Key Insights

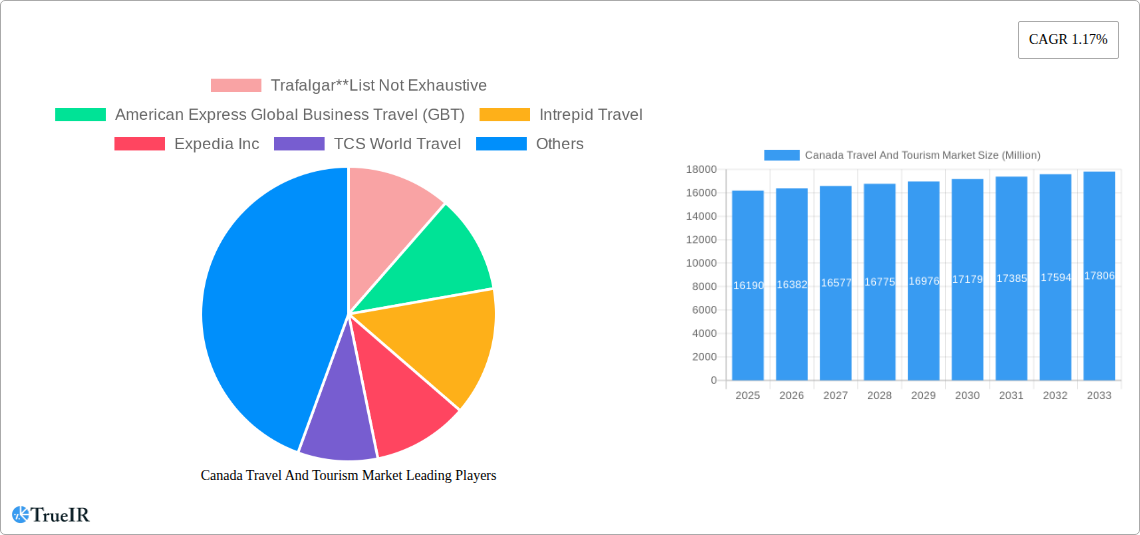

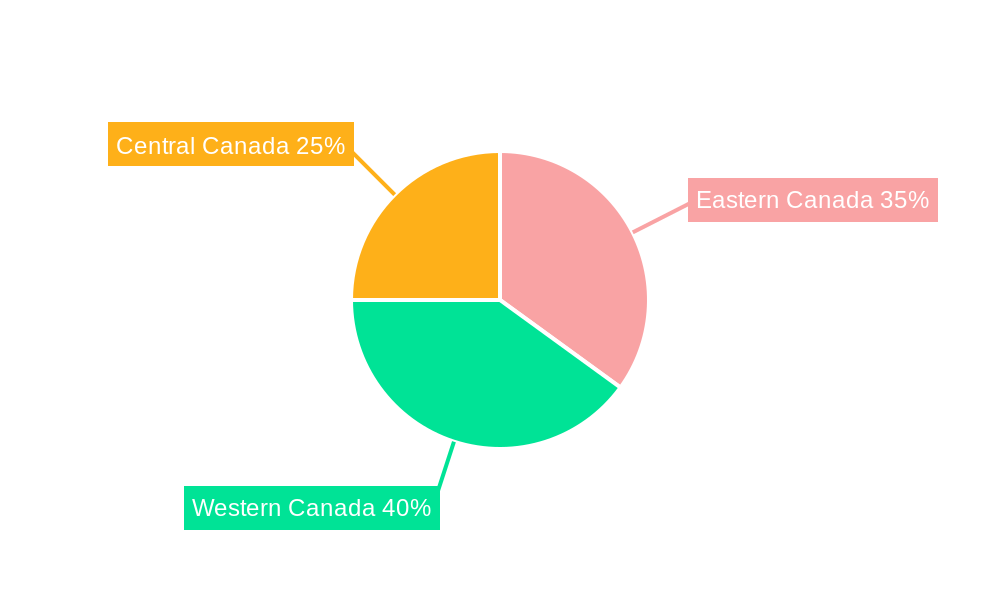

The Canadian travel and tourism market, valued at $16.19 billion in 2025, is projected to experience modest growth, with a Compound Annual Growth Rate (CAGR) of 1.17% from 2025 to 2033. This growth reflects a gradual recovery from the pandemic's impact and sustained interest in domestic and international travel within Canada. Key drivers include increasing disposable incomes among Canadians, a growing middle class with greater spending power, and the government's continued investment in tourism infrastructure and promotion. Popular travel segments include leisure tourism, driven by scenic destinations and outdoor activities, and business travel, fueled by economic activity in major urban centers. The online booking segment is expected to continue its strong growth trajectory, surpassing offline bookings as the preferred method for travel arrangements. Growth in specific areas, such as medical and sports tourism, presents opportunities for targeted marketing and investment. However, challenges remain, including seasonal variations in tourism demand, reliance on international visitors, and ongoing concerns about climate change and its potential impact on natural attractions. Regional disparities also exist, with Eastern and Western Canada likely demonstrating different growth patterns due to varied tourism attractions and economic conditions. The competitive landscape is diverse, with both established global players like American Express GBT and Expedia, and smaller, specialized operators catering to niche markets.

Canada Travel And Tourism Market Market Size (In Billion)

The forecast period (2025-2033) suggests a steady expansion of the Canadian travel and tourism market. While the CAGR of 1.17% indicates moderate growth, this is expected to fluctuate based on macroeconomic factors, global events, and evolving consumer preferences. To maintain momentum, businesses in the sector will need to adapt to changing demands, prioritize sustainable practices, and leverage digital technologies for efficient marketing and operational management. Strategic investments in improving infrastructure, enhancing visitor experiences, and fostering collaboration across the industry are crucial for maximizing growth potential and ensuring the long-term sustainability of this vital sector of the Canadian economy. Increased focus on niche markets, such as adventure tourism and eco-tourism, coupled with targeted marketing campaigns, will likely yield positive results.

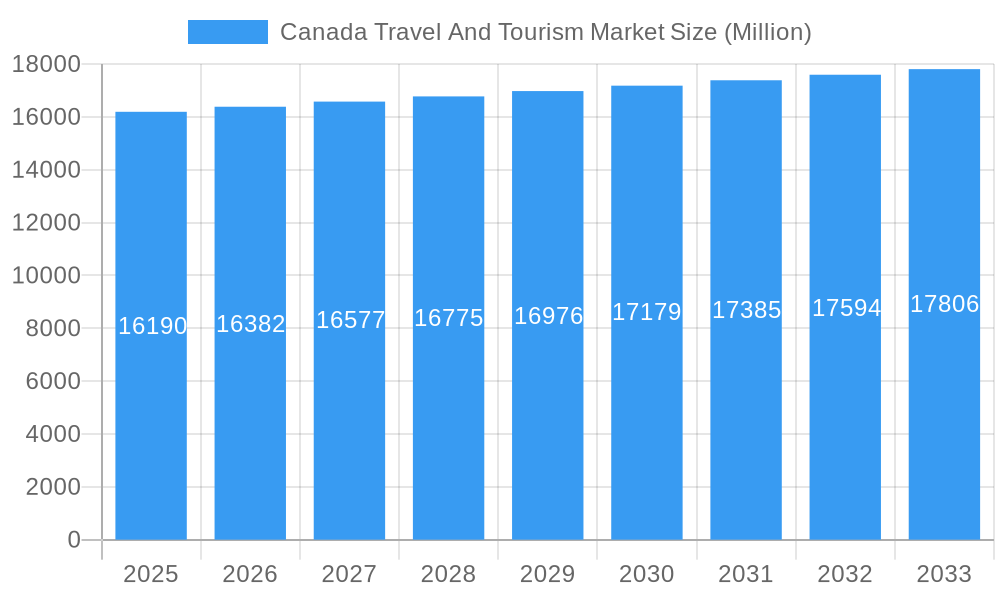

Canada Travel And Tourism Market Company Market Share

Canada Travel and Tourism Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canada Travel and Tourism Market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, growth drivers, challenges, and future outlook, empowering businesses to make informed strategic decisions. The report leverages extensive data analysis and incorporates key industry developments to provide a complete picture of this dynamic sector. The estimated market size in 2025 is projected at $XX Million, with a compound annual growth rate (CAGR) of XX% from 2025 to 2033.

Canada Travel And Tourism Market Structure & Competitive Landscape

The Canadian travel and tourism market exhibits a moderately concentrated structure, with several large multinational corporations and a significant number of smaller, specialized players. The market concentration ratio (CR4) for 2024 is estimated at XX%, indicating the presence of both established players and emerging businesses. Key factors shaping the competitive landscape include:

- Innovation: Technological advancements in booking platforms, personalized travel experiences, and sustainable tourism practices drive innovation.

- Regulatory Impacts: Government policies and regulations regarding visa requirements, environmental protection, and tourism infrastructure development directly influence market dynamics.

- Product Substitutes: The rise of alternative travel options, like staycations and virtual tours, presents competitive pressures.

- End-User Segmentation: The market is segmented by application (international, domestic), booking method (online, offline), and type of travel (leisure, education, business, sports, medical, other).

- M&A Trends: Consolidation through mergers and acquisitions is observed, leading to increased market share for major players. The volume of M&A transactions in the sector during 2019-2024 was approximately XX deals, resulting in a market value of $XX Million.

Canada Travel And Tourism Market Trends & Opportunities

The Canadian travel and tourism market demonstrates strong growth potential, driven by several key trends. The market size experienced substantial growth during the historical period (2019-2024), reaching $XX Million in 2024. This growth is expected to continue during the forecast period (2025-2033), fueled by:

- Increased Domestic Travel: A rising preference for domestic tourism, driven by factors such as affordability and accessibility, is a significant growth driver.

- Technological Advancements: Online travel agencies (OTAs) and mobile booking platforms have significantly transformed the travel booking experience, improving convenience and accessibility for consumers.

- Shifting Consumer Preferences: Consumers increasingly seek personalized experiences, sustainable travel options, and unique destinations, influencing the demand for specialized travel services.

- Competitive Dynamics: The competitive landscape is characterized by fierce competition amongst OTAs and travel operators, driving innovation and price competitiveness. This fosters growth through greater value and choice for consumers.

Dominant Markets & Segments in Canada Travel And Tourism Market

The Canadian travel and tourism market exhibits robust growth across various segments. However, certain segments demonstrate particularly strong performance:

- By Application: International tourism contributes significantly to the market size, driven by Canada's diverse attractions and welcoming environment. Domestic tourism also experiences substantial growth due to increased disposable incomes and accessibility.

- By Booking: Online bookings dominate the market, highlighting the increasing reliance on digital platforms for travel planning and purchasing.

- By Type: The leisure travel segment represents the largest portion of the market, reflecting the popularity of vacation travel within and into Canada. The business travel segment is also substantial, influenced by the strength of the Canadian economy.

Key Growth Drivers:

- Improved Infrastructure: Investments in airports, transportation networks, and tourist accommodations enhance the overall travel experience and attract more visitors.

- Supportive Government Policies: Government initiatives promoting tourism development and sustainability significantly contribute to market growth.

Canada Travel And Tourism Market Product Analysis

Technological advancements have significantly impacted the Canadian travel and tourism market. Innovations such as AI-powered travel planning tools, virtual reality travel experiences, and personalized recommendation systems enhance the customer experience and boost efficiency. These technological improvements enable better market penetration and create competitive advantages for businesses that embrace them.

Key Drivers, Barriers & Challenges in Canada Travel And Tourism Market

Key Drivers:

- Strong Canadian Dollar & Favorable Exchange Rates: A robust Canadian dollar and competitive exchange rates are significant attractors for international visitors, making Canada a more appealing and affordable travel destination.

- Proactive Government Support & Investment: Ongoing government initiatives, such as dedicated funding for Indigenous tourism development (e.g., the USD 500,000 investment in British Columbia), and broader strategies to promote Canada as a global destination, are crucial catalysts for market expansion and diversification.

- Pervasive Technological Advancements & Digitalization: The widespread adoption of digital platforms, from advanced booking systems and personalized itinerary planning tools to augmented reality experiences and seamless online payment solutions, significantly enhances accessibility, convenience, and overall customer engagement, thereby stimulating demand.

- Growing Demand for Experiential and Sustainable Tourism: Travelers increasingly seek authentic, immersive experiences that connect them with local culture, nature, and adventure. This growing preference for unique and responsible travel aligns well with Canada's diverse landscapes and rich heritage.

Barriers & Challenges:

- Persistent Seasonality and Weather Dependence: The inherent seasonality of tourism, particularly in regions heavily reliant on winter or summer activities, presents a recurring challenge. Developing strategies for year-round tourism and diversifying offerings are essential to mitigate revenue fluctuations.

- Infrastructure Capacity and Accessibility Limitations: While improving, certain popular tourist hubs and remote natural attractions may face capacity constraints due to limited infrastructure, including transportation networks, accommodation options, and public services. Addressing these limitations is vital for accommodating growing visitor numbers and ensuring a positive experience.

- Evolving Environmental Concerns & Sustainability Imperatives: The imperative to preserve Canada's pristine natural environments and promote eco-friendly practices is paramount. Balancing tourism growth with conservation efforts, managing the environmental impact of visitor activities, and fostering a strong commitment to sustainable tourism are ongoing challenges that also present significant opportunities for innovation and responsible development.

- Global Competition & Shifting Traveler Preferences: Canada competes with numerous other attractive global destinations. Keeping pace with evolving international travel trends, understanding diverse market needs, and continuously innovating to offer unique value propositions are critical to maintaining a competitive edge.

- Economic Fluctuations & Geopolitical Factors: Global economic uncertainties, currency fluctuations, and geopolitical events can influence international travel patterns and consumer spending, posing external challenges to market stability.

Growth Drivers in the Canada Travel And Tourism Market Market

Growth is propelled by rising disposable incomes, increased interest in experiential travel, and government initiatives promoting tourism. Technological advancements and improved infrastructure further facilitate market expansion.

Challenges Impacting Canada Travel And Tourism Market Growth

Despite its strong growth potential, the Canada Travel and Tourism Market faces several persistent challenges. Seasonality remains a significant hurdle, with tourism revenues often concentrated in specific periods, necessitating diversification strategies to ensure more equitable year-round economic benefits. Infrastructure constraints, particularly in rapidly developing or remote destinations, can limit the capacity to host larger visitor numbers and may impact the quality of the visitor experience. The growing global emphasis on environmental sustainability presents both an opportunity and a challenge; while there's a demand for eco-friendly travel, managing the environmental impact of increased tourism requires careful planning and responsible practices. Additionally, intense competition from other global destinations means Canada must constantly innovate and differentiate its offerings. Fluctuating exchange rates can also influence international visitor numbers, making the market susceptible to external economic shifts.

Key Players Shaping the Canada Travel And Tourism Market Market

- Trafalgar

- American Express Global Business Travel (GBT)

- Intrepid Travel

- Expedia Inc

- TCS World Travel

- BCD Travel

- Topdeck Travel Ltd

- Exodus Travels Ltd

- Abercrombie & Kent USA LLC

- Booking Holdings Inc

Significant Canada Travel And Tourism Market Industry Milestones

- October 2023: The Government of Canada invested USD 500,000 in British Columbia's Indigenous tourism sector, boosting sustainable and culturally rich tourism.

- October 2022: Sabre and BCD Travel's technology partnership is expected to significantly increase corporate travel bookings and accelerate innovation in the sector.

Future Outlook for Canada Travel And Tourism Market Market

The Canadian travel and tourism market is poised for continued growth, driven by increasing disposable incomes, technological advancements, and government support for sustainable tourism initiatives. Strategic investments in infrastructure and targeted marketing campaigns will further enhance the market's potential. The forecast period should see consistent expansion, solidifying Canada's position as a leading global tourism destination.

Canada Travel And Tourism Market Segmentation

-

1. Type

- 1.1. Leisure

- 1.2. Education

- 1.3. Business

- 1.4. Sports

- 1.5. Medical Tourism

- 1.6. Other Types

-

2. Application

- 2.1. International

- 2.2. Domestic

-

3. Booking

- 3.1. Online

- 3.2. Offline

Canada Travel And Tourism Market Segmentation By Geography

- 1. Canada

Canada Travel And Tourism Market Regional Market Share

Geographic Coverage of Canada Travel And Tourism Market

Canada Travel And Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Increasing Interest in Multi-Day Tours is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Travel And Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure

- 5.1.2. Education

- 5.1.3. Business

- 5.1.4. Sports

- 5.1.5. Medical Tourism

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trafalgar**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Express Global Business Travel (GBT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intrepid Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expedia Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TCS World Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCD Travel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topdeck Travel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Exodus Travels Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abercrombie & Kent USA LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trafalgar**List Not Exhaustive

List of Figures

- Figure 1: Canada Travel And Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Travel And Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 4: Canada Travel And Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 8: Canada Travel And Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Travel And Tourism Market?

The projected CAGR is approximately 1.17%.

2. Which companies are prominent players in the Canada Travel And Tourism Market?

Key companies in the market include Trafalgar**List Not Exhaustive, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, Booking Holdings Inc.

3. What are the main segments of the Canada Travel And Tourism Market?

The market segments include Type, Application, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Increasing Interest in Multi-Day Tours is Driving the Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

October 2023: The Government of Canada invested in tourism across British Columbia to attract new visitors and stimulate local economies. Funding of USD 500,000 has been provided to the Aboriginal Tourism Association of British Columbia to help Indigenous Tourism BC develop its "Invest in Iconic" tourism strategy with Destination BC to grow the Indigenous tourism sector in British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Travel And Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Travel And Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Travel And Tourism Market?

To stay informed about further developments, trends, and reports in the Canada Travel And Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence