Key Insights

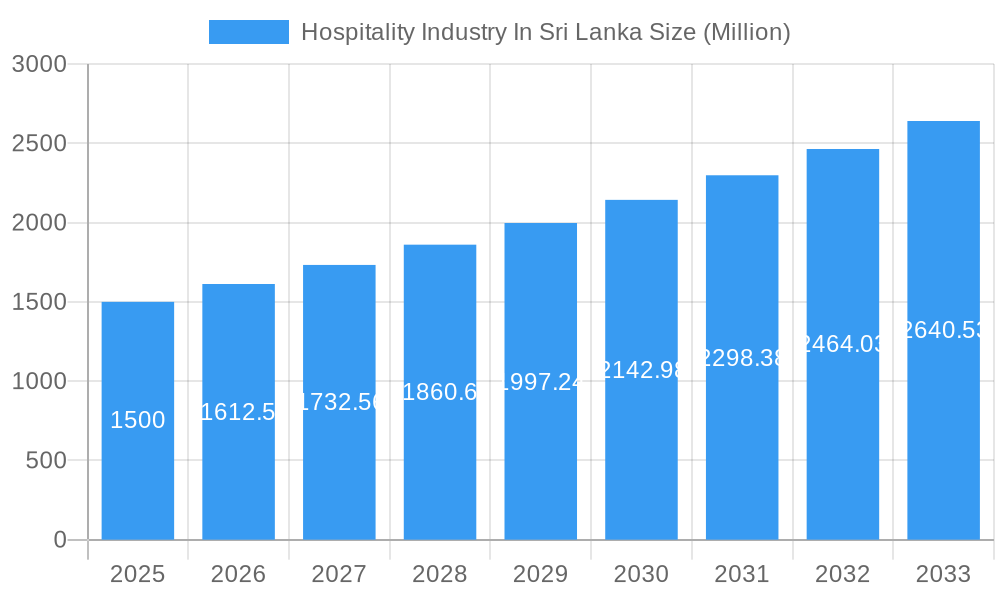

Sri Lanka's hospitality sector is poised for significant expansion, with an estimated market size of $503.2 million in 2025. The industry is projected to achieve a robust Compound Annual Growth Rate (CAGR) of 6.89% between 2025 and 2033. This growth is underpinned by increasing tourist arrivals, drawn by Sri Lanka's rich cultural heritage, natural beauty, and diverse attractions. Government efforts to enhance infrastructure and promote sustainable tourism further accelerate this positive trajectory. The market's diversification, offering a spectrum of accommodation from budget-friendly options to luxury resorts, effectively caters to a broad traveler base. A competitive landscape, featuring both international brands and local establishments, enhances guest choice and service quality. Key challenges include managing economic fluctuations and seasonal variations in visitor numbers. Strategic investments in infrastructure, talent development, and marketing focused on sustainability will be critical for sustained success.

Hospitality Industry In Sri Lanka Market Size (In Million)

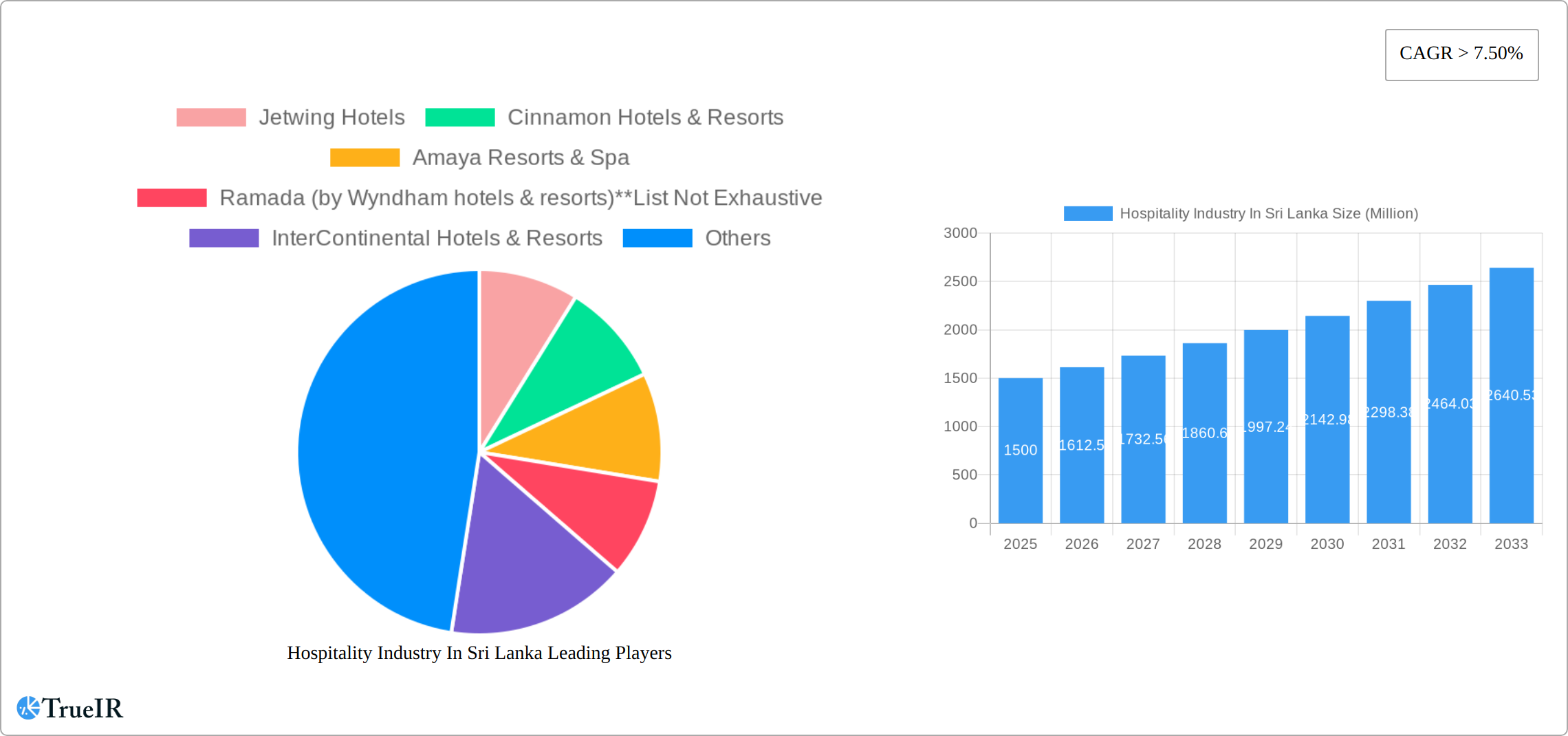

The Sri Lankan hospitality market segmentation highlights substantial opportunities. While established chains such as Jetwing, Cinnamon, Marriott, and Shangri-La lead in the luxury and mid-scale segments, the budget, economy, and serviced apartment categories present considerable growth potential. Independent hotels play a vital role in the industry's diversity, offering unique experiences and serving specific traveler needs. Future industry development hinges on addressing environmental sustainability, integrating technology for improved guest experiences, and capitalizing on emerging trends like wellness and adventure tourism. The sector's growth outlook is promising, provided consistent policy support and effective risk management.

Hospitality Industry In Sri Lanka Company Market Share

Sri Lanka Hospitality Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Sri Lanka hospitality industry, projecting market trends and opportunities from 2019 to 2033. With a focus on key players like Jetwing Hotels, Cinnamon Hotels & Resorts, and Marriott International Inc., this report offers invaluable insights for investors, businesses, and industry professionals. The study period covers 2019-2024 (historical period), with 2025 as the base year and a forecast period extending to 2033. The report leverages a wealth of data to present a clear picture of the market's structure, competitive landscape, and future potential, providing crucial information on market size and CAGR. Expect detailed analysis across segments including chain hotels, independent hotels, service apartments, and various hotel scales (budget, mid-scale, luxury). Millions (M) are used for all value references.

Hospitality Industry In Sri Lanka Market Structure & Competitive Landscape

Sri Lanka's hospitality market presents a moderately concentrated structure, with several large players commanding significant market share. While precise concentration ratios remain unavailable, the presence of international giants like Marriott International Inc. and Shangri-La Hotels and Resorts alongside established local brands such as Jetwing Hotels and Cinnamon Hotels & Resorts showcases a dynamic blend of established and emerging players. Innovation within the sector is fueled by the need to attract discerning travelers, with a strong emphasis on sustainable practices and the creation of unique, memorable experiences. Regulatory factors, including tourism policies and licensing stipulations, exert considerable influence on market dynamics. The substantial presence of numerous guesthouses and homestays acts as a significant substitute for formal hotels, particularly within the budget travel segment. The end-user base is highly diverse, encompassing both domestic and international tourists, ranging from budget-conscious travelers to luxury seekers. Mergers and acquisitions (M&A) activity has shown moderate levels in recent years, with a recorded xx M USD in deals during the historical period. Future M&A activity is projected to accelerate over the next decade, driven by anticipated growth within the hospitality market, reaching an estimated xx M USD during the forecast period.

- Key Market Characteristics: Moderately concentrated market, influenced by regulatory frameworks, significant substitution effects from alternative accommodations, and a diverse end-user base.

- Innovation Drivers: Emphasis on sustainable tourism practices, development of unique and immersive guest experiences, and the integration of technological advancements.

- Regulatory Impacts: Tourism policies, licensing procedures, environmental regulations, and other governmental initiatives significantly shape market operations.

- M&A Activity (2019-2024): xx M USD (Projected 2025-2033: xx M USD)

Hospitality Industry In Sri Lanka Market Trends & Opportunities

The Sri Lankan hospitality industry demonstrates substantial growth potential, driven by a rising tourism sector and increasing disposable incomes among the population. The market size in 2024 was estimated at xx M USD, with a projected Compound Annual Growth Rate (CAGR) of xx% anticipated during the 2025-2033 period. This positive growth trajectory is fueled by several key factors, including a notable increase in tourist arrivals, particularly from significant markets such as India and the Middle East. Technological advancements, such as the widespread adoption of online booking platforms and the implementation of smart hotel technologies, are significantly reshaping the sector. Furthermore, evolving consumer preferences are favoring personalized travel experiences and environmentally conscious accommodations, presenting lucrative opportunities for hotels adept at catering to these trends. Intense competition, particularly within the luxury hotel segment, necessitates the implementation of robust differentiation strategies to maintain a competitive edge. The market penetration rate for online booking platforms stood at approximately xx% in 2024 and is projected to reach xx% by 2033.

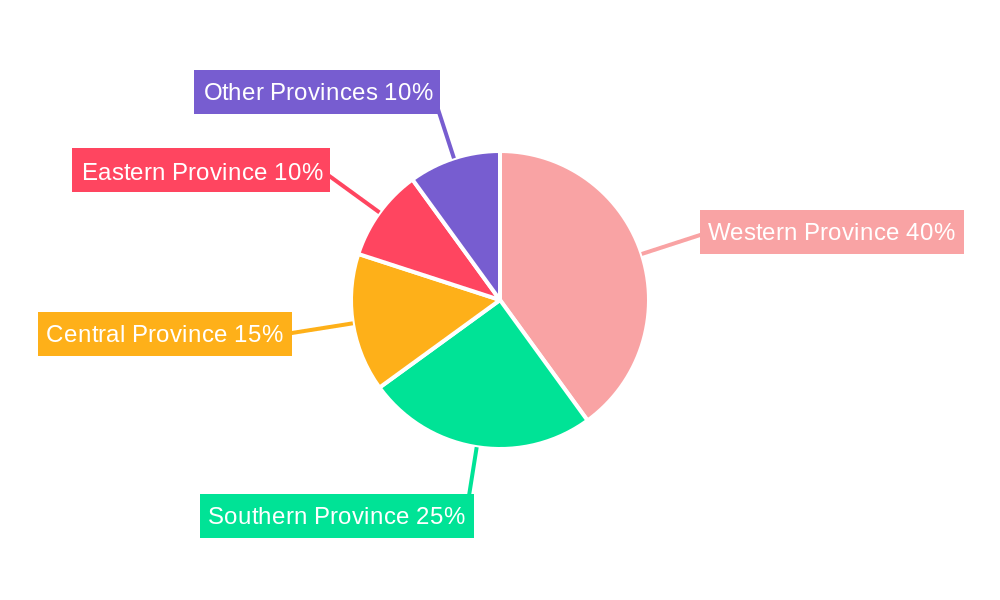

Dominant Markets & Segments in Hospitality Industry In Sri Lanka

Colombo and other coastal regions constitute the leading segments within Sri Lanka's hospitality market. The luxury hotel segment is experiencing robust growth, propelled by high-spending tourists seeking exclusive and upscale experiences. However, the budget and mid-scale segments also display strong growth, driven by the influx of budget-conscious and mid-range travelers. This diversified demand creates a balanced market dynamic.

Key Growth Drivers:

- Robust Tourism Growth: A significant increase in tourist arrivals from key source markets results in higher occupancy rates and increased revenue generation for hotels and related businesses.

- Infrastructure Development: Improvements in airport infrastructure and transportation networks enhance the accessibility of various destinations throughout the country, boosting tourism.

- Government Initiatives: Pro-tourism policies and strategic investments in infrastructure development enhance Sri Lanka's appeal as a compelling tourist destination, attracting both domestic and international visitors.

Market Dominance Analysis: The luxury hotel segment demonstrates rapid growth (xx% CAGR), driven by a rising number of affluent tourists and the escalating demand for premium hospitality services. Colombo maintains its position as the dominant market location due to its proximity to major attractions, the international airport, and key business centers. While independent hotels retain a significant market share, chain hotels are actively expanding their presence, resulting in a trend towards market consolidation.

Hospitality Industry In Sri Lanka Product Analysis

Recent innovations in the Sri Lankan hospitality market focus on eco-friendly practices, personalized guest experiences, and technology-driven services. Hotels are increasingly adopting digital technologies such as smart room controls, contactless check-in/check-out systems, and AI-powered concierge services. The competitive advantage lies in offering unique and immersive experiences that cater to specific segments, including wellness tourism, adventure tourism, and cultural tourism. The market shows a positive trend towards technological integration to enhance the guest experience and operational efficiency.

Key Drivers, Barriers & Challenges in Hospitality Industry In Sri Lanka

Key Drivers: The Sri Lankan hospitality industry is propelled by increasing tourist arrivals, government initiatives to boost tourism, and the growth of the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector. Technological advancements, improved infrastructure and strategic partnerships are contributing significantly to overall sector growth.

Challenges and Restraints: The industry faces challenges including seasonality, fluctuating currency rates, and the need for skilled labor. The impact of recent global events (e.g., the economic downturn and pandemic) resulted in a xx M USD loss in 2024, highlighting the vulnerability of the sector to external shocks. Supply chain disruptions impact operational efficiency and cost management, negatively affecting revenue.

Growth Drivers in the Hospitality Industry In Sri Lanka Market

The Sri Lankan hospitality industry's growth is propelled by several key factors: a surge in tourism, significant infrastructure development projects, robust government support for the tourism sector, and substantial investments in new hotels and resorts. The increasing focus on sustainable tourism practices and the rising popularity of Sri Lanka as a destination for wellness and adventure tourism further contribute to the market's expansion and positive outlook.

Challenges Impacting Hospitality Industry In Sri Lanka Growth

Key challenges include seasonality, economic volatility, skills gaps in the workforce, and environmental concerns. The industry is vulnerable to external shocks, requiring strategies for resilience. High operating costs and regulatory complexities further impact profitability.

Key Players Shaping the Hospitality Industry In Sri Lanka Market

- Jetwing Hotels

- Cinnamon Hotels & Resorts

- Amaya Resorts & Spa

- Ramada (by Wyndham hotels & resorts)

- InterContinental Hotels & Resorts

- Yoho Lanka (Pvt) Ltd

- Anatara Hotels Resorts & Spa

- Amari Galle

- Tangerine Group of Hotel

- Shangri-La Hotels and Resorts

- Mariott International Inc

Significant Hospitality Industry In Sri Lanka Industry Milestones

- April 2023: Cinnamon Hotels & Resorts made a notable debut at the Arabian Travel Market 2023, aiming to attract Middle Eastern and international travelers, expanding its reach into new markets.

- January 2023: The opening of the Courtyard by Marriott Colombo added a premium luxury hotel option to Colombo's hospitality landscape, catering to the growing demand for upscale accommodations.

- Add other significant milestones here with dates and brief descriptions. For example, any new hotel openings, major renovations, policy changes, awards won, etc.

Future Outlook for Hospitality Industry In Sri Lanka Market

The Sri Lankan hospitality industry is poised for continued growth, driven by sustained tourism growth, infrastructure improvements, and diversification into new tourism segments. Strategic investments in sustainable practices, technological integration, and workforce development will be key to unlocking the industry's full potential. The market is projected to reach xx M USD by 2033, creating opportunities for both established and emerging players.

Hospitality Industry In Sri Lanka Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper-mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Sri Lanka Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Sri Lanka Regional Market Share

Geographic Coverage of Hospitality Industry In Sri Lanka

Hospitality Industry In Sri Lanka REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments

- 3.3. Market Restrains

- 3.3.1. Sustainability and Competition Threaten Industry Success

- 3.4. Market Trends

- 3.4.1. Increase in the Number of SLTDA Registered Accommodation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper-mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper-mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper-mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper-mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper-mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper-mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jetwing Hotels

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cinnamon Hotels & Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amaya Resorts & Spa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramada (by Wyndham hotels & resorts)**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 InterContinental Hotels & Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yoho Lanka (Pvt) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anatara Hotels Resorts & Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amari Galle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tangerine Group of Hotel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shangri-La Hotels and Resorts

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mariott International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Jetwing Hotels

List of Figures

- Figure 1: Global Hospitality Industry In Sri Lanka Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Sri Lanka?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Hospitality Industry In Sri Lanka?

Key companies in the market include Jetwing Hotels, Cinnamon Hotels & Resorts, Amaya Resorts & Spa, Ramada (by Wyndham hotels & resorts)**List Not Exhaustive, InterContinental Hotels & Resorts, Yoho Lanka (Pvt) Ltd, Anatara Hotels Resorts & Spa, Amari Galle, Tangerine Group of Hotel, Shangri-La Hotels and Resorts, Mariott International Inc.

3. What are the main segments of the Hospitality Industry In Sri Lanka?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 503.2 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments.

6. What are the notable trends driving market growth?

Increase in the Number of SLTDA Registered Accommodation is Driving the Market.

7. Are there any restraints impacting market growth?

Sustainability and Competition Threaten Industry Success.

8. Can you provide examples of recent developments in the market?

Apr 2023: Hailing from the idyllic shores and boundless horizon of the Indian Ocean, Cinnamon Hotels & Resorts is set to offer Middle Eastern and international travelers the best of Sri Lanka as they debut at Arabian Travel Market 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Sri Lanka," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Sri Lanka report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Sri Lanka?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Sri Lanka, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence