Key Insights

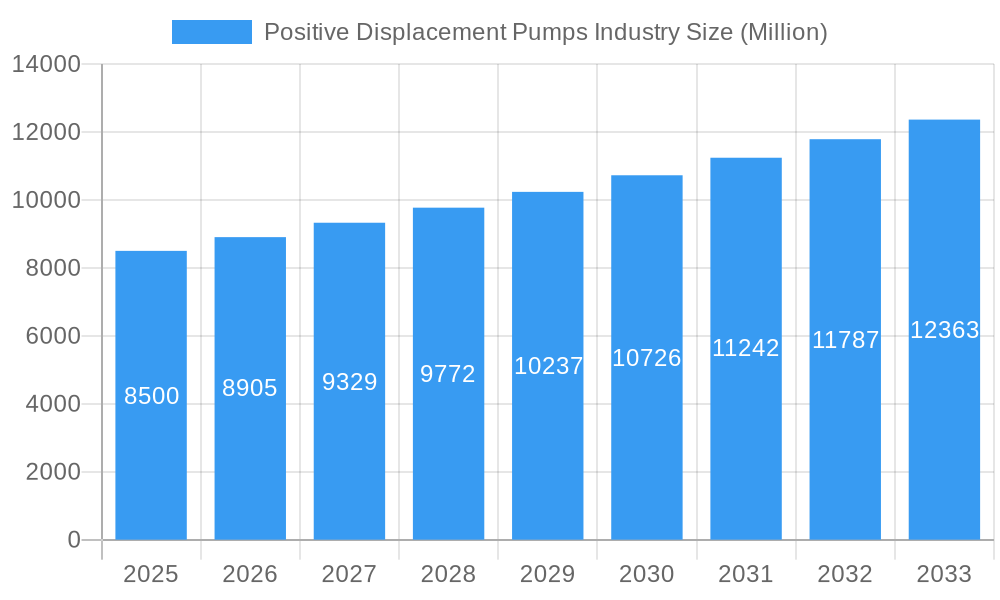

The global Positive Displacement Pumps market is projected for substantial expansion, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.42% through the forecast period of 2025-2033. The market size was valued at 29.38 billion in the base year 2025 and is expected to witness significant growth. This expansion is primarily driven by escalating demand from critical sectors including Oil and Gas, Power Generation, and Water and Wastewater treatment. These industries depend on the precise and consistent fluid transfer capabilities of positive displacement pumps for applications requiring high viscosity handling, accurate dosing, and operation under extreme pressures. The growing chemical industry, with its evolving process needs and stringent regulations, also presents a considerable growth opportunity. The inherent reliability and efficiency of positive displacement pumps in challenging fluid handling scenarios solidify their essential role in global industrial operations, fueling this positive market trajectory.

Positive Displacement Pumps Industry Market Size (In Billion)

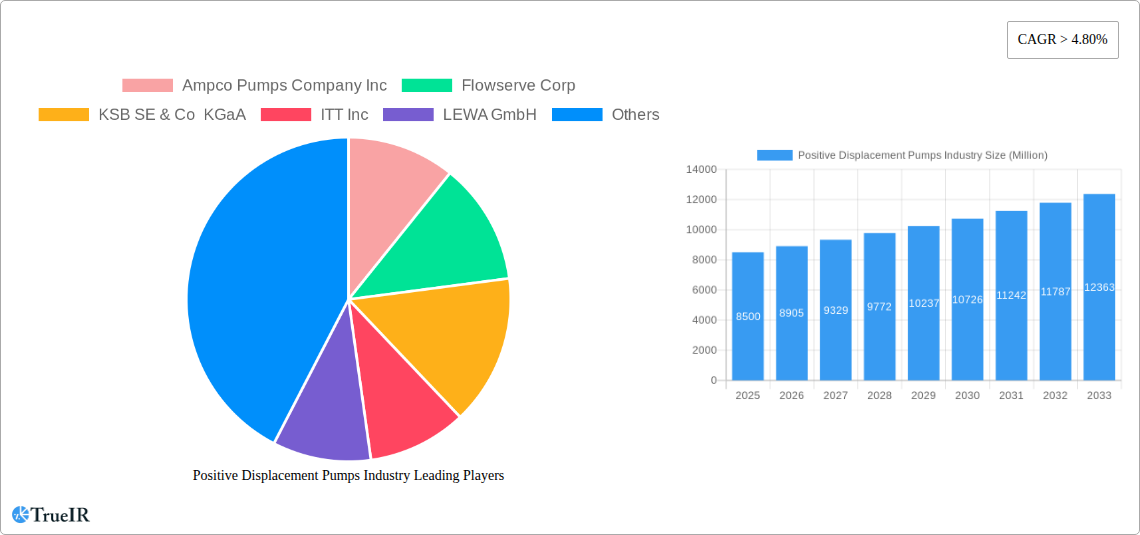

Key trends influencing the positive displacement pump industry revolve around technological advancements driving the development of more energy-efficient and intelligent pump designs. Manufacturers are prioritizing smart pump technologies with advanced monitoring, control, and predictive maintenance features to enhance operational efficiency and minimize end-user downtime. The integration of IoT and digital solutions is also a significant trend, facilitating remote diagnostics and optimized performance management. While strong demand fuels market growth, certain restraints exist, including the high initial capital expenditure for some pump types and increasing competition from alternative technologies in less demanding applications. Nevertheless, the distinct advantages of positive displacement pumps in high-performance niches, coupled with continuous innovation, are expected to overcome these challenges and maintain market dominance in critical industrial segments. Leading companies such as Flowserve Corp, KSB SE & Co KGaA, and Xylem Inc. are actively engaged in this dynamic market through product innovation and strategic expansions.

Positive Displacement Pumps Industry Company Market Share

Positive Displacement Pumps Industry: Comprehensive Market Analysis & Forecast (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the global Positive Displacement Pumps industry, offering unparalleled insights for stakeholders. Leveraging high-volume keywords and detailed market intelligence, this report is designed to enhance search rankings and engage industry professionals seeking comprehensive market understanding. The study encompasses a historical period from 2019 to 2024, a base year of 2025, and an extensive forecast period extending to 2033. This report is ready for immediate use without further modification.

Positive Displacement Pumps Industry Market Structure & Competitive Landscape

The global Positive Displacement Pumps industry is characterized by a moderately consolidated market structure, with key players investing heavily in research and development to drive innovation. Innovation drivers include the demand for higher efficiency, improved durability, and specialized solutions for complex fluid handling applications across various end-user industries. Regulatory impacts, particularly those related to environmental standards and safety in sectors like Oil and Gas and Water and Wastewater, also shape market dynamics by necessitating the adoption of advanced pump technologies. Product substitutes, while present in some niche applications, are generally unable to match the precise flow control and high-pressure capabilities offered by positive displacement pumps. End-user segmentation analysis reveals a significant reliance on critical industries such as Oil and Gas, Power Generation, and Water and Wastewater, with the Chemical sector also representing a substantial market share. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with companies seeking to expand their product portfolios, geographic reach, and technological capabilities. For instance, the acquisition of LEWA GmbH by Atlas Copco highlights a trend towards integrating specialized pump manufacturers into larger industrial conglomerates, aiming for synergistic growth and enhanced market presence. The concentration ratio among the top five players is estimated to be around 65%, underscoring the significant influence of established market leaders. M&A volumes have seen an upward trajectory in recent years, reflecting a robust appetite for strategic partnerships and acquisitions to gain competitive advantages.

Positive Displacement Pumps Industry Market Trends & Opportunities

The Positive Displacement Pumps market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of over $35 billion by the end of the forecast period. This robust expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and persistent competitive dynamics across a diverse range of end-user industries. The increasing demand for efficient and reliable fluid handling solutions in sectors like Water and Wastewater treatment, driven by growing global populations and stringent environmental regulations, represents a significant growth catalyst. Similarly, the Oil and Gas industry continues to be a cornerstone for positive displacement pumps, with ongoing exploration and production activities requiring dependable pumping systems for crude oil, chemicals, and other vital fluids. Technological shifts are a major trend, with manufacturers focusing on developing pumps with enhanced energy efficiency, reduced maintenance requirements, and improved material science for increased durability and chemical resistance. The advent of smart pumps, incorporating IoT capabilities for remote monitoring, predictive maintenance, and optimized performance, is creating new avenues for market penetration. Consumer preferences are increasingly leaning towards customized solutions that address specific application needs, leading to a surge in demand for specialized pump designs and configurations. This includes pumps designed for high viscosity fluids, abrasive materials, and critical dosing applications in the chemical and pharmaceutical industries. Competitive dynamics are intensifying, with both established players and emerging companies vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. The focus on sustainability and reduced environmental impact is also shaping preferences, with a growing emphasis on energy-efficient pump designs and leak-free operation. Opportunities abound for manufacturers who can offer solutions that align with these evolving trends, particularly in the areas of advanced material composites, intelligent control systems, and eco-friendly pump technologies. The increasing industrialization in developing economies further presents a significant untapped market potential for positive displacement pumps.

Dominant Markets & Segments in Positive Displacement Pumps Industry

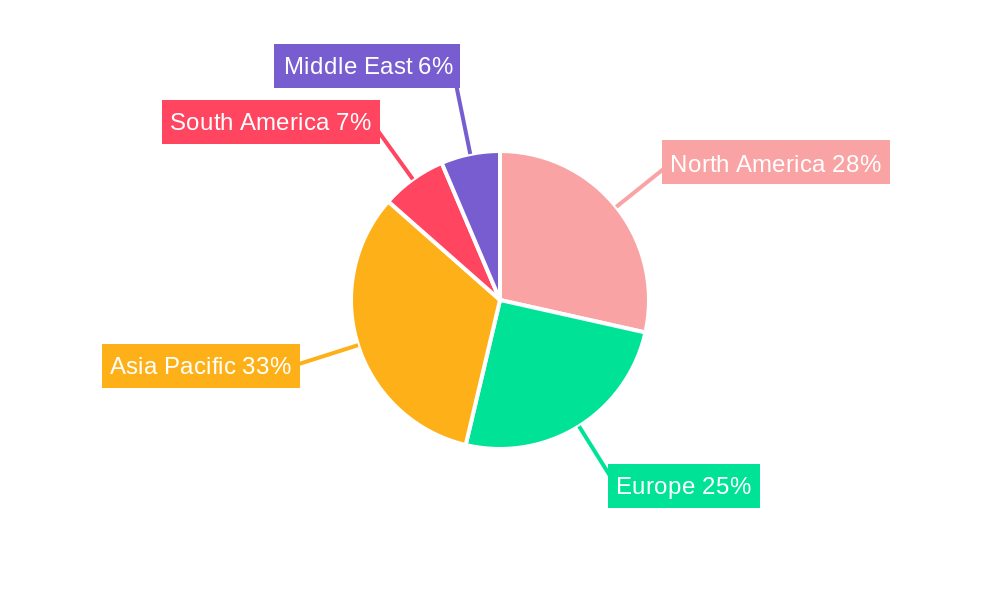

The global Positive Displacement Pumps industry demonstrates distinct dominance across specific regions and end-user segments, driven by robust industrial activity and specialized application needs.

Dominant Region: North America currently holds a significant market share, primarily due to its established and technologically advanced Oil and Gas sector, along with a strong presence in Water and Wastewater infrastructure development and a thriving Chemical industry.

Leading Country: The United States leads in terms of market value, benefiting from extensive investments in energy infrastructure, petrochemicals, and municipal water systems.

Dominant Segment by End-User Industry:

- Oil and Gas: This segment remains the largest consumer of positive displacement pumps, utilizing them extensively in exploration, production, transportation, and refining processes. The need for robust, high-pressure, and chemically resistant pumps for handling crude oil, natural gas, and various processing chemicals drives consistent demand. Global energy demand and price fluctuations continue to influence investment cycles in this sector.

- Water and Wastewater: This segment is experiencing rapid growth, propelled by increasing urbanization, aging infrastructure requiring upgrades, and stringent regulations on water quality and wastewater treatment. Positive displacement pumps are crucial for desalination, sewage treatment, sludge transfer, and precise chemical dosing for purification. The global push for sustainable water management and access to clean water is a significant growth driver.

- Chemical: The chemical industry relies heavily on positive displacement pumps for accurate metering, transfer of hazardous and corrosive chemicals, and processes requiring high viscosity fluid handling. Growth in specialty chemicals, pharmaceuticals, and agricultural chemicals contributes to the sustained demand.

- Power Generation: While not as dominant as Oil and Gas or Water and Wastewater, the power generation sector utilizes positive displacement pumps for boiler feed water, chemical treatment, and lubrication systems, particularly in thermal and nuclear power plants.

Dominant Segment by Type:

- Rotary Pumps: This category, encompassing gear, screw, vane, and lobe pumps, often leads in market share due to their versatility, continuous flow, and suitability for a wide range of viscosities and pressures. They are widely adopted across most end-user industries for their efficiency and reliability.

- Reciprocating Pumps: While sometimes having higher pressure capabilities and precise metering accuracy, reciprocating pumps, including piston, plunger, and diaphragm pumps, cater to specific high-demand applications within segments like Oil and Gas and specialized chemical processing. Diaphragm metering pumps, in particular, are critical for accurate dosing in various industrial applications.

Key growth drivers across these segments include ongoing infrastructure development projects, supportive government policies promoting industrial growth and environmental protection, and the continuous need for reliable and efficient fluid transfer in critical industrial processes. The increasing complexity of industrial operations and the demand for precise process control further solidify the importance of positive displacement pumps.

Positive Displacement Pumps Industry Product Analysis

Positive displacement pumps are crucial for applications demanding precise flow control, high pressure, and reliable performance with challenging fluids. Product innovations are focused on enhancing energy efficiency, improving material durability against corrosive and abrasive media, and integrating smart technologies for remote monitoring and diagnostics. Examples include advanced sealing technologies for leak-free operation, specialized coatings for extended wear life, and the development of pumps constructed from high-performance composites like the proprietary thermoplastic polymer composite material announced by CDI Energy Products in May 2021, aimed at improving performance and longevity in demanding environments. These advancements provide competitive advantages by reducing operational costs, minimizing downtime, and ensuring process safety and accuracy across diverse industries such as oil and gas, chemical processing, and water treatment.

Key Drivers, Barriers & Challenges in Positive Displacement Pumps Industry

Key Drivers:

The Positive Displacement Pumps industry is propelled by several key factors. Technologically, the growing demand for high-efficiency, energy-saving pumps that minimize operational costs is a significant driver. Economic factors, such as increased industrialization and infrastructure development globally, particularly in emerging economies, directly translate to higher demand for pumping solutions. Policy-driven factors, including stringent environmental regulations mandating improved water treatment and emissions control, necessitate the use of advanced and reliable positive displacement pumps for precise chemical dosing and fluid transfer. The ongoing expansion of the Oil and Gas sector, coupled with its need for robust fluid handling, remains a consistent growth driver.

Key Barriers & Challenges:

Despite its growth, the industry faces several challenges. Supply chain issues, including the availability of raw materials and components, can lead to production delays and increased costs. Regulatory hurdles, while often driving innovation, can also present complexities in terms of compliance and product certification, particularly for specialized applications in hazardous environments. Competitive pressures from both established players and new entrants, especially those offering lower-cost alternatives for less demanding applications, can impact market share and profitability. The initial capital investment for some advanced positive displacement pump systems can also be a barrier for smaller enterprises. Furthermore, the cyclical nature of some key end-user industries, like Oil and Gas, can lead to fluctuations in demand.

Growth Drivers in the Positive Displacement Pumps Industry Market

The Positive Displacement Pumps market is experiencing robust growth driven by several key factors. Technologically, the relentless pursuit of energy efficiency and reduced operational expenditure is pushing demand for advanced pump designs and materials. Economically, increased global industrialization, coupled with significant investments in infrastructure development across water and wastewater treatment, oil and gas exploration, and chemical manufacturing, directly fuels the need for reliable fluid handling systems. Policy-driven initiatives aimed at environmental protection, such as stricter water quality standards and emissions control mandates, are compelling industries to adopt more precise and efficient pumping technologies, often requiring the accuracy of positive displacement pumps for chemical dosing and waste management.

Challenges Impacting Positive Displacement Pumps Industry Growth

Several barriers and restraints are impacting the growth of the Positive Displacement Pumps industry. Regulatory complexities in different regions, particularly concerning safety standards and environmental compliance for handling hazardous materials, can lead to prolonged approval processes and increased operational costs. Persistent supply chain disruptions, including raw material shortages and logistics challenges, can affect production timelines and elevate manufacturing expenses. Intense competitive pressures from both established global manufacturers and emerging low-cost providers, especially for less specialized applications, can compress profit margins. Moreover, the significant upfront capital investment required for some of the more sophisticated positive displacement pump systems can act as a restraint for smaller businesses or those in developing markets.

Key Players Shaping the Positive Displacement Pumps Industry Market

- Ampco Pumps Company Inc

- Flowserve Corp

- KSB SE & Co KGaA

- ITT Inc

- LEWA GmbH

- SPX Flow Inc

- NETZSCH Holding

- Xylem Inc

- Sulzer AG

- Pentair PLC

Significant Positive Displacement Pumps Industry Industry Milestones

- March 2022: Atlas Copco announced the agreement to acquire LEWA GmbH and subsidiaries and Geveke BV and subsidiaries, significantly bolstering its position in the process pump and metering pump markets, particularly with LEWA's expertise in diaphragm metering, process, and positive displacement pumps.

- May 2021: CDI Energy Products announced the development and launch of its newest proprietary thermoplastic polymer composite material, specifically designed to enhance the performance and durability of centrifugal and positive displacement pumps in demanding industrial applications.

Future Outlook for Positive Displacement Pumps Industry Market

The future outlook for the Positive Displacement Pumps industry is exceptionally positive, driven by continuous technological advancements and expanding applications across critical sectors. The increasing global focus on sustainable water management, coupled with the ongoing demand from the energy sector for efficient fluid transfer, will serve as significant growth catalysts. Strategic opportunities lie in the development of smart, connected pumps offering predictive maintenance capabilities and optimized performance through IoT integration. Furthermore, the rising adoption of specialized positive displacement pumps for complex chemical processing, pharmaceutical manufacturing, and emerging bio-energy applications presents substantial market potential. Investments in advanced materials and energy-efficient designs will remain crucial for maintaining a competitive edge, ensuring the industry's sustained growth and relevance in a dynamic global market.

Positive Displacement Pumps Industry Segmentation

-

1. Type

- 1.1. Reciprocating

- 1.2. Rotary

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Water and Wastewater

- 2.4. Chemical

- 2.5. Other End-user Industries

Positive Displacement Pumps Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Positive Displacement Pumps Industry Regional Market Share

Geographic Coverage of Positive Displacement Pumps Industry

Positive Displacement Pumps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Increasing Demand from the EV4.; Growing Renewable Energy Market

- 3.3. Market Restrains

- 3.3.1. 4.; Demand-Supply Mismatch for Raw Materials

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Sector to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Reciprocating

- 5.1.2. Rotary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Water and Wastewater

- 5.2.4. Chemical

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Reciprocating

- 6.1.2. Rotary

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Water and Wastewater

- 6.2.4. Chemical

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Reciprocating

- 7.1.2. Rotary

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Water and Wastewater

- 7.2.4. Chemical

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Reciprocating

- 8.1.2. Rotary

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Water and Wastewater

- 8.2.4. Chemical

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Reciprocating

- 9.1.2. Rotary

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Water and Wastewater

- 9.2.4. Chemical

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Positive Displacement Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Reciprocating

- 10.1.2. Rotary

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Water and Wastewater

- 10.2.4. Chemical

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ampco Pumps Company Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KSB SE & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITT Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LEWA GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SPX Flow Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NETZSCH Holding

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xylem Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sulzer AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pentair PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ampco Pumps Company Inc

List of Figures

- Figure 1: Global Positive Displacement Pumps Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Positive Displacement Pumps Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Positive Displacement Pumps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Positive Displacement Pumps Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Positive Displacement Pumps Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Positive Displacement Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Positive Displacement Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Positive Displacement Pumps Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Positive Displacement Pumps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Positive Displacement Pumps Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Positive Displacement Pumps Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Positive Displacement Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Positive Displacement Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Positive Displacement Pumps Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Positive Displacement Pumps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Positive Displacement Pumps Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Positive Displacement Pumps Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Positive Displacement Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Positive Displacement Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Positive Displacement Pumps Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Positive Displacement Pumps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Positive Displacement Pumps Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Positive Displacement Pumps Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Positive Displacement Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Positive Displacement Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Positive Displacement Pumps Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Positive Displacement Pumps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Positive Displacement Pumps Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Positive Displacement Pumps Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Positive Displacement Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Positive Displacement Pumps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Positive Displacement Pumps Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Positive Displacement Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Positive Displacement Pumps Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the Positive Displacement Pumps Industry?

Key companies in the market include Ampco Pumps Company Inc, Flowserve Corp, KSB SE & Co KGaA, ITT Inc, LEWA GmbH, SPX Flow Inc, NETZSCH Holding, Xylem Inc *List Not Exhaustive, Sulzer AG, Pentair PLC.

3. What are the main segments of the Positive Displacement Pumps Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.38 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand from the EV4.; Growing Renewable Energy Market.

6. What are the notable trends driving market growth?

Water and Wastewater Sector to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Demand-Supply Mismatch for Raw Materials.

8. Can you provide examples of recent developments in the market?

In March 2022, Atlas Copco agreed to acquire LEWA GmbH and subsidiaries and Geveke BV and subsidiaries. LEWA is a leading manufacturer of diaphragm metering pumps, process pumps, and positive displacement pumps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Positive Displacement Pumps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Positive Displacement Pumps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Positive Displacement Pumps Industry?

To stay informed about further developments, trends, and reports in the Positive Displacement Pumps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence