Key Insights

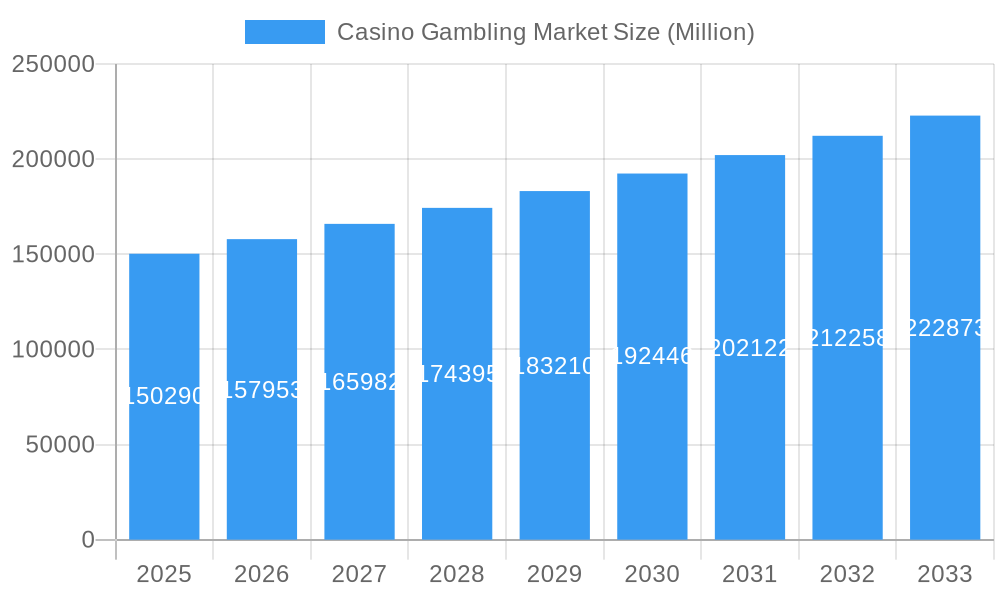

The global casino gambling market, valued at $150.29 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.95% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing disposable incomes in emerging economies, particularly across Asia-Pacific, are leading to higher spending on leisure and entertainment activities, including casino gambling. Secondly, technological advancements, such as the rise of online and mobile casino platforms and the integration of virtual reality (VR) and augmented reality (AR) technologies, are enhancing the gaming experience and attracting a wider audience. Furthermore, the legalization and regulation of online gambling in several jurisdictions are creating new avenues for growth. However, the market also faces challenges, including stringent regulations in certain regions, concerns about problem gambling, and economic downturns that can impact consumer spending. The market's segmentation by game type reveals a strong demand for diverse offerings, with slots, blackjack, and baccarat consistently popular. Major players like Caesars Entertainment, MGM Resorts International, and Las Vegas Sands are actively investing in expanding their offerings and geographical reach to capitalize on these trends. The competitive landscape is dynamic, with established players facing competition from new entrants and the continued evolution of gaming technologies.

Casino Gambling Market Market Size (In Billion)

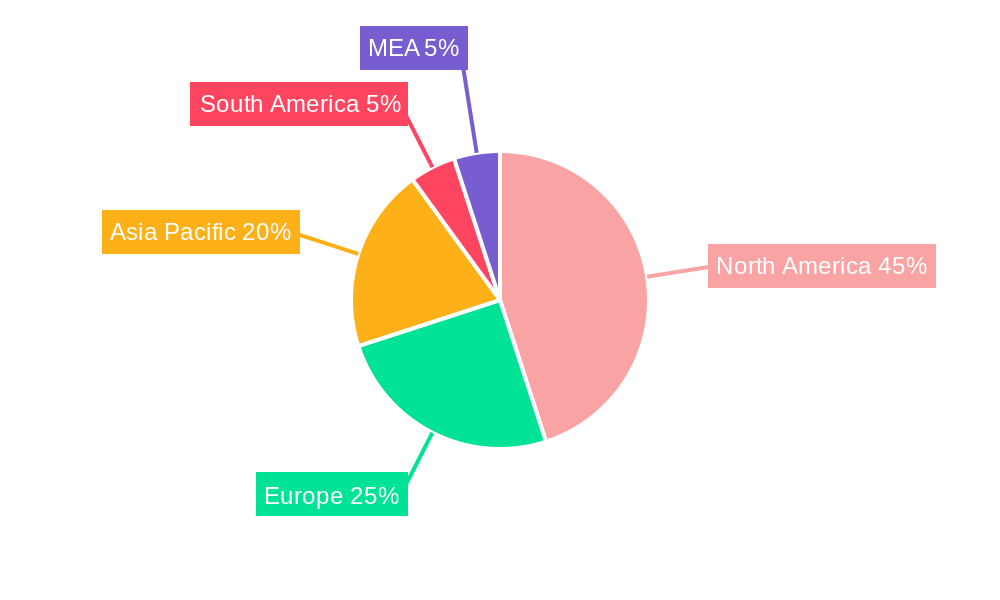

The regional distribution of the casino gambling market reflects established and emerging hubs of activity. North America currently dominates, fueled by the established Las Vegas market and growing online gambling segments. However, the Asia-Pacific region, particularly China and Southeast Asia, demonstrates significant growth potential due to increasing affluence and the relaxing of gambling regulations in specific areas. Europe maintains a substantial market share, with established casino locations in key countries. The growth trajectory in these regions will be shaped by regulatory changes, economic conditions, and the adoption of innovative technologies. Successfully navigating these factors will be crucial for companies aiming to secure a dominant position in this dynamic market.

Casino Gambling Market Company Market Share

Casino Gambling Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the Casino Gambling Market, offering invaluable insights into market trends, competitive dynamics, and future growth opportunities. With a detailed examination of the period from 2019 to 2033 (historical period: 2019-2024, base year: 2025, forecast period: 2025-2033, estimated year: 2025), this report is an essential resource for industry professionals, investors, and anyone seeking to understand this lucrative and ever-evolving market. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Casino Gambling Market Structure & Competitive Landscape

The casino gambling market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. The four-firm concentration ratio is estimated to be around xx%, indicating moderate competition. However, the market is dynamic, influenced by several factors:

- Innovation Drivers: Technological advancements, such as the rise of online and mobile gaming, virtual reality integration, and the development of innovative game mechanics, are driving significant changes.

- Regulatory Impacts: Stringent regulations regarding licensing, responsible gambling, and taxation vary across jurisdictions, influencing market access and profitability. Changes in regulations can significantly impact market dynamics.

- Product Substitutes: The entertainment industry offers various alternatives to casino gambling, including online gaming, sports betting, and other forms of leisure activities, all of which compete for consumer spending.

- End-User Segmentation: The market caters to diverse demographics, including high-rollers, casual players, and online gamers, each with distinct preferences and spending habits. Understanding these segments is critical for effective marketing and product development.

- M&A Trends: The casino gambling sector has witnessed significant mergers and acquisitions (M&A) activity in recent years, with a total M&A volume of approximately xx Million in the last five years. These deals reflect consolidation trends and the pursuit of growth through strategic acquisitions. Examples include MGM Resorts International's acquisition of Push Gaming.

Casino Gambling Market Trends & Opportunities

The global casino gambling market exhibits strong growth potential, fueled by several key factors:

The market size is experiencing substantial growth, driven by increasing disposable incomes, particularly in emerging economies. Technological advancements, such as mobile gaming and virtual reality, are expanding market reach and enhancing player engagement. Consumer preferences are shifting towards personalized experiences, leading to the development of customized gaming options and loyalty programs. The competitive landscape is dynamic, with companies continuously innovating to attract and retain customers. The market penetration rate for online casino gambling is currently at approximately xx%, with substantial room for expansion in both developed and developing markets. The rising popularity of eSports and the integration of gaming technologies into traditional casinos are creating new opportunities for growth.

Dominant Markets & Segments in Casino Gambling Market

The Asia-Pacific region currently holds the largest market share in the casino gambling market, driven by strong economic growth and increasing tourism in countries such as Macau and Singapore. Within the market segments, Slots consistently dominate, followed by Baccarat and Blackjack.

Key Growth Drivers:

- Strong Economic Growth: Rising disposable incomes in key regions drive increased spending on leisure activities, including casino gambling.

- Favorable Regulatory Environments: Jurisdictions with supportive regulatory frameworks attract significant investments and facilitate market expansion.

- Development of Integrated Resorts: The growth of integrated resorts, combining casinos with hotels, entertainment, and shopping, significantly boosts overall market size.

- Technological Advancements: Online and mobile gaming platforms broaden market access and attract new players.

Market Dominance Analysis: While Slots maintain the leading position, the growth rate of online casino games, particularly Live Casino, has seen a strong upward trend in recent years. This reflects evolving consumer preferences and the expansion of digital platforms.

Casino Gambling Market Product Analysis

The casino gambling market offers a wide array of products, including traditional casino games like slots, blackjack, baccarat, and poker, as well as increasingly popular online and mobile gaming platforms. Technological advancements, such as virtual reality (VR) and augmented reality (AR) integration, are enhancing the gaming experience and creating new product categories. The competitive advantage lies in providing innovative game designs, seamless user experiences, and strong loyalty programs. The integration of blockchain technology and cryptocurrencies is also emerging as a potentially disruptive innovation.

Key Drivers, Barriers & Challenges in Casino Gambling Market

Key Drivers: Technological advancements (mobile gaming, VR/AR), increasing disposable incomes in emerging markets, and the expansion of regulated online gambling are major drivers. The development of integrated resorts further boosts market growth.

Key Challenges: Stringent regulations and licensing requirements across various jurisdictions present significant hurdles. Supply chain disruptions can affect the availability of gaming equipment and software. Intense competition among established operators and new entrants creates significant pressure on pricing and profitability. Responsible gambling initiatives, while important, can also impact revenue streams. The estimated impact of regulatory hurdles on market growth is approximately xx% annually.

Growth Drivers in the Casino Gambling Market Market

Technological innovation, particularly in online and mobile gaming, is a primary driver. Economic growth in key markets increases disposable income, fueling spending on entertainment. Favorable regulatory environments encourage investment and market expansion.

Challenges Impacting Casino Gambling Market Growth

Strict regulations and licensing requirements hinder market expansion. Supply chain disruptions can impact the availability of equipment and software. Intense competition puts pressure on margins. The rising popularity of alternative forms of entertainment, including eSports and mobile games, poses a growing challenge.

Key Players Shaping the Casino Gambling Market Market

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Significant Casino Gambling Market Industry Milestones

- May 2023: MGM Resorts International's acquisition of Push Gaming strengthens LeoVegas' content creation capabilities.

- April 2023: Caesars Entertainment reopens Tropicana Online Casino in New Jersey, enhancing user experience and Caesars Rewards integration.

Future Outlook for Casino Gambling Market Market

The casino gambling market is poised for continued growth, driven by technological innovation, expanding regulated online markets, and the increasing popularity of integrated resorts. Strategic partnerships, innovative game development, and expansion into new markets present significant opportunities. The market's future hinges on adapting to evolving consumer preferences and addressing regulatory challenges effectively.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence