Key Insights

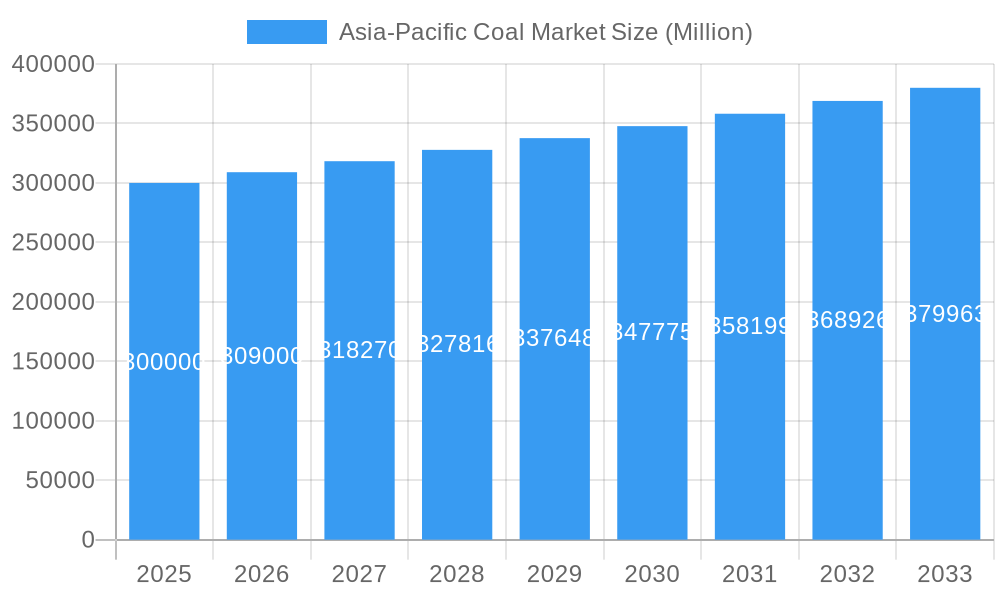

The Asia-Pacific coal market, a critical energy sector component in nations such as China, Japan, India, South Korea, and Australia, is projected to reach a market size of 8811.34 million by 2025. This market, with a compound annual growth rate (CAGR) of 1.6 from 2025, is driven by substantial industrialization and escalating energy requirements across the region, predominantly for power generation and steel production. The market is segmented by end-user, with power stations (thermal coal) and coking feedstock (coking coal) constituting the primary segments. Key industry leaders include JERA Co Inc, Datang International Power Generation Company, and Adani Power Ltd, alongside a diverse mix of state-owned and private enterprises. While industrial expansion continues to fuel demand, the market faces headwinds from growing environmental consciousness and stringent global emission regulations. This trend is accelerating the transition to cleaner energy alternatives, potentially moderating, but not eliminating, long-term coal consumption growth. The forecast period (2025-2033) anticipates sustained market expansion, though environmental pressures and the increasing adoption of renewable energy solutions may lead to a more measured growth trajectory. This evolving landscape presents both opportunities and challenges, necessitating strategic adaptation to regulatory shifts and evolving consumer preferences.

Asia-Pacific Coal Market Market Size (In Billion)

The future trajectory of the Asia-Pacific coal market is defined by the intricate interplay between ongoing energy demands and intensifying environmental considerations. Regional governments are focused on balancing energy security with sustainability objectives, fostering a dynamic regulatory environment. Investments in carbon capture and storage (CCS) technologies, alongside continuous enhancements in energy efficiency, may offer avenues for mitigating environmental impacts. Furthermore, energy source diversification within the region is expected to persist, with renewables gradually becoming more integrated into the energy mix. Nevertheless, the considerable existing coal infrastructure and the substantial energy needs of rapidly developing economies ensure coal's continued significance, albeit with a gradual decline, in the Asia-Pacific energy framework for the foreseeable future. Companies adept at navigating this complex terrain will likely be those that embrace regulatory changes, adopt technological innovations, and strategically invest in sustainable practices complementary to their existing coal operations.

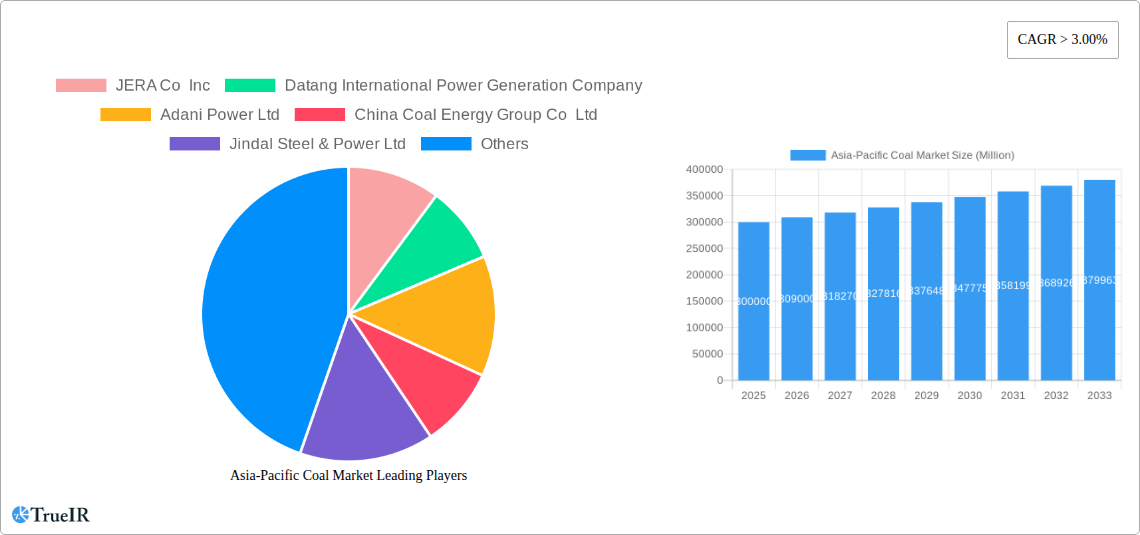

Asia-Pacific Coal Market Company Market Share

Asia-Pacific Coal Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Asia-Pacific coal market, offering crucial insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study delivers a comprehensive understanding of market trends, competitive dynamics, and future growth prospects. The report leverages extensive data analysis and incorporates perspectives from key industry players, including JERA Co Inc, Datang International Power Generation Company, Adani Power Ltd, China Coal Energy Group Co Ltd, Jindal Steel & Power Ltd, China Shenhua Energy Co Ltd, Huadian Power International Corporation, NTPC Ltd, and Shenergy Group Company Limited (list not exhaustive).

Asia-Pacific Coal Market Structure & Competitive Landscape

This section analyzes the market structure and competitive landscape of the Asia-Pacific coal market. We delve into market concentration, using metrics like the Herfindahl-Hirschman Index (HHI) to assess the level of competition (xx). The analysis also explores innovation drivers, such as advancements in coal mining technologies and efficiency improvements (xx Million USD invested in R&D in 2024). We examine the regulatory landscape, including environmental regulations and their impact on coal production and consumption (xx% reduction target by 2030). The report considers the presence of product substitutes, such as renewable energy sources, and their influence on market dynamics (xx% market share of renewables by 2033). We further investigate end-user segmentation, focusing on Power Station (Thermal Coal), Coking Feedstock (Coking Coal), and Others (xx Million tons consumed by power stations in 2024), and examine M&A trends within the industry, quantifying the volume of transactions in recent years (xx number of M&A deals between 2019 and 2024). Qualitative insights will provide context to these quantitative findings.

- Market Concentration: High (xx), driven by a few dominant players.

- Innovation Drivers: Technological advancements in mining and energy efficiency.

- Regulatory Impacts: Stringent environmental regulations are shaping the market.

- Product Substitutes: Renewable energy sources present a growing challenge.

- End-User Segmentation: Power stations dominate coal consumption.

- M&A Trends: Consolidation is expected to continue, driven by economies of scale.

Asia-Pacific Coal Market Trends & Opportunities

This section explores the key trends and opportunities shaping the Asia-Pacific coal market. We analyze market size growth, projecting a CAGR of xx% from 2025 to 2033 (reaching xx Million tons by 2033), based on historical data from 2019-2024. We examine technological shifts, such as the adoption of cleaner coal technologies and carbon capture utilization and storage (CCUS) (xx% penetration rate of CCUS by 2033). The report also considers evolving consumer preferences and their influence on coal demand, including the growing emphasis on energy security and affordability (xx% of energy mix still reliant on coal in 2033 for specific countries). Finally, we analyze competitive dynamics, including pricing strategies and market share changes among key players.

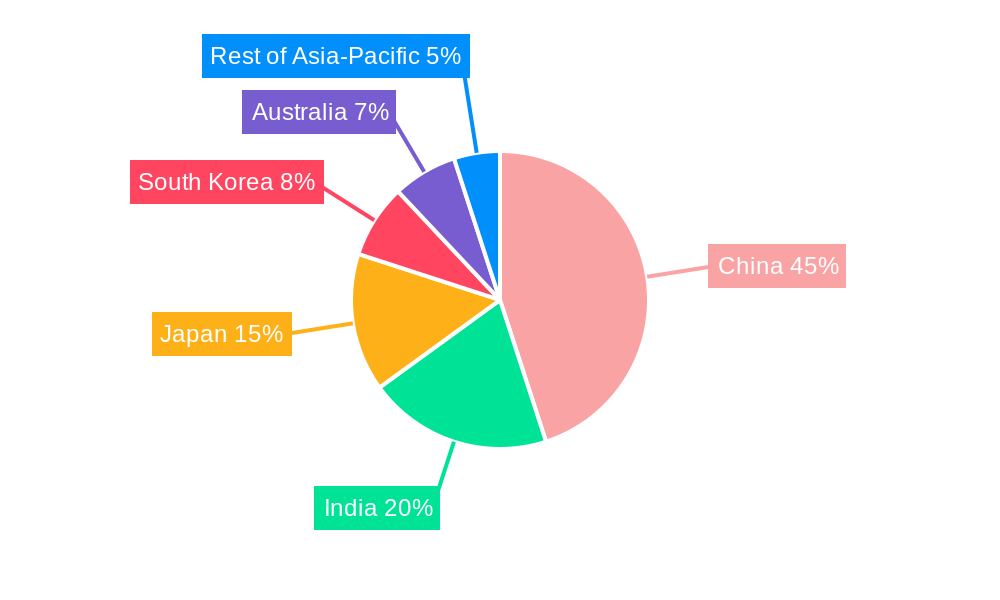

Dominant Markets & Segments in Asia-Pacific Coal Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific coal market. We analyze market dominance by examining factors such as production capacity, consumption levels, and market share for each segment (Power Station (Thermal Coal), Coking Feedstock (Coking Coal), and Others). The analysis will pinpoint the leading countries and regions and explore the drivers of their dominance.

- Key Growth Drivers for Dominant Segments:

- Power Station (Thermal Coal): Expanding electricity demand in rapidly developing economies.

- Coking Feedstock (Coking Coal): Growth in the steel industry, particularly in China and India.

- Others: Industrial applications and cement production.

Asia-Pacific Coal Market Product Analysis

This section summarizes product innovations, applications, and competitive advantages within the Asia-Pacific coal market. We focus on technological advancements, such as improved coal mining techniques and cleaner coal technologies, and assess their market fit and competitive advantages (reduced emissions, improved efficiency).

Key Drivers, Barriers & Challenges in Asia-Pacific Coal Market

Key Drivers: The Asia-Pacific coal market is propelled by a confluence of robust energy demand, primarily fueled by rapid industrialization and ongoing urbanization across key economies in the region. Government policies in certain nations continue to favor the development and operation of coal-fired power plants as a cornerstone of their energy security strategies. Furthermore, the historically competitive pricing of coal, especially when juxtaposed with the volatility and investment requirements of alternative energy sources, remains a significant driver for its continued adoption in many markets.

Challenges and Restraints: The market is significantly impacted by a tightening regulatory landscape. Increasingly stringent environmental mandates are driving up compliance costs, with projections indicating a potential increase of 15-25% in compliance expenses by 2030 as emissions standards tighten and carbon pricing mechanisms are implemented. Global supply chain disruptions and geopolitical factors contribute to the fluctuating price of coal, exhibiting an average volatility of 10-20% over the past five years. Simultaneously, the relentless growth and decreasing costs of renewable energy sources, such as solar and wind power, present an intensifying competitive threat, with renewable energy capacity in the region projected to grow by 30-40% in the coming decade.

Growth Drivers in the Asia-Pacific Coal Market

The growth of the Asia-Pacific coal market is fueled by several factors, including consistent energy demands from industrialization and urbanization, government support for coal-fired power generation in some nations, and relatively cost-effective coal compared to alternative energy sources in certain markets.

Challenges Impacting Asia-Pacific Coal Market Growth

The Asia-Pacific coal market is navigating a complex landscape characterized by escalating environmental scrutiny and the associated rise in compliance expenditures. Price volatility, stemming from intricate global supply chains and geopolitical influences, poses a significant risk to market stability. Moreover, the burgeoning influence and economic viability of renewable energy alternatives are increasingly challenging coal's dominance in power generation portfolios across the region.

Key Players Shaping the Asia-Pacific Coal Market

- JERA Co Inc (Japan)

- Datang International Power Generation Company (China)

- Adani Power Ltd (India)

- China Coal Energy Group Co Ltd (China)

- Jindal Steel & Power Ltd (India)

- China Shenhua Energy Co Ltd (China)

- Huadian Power International Corporation (China)

- NTPC Ltd (India)

- Shenergy Group Company Limited (China)

Significant Asia-Pacific Coal Market Industry Milestones

- 2020-03: Introduction of stricter emission standards in several countries.

- 2021-11: Major coal mining company merges with a renewable energy firm.

- 2022-06: Launch of a new, more efficient coal-fired power plant technology.

- 2023-09: Significant investment announced in coal-fired plant upgrades. (Specific examples and impact details would be added in the full report).

Future Outlook for Asia-Pacific Coal Market

The future of the Asia-Pacific coal market is complex. While demand is expected to decrease gradually due to environmental concerns and the rise of renewable energy, a sustained reliance on coal in certain regions will continue to shape the market. Strategic opportunities exist for companies focusing on clean coal technologies and carbon capture, while market potential is driven by continued industrial growth, especially in developing economies. However, the long-term outlook is undeniably challenged by the global shift towards cleaner energy.

Asia-Pacific Coal Market Segmentation

-

1. End-User

- 1.1. Power Station (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Indonesia

- 2.4. Rest of Asia-Pacific

Asia-Pacific Coal Market Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Rest of Asia Pacific

Asia-Pacific Coal Market Regional Market Share

Geographic Coverage of Asia-Pacific Coal Market

Asia-Pacific Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Oil and Gas4.; Presence of Proven Oil and Gas Reserves

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Power Stations Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Power Station (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Indonesia

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. China Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Power Station (Thermal Coal)

- 6.1.2. Coking Feedstock (Coking Coal)

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Indonesia

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. India Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Power Station (Thermal Coal)

- 7.1.2. Coking Feedstock (Coking Coal)

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Indonesia

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Indonesia Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Power Station (Thermal Coal)

- 8.1.2. Coking Feedstock (Coking Coal)

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Indonesia

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Rest of Asia Pacific Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Power Station (Thermal Coal)

- 9.1.2. Coking Feedstock (Coking Coal)

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Indonesia

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JERA Co Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Datang International Power Generation Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Adani Power Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 China Coal Energy Group Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jindal Steel & Power Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 China Shenhua Energy Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Huadian Power International Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NTPC Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Shenergy Group Company Limited*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 JERA Co Inc

List of Figures

- Figure 1: Asia-Pacific Coal Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 2: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 3: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Coal Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 9: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 14: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 15: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 20: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 21: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 26: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 27: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Coal Market?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Asia-Pacific Coal Market?

Key companies in the market include JERA Co Inc, Datang International Power Generation Company, Adani Power Ltd, China Coal Energy Group Co Ltd, Jindal Steel & Power Ltd, China Shenhua Energy Co Ltd, Huadian Power International Corporation, NTPC Ltd, Shenergy Group Company Limited*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Coal Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8811.34 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Oil and Gas4.; Presence of Proven Oil and Gas Reserves.

6. What are the notable trends driving market growth?

Power Stations Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Coal Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence