Key Insights

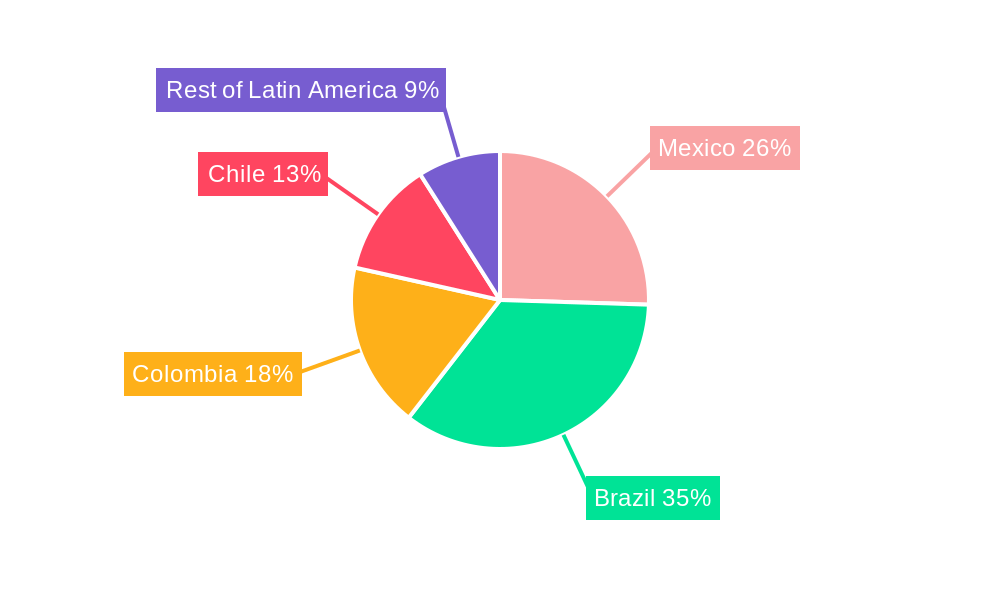

The Latin America Office Real Estate Market is projected for substantial growth, fueled by strong economic performance and evolving corporate space needs in major economies. Valued at approximately USD 122.4 billion in 2024, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 2.7% through 2033. This expansion is driven by increased foreign investment, a thriving startup scene, and sustained demand for modern, flexible, and technologically advanced office environments. Brazil is expected to remain the market leader, followed by Mexico and Colombia, both showing significant recovery and development in their commercial real estate sectors. A key trend is the demand for premium office spaces that promote collaboration and employee well-being, compelling developers to integrate sustainable features and smart building technologies.

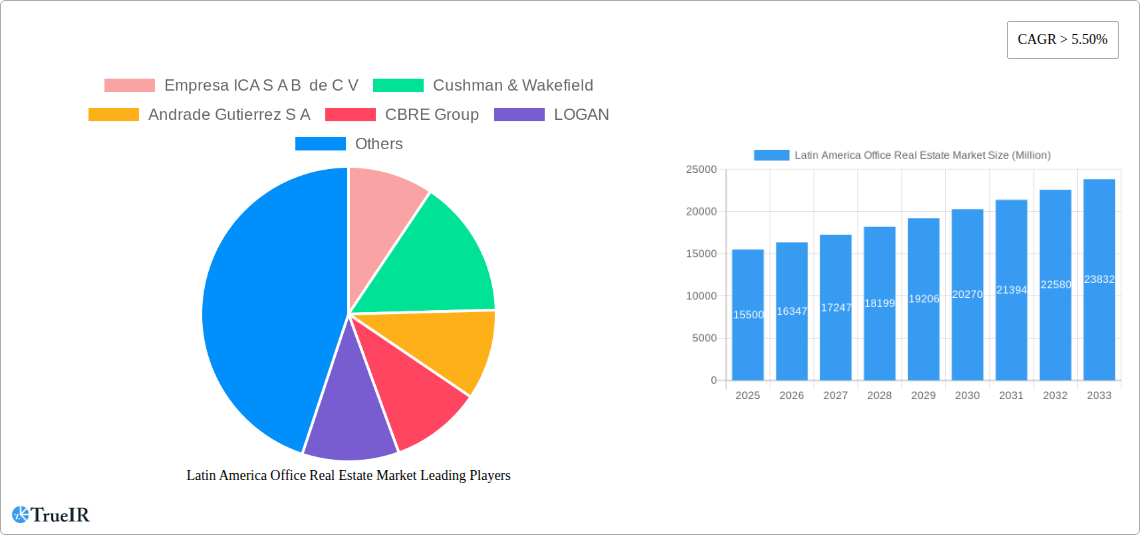

Latin America Office Real Estate Market Market Size (In Billion)

The adoption of hybrid work models is fundamentally altering office space requirements, driving demand for adaptable lease agreements, co-working solutions, and well-designed shared areas. While this presents innovation opportunities, it also poses challenges for older, less flexible buildings regarding vacancy rates. Potential restraints include regional political and economic volatility and escalating construction material costs, which may moderate growth. Nevertheless, the inherent economic resilience of Latin America and the strategic significance of its key cities as business hubs are expected to offset these concerns. Businesses are increasingly prioritizing office locations with superior connectivity, amenities, and access to talent, thereby concentrating investment in prime urban centers. Geographic segmentation reveals varied growth patterns across countries, with Mexico and Brazil identified as the most dynamic sub-markets, owing to their robust economic infrastructure and supportive business climates.

Latin America Office Real Estate Market Company Market Share

This report offers a dynamic, SEO-optimized analysis of the Latin America Office Real Estate Market, including market size, growth projections, and key trends.

Latin America Office Real Estate Market Market Structure & Competitive Landscape

The Latin America office real estate market exhibits a dynamic structure characterized by a moderate level of concentration, with key players like CBRE Group, Cushman & Wakefield, and LOGAN actively shaping the competitive landscape. Innovation drivers are primarily fueled by evolving tenant demands for flexible workspaces, ESG (Environmental, Social, and Governance) compliant buildings, and smart building technologies. Regulatory impacts vary significantly across geographies, with Brazil and Mexico often leading in the implementation of new zoning laws and tax incentives, influencing development and investment strategies. Product substitutes, such as co-working spaces and remote work policies, are increasingly integrated into traditional office leasing models, forcing landlords to adapt their offerings. End-user segmentation reveals a growing demand from technology, finance, and professional services sectors seeking prime locations and modern amenities. Mergers and acquisition (M&A) trends have seen significant activity, with reported M&A volumes in the range of hundreds of millions of dollars annually, driven by consolidation and strategic expansion by major real estate firms and investment funds. For instance, recent years have seen consolidation efforts, aiming to capitalize on market efficiencies and expand service portfolios.

Latin America Office Real Estate Market Market Trends & Opportunities

The Latin America office real estate market is poised for significant growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period of 2025–2033. The estimated market size for 2025 stands at xx Million, with substantial expansion anticipated by 2033. Technological shifts are paramount, with the integration of proptech solutions, AI-driven building management systems, and advanced cybersecurity features becoming standard expectations for modern office spaces. This digital transformation enhances operational efficiency, tenant experience, and sustainability credentials. Consumer preferences are increasingly leaning towards flexible lease terms, amenity-rich environments, and locations offering excellent connectivity and access to talent pools. The demand for "flight-to-quality" remains a dominant trend, with occupiers prioritizing high-specification, energy-efficient buildings that can attract and retain top talent. Competitive dynamics are intensified by the influx of global investment funds and the strategic partnerships formed between developers and property technology providers. Opportunities abound in the redevelopment of older office stock into Grade A properties and the creation of mixed-use developments that integrate residential, retail, and office components. The expansion of e-commerce and the growth of technology hubs in cities like São Paulo, Mexico City, and Bogotá are creating sustained demand for modern office infrastructure. Furthermore, the increasing adoption of hybrid work models is driving demand for well-appointed, collaborative office spaces that serve as hubs for innovation and employee engagement. Emerging markets within the "Rest of Latin America" also present untapped potential for investors seeking diversification and higher yields, albeit with increased geopolitical risk considerations.

Dominant Markets & Segments in Latin America Office Real Estate Market

Brazil and Mexico consistently emerge as the dominant markets within the Latin America office real estate sector, commanding a significant share of leasing activity and investment.

Brazil:

- Key Growth Drivers: A large domestic economy, a robust financial services sector, and increasing foreign direct investment are primary catalysts. Government initiatives promoting business growth and infrastructure development, such as the expansion of transportation networks in major cities like São Paulo, further bolster demand. The presence of multinational corporations and the thriving startup ecosystem contribute to sustained leasing requirements.

- Market Dominance Analysis: São Paulo, in particular, acts as the financial and corporate hub for Latin America, driving substantial demand for premium office space. The city's established business districts and ongoing urban regeneration projects ensure a consistent pipeline of new developments and attractive leasing opportunities. The concentration of major corporations, including entities like Cyrela Brazil Realty S A, underscores Brazil's importance.

Mexico:

- Key Growth Drivers: Proximity to the United States, a strong manufacturing base, and a growing technology sector are key drivers. Nearshoring trends are significantly boosting demand for commercial real estate as companies relocate production and operations closer to North American markets. Government policies aimed at attracting foreign investment and improving ease of doing business are also influential.

- Market Dominance Analysis: Mexico City, a vast metropolitan area, is the undisputed leader, housing a multitude of national and international corporations. The country's strategic location and competitive labor costs make it an attractive destination for businesses seeking to optimize their supply chains. Companies like Empresa ICA S A B de C V are integral to the nation's construction and real estate landscape.

Colombia:

- Key Growth Drivers: A stable political environment, a growing middle class, and a burgeoning tech and services sector are propelling growth. Bogotá is emerging as a key regional business hub, attracting significant investment and corporate expansion.

- Market Dominance Analysis: Bogotá is the primary driver, with its modern infrastructure and a growing ecosystem of startups and established businesses. The city's appeal is enhanced by its relatively competitive operating costs compared to other major Latin American capitals.

Chile:

- Key Growth Drivers: A mature economy, strong investor confidence, and a focus on innovation and technology. Santiago is a well-established financial center with a high standard of living, attracting multinational corporations seeking a stable operating environment.

- Market Dominance Analysis: Santiago is the focal point of Chile's office real estate market, characterized by a well-developed infrastructure and a strong demand for high-quality office spaces from sectors like mining, finance, and professional services.

Rest of Latin America:

- Key Growth Drivers: Emerging economies in countries like Peru and Argentina present evolving opportunities. Urbanization, increasing consumer spending, and a growing entrepreneurial spirit are contributing factors, albeit with higher volatility.

- Market Dominance Analysis: While fragmented, key cities in these regions are experiencing increased interest from investors and businesses, driven by specific sector growth and development initiatives.

Latin America Office Real Estate Market Product Analysis

The Latin America office real estate market is witnessing a wave of product innovations focused on enhancing sustainability, occupant well-being, and operational efficiency. Key advancements include the widespread adoption of smart building technologies, such as integrated IoT systems for energy management, space utilization tracking, and predictive maintenance. Green building certifications, like LEED and BREEAM, are no longer a niche requirement but a standard expectation, driving demand for buildings with superior energy efficiency, water conservation features, and healthy indoor environments. The rise of flexible workspace solutions, including hot-desking, agile office layouts, and adaptable modular designs, caters to evolving work patterns and reduces the overall footprint required by tenants. These innovations offer significant competitive advantages by attracting premium tenants, reducing operating costs, and contributing to corporate ESG goals.

Key Drivers, Barriers & Challenges in Latin America Office Real Estate Market

Key Drivers: The Latin America office real estate market is propelled by several key forces. Economic growth and stability in major economies like Brazil and Mexico are fundamental, attracting foreign investment and expanding corporate footprints. Technological advancements, particularly in proptech and smart building solutions, are driving demand for modern, efficient, and amenity-rich spaces. Government policies encouraging foreign direct investment, infrastructure development, and urban renewal projects also play a crucial role. The increasing adoption of hybrid work models is paradoxically fueling demand for well-designed, collaborative office spaces that serve as central hubs for employee engagement and innovation. ESG mandates are becoming increasingly important, pushing for sustainable and healthy office environments.

Barriers & Challenges: Despite positive momentum, the market faces significant barriers and challenges. Political and economic instability in some regions can deter investment and create uncertainty. Regulatory complexities and bureaucratic hurdles in certain countries can slow down development and increase project costs, with an estimated impact of 5-10% on project timelines and budgets. Supply chain disruptions, exacerbated by global events, can lead to construction delays and increased material costs. Intense competition from established players like CBRE and newer entrants, as well as from alternative workspace solutions, necessitates continuous adaptation and innovation. The geographic dispersion of talent and the varying levels of technological adoption across the region present localized challenges for market penetration.

Growth Drivers in the Latin America Office Real Estate Market Market

Key growth drivers in the Latin America office real estate market are multifaceted. Technologically, the integration of PropTech solutions for building management, tenant experience, and data analytics is enhancing efficiency and attracting occupiers. Economically, a growing Middle Class and increasing Foreign Direct Investment (FDI), particularly driven by nearshoring initiatives in Mexico, are creating sustained demand for quality office spaces. Regulatory factors, such as government incentives for business development and infrastructure upgrades in major urban centers, are also critical. Furthermore, a rising awareness and demand for ESG-compliant buildings are pushing developers to offer sustainable and healthy workspaces. XXX

Challenges Impacting Latin America Office Real Estate Market Growth

Challenges impacting Latin America office real estate market growth are significant. Regulatory complexities, including varying zoning laws and permitting processes across different countries and even cities, can create delays and increase development costs, with some projects experiencing impacts of up to 15% on overall budget. Supply chain issues for construction materials and technology components can lead to project delays and price volatility, affecting an estimated 10-20% of project timelines. Competitive pressures from alternative workspace solutions like co-working and the evolving demand for hybrid work models necessitate constant adaptation in space design and leasing strategies. Economic volatility and currency fluctuations in some markets also pose a risk to investment returns.

Key Players Shaping the Latin America Office Real Estate Market Market

- Empresa ICA S A B de C V

- Cushman & Wakefield

- Andrade Gutierrez S A

- CBRE Group

- LOGAN

- Cyrela Brazil Realty S A

- CBRE

- OAS S A

Significant Latin America Office Real Estate Market Industry Milestones

- 2020: Increased adoption of remote work policies by multinational corporations due to the global pandemic, sparking discussions around future office space needs.

- 2021: Growing emphasis on ESG principles and sustainable building certifications in new office developments across major Latin American cities.

- 2022: Rise in PropTech investments and integration of smart building technologies to enhance tenant experience and operational efficiency.

- 2023: Renewed interest in flexible workspace solutions and hybrid work models, leading to a demand for adaptable office designs and amenities.

- 2024: Significant uptick in nearshoring investments, particularly in Mexico, driving demand for modern industrial and office spaces.

Future Outlook for Latin America Office Real Estate Market Market

The future outlook for the Latin America office real estate market is characterized by a sustained demand for high-quality, sustainable, and technologically advanced office spaces. Growth catalysts include continued economic expansion in key markets, further integration of proptech, and the enduring adoption of hybrid work models that necessitate well-designed collaborative environments. Strategic opportunities lie in the redevelopment of existing stock into ESG-compliant buildings, the expansion into emerging urban centers, and the provision of flexible lease terms and amenity-rich facilities. The market is expected to see increased investment in Grade A office properties and a focus on creating dynamic, human-centric workplaces that foster innovation and employee well-being.

Latin America Office Real Estate Market Segmentation

-

1. Geogrpahy

- 1.1. Mexico

- 1.2. Brazil

- 1.3. Colombia

- 1.4. Chile

- 1.5. Rest of Latin America

Latin America Office Real Estate Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Office Real Estate Market Regional Market Share

Geographic Coverage of Latin America Office Real Estate Market

Latin America Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1 Demand for Grade-A Offices

- 3.4.2 Co-working Offices to Rise

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.1.1. Mexico

- 5.1.2. Brazil

- 5.1.3. Colombia

- 5.1.4. Chile

- 5.1.5. Rest of Latin America

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Geogrpahy

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Empresa ICA S A B de C V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cushman & Wakefield

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Andrade Gutierrez S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LOGAN

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cyrela Brazil Realty S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CBRE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OAS S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Empresa ICA S A B de C V

List of Figures

- Figure 1: Latin America Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Office Real Estate Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 2: Latin America Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America Office Real Estate Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 4: Latin America Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Office Real Estate Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Latin America Office Real Estate Market?

Key companies in the market include Empresa ICA S A B de C V, Cushman & Wakefield, Andrade Gutierrez S A, CBRE Group, LOGAN, Cyrela Brazil Realty S A, CBRE, OAS S A.

3. What are the main segments of the Latin America Office Real Estate Market?

The market segments include Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Demand for Grade-A Offices. Co-working Offices to Rise.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Latin America Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence