Key Insights

The Asia-Pacific office real estate market is poised for substantial growth, fueled by robust economic expansion in key nations such as China, India, and Japan. This surge in demand for modern office spaces is further amplified by the thriving technology sector, expanding multinational corporations, and a growing middle-class population. Increasing urbanization trends and the adoption of flexible work arrangements are also significant contributors to market expansion. While construction costs and potential economic downturns present challenges, the long-term outlook remains highly optimistic. The market is segmented geographically, with China, Japan, and India holding significant market shares, followed by Australia and South Korea. Leading industry players, including Mitsubishi Estate and Cushman & Wakefield, are actively engaged in property development and management, underscoring the market's maturity and competitive landscape. The market's projected CAGR of 6.6% indicates sustained expansion, with the market size expected to reach $2198.1 billion by the end of the forecast period. This growth is underpinned by ongoing economic development and infrastructure enhancements across the region, attracting considerable investment in commercial real estate.

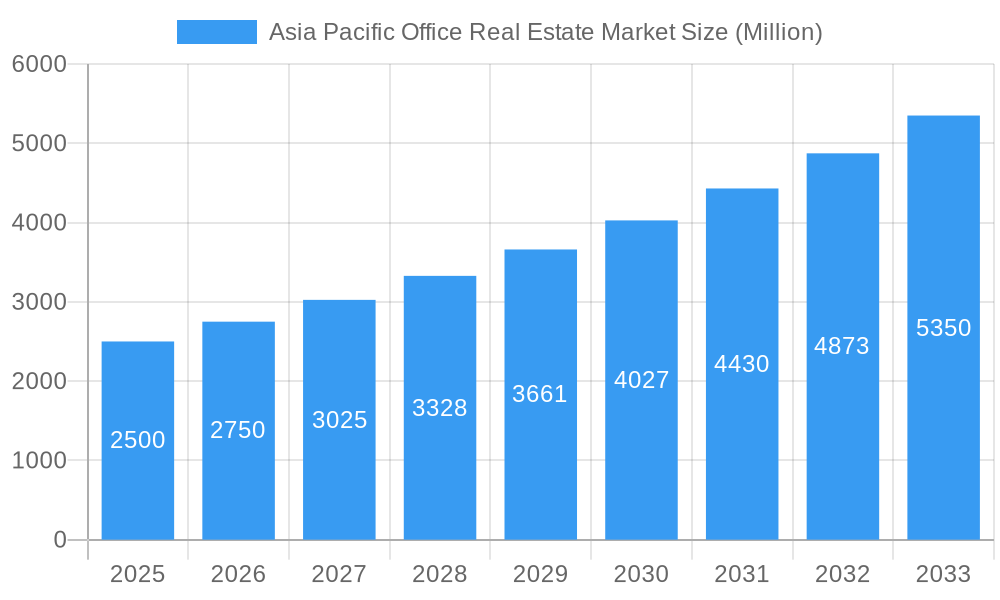

Asia Pacific Office Real Estate Market Market Size (In Million)

However, the market faces evolving dynamics. Geopolitical uncertainties and global economic shifts may influence investment decisions and potentially moderate growth. The increasing prevalence of remote work and the rise of co-working spaces are reshaping traditional office space requirements, necessitating adaptive strategies from landlords and developers. Intense industry competition demands innovative approaches to property management and development for sustained profitability and market share. Key success factors will include providing high-quality, sustainable, and technologically advanced office environments that meet the evolving needs of tenants. The integration of smart building technologies and a strong focus on sustainability are expected to be crucial differentiators.

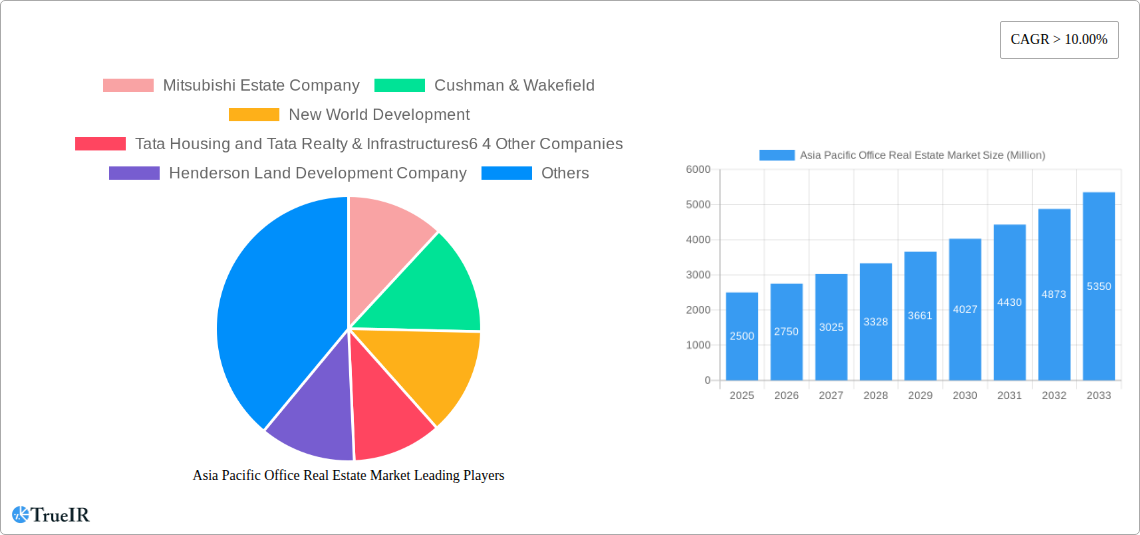

Asia Pacific Office Real Estate Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific office real estate market, providing critical insights for investors, developers, and industry stakeholders. With a study period covering 2019-2033, a base year of 2024, and a forecast period from 2024-2033, this report utilizes historical data (2019-2024) to forecast future market trends and opportunities. Explore key market drivers, challenges, and competitive dynamics, with detailed analyses of prominent players such as Mitsubishi Estate Company and Cushman & Wakefield.

Asia Pacific Office Real Estate Market Structure & Competitive Landscape

The Asia Pacific office real estate market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller firms. The Herfindahl-Hirschman Index (HHI) for the region is estimated at xx, indicating a moderately competitive landscape. Innovation drivers include sustainable building technologies, smart office solutions, and flexible workspace models. Regulatory impacts vary significantly across countries, with some exhibiting stricter zoning regulations and environmental standards than others. Product substitutes, such as co-working spaces and remote work arrangements, are increasingly impacting demand for traditional office spaces. End-user segmentation includes corporate offices, government agencies, and small and medium-sized enterprises (SMEs).

- Market Concentration: HHI estimated at xx. Top 5 players account for approximately xx% of market share.

- Innovation Drivers: Smart building technologies, sustainable design, flexible workspace models.

- Regulatory Impacts: Vary significantly across countries (e.g., China's stricter regulations vs. Australia's more liberal approach).

- Product Substitutes: Co-working spaces, remote work, flexible office leases.

- End-User Segmentation: Corporate, government, SMEs.

- M&A Trends: Annual M&A volume averaged USD xx Million between 2019-2024, with an increase predicted for the forecast period driven by consolidation among major players.

Asia Pacific Office Real Estate Market Market Trends & Opportunities

The Asia Pacific office real estate market is characterized by significant growth potential, driven by factors such as rapid urbanization, economic expansion, and increasing foreign direct investment (FDI). Market size is projected to reach USD xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. Technological advancements, such as the adoption of smart building technologies and flexible work arrangements, are reshaping consumer preferences. Competition is intensifying, with existing players focusing on differentiation through innovation and service quality. Market penetration rates for sustainable office buildings are expected to increase significantly, reaching xx% by 2033.

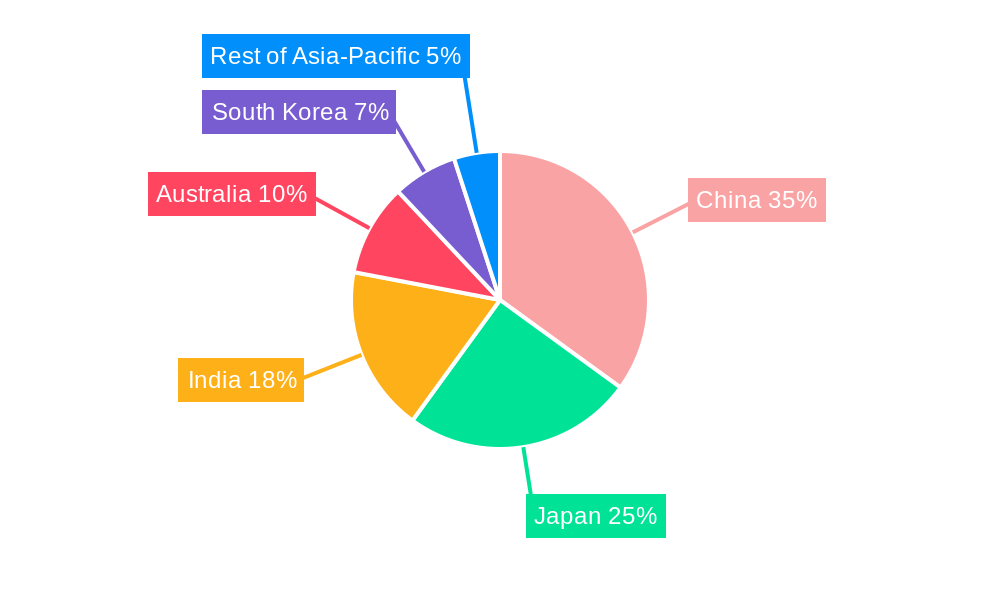

Dominant Markets & Segments in Asia Pacific Office Real Estate Market

China, Japan, and India represent the dominant markets in the Asia Pacific office real estate sector. These countries exhibit robust economic growth, expanding urban populations, and substantial infrastructure development.

China:

- Growth Drivers: Rapid urbanization, expanding tech sector, significant FDI.

- Market Dominance: Largest market in the region, driven by strong economic growth and demand from multinational corporations.

Japan:

- Growth Drivers: Strong economic fundamentals, advanced infrastructure, high demand from financial institutions.

- Market Dominance: Established market with sophisticated office infrastructure.

India:

- Growth Drivers: Rapid economic expansion, IT sector growth, rising middle class.

- Market Dominance: High growth potential driven by increasing demand from IT firms and SMEs.

Other significant markets include Australia and South Korea, while the "Rest of Asia-Pacific" segment exhibits moderate growth potential.

Asia Pacific Office Real Estate Market Product Analysis

The office real estate market is witnessing significant product innovation, focusing on improving building efficiency, enhancing tenant experience, and incorporating sustainable practices. Smart building technologies, such as IoT-enabled systems and energy-efficient designs, are increasingly being adopted to enhance operational efficiency and attract tenants. The market is also seeing a shift towards flexible workspace solutions and co-working spaces, providing businesses with greater adaptability and cost savings. These new product offerings are proving highly attractive to a wider range of users, driving stronger competition.

Key Drivers, Barriers & Challenges in Asia Pacific Office Real Estate Market

Key Drivers:

- Rapid urbanization and economic growth: Driving increased demand for office space across major cities.

- Technological advancements: Smart building technologies and flexible workspace solutions enhance efficiency and appeal.

- Government policies: Incentives and regulations promoting sustainable development.

Key Challenges:

- Supply chain disruptions: Increased material costs and project delays due to global supply constraints. Impacting project timelines and profitability (estimated USD xx Million loss in 2024).

- Regulatory complexities: Varying zoning regulations and environmental standards across countries create hurdles for developers.

- Competitive pressures: Intense competition among developers and landlords impacting pricing and occupancy rates.

Growth Drivers in the Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market is primarily driven by rapid urbanization, economic expansion, technological advancements (such as smart building technologies and flexible workspaces), and supportive government policies. The growing IT sector and increased foreign direct investment (FDI) further contribute to this growth.

Challenges Impacting Asia Pacific Office Real Estate Market Growth

Major challenges hindering market growth include supply chain disruptions causing material cost increases and construction delays, regulatory complexities varying across countries, and intense competition among developers leading to price wars and reduced profitability. Geopolitical instability and economic uncertainty also pose significant risks.

Key Players Shaping the Asia Pacific Office Real Estate Market Market

- Mitsubishi Estate Company

- Cushman & Wakefield

- New World Development

- Tata Housing and Tata Realty & Infrastructures

- Henderson Land Development Company

- Frasers Property

- JLL

- CDL

- Colliers

- CBRE

Significant Asia Pacific Office Real Estate Market Industry Milestones

- February 2022: Hulic and Japan Excellent's USD 25.4 Million Shintomicho Building transaction highlights investment activity in Tokyo's office market.

- July 2022: Google's 1.3 Million sq. ft lease in Bengaluru signifies significant demand in India's tech hub.

Future Outlook for Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market is poised for sustained growth, driven by ongoing urbanization, economic expansion, and technological innovation. Strategic opportunities exist in developing sustainable and smart office spaces, catering to evolving tenant preferences and incorporating flexible work models. The market's long-term potential remains strong, despite short-term challenges.

Asia Pacific Office Real Estate Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Office Real Estate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Office Real Estate Market Regional Market Share

Geographic Coverage of Asia Pacific Office Real Estate Market

Asia Pacific Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Coworking Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Estate Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cushman & Wakefield

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 New World Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Housing and Tata Realty & Infrastructures6 4 Other Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henderson Land Development Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frasers Property

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CDL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colliers

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CBRE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Estate Company

List of Figures

- Figure 1: Asia Pacific Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Office Real Estate Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Asia Pacific Office Real Estate Market?

Key companies in the market include Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures6 4 Other Companies, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, CBRE.

3. What are the main segments of the Asia Pacific Office Real Estate Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2198.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Rise in Demand for Coworking Spaces.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

February 2022 - Real estate firm Hulic and Japan Excellent executed a purchase agreement to exchange trust beneficiary rights in the Shintomicho Building for JPY 3.1 billion (USD 25.4 million). Japan Excellent mostly invests in office buildings in Tokyo. Two phases will be involved in the transfer of the Trust Beneficiary Rights in the Shintomicho Building: the first phase will involve the transfer of 40% ownership for JPY 1,24 billion (USD 10.1 million), and the second phase will involve the transfer of the remaining 60% ownership for JPY 1.86 billion (USD 15.3 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence