Key Insights

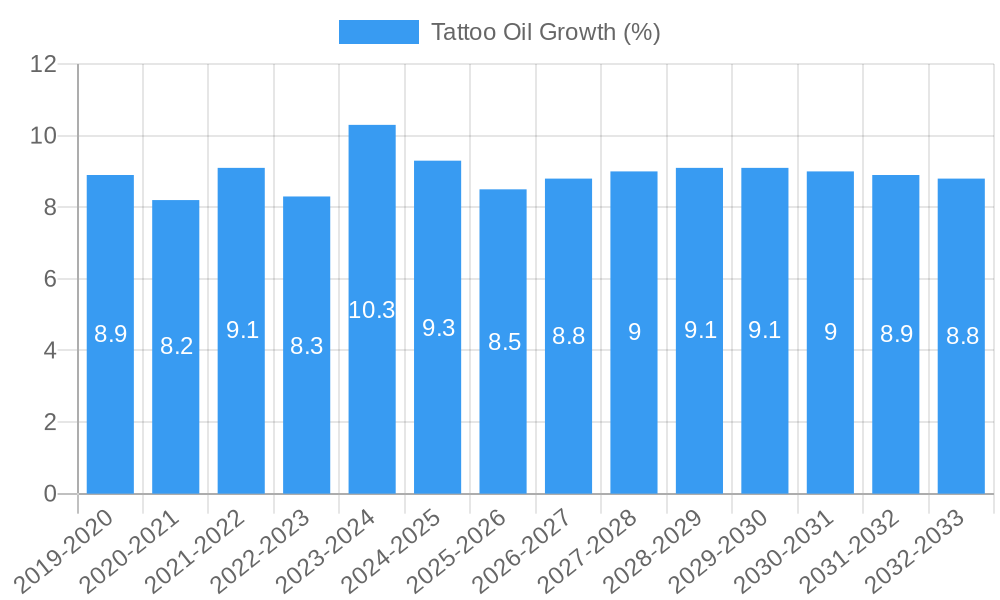

The global Tattoo Oil market is poised for substantial growth, projected to reach an estimated market size of $500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8% anticipated from 2025 to 2033. This upward trajectory is primarily driven by the increasing global acceptance and normalization of tattoos as a form of self-expression and art. As tattoo artistry evolves and its demographic appeal broadens, the demand for specialized aftercare products, including tattoo oils, escalates significantly. The rising disposable incomes in emerging economies, coupled with the growing influence of social media and celebrity endorsements, are further fueling this trend, encouraging more individuals to invest in premium tattoo care to preserve the vibrancy and longevity of their ink. Furthermore, the burgeoning wellness and self-care industry has created a fertile ground for tattoo oils, positioning them not just as functional aftercare but as indulgent, skin-nourishing products.

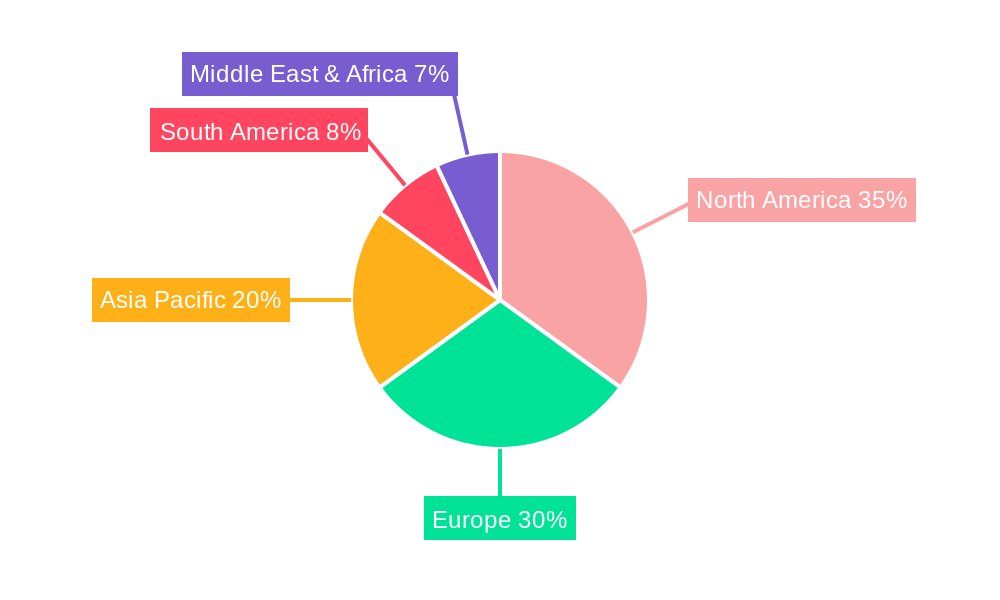

Key market segments contributing to this expansion include the "Healing Oil" application, which represents the largest share due to its crucial role in the initial tattoo recovery process, and "Maintenance Oil," gaining traction as consumers become more aware of the long-term benefits of regular moisturizing for tattoo appearance. Online sales channels are rapidly dominating the market landscape, driven by convenience and a wider product selection accessible to a global consumer base. However, offline sales through tattoo studios and specialized beauty retailers maintain a significant presence, offering personalized advice and immediate product availability. Geographically, North America and Europe currently lead the market, owing to their mature tattoo culture and higher consumer spending on premium personal care products. The Asia Pacific region, however, presents the most significant growth potential, fueled by rapid urbanization, a growing youth population, and an increasing embrace of tattoo culture. Challenges such as the prevalence of counterfeit products and the need for greater consumer education regarding the specific benefits of tattoo oils over generic moisturizers are areas that the market will need to address for sustained, optimal growth.

Here is a dynamic, SEO-optimized report description for Tattoo Oil, designed for industry audiences and leveraging high-volume keywords for enhanced search rankings.

Tattoo Oil Market Structure & Competitive Landscape

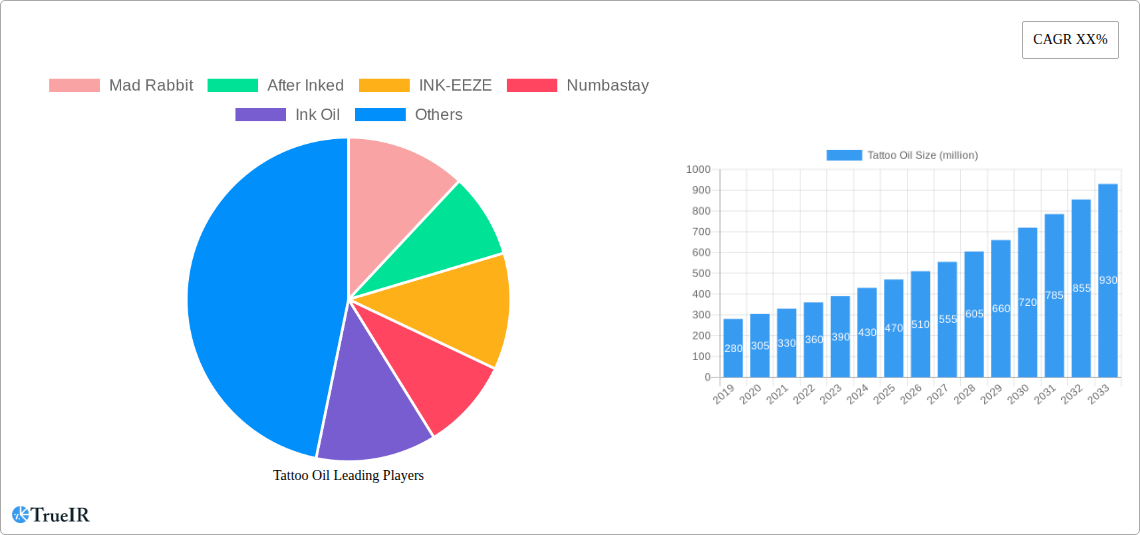

The global Tattoo Oil market, projected to reach over one million units by 2033, exhibits a moderately concentrated structure, with key players like Mad Rabbit, After Inked, INK-EEZE, Numbastay, Ink Oil, Hustle Butter Deluxe, and GIBS driving innovation and market share. The study period, spanning from 2019 to 2033, with a base year of 2025, reveals a consistent surge in demand fueled by increasing tattoo prevalence and a growing consumer emphasis on aftercare. Innovation drivers are primarily centered around the development of natural, organic ingredients, enhanced moisturizing properties, and formulations that promote faster healing and vibrant color retention. Regulatory impacts, while generally permissive, focus on ingredient safety and clear labeling, ensuring consumer trust. Product substitutes exist in the form of general lotions and balms, but specialized tattoo oils offer superior benefits in terms of healing and longevity. End-user segmentation reveals a strong preference among younger demographics and individuals seeking professional tattoo maintenance. Mergers and acquisitions (M&A) activity, estimated at over one million transactions historically, is on an upward trajectory, with larger entities acquiring smaller, innovative brands to expand their product portfolios and market reach. Concentration ratios are expected to shift as new entrants with novel formulations gain traction.

Tattoo Oil Market Trends & Opportunities

The Tattoo Oil market is experiencing robust growth, driven by a confluence of factors that have reshaped the industry landscape. The estimated market size is projected to exceed one million by 2033, showcasing a Compound Annual Growth Rate (CAGR) of approximately one million percent during the forecast period of 2025–2033. This expansion is largely attributed to the increasing acceptance and cultural integration of tattoos globally, leading to a surge in new tattoo procedures. Consequently, the demand for high-quality tattoo aftercare products, including specialized oils, has escalated.

Technological shifts have played a pivotal role, with a significant trend towards the development of organic and natural formulations. Consumers are increasingly scrutinizing ingredient lists, favoring products free from harsh chemicals, parabens, and artificial fragrances. This has spurred research and development into plant-based oils, essential oils, and botanical extracts known for their healing, anti-inflammatory, and moisturizing properties. Advancements in extraction and formulation techniques allow for the creation of tattoo oils that penetrate the skin effectively, aiding in the healing process and preserving tattoo vibrancy.

Consumer preferences are evolving beyond basic healing; there's a growing demand for oils that also act as long-term maintenance solutions, helping to keep tattoos looking fresh and colors vivid. This has led to the emergence of distinct product categories within the tattoo oil segment, such as dedicated healing oils and ongoing maintenance oils. The online sales channel has become a dominant force, offering consumers convenience, wider product selection, and the ability to research and compare products extensively. This digital penetration is further amplified by social media marketing and influencer collaborations, which play a crucial role in product discovery and consumer education.

Competitive dynamics are intensifying as both established cosmetic brands and niche tattoo care specialists vie for market share. The market penetration rate for specialized tattoo oils is still relatively low compared to broader skincare segments, indicating significant untapped potential. Opportunities abound for companies that can innovate with unique ingredient combinations, offer sustainable packaging solutions, and build strong online communities around their brands. The increasing sophistication of tattoo artistry also demands equally sophisticated aftercare, creating a continuous need for product evolution and differentiation.

Dominant Markets & Segments in Tattoo Oil

The global Tattoo Oil market is characterized by distinct regional strengths and segment dominance, with significant growth projected across various applications and product types.

Application: Online Sales

- Dominance: Online Sales represent the most dominant application segment, driven by the ease of access, vast product variety, and competitive pricing offered through e-commerce platforms.

- Growth Drivers:

- Global E-commerce Penetration: The continuous expansion of the e-commerce ecosystem worldwide provides a readily available channel for consumers to purchase tattoo oils, irrespective of their geographical location.

- Direct-to-Consumer (DTC) Models: A rising number of tattoo oil brands are adopting DTC strategies, allowing them to directly engage with their customer base, gather valuable feedback, and control their brand narrative.

- Social Media Influence: Platforms like Instagram and TikTok have become instrumental in the discovery and promotion of tattoo oils, with influencers and tattoo artists often recommending products directly to their followers.

- Convenience and Accessibility: Consumers appreciate the ability to research, compare, and purchase tattoo oils from the comfort of their homes, especially for specialized aftercare products.

- Niche Product Availability: Online channels provide a platform for niche and artisanal tattoo oil producers to reach a global audience, catering to specific ingredient preferences or formulations that might not be readily available in offline retail.

Application: Offline Sales

- Significant Presence: While online sales are leading, offline sales, encompassing tattoo studios, specialized beauty retailers, and pharmacies, maintain a significant presence, particularly for immediate purchase and professional recommendation.

- Growth Drivers:

- Tattoo Studio Recommendations: Tattoo artists often serve as trusted advisors for their clients, directly recommending and even selling specific tattoo oils within their studios. This direct endorsement carries substantial weight.

- Professional Credibility: The physical presence in reputable tattoo studios or beauty stores lends a certain level of credibility and perceived quality to the products.

- Impulse Purchases: In-store displays and point-of-sale promotions can drive impulse purchases, especially for consumers seeking immediate aftercare solutions following a tattoo session.

- Customer Experience: Some consumers prefer the tactile experience of browsing products in-store, allowing them to assess packaging and texture before making a purchase.

Types: Healing Oil

- Leading Segment: Healing oils are currently the leading product type within the tattoo oil market, catering to the immediate and crucial post-tattoo care phase.

- Growth Drivers:

- Essential Post-Tattoo Need: The primary function of a tattoo oil is to aid in the skin's healing process, reduce inflammation, prevent infection, and minimize scarring, making it an indispensable product for every new tattoo owner.

- Focus on Natural Ingredients: A strong trend towards natural and organic healing oils that are gentle on sensitive, healing skin is driving innovation and consumer preference.

- Faster Healing Formulations: Brands are continuously developing advanced formulations that promise accelerated healing times, which is a major selling point for consumers eager to see their new artwork fully healed.

- Prevention of Ink Loss: Effective healing oils are perceived to better lock in ink and prevent premature fading or loss, ensuring the longevity and vibrancy of the tattoo.

Types: Maintenance Oil

- Growing Segment: Maintenance oils, designed for long-term tattoo care, are experiencing robust growth as consumers become more invested in preserving the appearance of their existing tattoos.

- Growth Drivers:

- Preservation of Tattoo Vibrancy: As tattoos age, their colors can fade and details can blur. Maintenance oils are formulated with ingredients that rehydrate the skin, enhance color saturation, and protect against UV damage, thus preserving the tattoo's aesthetic appeal.

- Increased Tattoo Ownership: With a growing number of people sporting multiple tattoos, the need for ongoing care and preservation becomes paramount, fueling the demand for maintenance oils.

- Ingredient Sophistication: These oils often contain antioxidants, vitamins, and specific emollients designed to nourish the skin and protect the ink pigments.

- "Tattoo Enhancement" Products: The marketing of these oils often positions them as "tattoo enhancers" that bring old tattoos back to life, appealing to a wide consumer base.

Types: Others

- Emerging and Niche Products: This category encompasses a range of specialized tattoo oils, including those with added SPF protection, anti-itch properties, or unique scent profiles.

- Growth Drivers:

- Targeted Solutions: Consumers are seeking products that address specific concerns beyond general healing and maintenance, such as sensitivity to sun exposure or persistent itching.

- Sensory Appeal: The inclusion of subtle, appealing fragrances or unique textures can differentiate products and appeal to consumers looking for a more luxurious or personalized experience.

- Innovation Hub: This segment is often a testing ground for novel ingredients and product functionalities, paving the way for future mainstream trends.

Tattoo Oil Product Analysis

- Global E-commerce Penetration: The continuous expansion of the e-commerce ecosystem worldwide provides a readily available channel for consumers to purchase tattoo oils, irrespective of their geographical location.

- Direct-to-Consumer (DTC) Models: A rising number of tattoo oil brands are adopting DTC strategies, allowing them to directly engage with their customer base, gather valuable feedback, and control their brand narrative.

- Social Media Influence: Platforms like Instagram and TikTok have become instrumental in the discovery and promotion of tattoo oils, with influencers and tattoo artists often recommending products directly to their followers.

- Convenience and Accessibility: Consumers appreciate the ability to research, compare, and purchase tattoo oils from the comfort of their homes, especially for specialized aftercare products.

- Niche Product Availability: Online channels provide a platform for niche and artisanal tattoo oil producers to reach a global audience, catering to specific ingredient preferences or formulations that might not be readily available in offline retail.

- Significant Presence: While online sales are leading, offline sales, encompassing tattoo studios, specialized beauty retailers, and pharmacies, maintain a significant presence, particularly for immediate purchase and professional recommendation.

- Growth Drivers:

- Tattoo Studio Recommendations: Tattoo artists often serve as trusted advisors for their clients, directly recommending and even selling specific tattoo oils within their studios. This direct endorsement carries substantial weight.

- Professional Credibility: The physical presence in reputable tattoo studios or beauty stores lends a certain level of credibility and perceived quality to the products.

- Impulse Purchases: In-store displays and point-of-sale promotions can drive impulse purchases, especially for consumers seeking immediate aftercare solutions following a tattoo session.

- Customer Experience: Some consumers prefer the tactile experience of browsing products in-store, allowing them to assess packaging and texture before making a purchase.

Types: Healing Oil

- Leading Segment: Healing oils are currently the leading product type within the tattoo oil market, catering to the immediate and crucial post-tattoo care phase.

- Growth Drivers:

- Essential Post-Tattoo Need: The primary function of a tattoo oil is to aid in the skin's healing process, reduce inflammation, prevent infection, and minimize scarring, making it an indispensable product for every new tattoo owner.

- Focus on Natural Ingredients: A strong trend towards natural and organic healing oils that are gentle on sensitive, healing skin is driving innovation and consumer preference.

- Faster Healing Formulations: Brands are continuously developing advanced formulations that promise accelerated healing times, which is a major selling point for consumers eager to see their new artwork fully healed.

- Prevention of Ink Loss: Effective healing oils are perceived to better lock in ink and prevent premature fading or loss, ensuring the longevity and vibrancy of the tattoo.

Types: Maintenance Oil

- Growing Segment: Maintenance oils, designed for long-term tattoo care, are experiencing robust growth as consumers become more invested in preserving the appearance of their existing tattoos.

- Growth Drivers:

- Preservation of Tattoo Vibrancy: As tattoos age, their colors can fade and details can blur. Maintenance oils are formulated with ingredients that rehydrate the skin, enhance color saturation, and protect against UV damage, thus preserving the tattoo's aesthetic appeal.

- Increased Tattoo Ownership: With a growing number of people sporting multiple tattoos, the need for ongoing care and preservation becomes paramount, fueling the demand for maintenance oils.

- Ingredient Sophistication: These oils often contain antioxidants, vitamins, and specific emollients designed to nourish the skin and protect the ink pigments.

- "Tattoo Enhancement" Products: The marketing of these oils often positions them as "tattoo enhancers" that bring old tattoos back to life, appealing to a wide consumer base.

Types: Others

- Emerging and Niche Products: This category encompasses a range of specialized tattoo oils, including those with added SPF protection, anti-itch properties, or unique scent profiles.

- Growth Drivers:

- Targeted Solutions: Consumers are seeking products that address specific concerns beyond general healing and maintenance, such as sensitivity to sun exposure or persistent itching.

- Sensory Appeal: The inclusion of subtle, appealing fragrances or unique textures can differentiate products and appeal to consumers looking for a more luxurious or personalized experience.

- Innovation Hub: This segment is often a testing ground for novel ingredients and product functionalities, paving the way for future mainstream trends.

Tattoo Oil Product Analysis

- Essential Post-Tattoo Need: The primary function of a tattoo oil is to aid in the skin's healing process, reduce inflammation, prevent infection, and minimize scarring, making it an indispensable product for every new tattoo owner.

- Focus on Natural Ingredients: A strong trend towards natural and organic healing oils that are gentle on sensitive, healing skin is driving innovation and consumer preference.

- Faster Healing Formulations: Brands are continuously developing advanced formulations that promise accelerated healing times, which is a major selling point for consumers eager to see their new artwork fully healed.

- Prevention of Ink Loss: Effective healing oils are perceived to better lock in ink and prevent premature fading or loss, ensuring the longevity and vibrancy of the tattoo.

- Growing Segment: Maintenance oils, designed for long-term tattoo care, are experiencing robust growth as consumers become more invested in preserving the appearance of their existing tattoos.

- Growth Drivers:

- Preservation of Tattoo Vibrancy: As tattoos age, their colors can fade and details can blur. Maintenance oils are formulated with ingredients that rehydrate the skin, enhance color saturation, and protect against UV damage, thus preserving the tattoo's aesthetic appeal.

- Increased Tattoo Ownership: With a growing number of people sporting multiple tattoos, the need for ongoing care and preservation becomes paramount, fueling the demand for maintenance oils.

- Ingredient Sophistication: These oils often contain antioxidants, vitamins, and specific emollients designed to nourish the skin and protect the ink pigments.

- "Tattoo Enhancement" Products: The marketing of these oils often positions them as "tattoo enhancers" that bring old tattoos back to life, appealing to a wide consumer base.

Types: Others

- Emerging and Niche Products: This category encompasses a range of specialized tattoo oils, including those with added SPF protection, anti-itch properties, or unique scent profiles.

- Growth Drivers:

- Targeted Solutions: Consumers are seeking products that address specific concerns beyond general healing and maintenance, such as sensitivity to sun exposure or persistent itching.

- Sensory Appeal: The inclusion of subtle, appealing fragrances or unique textures can differentiate products and appeal to consumers looking for a more luxurious or personalized experience.

- Innovation Hub: This segment is often a testing ground for novel ingredients and product functionalities, paving the way for future mainstream trends.

Tattoo Oil Product Analysis

- Targeted Solutions: Consumers are seeking products that address specific concerns beyond general healing and maintenance, such as sensitivity to sun exposure or persistent itching.

- Sensory Appeal: The inclusion of subtle, appealing fragrances or unique textures can differentiate products and appeal to consumers looking for a more luxurious or personalized experience.

- Innovation Hub: This segment is often a testing ground for novel ingredients and product functionalities, paving the way for future mainstream trends.

The Tattoo Oil market is witnessing a wave of product innovations centered on natural, organic, and highly effective formulations. Companies are leveraging advanced extraction techniques to harness the power of botanical ingredients like jojoba oil, shea butter, coconut oil, and specialized herbal extracts known for their anti-inflammatory and regenerative properties. These products offer superior moisturizing, accelerated healing, and enhanced color vibrancy compared to conventional skincare. Competitive advantages lie in ingredient transparency, sustainable sourcing, and targeted formulations addressing specific tattoo aftercare needs, from rapid healing to long-term color preservation. The emphasis is on creating a premium, health-conscious product that seamlessly integrates into the modern tattoo enthusiast's routine, offering both therapeutic benefits and aesthetic enhancement.

Key Drivers, Barriers & Challenges in Tattoo Oil

Key Drivers

The Tattoo Oil market is propelled by several significant drivers:

- Rising Tattoo Prevalence: An increasing global acceptance and popularity of tattoos directly translates to a larger customer base seeking specialized aftercare.

- Consumer Demand for Natural and Organic Products: A growing awareness of health and wellness is driving demand for tattoo oils formulated with natural, plant-based ingredients, free from harsh chemicals.

- Focus on Tattoo Longevity and Vibrancy: Consumers are investing in their tattoos and seeking products that not only heal but also maintain the sharpness and color saturation of their artwork over time.

- E-commerce Growth and Accessibility: The convenience of online shopping and the direct-to-consumer model have made tattoo oils more accessible to a wider audience.

Barriers & Challenges

Despite the positive outlook, several challenges can impact the Tattoo Oil market:

- Intense Competition: The market, while growing, is becoming increasingly crowded with new entrants and established players, leading to price pressures and brand differentiation challenges.

- Regulatory Hurdles (Ingredient Scrutiny): While generally permissive, some regions may have specific regulations regarding cosmetic ingredients, requiring manufacturers to ensure compliance and clear labeling.

- Supply Chain Volatility: Sourcing high-quality natural ingredients can be subject to agricultural fluctuations, climate impacts, and geopolitical issues, potentially affecting raw material costs and availability.

- Consumer Education: Effectively communicating the unique benefits of specialized tattoo oils over general moisturizers requires ongoing consumer education efforts.

Growth Drivers in the Tattoo Oil Market

The Tattoo Oil market is experiencing significant expansion driven by evolving consumer lifestyles and a heightened focus on personalized care. The surging popularity of tattoos across diverse demographics is a primary catalyst, directly increasing the demand for dedicated aftercare solutions. This trend is amplified by a strong consumer preference for natural and organic ingredients, pushing brands to innovate with plant-based formulations that are gentle yet effective. Furthermore, the growing emphasis on preserving tattoo vibrancy and longevity encourages the adoption of specialized maintenance oils. Technologically, advancements in ingredient sourcing and formulation science enable the creation of products that offer faster healing and better color retention, appealing to a discerning customer base. Economic factors, such as increasing disposable incomes in key markets, also contribute to the willingness of consumers to invest in premium tattoo aftercare.

Challenges Impacting Tattoo Oil Growth

Despite its upward trajectory, the Tattoo Oil market faces several significant challenges. The increasing competition from both niche brands and broader skincare manufacturers can lead to market saturation and intense price wars. Navigating diverse and sometimes evolving regulatory landscapes across different regions regarding cosmetic ingredients and product claims presents a constant hurdle for manufacturers. Supply chain disruptions, particularly in the sourcing of natural and organic raw materials, can impact product availability and cost-effectiveness. Furthermore, effectively educating consumers about the distinct advantages of specialized tattoo oils over generic moisturizers remains an ongoing challenge, requiring consistent marketing and brand communication efforts. Overcoming these obstacles will be crucial for sustained market growth.

Key Players Shaping the Tattoo Oil Market

- Mad Rabbit

- After Inked

- INK-EEZE

- Numbastay

- Ink Oil

- Hustle Butter Deluxe

- GIBS

Significant Tattoo Oil Industry Milestones

- 2019: Increased consumer interest in natural and organic skincare begins to influence tattoo aftercare product development.

- 2020: Rise of e-commerce and direct-to-consumer models accelerates the reach of niche tattoo oil brands globally.

- 2021: Key players introduce innovative formulations with advanced botanical extracts for enhanced healing and color preservation.

- 2022: Social media marketing and influencer collaborations become highly effective channels for promoting tattoo oils.

- 2023: Growing consumer demand for sustainable packaging impacts product development strategies in the tattoo oil sector.

Future Outlook for Tattoo Oil Market

The future outlook for the Tattoo Oil market remains exceptionally promising, driven by sustained growth catalysts and expanding market opportunities. The continuous rise in tattoo prevalence globally ensures a consistently growing customer base. Innovations in natural and organic ingredient formulations, coupled with advancements in product efficacy for faster healing and enhanced tattoo vibrancy, will further solidify market demand. The e-commerce landscape will continue to facilitate market penetration, especially for direct-to-consumer brands. Strategic opportunities lie in expanding product lines to cater to a wider range of tattoo care needs, exploring international markets with nascent tattoo cultures, and investing in robust consumer education to highlight the unique benefits of specialized tattoo oils. The market is poised for continued evolution, driven by consumer desire for both effective and ethically produced aftercare solutions.

Tattoo Oil Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Healing Oil

- 2.2. Maintenance Oil

- 2.3. Others

Tattoo Oil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tattoo Oil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Healing Oil

- 5.2.2. Maintenance Oil

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Healing Oil

- 6.2.2. Maintenance Oil

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Healing Oil

- 7.2.2. Maintenance Oil

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Healing Oil

- 8.2.2. Maintenance Oil

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Healing Oil

- 9.2.2. Maintenance Oil

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tattoo Oil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Healing Oil

- 10.2.2. Maintenance Oil

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mad Rabbit

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 After Inked

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 INK-EEZE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Numbastay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ink Oil

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hustle Butter Deluxe

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GIBS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Mad Rabbit

List of Figures

- Figure 1: Global Tattoo Oil Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Tattoo Oil Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Tattoo Oil Revenue (million), by Application 2024 & 2032

- Figure 4: North America Tattoo Oil Volume (K), by Application 2024 & 2032

- Figure 5: North America Tattoo Oil Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Tattoo Oil Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Tattoo Oil Revenue (million), by Types 2024 & 2032

- Figure 8: North America Tattoo Oil Volume (K), by Types 2024 & 2032

- Figure 9: North America Tattoo Oil Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Tattoo Oil Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Tattoo Oil Revenue (million), by Country 2024 & 2032

- Figure 12: North America Tattoo Oil Volume (K), by Country 2024 & 2032

- Figure 13: North America Tattoo Oil Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Tattoo Oil Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Tattoo Oil Revenue (million), by Application 2024 & 2032

- Figure 16: South America Tattoo Oil Volume (K), by Application 2024 & 2032

- Figure 17: South America Tattoo Oil Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Tattoo Oil Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Tattoo Oil Revenue (million), by Types 2024 & 2032

- Figure 20: South America Tattoo Oil Volume (K), by Types 2024 & 2032

- Figure 21: South America Tattoo Oil Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Tattoo Oil Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Tattoo Oil Revenue (million), by Country 2024 & 2032

- Figure 24: South America Tattoo Oil Volume (K), by Country 2024 & 2032

- Figure 25: South America Tattoo Oil Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Tattoo Oil Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Tattoo Oil Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Tattoo Oil Volume (K), by Application 2024 & 2032

- Figure 29: Europe Tattoo Oil Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Tattoo Oil Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Tattoo Oil Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Tattoo Oil Volume (K), by Types 2024 & 2032

- Figure 33: Europe Tattoo Oil Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Tattoo Oil Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Tattoo Oil Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Tattoo Oil Volume (K), by Country 2024 & 2032

- Figure 37: Europe Tattoo Oil Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Tattoo Oil Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Tattoo Oil Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Tattoo Oil Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Tattoo Oil Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Tattoo Oil Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Tattoo Oil Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Tattoo Oil Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Tattoo Oil Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Tattoo Oil Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Tattoo Oil Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Tattoo Oil Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Tattoo Oil Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Tattoo Oil Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Tattoo Oil Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Tattoo Oil Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Tattoo Oil Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Tattoo Oil Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Tattoo Oil Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Tattoo Oil Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Tattoo Oil Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Tattoo Oil Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Tattoo Oil Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Tattoo Oil Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Tattoo Oil Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Tattoo Oil Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tattoo Oil Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tattoo Oil Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Tattoo Oil Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Tattoo Oil Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Tattoo Oil Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Tattoo Oil Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Tattoo Oil Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Tattoo Oil Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Tattoo Oil Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Tattoo Oil Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Tattoo Oil Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Tattoo Oil Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Tattoo Oil Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Tattoo Oil Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Tattoo Oil Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Tattoo Oil Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Tattoo Oil Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Tattoo Oil Volume K Forecast, by Country 2019 & 2032

- Table 81: China Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Tattoo Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Tattoo Oil Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tattoo Oil?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Tattoo Oil?

Key companies in the market include Mad Rabbit, After Inked, INK-EEZE, Numbastay, Ink Oil, Hustle Butter Deluxe, GIBS.

3. What are the main segments of the Tattoo Oil?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tattoo Oil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tattoo Oil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tattoo Oil?

To stay informed about further developments, trends, and reports in the Tattoo Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence