Key Insights

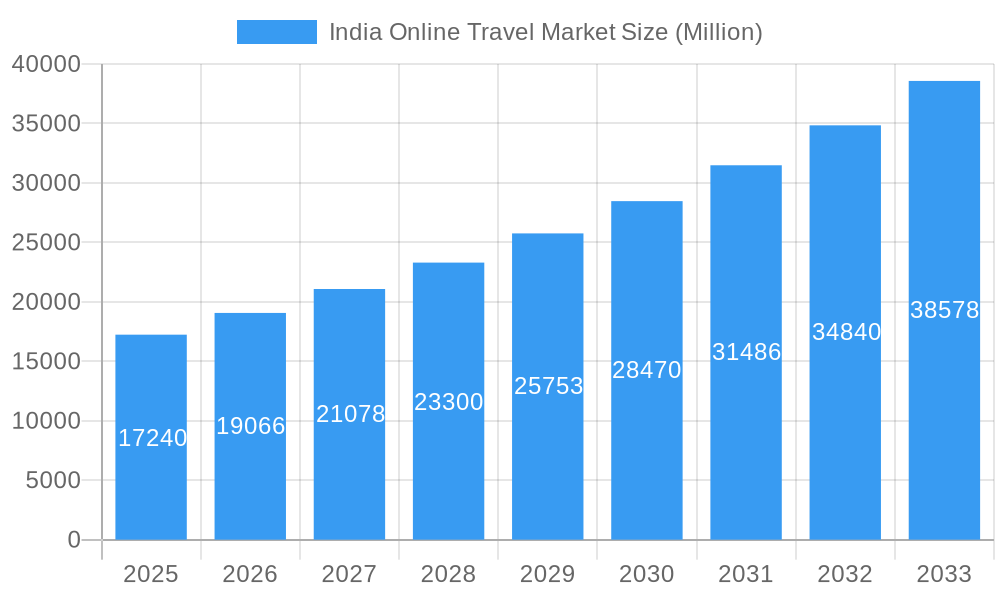

The India online travel market, valued at ₹17.24 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This surge is driven by several key factors. Rising disposable incomes, increased internet and smartphone penetration, particularly among younger demographics, are fueling a significant increase in online travel bookings. A preference for convenience and the ability to compare prices across various platforms are also major contributors. The market is segmented by service type (transportation, accommodation, packages, others), booking type (OTAs, direct suppliers), platform (desktop, mobile), and tour type (independent, group, package). The competitive landscape is dynamic, with established players like MakeMyTrip, Cleartrip, Yatra, and Booking.com vying for market share alongside emerging players and niche service providers. The growth of budget airlines and the increasing popularity of domestic tourism are also significant tailwinds. While challenges such as concerns over data security and occasional price volatility exist, the overall outlook for the India online travel market remains extremely positive, promising substantial growth opportunities for stakeholders in the coming years.

India Online Travel Market Market Size (In Billion)

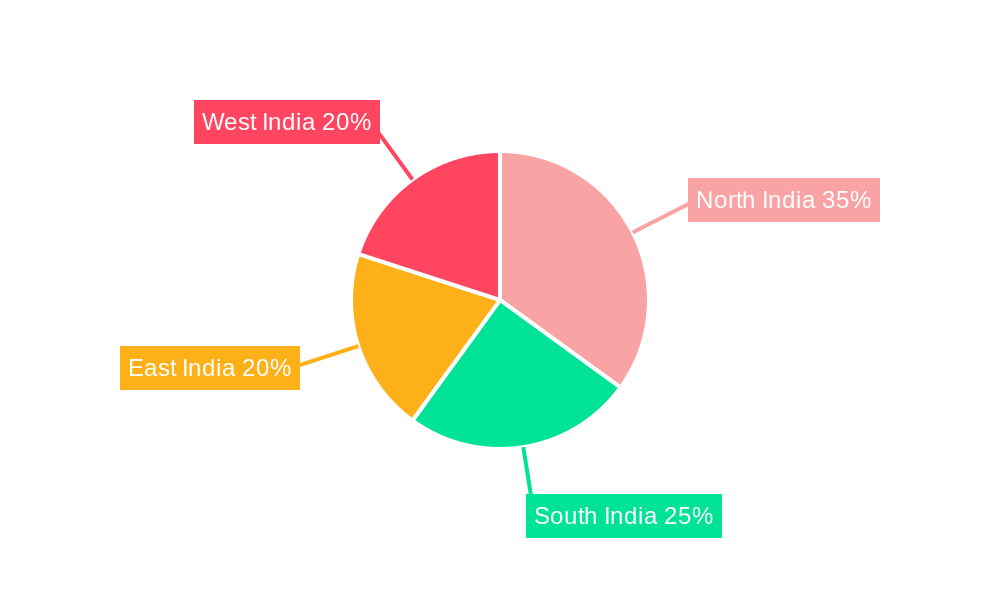

The regional breakdown reveals significant market potential across all regions of India (North, South, East, and West). However, the higher population density and economic activity in North and West India likely contribute to a larger market share in these regions. The increasing adoption of mobile booking platforms signifies a crucial shift in consumer behavior, indicating that mobile optimization is paramount for success. The segment of package travellers is expected to experience above average growth fueled by the convenience and cost-effectiveness of pre-booked itineraries. Continuous innovation in travel technology, personalized travel experiences, and strategic partnerships will be key to maintaining a competitive edge in this rapidly evolving market. Furthermore, focusing on enhancing user experience and addressing security concerns will be crucial for sustained growth.

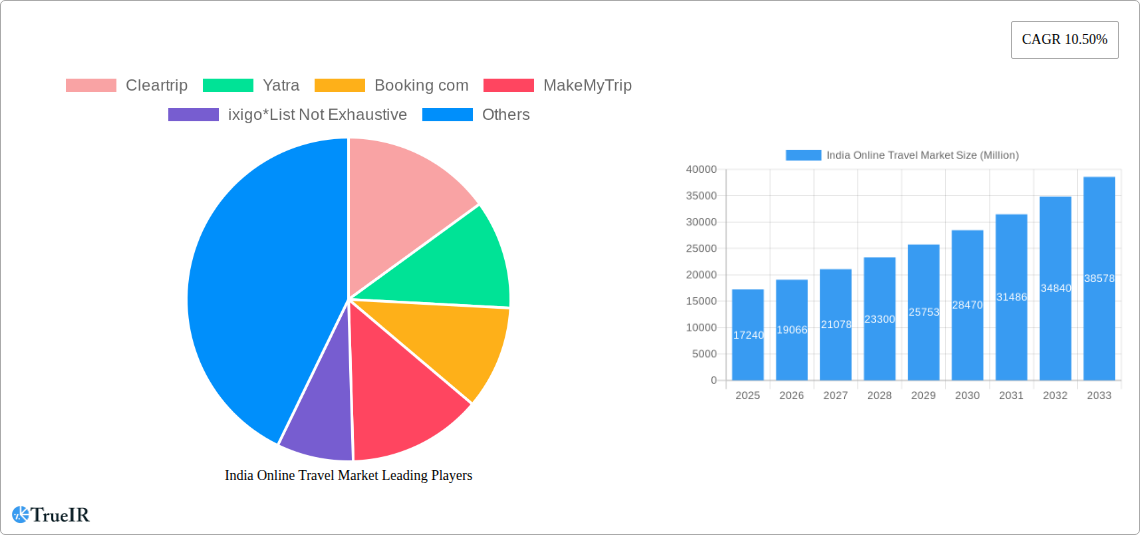

India Online Travel Market Company Market Share

India Online Travel Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning India online travel market, projecting robust growth from 2025 to 2033. Leveraging extensive market research and incorporating recent industry developments, this report is an indispensable resource for investors, businesses, and stakeholders seeking a comprehensive understanding of this rapidly evolving sector. We delve into market size, segmentation, competitive dynamics, key players, and future growth projections, offering invaluable insights for strategic decision-making. The report covers the period 2019-2033, with 2025 as the base and estimated year.

India Online Travel Market Structure & Competitive Landscape

The Indian online travel market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller agencies. MakeMyTrip, Cleartrip, and Yatra are among the key established players, while newer entrants like ixigo and EaseMyTrip are actively competing for market share. The market concentration ratio (CR4) is estimated at xx% in 2025. Innovation is a crucial driver, with companies constantly introducing new features and technologies to enhance user experience and broaden service offerings. Regulatory changes, including those related to data privacy and consumer protection, significantly impact market operations. The emergence of alternative booking platforms and evolving consumer preferences present challenges to established players. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx M&A deals recorded between 2019 and 2024, primarily focused on consolidation and expansion within specific segments.

- Market Concentration: Moderately concentrated, with a CR4 of xx% in 2025.

- Innovation Drivers: Technological advancements (AI, mobile-first solutions), personalized travel experiences.

- Regulatory Impacts: Data privacy regulations, consumer protection laws.

- Product Substitutes: Direct bookings with hotels and airlines, offline travel agencies.

- End-User Segmentation: Independent travelers, tour groups, package travelers, business travelers.

- M&A Trends: Consolidation within the OTA sector, expansion into new market segments.

India Online Travel Market Market Trends & Opportunities

The Indian online travel market is experiencing significant growth, driven by rising disposable incomes, increasing internet and smartphone penetration, and a burgeoning middle class with a penchant for travel. The market size is projected to reach xx Million USD in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements like AI-powered personalized recommendations and seamless mobile booking experiences. Consumer preferences are shifting towards customized itineraries, sustainable travel options, and value-for-money packages. Intense competition among players necessitates strategic innovations and targeted marketing efforts to capture market share. Market penetration rates are still relatively low, signifying vast untapped potential for expansion across diverse demographics and geographic regions.

Dominant Markets & Segments in India Online Travel Market

The online travel market in India is experiencing robust growth across all segments. However, certain segments exhibit particularly strong performance.

Service Type: Transportation (air and rail tickets) currently holds the largest market share, followed by Travel Accommodation. Growth in Vacation Packages and Other Service Types (e.g., activities, insurance) is expected to accelerate in the coming years.

Booking Type: Online Travel Agencies (OTAs) dominate the market, although Direct Travel Suppliers are seeing increasing traction.

Platform: Mobile bookings are rapidly surpassing desktop bookings, reflecting the widespread adoption of smartphones in India.

Tour Type: Independent travelers constitute a significant portion of the market, although the demand for packaged tours and group travel is also on the rise.

Key Growth Drivers:

- Rising Disposable Incomes: A growing middle class fuels demand for travel.

- Improved Infrastructure: Better connectivity and transportation networks facilitate travel.

- Government Initiatives: Tourism promotion schemes and infrastructure development programs.

India Online Travel Market Product Analysis

The online travel industry is characterized by continuous product innovation, focusing on enhanced user experience, personalized travel planning tools, and seamless mobile booking. OTAs are incorporating AI-powered recommendations, virtual reality tours, and advanced search filters to cater to diverse user preferences. These innovations contribute to improved customer engagement and higher conversion rates, strengthening competitive advantages in a dynamic market.

Key Drivers, Barriers & Challenges in India Online Travel Market

Key Drivers:

- Rising disposable incomes and increasing middle class.

- Growing internet and smartphone penetration.

- Government initiatives promoting tourism.

- Technological advancements enhancing user experience.

Key Challenges:

- Intense competition among numerous players.

- Cybersecurity concerns and data privacy issues.

- Fluctuations in fuel prices and currency exchange rates.

- Regulatory uncertainties and complexities.

Growth Drivers in the India Online Travel Market Market

The Indian online travel market is propelled by several key factors: a burgeoning middle class with increased disposable income, exponential growth in internet and smartphone usage, government initiatives promoting tourism, and constant technological innovations delivering more personalized and convenient travel experiences. These factors collectively contribute to a significant and sustained expansion of the market.

Challenges Impacting India Online Travel Market Growth

Despite its growth trajectory, the Indian online travel market faces hurdles like intense competition, potential cybersecurity risks, fluctuating fuel prices impacting airfare costs, and complexities in navigating India's regulatory environment. These challenges necessitate strategic planning and adaptation for sustained success within this competitive landscape.

Key Players Shaping the India Online Travel Market Market

- Cleartrip

- Yatra

- Booking.com

- MakeMyTrip

- ixigo

- EaseMyTrip

- Thomas Cook Ltd

- Oyo Rooms

- Expedia

- Cox & Kings Ltd

- Via.com

Significant India Online Travel Market Industry Milestones

August 2023: Skyscanner launched its Hindi language experience across all its products and services, expanding its reach in the Indian market. This move is expected to significantly improve user engagement and market penetration for Skyscanner.

August 2023: MakeMyTrip, in collaboration with the Ministry of Tourism, launched a "Travellers' Map of India," highlighting over 600 lesser-known destinations. This initiative aims to boost domestic tourism and promote lesser-visited regions within India.

Future Outlook for India Online Travel Market Market

The Indian online travel market is poised for continued strong growth, driven by favorable demographics, technological advancements, and supportive government policies. Strategic investments in technological infrastructure, personalized services, and targeted marketing will be crucial for companies seeking to capitalize on the vast untapped market potential. The focus on sustainable and responsible tourism practices will also shape the industry's future trajectory, leading to innovations in eco-friendly travel options and experiences.

India Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

-

4. Tour Type

- 4.1. Tour Group

- 4.2. Package Traveller

India Online Travel Market Segmentation By Geography

- 1. India

India Online Travel Market Regional Market Share

Geographic Coverage of India Online Travel Market

India Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Winter Sports and Outdoor Recreation

- 3.3. Market Restrains

- 3.3.1. Unpredictable Weather Conditions

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Tour Type

- 5.4.1. Tour Group

- 5.4.2. Package Traveller

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yatra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MakeMyTrip

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ixigo*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EaseMyTrip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oyo Rooms

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expedia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cox & Kings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Via com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 5: India Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 10: India Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Online Travel Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the India Online Travel Market?

Key companies in the market include Cleartrip, Yatra, Booking com, MakeMyTrip, ixigo*List Not Exhaustive, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, Via com.

3. What are the main segments of the India Online Travel Market?

The market segments include Service Type, Booking Type, Platform, Tour Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Winter Sports and Outdoor Recreation.

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in India is Driving the Market.

7. Are there any restraints impacting market growth?

Unpredictable Weather Conditions.

8. Can you provide examples of recent developments in the market?

August 2023: Skyscanner launched its Hindi language experience across all its products and services to penetrate deeper into the Indian market. Skyscanner acts as a one-stop solution for travelers looking to compare ticket fares, hotel tariffs, and intra-city commutes by curating data from its partner Online Travel Agent (OTA) sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Online Travel Market?

To stay informed about further developments, trends, and reports in the India Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence