Key Insights

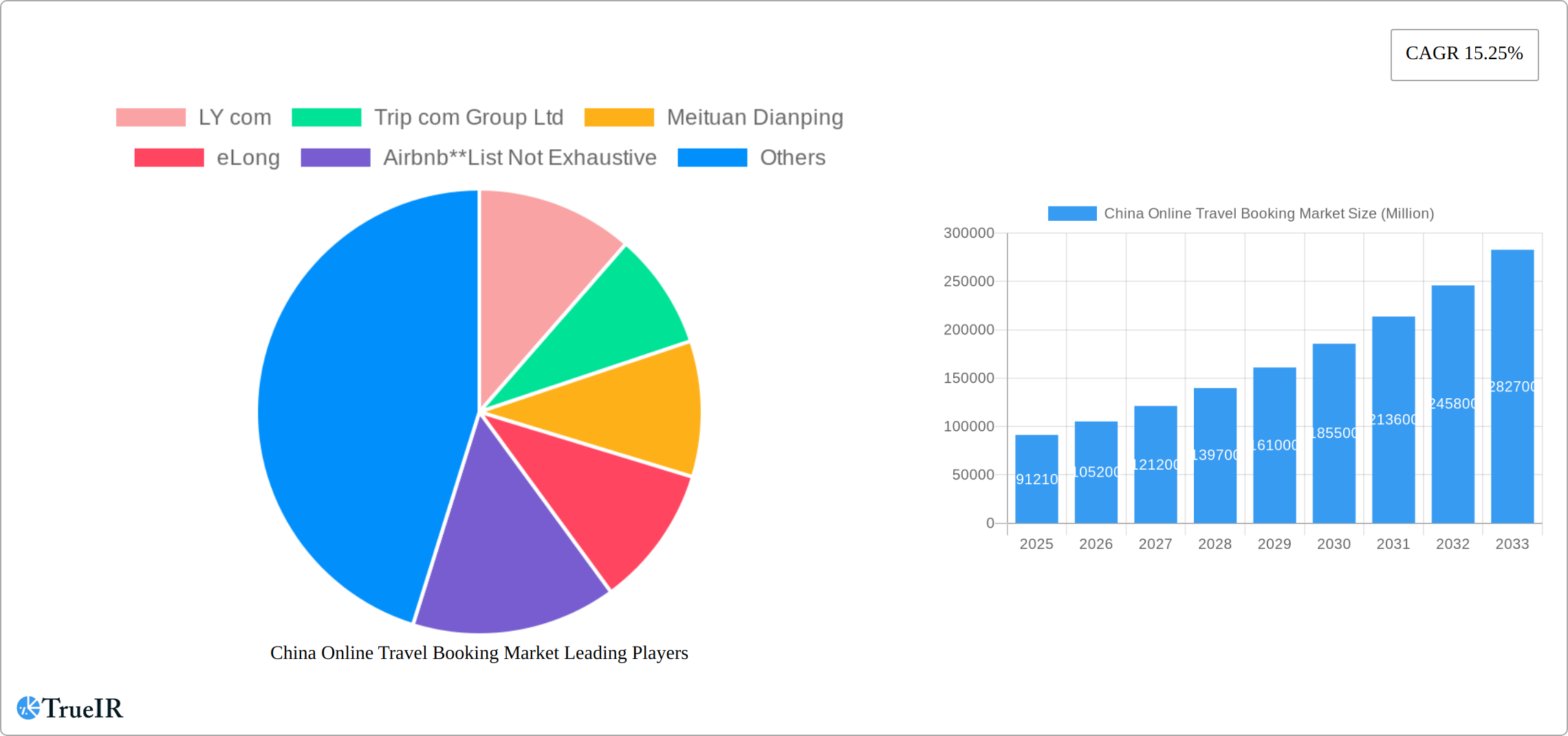

The China online travel booking market, valued at $91.21 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.25% from 2025 to 2033. This surge is fueled by several key drivers. The increasing penetration of smartphones and internet access across China's vast population empowers more individuals to book travel arrangements online, driving up demand. A rising middle class with greater disposable income and a yearning for travel experiences further fuels this market expansion. Government initiatives promoting domestic tourism and easing travel restrictions also contribute significantly. Furthermore, the continuous innovation in online travel platforms, including personalized recommendations, seamless booking processes, and attractive deals and packages, enhances user experience and boosts market growth. Competitive pricing strategies among established players such as Ctrip, Meituan, and Fliggy, along with the emergence of niche players catering to specific travel preferences, further intensifies the market dynamism.

China Online Travel Booking Market Market Size (In Billion)

However, the market is not without its challenges. Fluctuations in the global economy and potential travel restrictions due to unforeseen circumstances (e.g., pandemics) could temper growth. Maintaining cybersecurity and data privacy is paramount, given the sensitive nature of personal and financial information handled by these platforms. Intense competition necessitates continuous innovation and strategic investments to remain competitive. Moreover, ensuring a smooth and efficient customer service experience is crucial to building brand loyalty and retaining market share in a highly competitive environment. Successful navigation of these challenges will be crucial to sustaining the market’s impressive growth trajectory.

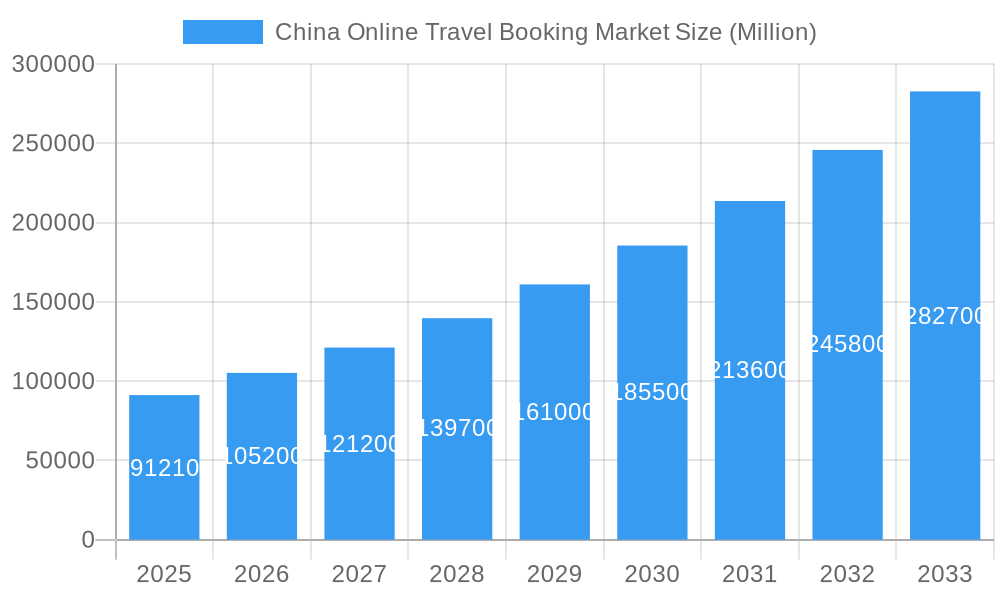

China Online Travel Booking Market Company Market Share

China Online Travel Booking Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning China online travel booking market, projecting robust growth from 2025 to 2033. Leveraging extensive data from 2019-2024, the report offers crucial insights for investors, businesses, and industry professionals seeking to navigate this rapidly evolving landscape. Discover key market trends, dominant players, and future opportunities within this multi-billion-dollar sector.

China Online Travel Booking Market Market Structure & Competitive Landscape

The Chinese online travel booking market is a dynamic and fiercely competitive landscape dominated by a few key players. While exhibiting moderate market concentration, as evidenced by a projected Herfindahl-Hirschman Index (HHI) of [Insert Updated HHI for 2025] in 2025, the continuous emergence of innovative business models and new entrants prevents any single entity from achieving absolute market dominance. This competitive pressure fuels innovation and ensures a constantly evolving market.

Key Market Structure Aspects:

- Market Concentration & Evolution: The HHI, currently estimated at [Insert Updated HHI for 2025], is projected to [Increase/Decrease] slightly to [Insert Updated HHI for 2033] by 2033, reflecting the ongoing impact of both consolidation and new market entrants. This signifies a market in constant flux.

- Innovation Drivers: Technological advancements are pivotal, particularly in mobile app development, AI-driven personalization, and the seamless integration of fintech solutions for streamlined payment processing. These innovations enhance user experience and drive market growth.

- Regulatory Impacts: Government regulations concerning data privacy, consumer protection, and anti-monopoly practices exert a considerable influence. Changes in these regulations present both opportunities and challenges, necessitating agile adaptation from market participants.

- Product Substitutes & Disruption: The rise of social media-based travel planning, the burgeoning popularity of peer-to-peer accommodation platforms (like Airbnb), and the integration of travel services within broader e-commerce platforms represent significant alternative channels and potential disruptors to traditional OTAs.

- End-User Segmentation: A nuanced understanding of consumer segmentation is crucial. The market is segmented based on demographics (age, income, lifestyle), travel purpose (leisure, business, medical tourism), and booking behavior (frequency, preferred booking channels, travel style – budget, luxury, adventure, etc.).

- M&A Activity & Consolidation: The past five years have witnessed [Insert Updated M&A Activity Value] in mergers and acquisitions. This trend is expected to accelerate, reaching [Insert Updated M&A Activity Value for 2033] by 2033, driven by larger players seeking to solidify their market positions and expand their service offerings.

China Online Travel Booking Market Market Trends & Opportunities

The China online travel booking market is experiencing exponential growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a burgeoning middle class with a thirst for travel experiences. The market size is projected to reach xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is largely fueled by a preference for mobile bookings, personalized travel experiences, and the increasing use of AI-powered travel planning tools.

Market penetration rates for online travel booking are expected to reach xx% by 2033. The shift towards mobile booking platforms presents a significant opportunity for businesses to optimize their mobile applications and user experiences. The rising demand for customized travel packages, focusing on unique experiences and niche destinations, also presents a significant opportunity for market expansion. Increased competition is driving innovation, resulting in a wider range of products and services at increasingly competitive prices.

Dominant Markets & Segments in China Online Travel Booking Market

Regional variations in online booking preferences and growth rates are significant. While comprehensive data for all segments remains limited, mobile and tablet devices are expected to remain the dominant platforms. Direct booking continues its upward trajectory, predicted to surpass travel agents as the primary booking method within the forecast period.

By Mode of Booking:

- Direct Booking: This segment demonstrates rapid growth fueled by increased consumer confidence in online transactions and the user-friendly interfaces of booking platforms. The annual growth rate is projected to average [Insert Updated Growth Rate]% during the forecast period.

- Travel Agents: While maintaining a presence, particularly among older demographics or those seeking highly specialized travel arrangements, this segment's growth rate is expected to lag behind the overall market average.

By Platform:

- Mobile/Tablet: This remains the dominant booking platform due to high smartphone penetration and the convenience of on-the-go booking. Robust growth is anticipated, surpassing desktop usage.

- Desktop: Although its relative share is declining, desktop booking will continue to hold a significant market share, especially among older users or those preferring a larger screen for detailed planning.

By Service Type:

- Accommodation Booking: This leading segment experiences consistent growth fueled by the increasing popularity of both domestic and international travel.

- Travel Tickets Booking (Air & Rail): This segment shows strong growth driven by increased air and rail travel demand.

- Holiday Package Booking: This segment shows significant growth, driven by the rising demand for convenient and all-inclusive travel experiences.

- Other Services (Ancillary Services): This includes travel insurance, visa assistance, and other value-added services, exhibiting considerable growth potential as consumers seek comprehensive travel solutions.

Key Growth Drivers:

- Rapid Urbanization & Rising Disposable Incomes: The expanding Chinese middle class with increased disposable income fuels a significant demand for both domestic and international travel.

- Technological Advancements & Enhanced User Experience: Mobile platforms, AI-powered travel tools, and personalized recommendations enhance booking convenience and create seamless travel experiences.

- Supportive Government Policies & Tourism Initiatives: Government policies aimed at boosting tourism, improving infrastructure, and facilitating travel contribute to a favorable market environment.

China Online Travel Booking Market Product Analysis

The market offers a diverse range of products and services, encompassing flight and hotel bookings, package tours, car rentals, and travel insurance. Technological advancements, particularly AI-driven personalized recommendations and chatbots, have enhanced user experience and booking efficiency. The integration of payment gateways and loyalty programs also contributes to product innovation and competitive advantage. Companies focus on seamless mobile experiences and personalized services to differentiate themselves in a crowded market.

Key Drivers, Barriers & Challenges in China Online Travel Booking Market

Key Drivers:

- The rapid expansion of the Chinese middle class and their increasing disposable incomes, creating a larger pool of potential travelers.

- Government initiatives designed to stimulate tourism and upgrade infrastructure, making travel more accessible and appealing.

- Continuous technological advancements that enhance booking convenience, personalization, and the overall travel experience.

Key Challenges:

- Fierce competition among established players and the constant influx of new startups, requiring companies to differentiate and innovate to maintain market share.

- Regulatory hurdles and ever-evolving data privacy laws that impact data collection, usage, and compliance, demanding robust data security measures.

- Supply chain disruptions (e.g., flight cancellations, accommodation shortages) that affect the availability of travel services. For instance, [Insert Updated Percentage]% of planned travel was impacted during the last major pandemic-related travel restrictions.

Growth Drivers in the China Online Travel Booking Market Market

The growth of this market is primarily driven by a confluence of factors, including increasing internet penetration and smartphone usage, the rise of the Chinese middle class, and improved travel infrastructure. Government policies aimed at boosting the tourism sector further fuel growth. Technological innovation, like AI-powered recommendation engines and personalized travel planning, significantly enhances user experience and drives market expansion.

Challenges Impacting China Online Travel Booking Market Growth

Challenges include intense competition, evolving regulatory landscapes concerning data privacy and cybersecurity, and maintaining a secure and reliable payment infrastructure. Economic fluctuations, geopolitical instability, and unforeseen events like pandemics can significantly disrupt travel plans and negatively impact revenue streams.

Key Players Shaping the China Online Travel Booking Market Market

- LY.com

- Trip.com Group Ltd

- Meituan Dianping

- eLong

- Airbnb

- Fliggy

- Tuniu

- Didi Chuxing

- Qunar

- Mafengwo

- Lvmama

Significant China Online Travel Booking Market Industry Milestones

- July 2021: Trip.com became the first OTA to offer Eurail and Interrail passes, expanding its product offerings and targeting international travelers.

- February 2022: CWT launched myCWT in China, a platform simplifying business travel and showcasing the expanding potential for B2B4E travel management solutions.

Future Outlook for China Online Travel Booking Market Market

The Chinese online travel booking market is poised for continued robust growth, propelled by sustained economic expansion, a burgeoning middle class with increased spending power, and ongoing technological advancements. Significant opportunities exist in niche travel segments (e.g., sustainable tourism, adventure travel), personalized travel experiences tailored to individual preferences, and the development of innovative travel technology solutions such as AI-powered itinerary planning and virtual reality travel previews. The market’s potential is substantial, with a projected increase in market size of [Insert Updated Market Size Increase] over the forecast period.

China Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

China Online Travel Booking Market Segmentation By Geography

- 1. China

China Online Travel Booking Market Regional Market Share

Geographic Coverage of China Online Travel Booking Market

China Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in China is Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LY com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trip com Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan Dianping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eLong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbnb**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fliggy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tuniu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Didi Chuxing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qunar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mafengwo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lvmama

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LY com

List of Figures

- Figure 1: China Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: China Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 7: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: China Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Travel Booking Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the China Online Travel Booking Market?

Key companies in the market include LY com, Trip com Group Ltd, Meituan Dianping, eLong, Airbnb**List Not Exhaustive, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, Lvmama.

3. What are the main segments of the China Online Travel Booking Market?

The market segments include Service Type, Mode of Booking, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in China is Helping in Market Expansion.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: CWT launched myCWT, a flagship platform in China aimed at simplifying business travel for companies and employees. CWT is a global B2B4E travel management specialist based in the United States. The myCWT platform offers extensive international and domestic travel content, including rail, flights, hotels, and ground transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the China Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence