Key Insights

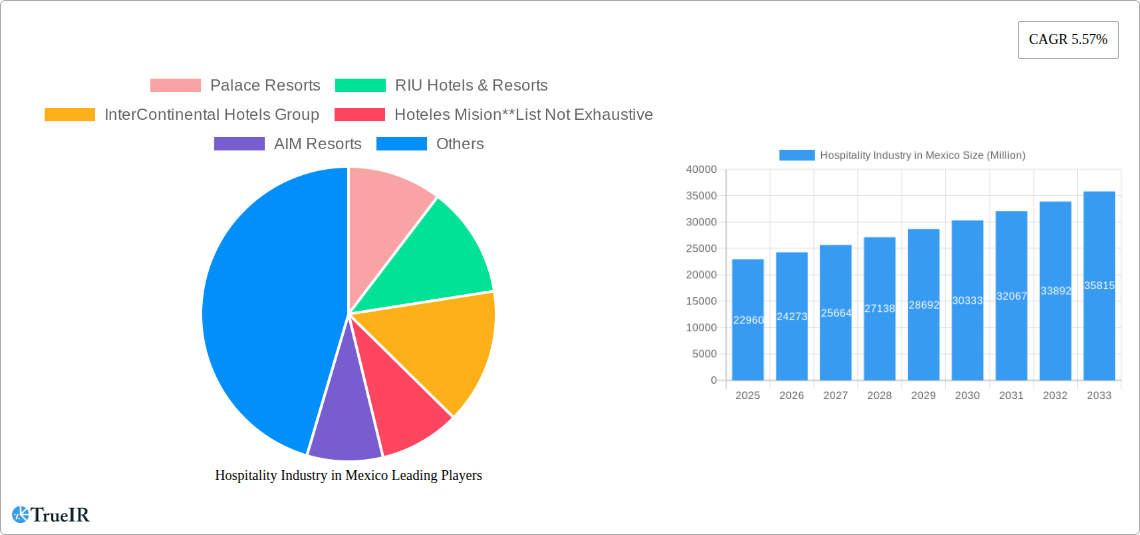

The Mexican hospitality industry, valued at $22.96 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.57% from 2025 to 2033. This growth is fueled by several key factors. Increased tourism, driven by Mexico's diverse attractions – from ancient ruins and vibrant culture to stunning beaches and eco-tourism opportunities – is a significant driver. Furthermore, rising disposable incomes among both domestic and international travelers are boosting demand for diverse accommodation options, from budget-friendly to luxury hotels and service apartments. Strategic investments in infrastructure, including improvements to airports and transportation networks, further enhance accessibility and contribute to the industry's expansion. The segmentation of the market into chain hotels, independent hotels, and various price points (budget/economy, mid-scale, luxury) caters to a broad spectrum of traveler preferences and budgets, maximizing market reach and revenue streams. Competition among established players like Palace Resorts, RIU Hotels & Resorts, Marriott International, and Grupo Posadas, alongside the emergence of innovative boutique hotels, ensures a dynamic and evolving landscape. However, challenges remain, including potential economic fluctuations, seasonality in tourism, and the need for sustainable tourism practices to ensure the long-term health of the industry and its environment.

Hospitality Industry in Mexico Market Size (In Billion)

The forecast for 2026-2033 anticipates continued growth, albeit potentially with some year-over-year variation reflecting global economic conditions and seasonal tourism patterns. The segment breakdown (chain vs. independent, and by price point) offers opportunities for targeted marketing and investment strategies. The success of individual players will depend on their ability to adapt to evolving consumer preferences, embrace technological advancements (e.g., online booking platforms, digital marketing), and prioritize sustainability initiatives. Mexico’s strategic location, rich cultural heritage, and burgeoning tourism sector suggest a positive outlook for the hospitality industry in the coming decade, despite the inherent challenges of a fluctuating global market.

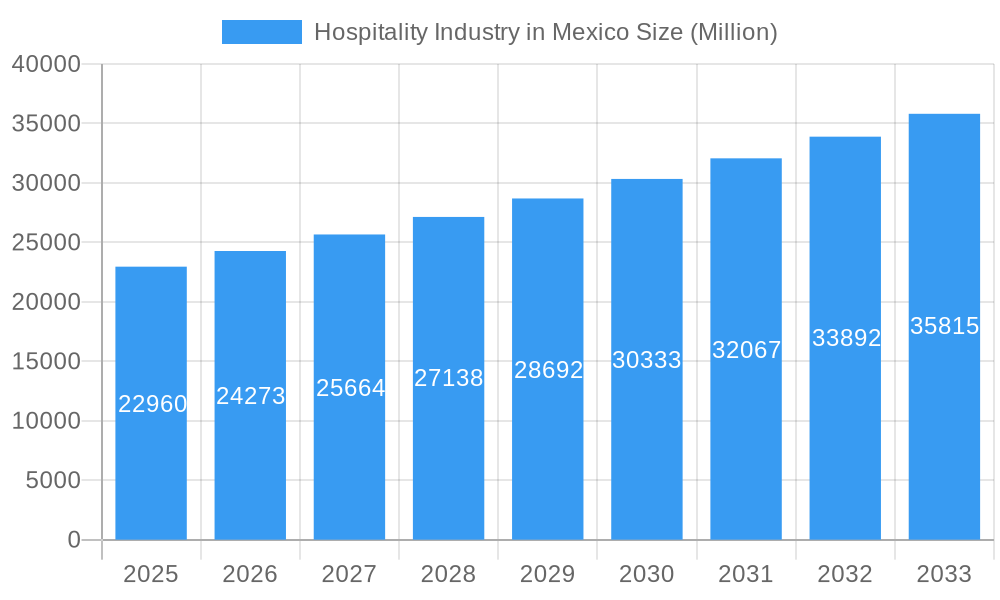

Hospitality Industry in Mexico Company Market Share

Mexico's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into Mexico's thriving hospitality sector, analyzing market trends, competitive landscapes, and future growth projections from 2019 to 2033. With a focus on key players like Palace Resorts, RIU Hotels & Resorts, InterContinental Hotels Group, and Marriott International, this report is an essential resource for investors, industry professionals, and anyone seeking to understand the opportunities and challenges within this vibrant market. The report leverages extensive data analysis and insightful commentary, providing a comprehensive overview of the Mexican hospitality landscape. The Base Year is 2025, and the Estimated and Forecast periods are 2025-2033. The Historical Period covered is 2019-2024. Market values are expressed in Millions.

Hospitality Industry in Mexico Market Structure & Competitive Landscape

Mexico's hospitality market exhibits a moderately concentrated structure, with a few large international chains and numerous smaller, independent hotels competing for market share. The Herfindahl-Hirschman Index (HHI) for the sector is estimated at xx in 2025, indicating a moderately concentrated market. Innovation drivers include technological advancements in booking platforms, personalized guest experiences, and sustainable practices. Regulatory impacts, such as environmental regulations and labor laws, influence operational costs and profitability. Product substitutes, such as vacation rentals and alternative accommodations, exert competitive pressure on traditional hotels. End-user segmentation is diverse, encompassing business travelers, leisure tourists, and event attendees. M&A activity in the Mexican hospitality market has shown a moderate increase in recent years, with an estimated xx Million USD in transaction volume in 2024.

- Market Concentration: Moderately concentrated, with a HHI of xx in 2025.

- Innovation Drivers: Technological advancements, personalized experiences, sustainability.

- Regulatory Impacts: Environmental regulations, labor laws.

- Product Substitutes: Vacation rentals, alternative accommodations.

- End-User Segmentation: Business travelers, leisure tourists, event attendees.

- M&A Trends: Moderate increase in recent years, with xx Million USD volume in 2024.

Hospitality Industry in Mexico Market Trends & Opportunities

The Mexican hospitality market is experiencing robust growth, driven by increasing tourism, rising disposable incomes, and infrastructure development. The market size is projected to reach xx Million USD in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts, such as the adoption of cloud-based booking systems and personalized services, are reshaping the industry. Consumer preferences are evolving towards unique experiences, sustainability, and value for money. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Market penetration rates for various hotel segments are expected to increase significantly in the coming years.

Dominant Markets & Segments in Hospitality Industry in Mexico

Mexico's hospitality sector is characterized by strong regional performance, with coastal destinations like Quintana Roo and Baja California Sur leading the charge due to their established tourism appeal. The Luxury Hotel segment is experiencing a notable surge, attracting discerning travelers with higher spending power.

-

By Type:

- Chain Hotels: These hotels continue to dominate the landscape, leveraging the power of established brands, consistent service standards, and significant economies of scale to attract a broad customer base.

- Independent Hotels: While smaller in overall market share, independent hotels play a crucial role in offering unique, culturally immersive experiences and catering to specialized niche markets, contributing to the sector's rich diversity.

-

By Segment:

- Luxury Hotels: This segment is witnessing the most dynamic growth, fueled by an influx of high-net-worth individuals, significant investment in high-end properties, and a growing demand for exclusive amenities and personalized services.

- Mid and Upper-Mid Scale Hotels: This remains the largest and most robust segment, catering to a wide spectrum of travelers seeking value, comfort, and essential amenities, from business travelers to families.

- Budget and Economy Hotels: Demonstrating significant potential for expansion, this segment is increasingly attractive to price-conscious travelers, digital nomads, and those seeking value-driven accommodation options.

- Service Apartments: Experiencing steady growth, serviced apartments are becoming increasingly popular for extended stays, offering the convenience of hotel services combined with the privacy and comfort of a residential setting.

-

Key Growth Drivers:

- Sustained Tourism Growth: Mexico's enduring popularity as a global tourist destination, driven by its rich cultural heritage, diverse natural landscapes, and vibrant culinary scene, continues to be the bedrock of demand.

- Enhanced Infrastructure Development: Ongoing investments in modernizing airports, improving transportation networks, and developing supporting infrastructure are making travel to and within Mexico more accessible and appealing.

- Proactive Government Policies: Strategic initiatives by the Mexican government focused on tourism promotion, investment incentives, and sustainable development are instrumental in fostering a favorable environment for the hospitality industry.

Hospitality Industry in Mexico Product Analysis

Product innovation in Mexico's hospitality sector is driven by technological advancements such as AI-powered chatbots, personalized mobile applications, and contactless check-in/checkout systems. These innovations aim to enhance guest experience, increase operational efficiency, and cater to evolving customer preferences. The market fit for these innovations is positive due to increasing consumer expectations for convenience and seamless experiences. Moreover, sustainable practices, like water conservation and waste reduction initiatives, are gaining traction as eco-conscious travelers become a larger segment.

Key Drivers, Barriers & Challenges in Hospitality Industry in Mexico

Key Drivers: The hospitality industry in Mexico is propelled by a combination of factors, including rapid technological integration in hotel operations and customer service, a sustained increase in international and domestic tourism, and rising disposable incomes among key demographics. Furthermore, government support through targeted tourism promotion campaigns and infrastructure development initiatives plays a vital role in market expansion.

Challenges: The sector faces potential headwinds such as supply chain volatility, which can impact the availability and cost of essential goods and services, and persistent labor shortages in certain regions, affecting operational efficiency. Navigating complex regulatory frameworks, including obtaining necessary permits and licenses, can also present hurdles. Intense competition, both from established domestic players and international brands, necessitates continuous innovation and service excellence. Moreover, the industry remains susceptible to the impact of economic downturns, which can directly affect discretionary spending on travel. These factors collectively could moderate the growth trajectory, potentially by an estimated xx% during periods of economic stress.

Growth Drivers in the Hospitality Industry in Mexico Market

The expansion of Mexico's hospitality sector is underpinned by a powerful synergy of growth factors. A significant surge in tourism, attributed to the country's unparalleled array of attractions, from ancient ruins to pristine beaches, coupled with a favorable exchange rate for international visitors, forms the primary engine of demand. Substantial investments in infrastructure, encompassing state-of-the-art airport expansions and improved road and rail connectivity, are crucial in facilitating increased visitor numbers. Supportive government policies designed to stimulate tourism, alongside a growing middle class with enhanced purchasing power, further amplify market potential. The adoption of advanced technologies in hotel management systems and guest experience platforms is also a key contributor, driving operational efficiencies and enhancing the overall attractiveness of Mexico as a destination.

Challenges Impacting Hospitality Industry in Mexico Growth

Several factors hinder growth in Mexico's hospitality sector. Fluctuations in the global economy can impact tourism spending, negatively affecting occupancy rates. Supply chain disruptions, particularly related to labor shortages and material costs, can affect operations and profitability. Intense competition among domestic and international hotel chains puts pressure on pricing and profitability. Complex regulatory environments can add administrative burdens and increase operational costs. These challenges, if not managed effectively, can reduce projected growth rates by an estimated xx% in adverse scenarios.

Key Players Shaping the Hospitality Industry in Mexico Market

- Palace Resorts

- RIU Hotels & Resorts

- InterContinental Hotels Group

- Hoteles Mision

- AIM Resorts

- Marriott International

- Grupo Posadas

- Cityexpress Hoteles

- Grupo Real Turismo

Significant Hospitality Industry in Mexico Industry Milestones

- November 2022: Marriott International significantly bolstered its luxury presence in Mexico through multi-brand, all-inclusive agreements with AB Living Group. This strategic expansion substantially increased the availability of high-end accommodations, invigorating market competition and raising service standards.

- September 2023: IHG Hotels & Resorts introduced a revamped digital booking platform, designed to optimize user experience and streamline the reservation process. This initiative aimed to enhance customer engagement, capture a larger market share, and improve operational efficiency through advanced technology.

Future Outlook for Hospitality Industry in Mexico Market

The future trajectory for Mexico's hospitality market appears exceptionally promising, fueled by the sustained momentum of tourism growth, continued investment in infrastructure modernization, and the pervasive integration of technological advancements. A strategic focus on embedding sustainable practices across operations and delivering highly personalized guest experiences will be paramount for future success. The market's inherent potential for expansion, particularly within the thriving luxury and the ever-popular budget segments, points towards a robust and positive outlook for the coming years. Nevertheless, navigating potential economic volatility, mitigating supply chain vulnerabilities, and adeptly managing evolving regulatory landscapes will remain critical imperatives for achieving sustained growth and ensuring long-term profitability.

Hospitality Industry in Mexico Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper mid scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Mexico Regional Market Share

Geographic Coverage of Hospitality Industry in Mexico

Hospitality Industry in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth In The Tourist Attractions Driving The Market; Increased Investments In hotels

- 3.2.2 Restaurants And Cafes Drives The Market

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences And Demands; Digital Skills Gap

- 3.4. Market Trends

- 3.4.1. Rising Number of Tourists In Mexico are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper mid scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper mid scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper mid scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper mid scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper mid scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper mid scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Palace Resorts

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RIU Hotels & Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 InterContinental Hotels Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hoteles Mision**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AIM Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marriott International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grupo Posadas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cityexpress Hoteles

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grupo Real Turismo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Palace Resorts

List of Figures

- Figure 1: Global Hospitality Industry in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Mexico Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Mexico Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Mexico Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Mexico Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Mexico Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Mexico Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Mexico Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Mexico Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Mexico Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Mexico Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Mexico Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Mexico Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Mexico Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Mexico Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Mexico Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Mexico Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Mexico Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Mexico Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Mexico Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Mexico Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Mexico Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Mexico Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Mexico?

The projected CAGR is approximately 5.57%.

2. Which companies are prominent players in the Hospitality Industry in Mexico?

Key companies in the market include Palace Resorts, RIU Hotels & Resorts, InterContinental Hotels Group, Hoteles Mision**List Not Exhaustive, AIM Resorts, Marriott International, Grupo Posadas, Cityexpress Hoteles, Grupo Real Turismo.

3. What are the main segments of the Hospitality Industry in Mexico?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth In The Tourist Attractions Driving The Market; Increased Investments In hotels. Restaurants And Cafes Drives The Market.

6. What are the notable trends driving market growth?

Rising Number of Tourists In Mexico are Driving the Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences And Demands; Digital Skills Gap.

8. Can you provide examples of recent developments in the market?

September 2023: IHG Hotels & Resorts, a prominent player in cloud-based solutions and a major player in the global hotel industry, unveiled an enhanced digital booking platform. Harnessing the capabilities of cloud technology, IHG is revolutionizing the hospitality landscape, offering guests a more streamlined, user-friendly, and expeditious booking process with added options for personalization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Mexico?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence