentum, with mobile gambling anticipated to dominate over desktop access due to its inherent flexibility and ease of use. Major players like Flutter Entertainment PLC, DraftKings Inc., and MGM Resorts International are at the forefront, investing heavily in innovation and strategic expansions to capture a larger share of this lucrative market. The United States, being a key region, is expected to significantly contribute to the global online gambling market's overall value.

United States Online Gambling Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the United States Online Gambling Market, leveraging high-volume keywords to enhance search rankings and engage industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report offers unparalleled insights into market structure, trends, competitive landscape, product analysis, growth drivers, challenges, key players, and future outlook.

United States Online Gambling Market Market Structure & Competitive Landscape

The United States online gambling market is characterized by a dynamic and evolving competitive landscape, marked by increasing market concentration driven by strategic mergers and acquisitions and a strong emphasis on innovation. Regulatory frameworks, though still fragmented across states, play a pivotal role in shaping market entry and operational strategies, influencing product substitutes and the speed of market maturation. End-user segmentation by platform (desktop vs. mobile) reveals a clear shift towards mobile dominance, impacting product development and marketing efforts. Key M&A trends are focused on expanding market share, acquiring advanced technology, and entering newly regulated states. The presence of both established land-based casino operators and agile online-native companies fuels a competitive environment where technological prowess and user experience are paramount.

- Market Concentration: Increasing consolidation, particularly through M&A, signals a trend towards larger entities dominating significant market share.

- Innovation Drivers: Technological advancements in mobile, AI, and data analytics are crucial for differentiating offerings and enhancing user engagement.

- Regulatory Impacts: State-specific regulations create a complex patchwork, influencing expansion strategies and product offerings.

- Product Substitutes: While direct substitutes are limited within the regulated market, emerging alternative entertainment options pose indirect competition.

- End-User Segmentation: Mobile platforms account for the vast majority of online gambling activity, necessitating mobile-first strategies.

- M&A Trends: Acquisitions focus on market access, technology integration, and expanding product portfolios, driving market consolidation.

United States Online Gambling Market Market Trends & Opportunities

The United States online gambling market is experiencing robust growth, projected to reach a valuation of over $XX Million by 2033. This expansion is fueled by several key trends, including the increasing legalization and regulation of online sports betting and casino games across more states, leading to a significant surge in market penetration rates. Technological advancements are at the forefront of this evolution, with the widespread adoption of mobile devices for gambling, enhanced by seamless user interfaces, sophisticated live dealer options, and the integration of AI for personalized player experiences. Consumer preferences are leaning towards convenience, a wider variety of game offerings, and secure payment methods. The competitive dynamics are intensifying, with established players investing heavily in marketing and platform development to capture market share, while new entrants vie for attention through innovative strategies and niche offerings.

The growing acceptance of online gambling as a legitimate entertainment form, coupled with increasing disposable incomes, further contributes to market expansion. The sports betting segment, in particular, is a major growth engine, benefiting from the popularity of major US sports leagues and the convenience of in-play wagering. Casino games, including live casino, slots, and poker, are also seeing substantial growth, driven by the desire for authentic casino experiences from the comfort of one's home.

Opportunities abound for companies that can effectively navigate the regulatory landscape, leverage cutting-edge technology, and deliver exceptional user experiences. The integration of responsible gambling tools and features is becoming increasingly important for long-term market sustainability and consumer trust. Furthermore, the expansion into newer states that are considering or have recently legalized online gambling presents significant untapped potential. The development of innovative game mechanics, augmented reality (AR) and virtual reality (VR) integration, and the use of blockchain for enhanced security and transparency are areas ripe for exploration and can provide a competitive edge in this rapidly evolving market. The overall market CAGR is estimated to be XX% during the forecast period.

Dominant Markets & Segments in United States Online Gambling Market

The United States online gambling market exhibits distinct regional and segmental dominance, driven by a confluence of regulatory frameworks, consumer demographics, and infrastructure development. The Sports Betting segment stands out as a primary growth driver, benefiting from the immense popularity of professional and collegiate sports across the nation. States with a strong sporting culture and progressive regulatory environments have become hotspots for sports betting, attracting significant investment and user engagement.

Within the Casino segment, Live Casino is rapidly gaining traction due to its ability to replicate the immersive experience of traditional brick-and-mortar casinos, offering real-time interaction with dealers and other players. This segment is particularly appealing to a demographic seeking social interaction and a higher degree of authenticity. Slots continue to be a foundational element of online casino offerings, consistently attracting a broad player base due to their accessibility and variety of themes and gameplay. Poker, while perhaps not as universally dominant as sports betting or slots, maintains a dedicated following and plays a crucial role in the broader online gaming ecosystem, especially in states where it is independently regulated.

The Mobile end-user segment is overwhelmingly dominant, reflecting the global shift towards mobile-first digital experiences. This dominance is underpinned by the convenience and accessibility of smartphones and tablets, enabling users to engage with online gambling platforms anytime, anywhere. Consequently, operators are prioritizing mobile-responsive design, dedicated mobile apps, and optimized user interfaces to cater to this vast majority of their customer base.

- Leading Region: The Northeastern United States and Midwestern United States are currently leading in terms of online gambling revenue, due to early legalization and established market presence in key states.

- Key Game Type Dominance:

- Sports Betting: Benefits from widespread legalization, major sporting events, and in-play betting features.

- Casino Games: Continues to grow, with Live Casino and Slots being major contributors to revenue.

- Dominant End-User: Mobile is the primary access point for online gambling, with a significant majority of wagers placed via smartphones and tablets.

- Growth Drivers:

- Progressive State Legalization: Increasing number of states adopting regulated online gambling frameworks.

- Technological Advancements: Enhanced mobile platforms, live dealer technology, and secure payment gateways.

- Partnerships and Sponsorships: Collaborations with sports leagues and media outlets to increase brand visibility.

- Player Engagement Features: Loyalty programs, bonuses, and personalized experiences driving retention.

- Market Penetration: While growing rapidly, there remains significant room for market penetration as more states legalize and existing markets mature.

United States Online Gambling Market Product Analysis

The United States online gambling market is defined by continuous product innovation, driven by the need to enhance user experience, ensure fairness, and comply with evolving regulations. Key product developments include the sophisticated integration of live dealer functionality in casino games, offering a more immersive and social experience. Mobile-first design principles are paramount, ensuring seamless gameplay across devices. Advanced analytical tools are being employed to personalize game recommendations and betting options, while robust security protocols are fundamental to building player trust. Competitive advantages are being forged through unique game variations, exclusive betting markets, and user-friendly interfaces that simplify complex wagering. The emphasis is on creating engaging, secure, and accessible entertainment platforms that cater to a diverse player base.

Key Drivers, Barriers & Challenges in United States Online Gambling Market

Key Drivers:

- Technological Advancements: The proliferation of smartphones, high-speed internet, and sophisticated software platforms are enabling more engaging and accessible online gambling experiences.

- Regulatory Liberalization: The ongoing trend of states legalizing and regulating online sports betting and casino games is a primary growth catalyst, opening up new markets and revenue streams.

- Consumer Demand for Convenience: The ability to gamble anytime, anywhere, without the need for physical travel, caters to modern consumer lifestyles and preferences.

- Growth of Sports Betting: The immense popularity of major US sports leagues and the ease of placing bets, especially in-play, are driving substantial growth.

Barriers & Challenges:

- Fragmented Regulatory Landscape: The patchwork of state-by-state regulations creates complexity for operators seeking nationwide expansion, leading to increased compliance costs and operational hurdles.

- Responsible Gambling Concerns: Addressing issues of problem gambling and ensuring robust responsible gaming measures are crucial for long-term sustainability and public trust.

- Intense Competition: The market is becoming increasingly crowded, leading to higher customer acquisition costs and a constant need for differentiation and innovation.

- Payment Processing Hurdles: While improving, some payment methods can still face challenges due to existing financial regulations.

- Data Security and Privacy: Protecting sensitive player data from cyber threats is a paramount concern, requiring continuous investment in advanced security infrastructure.

Growth Drivers in the United States Online Gambling Market Market

The United States online gambling market is propelled by several significant growth drivers. Technologically, the widespread adoption of mobile devices and advancements in mobile application development have made online gambling more accessible and user-friendly than ever before. Economically, increasing disposable incomes and a growing comfort with digital transactions contribute to higher spending on online entertainment. Crucially, the regulatory environment is a major catalyst; as more states legalize and regulate online sports betting and casino games, new markets are opened, leading to substantial revenue growth. The increasing sophistication of live dealer technologies and the integration of AI for personalized player experiences further enhance engagement and retention, creating a virtuous cycle of growth.

Challenges Impacting United States Online Gambling Market Growth

The growth of the United States online gambling market is not without its challenges. Regulatory complexities, with each state having its own set of rules and licensing requirements, pose a significant barrier to streamlined nationwide expansion. Supply chain issues, particularly concerning technological infrastructure and platform development, can sometimes impact the speed of new market entry or product rollout. Moreover, intense competitive pressures from both established players and new entrants drive up customer acquisition costs and necessitate continuous innovation, which can be resource-intensive. The need for robust responsible gambling measures, while essential for ethical operation, also adds to operational complexity and cost. Quantifiable impacts include increased legal and compliance expenditures and the potential for delayed market entry due to licensing bottlenecks.

Key Players Shaping the United States Online Gambling Market Market

- Churchill Downs Incorporated

- Flutter Entertainment PLC

- 888 Holdings PLC

- Fertitta Group Inc

- Lotto Direct Limited

- MGM Resorts International (Borgata Hotel Casino & Spa)

- DraftKings Inc

- Cherry Gold Casino

- El Royale Casino

- Caesars Entertainment Inc

Significant United States Online Gambling Market Industry Milestones

- September 2022: Caesars Entertainment launched its most advanced sports betting and iGaming platform, Caesars Sportsbook & Casino in Pennsylvania, significantly enhancing the state's mobile sports betting and casino game offerings.

- July 2022: EveryMatrix, a B2B iGaming platform provider, signed a distribution agreement with 888casino, part of 888 Holdings PLC, extending EveryMatrix's reach into the US market from its Miami hub.

- January 2022: BetMGM launched its online sportsbook in New York, providing a user-friendly platform for customizable sports wagers, including pre-game, in-play, futures, and parlay bets.

Future Outlook for United States Online Gambling Market Market

The future outlook for the United States online gambling market is exceptionally promising, characterized by sustained growth driven by ongoing legislative expansion and technological innovation. Strategic opportunities lie in further penetrating newly regulated states, enhancing mobile user experiences, and integrating emerging technologies like AI and potentially VR for more immersive gameplay. The market is expected to see continued consolidation as larger players acquire smaller ones to gain market share and technological capabilities. Player engagement will likely be further amplified through sophisticated personalization algorithms, loyalty programs, and the expansion of live dealer offerings. The focus on responsible gambling will remain critical, with operators that prioritize player safety and ethical practices poised for long-term success and market leadership. The overall market is projected to reach substantial valuations, reflecting its significant growth potential.

United States Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. End User

- 2.1. Desktop

- 2.2. Mobile

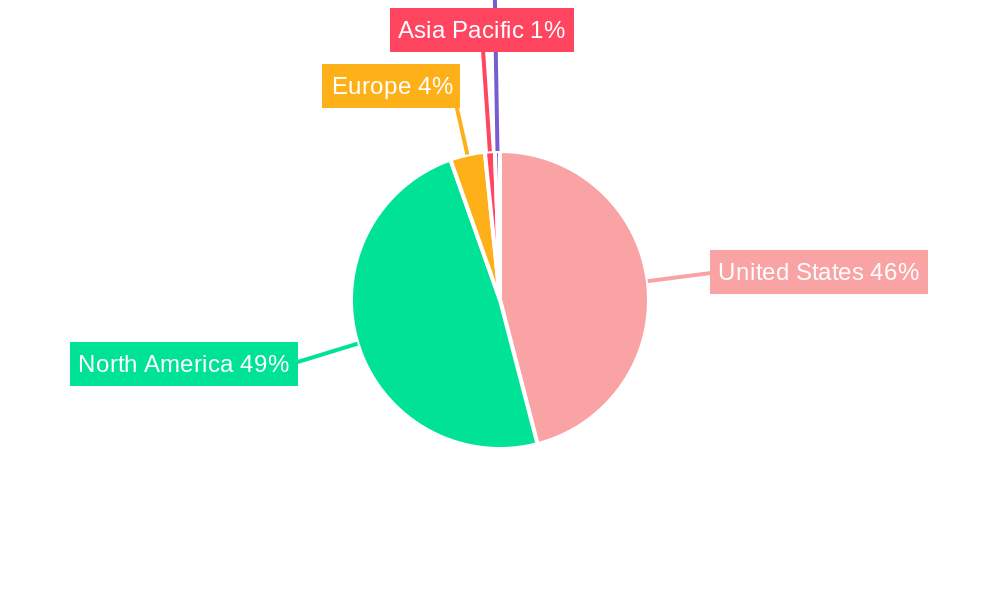

United States Online Gambling Market Segmentation By Geography

- 1. United States

United States Online Gambling Market Regional Market Share

Geographic Coverage of United States Online Gambling Market

United States Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Popularity of Online Gambling; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 and Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory Uncertainty And Compliance

- 3.4. Market Trends

- 3.4.1. Consumer's Inclination Towards Gambling Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Churchill Downs Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flutter Entertainment PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 888 Holdings PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fertitta Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lotto Direct Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MGM Resorts International (Borgata Hotel Casino & Spa)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DraftKings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cherry Gold Casino

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 El Royale Casino*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Caesars Entertainment Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Churchill Downs Incorporated

List of Figures

- Figure 1: United States Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: United States Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: United States Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: United States Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: United States Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: United States Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Online Gambling Market?

The projected CAGR is approximately 16.52%.

2. Which companies are prominent players in the United States Online Gambling Market?

Key companies in the market include Churchill Downs Incorporated, Flutter Entertainment PLC, 888 Holdings PLC, Fertitta Group Inc, Lotto Direct Limited, MGM Resorts International (Borgata Hotel Casino & Spa), DraftKings Inc, Cherry Gold Casino, El Royale Casino*List Not Exhaustive, Caesars Entertainment Inc.

3. What are the main segments of the United States Online Gambling Market?

The market segments include Game Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Online Gambling; Advancement In Security. Encryption. and Streaming Technology.

6. What are the notable trends driving market growth?

Consumer's Inclination Towards Gambling Culture.

7. Are there any restraints impacting market growth?

Regulatory Uncertainty And Compliance.

8. Can you provide examples of recent developments in the market?

In September 2022, Caesars Entertainment launched its most advanced sports betting and iGaming platform, Caesars Sportsbook & Casino in Pennsylvania. Featuring the introduction, the state will have access to a significantly improved, feature-rich version of the Caesars Sportsbook & Casino app with mobile sports betting and casino games befitting of a Caesar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Online Gambling Market?

To stay informed about further developments, trends, and reports in the United States Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence