Key Insights

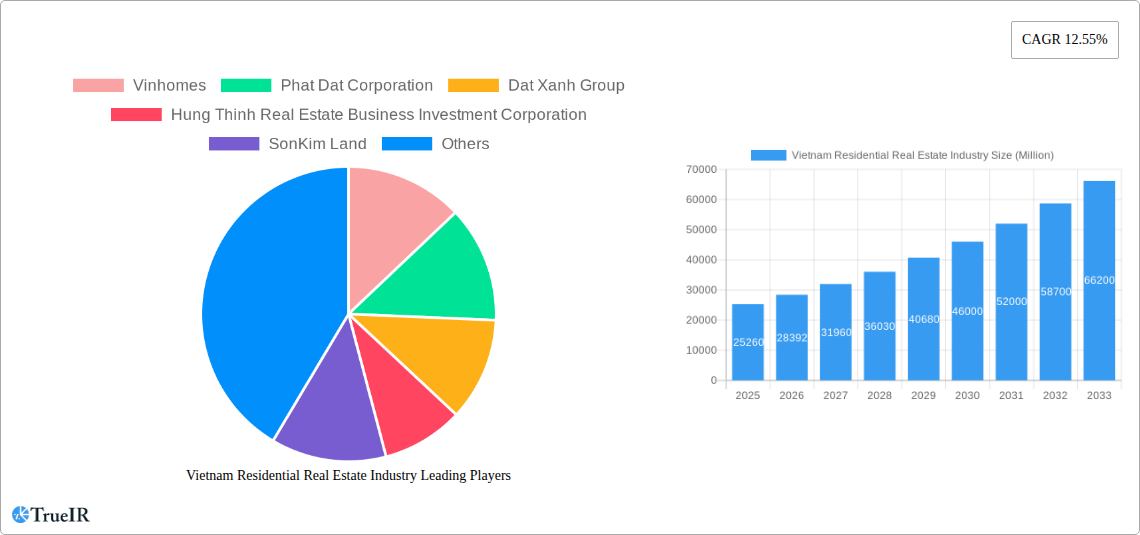

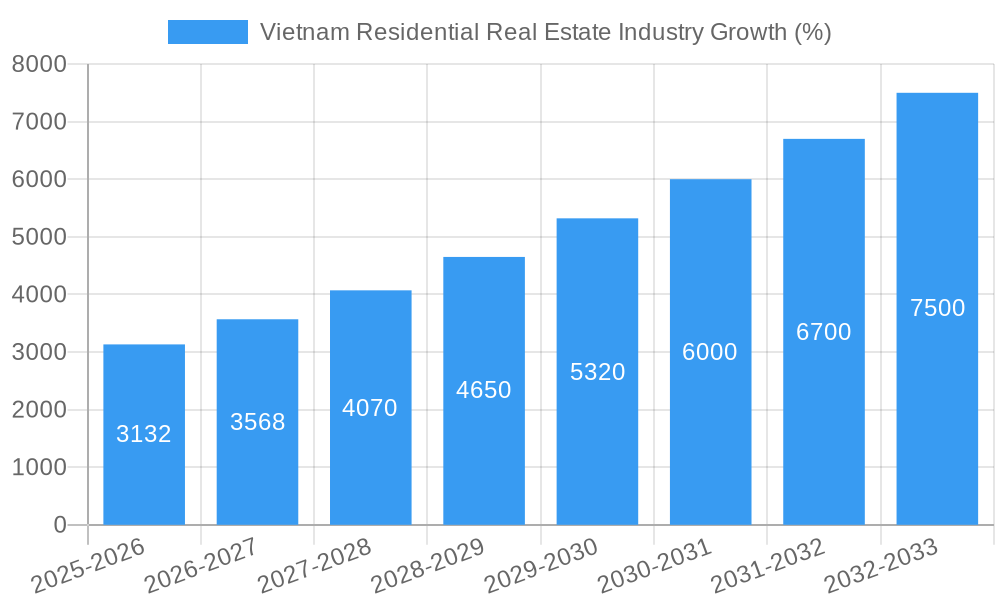

The Vietnam residential real estate market exhibits robust growth potential, projected to reach a market size of $25.26 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.55% from 2025 to 2033. This expansion is driven by several key factors. Rapid urbanization, particularly in major cities like Ho Chi Minh City, Hanoi, and Da Nang, fuels strong demand for housing. A burgeoning middle class with increasing disposable income further contributes to this demand, particularly for apartments and condominiums which represent a significant portion of the market. Government initiatives promoting infrastructure development and affordable housing also play a crucial role. However, challenges such as land scarcity in prime locations and fluctuating interest rates pose potential restraints on market growth. The market is characterized by a diverse range of developers, including both large national players like Vinhomes, Novaland Group, and Sun Group, and smaller, regional companies. Competition is fierce, leading to innovation in design, amenities, and financing options to attract buyers. The segment of Villas and Landed Houses, although smaller than apartments and condominiums, also shows promising growth potential driven by increasing demand for luxury housing and suburban living.

Looking ahead, the Vietnam residential real estate market is poised for continued expansion, although the rate of growth may moderate slightly in the later years of the forecast period due to potential macroeconomic factors. The ongoing development of smart city initiatives and the government's focus on sustainable development will likely influence future trends. The market's ongoing diversification, with the entry of new players and the evolution of existing ones, promises a dynamic and competitive landscape. Continued focus on meeting the diverse needs of a rapidly evolving population, including the provision of affordable housing solutions and environmentally sustainable developments, will be key to sustaining long-term market success. The luxury segment, especially villas and landed houses in desirable locations, will likely continue to perform strongly, appealing to high-net-worth individuals and foreign investors.

Vietnam Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Vietnam residential real estate market, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive data and expert analysis to illuminate current trends and forecast future growth. Expect in-depth coverage of key market segments, competitive landscapes, and emerging opportunities within this dynamic sector. Discover the potential of Vietnam's booming real estate market and make informed decisions based on robust data and insightful analysis.

Vietnam Residential Real Estate Industry Market Structure & Competitive Landscape

This section analyzes the structure and competitive dynamics of Vietnam's residential real estate market from 2019-2024, projecting trends to 2033. We examine market concentration, revealing the dominance of key players and identifying emerging competitors. The analysis considers factors influencing market structure, including:

- Market Concentration: The market exhibits a moderately concentrated structure with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2024, indicating the presence of several significant players alongside numerous smaller firms. The top 5 players likely hold approximately xx% of the market share.

- Innovation Drivers: Technological advancements in construction techniques, smart home technologies, and sustainable building practices are driving innovation. The increasing adoption of PropTech solutions is also shaping the market.

- Regulatory Impacts: Government policies concerning land use, construction permits, and foreign investment significantly influence market activity. Recent regulatory changes have impacted the pace of development and investment in certain segments.

- Product Substitutes: The availability of rental housing and the growing popularity of co-living spaces present some level of substitution for homeownership, although owner-occupation remains the dominant preference.

- End-User Segmentation: The market caters to a diverse range of end-users, including first-time homebuyers, upgraders, and investors, with varying preferences and purchasing power. Demand is significantly influenced by demographic trends, particularly urbanization and rising incomes.

- M&A Trends: The past five years have witnessed a moderate level of mergers and acquisitions (M&A) activity, with an estimated xx Million USD worth of deals completed in 2024, driven by consolidation efforts among larger players and strategic expansion by foreign investors. This trend is expected to continue but may be impacted by macroeconomic conditions.

The qualitative analysis suggests that competition is intense, particularly in major cities like Ho Chi Minh City and Hanoi, where large developers compete for prime locations and market share. This dynamic competitive landscape is further intensified by fluctuating construction costs and evolving consumer preferences.

Vietnam Residential Real Estate Industry Market Trends & Opportunities

The Vietnam residential real estate market exhibits strong growth potential driven by several factors. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, with the market size reaching an estimated xx Million USD in 2024. This growth is projected to continue, albeit at a potentially moderated pace, reaching an estimated xx Million USD by 2033. The forecast reflects a CAGR of xx% during the period of 2025-2033. This sustained growth is fueled by:

- Rapid Urbanization: The ongoing migration from rural areas to urban centers fuels demand for housing, particularly in major cities like Ho Chi Minh City, Hanoi, and Da Nang.

- Rising Disposable Incomes: Growing middle class and rising disposable incomes empower more individuals to purchase homes, increasing demand across various housing types.

- Government Initiatives: Government policies focused on infrastructure development and affordable housing initiatives contribute to market expansion and accessibility.

- Technological Advancements: The adoption of PropTech and innovative construction methods increases efficiency, reduces costs, and enhances the overall customer experience.

- Foreign Investment: Continued foreign investment, particularly in large-scale projects, drives market growth and brings international expertise.

- Shifting Consumer Preferences: A preference for modern, high-quality housing with amenities and convenient locations is driving demand in specific market segments.

However, the market also faces challenges, including fluctuating interest rates, land scarcity in prime locations, and potential regulatory changes. The overall market penetration rate is estimated at xx% in 2024 and is projected to grow to xx% by 2033. Despite challenges, Vietnam’s residential real estate sector demonstrates significant long-term growth prospects.

Dominant Markets & Segments in Vietnam Residential Real Estate Industry

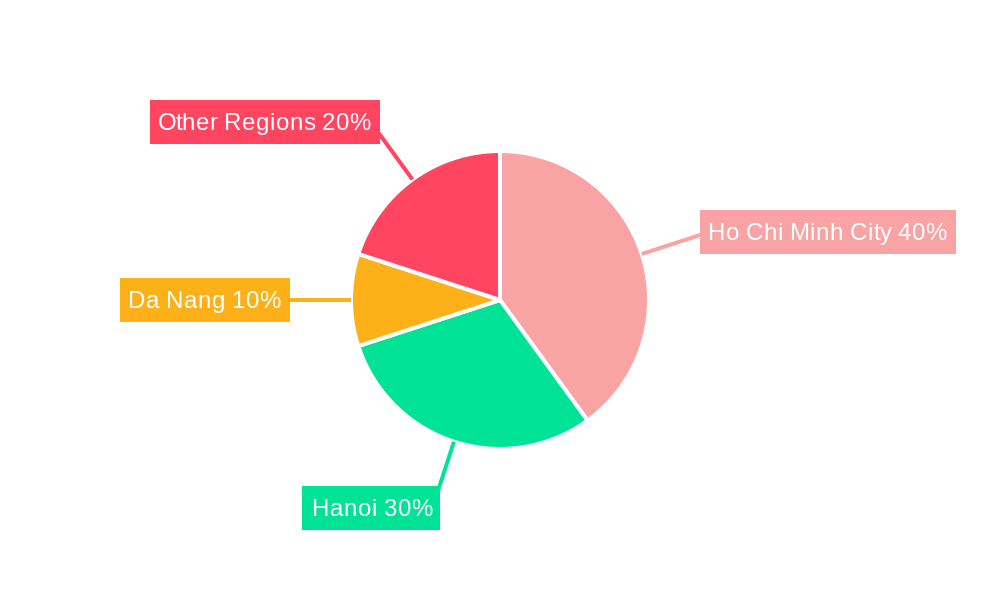

The Vietnamese residential real estate market displays significant variations across different cities and housing types.

By Key Cities:

- Ho Chi Minh City: Dominates the market, driven by strong economic activity, substantial foreign investment, and a large population. Key growth drivers include robust infrastructure development, high employment rates, and government initiatives to improve urban living standards. This segment represents an estimated xx% of the total market value in 2025.

- Hanoi: Represents the second-largest market, benefiting from its role as the capital city and a growing population. Its growth is fueled by government investment in infrastructure and a rising demand for high-quality housing. This segment accounts for approximately xx% of the total market value in 2025.

- Da Nang: A rapidly developing market, fueled by tourism and economic diversification. Infrastructure improvements, a relatively lower cost of living compared to Ho Chi Minh City and Hanoi, and a growing population are major growth drivers. This segment is estimated to account for approximately xx% of the total market value in 2025.

By Type:

- Apartments and Condominiums: This segment accounts for the largest share of the market, driven by affordability, convenience, and the concentration of urban development. Growth in this segment is largely driven by the increasing urbanization and young population.

- Villas and Landed Houses: This segment appeals to a wealthier demographic seeking more spacious living and privacy. Growth is fueled by rising incomes and a preference for larger homes in suburban areas.

The dominance of specific cities and housing types is expected to persist, although the relative shares might shift slightly based on macroeconomic factors and government policies.

Vietnam Residential Real Estate Industry Product Analysis

Product innovation in the Vietnam residential real estate market focuses on improving energy efficiency, incorporating smart home technologies, and enhancing building quality to meet the evolving preferences of consumers. Developers are increasingly incorporating sustainable building materials and designs to cater to environmentally conscious buyers. Competitive advantages are derived from strategic location, superior quality of construction, innovative design, and provision of enhanced amenities and services. The market is seeing a rise in mixed-use developments, integrating residential units with commercial spaces and lifestyle amenities, reflecting changing consumer preferences.

Key Drivers, Barriers & Challenges in Vietnam Residential Real Estate Industry

Key Drivers:

- Rapid urbanization and population growth: Continuous movement from rural to urban areas is significantly driving demand.

- Rising incomes and a growing middle class: Increased purchasing power enables more people to afford homes.

- Government supportive policies: Initiatives focused on infrastructure development and affordable housing are boosting the sector.

- Foreign direct investment: Significant capital inflow supports large-scale projects and development.

Challenges:

- Land scarcity and high land prices: Limited availability of land in prime locations drives up costs.

- Regulatory complexities and bureaucratic processes: Lengthy approval times for projects can impede development.

- Supply chain disruptions: Global supply chain volatility affects the availability and cost of building materials.

- Competition: Intense competition among developers leads to price wars and reduced profit margins.

Growth Drivers in the Vietnam Residential Real Estate Industry Market

Growth is driven by rapid urbanization, a burgeoning middle class, government support, and foreign investment. Infrastructure development in key cities enhances attractiveness, and technological advancements in construction and property management create efficiencies and improve consumer experiences. Government policies promoting affordable housing and sustainable development further contribute to market expansion.

Challenges Impacting Vietnam Residential Real Estate Industry Growth

Challenges include land scarcity, increasing land costs, complex regulations, and supply chain vulnerabilities. Competition among developers can lead to price pressures and reduced profitability. Addressing these obstacles requires effective regulatory reform, sustainable land use planning, and diversification of the supply chain.

Key Players Shaping the Vietnam Residential Real Estate Industry Market

- Vinhomes

- Phat Dat Corporation

- Dat Xanh Group

- Hung Thinh Real Estate Business Investment Corporation

- SonKim Land

- Sun Group

- Capital and Limited

- FLC Group

- Rever

- Phu My Hung Development Corporation

- Novaland Group

Significant Vietnam Residential Real Estate Industry Industry Milestones

- October 2023: Phat Dat's investment project of over 10,000 billion VND in Binh Duong received planning approval, signifying a significant commitment to expanding the company's presence.

- November 2023: Phat Dat Corporation and MB Bank signed a comprehensive cooperation agreement to provide financial support for investors and customers in Phat Dat's Thuan An 1&2 high-rise housing complex project (investment exceeding 10,800 billion VND), boosting investor confidence and facilitating project sales. This highlights the importance of financial partnerships in driving large-scale development.

Future Outlook for Vietnam Residential Real Estate Industry Market

The Vietnam residential real estate market is poised for continued growth, driven by sustained urbanization, rising incomes, and government initiatives. Strategic opportunities exist in developing sustainable and technologically advanced housing solutions, tapping into the demand for affordable housing, and capitalizing on the increasing foreign investment. The market's long-term prospects remain positive, although external economic factors and regulatory changes could influence the pace of growth.

Vietnam Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Ho Chi Minh City

- 2.2. Hanoi

- 2.3. Danang

Vietnam Residential Real Estate Industry Segmentation By Geography

- 1. Vietnam

Vietnam Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability4.; Economic Uncertainties

- 3.4. Market Trends

- 3.4.1. Rising Government Initiatives and Social Housing Development Policies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Ho Chi Minh City

- 5.2.2. Hanoi

- 5.2.3. Danang

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vinhomes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Phat Dat Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dat Xanh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hung Thinh Real Estate Business Investment Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SonKim Land

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sun Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Capital and Limited**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FLC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rever

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phu My Hung Development Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novaland Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Vinhomes

List of Figures

- Figure 1: Vietnam Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Residential Real Estate Industry?

The projected CAGR is approximately 12.55%.

2. Which companies are prominent players in the Vietnam Residential Real Estate Industry?

Key companies in the market include Vinhomes, Phat Dat Corporation, Dat Xanh Group, Hung Thinh Real Estate Business Investment Corporation, SonKim Land, Sun Group, Capital and Limited**List Not Exhaustive, FLC Group, Rever, Phu My Hung Development Corporation, Novaland Group.

3. What are the main segments of the Vietnam Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.26 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy.

6. What are the notable trends driving market growth?

Rising Government Initiatives and Social Housing Development Policies.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability4.; Economic Uncertainties.

8. Can you provide examples of recent developments in the market?

November 2023: Phat Dat Real Estate Development Joint Stock Company and Military Commercial Joint Stock Bank (MB Bank) signed a comprehensive cooperation agreement with the purpose of financial sponsorship for investors and customers. Products at Phat Dat projects. The sponsored project is the Thuan An 1&2 high-rise housing complex with a scale of 4.47 hectares, located in a prime location right in the central area of Thuan An City, connected to many large industrial clusters in Binh Duong. The project has completed its legality with an investment of more than 10,800 billion VND, including apartment products, shophouses, and townhouses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Vietnam Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence