Key Insights

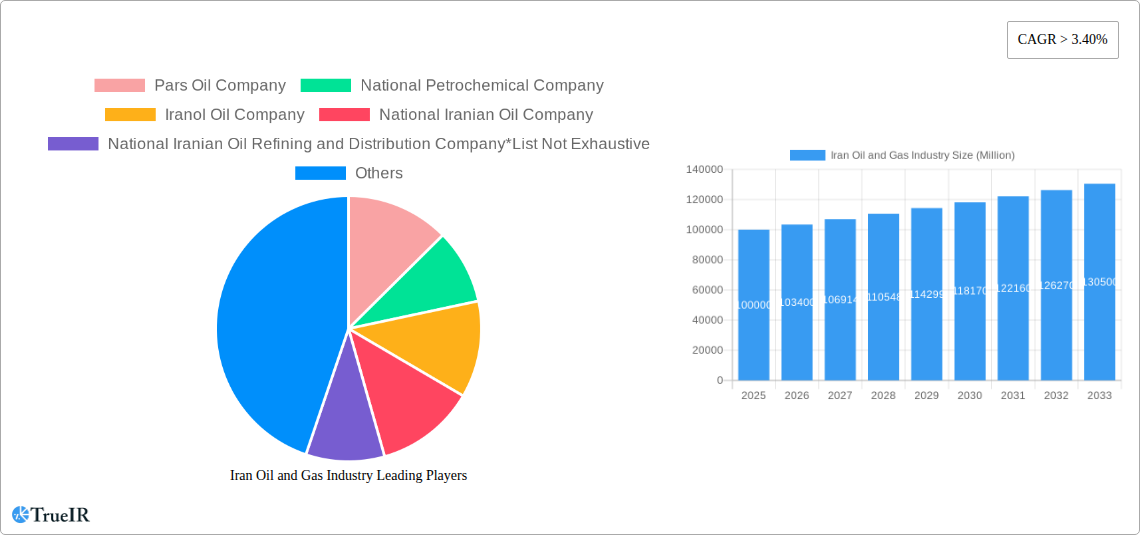

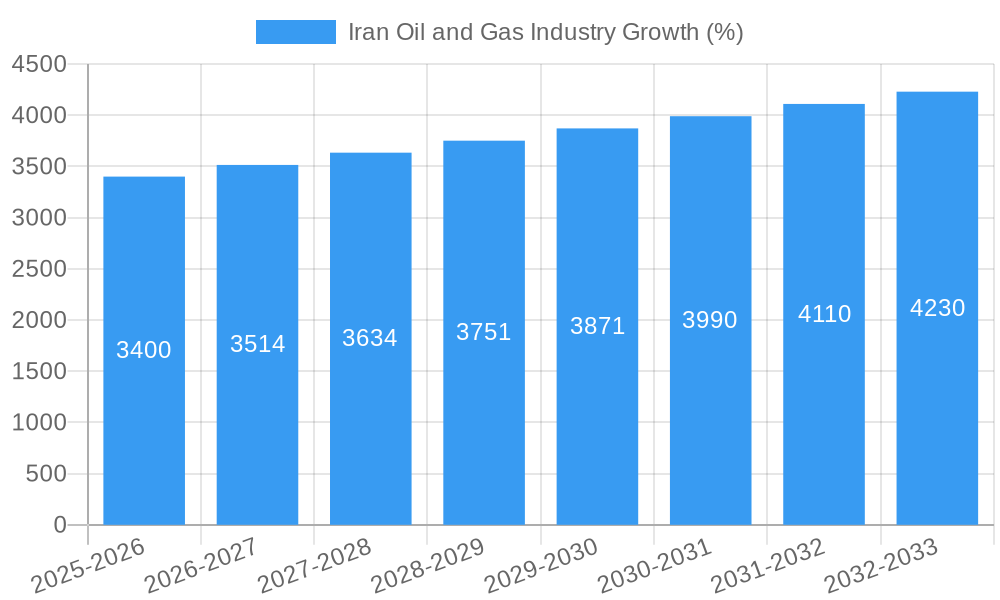

The Iranian oil and gas industry, while facing geopolitical challenges, presents a complex market with significant potential for growth. The market, valued at approximately $100 billion in 2025 (estimated based on a substantial, though unspecified, market size and the provided value unit of millions), exhibits a Compound Annual Growth Rate (CAGR) exceeding 3.40%. This growth is propelled by several factors. Firstly, Iran possesses substantial proven reserves of both crude oil and natural gas, providing a robust resource base. Secondly, increasing domestic demand, driven by population growth and industrial expansion, fuels market expansion. Thirdly, strategic investments in infrastructure development and modernization of oil refineries enhance production and export capabilities. However, international sanctions and their impact on foreign investment and trade remain significant restraints on industry expansion. Furthermore, global shifts towards renewable energy sources and fluctuating oil prices introduce uncertainty into the long-term outlook. Segmentation analysis reveals that crude oil and natural gas constitute the largest portions of the product type segment, while the export market sector dominates in terms of end-user classification. Major players such as the National Iranian Oil Company (NIOC), Pars Oil Company, and Iranol Oil Company are key contributors to the industry’s overall performance.

The forecast period from 2025 to 2033 suggests continued growth, although the rate might fluctuate depending on global economic conditions and geopolitical developments. Careful management of resources and strategic partnerships are crucial to mitigate risks associated with sanctions and price volatility. A focus on technological advancements to improve efficiency and environmental sustainability will be vital for long-term competitiveness and aligning with global environmental goals. The industry's future will depend on a skillful balance between maximizing revenue generation from existing resources and diversifying into cleaner energy solutions while navigating the complexities of the international energy landscape.

Iran Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Iranian oil and gas industry, encompassing market structure, competitive landscape, trends, opportunities, and future outlook from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this in-depth study leverages extensive data and insights to offer a comprehensive understanding of this crucial sector. Key players such as National Iranian Oil Company (NIOC), Pars Oil Company, National Petrochemical Company (NPC), and Iranol Oil Company are analyzed, alongside industry developments and market challenges. This report is essential for investors, industry professionals, and policymakers seeking a clear picture of Iran's energy landscape.

Iran Oil and Gas Industry Market Structure & Competitive Landscape

The Iranian oil and gas industry exhibits a concentrated market structure, dominated by state-owned enterprises like the National Iranian Oil Company (NIOC). The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a high level of market concentration. Innovation is driven primarily by government initiatives focused on boosting domestic production and diversifying exports. Stringent regulations, including sanctions, significantly impact market dynamics, creating both challenges and opportunities for international players. Product substitutes, such as renewable energy sources, are increasingly relevant, although their penetration rate remains relatively low (xx% in 2024).

End-user segmentation is primarily split between domestic consumption and exports. The domestic market is characterized by stable demand, while export markets are subject to global price fluctuations and geopolitical factors. Mergers and acquisitions (M&A) activity has been limited in recent years due to sanctions and political uncertainty, with a total M&A volume of approximately xx Million USD in the period 2019-2024. However, future M&A activity is anticipated to increase with easing sanctions (predicted increase of xx% by 2033).

- Market Concentration: High, dominated by state-owned enterprises.

- Innovation Drivers: Government initiatives, technological advancements (albeit limited due to sanctions).

- Regulatory Impacts: Significant, driven by sanctions and domestic policies.

- Product Substitutes: Renewable energy sources (low penetration rate).

- End-User Segmentation: Domestic and Export markets.

- M&A Trends: Limited historically, but potential for increased activity with geopolitical shifts.

Iran Oil and Gas Industry Market Trends & Opportunities

The Iranian oil and gas market is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), driven by rising domestic demand and potential increases in exports following easing sanctions. Market size is estimated at xx Million USD in 2025, with projected growth to xx Million USD by 2033. Technological shifts, such as the adoption of enhanced oil recovery (EOR) techniques and investments in gas processing infrastructure, are crucial for unlocking further growth. However, consumer preferences are evolving, with a gradual shift towards cleaner energy sources, posing a long-term challenge to the industry. Competitive dynamics are primarily shaped by the interplay between state-owned enterprises and limited private sector participation. Market penetration rates for various products vary significantly, with crude oil maintaining the highest share (xx%).

Dominant Markets & Segments in Iran Oil and Gas Industry

The dominant segment within the Iranian oil and gas industry is crude oil exports, contributing significantly to the nation’s revenue. The South Pars gas field is a key player in the natural gas sector, while the petrochemical industry displays strong growth potential. The domestic market represents a significant portion of the end-user segment, driven by energy needs of the industrial and residential sectors.

- Key Growth Drivers for Crude Oil: Existing infrastructure, global demand (though subject to geopolitical factors).

- Key Growth Drivers for Natural Gas: South Pars gas field development, growing domestic demand for power generation and industrial use.

- Key Growth Drivers for Petrochemicals: Increasing domestic demand, potential for export growth.

- Key Growth Drivers for Domestic Market: Rising population, industrial expansion.

- Key Growth Drivers for Export Market: Global demand, potential for increased export volumes following easing sanctions.

Iran Oil and Gas Industry Product Analysis

The Iranian oil and gas industry is characterized by a focus on refining and processing crude oil and natural gas. Recent advancements in EOR technologies aim to improve extraction efficiency from aging fields. The petrochemical sector offers significant potential for diversification and value addition through the production of various downstream products. Technological advancements are primarily concentrated on improving efficiency and reducing costs within the existing infrastructure. Market fit is largely determined by domestic demand and export opportunities.

Key Drivers, Barriers & Challenges in Iran Oil and Gas Industry

Key Drivers:

- Government investment in infrastructure development.

- Abundant reserves of oil and gas.

- Growing domestic demand for energy.

- Potential for increased exports with geopolitical changes.

Key Challenges:

- Sanctions and international pressure.

- Aging infrastructure and limited investment in modernization.

- Dependence on fossil fuels amid global push for energy transition.

- Geopolitical instability and security concerns. The impact of these challenges is estimated to reduce potential output by xx Million barrels of oil equivalent annually.

Growth Drivers in the Iran Oil and Gas Industry Market

Key drivers for growth include government support for infrastructure projects, the development of new gas fields like North Pars and South Pars Phase 11, and a potential increase in exports with eased international sanctions. Technological advancements in extraction and processing also contribute positively. The ongoing investment in petrochemical plants promises a diversification away from crude oil export reliance.

Challenges Impacting Iran Oil and Gas Industry Growth

The industry faces significant challenges, including the impact of international sanctions, limiting investment and technology transfers. Aging infrastructure requires significant modernization investments, and the transition to cleaner energy sources presents a longer-term challenge. Geopolitical instability creates ongoing uncertainties.

Key Players Shaping the Iran Oil and Gas Industry Market

- National Iranian Oil Company (NIOC)

- Pars Oil Company

- National Petrochemical Company (NPC)

- Iranol Oil Company

- National Iranian Oil Refining and Distribution Company

Significant Iran Oil and Gas Industry Industry Milestones

- November 2021: Iran announced a USD 11 billion investment plan to increase gas production capacity by 240 Million cubic meters/day.

- January 2022: The Lavan Refinery announced plans to construct a 150,000-barrel petro-refinery and increase daily production by 1 Million liters.

Future Outlook for Iran Oil and Gas Industry Market

The future of the Iranian oil and gas industry hinges on geopolitical factors and the level of international engagement. While substantial reserves ensure long-term potential, strategic investments in modernization, diversification, and sustainable practices are essential to navigate the challenges of a changing global energy landscape. The potential for export growth and domestic development remains significant, contingent on addressing regulatory and technological hurdles.

Iran Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Iran Oil and Gas Industry Segmentation By Geography

- 1. Iran

Iran Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pars Oil Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Petrochemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iranol Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Iranian Oil Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Iranian Oil Refining and Distribution Company*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Pars Oil Company

List of Figures

- Figure 1: Iran Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 5: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 7: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 9: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 11: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

- Table 13: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 14: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 15: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 16: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 17: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 18: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 19: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Oil and Gas Industry?

The projected CAGR is approximately > 3.40%.

2. Which companies are prominent players in the Iran Oil and Gas Industry?

Key companies in the market include Pars Oil Company, National Petrochemical Company, Iranol Oil Company, National Iranian Oil Company, National Iranian Oil Refining and Distribution Company*List Not Exhaustive.

3. What are the main segments of the Iran Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, the Lavan Refinery, in the south of Iran, announced the construction of a 150,000-barrel petro-refinery next to the Lavan Refinery and its efforts to increase the refinery's production by one million liters per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Iran Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence