Key Insights

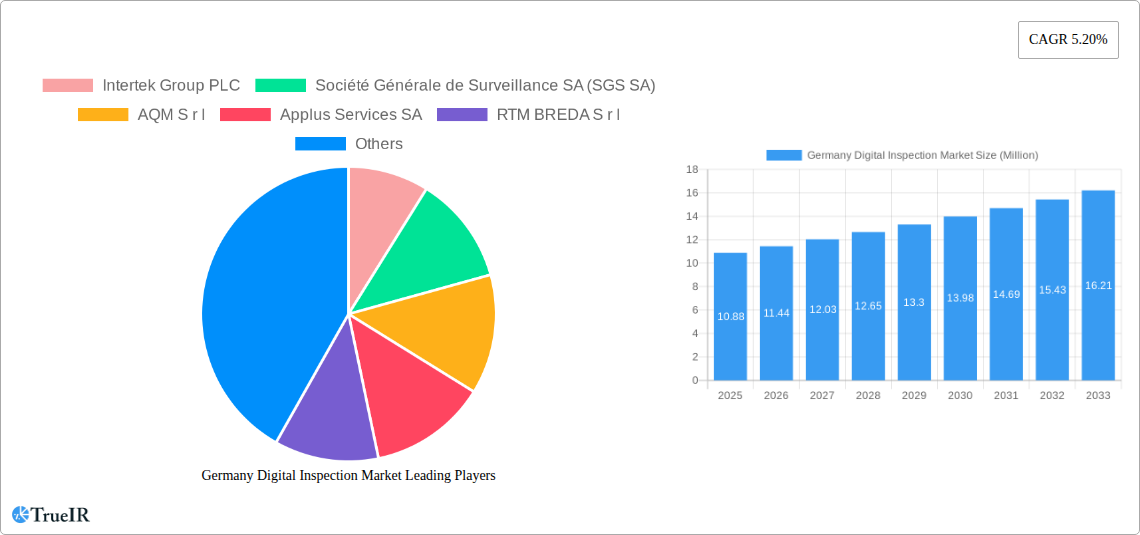

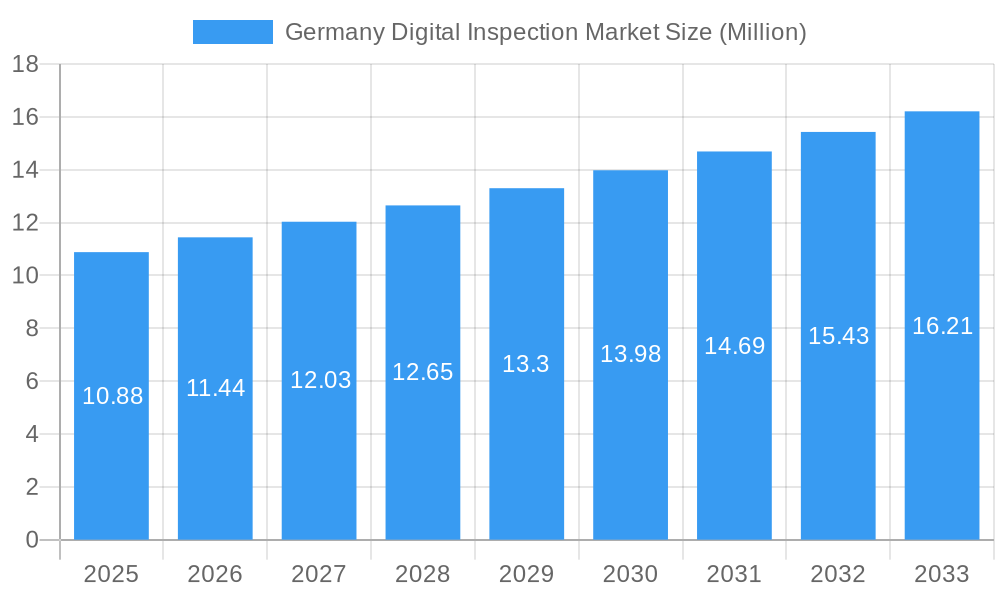

The German digital inspection market, valued at €10.88 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of Industry 4.0 technologies across various sectors, including automotive, manufacturing, and food and agriculture, is creating significant demand for efficient and precise digital inspection solutions. Furthermore, stringent regulatory requirements for quality control and safety standards in these industries necessitate the implementation of advanced digital inspection methods. The growing emphasis on predictive maintenance and reducing operational downtime also contributes to the market's growth trajectory. Germany's strong industrial base and technological prowess provide a fertile ground for innovation and adoption of these technologies. Leading companies like Intertek, SGS, and TÜV SÜD are actively investing in developing and deploying cutting-edge digital inspection solutions, fostering market competitiveness and further driving growth.

Germany Digital Inspection Market Market Size (In Million)

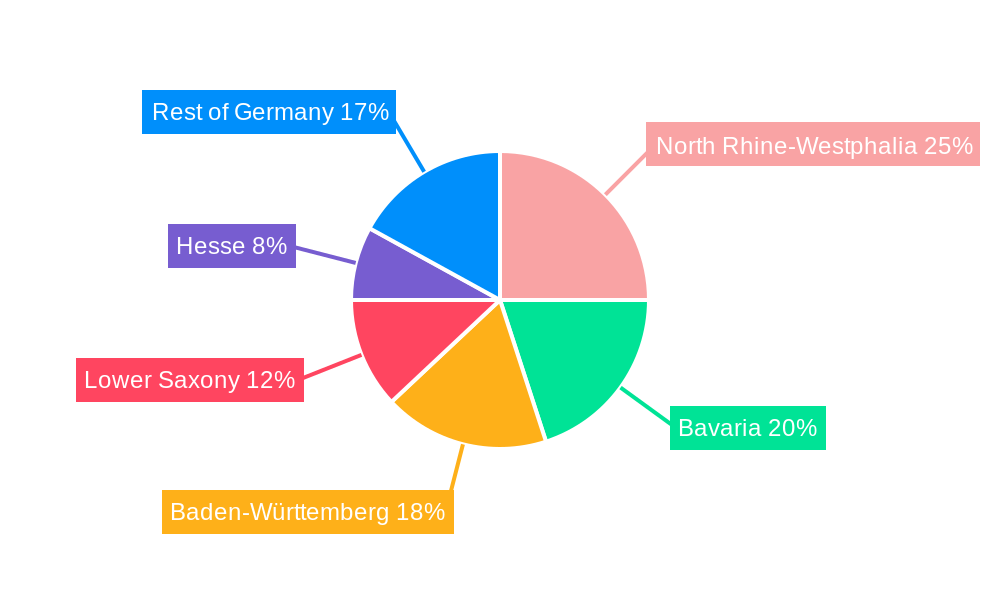

The market segmentation reveals a diverse landscape. The outsourced segment is expected to dominate, reflecting the preference for specialized expertise and cost-effectiveness. Testing and inspection services account for a significant portion of the market, followed by certification and in-house/government services. Among end-user verticals, the automotive and manufacturing sectors are key contributors, driven by the need for high-quality control and stringent production standards. Regional variations within Germany are evident, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, known for their strong industrial presence, likely leading the market adoption. However, challenges remain. High initial investment costs for digital inspection systems and the need for skilled professionals to operate and interpret the data could potentially restrain market growth to some extent. Nonetheless, the long-term prospects for the German digital inspection market remain positive, driven by continuous technological advancements, increasing regulatory scrutiny, and the growing adoption of smart manufacturing practices.

Germany Digital Inspection Market Company Market Share

Germany Digital Inspection Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Germany Digital Inspection Market, encompassing market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The report leverages extensive market research and data analysis to offer invaluable insights for businesses, investors, and stakeholders operating within this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by sourcing type (outsourced, in-house/government), type of service (testing and inspection, certification), and end-user vertical (consumer goods and retail, automotive, food and agriculture, manufacturing and industrial goods, minerals and metals, oil & gas and chemicals, construction, transport, aerospace and rail, other). Key players include Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), AQM S r l, and others. The report projects significant growth, driven by technological advancements and increasing regulatory requirements.

Germany Digital Inspection Market Structure & Competitive Landscape

The German digital inspection market exhibits a moderately concentrated structure, with several large multinational companies and a number of smaller specialized firms competing for market share. The top 5 players account for approximately xx% of the market in 2025 (estimated), indicating a moderately consolidated landscape. Innovation is a significant driver, with companies continuously investing in advanced technologies such as AI, machine learning, and automation to enhance inspection efficiency and accuracy. Stringent regulatory frameworks, particularly within sectors like automotive and food & beverage, are key influencing factors, pushing for higher quality assurance and compliance standards. Substitute products or services are limited, reinforcing the market’s overall resilience. M&A activity has been moderate in recent years, with a total of xx acquisitions reported between 2019 and 2024, driven by strategies to expand service offerings and geographic reach.

- Market Concentration: Top 5 players control approximately xx% of the market (2025 estimate).

- Innovation Drivers: AI, machine learning, automation, and advanced sensor technologies.

- Regulatory Impacts: Stringent quality and safety standards across various sectors.

- Product Substitutes: Limited direct substitutes, fostering market resilience.

- M&A Trends: Moderate activity with xx acquisitions between 2019 and 2024.

- End-user Segmentation: Diverse across various sectors, with varying adoption rates.

Germany Digital Inspection Market Trends & Opportunities

The German digital inspection market is projected to experience substantial growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is fueled by several key factors, including the increasing adoption of digital technologies, stringent regulatory requirements across multiple sectors, and the rising demand for efficient and reliable quality control solutions. Technological shifts towards automation and AI-powered inspection are accelerating market transformation, improving accuracy and reducing inspection time. Consumer preferences for higher quality products and increased focus on safety are also driving demand. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and M&A activities among industry participants. Market penetration of digital inspection solutions remains relatively low in certain end-user segments, offering significant untapped potential. The market size is projected to reach €xx Million by 2033.

Dominant Markets & Segments in Germany Digital Inspection Market

The automotive sector dominates the German digital inspection market, accounting for the largest share of revenue in 2025. This is primarily due to the stringent safety and quality standards within this industry and the increased adoption of advanced technologies for vehicle testing and inspection. The outsourced sourcing type segment also shows robust growth driven by the efficiency and cost-effectiveness it provides to businesses. In terms of service type, testing and inspection services represent the largest portion of the market.

Key Growth Drivers (Automotive Sector):

- Stringent automotive safety and quality standards.

- High demand for efficient and reliable quality control solutions.

- Increased adoption of automation and AI-powered inspection technologies.

Key Growth Drivers (Outsourcing):

- Cost optimization and access to specialized expertise.

- Increased operational flexibility for businesses.

- Efficiency gains through outsourcing non-core functions.

Dominant Regions: Southern and Western Germany, given higher industrial concentration and advanced manufacturing sectors.

Germany Digital Inspection Market Product Analysis

The market features a diverse range of digital inspection solutions, including advanced sensor technologies, AI-powered image analysis software, and automated inspection systems. These solutions offer improved accuracy, efficiency, and cost-effectiveness compared to traditional inspection methods. The integration of data analytics and cloud-based platforms enables real-time monitoring and data-driven decision-making. The competitive advantage lies in offering comprehensive solutions tailored to specific industry needs, coupled with robust data security and seamless integration with existing workflows.

Key Drivers, Barriers & Challenges in Germany Digital Inspection Market

Key Drivers:

- Increasing demand for high-quality products and enhanced safety standards.

- Rising adoption of Industry 4.0 technologies and automation across sectors.

- Stringent regulations and compliance requirements driving the need for accurate inspection.

- Growing investments in R&D to improve inspection accuracy and efficiency.

Challenges & Restraints:

- High initial investment costs associated with implementing new technologies.

- Integration challenges with existing legacy systems in some industries.

- Cybersecurity concerns related to data storage and transmission in digital inspection.

- Skilled labor shortages in areas requiring expertise in advanced inspection technologies. This shortage is estimated to impact growth by approximately xx% by 2030.

Growth Drivers in the Germany Digital Inspection Market

The market’s growth is fueled by several key factors, including increasing automation across various sectors, stringent regulatory compliance needs, and the demand for improved product quality and safety. Government initiatives promoting digitalization and Industry 4.0 also contribute to market expansion. The rise of smart manufacturing and the increasing use of data analytics in quality control provide further opportunities.

Challenges Impacting Germany Digital Inspection Market Growth

Challenges include high initial investment costs for advanced technologies, potential cybersecurity risks, and the need for skilled labor to operate and maintain sophisticated inspection systems. Integration complexities with legacy systems also hinder the rapid adoption of digital solutions. Regulatory complexities across different sectors pose further hurdles to growth.

Key Players Shaping the Germany Digital Inspection Market

- Intertek Group PLC

- Société Générale de Surveillance SA (SGS SA)

- AQM S r l

- Applus Services SA

- RTM BREDA S r l

- A/S Baltic Control Group Ltd

- TÜV SÜD Limited

- Mistras GMA - Holding GmbH

- TUV Nord

- CIS Commodity Inspection Services BV

- VIC Inspection Services Holding Ltd

- Element Materials Technology Group Limited

- DEKRA SE

- UL LLC

- Kiwa NV

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- ATG Technology Group

Significant Germany Digital Inspection Market Industry Milestones

- June 2023: TÜV SÜD developed a new directional photometer for lighting system planning, offering precise 3D light distribution data.

- June 2023: DAkkS accredited a biobank at Heidelberg University Hospital, setting a standard for biobank operations in Germany.

Future Outlook for Germany Digital Inspection Market

The German digital inspection market is poised for continued growth driven by technological advancements, increasing regulatory requirements, and a focus on improved product quality and safety. Strategic partnerships and investments in R&D will further shape market dynamics. The market presents significant opportunities for companies offering innovative solutions that address the evolving needs of various sectors, while effectively navigating the challenges of technological integration and skilled labor availability.

Germany Digital Inspection Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End-user Vertical

- 2.1. Consumer Goods and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Minerals and Metals

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace and Rail

- 2.9. Other End-user Verticals

Germany Digital Inspection Market Segmentation By Geography

- 1. Germany

Germany Digital Inspection Market Regional Market Share

Geographic Coverage of Germany Digital Inspection Market

Germany Digital Inspection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Certification to be the Fastest Growing Type of Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Digital Inspection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Consumer Goods and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Minerals and Metals

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace and Rail

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Société Générale de Surveillance SA (SGS SA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AQM S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus Services SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RTM BREDA S r l

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A/S Baltic Control Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV SÜD Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mistras GMA - Holding GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TUV Nord*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CIS Commodity Inspection Services BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIC Inspection Services Holding Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Element Materials Technology Group Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DEKRA SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 UL LLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kiwa NV

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ALS Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bureau Veritas SA

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eurofins Scientific SE

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 ATG Technology Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Germany Digital Inspection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Digital Inspection Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Germany Digital Inspection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Germany Digital Inspection Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Digital Inspection Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Germany Digital Inspection Market?

Key companies in the market include Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), AQM S r l, Applus Services SA, RTM BREDA S r l, A/S Baltic Control Group Ltd, TÜV SÜD Limited, Mistras GMA - Holding GmbH, TUV Nord*List Not Exhaustive, CIS Commodity Inspection Services BV, VIC Inspection Services Holding Ltd, Element Materials Technology Group Limited, DEKRA SE, UL LLC, Kiwa NV, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Germany Digital Inspection Market?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations and Mandates to Ensure Product Safety and Environmental Protection.

6. What are the notable trends driving market growth?

Certification to be the Fastest Growing Type of Service.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: The TUV SUD created and tested a new directional photometer for use in lighting system planning. The tool is the first to offer extremely precise three-dimensional measuring information on how light is spread over things in a place. Lighting designers and manufacturers can greatly benefit from this information, which will help them examine and evaluate lighting circumstances more precisely in order to create particular moods or conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Digital Inspection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Digital Inspection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Digital Inspection Market?

To stay informed about further developments, trends, and reports in the Germany Digital Inspection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence