Key Insights

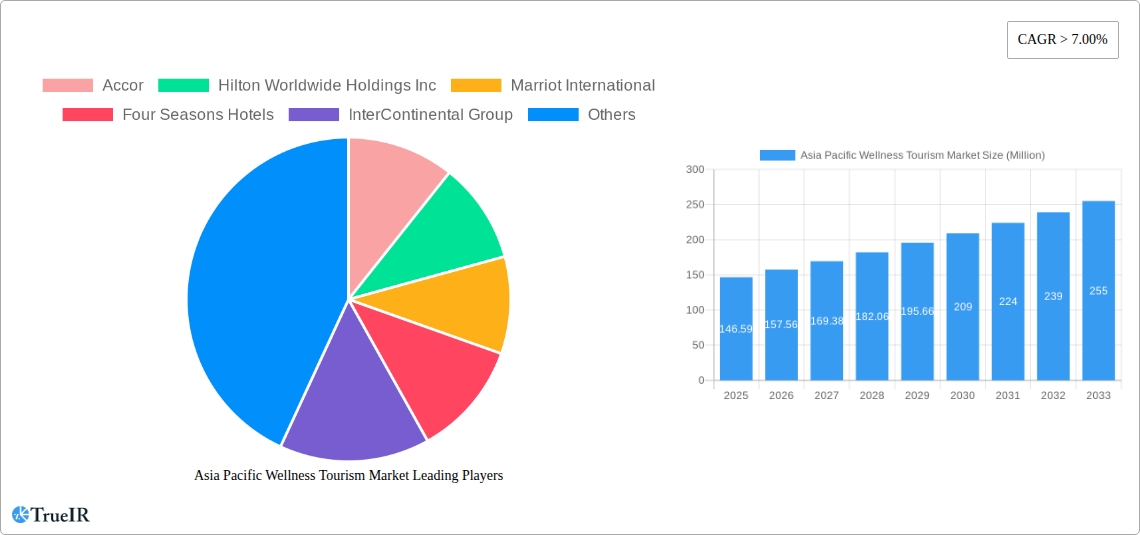

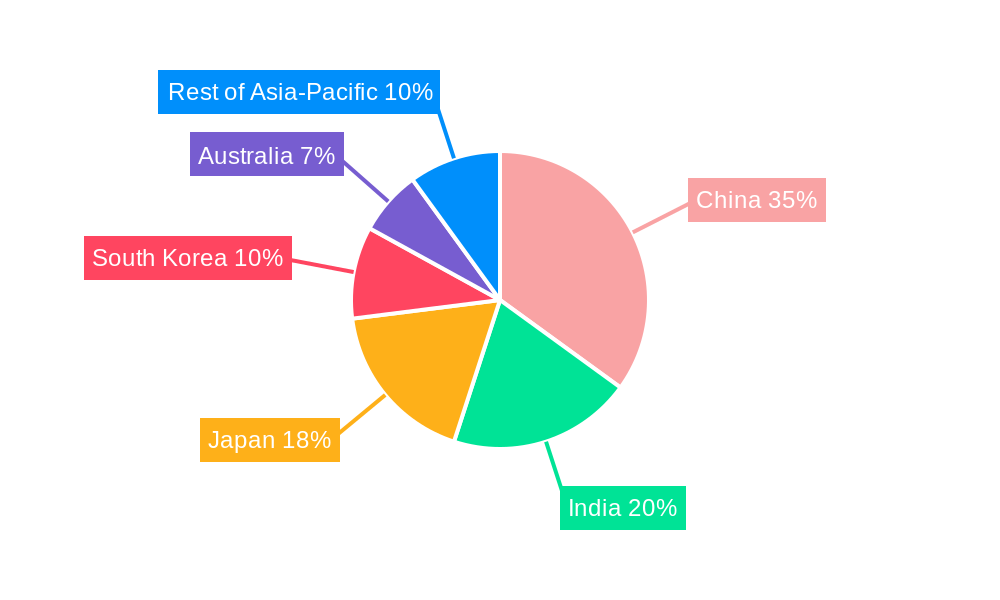

The Asia Pacific wellness tourism market, valued at $146.59 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across the region, particularly in rapidly developing economies like China and India, are empowering consumers to prioritize health and wellness, translating into increased spending on wellness travel. Furthermore, a growing awareness of preventative healthcare and the increasing prevalence of stress-related illnesses are driving demand for holistic wellness experiences. The market is segmented by travel type (domestic and international), activity (in-country transport, lodging, food and beverage, shopping, activities and excursions, other services), and traveler type (primary and secondary wellness travelers). The diverse offerings within the Asia-Pacific region, ranging from traditional Asian healing practices to luxurious spa resorts, cater to a broad spectrum of wellness seekers. Countries like China, Japan, India, and South Korea are major contributors to market growth, reflecting their substantial populations and burgeoning middle classes. Leading players such as Accor, Hilton, Marriott, and others are capitalizing on this trend by investing in wellness-focused properties and services, further driving market expansion. The continued emphasis on sustainable and responsible tourism will also shape future growth, influencing traveler preferences and shaping the offerings of wellness providers.

Asia Pacific Wellness Tourism Market Market Size (In Million)

The market's growth trajectory is expected to remain strong throughout the forecast period (2025-2033). However, potential restraints include economic fluctuations, geopolitical instability, and the impact of future pandemics. Nevertheless, the inherent appeal of wellness tourism and the region's commitment to developing its infrastructure and offerings suggest that the market will likely surpass initial projections. Specific growth within segments will be influenced by factors such as the development of specialized wellness programs, technological advancements in the hospitality sector, and the introduction of novel wellness concepts tailored to the unique cultural preferences of each market within the Asia-Pacific region. The ongoing investment in infrastructure and the rising popularity of experiential travel are further strengthening the market’s potential.

Asia Pacific Wellness Tourism Market Company Market Share

Asia Pacific Wellness Tourism Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Asia Pacific wellness tourism market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data from 2019-2024 (historical period), a base year of 2025, and projecting to 2033 (forecast period), this report unveils the market's structure, trends, opportunities, and challenges. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Asia Pacific Wellness Tourism Market Structure & Competitive Landscape

The Asia Pacific wellness tourism market is characterized by a moderately concentrated landscape, with several large multinational hotel chains and healthcare providers holding significant market share. Key players include Accor, Hilton Worldwide Holdings Inc, Marriott International, Four Seasons Hotels, InterContinental Group, Rosewood Hotels, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Radisson Hotel Group, and Hyatt Hotel Corporation. However, numerous smaller, specialized wellness centers and boutique hotels also contribute significantly.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately concentrated market.

- Innovation Drivers: Technological advancements in digital marketing, personalized wellness programs, and telehealth are driving innovation.

- Regulatory Impacts: Varying regulations across countries influence market access and service offerings. Standardization and harmonization efforts are needed.

- Product Substitutes: The rise of home-based wellness solutions presents a challenge but also an opportunity for innovation and creating hybrid models.

- End-User Segmentation: The market caters to both primary wellness travelers (those whose main purpose is wellness) and secondary wellness travelers (those who incorporate wellness activities into other trips).

- M&A Trends: The past five years have witnessed xx M&A deals in the Asia Pacific wellness tourism sector, with a value of approximately xx Million. Consolidation is expected to continue, driven by economies of scale and access to wider customer bases.

Asia Pacific Wellness Tourism Market Trends & Opportunities

The Asia Pacific wellness tourism market is experiencing significant growth, fueled by rising disposable incomes, increasing health consciousness, and a growing preference for experiential travel. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033. Technological advancements are playing a crucial role, with the rise of online booking platforms, personalized wellness apps, and virtual consultations transforming the customer journey. Consumer preferences are shifting towards customized experiences, sustainable practices, and authentic cultural immersion. Competitive dynamics are intensifying, with established players expanding their wellness offerings and new entrants emerging with innovative concepts.

The market penetration rate for wellness tourism is currently estimated at xx%, with significant potential for growth.

Dominant Markets & Segments in Asia Pacific Wellness Tourism Market

While the entire Asia Pacific region presents substantial growth opportunities, several markets and segments stand out.

- Leading Region: Southeast Asia demonstrates exceptional growth, driven by strong economic expansion and increasing tourism infrastructure.

- Leading Country: Thailand and Singapore lead the market in terms of revenue generation.

- Leading Segment (Travel Type): International wellness tourism is experiencing faster growth compared to domestic travel, driven by increased global interest in Asia's unique wellness offerings.

- Leading Segment (Activity): Lodging and activities and excursions constitute the highest revenue-generating segments, though "Food and Beverage" and "Other Services" also present significant value.

- Leading Segment (Traveler Type): Primary wellness travelers represent a significant proportion of the market.

Key Growth Drivers:

- Improved Infrastructure: Development of airports, transportation networks, and high-quality accommodation.

- Supportive Government Policies: Incentives for wellness tourism development and promotion.

- Rising Disposable Incomes: Increased spending power allows for more discretionary travel.

- Health and Wellness Awareness: Growing focus on preventative healthcare and holistic wellbeing.

Asia Pacific Wellness Tourism Market Product Analysis

Product innovation is heavily focused on integrating technology into the wellness experience, such as wearable health trackers, personalized wellness apps, and virtual reality (VR) experiences. This enhances the personalized, data-driven approach to wellness travel. This is coupled with a focus on sustainability and local experiences to attract the increasingly environmentally and socially conscious traveler. The market caters to a wide range of wellness needs including stress reduction, detoxification, weight management, and preventative healthcare.

Key Drivers, Barriers & Challenges in Asia Pacific Wellness Tourism Market

Key Drivers:

- Rising disposable incomes and increased health awareness in the region.

- Technological advancements enhancing the wellness experience (apps, trackers).

- Government initiatives promoting tourism and wellness infrastructure.

Key Challenges:

- Varying regulations across countries impacting market access.

- Supply chain disruptions impacting the availability of resources.

- Intense competition from established and new market entrants.

Growth Drivers in the Asia Pacific Wellness Tourism Market Market

The Asia Pacific wellness tourism market is experiencing rapid growth, driven by increased health consciousness, rising disposable incomes, and technological advancements that enhance the consumer experience. Government initiatives promoting tourism and wellness infrastructure further accelerate this growth.

Challenges Impacting Asia Pacific Wellness Tourism Market Growth

The market faces challenges including varying regulations across countries, potential supply chain disruptions, and significant competitive pressure from both established and emerging players.

Key Players Shaping the Asia Pacific Wellness Tourism Market Market

- Accor

- Hilton Worldwide Holdings Inc

- Marriott International

- Four Seasons Hotels

- InterContinental Group

- Rosewood Hotels

- KPJ Healthcare Berhad

- Apollo Hospital Enterprise Limited

- Radisson Hotel Group

- Hyatt Hotel Corporation

Significant Asia Pacific Wellness Tourism Market Industry Milestones

- November 2023: 2Herr and IGOAFRIKA announced a strategic collaboration to enhance medical wellness tourism with end-to-end support for African patients and visitors.

- April 2024: BDMS Wellness Clinic partnered with Movenpick, a Swiss hotel operator, to provide various health and preventive care programs, tapping into the growing market for wellness tourism.

Future Outlook for Asia Pacific Wellness Tourism Market Market

The Asia Pacific wellness tourism market is poised for continued strong growth, driven by evolving consumer preferences, technological innovation, and supportive government policies. Strategic partnerships, personalized offerings, and sustainable practices will be crucial for success in this dynamic market. The integration of technology and holistic wellness experiences promises to shape the future of this sector, further expanding its market potential.

Asia Pacific Wellness Tourism Market Segmentation

-

1. Travel Type

- 1.1. Domestic

- 1.2. International

-

2. Activity

- 2.1. In-country Transport

- 2.2. Lodging

- 2.3. Food and Beverage

- 2.4. Shopping

- 2.5. Activities and Excursions

- 2.6. Other Services

-

3. Travelers Type

- 3.1. Primary Wellness Travelers

- 3.2. Secondary Wellness Travelers

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Thailand

- 4.6. Rest of Asia-Pacific

Asia Pacific Wellness Tourism Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Thailand

- 6. Rest of Asia Pacific

Asia Pacific Wellness Tourism Market Regional Market Share

Geographic Coverage of Asia Pacific Wellness Tourism Market

Asia Pacific Wellness Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Personal Health and Well Being; Growing Interest in Holistic and Alternative Healing Practices

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Wellness Travel

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Regarding Wellness as Travel Category

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Travel Type

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Activity

- 5.2.1. In-country Transport

- 5.2.2. Lodging

- 5.2.3. Food and Beverage

- 5.2.4. Shopping

- 5.2.5. Activities and Excursions

- 5.2.6. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Travelers Type

- 5.3.1. Primary Wellness Travelers

- 5.3.2. Secondary Wellness Travelers

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Thailand

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Thailand

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Travel Type

- 6. China Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Travel Type

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Activity

- 6.2.1. In-country Transport

- 6.2.2. Lodging

- 6.2.3. Food and Beverage

- 6.2.4. Shopping

- 6.2.5. Activities and Excursions

- 6.2.6. Other Services

- 6.3. Market Analysis, Insights and Forecast - by Travelers Type

- 6.3.1. Primary Wellness Travelers

- 6.3.2. Secondary Wellness Travelers

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Thailand

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Travel Type

- 7. India Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Travel Type

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Activity

- 7.2.1. In-country Transport

- 7.2.2. Lodging

- 7.2.3. Food and Beverage

- 7.2.4. Shopping

- 7.2.5. Activities and Excursions

- 7.2.6. Other Services

- 7.3. Market Analysis, Insights and Forecast - by Travelers Type

- 7.3.1. Primary Wellness Travelers

- 7.3.2. Secondary Wellness Travelers

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Thailand

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Travel Type

- 8. Japan Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Travel Type

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Activity

- 8.2.1. In-country Transport

- 8.2.2. Lodging

- 8.2.3. Food and Beverage

- 8.2.4. Shopping

- 8.2.5. Activities and Excursions

- 8.2.6. Other Services

- 8.3. Market Analysis, Insights and Forecast - by Travelers Type

- 8.3.1. Primary Wellness Travelers

- 8.3.2. Secondary Wellness Travelers

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Thailand

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Travel Type

- 9. Australia Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Travel Type

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Activity

- 9.2.1. In-country Transport

- 9.2.2. Lodging

- 9.2.3. Food and Beverage

- 9.2.4. Shopping

- 9.2.5. Activities and Excursions

- 9.2.6. Other Services

- 9.3. Market Analysis, Insights and Forecast - by Travelers Type

- 9.3.1. Primary Wellness Travelers

- 9.3.2. Secondary Wellness Travelers

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Thailand

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Travel Type

- 10. Thailand Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Travel Type

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Activity

- 10.2.1. In-country Transport

- 10.2.2. Lodging

- 10.2.3. Food and Beverage

- 10.2.4. Shopping

- 10.2.5. Activities and Excursions

- 10.2.6. Other Services

- 10.3. Market Analysis, Insights and Forecast - by Travelers Type

- 10.3.1. Primary Wellness Travelers

- 10.3.2. Secondary Wellness Travelers

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Thailand

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Travel Type

- 11. Rest of Asia Pacific Asia Pacific Wellness Tourism Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Travel Type

- 11.1.1. Domestic

- 11.1.2. International

- 11.2. Market Analysis, Insights and Forecast - by Activity

- 11.2.1. In-country Transport

- 11.2.2. Lodging

- 11.2.3. Food and Beverage

- 11.2.4. Shopping

- 11.2.5. Activities and Excursions

- 11.2.6. Other Services

- 11.3. Market Analysis, Insights and Forecast - by Travelers Type

- 11.3.1. Primary Wellness Travelers

- 11.3.2. Secondary Wellness Travelers

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Japan

- 11.4.4. Australia

- 11.4.5. Thailand

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Travel Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Accor

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hilton Worldwide Holdings Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Marriot International

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Four Seasons Hotels

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 InterContinental Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rosewood Hotels

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 KPJ Healthcare Berhad**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Apollo Hospital Enterprise Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Radisson Hotel Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Hyatt Hotel Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Accor

List of Figures

- Figure 1: Asia Pacific Wellness Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Wellness Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 2: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 3: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 4: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 7: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 8: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 9: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 12: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 13: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 14: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 17: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 18: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 19: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 22: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 23: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 24: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 27: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 28: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 29: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travel Type 2020 & 2033

- Table 32: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Activity 2020 & 2033

- Table 33: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Travelers Type 2020 & 2033

- Table 34: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 35: Asia Pacific Wellness Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Wellness Tourism Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Asia Pacific Wellness Tourism Market?

Key companies in the market include Accor, Hilton Worldwide Holdings Inc, Marriot International, Four Seasons Hotels, InterContinental Group, Rosewood Hotels, KPJ Healthcare Berhad**List Not Exhaustive, Apollo Hospital Enterprise Limited, Radisson Hotel Group, Hyatt Hotel Corporation.

3. What are the main segments of the Asia Pacific Wellness Tourism Market?

The market segments include Travel Type, Activity, Travelers Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Personal Health and Well Being; Growing Interest in Holistic and Alternative Healing Practices.

6. What are the notable trends driving market growth?

Increasing Awareness Regarding Wellness as Travel Category.

7. Are there any restraints impacting market growth?

High Cost Associated with Wellness Travel.

8. Can you provide examples of recent developments in the market?

In April 2024, BDMS Wellness Clinic partnered with Movenpick, a Swiss hotel operator, and provides various health and preventive care programs, to tap the growing market for wellness tourism,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Wellness Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Wellness Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Wellness Tourism Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Wellness Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence