Key Insights

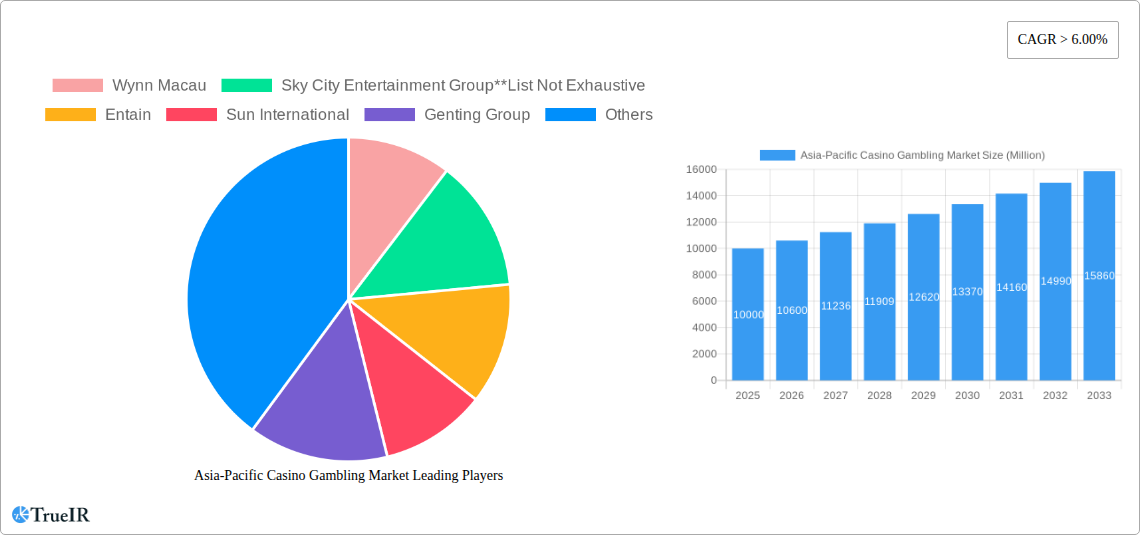

The Asia-Pacific casino gambling market is projected for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 7.24%. The market size was valued at $59.14 billion in the base year, 2025. This growth is propelled by increasing disposable incomes, a burgeoning middle class in key economies such as China, India, South Korea, and Japan, and the rising popularity of accessible online casino platforms. A robust tourism sector further bolsters revenue through substantial international visitor contributions. Navigating regulatory complexities and addressing social concerns related to problem gambling remain key considerations. The market is segmented by game type, with live casino games, baccarat, blackjack, poker, and slots currently leading, while online platforms are steadily increasing their share. Leading market participants, including Wynn Macau, Sky City Entertainment Group, and Entain, are actively pursuing technological innovation, service diversification, and enhanced customer experiences to maintain competitive advantage amidst diverse regional regulatory frameworks.

Asia-Pacific Casino Gambling Market Market Size (In Billion)

The competitive environment comprises both established international operators and adept local entities. Incumbent players benefit from brand equity and operational proficiency, while local firms possess a deeper understanding of regional consumer preferences and market nuances. Sustained growth hinges on adept regulatory adaptation, strategic alliances, technological integration, and tailored marketing strategies addressing diverse regional consumer behaviors. Future success will be defined by adaptability to evolving consumer trends, commitment to responsible gaming, and effective risk management within dynamic regulatory landscapes. The continued expansion of the middle class, alongside the growing adoption of online gaming, presents substantial long-term growth prospects for the Asia-Pacific casino gambling sector.

Asia-Pacific Casino Gambling Market Company Market Share

Asia-Pacific Casino Gambling Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Asia-Pacific casino gambling market, offering crucial insights for investors, operators, and industry stakeholders. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period. This report leverages extensive primary and secondary research, encompassing detailed financial data, competitive landscaping, and future growth projections. Key players like Wynn Macau, Sky City Entertainment Group, Entain, Sun International, Genting Group, IGT, Melco, SJM, Crown Resorts, Galaxy Entertainment, Aristocrat, Light and Wonder, and Sands China are analyzed extensively. The report segments the market by type (Live Casino, Baccarat, Blackjack, Poker, Slots, Other Types) and application (Online, Offline).

Asia-Pacific Casino Gambling Market Market Structure & Competitive Landscape

The Asia-Pacific casino gambling market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. However, the presence of numerous smaller operators and the continuous entry of new players contribute to intense competition. The market is characterized by significant innovation, driven by technological advancements in gaming technology, virtual reality (VR), augmented reality (AR), and mobile gaming. Regulatory frameworks vary considerably across different jurisdictions within the region, creating both opportunities and challenges for operators. Product substitution, largely driven by the rise of online gaming and alternative entertainment options, is a key factor impacting market dynamics. End-user segmentation, based on demographics, gambling habits, and spending power, is a crucial element in the report's detailed competitive landscape analysis. Mergers and acquisitions (M&A) activity is relatively high, reflecting the industry's dynamic nature and the pursuit of market consolidation. The report includes analysis of historical M&A volumes and forecasts future trends, highlighting potential implications for market structure. The concentration ratio (CR4) is estimated at xx% in 2025, indicating a moderately consolidated market.

Asia-Pacific Casino Gambling Market Market Trends & Opportunities

The Asia-Pacific casino gambling market is experiencing significant growth, driven by factors such as rising disposable incomes, increasing tourism, and favorable regulatory changes in some regions. Technological advancements, particularly in online gaming and mobile platforms, are transforming the market landscape, allowing for wider accessibility and enhanced player engagement. Consumer preferences are shifting towards more immersive and interactive gaming experiences, leading to increased demand for innovative game formats and technologies. This report details specific market size growth projections for each segment, along with a breakdown of market penetration rates for various gaming types across different regions. The increasing adoption of online gaming channels presents significant opportunities for growth, particularly in regions with robust internet infrastructure and favorable regulatory environments. However, intense competition among established and emerging players poses a challenge for market participants. The competitive dynamics are further shaped by regulatory changes, technological advancements, and evolving consumer preferences.

Dominant Markets & Segments in Asia-Pacific Casino Gambling Market

The Asia-Pacific casino gambling market is dominated by several key regions and segments.

- Leading Regions: Specific regions will be detailed in the full report. (e.g., Macau, Singapore, Philippines, etc.) Their dominance is attributed to factors such as established infrastructure, liberal gaming regulations, and a large concentration of tourists.

- Leading Countries: Specific countries will be detailed in the full report based on market share, growth, etc.

- Leading Segments by Type: The full report details the dominance of specific game types (e.g., Slots, Baccarat, etc.), influenced by cultural preferences and regional gaming habits. Growth drivers include the rising popularity of certain games, technological improvements enhancing the gaming experience, and effective marketing strategies.

- Leading Segments by Application: The full report will detail the dominance of online or offline gambling based on regional infrastructure, regulations, and consumer preferences. Growth drivers for each segment include factors like increased internet penetration, advancements in mobile gaming technology, and changing consumer behavior.

Key Growth Drivers (Examples):

- Robust tourism infrastructure

- Favorable government policies and regulations

- Increasing disposable incomes

- Technological advancements

Asia-Pacific Casino Gambling Market Product Analysis

The Asia-Pacific casino gambling market is characterized by continuous product innovation, driven by the relentless pursuit of enhanced player engagement and differentiated offerings. Technological advancements are creating immersive gaming experiences through the integration of VR, AR, and AI technologies. The market is seeing the launch of new game formats and designs, personalized gaming experiences, and advanced analytics to improve operations and player retention. The adoption of mobile gaming platforms is expanding market reach, while improved security and anti-fraud measures enhance player trust and loyalty. The competitive advantages are determined by a combination of technological sophistication, game design innovation, brand reputation, and effective marketing strategies.

Key Drivers, Barriers & Challenges in Asia-Pacific Casino Gambling Market

Key Drivers:

Technological advancements in gaming technology, particularly mobile and online platforms, are a primary driver of market growth. Expanding tourism in key Asian markets fuels casino revenue, while increasing disposable incomes among middle-class populations contribute to higher gambling expenditure. Favorable regulatory changes in certain jurisdictions present new opportunities for market expansion.

Key Challenges and Restraints:

Strict regulatory frameworks and licensing requirements in many countries pose substantial barriers to market entry and expansion. Fluctuations in economic conditions and currency exchange rates can impact gambling expenditure, while competition among existing players and the entry of new operators creates pricing pressures. Supply chain disruptions (particularly in the manufacturing of gaming equipment) can lead to delays and cost increases. The estimated impact of these factors will be detailed numerically in the full report.

Growth Drivers in the Asia-Pacific Casino Gambling Market Market

Growth is driven by technological advancements, such as immersive VR and AR experiences, mobile gaming, and AI-powered personalization. Favorable regulatory changes in some markets are opening up new opportunities. Rising disposable incomes among the Asian middle class boost spending on entertainment and leisure. The expansion of tourism, specifically in areas with well-established casino infrastructure, contributes significantly to revenue generation.

Challenges Impacting Asia-Pacific Casino Gambling Market Growth

Challenges include stringent regulatory environments, particularly licensing and compliance hurdles in several Asian countries. Economic downturns can significantly impact consumer spending on non-essential activities like gambling. Intense competition among established and emerging players creates pricing pressures and limits profit margins. Supply chain vulnerabilities can lead to delays and increased costs in acquiring gaming equipment and technology.

Key Players Shaping the Asia-Pacific Casino Gambling Market Market

- Wynn Macau

- Sky City Entertainment Group

- Entain

- Sun International

- Genting Group

- IGT

- Melco

- SJM

- Crown Resorts

- Galaxy Entertainment

- Aristocrat

- Light and Wonder

- Sands China

Significant Asia-Pacific Casino Gambling Market Industry Milestones

- September 2023: Sands China Ltd partnered with Hong Kong's Emperor Entertainment Group to create "residency shows" for the Londoner Macao resort. This reflects a strategic shift towards diversifying entertainment offerings beyond traditional casino gaming.

- July 2023: Novomatic's agreement with Tecnet Asia for distribution rights in the Philippines expands the reach of Novomatic gaming products, indicating increasing market penetration in a key Asian region.

Future Outlook for Asia-Pacific Casino Gambling Market Market

The Asia-Pacific casino gambling market is poised for continued growth, driven by factors such as increasing disposable incomes, technological advancements, and strategic investments by major players. The expanding popularity of online and mobile gaming platforms offers significant opportunities for market expansion. Government initiatives to promote tourism and improve infrastructure in key gaming hubs further support market growth. Emerging technologies, like VR and AR, will reshape the gaming experience, attracting new demographics and driving increased player engagement. The market will likely see continued consolidation through M&A activity, shaping the competitive landscape in the years to come.

Asia-Pacific Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Other Types

-

2. Application

- 2.1. Online

- 2.2. Offline

-

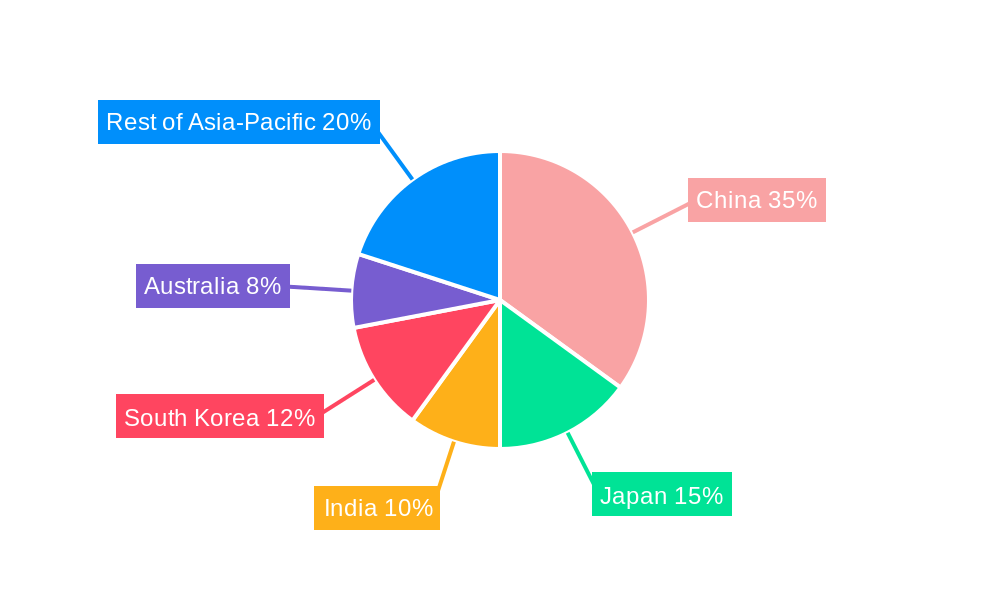

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

Asia-Pacific Casino Gambling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Japan

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Casino Gambling Market Regional Market Share

Geographic Coverage of Asia-Pacific Casino Gambling Market

Asia-Pacific Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Online Gambling is Propelling the Market Growth across Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Australia

- 5.3.4. Japan

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Japan

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Australia

- 6.3.4. Japan

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Australia

- 7.3.4. Japan

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Australia Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Australia

- 8.3.4. Japan

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Australia

- 9.3.4. Japan

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Australia

- 10.3.4. Japan

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Live Casino

- 11.1.2. Baccarat

- 11.1.3. Blackjack

- 11.1.4. Poker

- 11.1.5. Slots

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Online

- 11.2.2. Offline

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Australia

- 11.3.4. Japan

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Wynn Macau

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sky City Entertainment Group**List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Entain

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sun International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Genting Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 IGT

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Melco

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SJM

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Crown Resorts

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Galaxy Entertainment

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Aristocrat

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Light and Wonder

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Sands China

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Wynn Macau

List of Figures

- Figure 1: Asia-Pacific Casino Gambling Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Casino Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Casino Gambling Market?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Asia-Pacific Casino Gambling Market?

Key companies in the market include Wynn Macau, Sky City Entertainment Group**List Not Exhaustive, Entain, Sun International, Genting Group, IGT, Melco, SJM, Crown Resorts, Galaxy Entertainment, Aristocrat, Light and Wonder, Sands China.

3. What are the main segments of the Asia-Pacific Casino Gambling Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Gambling is Propelling the Market Growth across Asia-Pacific.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Macau-based casino operator Sands China Ltd has partnered with Hong Kong's Emperor Entertainment Group to produce a gaming firm called 'residency shows' for the Londoner Macao resort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence