Key Insights

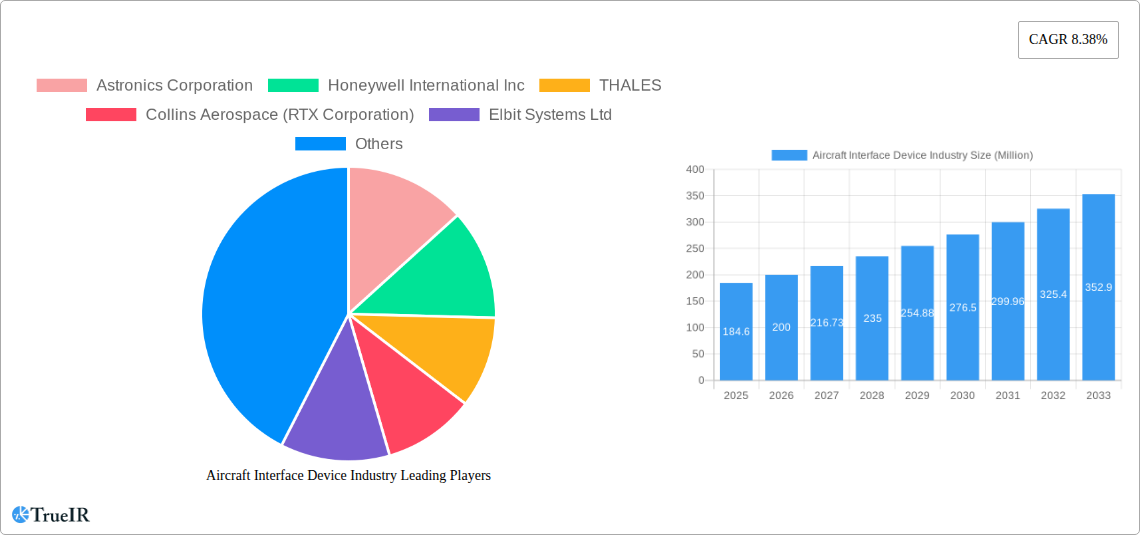

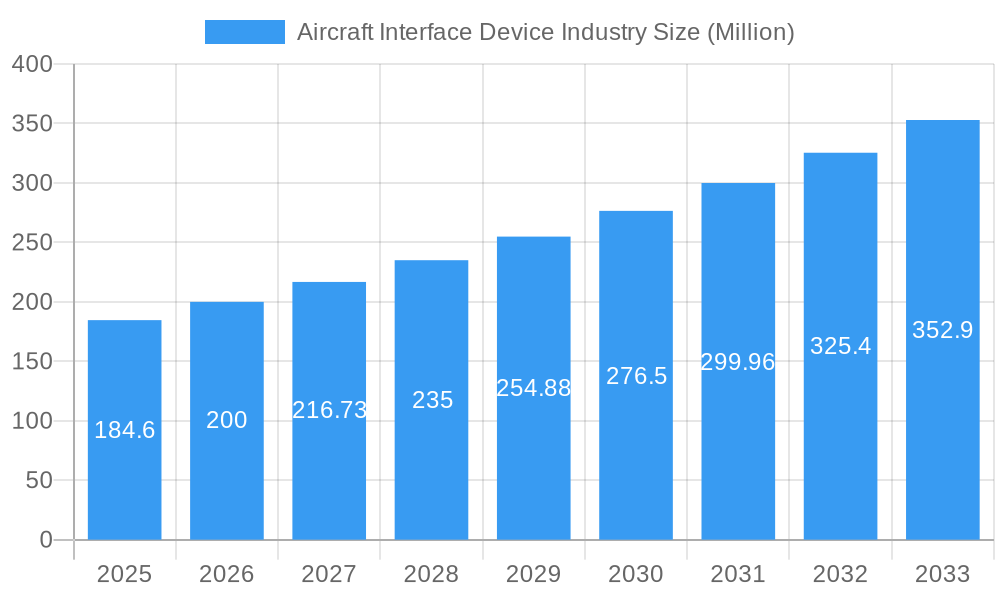

The Aircraft Interface Device (AID) market, valued at $184.60 million in 2025, is projected to experience robust growth, driven by increasing demand for advanced in-flight connectivity and enhanced passenger experience. A Compound Annual Growth Rate (CAGR) of 8.38% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include the growing adoption of in-flight entertainment systems, improved data communication capabilities for both passengers and crew, and the rising integration of sophisticated safety and operational systems that rely on efficient AID technology. The commercial aviation segment is anticipated to dominate due to the significant number of aircraft requiring these devices and airlines' continuous efforts to improve passenger satisfaction. Military and general aviation segments are also expected to exhibit notable growth, driven by increasing modernization efforts and the adoption of advanced technologies for enhanced situational awareness and communication. Technological advancements, such as the development of high-bandwidth, lightweight, and cost-effective AID solutions, are major trends shaping the market. However, challenges such as high initial investment costs for implementation and the potential for cybersecurity vulnerabilities could act as restraints on market growth.

Aircraft Interface Device Industry Market Size (In Million)

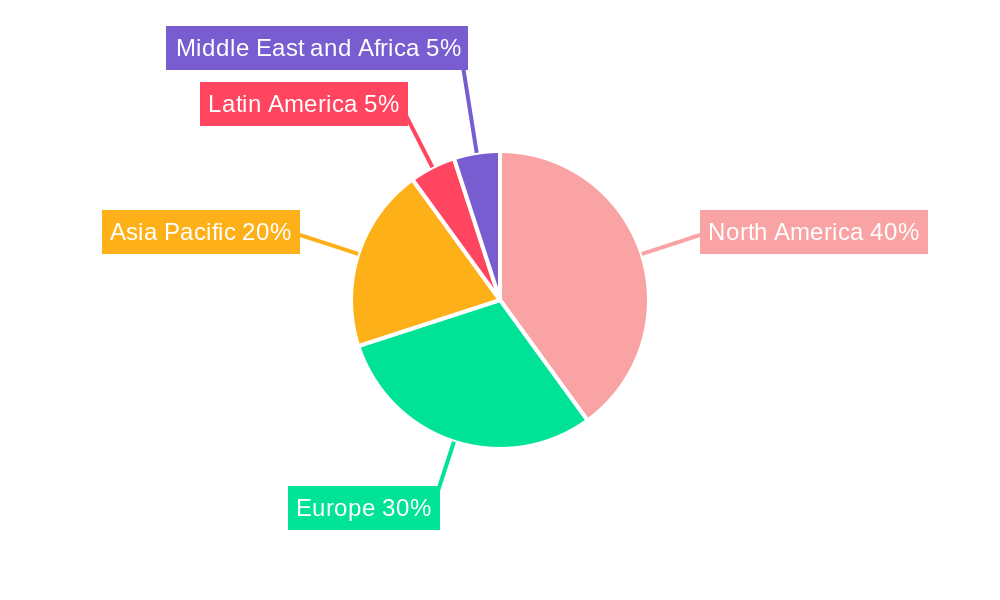

The regional market is geographically diverse, with North America currently holding a substantial share, primarily due to a large commercial aviation fleet and strong technological advancements. However, the Asia-Pacific region is expected to witness significant growth during the forecast period due to rapid expansion of its air travel sector and rising investments in infrastructure. Europe's mature aviation market will continue to provide steady growth. Competition in the AID market is intense, with major players such as Astronics Corporation, Honeywell International Inc., Thales, and Collins Aerospace vying for market share through continuous innovation and strategic partnerships. Smaller, specialized companies focusing on niche technologies are also contributing to the overall market dynamism and innovation. The continued focus on enhancing safety, improving passenger experiences, and optimizing operational efficiency will further propel the demand for sophisticated aircraft interface devices in the coming years.

Aircraft Interface Device Industry Company Market Share

Aircraft Interface Device Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Aircraft Interface Device industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report projects a market valued at xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% expected from 2025 to 2033.

Aircraft Interface Device Industry Market Structure & Competitive Landscape

The Aircraft Interface Device market exhibits a moderately concentrated structure, with several key players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Astronics Corporation, Honeywell International Inc, THALES, Collins Aerospace (RTX Corporation), and Elbit Systems Ltd are among the leading companies, driving innovation through continuous product development and strategic partnerships. Regulatory compliance, particularly concerning data security and safety standards, significantly impacts market dynamics. The industry is characterized by ongoing M&A activity, with xx Million in transactions recorded between 2019 and 2024, primarily driven by the desire to expand market reach and technological capabilities. Product substitution is limited due to the specialized nature of aircraft interface devices, but competitive pressure is substantial, forcing companies to focus on cost optimization and differentiation through enhanced features and functionalities. End-user segmentation is primarily driven by the application segments (Commercial, Military, General Aviation), with commercial aviation currently dominating the market.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx.

- Innovation Drivers: Continuous product development, focus on data analytics, and integration of advanced communication technologies.

- Regulatory Impacts: Stringent safety and security standards influencing product design and certification processes.

- Product Substitutes: Limited due to specialized nature, but competitive pressure encourages innovation.

- End-User Segmentation: Dominated by the commercial aviation sector, followed by military and general aviation.

- M&A Trends: xx Million in transactions between 2019-2024, driving market consolidation and expansion.

Aircraft Interface Device Industry Market Trends & Opportunities

The Aircraft Interface Device market is experiencing significant growth driven by the increasing demand for enhanced connectivity, real-time data analytics, and improved operational efficiency in the aviation industry. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of 5G and satellite communication technologies, are significantly impacting market dynamics. Growing adoption of cloud-based data management solutions and the increasing focus on predictive maintenance are creating lucrative opportunities for market players. However, the market faces challenges from economic fluctuations, particularly affecting the general aviation segment, and intense competitive pressure requiring continuous innovation and strategic alliances. The market penetration rate for advanced features such as real-time data streaming is currently at xx% and expected to reach xx% by 2033.

Dominant Markets & Segments in Aircraft Interface Device Industry

The commercial aviation segment currently dominates the Aircraft Interface Device market, accounting for approximately xx% of the global market share in 2025. This is primarily driven by the increasing adoption of advanced aircraft technologies, growing air passenger traffic, and the demand for enhanced passenger connectivity. The North American region leads the global market, owing to its large fleet size, significant investments in aviation infrastructure, and the presence of major aerospace manufacturers and airlines.

Key Growth Drivers in Commercial Aviation:

- High air passenger traffic growth.

- Demand for enhanced in-flight connectivity.

- Investment in new aircraft and fleet modernization.

- Stringent safety and security regulations driving adoption of advanced devices.

Key Growth Drivers in North America:

- Large aircraft fleet size.

- Significant investments in aviation infrastructure.

- Presence of major aerospace manufacturers and airlines.

- Favorable regulatory environment.

The military segment is also expected to witness significant growth, driven by the modernization of military aircraft fleets and the increasing demand for secure communication and data transmission systems. The General Aviation segment shows slower growth, primarily due to its smaller fleet size and economic sensitivity to market fluctuations.

Aircraft Interface Device Industry Product Analysis

Aircraft interface devices are evolving from simple data transfer units to sophisticated systems integrating various communication protocols and data analytics capabilities. Advancements in miniaturization, power efficiency, and cybersecurity are key drivers of product innovation. The market sees growing adoption of devices supporting high-speed data transmission, real-time monitoring, and remote diagnostics, providing improved operational efficiency and enhanced safety features. Competitive advantage is derived from superior data processing capabilities, ease of integration, robust cybersecurity features, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Aircraft Interface Device Industry

Key Drivers: Technological advancements in communication and data processing technologies, increasing demand for real-time data analytics for improved flight safety and efficiency, and regulatory mandates driving enhanced data security are key drivers. The growing adoption of cloud-based data management and predictive maintenance further strengthens market growth.

Key Challenges: Supply chain disruptions due to global events, increasing regulatory complexities impacting certification and deployment timelines, and intense competition leading to pressure on pricing and profitability are significant challenges. These challenges could result in delays in project implementation and affect market growth potential. The estimated impact on market revenue due to supply chain disruptions is projected at xx Million annually.

Growth Drivers in the Aircraft Interface Device Industry Market

The increasing demand for enhanced connectivity and data analytics in the aviation industry is driving significant growth. Technological advancements, such as 5G and satellite communication, are enabling real-time data transmission and improving operational efficiency. Stringent safety and security regulations are further driving adoption. These factors are projected to push the market value to xx Million by 2033.

Challenges Impacting Aircraft Interface Device Industry Growth

Supply chain disruptions, regulatory hurdles, and intense competition present major challenges. These factors can lead to delays in product development, increased costs, and reduced profitability. The estimated impact of regulatory complexities on market growth is approximately xx% annually.

Key Players Shaping the Aircraft Interface Device Industry Market

Significant Aircraft Interface Device Industry Industry Milestones

May 2023: RTX Corporation announced the installation of Collins Aerospace's InteliSight aircraft interface device on over 200 JetBlue Airways Airbus A320 aircraft, enhancing data collection and real-time access. This significantly impacted the market by showcasing the capabilities of advanced interface devices and driving adoption among major airlines.

August 2023: FLYHT Aerospace Solutions LLC secured a five-year contract extension for software services related to Boeing B777 and B767 fleets, demonstrating the growing demand for ongoing software support and maintenance in the industry. This milestone emphasizes the long-term service contracts and recurring revenue model for software solutions within the Aircraft Interface Device ecosystem.

Future Outlook for Aircraft Interface Device Industry Market

The Aircraft Interface Device market is poised for sustained growth, driven by technological innovation, increasing demand for connectivity, and the focus on operational efficiency. The integration of advanced communication technologies like 5G and satellite communications will open new avenues for data-driven insights and improved decision-making. Strategic partnerships and collaborations among industry players will further accelerate market expansion, leading to the development of innovative and integrated solutions. The market's future prospects are bright, with significant potential for growth and development in the coming years.

Aircraft Interface Device Industry Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Military

- 1.3. General Aviation

Aircraft Interface Device Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Qatar

- 5.5. Rest of Middle East and Africa

Aircraft Interface Device Industry Regional Market Share

Geographic Coverage of Aircraft Interface Device Industry

Aircraft Interface Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aircraft Segment to have the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Military

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Military

- 6.1.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Military

- 7.1.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Military

- 8.1.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Military

- 9.1.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aircraft Interface Device Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Military

- 10.1.3. General Aviation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astronics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Collins Aerospace (RTX Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Elbit Systems Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SCI Technology Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Teledyne Technologies Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anuvu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKYTRAC Systems Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ViaSat Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avionics Interface Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Astronics Corporation

List of Figures

- Figure 1: Global Aircraft Interface Device Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Interface Device Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Aircraft Interface Device Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aircraft Interface Device Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Aircraft Interface Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Aircraft Interface Device Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Aircraft Interface Device Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Aircraft Interface Device Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Aircraft Interface Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Aircraft Interface Device Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Aircraft Interface Device Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Aircraft Interface Device Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Aircraft Interface Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Aircraft Interface Device Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Aircraft Interface Device Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Aircraft Interface Device Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Aircraft Interface Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Aircraft Interface Device Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Aircraft Interface Device Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Aircraft Interface Device Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Aircraft Interface Device Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Aircraft Interface Device Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Aircraft Interface Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Aircraft Interface Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Aircraft Interface Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Aircraft Interface Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Latin America Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Aircraft Interface Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Aircraft Interface Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: United Arab Emirates Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Saudi Arabia Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Qatar Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Aircraft Interface Device Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Interface Device Industry?

The projected CAGR is approximately 8.38%.

2. Which companies are prominent players in the Aircraft Interface Device Industry?

Key companies in the market include Astronics Corporation, Honeywell International Inc, THALES, Collins Aerospace (RTX Corporation), Elbit Systems Ltd, SCI Technology Inc, Teledyne Technologies Incorporated, Anuvu, SKYTRAC Systems Ltd, ViaSat Inc, Avionics Interface Technologies.

3. What are the main segments of the Aircraft Interface Device Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aircraft Segment to have the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: FLYHT Aerospace Solutions LLC announced that it had signed a five-year contract extension with one of its long-term aircraft lease customers to provide ongoing software services for its entire Boeing B777 and B767 fleets

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Interface Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Interface Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Interface Device Industry?

To stay informed about further developments, trends, and reports in the Aircraft Interface Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence