Key Insights

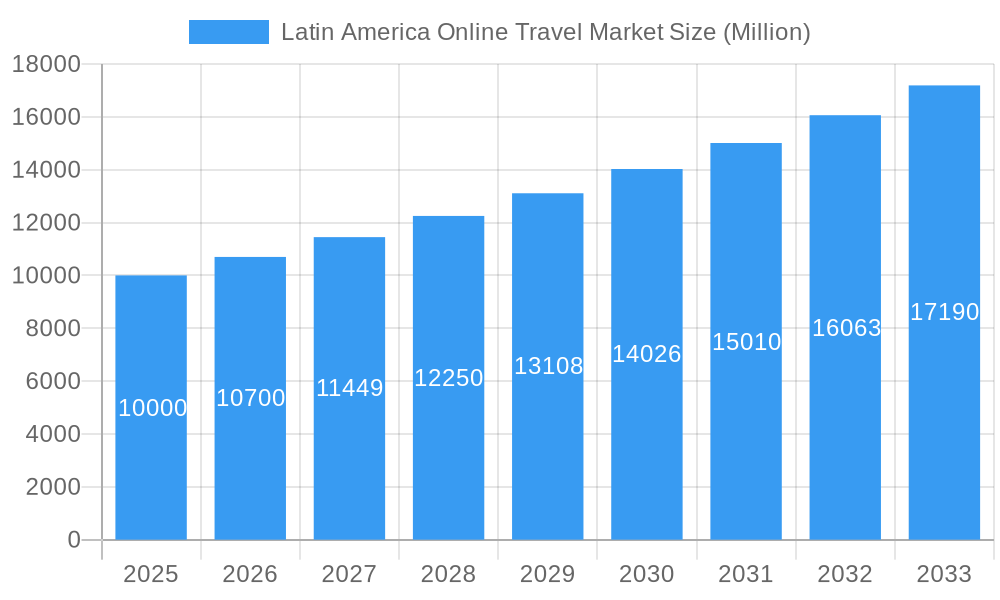

The Latin American online travel market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing internet and smartphone penetration across the region, particularly in Brazil, Mexico, and Argentina, is empowering a larger segment of the population to book travel arrangements online. The rising middle class, with increased disposable income, is also significantly contributing to this growth, as is the growing preference for convenient and cost-effective online booking platforms compared to traditional travel agencies. Furthermore, the emergence of innovative travel technology, such as personalized travel recommendations and AI-powered chatbots, is enhancing the user experience and driving market adoption. While competitive pressures from established players and new entrants exist, the market's growth trajectory remains positive, with opportunities for both established players like Booking Holdings and Decolar and emerging local players like Hotel Urbano and Flutouviagens. The segments experiencing the strongest growth are mobile/tablet bookings, reflecting the increasing preference for mobile-first travel planning. Holiday package bookings are also seeing a significant upswing due to growing demand for comprehensive travel solutions.

Latin America Online Travel Market Market Size (In Billion)

However, challenges remain. Economic fluctuations in certain Latin American countries could potentially impact consumer spending on travel. Infrastructure limitations in some regions might hinder seamless online booking experiences. Furthermore, concerns regarding data security and online fraud could deter some users from embracing online travel booking. Despite these restraints, the long-term outlook for the Latin American online travel market remains positive, fueled by technological advancements and changing consumer preferences. The market is expected to see significant expansion across various segments, leading to lucrative opportunities for businesses that can adapt to the evolving needs and preferences of the increasingly tech-savvy travelers in the region. The ongoing development of robust and secure online travel platforms, along with targeted marketing strategies catering to the specific needs of different demographics, will be crucial for success in this dynamic and growing market.

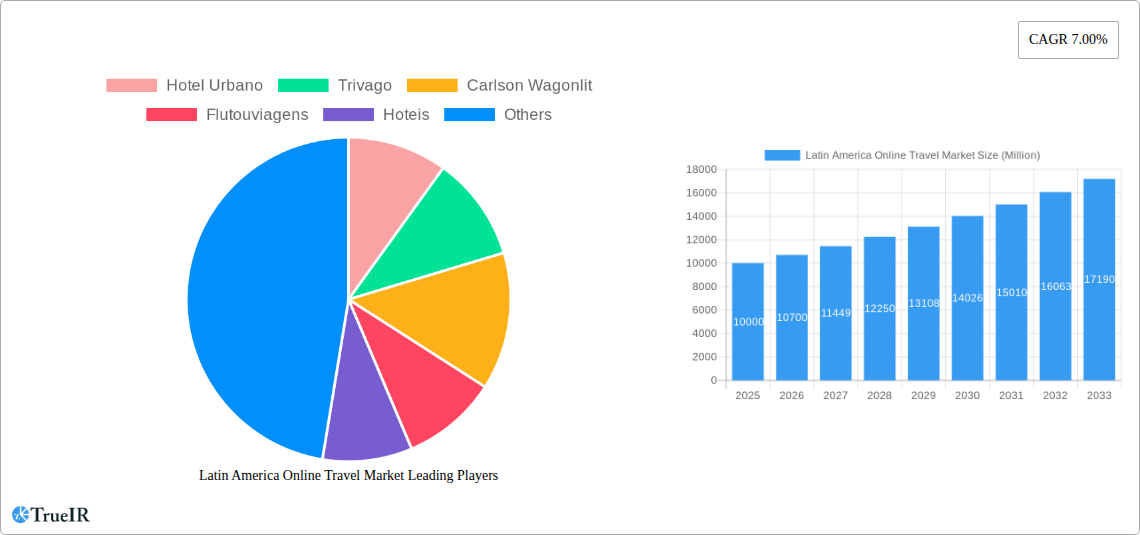

Latin America Online Travel Market Company Market Share

Latin America Online Travel Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Latin America online travel market, offering invaluable insights for businesses and investors seeking to navigate this rapidly evolving landscape. With a detailed examination spanning the period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report delves deep into market size, key players, growth drivers, and emerging trends. Expect in-depth analysis covering market segmentation by service type (accommodation, tickets, packages, others), booking mode (direct, agents), and platform (desktop, mobile/tablet). Discover the competitive dynamics shaped by major players such as Booking Holdings, Despegar, CVC Corp, Airbnb, and many more. The report utilizes high-volume keywords like "Latin America online travel market," "online travel agency," "travel booking," "e-travel," "Latin American tourism," and "M&A in travel," to ensure maximum search engine visibility.

Latin America Online Travel Market Market Structure & Competitive Landscape

The Latin American online travel market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. While precise concentration ratios require detailed data analysis within the full report, preliminary estimates suggest a Herfindahl-Hirschman Index (HHI) exceeding xx, indicating moderate concentration. Innovation is driven by technological advancements like AI-powered personalization, improved mobile interfaces, and the rise of metasearch engines. Regulatory impacts vary across countries, with some nations implementing stricter consumer protection laws and data privacy regulations. Product substitutes include traditional travel agencies and direct bookings via hotel and airline websites. End-user segmentation is driven by demographics (age, income), travel preferences (luxury vs. budget), and purpose of travel (leisure, business).

Mergers and acquisitions (M&A) activity has been significant, reflecting consolidation trends within the industry. For instance, Despegar's acquisition of Viajanet in 2022 signifies the pursuit of market expansion and enhanced competitiveness. The proposed acquisition of Etraveli by Booking Holdings, currently under investigation, highlights further consolidation potential and its potential impact on the competitive landscape. The volume of M&A deals within the period of 2019-2024 is estimated at xx deals. The report delves further into this information.

Latin America Online Travel Market Market Trends & Opportunities

The Latin American online travel market has witnessed substantial growth over the past years, with a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024. This growth is fueled by rising internet and smartphone penetration, increasing disposable incomes, and a growing preference for convenient online booking platforms. Technological shifts, including the adoption of AI-driven recommendations and personalized travel experiences, are transforming customer interactions. Consumer preferences are shifting toward mobile-first booking experiences, value-added services, and curated travel packages. The market's competitive dynamics are influenced by factors such as pricing strategies, brand loyalty, and the ability to offer seamless and personalized travel solutions. Market penetration rates for online travel bookings are expected to reach xx% by 2033, indicating significant growth potential.

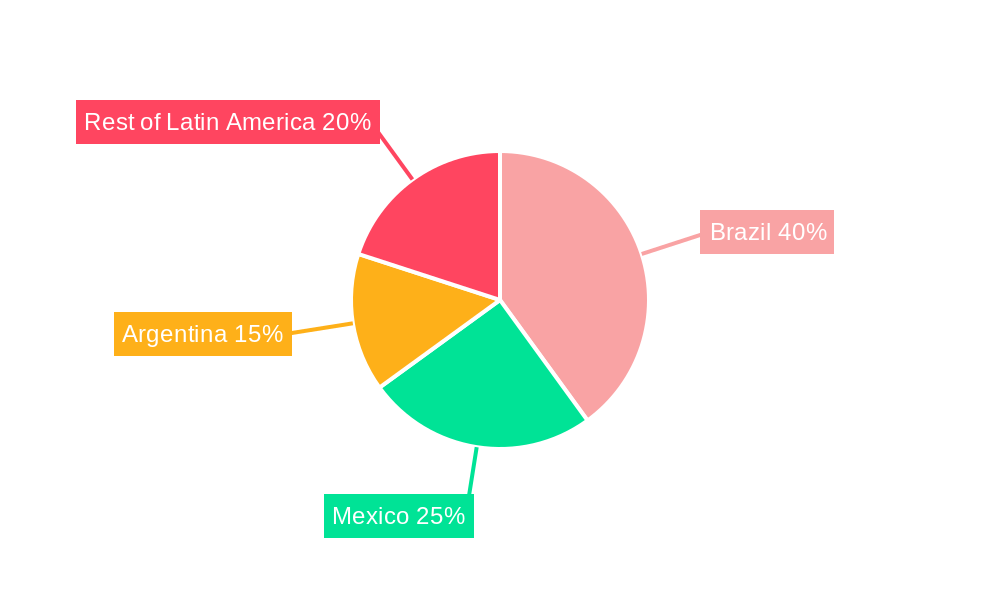

Dominant Markets & Segments in Latin America Online Travel Market

- Leading Region: Brazil consistently dominates the market due to its large population and robust economy.

- Leading Country: Brazil remains the key market within Latin America.

- Dominant Segments:

- By Service Type: Accommodation booking accounts for the largest segment, followed by travel ticket booking and holiday package bookings. Other services, such as travel insurance and activity bookings, are also exhibiting strong growth.

- By Mode of Booking: Direct booking through online platforms is increasing its market share, while travel agents still play a significant role, especially for complex or customized travel itineraries.

- By Booking Platform: Mobile/Tablet bookings are experiencing rapid growth, surpassing desktop bookings in recent years. This trend is likely to continue due to increased smartphone penetration and user preference.

Growth Drivers:

- Improving infrastructure: Expansion of internet and mobile network access across Latin America is a major catalyst for growth.

- Government policies: Initiatives promoting tourism and investment in travel infrastructure positively impact the market.

- Increasing disposable income: Rising middle class and increased purchasing power are driving demand for online travel services.

Latin America Online Travel Market Product Analysis

Product innovation is primarily driven by technological advancements such as AI-powered chatbots for customer service, personalized travel recommendations using machine learning, and the integration of virtual reality for immersive travel planning. These innovations enhance user experience, improve operational efficiency, and create competitive advantages for online travel agencies. The market favors user-friendly interfaces, secure payment gateways, and comprehensive travel information.

Key Drivers, Barriers & Challenges in Latin America Online Travel Market

Key Drivers: Rising disposable incomes, increasing internet penetration, technological advancements (AI, VR), government initiatives to promote tourism, and a growing preference for convenient online bookings.

Challenges: High levels of inflation in some economies might limit consumer spending on travel; intense competition from established players and new entrants; regulatory complexities related to data privacy and consumer protection; dependence on external factors such as global economic fluctuations and health crises like pandemics.

Growth Drivers in the Latin America Online Travel Market Market

Several factors fuel the market's growth, including the rising middle class, increased smartphone penetration, and improved internet connectivity. Government initiatives aimed at boosting tourism, coupled with technological advancements offering personalized travel experiences, further contribute to growth.

Challenges Impacting Latin America Online Travel Market Growth

Significant challenges include economic instability in certain regions, potentially impacting consumer spending; intense competition from established and emerging players, necessitating continuous innovation; and regulatory hurdles surrounding data protection and consumer rights, requiring careful compliance.

Key Players Shaping the Latin America Online Travel Market Market

- Hotel Urbano

- Trivago

- Carlson Wagonlit

- Flutouviagens

- Hoteis

- CVC Corp

- Airbnb

- Booking Holdings

- Decolar

- Pricetravel

- Despegar

Significant Latin America Online Travel Market Industry Milestones

- May 2022: Despegar acquires Viajanet, expanding its presence in the Brazilian market.

- November 2022: The European Commission investigates Booking Holdings' proposed acquisition of Etraveli, raising concerns about market dominance.

Future Outlook for Latin America Online Travel Market Market

The Latin America online travel market is poised for sustained growth, driven by continued increases in internet and smartphone penetration, rising disposable incomes, and the ongoing adoption of innovative technologies. Strategic opportunities exist for companies focused on providing personalized travel experiences, leveraging mobile-first strategies, and addressing the specific needs of the diverse Latin American market. The market is expected to continue its robust growth trajectory, presenting significant potential for both established and emerging players.

Latin America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Service Types

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

Latin America Online Travel Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Online Travel Market Regional Market Share

Geographic Coverage of Latin America Online Travel Market

Latin America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growing Tourism Sector is Helping the Market to Grow Further

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Mexico Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Brazil Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Argentina Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Accommodation Booking

- 8.1.2. Travel Tickets Booking

- 8.1.3. Holiday Package Booking

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Direct Booking

- 8.2.2. Travel Agents

- 8.3. Market Analysis, Insights and Forecast - by Booking Platform

- 8.3.1. Desktop

- 8.3.2. Mobile/Tablet

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Latin America Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Accommodation Booking

- 9.1.2. Travel Tickets Booking

- 9.1.3. Holiday Package Booking

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Direct Booking

- 9.2.2. Travel Agents

- 9.3. Market Analysis, Insights and Forecast - by Booking Platform

- 9.3.1. Desktop

- 9.3.2. Mobile/Tablet

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hotel Urbano

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivago

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Carlson Wagonlit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutouviagens

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hoteis

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CVC Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Airbnb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Booking Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Decolar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pricetravel**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Despegar

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hotel Urbano

List of Figures

- Figure 1: Latin America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 19: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 23: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 24: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Online Travel Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Online Travel Market?

Key companies in the market include Hotel Urbano, Trivago, Carlson Wagonlit, Flutouviagens, Hoteis, CVC Corp, Airbnb, Booking Holdings, Decolar, Pricetravel**List Not Exhaustive, Despegar.

3. What are the main segments of the Latin America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growing Tourism Sector is Helping the Market to Grow Further.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In November 2022, The European Commission has opened an investigation into the proposed acquisition of Sweden's Flugo Group Holdings AB which operates as Etraveli by Booking Holdings Inc.. The proposed transaction would allow Booking to strengthen its position in the market for online travel agencies, and increase the barrier to entry and expansion for rivals

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Online Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence