Key Insights

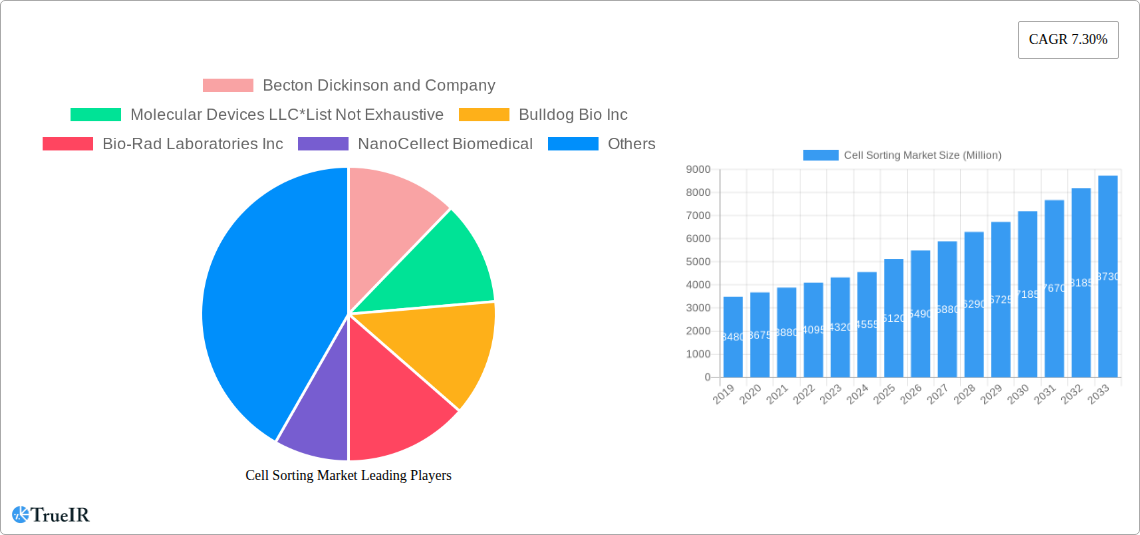

The global cell sorting market is projected for significant expansion, reaching an estimated market size of $281.6 million by 2025, with a Compound Annual Growth Rate (CAGR) of 9.2% through 2033. This growth is driven by the increasing prevalence of chronic diseases, the rising demand for personalized medicine, and continuous technological advancements, including fluorescence-based droplet cell sorting and magnetic-activated cell sorting (MACS). Substantial investments in life sciences R&D further support market expansion.

Cell Sorting Market Market Size (In Million)

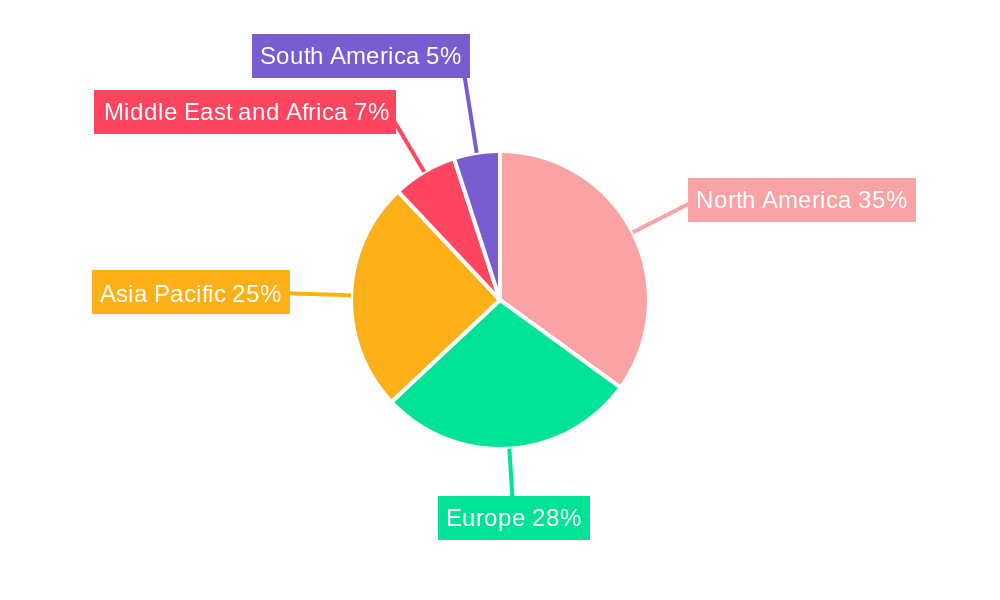

North America is anticipated to lead the market due to its robust research infrastructure and high adoption of advanced technologies. Europe and Asia Pacific will also experience strong growth, fueled by increasing R&D investments and a burgeoning biotechnology sector. Key restraints, such as the high cost of advanced instruments, are being mitigated by the growing availability of cell sorting services and more cost-effective solutions. The market is characterized by intense competition and dynamic innovation.

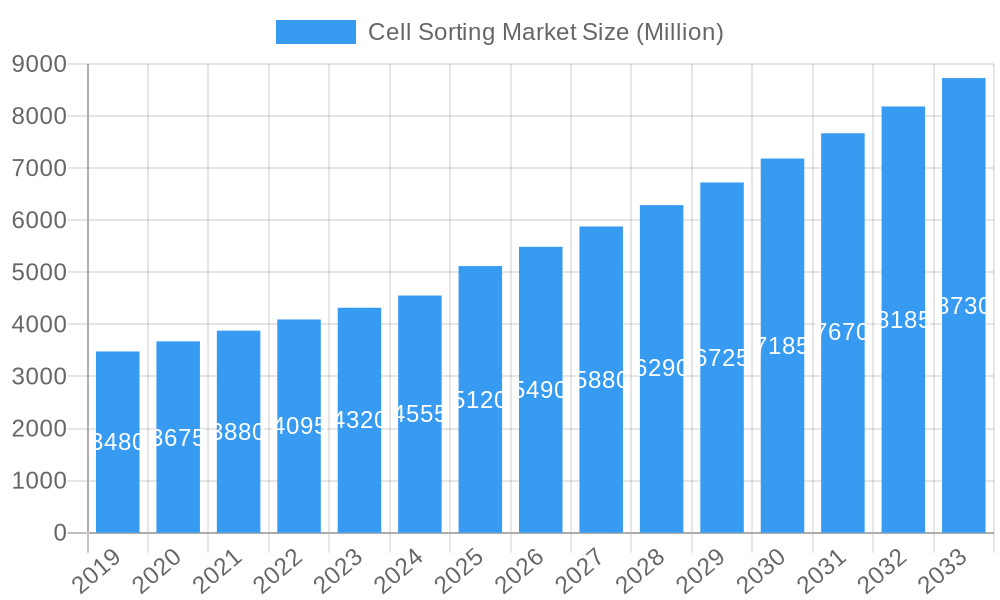

Cell Sorting Market Company Market Share

This report provides an in-depth analysis of the global cell sorting market, a critical sector for life sciences, diagnostics, and therapeutics. It examines market dynamics, technological advancements such as fluorescence-based droplet cell sorting and magnetic-activated cell sorting (MACS), competitive landscape, and future potential. The study covers the period 2019-2033, with a base year of 2025.

Cell Sorting Market Market Structure & Competitive Landscape

The cell sorting market exhibits a moderately concentrated structure, characterized by a mix of established global players and emerging innovators. Key innovation drivers include the relentless pursuit of higher throughput, increased accuracy, and novel applications in areas like single-cell genomics, immunotherapy, and drug discovery. Regulatory impacts, particularly stringent FDA and EMA guidelines for diagnostic and therapeutic applications, shape product development and market entry strategies. Product substitutes, while limited, can emerge from advancements in other cell analysis techniques. The end-user segmentation is crucial, with pharmaceutical and biotechnology companies and research institutions representing the largest consumer bases. Mergers and acquisitions (M&A) trends are observed as major companies seek to expand their portfolios, acquire disruptive technologies, or gain market share. For instance, the historical period saw an average of 2-3 significant M&A activities annually, totaling an estimated market value of over $500 Million. Concentration ratios among the top five players are estimated to be around 60-65%, indicating a significant but not fully consolidated market.

Cell Sorting Market Market Trends & Opportunities

The global cell sorting market is poised for substantial growth, driven by an accelerating demand for precise cellular analysis across various life science disciplines. Market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 10-12% during the forecast period, reaching an estimated market value exceeding $3,500 Million by 2033. This growth is fueled by significant technological shifts, including the miniaturization of cell sorting devices, the integration of artificial intelligence for enhanced data analysis, and the development of higher-parameter sorting capabilities. Consumer preferences are increasingly leaning towards solutions offering greater automation, reduced hands-on time, and superior cell viability post-sorting. The competitive dynamics are intensifying, with companies investing heavily in R&D to differentiate their offerings and capture market share. Opportunities abound in the development of cost-effective solutions for emerging markets, specialized cell sorters for niche applications like rare cell isolation, and integrated platforms that combine cell sorting with downstream analysis. The growing adoption of cell-based assays in drug discovery and development further amplifies the market's potential. The increasing prevalence of chronic diseases and the burgeoning field of regenerative medicine are also significant growth catalysts.

Dominant Markets & Segments in Cell Sorting Market

The cell sorting market is dominated by several key regions and segments, each exhibiting unique growth drivers and opportunities.

- Dominant Technology Segment: Fluorescence-based Droplet Cell Sorting currently holds the largest market share, estimated at over 50% of the total technology segment revenue, due to its high throughput and broad applicability in research and clinical settings. However, Magnetic-activated Cell Sorting (MACS) is experiencing robust growth, particularly for applications requiring less complex cell labeling.

- Dominant Product & Service Segment: Cell Sorters constitute the largest revenue-generating segment, estimated to be worth over $1,200 Million in 2025. This is closely followed by Cell Sorting Reagents and Consumables, which are critical for the ongoing operation of sorting instruments.

- Dominant End User Segment: Pharmaceutical and Biotechnology Companies represent the largest end-user segment, accounting for an estimated 45-50% of the market, driven by extensive R&D activities in drug discovery, development, and manufacturing. Research Institutions are also significant contributors, fueled by academic research into fundamental biological processes and disease mechanisms.

- Geographic Dominance: North America, particularly the United States, is the leading regional market, estimated at over $800 Million in 2025, owing to its advanced research infrastructure, substantial R&D investments, and the presence of leading biopharmaceutical companies. Europe follows as a significant market, with strong contributions from Germany, the UK, and France. The Asia-Pacific region is expected to witness the highest growth rate, driven by increasing government funding for life sciences research, the expanding biopharmaceutical industry in countries like China and India, and growing adoption of advanced cell sorting technologies. Key growth drivers in this region include increasing healthcare expenditure, government initiatives to promote domestic biotechnology manufacturing, and a rising prevalence of infectious and chronic diseases necessitating advanced diagnostic and therapeutic solutions.

Cell Sorting Market Product Analysis

Product innovation in the cell sorting market is primarily focused on enhancing speed, accuracy, and cell viability. Key advancements include the development of microfluidic-based sorters for high-precision single-cell isolation, multi-laser systems enabling the simultaneous detection of numerous fluorescent markers, and automated platforms that reduce hands-on time and minimize human error. Applications span a wide spectrum, from fundamental research in immunology, stem cell biology, and cancer research to critical applications in therapeutic development, such as CAR-T cell manufacturing and infectious disease diagnostics. The competitive advantage lies in the ability of manufacturers to offer scalable, user-friendly solutions that integrate seamlessly into existing laboratory workflows and provide robust data analysis capabilities.

Key Drivers, Barriers & Challenges in Cell Sorting Market

Key Drivers:

- Technological Advancements: Continuous innovation in flow cytometry and microfluidics drives the development of more sensitive and efficient cell sorting systems.

- Growing Demand for Personalized Medicine: The need for highly specific cell populations for targeted therapies fuels the demand for advanced sorting technologies.

- Increased R&D Spending: Significant investments in life sciences research by academic institutions and biopharmaceutical companies are a primary growth catalyst.

- Advancements in Genomics and Proteomics: These fields rely heavily on precise cell isolation for downstream analysis.

Barriers & Challenges:

- High Cost of Instruments: Sophisticated cell sorters can be prohibitively expensive for smaller research labs and institutions in emerging economies, limiting market penetration.

- Complex Operational Requirements: The operation and maintenance of advanced cell sorting systems often require specialized training and skilled personnel.

- Regulatory Hurdles: Stringent regulatory approval processes for diagnostic and therapeutic applications can slow down market entry and adoption.

- Supply Chain Disruptions: Global events can impact the availability of critical components and reagents, affecting production and delivery timelines. The estimated impact of supply chain disruptions on market growth is projected to be around 5-7% reduction in potential growth.

Growth Drivers in the Cell Sorting Market Market

The cell sorting market is propelled by a confluence of factors. Technologically, the ongoing miniaturization and automation of cell sorters are making these powerful tools more accessible and user-friendly. Economically, the escalating investments in biopharmaceutical R&D, particularly in areas like immunotherapy and gene therapy, directly translate into increased demand for precise cell isolation. Policy-driven initiatives aimed at fostering life sciences innovation and promoting advanced healthcare solutions also play a crucial role. For instance, government grants for cancer research and stem cell therapy development directly stimulate the need for sophisticated cell sorting technologies.

Challenges Impacting Cell Sorting Market Growth

Several challenges can impede the growth of the cell sorting market. Regulatory complexities, especially for instruments intended for clinical diagnostics or therapeutic manufacturing, can lead to lengthy approval processes and increased development costs. Supply chain issues, as evidenced during recent global disruptions, can impact the availability of essential components and lead to production delays. Competitive pressures from established players and emerging disruptive technologies also necessitate continuous innovation and strategic market positioning. The high initial investment required for cutting-edge cell sorting equipment can also be a significant barrier for smaller research entities.

Key Players Shaping the Cell Sorting Market Market

- Becton Dickinson and Company

- Molecular Devices LLC

- Bulldog Bio Inc

- Bio-Rad Laboratories Inc

- NanoCellect Biomedical

- Miltenyi Biotec GmbH

- Sysmex Partec GmbH (Sysmex Corporation)

- Namocell Inc

- Cell Microsystems Inc

- Sony Biotechnology Inc (Sony Corporation of America)

- On-Chip Biotechnologies Co Ltd

- Union Biometrica Inc

- Beckman Coulter Inc (Danaher Corporation)

- Cytonome/St LLC

- Affymetrix Inc (Thermo Fisher Scientific )

Significant Cell Sorting Market Industry Milestones

- June 2020: LevitasBio announced the launch of a technology that is magnetic levitation-based cell separation. The technology uses magnet-induced density gradients to spread out different types of cells and could be used, for example, to separate live cells from dead ones.

- October 2020: PHC Corporation of North America announced the partnership with On-chip Biotechnologies (USA) Co. Ltd to drive delivery of total cell culturing solutions for researchers and organizations across a wide range of critical applications.

Future Outlook for Cell Sorting Market Market

The future of the cell sorting market is exceptionally bright, driven by the burgeoning fields of single-cell biology, precision medicine, and advanced cell therapies. Strategic opportunities lie in the development of more affordable and accessible cell sorting solutions, enhancing automation and AI integration for data interpretation, and expanding applications into novel areas like liquid biopsies and synthetic biology. The increasing focus on regenerative medicine and the growing need for high-purity cell populations for therapeutic purposes will continue to be significant growth catalysts. Continued innovation in microfluidics and the development of multi-functional platforms that integrate sorting with other analytical capabilities will further shape the market's trajectory, pushing its value well beyond an estimated $5,000 Million by the end of the forecast period.

Cell Sorting Market Segmentation

-

1. Technology

- 1.1. Fluorescence-based Droplet Cell Sorting

- 1.2. Magnetic-activated Cell Sorting (MACS)

- 1.3. Micro-el

-

2. Product and Service

- 2.1. Cell Sorters

- 2.2. Cell Sorting Reagents and Consumables

- 2.3. Cell Sorting Services

-

3. End User

- 3.1. Research Institutions

- 3.2. Pharmaceutical and Biotechnology Companies

- 3.3. Other End Users

Cell Sorting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell Sorting Market Regional Market Share

Geographic Coverage of Cell Sorting Market

Cell Sorting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of HIV and Cancer; Expanding Pharmaceutical and Biotechnology Industries; Technological Advancements in Cell Sorters

- 3.3. Market Restrains

- 3.3.1. High Cost of Cell Sorting Instruments; Lack of Awareness Regarding the Use of Cell Sorters

- 3.4. Market Trends

- 3.4.1. Fluorescence-based Droplet Cell Sorting (FACS) is Expected to be the Largest Growing Segment in the Cell Sorting Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fluorescence-based Droplet Cell Sorting

- 5.1.2. Magnetic-activated Cell Sorting (MACS)

- 5.1.3. Micro-el

- 5.2. Market Analysis, Insights and Forecast - by Product and Service

- 5.2.1. Cell Sorters

- 5.2.2. Cell Sorting Reagents and Consumables

- 5.2.3. Cell Sorting Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Research Institutions

- 5.3.2. Pharmaceutical and Biotechnology Companies

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fluorescence-based Droplet Cell Sorting

- 6.1.2. Magnetic-activated Cell Sorting (MACS)

- 6.1.3. Micro-el

- 6.2. Market Analysis, Insights and Forecast - by Product and Service

- 6.2.1. Cell Sorters

- 6.2.2. Cell Sorting Reagents and Consumables

- 6.2.3. Cell Sorting Services

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Research Institutions

- 6.3.2. Pharmaceutical and Biotechnology Companies

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fluorescence-based Droplet Cell Sorting

- 7.1.2. Magnetic-activated Cell Sorting (MACS)

- 7.1.3. Micro-el

- 7.2. Market Analysis, Insights and Forecast - by Product and Service

- 7.2.1. Cell Sorters

- 7.2.2. Cell Sorting Reagents and Consumables

- 7.2.3. Cell Sorting Services

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Research Institutions

- 7.3.2. Pharmaceutical and Biotechnology Companies

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fluorescence-based Droplet Cell Sorting

- 8.1.2. Magnetic-activated Cell Sorting (MACS)

- 8.1.3. Micro-el

- 8.2. Market Analysis, Insights and Forecast - by Product and Service

- 8.2.1. Cell Sorters

- 8.2.2. Cell Sorting Reagents and Consumables

- 8.2.3. Cell Sorting Services

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Research Institutions

- 8.3.2. Pharmaceutical and Biotechnology Companies

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fluorescence-based Droplet Cell Sorting

- 9.1.2. Magnetic-activated Cell Sorting (MACS)

- 9.1.3. Micro-el

- 9.2. Market Analysis, Insights and Forecast - by Product and Service

- 9.2.1. Cell Sorters

- 9.2.2. Cell Sorting Reagents and Consumables

- 9.2.3. Cell Sorting Services

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Research Institutions

- 9.3.2. Pharmaceutical and Biotechnology Companies

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Cell Sorting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Fluorescence-based Droplet Cell Sorting

- 10.1.2. Magnetic-activated Cell Sorting (MACS)

- 10.1.3. Micro-el

- 10.2. Market Analysis, Insights and Forecast - by Product and Service

- 10.2.1. Cell Sorters

- 10.2.2. Cell Sorting Reagents and Consumables

- 10.2.3. Cell Sorting Services

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Research Institutions

- 10.3.2. Pharmaceutical and Biotechnology Companies

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Molecular Devices LLC*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bulldog Bio Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NanoCellect Biomedical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Miltenyi Biotec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sysmex Partec GmbH (Sysmex Corporation)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Namocell Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cell Microsystems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sony Biotechnology Inc (Sony Corporation of America)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 On-Chip Biotechnologies Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Union Biometrica Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Beckman Coulter Inc (Danaher Corporation)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Cytonome/St LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Affymetrix Inc (Thermo Fisher Scientific )

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Cell Sorting Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Cell Sorting Market Revenue (million), by Technology 2025 & 2033

- Figure 3: North America Cell Sorting Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Cell Sorting Market Revenue (million), by Product and Service 2025 & 2033

- Figure 5: North America Cell Sorting Market Revenue Share (%), by Product and Service 2025 & 2033

- Figure 6: North America Cell Sorting Market Revenue (million), by End User 2025 & 2033

- Figure 7: North America Cell Sorting Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Cell Sorting Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Cell Sorting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cell Sorting Market Revenue (million), by Technology 2025 & 2033

- Figure 11: Europe Cell Sorting Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Cell Sorting Market Revenue (million), by Product and Service 2025 & 2033

- Figure 13: Europe Cell Sorting Market Revenue Share (%), by Product and Service 2025 & 2033

- Figure 14: Europe Cell Sorting Market Revenue (million), by End User 2025 & 2033

- Figure 15: Europe Cell Sorting Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Cell Sorting Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Cell Sorting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cell Sorting Market Revenue (million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Cell Sorting Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Cell Sorting Market Revenue (million), by Product and Service 2025 & 2033

- Figure 21: Asia Pacific Cell Sorting Market Revenue Share (%), by Product and Service 2025 & 2033

- Figure 22: Asia Pacific Cell Sorting Market Revenue (million), by End User 2025 & 2033

- Figure 23: Asia Pacific Cell Sorting Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Cell Sorting Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cell Sorting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cell Sorting Market Revenue (million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Cell Sorting Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Cell Sorting Market Revenue (million), by Product and Service 2025 & 2033

- Figure 29: Middle East and Africa Cell Sorting Market Revenue Share (%), by Product and Service 2025 & 2033

- Figure 30: Middle East and Africa Cell Sorting Market Revenue (million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Cell Sorting Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Cell Sorting Market Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Cell Sorting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Cell Sorting Market Revenue (million), by Technology 2025 & 2033

- Figure 35: South America Cell Sorting Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: South America Cell Sorting Market Revenue (million), by Product and Service 2025 & 2033

- Figure 37: South America Cell Sorting Market Revenue Share (%), by Product and Service 2025 & 2033

- Figure 38: South America Cell Sorting Market Revenue (million), by End User 2025 & 2033

- Figure 39: South America Cell Sorting Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Cell Sorting Market Revenue (million), by Country 2025 & 2033

- Figure 41: South America Cell Sorting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 3: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Cell Sorting Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 6: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 7: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global Cell Sorting Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 13: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 14: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global Cell Sorting Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 23: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 24: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 25: Global Cell Sorting Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 33: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 34: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 35: Global Cell Sorting Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: GCC Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Global Cell Sorting Market Revenue million Forecast, by Technology 2020 & 2033

- Table 40: Global Cell Sorting Market Revenue million Forecast, by Product and Service 2020 & 2033

- Table 41: Global Cell Sorting Market Revenue million Forecast, by End User 2020 & 2033

- Table 42: Global Cell Sorting Market Revenue million Forecast, by Country 2020 & 2033

- Table 43: Brazil Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Cell Sorting Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Sorting Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Cell Sorting Market?

Key companies in the market include Becton Dickinson and Company, Molecular Devices LLC*List Not Exhaustive, Bulldog Bio Inc, Bio-Rad Laboratories Inc, NanoCellect Biomedical, Miltenyi Biotec GmbH, Sysmex Partec GmbH (Sysmex Corporation), Namocell Inc, Cell Microsystems Inc, Sony Biotechnology Inc (Sony Corporation of America), On-Chip Biotechnologies Co Ltd, Union Biometrica Inc, Beckman Coulter Inc (Danaher Corporation), Cytonome/St LLC, Affymetrix Inc (Thermo Fisher Scientific ).

3. What are the main segments of the Cell Sorting Market?

The market segments include Technology, Product and Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 281.6 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of HIV and Cancer; Expanding Pharmaceutical and Biotechnology Industries; Technological Advancements in Cell Sorters.

6. What are the notable trends driving market growth?

Fluorescence-based Droplet Cell Sorting (FACS) is Expected to be the Largest Growing Segment in the Cell Sorting Market.

7. Are there any restraints impacting market growth?

High Cost of Cell Sorting Instruments; Lack of Awareness Regarding the Use of Cell Sorters.

8. Can you provide examples of recent developments in the market?

In June 2020, LevitasBio announced the launch of a technology that is magnetic levitation-based cell separation. The technology uses magnet-induced density gradients to spread out different types of cells and could be used, for example, to separate live cells from dead ones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Sorting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Sorting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Sorting Market?

To stay informed about further developments, trends, and reports in the Cell Sorting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence