Key Insights

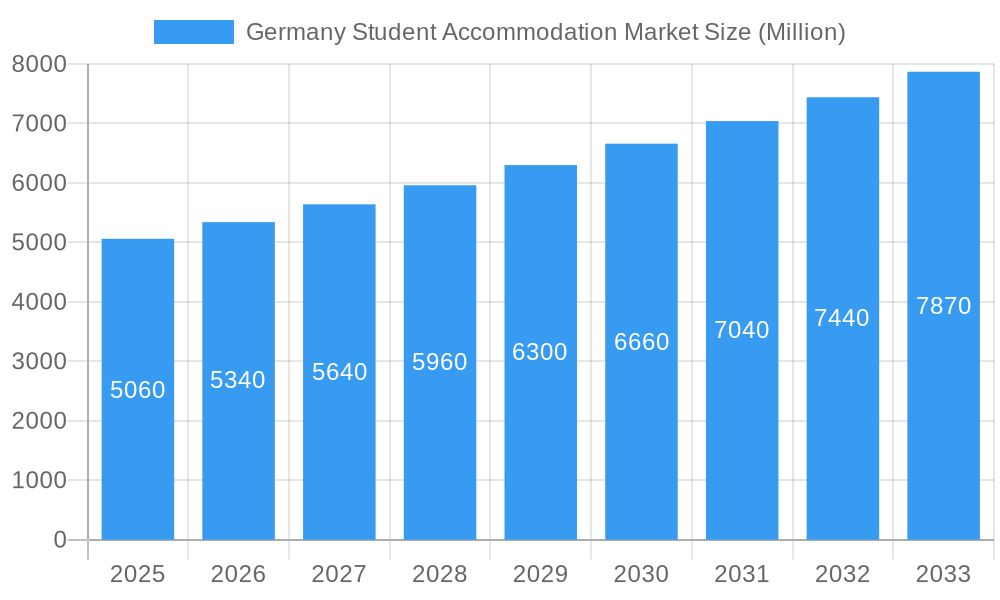

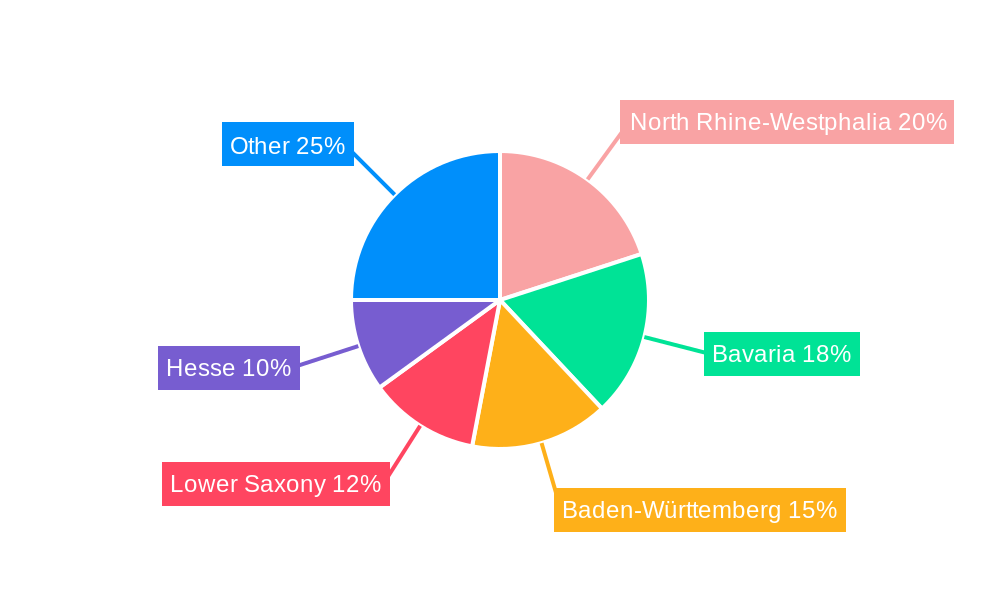

The German student accommodation market, valued at €5.06 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This growth is fueled by several key factors. Rising student enrollment numbers across German universities, particularly in major cities like Munich, Berlin, and Hamburg, are driving demand. Furthermore, the increasing preference for comfortable and convenient accommodation options, including private student accommodation and halls of residence, is contributing to market expansion. The market is segmented by price (economy, mid-range, luxury), rent type (basic, total), mode of booking (online, offline), accommodation type (halls, rented houses/rooms, private accommodation), and location (city center, periphery). The popularity of online booking platforms is streamlining the process for students, while the presence of established players like Iam Expat, Amber Student, and Unite Group indicates a competitive landscape with opportunities for further consolidation and innovation. The market is also witnessing the rise of specialized services catering to international students, reflecting Germany's growing attractiveness as a study destination. Regional variations exist, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg showing higher demand due to their established universities and strong student populations.

Germany Student Accommodation Market Market Size (In Billion)

Challenges remain, however. Affordability concerns persist, particularly for students opting for city-center accommodation. Competition for available units in desirable locations remains fierce, pushing rental prices upwards. Regulatory frameworks and building permits can also influence the supply side of the market. Nevertheless, the long-term outlook remains positive, driven by consistent student population growth, increasing disposable income among students, and a growing awareness of the importance of quality student housing. The market's dynamic nature, coupled with technological advancements and evolving student preferences, suggests significant potential for innovation and investment in the coming years. This includes the development of sustainable and technologically advanced accommodation solutions catering to the specific needs of a diverse student body.

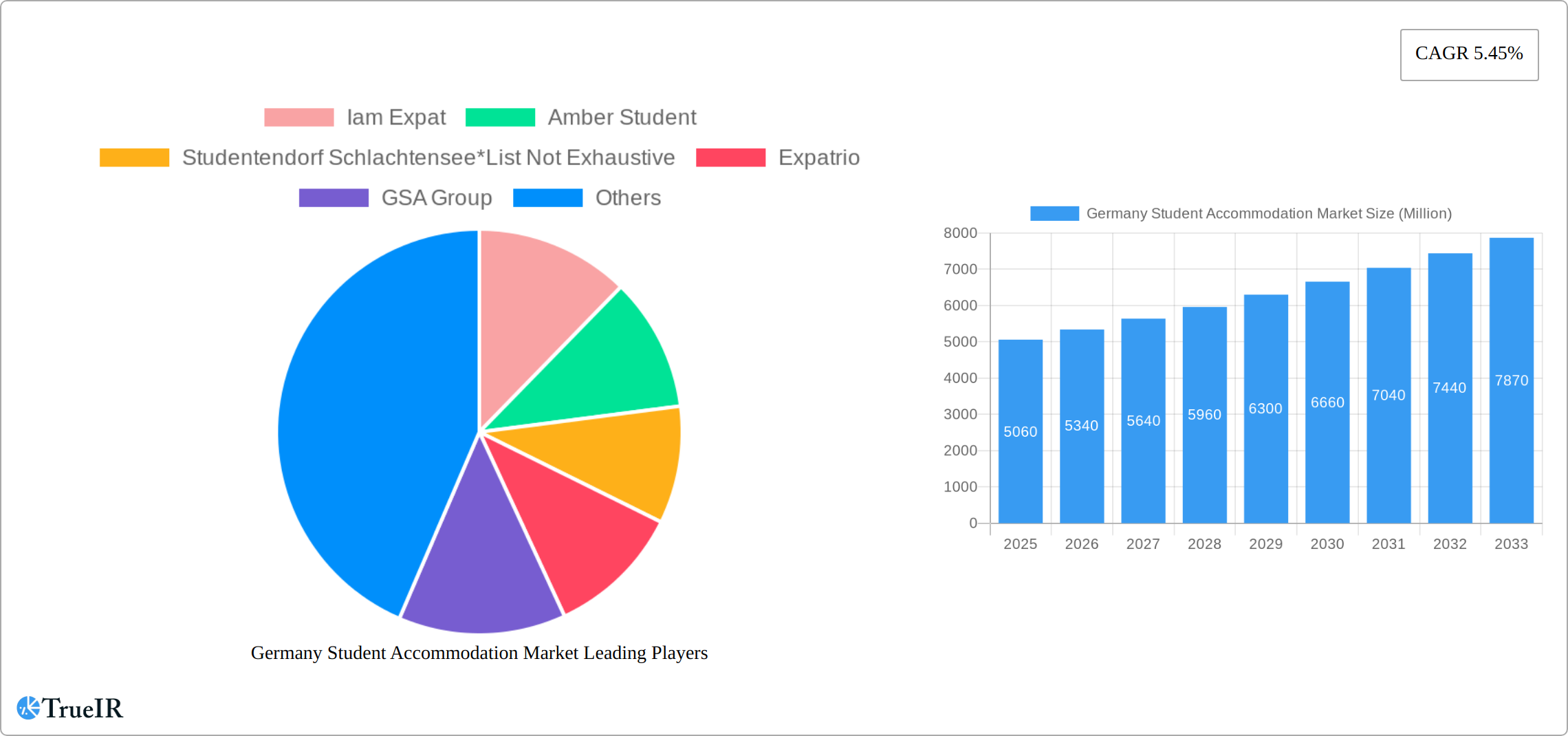

Germany Student Accommodation Market Company Market Share

Germany Student Accommodation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany student accommodation market, covering market structure, trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and forecast period of 2025-2033, this report is an essential resource for investors, stakeholders, and industry professionals seeking to understand this dynamic market. The report leverages data from the historical period (2019-2024) and estimated data for 2025 to provide a robust and reliable forecast. The market is segmented by price (economy, mid-range, luxury), rent type (basic rent, total rent), mode (online, offline), accommodation type (halls of residence, rented houses/rooms, private student accommodation), and location (city centre, periphery). Key players analyzed include Iam Expat, Amber Student, Studentendorf Schlachtensee, Expatrio, GSA Group, Unite Group, University Living, and Uni Acco. The report also delves into significant industry milestones, including major acquisitions and market developments, influencing the future growth trajectory.

Germany Student Accommodation Market Structure & Competitive Landscape

The German student accommodation market is characterized by a moderately fragmented competitive landscape. While a few large players like Unite Group and GSA Group exist, numerous smaller operators and private landlords also contribute significantly. The market concentration ratio (CR4) is estimated at xx%, indicating a competitive but not hyper-competitive environment. Innovation is driven by technological advancements in online booking platforms and property management systems. Regulatory frameworks, such as building codes and tenant protection laws, significantly influence market operations. Substitutes include shared apartments, co-living spaces, and homestays, posing challenges to traditional student accommodation providers. The end-user segmentation is primarily driven by student demographics, budget constraints, and preferred accommodation types.

- Market Concentration: Estimated CR4 at xx% (2025).

- Innovation Drivers: Online booking platforms, smart home technologies, sustainable building practices.

- Regulatory Impacts: Building codes, tenant rights, zoning regulations.

- Product Substitutes: Shared apartments, co-living spaces, homestays.

- End-User Segmentation: Students by university, year of study, budget, and accommodation preferences.

- M&A Trends: Recent activity indicates a rise in consolidation, with larger operators acquiring smaller portfolios. Total M&A volume in the past five years is estimated at xx Million USD.

Germany Student Accommodation Market Market Trends & Opportunities

The German student accommodation market is experiencing robust growth, driven by a confluence of factors. The market is projected to reach [Insert Updated Market Size in Million USD] by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). This significant expansion is fueled by several key drivers: a steadily increasing number of students enrolling in German higher education institutions; a rise in student disposable income, enabling them to invest more in quality accommodation; and the increasing preference for convenient, modern living spaces. Technological advancements, such as sophisticated online booking platforms and streamlined digital property management systems, are enhancing accessibility and convenience for both students and operators. This has led to a noticeable shift towards amenity-rich accommodation, with students demanding high-speed internet, communal study spaces, and on-site amenities like fitness centers and laundry facilities. The competitive landscape is intensifying, pushing operators to innovate and differentiate their offerings through value-added services and enhanced customer experiences. The market penetration rate of online booking platforms is estimated at [Insert Updated Percentage]% (2025), highlighting the considerable potential for further growth within the digital sphere. Furthermore, the growing emphasis on sustainability and eco-friendly practices presents a substantial opportunity for market players to attract environmentally conscious students and investors alike. This includes the incorporation of green building materials, energy-efficient technologies, and initiatives aimed at reducing carbon footprints.

Dominant Markets & Segments in Germany Student Accommodation Market

The city centers of major university towns like Munich, Berlin, and Cologne represent the most dominant segments in the German student accommodation market. The high demand for accommodation in these areas leads to premium pricing and high occupancy rates. However, the periphery also displays significant growth potential driven by improving infrastructure and affordability. Based on the various segmentations:

- By Price: Mid-range accommodation constitutes the largest segment due to the balance between affordability and quality.

- By Rent Type: Total rent, including utilities and other charges, is the most common type.

- By Mode: Online booking platforms are gaining traction, but offline channels remain important.

- By Accommodation Type: Rented houses or rooms are the most prevalent accommodation type, offering more flexibility and privacy compared to halls of residence.

- By Location: City centers experience higher demand and rental prices compared to the periphery.

Key Growth Drivers:

- Strong university enrollment: Germany has a large and growing student population.

- Improved infrastructure: Improved public transportation and amenities in suburban areas.

- Government policies: Initiatives supporting student housing development.

Germany Student Accommodation Market Product Analysis

The student accommodation market offers a diverse range of products, ranging from traditional halls of residence to modern, purpose-built student apartments. Technological advancements in building management systems, online booking platforms, and smart home integrations are improving the quality and convenience of student living. Products are differentiated based on amenities, location, price points, and levels of service offered. The market is witnessing a growing preference for purpose-built student accommodation (PBSA) that offers a range of services and enhanced facilities.

Key Drivers, Barriers & Challenges in Germany Student Accommodation Market

Key Drivers:

The German student accommodation market is driven by the rising student population, increased urbanization, and a growing preference for modern and well-equipped accommodation. Technological advancements in online platforms are streamlining the booking process, improving efficiency. Supportive government policies and investments in infrastructure also play a crucial role.

Challenges:

The market faces several challenges, including regulatory complexities in obtaining building permits and land acquisition. Supply chain disruptions, specifically in construction materials, impact project timelines and costs. Intense competition among providers also put pressure on pricing and profitability. These challenges can potentially restrict the market's growth trajectory.

Growth Drivers in the Germany Student Accommodation Market Market

Increased student enrolment, urbanisation trends, improved public transport links, and government initiatives supporting student housing development are key growth drivers. Technological innovations, such as online booking platforms, enhance convenience and efficiency. Increased disposable incomes among students also fuel demand for more comfortable and better-equipped accommodation.

Challenges Impacting Germany Student Accommodation Market Growth

Despite the positive outlook, several challenges impede the growth of the German student accommodation market. Regulatory hurdles, particularly in obtaining building permits and navigating complex zoning regulations, pose significant obstacles for new developments. Limited land availability in major university cities further constrains supply. Rising construction costs, exacerbated by inflation and supply chain disruptions, increase the financial burden on developers and operators. Intense competition amongst providers necessitates strategic investments in marketing and operational efficiency. Furthermore, fluctuating interest rates and potential economic downturns could influence investment decisions and affect market expansion. Addressing these challenges effectively will be crucial for sustained growth within the sector.

Key Players Shaping the Germany Student Accommodation Market Market

- Iam Expat

- Amber Student

- Studentendorf Schlachtensee

- Expatrio

- GSA Group

- Unite Group

- University living

- Uni Acco

- [Add other key players - consider including both large national and regional players]

Significant Germany Student Accommodation Market Industry Milestones

- January 2023: International Campus acquired five student apartment blocks in Berlin, Frankfurt am Main, Hanover, and Vienna, representing one of the largest transactions in the German-speaking region. This significantly strengthens their market position.

- November 2022: Catella Residential Investment Management GmbH (CRIM) sold two student housing assets in Poland for more than USD 65.38 Million, highlighting investor interest in the sector.

Future Outlook for Germany Student Accommodation Market Market

The German student accommodation market is projected to maintain its positive trajectory, driven by sustained growth in student enrollment, ongoing urbanization trends, and a persistent preference for modern, well-equipped living spaces. Strategic opportunities abound for providers who focus on sustainable development practices, incorporate cutting-edge technology, and prioritize exceptional customer service. The market is anticipated to witness further consolidation, with larger operators strategically acquiring smaller portfolios to enhance their market share and operational scale. Expansion into currently underserved markets and the development of innovative accommodation models, such as co-living spaces or purpose-built student accommodation (PBSA) complexes integrated with campus facilities, will further shape the evolving landscape of the German student housing market. The increasing demand for flexible lease terms and tailored accommodation packages catering to diverse student needs will also play a significant role in shaping the future of this dynamic sector.

Germany Student Accommodation Market Segmentation

-

1. Accomodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accommodation

-

2. location

- 2.1. City Center

- 2.2. Periphery

-

3. Price

- 3.1. Economy

- 3.2. Mid-range

- 3.3. Luxury

-

4. Rent Type

- 4.1. Basic Rent

- 4.2. Total Rent

-

5. Mode

- 5.1. Online

- 5.2. Offline

Germany Student Accommodation Market Segmentation By Geography

- 1. Germany

Germany Student Accommodation Market Regional Market Share

Geographic Coverage of Germany Student Accommodation Market

Germany Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Cost of Living In Germany Affecting Student Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accommodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Center

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Price

- 5.3.1. Economy

- 5.3.2. Mid-range

- 5.3.3. Luxury

- 5.4. Market Analysis, Insights and Forecast - by Rent Type

- 5.4.1. Basic Rent

- 5.4.2. Total Rent

- 5.5. Market Analysis, Insights and Forecast - by Mode

- 5.5.1. Online

- 5.5.2. Offline

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iam Expat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amber Student

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Studentendorf Schlachtensee*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expatrio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GSA Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unite Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 University living

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uni Acco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Iam Expat

List of Figures

- Figure 1: Germany Student Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 2: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 4: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 5: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 6: Germany Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 8: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 9: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 10: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 11: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 12: Germany Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Student Accommodation Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Germany Student Accommodation Market?

Key companies in the market include Iam Expat, Amber Student, Studentendorf Schlachtensee*List Not Exhaustive, Expatrio, GSA Group, Unite Group, University living, Uni Acco.

3. What are the main segments of the Germany Student Accommodation Market?

The market segments include Accomodation Type, location, Price, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Cost of Living In Germany Affecting Student Accommodation Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

January 2023: International Campus acquired five student apartment blocks from Allianz Real Estate and CBRE Investment Management. This acquisition was one of the largest transactions of an International Campus in German Speaking region. The properties are in Berlin, Frankfurt, am Main, Hanover, and Vienna.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Student Accommodation Market?

To stay informed about further developments, trends, and reports in the Germany Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence