Key Insights

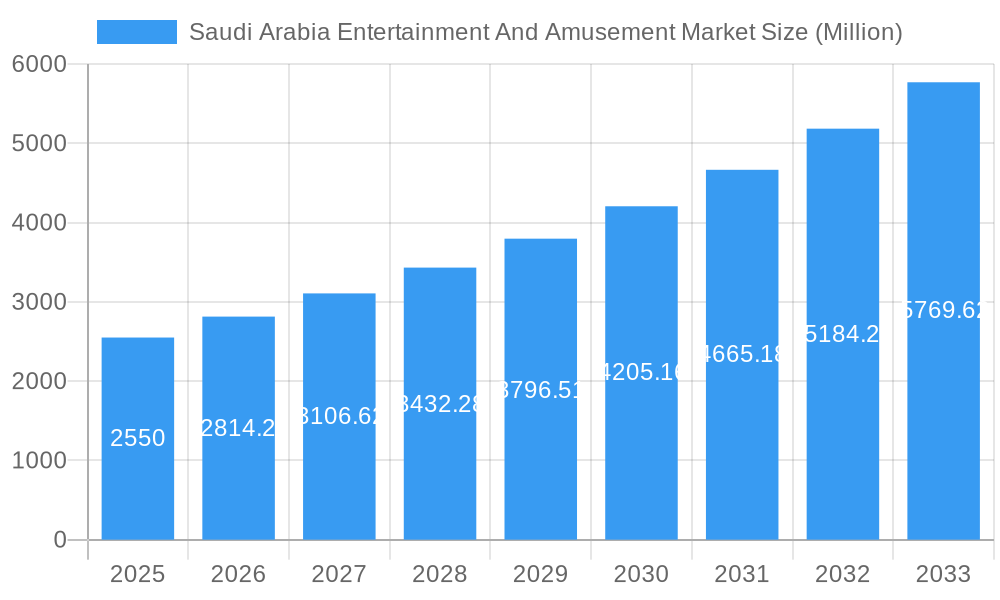

The Saudi Arabia entertainment and amusement market is experiencing robust growth, projected to reach $2.55 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This expansion is fueled by several key drivers. Significant government investment in Vision 2030, aimed at diversifying the Saudi economy and enhancing the quality of life, is a major catalyst. This initiative is fostering the development of world-class entertainment infrastructure, attracting both domestic and international players. The burgeoning tourism sector, coupled with a young and growing population with high disposable incomes, further fuels demand for diverse entertainment options. Popular segments include theme parks (like Jungle Land and AlShallal), cinemas (with international chains like AMC), and live entertainment (Cirque du Soleil, Broadway Entertainment). The increasing popularity of immersive experiences and technologically advanced attractions also contributes to the market's growth.

Saudi Arabia Entertainment And Amusement Market Market Size (In Billion)

However, the market faces certain challenges. While growth is significant, potential restraints include the need for continued infrastructure development to support the expanding visitor numbers and the cost of attracting and retaining top-tier international entertainment brands. Furthermore, maintaining a balance between catering to both local cultural preferences and international appeal remains a key consideration for market players. The market segmentation reveals a strong concentration in major cities like Riyadh, Jeddah, and Makkah, indicating opportunities for expansion in other regions. Revenue streams are diversified across ticket sales, food & beverage, merchandise, and advertising, suggesting a resilient and multi-faceted market structure. The consistent influx of major international entertainment companies signals confidence in the long-term potential of the Saudi Arabian entertainment and amusement industry. Competition is likely to intensify as more players enter this rapidly evolving market.

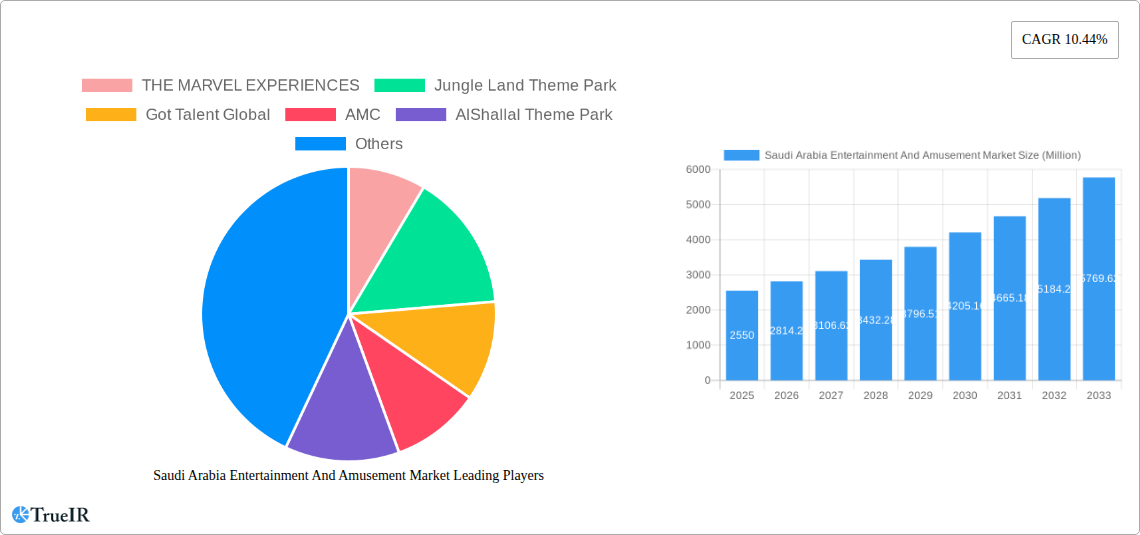

Saudi Arabia Entertainment And Amusement Market Company Market Share

Saudi Arabia Entertainment and Amusement Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning Saudi Arabia entertainment and amusement market, offering invaluable insights for investors, industry players, and strategists. With a focus on market trends, competitive dynamics, and future growth projections, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report leverages extensive data analysis to provide a clear and concise picture of this rapidly expanding sector, fueled by Vision 2030 initiatives and a growing young population.

Saudi Arabia Entertainment And Amusement Market Market Structure & Competitive Landscape

The Saudi Arabia entertainment and amusement market exhibits a moderately concentrated structure, with a few major players dominating certain segments like cinemas and theme parks. However, the market is characterized by significant fragmentation, especially in smaller entertainment venues and niche offerings. The concentration ratio (CR4) for cinemas is estimated at xx%, while for theme parks it's approximately xx%. This indicates room for both expansion by existing players and the emergence of new entrants.

Innovation plays a crucial role, driven by technological advancements in areas like virtual reality (VR), augmented reality (AR), and interactive experiences. Regulatory changes, particularly those aligned with Vision 2030, are shaping the market, fostering growth and attracting foreign investment. Product substitution is a factor, with competition between different types of entertainment venues (e.g., theme parks versus malls with entertainment components).

End-user segmentation is primarily based on demographics (age, income) and geographic location. M&A activity has been moderate, with several smaller acquisitions and partnerships observed in recent years. The volume of M&A deals is projected to increase to xx deals by 2033, driven by the consolidation trend among players seeking to gain market share and expand their offerings. This trend is further accelerated by the government's support for large scale entertainment projects.

Saudi Arabia Entertainment And Amusement Market Market Trends & Opportunities

The Saudi Arabia entertainment and amusement market is experiencing robust growth, driven by several key factors. The market size, estimated at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx%. This growth is fueled by several factors, including:

- Rising Disposable Incomes: A burgeoning middle class with increasing disposable income is driving demand for entertainment and leisure activities.

- Government Initiatives: Saudi Vision 2030's focus on diversification and entertainment development has created a favorable environment for market expansion.

- Technological Advancements: The adoption of innovative technologies like VR and AR is enhancing the entertainment experience, attracting a wider audience.

- Changing Consumer Preferences: Young Saudis, representing a significant portion of the population, are increasingly seeking diverse and engaging entertainment options.

- Increased Tourism: The Kingdom's efforts to boost tourism are contributing to higher visitor numbers, further boosting the entertainment sector's revenue streams.

- Foreign Investment: Significant foreign investment in entertainment infrastructure is creating new opportunities and accelerating market development.

Market penetration rates vary across segments, with cinemas and malls exhibiting higher penetration than theme parks. However, rapid growth is anticipated across all segments. The market is becoming increasingly competitive, with both local and international players vying for market share.

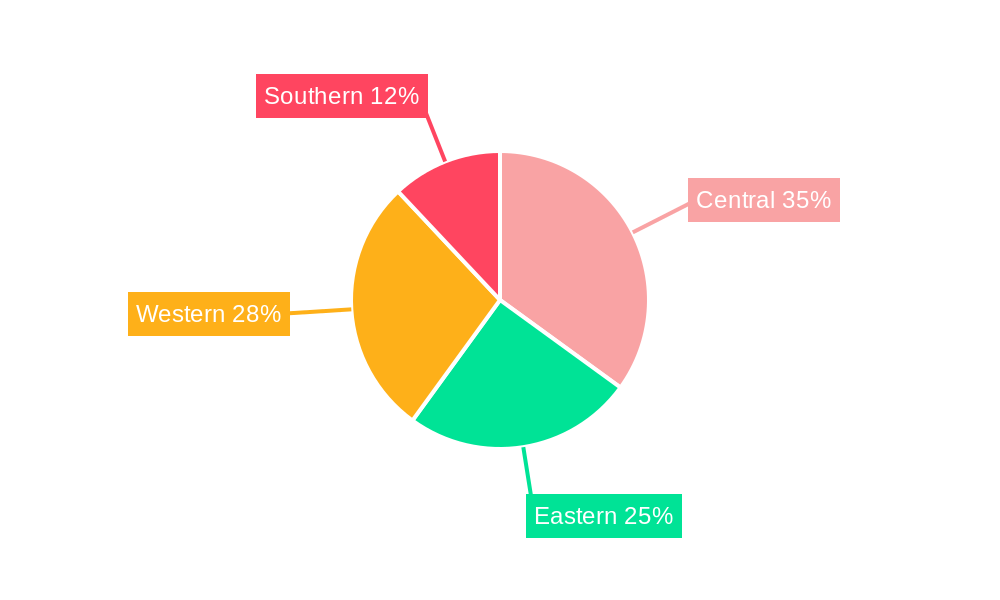

Dominant Markets & Segments in Saudi Arabia Entertainment And Amusement Market

Riyadh, being the capital city and a major economic hub, represents the largest and most dominant market segment. Jeddah follows as a significant contributor, driven by its tourism sector. Makkah and Medina benefit from religious tourism, creating specific demands in the entertainment sector. Dammam and the rest of Saudi Arabia also showcase considerable growth potential.

By Type of Entertainment Destination: Amusement and theme parks are witnessing exceptional growth due to significant investments in infrastructure. Cinemas and theatres constitute a mature yet expanding segment, showcasing robust growth. The "Others" category, including immersive experiences, e-sports, and interactive venues, shows remarkable potential.

By Source of Revenue: Ticket sales continue to dominate revenue streams, complemented by substantial contributions from food and beverages, and merchandise sales. Advertising revenue is anticipated to grow significantly with increased investments in the sector.

Key Growth Drivers:

- Government Support: Vision 2030 investments in infrastructure, tourism, and entertainment are major growth drivers.

- Investment in Infrastructure: The development of world-class entertainment facilities across major cities is boosting market growth.

- Favorable Regulatory Environment: Policy reforms aimed at promoting the entertainment sector are attracting both domestic and foreign investment.

The dominance of Riyadh and Jeddah is expected to continue in the forecast period, however, the relatively slower growth rates in these areas compared to other cities indicate a significant potential for diversification across the Kingdom.

Saudi Arabia Entertainment And Amusement Market Product Analysis

The Saudi Arabia entertainment and amusement market is witnessing a wave of product innovation, encompassing cutting-edge technologies and immersive experiences. The integration of VR/AR technologies is transforming the offerings of theme parks and gaming centers. Interactive shows, augmented reality games, and personalized entertainment experiences are becoming increasingly popular, reflecting evolving consumer preferences for engaging and interactive content. These technological advancements are enhancing the overall entertainment experience, attracting a wider audience, and bolstering the competitive advantage of businesses adopting them.

Key Drivers, Barriers & Challenges in Saudi Arabia Entertainment And Amusement Market

Key Drivers:

- Vision 2030's focus on entertainment and diversification is driving significant investment in the sector.

- Rising disposable incomes are increasing consumer spending on leisure activities.

- Technological innovations are enhancing the entertainment experience and attracting new customer segments.

Key Challenges:

- Competition from established international players can pressure profit margins for local businesses.

- Supply chain disruptions can impact the availability of necessary equipment and resources.

- Regulatory complexities, while improving, might still pose hurdles for new entrants or expansion.

Growth Drivers in the Saudi Arabia Entertainment And Amusement Market Market

The market’s growth is driven by Vision 2030's transformative impact on the Kingdom's economy and social landscape, coupled with rising disposable incomes and a young, entertainment-seeking population. Technological advancements, including the integration of VR and AR, are also enhancing the entertainment experience, attracting broader audiences and creating new revenue streams. Furthermore, increased tourism and the influx of foreign investment contribute substantially to the industry’s expansion.

Challenges Impacting Saudi Arabia Entertainment And Amusement Market Growth

Challenges include competition from established international players, potential supply chain disruptions, and navigating evolving regulatory landscapes. Balancing the need for rapid expansion with sustainability and preserving cultural sensitivities also present ongoing concerns for market stakeholders. Successfully managing these challenges will be critical for realizing the full potential of this growing market.

Key Players Shaping the Saudi Arabia Entertainment And Amusement Market Market

- THE MARVEL EXPERIENCES

- Jungle Land Theme Park

- Got Talent Global

- AMC

- AlShallal Theme Park

- Cirque Du Soleil

- IMG Artists

- National geographic

- Broadway Entertainment

- AVEX

- SIX FLAGS

- Disney Frozen

- FELD ENTERTAINMENT

- Loopagoon Water Park

- List Not Exhaustive

Significant Saudi Arabia Entertainment And Amusement Market Industry Milestones

May 2022: Muvi Cinemas launched Muvi Studios, focusing on Saudi and Egyptian film production for the domestic market. This signifies a strategic move to bolster the local film industry and enhance domestic content in cinemas.

September 2022: Flash Entertainment established its KSA headquarters in Riyadh, demonstrating a commitment to the Kingdom's entertainment sector growth and aligning with Saudi Vision 2030's objectives. This underscores the increasing importance of foreign investment and international collaboration in driving market expansion.

Future Outlook for Saudi Arabia Entertainment And Amusement Market Market

The Saudi Arabia entertainment and amusement market is poised for continued strong growth, driven by sustained government support, increased investment, and evolving consumer preferences. The ongoing diversification of the economy and focus on attracting tourism will further fuel this expansion. Strategic partnerships between international and local players will be key to capturing market share and delivering innovative entertainment experiences that cater to the evolving demands of the Saudi population. The potential for the market is immense, promising significant opportunities for investors and industry participants alike.

Saudi Arabia Entertainment And Amusement Market Segmentation

-

1. Type of Entertainment Destination

- 1.1. Cinemas and Theatres

- 1.2. Amusement and Theme Parks

- 1.3. Gardens and Zoos

- 1.4. Malls

- 1.5. Gaming Centers

- 1.6. Others

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Food & Beverages

- 2.3. Merchandise

- 2.4. Advertising

- 2.5. Others

-

3. City

- 3.1. Riyadh

- 3.2. Jeddah

- 3.3. Makkah

- 3.4. Dammam

- 3.5. Rest of Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Regional Market Share

Geographic Coverage of Saudi Arabia Entertainment And Amusement Market

Saudi Arabia Entertainment And Amusement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Costs is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Entertainment And Amusement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 5.1.1. Cinemas and Theatres

- 5.1.2. Amusement and Theme Parks

- 5.1.3. Gardens and Zoos

- 5.1.4. Malls

- 5.1.5. Gaming Centers

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Food & Beverages

- 5.2.3. Merchandise

- 5.2.4. Advertising

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Riyadh

- 5.3.2. Jeddah

- 5.3.3. Makkah

- 5.3.4. Dammam

- 5.3.5. Rest of Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THE MARVEL EXPERIENCES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jungle Land Theme Park

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Got Talent Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlShallal Theme Park

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cirque Du Soleil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMG Artists

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National geographic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broadway Entertainment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVEX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIX FLAGS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Disney Frozen

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FELD ENTERTAINMENT

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Loopagoon Water Park**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 THE MARVEL EXPERIENCES

List of Figures

- Figure 1: Saudi Arabia Entertainment And Amusement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Entertainment And Amusement Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 2: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 4: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 6: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 8: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Entertainment And Amusement Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Saudi Arabia Entertainment And Amusement Market?

Key companies in the market include THE MARVEL EXPERIENCES, Jungle Land Theme Park, Got Talent Global, AMC, AlShallal Theme Park, Cirque Du Soleil, IMG Artists, National geographic, Broadway Entertainment, AVEX, SIX FLAGS, Disney Frozen, FELD ENTERTAINMENT, Loopagoon Water Park**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Entertainment And Amusement Market?

The market segments include Type of Entertainment Destination, Source of Revenue, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs is Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Arabia's leading theater operator Muvi Cinemas launched Muvi Studios. The new Studio will focus on developing both Saudi and Egyptian films for the Saudi public, concentrating on films for the big screen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Entertainment And Amusement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Entertainment And Amusement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Entertainment And Amusement Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Entertainment And Amusement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence