Key Insights

The power-to-gas market is experiencing substantial growth, projected to reach $78.9 billion by 2033 with a Compound Annual Growth Rate (CAGR) of 6.4%. This expansion is driven by the imperative to decarbonize energy systems, increased adoption of renewable energy sources, and the demand for flexible energy storage. Power-to-gas technologies efficiently convert surplus renewable electricity into storable gaseous fuels like hydrogen and methane, enabling grid stabilization and enhanced renewable energy integration. Technological advancements and cost reductions further support this market trajectory. The market is segmented by technology (Power-to-Hydrogen, Power-to-Methane), capacity (>1000 KW, 100-1000 KW, <100 KW), and end-user (utilities, industrial, commercial). While the industrial sector currently leads, significant growth is anticipated across all segments.

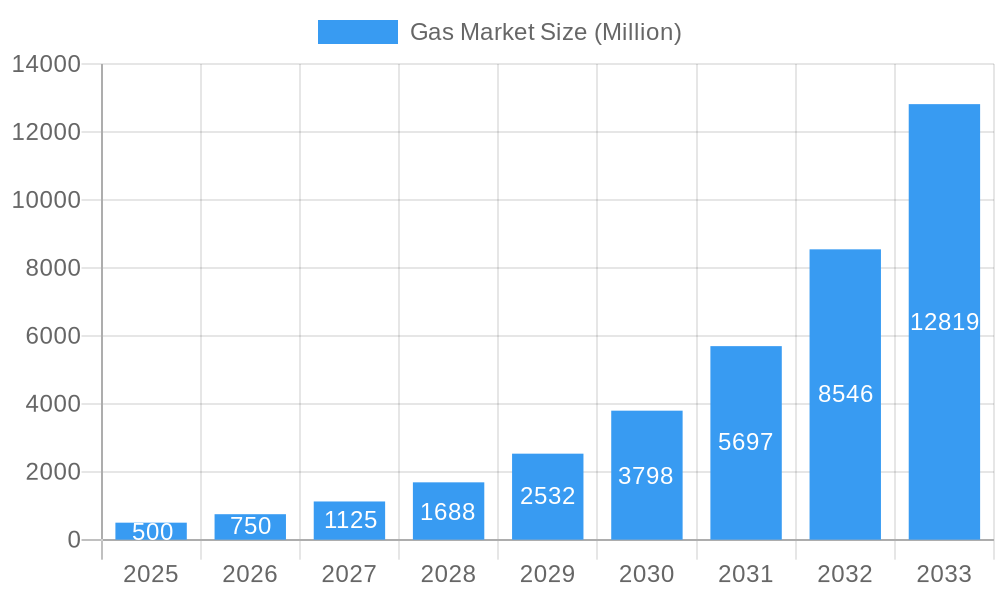

Gas Market Market Size (In Billion)

Key restraints include high initial investment costs and the need for robust infrastructure for gas transportation and distribution. However, supportive government policies and incentives are mitigating these challenges. Leading players such as MAN Energy Solutions, Siemens Energy AG, and Nel ASA are driving innovation and market development. Geographic growth is expected across North America, Europe, and Asia-Pacific, particularly in regions with abundant renewable resources and favorable regulatory environments. The burgeoning hydrogen economy and rising demand for sustainable fuels will continue to propel the power-to-gas market's significant expansion.

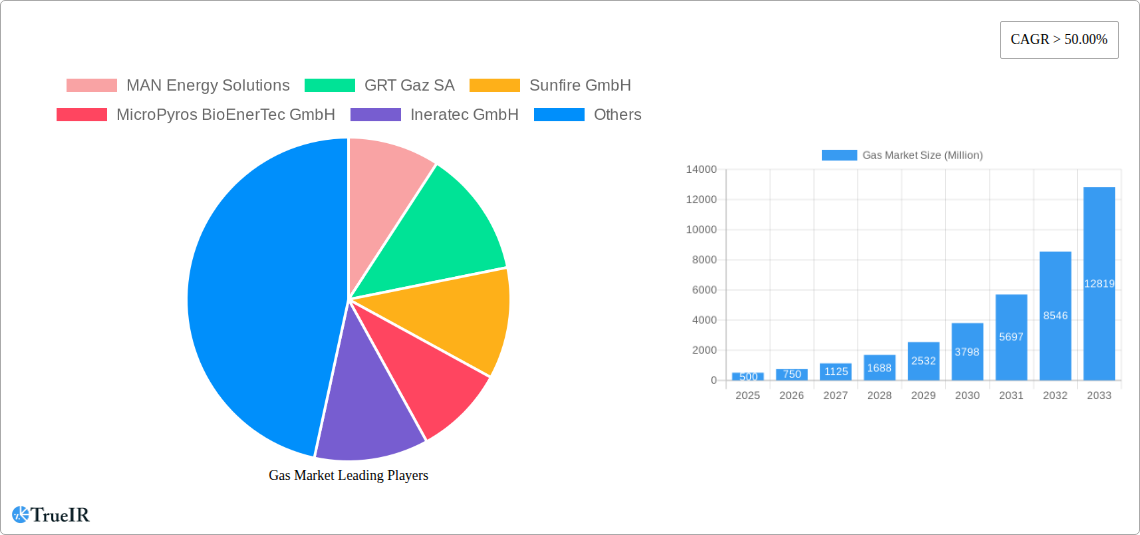

Gas Market Company Market Share

Gas Market Analysis: Market Size, CAGR & Forecast (2024-2033)

This comprehensive report analyzes the Gas Market, providing crucial insights for industry stakeholders. It covers market size, growth projections, competitive landscape, technological advancements, and key industry trends from 2019 to 2033, with a base year of 2024 and a forecast period from 2025 to 2033. The report details segments including Power-to-Hydrogen and Power-to-Methane technologies, capacity (more than 1000 KW, 100 to 1000 KW, less than 100 KW), and end-user sectors (Utilities, Industrial, Commercial). Profiles of key players like MAN Energy Solutions, Siemens Energy AG, and Nel ASA are included for a holistic market understanding.

Gas Market Market Structure & Competitive Landscape

The Gas Market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025, indicating the presence of both established players and emerging entrants. The market's competitive intensity is driven by continuous innovation in hydrogen and methane production technologies, particularly within the Power-to-X sector. Stringent environmental regulations globally are pushing companies to adopt cleaner energy sources, shaping the competitive landscape. The increasing availability of renewable energy sources like wind and solar further fuels market growth.

- Market Concentration: The HHI is projected to increase to xx by 2033, suggesting potential consolidation through mergers and acquisitions (M&A).

- Innovation Drivers: Advancements in electrolysis technologies, carbon capture, and storage are major innovation drivers.

- Regulatory Impacts: Government subsidies and incentives for renewable energy projects are significantly influencing market dynamics. Carbon pricing mechanisms also play a crucial role.

- Product Substitutes: Natural gas and other fossil fuels remain significant substitutes; however, increasing environmental concerns are accelerating the shift toward cleaner alternatives.

- End-User Segmentation: The Utilities sector is currently the dominant end-user, followed by the Industrial and Commercial sectors. This segmentation is expected to evolve with increasing industrial adoption of green hydrogen.

- M&A Trends: The annual M&A volume in the Gas Market is estimated to reach USD xx Million in 2025 and is projected to increase to USD xx Million by 2033.

Gas Market Market Trends & Opportunities

The Gas Market is experiencing significant growth, driven by increasing demand for clean energy and stringent environmental regulations. The market size is estimated to reach USD xx Million in 2025, with a projected CAGR of xx% from 2025 to 2033. This growth is fueled by the widespread adoption of Power-to-X technologies, enabling the conversion of renewable energy sources into hydrogen and methane. The shift towards decarbonization is a primary market driver. Technological advancements, particularly in electrolyzer efficiency and scalability, are improving cost-effectiveness and accelerating market penetration. Consumer preferences for environmentally friendly energy solutions are also fostering market growth. The market is characterized by intense competition, with established players and new entrants vying for market share. This competition is driving innovation and cost reduction, benefiting end-users. The significant growth opportunities lie in developing infrastructure for hydrogen storage and transportation, alongside the increasing integration of hydrogen into existing energy systems.

Dominant Markets & Segments in Gas Market

Leading Region/Country: The United States is expected to remain a dominant market in terms of both production and consumption, supported by significant policy support and investments in clean energy infrastructure. Europe is also a key market, driven by ambitious climate targets and supportive policy frameworks.

By Technology:

- Power-to-Hydrogen: This segment is anticipated to dominate due to the growing demand for hydrogen in various applications, including transportation, industrial processes, and energy storage. This is further supported by substantial R&D investments into improving the efficiency of electrolysis and reducing production costs.

- Power-to-Methane: This segment is experiencing growth as methane can be easily integrated into existing natural gas infrastructure, offering a readily available pathway for decarbonizing gas grids.

By Capacity:

- More than 1000 KW: This segment shows considerable growth potential, supported by large-scale projects aimed at decarbonizing industrial processes and creating bulk hydrogen storage.

- 100 to 1000 KW: This segment serves a wide range of applications, from small-scale industrial uses to localized energy generation projects, driving steady growth.

- Less than 100 KW: This segment is primarily driven by residential and commercial applications and will continue to experience consistent growth.

By End-User:

- Utilities: Utilities are leading adopters of gas market technologies to integrate renewable energy sources, and meet their decarbonization commitments.

- Industrial: Industrial sectors are experiencing rapid growth in hydrogen adoption, driven by the need for clean energy in production processes.

- Commercial: Commercial adoption of gas market solutions is steadily growing, driven by both cost savings and environmental responsibility.

Key Growth Drivers: Infrastructure development (pipelines, storage facilities) and supportive government policies, including subsidies and tax incentives, are critical growth drivers for this sector.

Gas Market Product Analysis

The Gas Market is characterized by diverse products, including electrolyzers, gas turbines, and hydrogen storage solutions. Key innovations center on improving the efficiency and reducing the cost of electrolysis technologies, allowing for greater scalability and accessibility. Power-to-X systems integrating renewable energy sources are gaining traction, providing clean and sustainable gas production solutions. The market fit is strong, driven by environmental regulations and a growing demand for renewable alternatives to fossil fuels.

Key Drivers, Barriers & Challenges in Gas Market

Key Drivers: Growing demand for renewable energy, stringent environmental regulations, and government support for clean energy technologies are driving market growth. Technological advancements in electrolysis and carbon capture are further accelerating this trend.

Challenges & Restraints: High initial investment costs, limited infrastructure for hydrogen storage and transport, and competition from existing fossil fuel infrastructure pose significant challenges. Regulatory uncertainties and the complexity of integrating hydrogen into existing energy systems also hinder market expansion. Supply chain disruptions related to critical materials for electrolyzers also have a significant impact on production and cost.

Growth Drivers in the Gas Market Market

Technological advancements such as improvements in electrolyzer efficiency and the development of Power-to-X technologies are key drivers. Government policies promoting clean energy and carbon reduction targets are incentivizing investment in the Gas Market. Furthermore, the increasing cost competitiveness of renewable energy sources compared to fossil fuels strengthens the market's growth trajectory.

Challenges Impacting Gas Market Growth

High capital expenditure requirements for electrolyzer installations and associated infrastructure remain a significant challenge. The lack of standardized hydrogen infrastructure for storage and transportation limits market expansion. Furthermore, competition from established fossil fuel industries and the need for improved public awareness and acceptance of hydrogen technologies pose considerable barriers.

Key Players Shaping the Gas Market Market

- MAN Energy Solutions

- GRT Gaz SA

- Sunfire GmbH

- MicroPyros BioEnerTec GmbH

- Ineratec GmbH

- AquahydreX Inc

- Siemens Energy AG

- Electrochaea GmbH

- Hitachi Zosen Inova AG

- Sempra Energy

- Nel ASA

Significant Gas Market Industry Milestones

June 2022: The United States Department of Energy announced a USD 504.4 Million investment in Advanced Clean Energy Storage, a clean hydrogen facility in Delta, Utah. This significantly boosted confidence in the sector and signaled a strong push towards large-scale hydrogen production and storage.

February 2022: Mitsubishi Power's contract with HydrogenPro for a large-scale electrolyzer system demonstrated the growing demand for efficient green hydrogen production. This signified a major step towards using renewable energy sources for industrial-scale hydrogen generation.

Future Outlook for Gas Market Market

The Gas Market is poised for significant growth, driven by technological advancements, supportive government policies, and the urgent need for clean energy solutions. Strategic investments in infrastructure, technological innovation, and efficient hydrogen storage and distribution systems will be crucial for realizing the market's substantial potential. The market will likely see increased consolidation through mergers and acquisitions as companies strive to achieve economies of scale and enhance their competitive position. The integration of hydrogen into existing energy systems and the development of new applications for hydrogen will create further market opportunities.

Gas Market Segmentation

-

1. Technology

- 1.1. Power-to-Hydrogen

- 1.2. Power-to-Methane

-

2. Capacity (Qualitative Analysis Only)

- 2.1. More than 1000 KW

- 2.2. 100 to 1000 KW

- 2.3. Less than 100 KW

-

3. y End-User

- 3.1. Utilities

- 3.2. Industrial

- 3.3. Commercial

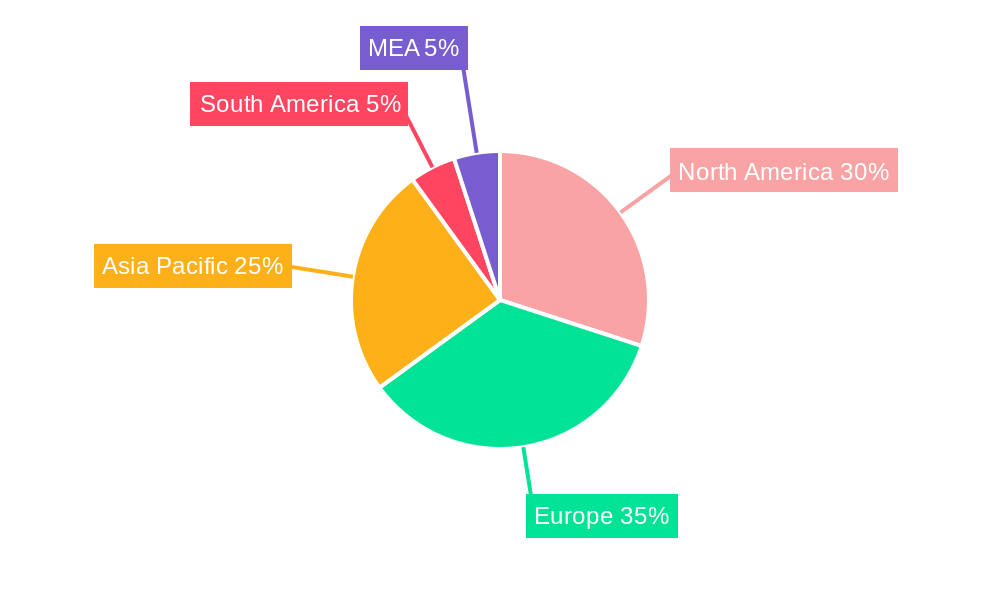

Gas Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Gas Market Regional Market Share

Geographic Coverage of Gas Market

Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Power-to-hydrogen to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Power-to-Hydrogen

- 5.1.2. Power-to-Methane

- 5.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 5.2.1. More than 1000 KW

- 5.2.2. 100 to 1000 KW

- 5.2.3. Less than 100 KW

- 5.3. Market Analysis, Insights and Forecast - by y End-User

- 5.3.1. Utilities

- 5.3.2. Industrial

- 5.3.3. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Power-to-Hydrogen

- 6.1.2. Power-to-Methane

- 6.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 6.2.1. More than 1000 KW

- 6.2.2. 100 to 1000 KW

- 6.2.3. Less than 100 KW

- 6.3. Market Analysis, Insights and Forecast - by y End-User

- 6.3.1. Utilities

- 6.3.2. Industrial

- 6.3.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Power-to-Hydrogen

- 7.1.2. Power-to-Methane

- 7.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 7.2.1. More than 1000 KW

- 7.2.2. 100 to 1000 KW

- 7.2.3. Less than 100 KW

- 7.3. Market Analysis, Insights and Forecast - by y End-User

- 7.3.1. Utilities

- 7.3.2. Industrial

- 7.3.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Power-to-Hydrogen

- 8.1.2. Power-to-Methane

- 8.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 8.2.1. More than 1000 KW

- 8.2.2. 100 to 1000 KW

- 8.2.3. Less than 100 KW

- 8.3. Market Analysis, Insights and Forecast - by y End-User

- 8.3.1. Utilities

- 8.3.2. Industrial

- 8.3.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Power-to-Hydrogen

- 9.1.2. Power-to-Methane

- 9.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 9.2.1. More than 1000 KW

- 9.2.2. 100 to 1000 KW

- 9.2.3. Less than 100 KW

- 9.3. Market Analysis, Insights and Forecast - by y End-User

- 9.3.1. Utilities

- 9.3.2. Industrial

- 9.3.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Power-to-Hydrogen

- 10.1.2. Power-to-Methane

- 10.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 10.2.1. More than 1000 KW

- 10.2.2. 100 to 1000 KW

- 10.2.3. Less than 100 KW

- 10.3. Market Analysis, Insights and Forecast - by y End-User

- 10.3.1. Utilities

- 10.3.2. Industrial

- 10.3.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MAN Energy Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GRT Gaz SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunfire GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MicroPyros BioEnerTec GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ineratec GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AquahydreX Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens Energy AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrochaea GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Zosen Inova AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sempra Energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nel ASA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 MAN Energy Solutions

List of Figures

- Figure 1: Global Gas Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 5: North America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 6: North America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 7: North America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 8: North America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 13: Europe Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 14: Europe Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 15: Europe Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 16: Europe Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 19: Asia Pacific Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 21: Asia Pacific Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 22: Asia Pacific Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 23: Asia Pacific Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 24: Asia Pacific Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 27: South America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: South America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 29: South America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 30: South America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 31: South America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 32: South America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 37: Middle East and Africa Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 38: Middle East and Africa Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 39: Middle East and Africa Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 40: Middle East and Africa Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Gas Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 3: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 4: Global Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 7: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 8: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 11: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 12: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 15: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 16: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 19: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 20: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 22: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 23: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 24: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Gas Market?

Key companies in the market include MAN Energy Solutions, GRT Gaz SA, Sunfire GmbH, MicroPyros BioEnerTec GmbH, Ineratec GmbH, AquahydreX Inc *List Not Exhaustive, Siemens Energy AG, Electrochaea GmbH, Hitachi Zosen Inova AG, Sempra Energy, Nel ASA.

3. What are the main segments of the Gas Market?

The market segments include Technology, Capacity (Qualitative Analysis Only), y End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Power-to-hydrogen to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

June 2022- The United States Department of Energy announced a USD 504.4 million investment to finance Advanced Clean Energy Storage, a clean hydrogen and energy storage facility capable of providing long-term energy storage. Located in Delta, Utah, the facility will combine 220 megawatts of alkaline electrolysis with two 4.5-million-barrel salt caverns to store clean hydrogen. When operational, the projects will capture excess renewable energy, store it as hydrogen, and deploy it as fuel for the Intermountain Power Agency's (IPA) Renewed Project-a hydrogen-capable gas turbine combined cycle power plant that intends to be fueled by 100% clean hydrogen by 2045 incrementally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Market?

To stay informed about further developments, trends, and reports in the Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence