Key Insights

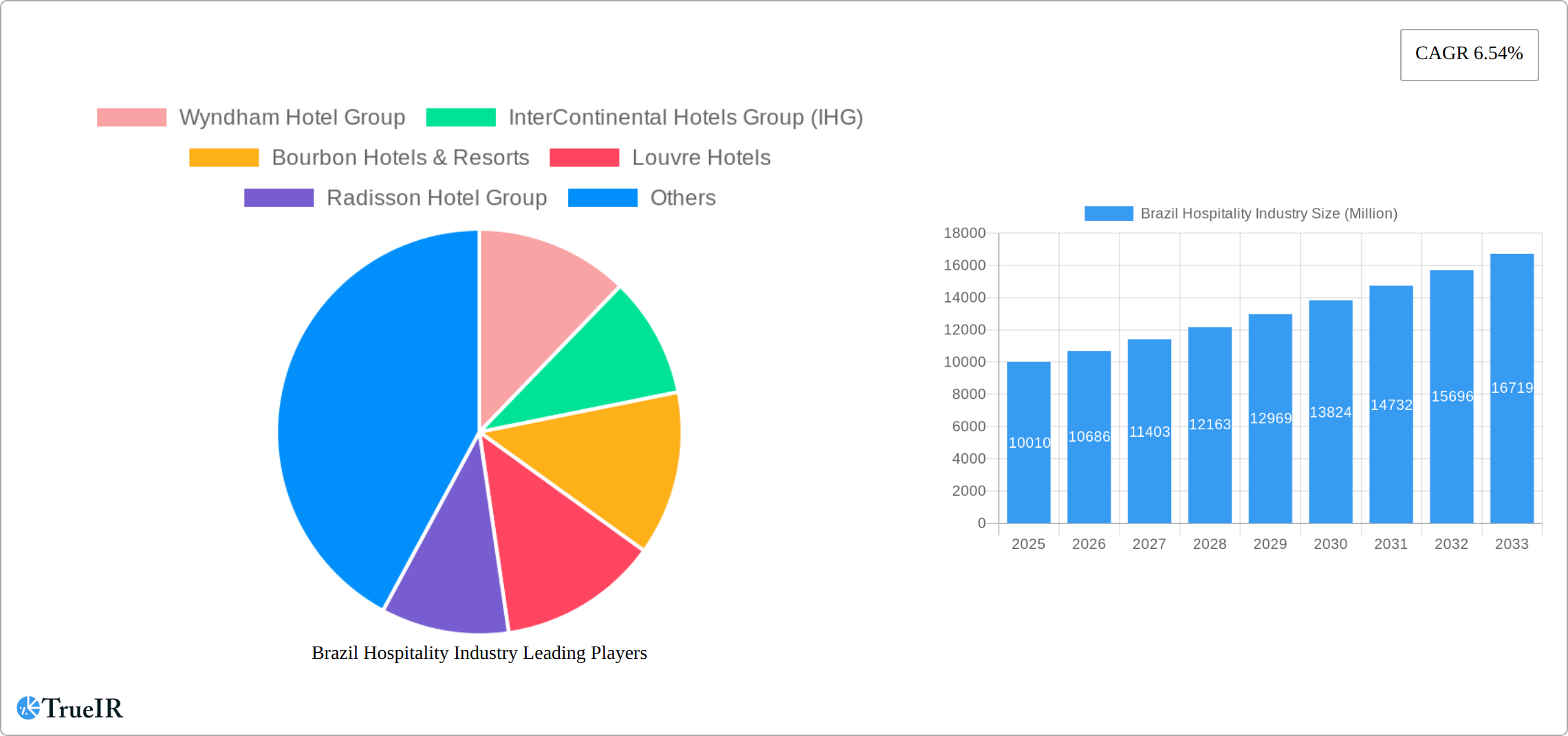

The Brazilian hospitality industry, valued at $10.01 billion in 2025, is projected to experience robust growth, driven by a rising middle class with increased disposable income and a surge in domestic and international tourism. Factors such as government initiatives promoting tourism infrastructure and the increasing popularity of Brazil as a leisure and business destination further fuel this expansion. The market is segmented by type (chain hotels, independent hotels, service apartments) and hotel class (budget/economy, mid/upper-mid-scale, luxury), reflecting diverse consumer preferences and price sensitivities. While the market faces challenges such as economic volatility and infrastructure limitations in certain regions, the overall outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 6.54% from 2025 to 2033. Major players like Wyndham, IHG, Marriott, and Accor are actively competing for market share, often through strategic acquisitions and brand expansions. The industry’s success hinges on adapting to evolving consumer demands, enhancing technological integration (e.g., online booking platforms, mobile check-in), and prioritizing sustainability initiatives to attract environmentally conscious travelers.

Brazil Hospitality Industry Market Size (In Billion)

The forecast period, 2025-2033, anticipates consistent growth, with the market size exceeding $10.01 billion by a significant margin. This expansion will likely be uneven across segments, with the mid-range and luxury hotel sectors potentially outpacing budget options due to changing consumer preferences. The increasing popularity of eco-tourism and wellness tourism presents opportunities for hotels to differentiate their offerings and attract a growing segment of environmentally and health-conscious travelers. However, sustained growth will require addressing infrastructural bottlenecks, investing in skilled workforce development, and implementing effective marketing strategies to attract both domestic and international tourists. The competitive landscape is intense, demanding continuous innovation and investment from established players and emerging brands alike.

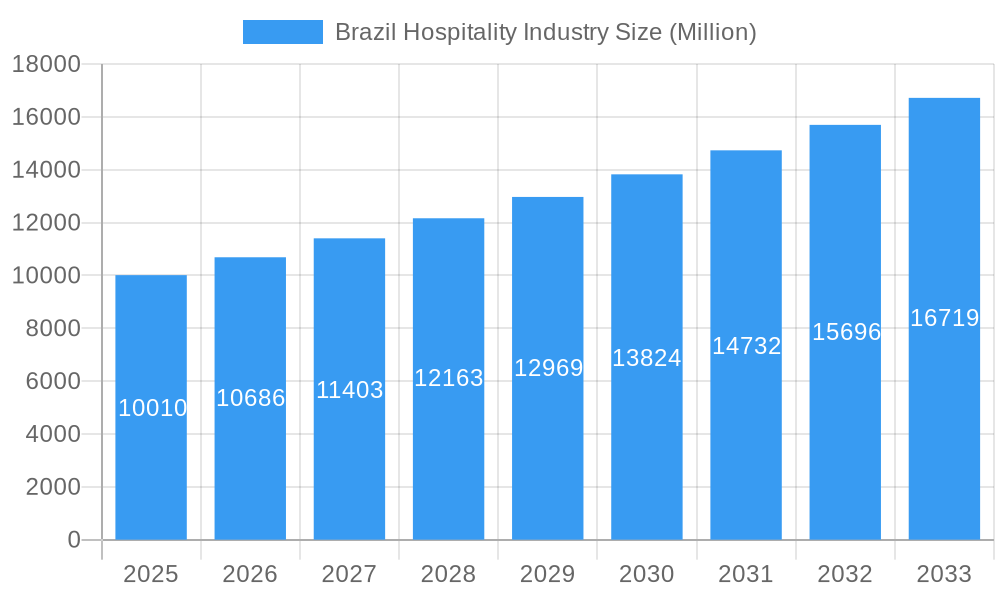

Brazil Hospitality Industry Company Market Share

Brazil Hospitality Industry Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the dynamic Brazil hospitality industry, offering invaluable insights for investors, stakeholders, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research and data analysis to present a clear and actionable understanding of the sector’s current state and future trajectory. The market size is projected to reach xx Million by 2033, demonstrating significant growth potential.

Brazil Hospitality Industry Market Structure & Competitive Landscape

The Brazilian hospitality market presents a dynamic competitive landscape shaped by moderate concentration, ongoing innovation, regulatory influences, and notable M&A activity from 2019 to 2024. Key players, including Wyndham Hotel Group, InterContinental Hotels Group (IHG), Bourbon Hotels & Resorts, Louvre Hotels, Radisson Hotel Group, Marriott International Inc, Nacional Inn Hoteis e Centros de Convencoes, Intercity Hotels, and Accor SA, hold significant market share. However, a substantial and vibrant independent hotel sector contributes significantly to the overall market's dynamism. This section delves into a detailed analysis of these factors.

- Market Concentration: While precise figures are proprietary, the Herfindahl-Hirschman Index (HHI) suggests a moderately concentrated market, indicating both established players and opportunities for smaller chains and independent hotels. Further research into specific sub-segments (e.g., luxury vs. budget) may reveal variations in concentration.

- Innovation Drivers: The sector is experiencing rapid technological advancements, with revenue management systems (RMS), online booking platforms (OBPs), and customer relationship management (CRM) systems significantly improving efficiency and guest experience. The integration of artificial intelligence (AI) and machine learning (ML) presents further opportunities for optimization.

- Regulatory Impacts: Government regulations concerning tourism, licensing, labor laws, environmental standards, and taxation directly impact operating costs and market access for all participants. Navigating these regulatory frameworks is a crucial aspect of success in the Brazilian hospitality industry.

- Product Substitutes: The rise of alternative accommodations, such as Airbnb and other home-sharing platforms, presents a persistent competitive pressure, forcing traditional hotels to adapt and differentiate their offerings. Understanding this segment is crucial for strategic planning.

- End-User Segmentation: The Brazilian hospitality market caters to a diverse range of clientele, including business travelers, leisure tourists (domestic and international), families, and specialized niche segments such as eco-tourism or adventure travel. Tailoring services to these specific needs is critical for maximizing market share.

- M&A Trends: The acquisition of Radisson Hotels Americas by Choice Hotels in August 2023 exemplifies the ongoing consolidation within the sector. While precise figures require further investigation, M&A activity from 2019 to 2024 indicates significant investment and restructuring within the Brazilian hospitality market. This activity highlights the ongoing search for scale and efficiency in a competitive landscape.

Brazil Hospitality Industry Market Trends & Opportunities

The Brazilian hospitality market exhibits robust growth potential, fueled by several key factors: a burgeoning tourism sector, rising disposable incomes among the expanding middle class, and continuous infrastructural improvements. The market is projected to experience a Compound Annual Growth Rate (CAGR) of [Insert CAGR]% during the forecast period (2025-2033), reaching an estimated [Insert Market Size] Million by 2033. This growth is further driven by technological advancements, evolving consumer preferences, and emerging niche markets.

The adoption of AI-powered chatbots for customer service, smart room technologies, and personalized guest experiences are transforming the guest journey. The growing demand for experiential and sustainable travel presents opportunities for hotels to develop unique and eco-conscious offerings, catering to a more discerning and socially responsible traveler. Finally, the increasing market penetration of online booking platforms, estimated at [Insert Percentage]% in 2025, showcases the importance of digital strategies in the sector.

Dominant Markets & Segments in Brazil Hospitality Industry

The Brazilian hospitality industry is geographically diverse, with significant activity in major metropolitan areas such as São Paulo, Rio de Janeiro, and Brasília. However, growth is also evident in emerging tourist destinations.

By Type:

- Chain Hotels: This segment dominates the market, benefiting from brand recognition, established distribution networks, and economies of scale. Key growth drivers include strategic investments in infrastructure and expansion into new locations.

- Independent Hotels: This segment offers unique experiences and localized services but faces challenges in terms of marketing and branding.

- Service Apartments: This segment is witnessing increasing demand driven by extended-stay travelers and business professionals.

By Segment:

- Budget and Economy Hotels: This segment is experiencing strong growth due to price sensitivity and increasing affordability.

- Mid and Upper Mid-scale Hotels: This segment is experiencing steady growth, catering to a broader range of travelers seeking comfortable and well-equipped accommodations.

- Luxury Hotels: This segment is driven by high-net-worth individuals and discerning travelers, focusing on personalized service and exclusive amenities. Growth is influenced by increased tourism and investment in luxury infrastructure.

Brazil Hospitality Industry Product Analysis

Technological innovation is profoundly reshaping the Brazilian hospitality landscape. Advancements in revenue management systems (RMS), mobile check-in/check-out processes, smart room technologies (IoT integration), and personalized guest services are enhancing both the guest experience and operational efficiency. The widespread adoption of cloud-based property management systems (PMS) and customer relationship management (CRM) tools is improving data-driven decision-making and operational streamlining. Furthermore, the integration of AI and machine learning is optimizing pricing strategies, enhancing demand forecasting capabilities, and personalizing the guest journey, thus fostering greater market competitiveness and profitability for hotels that embrace these technologies.

Key Drivers, Barriers & Challenges in Brazil Hospitality Industry

Key Drivers: The Brazilian hospitality industry's growth is propelled by a confluence of factors: significant technological advancements, rising disposable incomes driving domestic tourism, an increase in international tourism, and supportive government initiatives aimed at boosting tourism. Strategic infrastructural improvements in key tourist destinations are further enhancing accessibility and visitor experience, contributing directly to industry expansion.

Challenges: Despite significant opportunities, the sector faces several challenges: regulatory hurdles that require careful navigation, fluctuating exchange rates that impact profitability, persistent inflation affecting operating costs, and infrastructure limitations in certain regions. Supply chain disruptions (especially post-pandemic) and the associated increases in operating costs due to inflation pose significant risks. Lastly, the ongoing competitive pressure from alternative accommodations like Airbnb necessitates ongoing adaptation and innovation to maintain market share.

Growth Drivers in the Brazil Hospitality Industry Market

The Brazilian hospitality market's growth is propelled by increasing domestic and international tourism, rising disposable incomes, and investments in infrastructure. Government initiatives aimed at boosting tourism further fuel this expansion. Technological advancements, such as the implementation of sophisticated revenue management systems, are improving efficiency and optimizing pricing strategies.

Challenges Impacting Brazil Hospitality Industry Growth

Challenges include navigating complex regulations, managing fluctuating currency exchange rates, and addressing infrastructure gaps in certain regions. Supply chain issues, labor costs, and competition from alternative accommodations remain significant obstacles to sustained growth.

Key Players Shaping the Brazil Hospitality Industry Market

- Wyndham Hotel Group

- InterContinental Hotels Group (IHG)

- Bourbon Hotels & Resorts

- Louvre Hotels

- Radisson Hotel Group

- Marriott International Inc

- Nacional Inn Hoteis e Centros de Convencoes

- Intercity Hotels

- Accor SA

Significant Brazil Hospitality Industry Milestones

- August 2023: Choice Hotels acquired Radisson Hotels Americas for approximately USD 675 Million, significantly altering the competitive landscape.

- February 2024: Accor partnered with IDeaS to implement global revenue management software, enhancing operational efficiency and pricing strategies.

Future Outlook for Brazil Hospitality Industry Market

The Brazilian hospitality market is poised for continued growth, driven by sustained tourism expansion, rising disposable incomes, and infrastructure improvements. Strategic investments in technology and innovative service offerings will be crucial for success. The market's potential is significant, with opportunities for both established players and new entrants to capitalize on the expanding demand for diverse hospitality experiences.

Brazil Hospitality Industry Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

- 1.3. Service Apartments

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper Mid-scale Hotels

- 2.3. Luxury Hotels

Brazil Hospitality Industry Segmentation By Geography

- 1. Brazil

Brazil Hospitality Industry Regional Market Share

Geographic Coverage of Brazil Hospitality Industry

Brazil Hospitality Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism; Consistent Demand for Business Travel and Corporate Hospitality Services

- 3.3. Market Restrains

- 3.3.1 Political Instability and Uncertainty; Limited Access to Transportation

- 3.3.2 Inadequate Roads

- 3.3.3 and Insufficient Connectivity

- 3.4. Market Trends

- 3.4.1. Rising Tourism is Fueling Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Hospitality Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.1.3. Service Apartments

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper Mid-scale Hotels

- 5.2.3. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wyndham Hotel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 InterContinental Hotels Group (IHG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bourbon Hotels & Resorts

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Louvre Hotels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Radisson Hotel Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marriott International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nacional Inn Hoteis e Centros de Convencoes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intercity Hotels**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Accor SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wyndham Hotel Group

List of Figures

- Figure 1: Brazil Hospitality Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Hospitality Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Brazil Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Brazil Hospitality Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Brazil Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Brazil Hospitality Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Hospitality Industry?

The projected CAGR is approximately 6.54%.

2. Which companies are prominent players in the Brazil Hospitality Industry?

Key companies in the market include Wyndham Hotel Group, InterContinental Hotels Group (IHG), Bourbon Hotels & Resorts, Louvre Hotels, Radisson Hotel Group, Marriott International Inc, Nacional Inn Hoteis e Centros de Convencoes, Intercity Hotels**List Not Exhaustive, Accor SA.

3. What are the main segments of the Brazil Hospitality Industry?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism; Consistent Demand for Business Travel and Corporate Hospitality Services.

6. What are the notable trends driving market growth?

Rising Tourism is Fueling Market Growth.

7. Are there any restraints impacting market growth?

Political Instability and Uncertainty; Limited Access to Transportation. Inadequate Roads. and Insufficient Connectivity.

8. Can you provide examples of recent developments in the market?

February 2024: Accor made an agreement with IDeaS, a leading provider of hospitality revenue optimization software and services. With this partnership, IDeaS will provide Accor with global revenue management software (RMS) services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Hospitality Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Hospitality Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Hospitality Industry?

To stay informed about further developments, trends, and reports in the Brazil Hospitality Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence