Key Insights

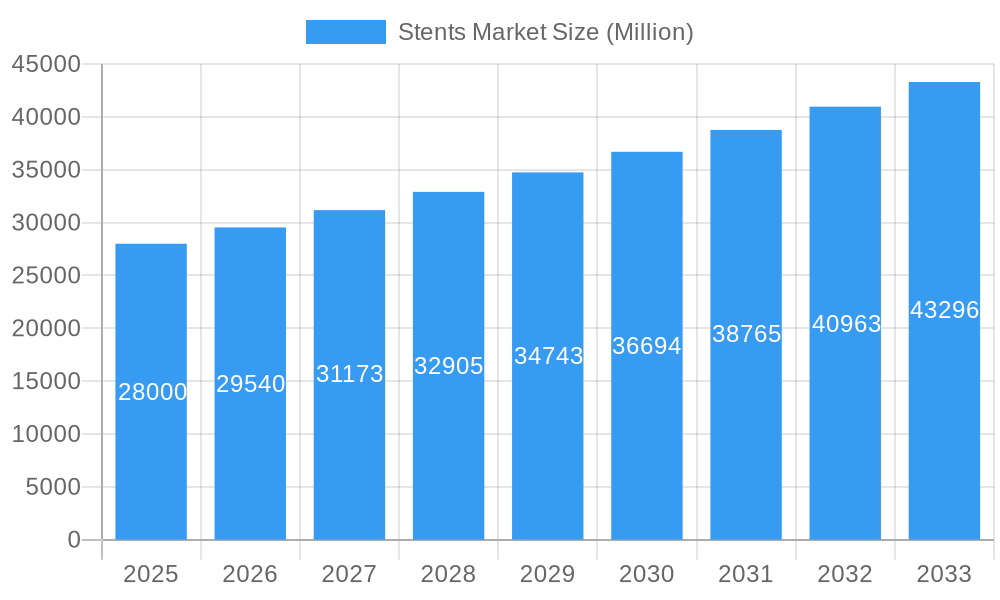

The global Stents Market is poised for robust expansion, projected to reach a substantial market size of approximately $28,000 million by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.50% through 2033. This growth is primarily fueled by the increasing prevalence of cardiovascular diseases (CVDs) worldwide, driven by aging populations, sedentary lifestyles, and the rising incidence of risk factors such as diabetes and hypertension. Advancements in stent technology, including the development of drug-eluting stents (DES) offering superior efficacy in preventing restenosis and the emergence of bioabsorbable stents, are further stimulating market demand. Moreover, a growing focus on minimally invasive procedures and expanding healthcare infrastructure, particularly in emerging economies, are significant contributors to the market's upward trajectory.

Stents Market Market Size (In Billion)

Key market drivers include the escalating burden of coronary artery disease (CAD) and peripheral artery disease (PAD), leading to a higher volume of angioplasty and stenting procedures. Technological innovations, such as improved stent designs for complex anatomies and the integration of advanced biomaterials, are enhancing treatment outcomes and patient quality of life, thereby boosting market adoption. Conversely, the market faces certain restraints, including the high cost of advanced stent technologies, which can limit accessibility in resource-constrained regions, and stringent regulatory approval processes for new medical devices. Reimbursement policies and the potential for post-procedural complications, though diminishing with technological progress, also represent factors influencing market dynamics. The market is segmented by product into Coronary Stents (further divided into Drug-eluting Stents, Bare-metal coronary Stents, and Bioabsorbable Stents) and Peripheral stents (including Iliac Stents, Femoral-popliteal Stents, Renal and Related Stents, and Carotid Stents), as well as Stent Implants. Material segmentation includes Metallic biomaterials, Polymeric biomaterials, and Natural biomaterials.

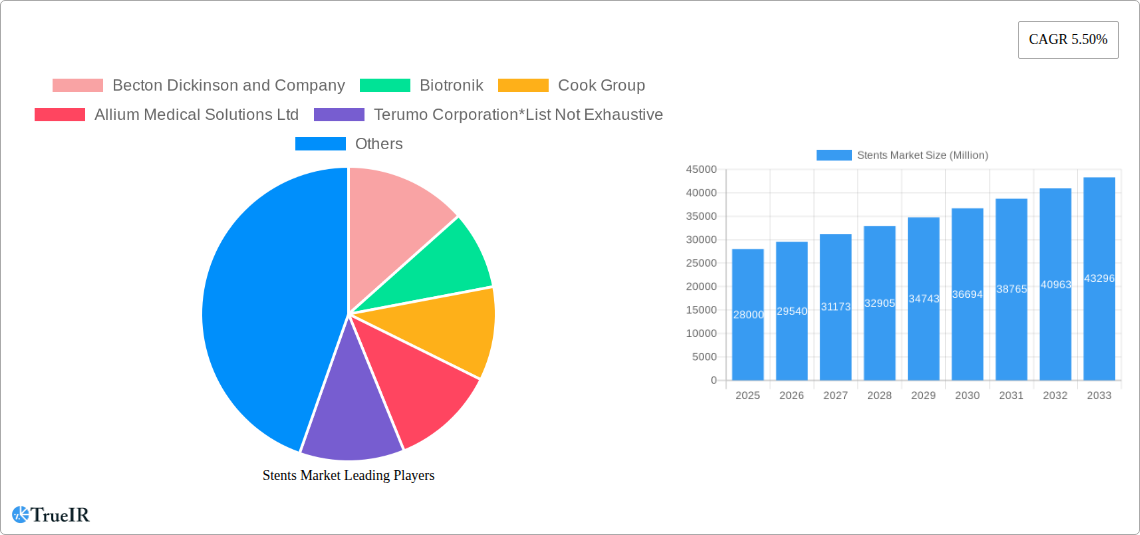

Stents Market Company Market Share

This in-depth analysis of the global Stents Market provides critical insights for stakeholders navigating this dynamic sector. Covering the historical period of 2019-2024, the base year of 2025, and an extensive forecast period extending to 2033, this report offers a robust understanding of market structure, evolving trends, dominant segments, and key growth drivers and challenges.

Stents Market Market Structure & Competitive Landscape

The global Stents Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized regional players. Innovation remains a primary driver, fueled by ongoing research and development in advanced stent designs, drug coatings, and bioabsorbable materials. Regulatory frameworks, such as FDA approvals and CE certifications, significantly influence market entry and product lifecycle. The market is characterized by fierce competition, driven by the need for superior clinical outcomes, cost-effectiveness, and expanded indications.

Key aspects of the market structure include:

- Innovation Hotspots: Focus on drug-eluting stents (DES) with improved drug elution profiles, biodegradable polymers, and novel delivery systems.

- Regulatory Scrutiny: Stringent approval processes for novel stent technologies and materials, impacting R&D timelines and market accessibility.

- Product Substitutes: While direct substitutes are limited, advancements in minimally invasive surgical techniques and alternative therapies (e.g., angioplasty balloons, atherectomy devices) present indirect competition.

- End-User Segmentation: Hospitals, cardiac catheterization labs, and interventional radiology centers constitute the primary end-users, each with specific purchasing preferences and volume demands.

- Mergers & Acquisitions (M&A) Trends: The market has witnessed strategic M&A activities aimed at consolidating market share, acquiring innovative technologies, and expanding product portfolios. For instance, the past few years have seen several smaller players being acquired by larger entities to gain access to specialized technologies or geographical markets, contributing to an estimated XX number of significant M&A deals contributing to market consolidation. Concentration ratios for the top 5 players are estimated to be around XX%.

Stents Market Market Trends & Opportunities

The Stents Market is poised for significant expansion, driven by the escalating prevalence of cardiovascular diseases (CVDs), a burgeoning geriatric population, and continuous technological advancements in interventional cardiology. The global market size is projected to reach an impressive $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025-2033. This growth is underpinned by an increasing demand for minimally invasive procedures, a key trend that favors stent implantation over traditional open-heart surgery.

Technological shifts are revolutionizing stent development. The focus is increasingly shifting towards drug-eluting stents (DES) due to their proven efficacy in reducing restenosis rates compared to bare-metal stents. Furthermore, the development of bioabsorbable stents represents a significant frontier, offering the potential to restore vascular function without leaving a permanent implant. This innovation addresses concerns related to long-term complications such as in-stent restenosis and stent thrombosis.

Consumer preferences are aligning with less invasive and more effective treatment options, leading to higher adoption rates for advanced stent technologies. The growing awareness among patients and healthcare providers about the benefits of interventional cardiology procedures is also a major catalyst.

Competitive dynamics are intensifying, with companies investing heavily in R&D to launch next-generation stents with enhanced features. The pursuit of intellectual property and strategic partnerships are key to maintaining a competitive edge. Emerging markets present substantial growth opportunities, driven by improving healthcare infrastructure, rising disposable incomes, and increasing access to advanced medical treatments. Government initiatives aimed at improving cardiovascular healthcare access and affordability, such as the inclusion of coronary stents in essential medicines lists, are expected to further boost market penetration. The market penetration rate for advanced stent technologies, particularly DES, is projected to reach XX% by 2033.

Dominant Markets & Segments in Stents Market

The Stents Market is segmented by product type and material, with distinct segments exhibiting varying growth trajectories and market dominance.

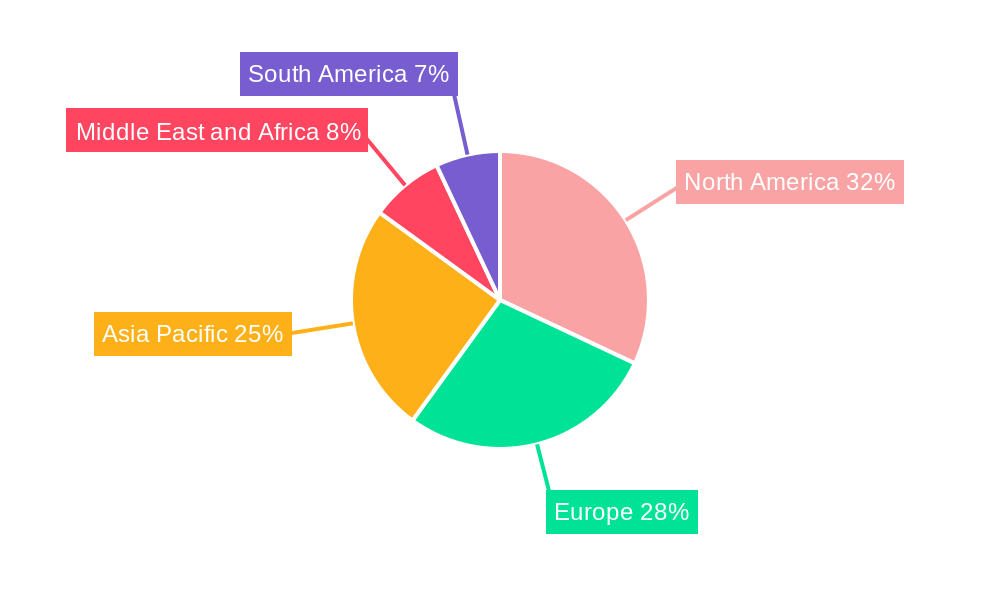

Dominant Regions and Countries:

North America, particularly the United States, currently holds the largest market share due to a high incidence of cardiovascular diseases, advanced healthcare infrastructure, strong reimbursement policies, and significant investment in R&D. Europe follows closely, with countries like Germany, the UK, and France leading in stent adoption. Asia-Pacific is emerging as the fastest-growing region, driven by increasing healthcare expenditure, a growing patient pool, and a rising number of interventional cardiology procedures in countries such as China and India.

Dominant Product Segments:

- Coronary Stents: This segment is the largest contributor to the overall market revenue.

- Drug-Eluting Stents (DES): These stents dominate the coronary stent market due to their superior efficacy in preventing restenosis, leading to improved patient outcomes and reduced re-hospitalization rates. The estimated market share for DES is XX%.

- Bare-metal Coronary Stents: While still used, their market share is gradually declining as DES offer better clinical results.

- Bioabsorbable Stents: This segment, though nascent, holds immense future potential, driven by the desire for fully transient implants. Ongoing research and clinical trials are expected to fuel its growth.

- Peripheral Stents: This segment is experiencing robust growth due to the increasing incidence of peripheral artery disease (PAD).

- Iliac Stents: Commonly used for treating iliac artery occlusive disease.

- Femoral-popliteal Stents: Critical for managing PAD in the legs.

- Renal and Related Stents: Essential for treating renal artery stenosis, a contributor to hypertension.

- Carotid Stents: Used in carotid artery stenting procedures to prevent stroke.

- Stent Implants: This category encompasses the broader application of stenting procedures across various vascular beds, highlighting the overall procedural volume.

Dominant Material Segments:

- Metallic Biomaterials: Primarily comprising Cobalt-Chromium (CoCr) and Stainless Steel alloys, these remain the most widely used materials due to their strength, durability, and biocompatibility.

- Polymeric Biomaterials: These are gaining traction, especially in bioabsorbable stents and drug delivery systems, offering advantages such as controlled drug release and eventual degradation.

- Natural Biomaterials: Research is ongoing in this area, exploring materials like biodegradable polymers derived from natural sources for potential future applications.

Key growth drivers for these dominant segments include increasing prevalence of lifestyle diseases, aging populations, advancements in minimally invasive techniques, and favorable reimbursement policies.

Stents Market Product Analysis

The Stents Market is characterized by continuous product innovation aimed at enhancing patient outcomes and procedural efficacy. Drug-eluting stents (DES) remain at the forefront, with ongoing developments in drug formulations, polymer coatings, and elution profiles to further minimize the risk of restenosis and thrombosis. The emergence of polymer-free DES and bioabsorbable stents represents significant technological advancements, offering potential long-term benefits such as reduced inflammatory response and complete vascular restoration. Companies are focusing on developing stents with improved deliverability, navigability through complex anatomies, and compatibility with advanced imaging techniques.

Key Drivers, Barriers & Challenges in Stents Market

Key Drivers:

The Stents Market is propelled by a confluence of factors including the escalating global burden of cardiovascular and peripheral vascular diseases, a rapidly aging population prone to these conditions, and continuous technological innovations leading to safer and more effective stent designs.

- Rising CVD Prevalence: Increased incidence of atherosclerosis, coronary artery disease (CAD), and peripheral artery disease (PAD) fuels demand.

- Technological Advancements: Development of drug-eluting stents (DES) with advanced coatings, bioabsorbable stents, and improved delivery systems enhances clinical efficacy and patient safety.

- Minimally Invasive Procedures: Preference for minimally invasive surgery over open-heart procedures drives the adoption of stenting.

- Growing Geriatric Population: Elderly individuals are more susceptible to vascular diseases, increasing the patient pool.

- Favorable Reimbursement Policies: Government and private insurance coverage for stenting procedures supports market growth.

- Healthcare Infrastructure Development: Expansion of healthcare facilities and interventional cardiology services, especially in emerging economies, expands access.

Barriers and Challenges:

Despite robust growth, the Stents Market faces several challenges that can impede its progress.

- Stringent Regulatory Approvals: The lengthy and complex approval processes for new stent technologies can delay market entry and increase R&D costs.

- High Cost of Advanced Stents: The premium pricing of DES and novel stent technologies can limit their accessibility in price-sensitive markets.

- Post-Procedure Complications: Although minimized with modern stents, risks such as in-stent restenosis and stent thrombosis remain a concern, influencing physician and patient choices.

- Competition and Pricing Pressures: Intense competition among established players and emerging manufacturers can lead to pricing pressures, impacting profit margins.

- Supply Chain Disruptions: Global supply chain vulnerabilities can affect the availability of raw materials and finished stent products.

- Development of Alternative Therapies: While not direct substitutes, advancements in other minimally invasive treatments could potentially impact certain stent applications.

Growth Drivers in the Stents Market Market

The Stents Market is experiencing significant growth driven by several interconnected factors. Technological innovation is paramount, with a consistent focus on developing drug-eluting stents (DES) that offer superior efficacy in preventing restenosis and stent thrombosis. The advent of bioabsorbable stents represents a paradigm shift, promising to eliminate long-term implant-related complications. Economically, the increasing healthcare expenditure globally, coupled with rising disposable incomes in emerging economies, is making advanced cardiovascular treatments more accessible. Government initiatives and favorable reimbursement policies play a crucial role by enhancing affordability and encouraging the adoption of interventional cardiology procedures. The expanding elderly population, a demographic highly susceptible to cardiovascular diseases, further augments the demand for stenting procedures.

Challenges Impacting Stents Market Growth

The growth trajectory of the Stents Market is not without its hurdles. Regulatory complexities present a significant barrier, with stringent approval processes for novel stent technologies demanding substantial time and investment. The high cost associated with advanced stents, particularly drug-eluting and bioabsorbable variants, can limit their adoption in price-sensitive markets and healthcare systems with budget constraints. While complications are on the decline, concerns surrounding potential long-term issues like in-stent restenosis and stent thrombosis can still influence clinical decision-making. Intense competition among numerous global and regional manufacturers leads to pricing pressures, potentially affecting profit margins for market players. Furthermore, global supply chain vulnerabilities can disrupt the availability of essential raw materials and finished stent products, posing a risk to consistent market supply.

Key Players Shaping the Stents Market Market

- Becton Dickinson and Company

- Biotronik

- Cook Group

- Allium Medical Solutions Ltd

- Terumo Corporation

- Medtronic

- Microport Scientific Corporation

- Abbott

- Boston Scientific Corporation

- B Braun SE

- Elixir Medical

Significant Stents Market Industry Milestones

- November 2022: The Union Health Ministry of India announced the inclusion of coronary stents in the National List of Essential Medicines 2022, aiming to improve affordability and accessibility.

- May 2022: Medtronic received US FDA approval for its Onyx Frontier drug-eluting stent (DES), further expanding its portfolio of advanced coronary devices.

- April 2022: Translumina launched its dual drug polymer-free coated stent (DDCS), VIVO ISAR, in various international markets, including Europe, highlighting innovation in drug delivery.

Future Outlook for Stents Market Market

The future outlook for the Stents Market is exceptionally promising, fueled by continuous technological innovation and a growing global demand for cardiovascular interventions. The market will witness further advancements in bioabsorbable stents, promising a future where implants fully degrade, leaving no permanent foreign body. Drug-eluting stents will evolve with more sophisticated drug delivery mechanisms and biocompatible materials, aiming for even lower complication rates. Emerging economies represent a significant growth catalyst, with improving healthcare infrastructure and increasing patient access to advanced medical procedures. Strategic collaborations, product launches, and a focus on cost-effectiveness will define the competitive landscape. The sustained rise in cardiovascular disease prevalence, coupled with an aging global population, will ensure a robust and growing market for stent technologies in the years to come.

Stents Market Segmentation

-

1. Product

-

1.1. Coronary Stents

- 1.1.1. Drug-eluting Stents

- 1.1.2. Bare-metal coronary Stents

- 1.1.3. Bioabsorbable Stents

-

1.2. Peripheral stents

- 1.2.1. Iliac Stents

- 1.2.2. Femoral-popliteal Stents

- 1.2.3. Renal and Related Stents

- 1.2.4. Carotid Stents

- 1.3. Stent Implants

-

1.1. Coronary Stents

-

2. Material

- 2.1. Metallic biomaterials

- 2.2. Polymeric biomaterials

- 2.3. Natural biomaterials

Stents Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Stents Market Regional Market Share

Geographic Coverage of Stents Market

Stents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic Diseases; Increasing Geriatric Population; Technological Advancements in Stent Development

- 3.3. Market Restrains

- 3.3.1. Stringent Approval Process for Stents; High Product Recalls

- 3.4. Market Trends

- 3.4.1. The Drug-eluting Stents Segment is Expected to Witness Significant Growth During the Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Coronary Stents

- 5.1.1.1. Drug-eluting Stents

- 5.1.1.2. Bare-metal coronary Stents

- 5.1.1.3. Bioabsorbable Stents

- 5.1.2. Peripheral stents

- 5.1.2.1. Iliac Stents

- 5.1.2.2. Femoral-popliteal Stents

- 5.1.2.3. Renal and Related Stents

- 5.1.2.4. Carotid Stents

- 5.1.3. Stent Implants

- 5.1.1. Coronary Stents

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Metallic biomaterials

- 5.2.2. Polymeric biomaterials

- 5.2.3. Natural biomaterials

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Stents Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Coronary Stents

- 6.1.1.1. Drug-eluting Stents

- 6.1.1.2. Bare-metal coronary Stents

- 6.1.1.3. Bioabsorbable Stents

- 6.1.2. Peripheral stents

- 6.1.2.1. Iliac Stents

- 6.1.2.2. Femoral-popliteal Stents

- 6.1.2.3. Renal and Related Stents

- 6.1.2.4. Carotid Stents

- 6.1.3. Stent Implants

- 6.1.1. Coronary Stents

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Metallic biomaterials

- 6.2.2. Polymeric biomaterials

- 6.2.3. Natural biomaterials

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Stents Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Coronary Stents

- 7.1.1.1. Drug-eluting Stents

- 7.1.1.2. Bare-metal coronary Stents

- 7.1.1.3. Bioabsorbable Stents

- 7.1.2. Peripheral stents

- 7.1.2.1. Iliac Stents

- 7.1.2.2. Femoral-popliteal Stents

- 7.1.2.3. Renal and Related Stents

- 7.1.2.4. Carotid Stents

- 7.1.3. Stent Implants

- 7.1.1. Coronary Stents

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Metallic biomaterials

- 7.2.2. Polymeric biomaterials

- 7.2.3. Natural biomaterials

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Stents Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Coronary Stents

- 8.1.1.1. Drug-eluting Stents

- 8.1.1.2. Bare-metal coronary Stents

- 8.1.1.3. Bioabsorbable Stents

- 8.1.2. Peripheral stents

- 8.1.2.1. Iliac Stents

- 8.1.2.2. Femoral-popliteal Stents

- 8.1.2.3. Renal and Related Stents

- 8.1.2.4. Carotid Stents

- 8.1.3. Stent Implants

- 8.1.1. Coronary Stents

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Metallic biomaterials

- 8.2.2. Polymeric biomaterials

- 8.2.3. Natural biomaterials

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Stents Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Coronary Stents

- 9.1.1.1. Drug-eluting Stents

- 9.1.1.2. Bare-metal coronary Stents

- 9.1.1.3. Bioabsorbable Stents

- 9.1.2. Peripheral stents

- 9.1.2.1. Iliac Stents

- 9.1.2.2. Femoral-popliteal Stents

- 9.1.2.3. Renal and Related Stents

- 9.1.2.4. Carotid Stents

- 9.1.3. Stent Implants

- 9.1.1. Coronary Stents

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Metallic biomaterials

- 9.2.2. Polymeric biomaterials

- 9.2.3. Natural biomaterials

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Stents Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Coronary Stents

- 10.1.1.1. Drug-eluting Stents

- 10.1.1.2. Bare-metal coronary Stents

- 10.1.1.3. Bioabsorbable Stents

- 10.1.2. Peripheral stents

- 10.1.2.1. Iliac Stents

- 10.1.2.2. Femoral-popliteal Stents

- 10.1.2.3. Renal and Related Stents

- 10.1.2.4. Carotid Stents

- 10.1.3. Stent Implants

- 10.1.1. Coronary Stents

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Metallic biomaterials

- 10.2.2. Polymeric biomaterials

- 10.2.3. Natural biomaterials

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biotronik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cook Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allium Medical Solutions Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Terumo Corporation*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medtronic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microport Scientific Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boston Scientific Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 B Braun SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elixir Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Stents Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Stents Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Stents Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Stents Market Revenue (Million), by Material 2025 & 2033

- Figure 5: North America Stents Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Stents Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Stents Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Stents Market Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Stents Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Stents Market Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Stents Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Stents Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Stents Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Stents Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Stents Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Stents Market Revenue (Million), by Material 2025 & 2033

- Figure 17: Asia Pacific Stents Market Revenue Share (%), by Material 2025 & 2033

- Figure 18: Asia Pacific Stents Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Stents Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Stents Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East and Africa Stents Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Stents Market Revenue (Million), by Material 2025 & 2033

- Figure 23: Middle East and Africa Stents Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Middle East and Africa Stents Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Stents Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Stents Market Revenue (Million), by Product 2025 & 2033

- Figure 27: South America Stents Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Stents Market Revenue (Million), by Material 2025 & 2033

- Figure 29: South America Stents Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: South America Stents Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Stents Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Global Stents Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Stents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global Stents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 21: Global Stents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Stents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Stents Market Revenue Million Forecast, by Product 2020 & 2033

- Table 35: Global Stents Market Revenue Million Forecast, by Material 2020 & 2033

- Table 36: Global Stents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Stents Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stents Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Stents Market?

Key companies in the market include Becton Dickinson and Company, Biotronik, Cook Group, Allium Medical Solutions Ltd, Terumo Corporation*List Not Exhaustive, Medtronic, Microport Scientific Corporation, Abbott, Boston Scientific Corporation, B Braun SE, Elixir Medical.

3. What are the main segments of the Stents Market?

The market segments include Product, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic Diseases; Increasing Geriatric Population; Technological Advancements in Stent Development.

6. What are the notable trends driving market growth?

The Drug-eluting Stents Segment is Expected to Witness Significant Growth During the Forecast period.

7. Are there any restraints impacting market growth?

Stringent Approval Process for Stents; High Product Recalls.

8. Can you provide examples of recent developments in the market?

November 2022: The Union Health Ministry of India announced the inclusion of coronary stents in the National List of Essential Medicines 2022; this was expected to help make these stents more affordable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stents Market?

To stay informed about further developments, trends, and reports in the Stents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence