Key Insights

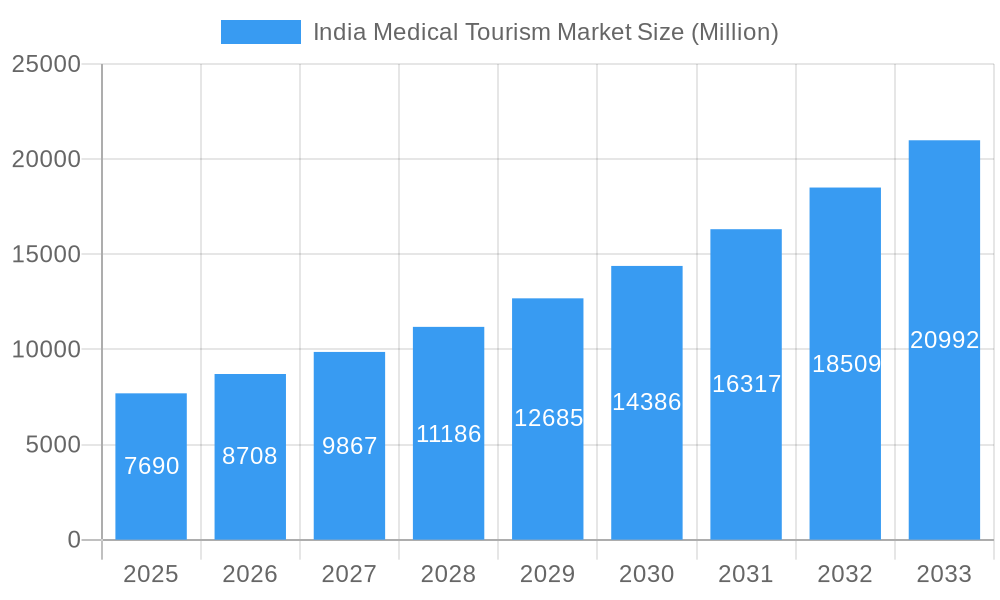

The India medical tourism market, valued at $7.69 billion in 2025, is projected to experience robust growth, driven by several key factors. A significant driver is the increasing affordability of high-quality medical care in India compared to developed nations. This is coupled with advancements in medical technology and infrastructure, particularly in specialized areas like cardiac surgery, orthopedics, and oncology. Furthermore, the rising prevalence of chronic diseases globally fuels demand for cost-effective treatment options, making India an attractive destination. The government's initiatives to promote medical tourism, including streamlined visa processes and improved healthcare infrastructure, further enhance market appeal. While language barriers and concerns about healthcare quality might pose some challenges, the overall positive perception of Indian medical expertise and the country's rich cultural heritage contribute significantly to the market's growth trajectory. The market is segmented by treatment type (dental, cosmetic, cardiovascular, orthopedic, neurological, cancer, fertility, and others) and service provider (public and private). The private sector dominates, fueled by investments in advanced facilities and specialized services. Regional variations exist, with states like Kerala and Karnataka establishing themselves as prominent medical tourism hubs. The consistent Compound Annual Growth Rate (CAGR) of 13.23% projects a substantial expansion of the market to approximately $26.6 billion by 2033, solidifying India’s position as a leading global medical tourism destination.

India Medical Tourism Market Market Size (In Billion)

The projected growth is fueled by both domestic and international patients seeking affordable and high-quality medical care. The diverse range of treatments available caters to a broad spectrum of medical needs, further boosting market attractiveness. However, maintaining consistent quality standards across all healthcare providers and addressing infrastructural limitations in certain regions remain crucial for sustained growth. Effective marketing strategies, focused on building trust and transparency, are essential to capitalize on the growing global demand for medical tourism services. The competitive landscape features established players like Apollo Hospitals alongside emerging clinics and agencies facilitating medical travel. Continued investment in training medical professionals, enhancing digital infrastructure, and improving patient experience will significantly shape the future trajectory of this burgeoning market.

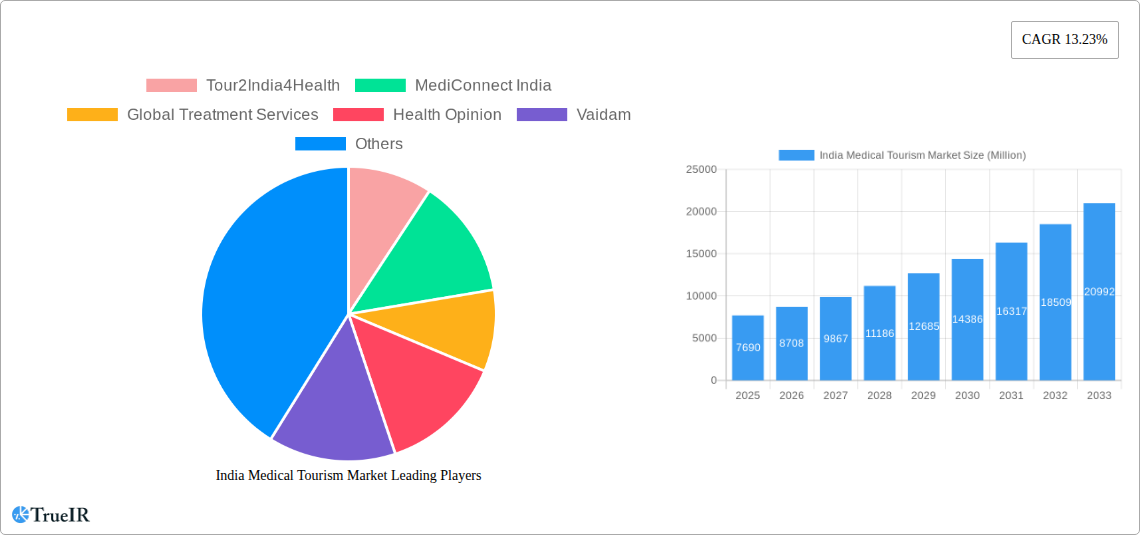

India Medical Tourism Market Company Market Share

India Medical Tourism Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the India Medical Tourism Market, offering invaluable insights for investors, healthcare providers, and industry stakeholders. With a comprehensive study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report leverages extensive data and expert analysis to illuminate market trends, opportunities, and challenges. The report delves into market segmentation (By Treatment Type and By Service Provider), competitive landscape, key players, and future growth projections, providing a holistic understanding of this rapidly evolving sector. Projected market values are in Millions (USD).

India Medical Tourism Market Structure & Competitive Landscape

The Indian medical tourism market exhibits a moderately concentrated structure, with a few large players like Apollo Hospitals and several smaller, specialized providers vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a mix of established players and emerging businesses. Innovation, particularly in areas like AI-powered healthcare solutions and telemedicine, is a key driver of growth. Regulatory changes, including those related to medical licensing and data privacy, significantly impact market dynamics. Product substitutes, such as treatments offered in developed nations, present competitive pressure, while the increasing demand for specialized treatments contributes to market expansion. End-user segmentation, primarily driven by international patients seeking affordable yet high-quality care, is a defining characteristic. The M&A activity in the sector, as evidenced by the Apollo Hospitals acquisition in 2022 (USD 6.075 Million), underscores consolidation and the pursuit of economies of scale. The volume of M&A transactions in the period 2019-2024 is estimated at xx deals, with an average transaction value of xx Million USD. This dynamic interplay of factors shapes the competitive landscape and drives market evolution.

India Medical Tourism Market Market Trends & Opportunities

The India Medical Tourism Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing affordability of medical treatments in India compared to developed countries attracts a significant number of medical tourists. Technological advancements, particularly in minimally invasive surgeries and advanced diagnostic techniques, are enhancing the quality of care and attracting more patients. A growing preference among international patients for culturally sensitive healthcare services also contributes to the market's expansion. The competitive landscape remains dynamic, with established players consolidating their positions while new entrants innovate to capture market share. Market penetration rates are expected to reach xx% by 2033, reflecting the increasing awareness and accessibility of medical tourism services. The rising prevalence of chronic diseases globally further fuels demand for specialized treatments in India, expanding market opportunities. Furthermore, improvements in medical infrastructure and regulatory reforms further accelerate market growth, creating numerous opportunities for new players and established ones alike.

Dominant Markets & Segments in India Medical Tourism Market

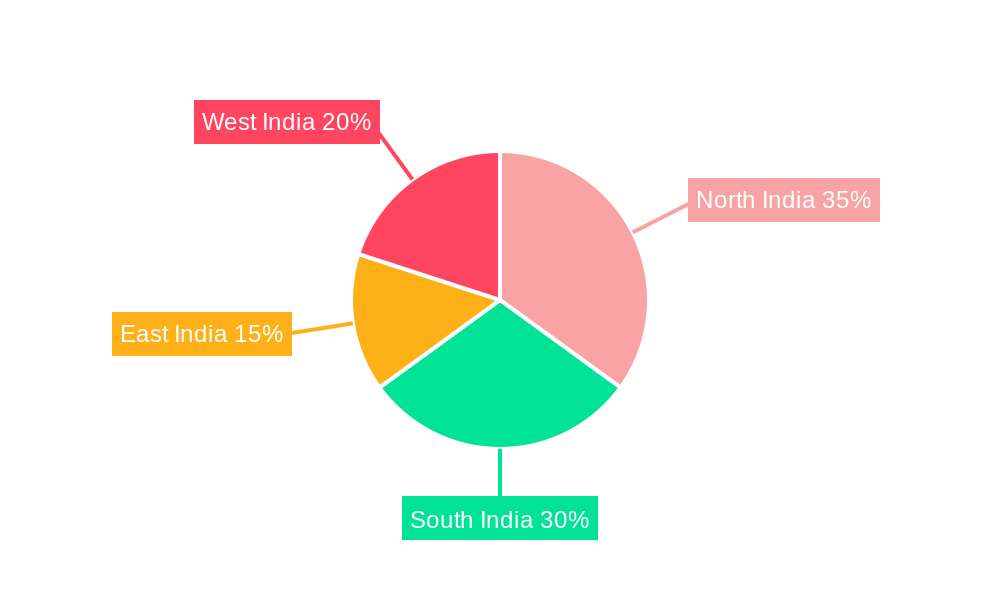

- Leading Regions/States: The states of Maharashtra, Kerala, Karnataka, and Tamil Nadu are currently the most dominant markets within India, largely due to established medical infrastructure and specialized healthcare facilities.

- Leading Treatment Types: Dental treatment, cosmetic treatment, and cardiovascular treatment currently represent the largest segments within the Indian medical tourism market, driven by high demand and comparatively lower costs than in many Western countries.

- Leading Service Provider Type: The private sector is significantly larger than the public sector in India's medical tourism market, due to superior infrastructure, advanced technology, and a more patient-focused approach.

Key Growth Drivers:

- Advanced Medical Infrastructure: Significant investments in hospitals, diagnostic centers, and technology are upgrading the quality of healthcare services available.

- Favorable Government Policies: Supportive government policies and initiatives promote medical tourism in the country.

- Cost-Effectiveness: Treatments in India are significantly more affordable compared to many other countries, offering considerable savings for medical tourists.

The dominance of these segments is underpinned by factors like established expertise in these fields, readily available specialized professionals, and competitive pricing. However, other segments, such as orthopedic, neurological, cancer, and fertility treatments, are experiencing strong growth due to rising prevalence and advancements in medical technology. The market will continue to grow across all categories, driven by the previously mentioned drivers.

India Medical Tourism Market Product Analysis

Technological advancements significantly influence the Indian medical tourism market. Innovations in robotic surgery, minimally invasive procedures, and advanced imaging techniques attract patients seeking high-quality, less-invasive treatments. These advancements enhance treatment outcomes, reduce recovery times, and improve patient satisfaction, reinforcing the market's competitive advantage. The integration of AI and telemedicine further enhances efficiency and accessibility, broadening the reach of medical tourism services. These factors contribute to the market's sustained growth.

Key Drivers, Barriers & Challenges in India Medical Tourism Market

Key Drivers:

- Cost Advantage: Significantly lower treatment costs compared to developed nations.

- Technological Advancements: Adoption of advanced medical technologies and techniques.

- Improved Infrastructure: Investments in hospitals and healthcare facilities.

Challenges & Restraints:

- Regulatory Hurdles: Navigating complex regulations and licensing requirements can be challenging.

- Supply Chain Issues: Ensuring a consistent and reliable supply of medical equipment and resources.

- Competitive Pressures: Competition from other medical tourism destinations and domestic providers. The estimated impact of these challenges on market growth is a reduction of xx% in the projected CAGR.

Growth Drivers in the India Medical Tourism Market Market

The Indian medical tourism market benefits from several strong growth drivers: Lower treatment costs compared to Western countries are a major attraction for medical tourists. Advances in medical technology and infrastructure continue to improve the quality of care. Government initiatives to promote medical tourism further enhance its appeal. These factors are expected to fuel sustained and significant market growth in the coming years.

Challenges Impacting India Medical Tourism Market Growth

The market faces several challenges that could impact its growth. Regulatory complexities and bureaucratic hurdles can impede smooth operations. Supply chain vulnerabilities, particularly regarding the availability of advanced medical equipment, can affect service delivery. Intense competition from other global medical tourism destinations and domestic providers necessitates constant innovation and improvement.

Key Players Shaping the India Medical Tourism Market Market

- Tour2India4Health

- MediConnect India

- Global Treatment Services

- Health Opinion

- Vaidam

- ANAVARA

- Apollo Hospital

- Clinicspots

- Mediniq

- Forerunners Healthcare

Significant India Medical Tourism Market Industry Milestones

- August 2022: Apollo Hospitals Enterprise acquired a hospital asset in Gurugram for USD 6.075 Million, consolidating its market position.

- January 2023: Alpine Health Systems launched an AI-powered solution to streamline hospital discharges, improving efficiency and patient care. This reflects the increasing adoption of technology within the industry.

Future Outlook for India Medical Tourism Market Market

The future of the Indian medical tourism market is bright. Continued technological advancements, infrastructure improvements, and supportive government policies will drive significant growth. Strategic partnerships between healthcare providers and medical tourism facilitators will enhance service offerings and attract a broader range of patients. The market is poised for expansion, with significant potential for both established players and new entrants. The focus on quality, affordability, and technological innovation will be key to success in this dynamic market.

India Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Others

-

2. Service Provider

- 2.1. Public

- 2.2. Private

India Medical Tourism Market Segmentation By Geography

- 1. India

India Medical Tourism Market Regional Market Share

Geographic Coverage of India Medical Tourism Market

India Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Medical Tourists in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tour2India4Health

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MediConnect India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Treatment Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Health Opinion

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vaidam

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANAVARA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apollo Hospital**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clinicspots

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediniq

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Forerunners Healthcare

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tour2India4Health

List of Figures

- Figure 1: India Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: India Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: India Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Medical Tourism Market?

The projected CAGR is approximately 13.23%.

2. Which companies are prominent players in the India Medical Tourism Market?

Key companies in the market include Tour2India4Health, MediConnect India, Global Treatment Services, Health Opinion, Vaidam, ANAVARA, Apollo Hospital**List Not Exhaustive, Clinicspots, Mediniq, Forerunners Healthcare.

3. What are the main segments of the India Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Increase in the Number of Medical Tourists in India is Driving the Market.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

January 2023: Alpine Health Systems launched a new AI-powered solution to streamline complex hospital discharge with OSF HealthCare and High Alpha Innovation support. The platform allows case managers to quickly identify at-risk patients and safely transition to an appropriate care site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Medical Tourism Market?

To stay informed about further developments, trends, and reports in the India Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence