Key Insights

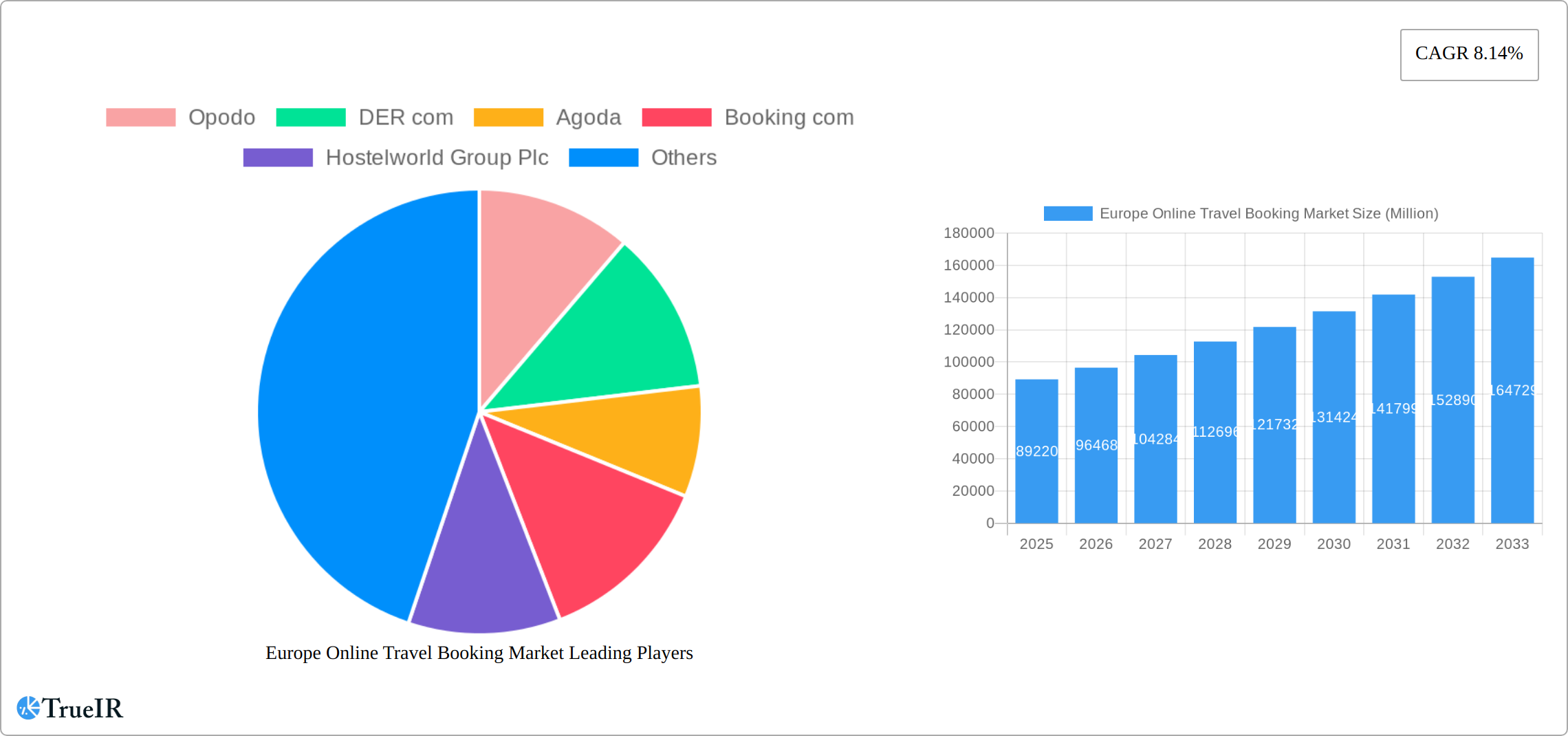

The European online travel booking market, valued at €89.22 billion in 2025, is projected to experience robust growth, driven by increasing internet and smartphone penetration, a rising preference for convenient online booking platforms, and the growing popularity of budget travel and personalized travel experiences. The market's Compound Annual Growth Rate (CAGR) of 8.14% from 2025 to 2033 indicates a significant expansion, reaching an estimated €170 billion by 2033. Key drivers include the expanding middle class with increased disposable income, the rise of mobile-first travel booking, and the increasing adoption of sophisticated travel booking technologies offering personalized recommendations and dynamic pricing. The market is segmented by service type (transportation, accommodation, packages, and others), booking type (online travel agencies (OTAs) and direct suppliers), and platform (desktop and mobile). Germany, France, the United Kingdom, and Italy represent the largest national markets within Europe, collectively accounting for a significant share of the overall market value. While the market enjoys considerable growth momentum, potential restraints include economic fluctuations impacting consumer spending, increased competition among established players and emerging startups, and concerns regarding data security and privacy. The competitive landscape features both major global players like Expedia, Booking.com, and Airbnb, and regional specialists catering to niche markets. The continued integration of Artificial Intelligence (AI) and personalization techniques within online platforms is expected to further shape the market's trajectory in the coming years.

Europe Online Travel Booking Market Market Size (In Billion)

The strategic focus of key players is shifting toward enhancing user experience, offering personalized travel solutions, and leveraging data analytics to optimize pricing and marketing strategies. The expansion into sustainable and responsible tourism options is also gaining traction, reflecting a growing consumer preference for eco-friendly travel choices. Mobile booking continues to be a primary growth driver, particularly among younger demographics. The ongoing evolution of technological advancements within the online travel space will undoubtedly influence the market's dynamic competition, with a potential shift toward innovative business models and service offerings. Future growth will likely be influenced by factors such as evolving travel patterns, economic stability across European nations, and the ability of companies to effectively adapt to changing consumer preferences and technological advancements. The success of online travel platforms will hinge on their ability to provide seamless user experiences, comprehensive travel options, and effective customer service.

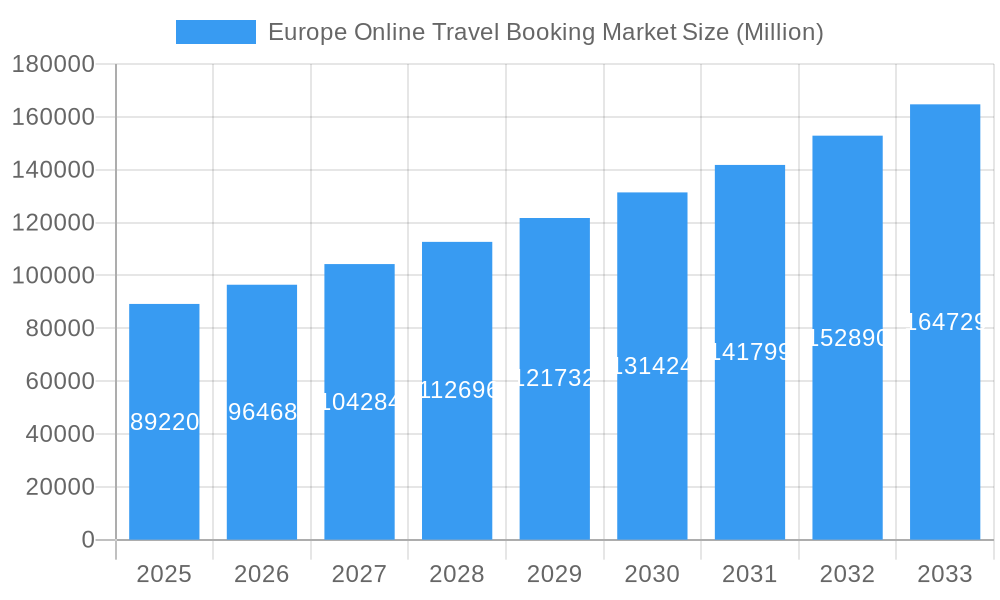

Europe Online Travel Booking Market Company Market Share

Europe Online Travel Booking Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic Europe online travel booking market, offering invaluable insights for stakeholders across the industry. With a focus on key players, market segments, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%. This in-depth analysis examines market size, growth drivers, challenges, and opportunities across various segments and geographical regions.

Europe Online Travel Booking Market Structure & Competitive Landscape

The European online travel booking market is characterized by a moderately concentrated structure with several dominant players and a significant number of smaller, niche operators. Key players such as Booking.com, Expedia, eDreams ODIGEO, and others compete fiercely, leveraging technological advancements and strategic partnerships to gain market share. The market exhibits significant innovation, driven by the constant need to improve user experience, integrate new technologies, and enhance personalized travel solutions.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, suggesting a moderately concentrated market with significant competition.

- Innovation Drivers: Artificial intelligence (AI), machine learning (ML), and big data analytics are key drivers of innovation, enabling better price optimization, personalized recommendations, and improved customer service.

- Regulatory Impacts: GDPR (General Data Protection Regulation) and other data privacy regulations significantly impact data collection and usage practices, influencing the competitive landscape.

- Product Substitutes: Traditional travel agencies and direct bookings from airlines and hotels present some level of competition, although the online market continues to dominate.

- End-User Segmentation: The market caters to diverse customer segments, including leisure travelers, business travelers, and groups, each with varying needs and preferences.

- M&A Trends: The market has witnessed a moderate number of mergers and acquisitions (M&A) activities over the past few years, with an estimated xx M&A deals in the historical period (2019-2024). This activity is expected to continue as companies seek to expand their market share and product offerings.

Europe Online Travel Booking Market Market Trends & Opportunities

The European online travel booking market is experiencing significant growth, fueled by several key trends:

- Rising Smartphone Penetration: The increasing adoption of smartphones and mobile devices has facilitated easy access to travel booking platforms, expanding market reach and contributing to growth.

- Growth in Online Travel Spending: Consumers are increasingly adopting online channels for travel booking, primarily driven by convenience and access to better deals and information.

- Shifting Consumer Preferences: Travelers are increasingly seeking personalized travel experiences, customized itineraries, and sustainable travel options, influencing the development of innovative services.

- Technological Advancements: The development and adoption of technologies like AI, VR/AR, and blockchain are revolutionizing the travel booking experience, leading to enhanced efficiency and personalized offerings.

- Increased Competition: The growing competition among online travel agencies (OTAs) is driving innovation and pushing companies to improve service quality and pricing strategies.

- Market Size Growth: The market size has exhibited robust growth throughout the historical period (2019-2024), and this positive trend is expected to continue in the forecast period (2025-2033).

The market's growth is expected to be driven by increasing disposable incomes, a rising middle class, and the growing popularity of online travel booking among millennials and Gen Z. The increasing adoption of mobile booking platforms and the growing demand for customized travel packages are also significant factors influencing market growth.

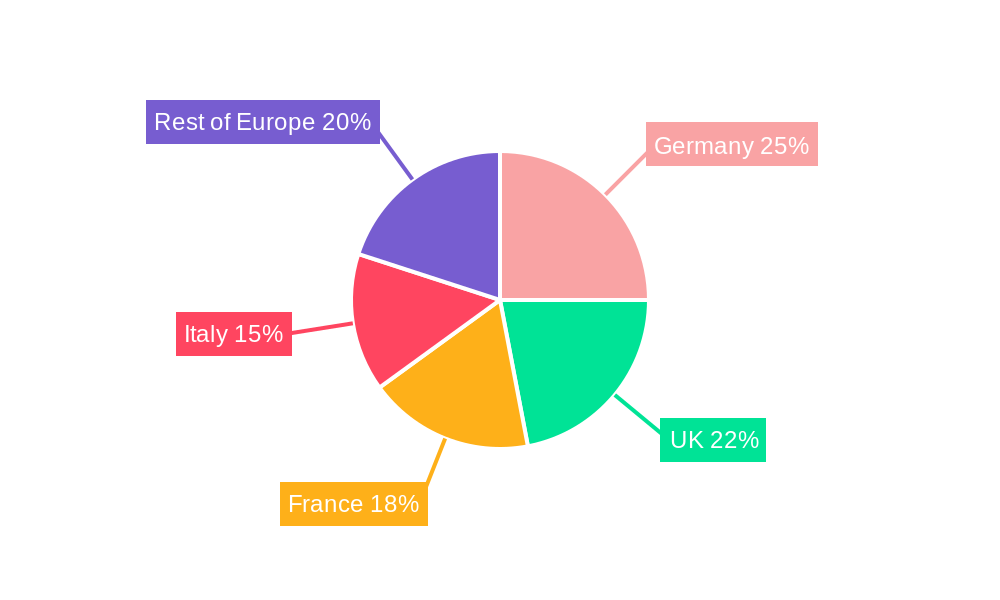

Dominant Markets & Segments in Europe Online Travel Booking Market

The UK, Germany, and France represent the dominant markets within the European online travel booking sector. Italy and the Rest of Europe also show significant growth potential.

- Leading Region: Western Europe accounts for the largest market share.

- Leading Country: The United Kingdom holds the largest market share, followed by Germany and France.

- Service Type: Travel Accommodation and Vacation Packages are currently the largest segments, showcasing robust growth, although Transportation remains a significant and competitive sector.

- Booking Type: Online Travel Agencies (OTAs) currently dominate the market share.

- Platform: Mobile platforms are experiencing rapid growth, exceeding desktop in market share.

Key Growth Drivers:

- Robust Tourism Infrastructure: Well-developed transportation networks and ample accommodation options are key growth drivers in major European countries.

- Favorable Government Policies: Government initiatives to promote tourism and improve travel infrastructure positively impact market growth.

- Strong Economic Growth: Increased disposable incomes across many European countries fuel demand for travel and leisure activities.

Europe Online Travel Booking Market Product Analysis

The online travel booking market in Europe is a dynamic and rapidly evolving landscape, characterized by a relentless pursuit of enhanced user experiences and expanded service portfolios. Major players are strategically integrating cutting-edge technologies to stay ahead. This includes the sophisticated deployment of AI-powered recommendation engines that anticipate traveler needs, the creation of deeply personalized travel itineraries tailored to individual preferences, and the immersive exploration of virtual reality (VR) experiences that offer a glimpse into destinations before booking. This commitment to innovation is paramount for cultivating a competitive edge and capturing a significant share of this increasingly dynamic and customer-centric sector.

Key Drivers, Barriers & Challenges in Europe Online Travel Booking Market

Key Drivers:

- Technological advancements such as AI and mobile apps enhance user experience and personalize travel plans.

- Growing disposable income in several European countries increases travel spending.

- Government tourism initiatives and improved infrastructure create more favorable conditions for the market.

Challenges and Restraints:

- Intense Competition: The market faces fierce competition among established players and emerging startups. This pressure impacts pricing strategies and profitability.

- Regulatory Hurdles: Data privacy regulations (e.g., GDPR) and other regulatory complexities add compliance costs and operational challenges. Estimates suggest these regulations increase operational costs by xx% for some businesses.

- Economic Downturns: Economic uncertainties and recessions can significantly reduce travel spending, impacting market growth.

Growth Drivers in the Europe Online Travel Booking Market Market

The market’s growth is fueled by factors such as increasing smartphone penetration, rising online travel spending, technological advancements, and the evolving preferences of travelers seeking personalized experiences. The growing popularity of sustainable travel also presents opportunities for businesses to capitalize on eco-conscious travelers.

Challenges Impacting Europe Online Travel Booking Market Growth

The market faces challenges such as intense competition from established and emerging players, data privacy regulations, economic fluctuations, and potential cybersecurity risks. These factors necessitate robust strategies to maintain profitability and security within the competitive landscape.

Key Players Shaping the Europe Online Travel Booking Market Market

- Opodo

- DER com

- Agoda

- Booking.com

- Hostelworld Group Plc

- HRS

- Orbitz

- Airbnb

- lastminute.com

- Unique Villas

- Expedia

- eDreams

- ZenHotels.com

- TUI AG

List Not Exhaustive

Significant Europe Online Travel Booking Market Industry Milestones

- November 2022: Booking.com reinforced its commitment to sustainability by launching enhanced features for accommodation, car rentals, and flights, coinciding with the anniversary of its sustainability program. This strategic move underscores the growing imperative for eco-friendly practices within the travel sector.

- July 2022: Booking.com's "Ultimate Pride Amsterdam Experience" exemplified its dedication to inclusivity and impactful community engagement, effectively targeting and resonating with specific market demographics.

- May 2022: lastminute.com strategically broadened its accessibility and distribution channels by introducing its inaugural physical gift card, reaching a wider customer base.

- February 2022: eDreams ODIGEO fortified its flight offerings and competitive positioning through the signing of an NDC (New Distribution Capability) agreement with British Airways and Iberia.

Future Outlook for Europe Online Travel Booking Market Market

The European online travel booking market is poised for continued growth, driven by technological innovations, evolving consumer preferences, and the expansion of sustainable travel options. The focus on personalized experiences, seamless booking processes, and value-added services will be key for market success. Strategic partnerships and the adoption of innovative technologies will shape the competitive landscape in the coming years, presenting opportunities for both established players and emerging companies.

Europe Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

Europe Online Travel Booking Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Travel Booking Market Regional Market Share

Geographic Coverage of Europe Online Travel Booking Market

Europe Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Shift towards Mobile Phones for Travel Booking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Opodo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DER com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Booking com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hostelworld Group Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HRS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbitz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unique Villas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Expedia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eDreams

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ZenHotels com

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TUI AG**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Opodo

List of Figures

- Figure 1: Europe Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Europe Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Europe Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Travel Booking Market?

The projected CAGR is approximately 8.14%.

2. Which companies are prominent players in the Europe Online Travel Booking Market?

Key companies in the market include Opodo, DER com, Agoda, Booking com, Hostelworld Group Plc, HRS, Orbitz, Airbnb, lastminute com, Unique Villas, Expedia, eDreams, ZenHotels com, TUI AG**List Not Exhaustive.

3. What are the main segments of the Europe Online Travel Booking Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 89.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips.

6. What are the notable trends driving market growth?

Shift towards Mobile Phones for Travel Booking.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

15th November 2022: Booking.com, the leading digital travel platform, announced a series of new features for accommodation, car rental, and flights, to mark the one-year anniversary of its sustainability program launched in 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the Europe Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence