Key Insights

The global Oil & Gas Asset Tracking market is projected for substantial growth, reaching an estimated $8.9 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 25% through 2033. This expansion is driven by the imperative for enhanced operational efficiency, stringent safety standards, and optimized asset management throughout the oil and gas lifecycle. The upstream sector, characterized by complex and remote operations, demands precise tracking of exploration, drilling, and pipeline assets. Midstream and downstream operations, including transportation and refining, benefit significantly from real-time visibility for streamlined logistics, minimized downtime, and proactive maintenance. Advancements in IoT, AI analytics, and cloud platforms are crucial for delivering granular insights into asset performance, location, and condition, thereby mitigating risks of equipment failure and unauthorized access.

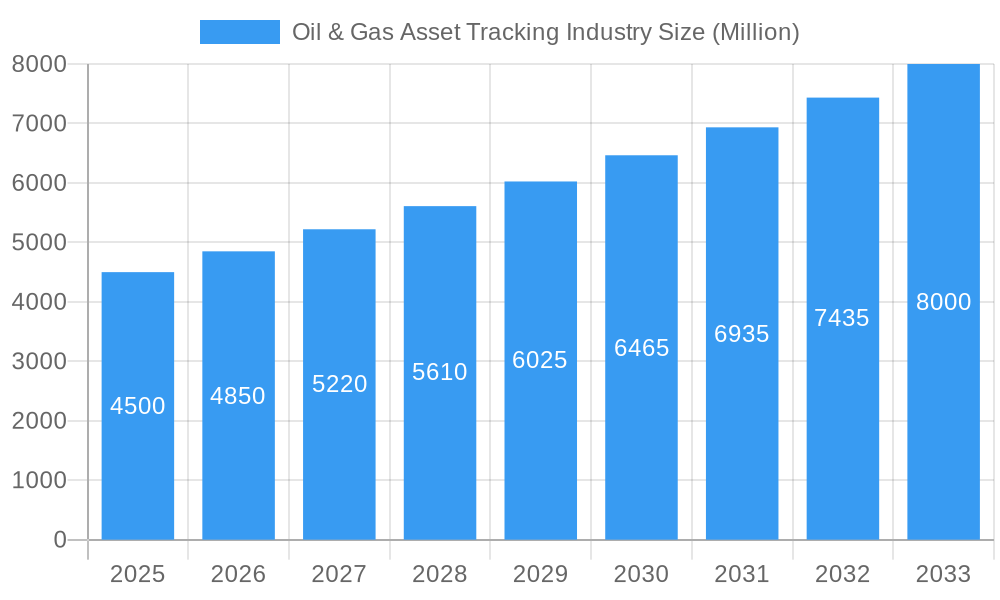

Oil & Gas Asset Tracking Industry Market Size (In Billion)

Regulatory compliance and growing Environmental, Social, and Governance (ESG) demands are further bolstering market growth, necessitating meticulous asset monitoring for leak detection, emissions control, and operational integrity. Key trends include the adoption of predictive maintenance leveraging historical and real-time data to prevent costly disruptions, and the increasing use of drones and remote sensing for inspecting hazardous infrastructure. While high initial investment and data security concerns may pose challenges, established and emerging players are actively developing comprehensive solutions for the evolving industry needs. Significant contributions are anticipated from North America and Europe, owing to their developed energy infrastructure and advanced technology adoption.

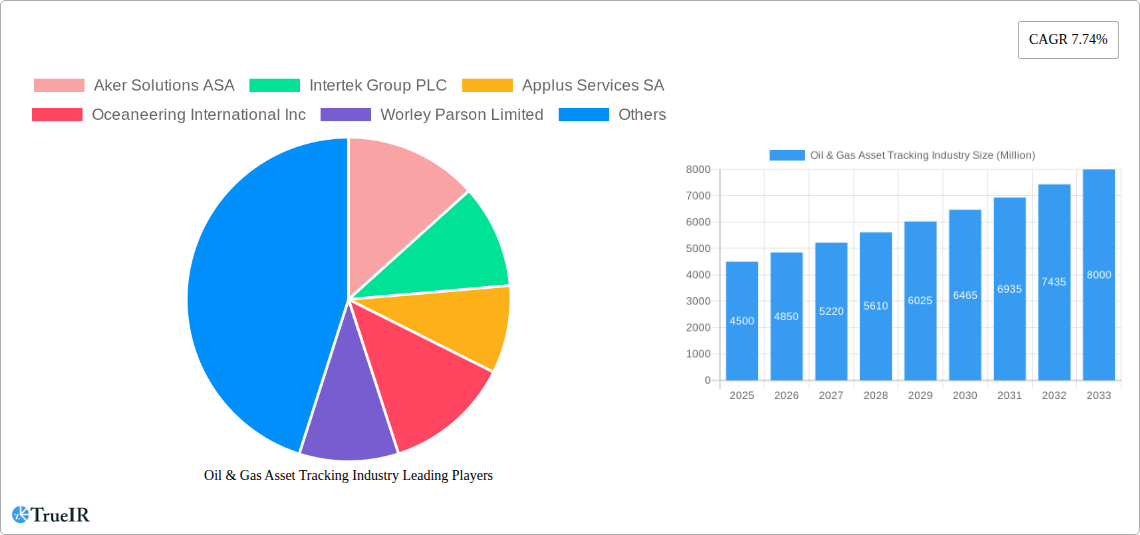

Oil & Gas Asset Tracking Industry Company Market Share

Oil & Gas Asset Tracking Industry Market Structure & Competitive Landscape

The Oil & Gas Asset Tracking industry exhibits a moderately consolidated market structure, driven by significant capital investment requirements and the imperative for specialized technological solutions. Innovation in areas such as IoT, AI-powered analytics, and advanced sensor technologies are key drivers, enabling enhanced predictive maintenance, operational efficiency, and safety compliance. Regulatory frameworks, particularly concerning environmental protection and asset integrity, also play a crucial role in shaping market strategies and product development. The threat of product substitutes, while present in basic tracking solutions, is mitigated by the complex and hazardous operating environments of the oil and gas sector, which demand robust and specialized asset tracking systems. End-user segmentation, primarily into Upstream, Midstream, and Downstream sectors, dictates varied demands for tracking capabilities. Mergers and acquisitions (M&A) trends are observed, with larger, established players acquiring innovative startups or expanding their service portfolios to capture a greater market share. For instance, recent M&A activity suggests a trend towards consolidation, aiming to achieve economies of scale and offer comprehensive solutions. Concentration ratios indicate that the top 5 players hold approximately 55% of the market share, with significant investments in R&D, valued at over $100 Million annually, fueling further market evolution.

Oil & Gas Asset Tracking Industry Market Trends & Opportunities

The global Oil & Gas Asset Tracking industry is poised for substantial growth, driven by increasing complexities in exploration, production, and distribution, coupled with stringent safety and environmental regulations. The market size is projected to reach an impressive USD 12,500 Million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period of 2025–2033. This expansion is fueled by a convergence of technological advancements and evolving operational demands.

Technological shifts are at the forefront of this growth. The integration of the Internet of Things (IoT) has revolutionized asset tracking, enabling real-time monitoring of equipment health, location, and operational status. This allows for proactive maintenance, minimizing costly downtime and enhancing operational efficiency. Advanced sensor technologies, coupled with AI and machine learning algorithms, are being deployed to predict equipment failures, optimize resource allocation, and improve overall safety protocols. The proliferation of digital twins for critical assets provides a virtual replica, facilitating comprehensive analysis and decision-making.

Consumer preferences, or rather, end-user demands, are increasingly leaning towards comprehensive, integrated solutions rather than standalone tracking devices. Oil and gas companies are seeking platforms that offer end-to-end asset lifecycle management, encompassing monitoring, maintenance, compliance, and performance optimization. This has led to a demand for customized solutions tailored to the unique needs of upstream, midstream, and downstream operations. The focus is shifting from mere location tracking to intelligent asset performance management.

Competitive dynamics are intensifying, with established players expanding their service offerings and new entrants bringing disruptive technologies to the market. Companies are investing heavily in research and development to stay ahead of the curve, leading to a continuous stream of product innovations. Strategic partnerships and collaborations are becoming common, aimed at leveraging complementary expertise and expanding market reach. The increasing adoption of cloud-based solutions is also a significant trend, offering scalability, accessibility, and advanced data analytics capabilities. Furthermore, the global push towards digital transformation within the oil and gas sector is a primary catalyst, encouraging companies to invest in advanced tracking and management systems to improve operational resilience and profitability. The market penetration rate for advanced asset tracking solutions is estimated to be around 60% by 2025, with significant potential for further growth.

Dominant Markets & Segments in Oil & Gas Asset Tracking Industry

The Oil & Gas Asset Tracking industry is characterized by distinct market dominance across various segments and geographical regions, driven by infrastructure, regulatory policies, and operational priorities.

Dominant Location of Deployment:

- Onshore: The onshore segment currently holds a dominant position, accounting for approximately 65% of the total market share in 2025. This dominance is attributed to the vast network of onshore oil and gas fields, pipelines, processing plants, and storage facilities that require continuous monitoring and management. Key growth drivers in the onshore sector include the increasing need for efficient management of aging infrastructure, the development of new unconventional resources requiring sophisticated tracking, and enhanced safety regulations for land-based operations. The growing emphasis on pipeline integrity management and leak detection further bolsters the demand for advanced tracking solutions.

- Offshore: While currently representing a smaller share, the offshore segment is experiencing rapid growth and is projected to significantly increase its market presence. The inherent complexities and hazardous nature of offshore operations, including deepwater exploration and production, necessitate highly reliable and precise asset tracking systems. Growth drivers include the exploration of new offshore frontiers, the need for robust integrity management of subsea assets, and stringent safety protocols for offshore platforms. Technological advancements in subsea robotics and remote monitoring are also contributing to the expansion of offshore asset tracking.

Dominant Sector:

- Upstream: The upstream sector, encompassing exploration and production, is a leading segment within the Oil & Gas Asset Tracking industry. This is driven by the critical need to monitor vast and often remote exploration sites, drilling equipment, and production assets in real-time. The upstream sector accounts for an estimated 50% of the market share in 2025. Growth drivers include the increasing demand for oil and gas, the drive to optimize production from existing reserves, and the application of new technologies like AI for reservoir management and predictive maintenance of drilling rigs and associated equipment. The cost-effectiveness derived from efficient asset utilization and reduced downtime in exploration activities further propels its dominance.

- Midstream: The midstream sector, responsible for the transportation and storage of oil and gas, is another significant segment. This includes pipelines, terminals, and storage facilities. The market share for the midstream sector is estimated at 30% in 2025. Key growth drivers are the continuous expansion and maintenance of pipeline networks, the need for leak detection and prevention, and efficient inventory management. Regulatory pressures for pipeline safety and environmental protection are also significant contributors to growth.

- Downstream: The downstream sector, involving refining and marketing, represents the remaining 20% of the market share in 2025. While seemingly smaller, this segment is increasingly adopting advanced tracking for optimizing refinery operations, managing logistics of refined products, and ensuring supply chain efficiency. Growth drivers include the need for real-time monitoring of complex refining processes, managing a distributed network of retail outlets, and ensuring compliance with product quality standards. The implementation of smart technologies in refineries for asset performance and safety is also a growing trend.

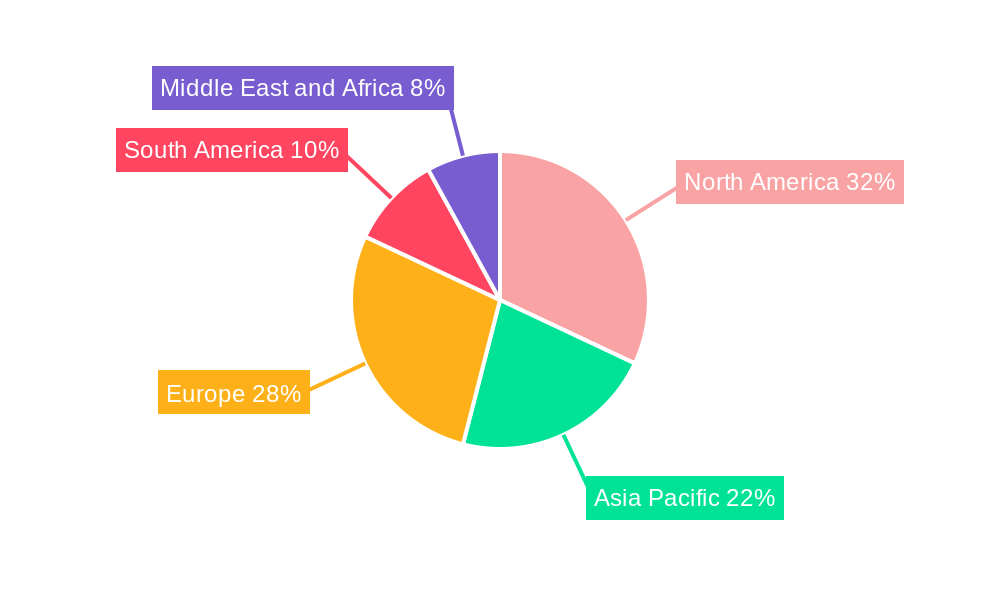

Dominant Regions:

North America currently leads the market, driven by its substantial oil and gas production, advanced technological adoption, and stringent regulatory environment. Asia Pacific is emerging as a high-growth region due to increasing exploration activities and infrastructure development.

Oil & Gas Asset Tracking Industry Product Analysis

The Oil & Gas Asset Tracking industry is witnessing rapid product innovation focused on enhancing operational efficiency, safety, and compliance. Key advancements include the development of highly robust, ruggedized IoT sensors capable of withstanding extreme environmental conditions, from deep offshore subsea pressures to arid desert temperatures. These sensors, integrated with GPS, RFID, and cellular technologies, provide real-time location and condition monitoring for a wide range of assets, including pipelines, drilling equipment, vehicles, and personnel. Furthermore, AI-powered analytics platforms are transforming raw data into actionable insights, enabling predictive maintenance, anomaly detection, and optimized resource allocation. The competitive advantage lies in the ability of these solutions to offer comprehensive asset lifecycle management, seamlessly integrating data from multiple sources and providing end-to-end visibility across upstream, midstream, and downstream operations.

Key Drivers, Barriers & Challenges in Oil & Gas Asset Tracking Industry

Key Drivers:

The Oil & Gas Asset Tracking industry is propelled by several key drivers. The increasing demand for oil and gas, coupled with the need to optimize production from existing and new reserves, necessitates efficient asset management. Technological advancements, particularly in IoT, AI, and drone technology, are enabling more sophisticated tracking and monitoring solutions, leading to improved operational efficiency and reduced downtime. Stringent safety and environmental regulations worldwide mandate better oversight of assets, driving the adoption of tracking systems for compliance and risk mitigation. The trend towards digitalization and Industry 4.0 within the oil and gas sector further fuels the integration of advanced tracking technologies.

Barriers & Challenges:

Despite robust growth drivers, the industry faces significant barriers and challenges. The high upfront capital investment required for implementing advanced tracking systems can be a constraint, particularly for smaller operators. The complex and often remote operating environments present challenges in terms of connectivity, power supply, and the durability of tracking devices. Cybersecurity threats to connected assets are a growing concern, requiring robust security protocols. Furthermore, the industry faces a shortage of skilled personnel capable of implementing and managing these sophisticated technologies. Integrating new tracking systems with legacy infrastructure can also be a complex and time-consuming process. Supply chain disruptions can impact the availability of critical components, leading to project delays.

Growth Drivers in the Oil & Gas Asset Tracking Industry Market

The Oil & Gas Asset Tracking industry's growth is primarily fueled by the persistent global demand for energy resources, pushing exploration and production into more challenging environments. Technological innovation serves as a major catalyst, with the widespread adoption of the Internet of Things (IoT) enabling real-time monitoring of asset performance and health, thereby minimizing costly downtime. Artificial intelligence (AI) and machine learning are further enhancing these capabilities through predictive maintenance and anomaly detection. Stringent safety and environmental regulations across the globe are compelling companies to invest in robust tracking solutions to ensure compliance and mitigate operational risks. Moreover, the broader digital transformation initiatives within the oil and gas sector are accelerating the integration of advanced asset management technologies.

Challenges Impacting Oil & Gas Asset Tracking Industry Growth

Despite its growth trajectory, the Oil & Gas Asset Tracking industry encounters several significant challenges. The substantial initial investment required for sophisticated tracking systems can be a deterrent, especially for smaller exploration and production companies. The inherent complexities of the oil and gas operating environments, often characterized by remote locations and extreme conditions, pose connectivity and device durability challenges. Cybersecurity threats targeting connected assets represent a growing concern, necessitating advanced security measures. Furthermore, a persistent skills gap exists within the industry, with a shortage of qualified professionals to effectively implement and manage these cutting-edge tracking solutions. Integrating new technological frameworks with existing legacy systems also presents a considerable hurdle, often leading to extended implementation timelines and increased costs.

Key Players Shaping the Oil & Gas Asset Tracking Industry Market

- Aker Solutions ASA

- Intertek Group PLC

- Applus Services SA

- Oceaneering International Inc

- Worley Parson Limited

- GE Digital

- Penspen Ltd

- Fluor Corporation

- EMI Group

- Technip FMC PLC

- Bureau Veritas SA

- ABS Group

- FLYABILITY SA

Significant Oil & Gas Asset Tracking Industry Industry Milestones

- January 2021: Neptune Energy announced contracts for integrity management and fabric maintenance for its operated gas production platform, Cygnus. Oceaneering was awarded contracts valued at approximately USD 6.5 Million, likely to encompass pressure systems, structural, pipeline, erosion management, and offshore inspection services. Oceaneering's close collaboration with Stork, responsible for fabric maintenance and scaffolding for Cygnus in the UK Southern North Sea, highlights integrated service approaches.

Future Outlook for Oil & Gas Asset Tracking Industry Market

The future outlook for the Oil & Gas Asset Tracking industry is exceptionally promising, driven by an unwavering global energy demand and the relentless pursuit of operational excellence. Strategic opportunities lie in the continued integration of AI and machine learning for advanced predictive analytics, enabling even greater precision in asset performance management and risk mitigation. The expansion of IoT network coverage and the development of more energy-efficient and resilient tracking devices will further solidify market penetration. Growth will be further catalyzed by the increasing adoption of autonomous systems and drone technology for inspections and monitoring in hazardous or inaccessible areas. Companies that can offer comprehensive, end-to-end digital solutions, encompassing data analytics, cybersecurity, and seamless integration with existing infrastructure, will be best positioned for success in this evolving market.

Oil & Gas Asset Tracking Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Sector

- 2.1. Upstream

- 2.2. Midstream

- 2.3. Downstream

Oil & Gas Asset Tracking Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Oil & Gas Asset Tracking Industry Regional Market Share

Geographic Coverage of Oil & Gas Asset Tracking Industry

Oil & Gas Asset Tracking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Upstream

- 5.2.2. Midstream

- 5.2.3. Downstream

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Upstream

- 6.2.2. Midstream

- 6.2.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Asia Pacific Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Upstream

- 7.2.2. Midstream

- 7.2.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Upstream

- 8.2.2. Midstream

- 8.2.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. South America Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Sector

- 9.2.1. Upstream

- 9.2.2. Midstream

- 9.2.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Middle East and Africa Oil & Gas Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Sector

- 10.2.1. Upstream

- 10.2.2. Midstream

- 10.2.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aker Solutions ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intertek Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Applus Services SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oceaneering International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Worley Parson Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Digital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Penspen Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fluor Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EMI Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Technip FMC PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bureau Veritas SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ABS Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FLYABILITY SA*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Global Oil & Gas Asset Tracking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Oil & Gas Asset Tracking Industry Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 3: North America Oil & Gas Asset Tracking Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Oil & Gas Asset Tracking Industry Revenue (billion), by Sector 2025 & 2033

- Figure 5: North America Oil & Gas Asset Tracking Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 6: North America Oil & Gas Asset Tracking Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Oil & Gas Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Oil & Gas Asset Tracking Industry Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 9: Asia Pacific Oil & Gas Asset Tracking Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 10: Asia Pacific Oil & Gas Asset Tracking Industry Revenue (billion), by Sector 2025 & 2033

- Figure 11: Asia Pacific Oil & Gas Asset Tracking Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Asia Pacific Oil & Gas Asset Tracking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Oil & Gas Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Oil & Gas Asset Tracking Industry Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 15: Europe Oil & Gas Asset Tracking Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: Europe Oil & Gas Asset Tracking Industry Revenue (billion), by Sector 2025 & 2033

- Figure 17: Europe Oil & Gas Asset Tracking Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 18: Europe Oil & Gas Asset Tracking Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Oil & Gas Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Oil & Gas Asset Tracking Industry Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 21: South America Oil & Gas Asset Tracking Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 22: South America Oil & Gas Asset Tracking Industry Revenue (billion), by Sector 2025 & 2033

- Figure 23: South America Oil & Gas Asset Tracking Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 24: South America Oil & Gas Asset Tracking Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Oil & Gas Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 27: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 28: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue (billion), by Sector 2025 & 2033

- Figure 29: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 30: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Oil & Gas Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 3: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 5: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 6: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 9: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 12: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 14: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 15: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 17: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 18: Global Oil & Gas Asset Tracking Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil & Gas Asset Tracking Industry?

The projected CAGR is approximately 25%.

2. Which companies are prominent players in the Oil & Gas Asset Tracking Industry?

Key companies in the market include Aker Solutions ASA, Intertek Group PLC, Applus Services SA, Oceaneering International Inc, Worley Parson Limited, GE Digital, Penspen Ltd, Fluor Corporation, EMI Group, Technip FMC PLC, Bureau Veritas SA, ABS Group, FLYABILITY SA*List Not Exhaustive.

3. What are the main segments of the Oil & Gas Asset Tracking Industry?

The market segments include Location of Deployment, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In January 2021, contracts regarding integrity management and fabric maintenance were announced by Neptune Energy for its operated gas production platform, Cygnus, to Oceaneering and Stork companies, which were valued at approximately USD 6.5 million. Oceaneering is likely to supply integrity management services covering pressure systems, structural, pipeline, erosion management, and offshore inspection services. Moreover, Oceaneering works closely with Stork, which delivers fabric maintenance and scaffolding services for Cygnus, located in the UK Southern North Sea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil & Gas Asset Tracking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil & Gas Asset Tracking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil & Gas Asset Tracking Industry?

To stay informed about further developments, trends, and reports in the Oil & Gas Asset Tracking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence