Key Insights

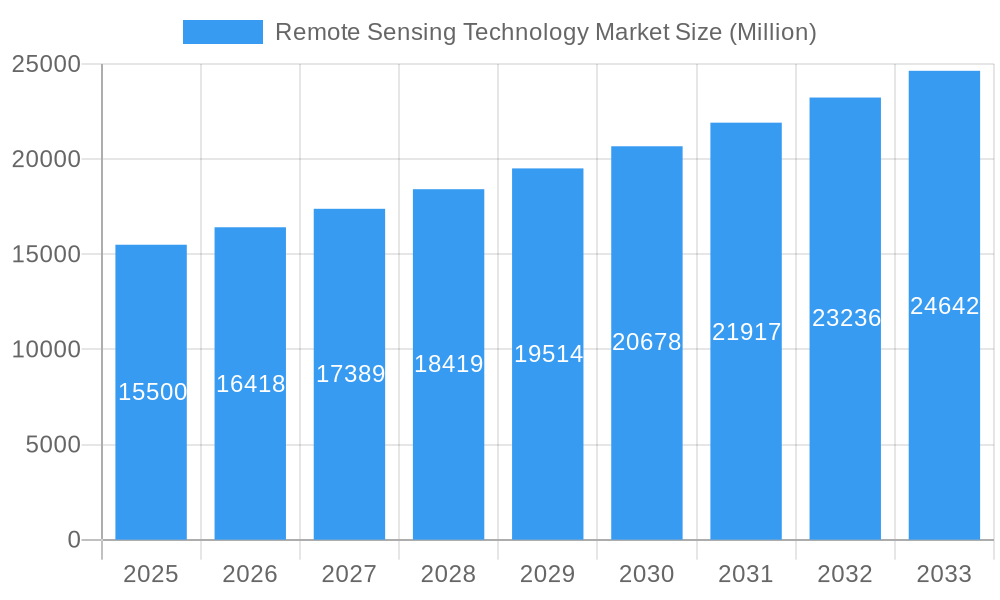

The global Remote Sensing Technology Market is projected for substantial growth, anticipated to reach approximately $25.37 billion by 2025, driven by a compound annual growth rate (CAGR) of 11.59%. This expansion is fueled by increasing demand from commercial and defense sectors, rapid advancements in satellite technology, and the growing utilization of satellite-derived data across diverse applications. The "Above 1000kg" satellite mass segment and the Low Earth Orbit (LEO) are expected to be key growth drivers due to the proliferation of large satellite constellations and the operational efficiencies of LEO for sensing tasks. Additionally, the demand for advanced propulsion systems and satellite bus technologies for extended missions and enhanced data acquisition will further propel market momentum.

Remote Sensing Technology Market Market Size (In Billion)

Key market trends include the rising adoption of small satellites for specialized remote sensing missions and the integration of artificial intelligence (AI) and machine learning (ML) for sophisticated data analysis. Increased defense spending and geopolitical developments are also significantly boosting the defense and government end-user segment. Challenges include high initial investment costs, stringent regulatory frameworks, and space debris management. However, continuous innovation in sensor technology, improved data processing, and expanding applications in agriculture, environmental monitoring, urban planning, and disaster management will drive the market forward.

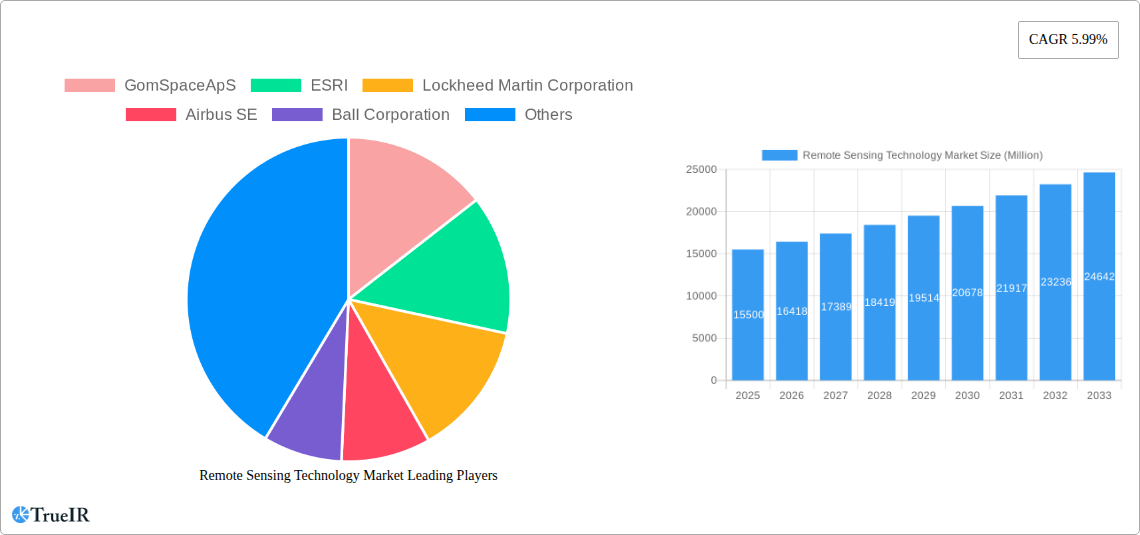

Remote Sensing Technology Market Company Market Share

This report provides a comprehensive analysis of the dynamic remote sensing technology market, examining its structure, trends, and future outlook. It focuses on key growth drivers and opportunities, with detailed market size and forecast data from the base year 2025 through 2033. Understanding the critical role of remote sensing in commercial applications, national security, environmental monitoring, and scientific research is paramount.

Remote Sensing Technology Market Market Structure & Competitive Landscape

The remote sensing technology market exhibits a moderately concentrated structure, driven by significant investments in R&D and the high capital expenditure required for satellite development and launch. Innovation is primarily fueled by advancements in sensor technology, data processing algorithms, and the increasing demand for real-time, high-resolution geospatial data. Regulatory impacts, particularly regarding data ownership, privacy, and spectrum allocation, play a crucial role in shaping market entry and operations. Product substitutes, such as aerial photography and ground-based sensors, exist but are often limited in their scope and scalability compared to satellite-based solutions. The end-user segmentation, spanning commercial, military & government, and other sectors, dictates varying levels of demand for specific data types and analytical capabilities. Mergers and acquisitions (M&A) are a recurring trend as larger players consolidate their market position and acquire specialized technologies. For instance, the period saw a number of strategic partnerships aimed at enhancing data acquisition and processing capabilities. The market concentration ratio is estimated to be around 45% for the top five players. M&A activities have accounted for approximately 15 significant transactions between 2021 and 2024, indicating a robust consolidation drive.

Remote Sensing Technology Market Market Trends & Opportunities

The remote sensing technology market is poised for substantial growth, projected to expand from an estimated XX Million in 2025 to XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5%. This expansion is propelled by a confluence of technological advancements, evolving consumer preferences, and increasing governmental investments. The proliferation of small satellite constellations, coupled with miniaturization in satellite subsystems like solar arrays and propulsion hardware, is significantly reducing launch costs and increasing data acquisition frequency. This trend is democratizing access to space-based data, fostering innovation across various industries.

Technological shifts are paramount, with a growing emphasis on artificial intelligence (AI) and machine learning (ML) for automated data analysis, feature extraction, and predictive modeling. These capabilities are transforming raw satellite imagery into actionable intelligence for a wide array of applications. Consumer preferences are increasingly leaning towards subscription-based models for readily available, processed geospatial data, moving away from one-off data purchases. This shift is driving the development of user-friendly platforms and APIs.

Competitive dynamics are intensifying, with established aerospace giants coexisting alongside agile new entrants specializing in niche data services and analytics. The market penetration rate for advanced remote sensing solutions is steadily increasing across sectors like agriculture, disaster management, urban planning, and resource exploration. The development of advanced sensor technologies, such as hyperspectral and synthetic aperture radar (SAR), is opening up new frontiers for detailed environmental monitoring and infrastructure assessment. The increasing demand for climate change monitoring and sustainable resource management is a significant opportunity, driving the need for consistent and reliable Earth observation data. The burgeoning LEO satellite market, characterized by constellations of smaller, more agile satellites, is a key trend enabling more frequent revisits and broader coverage, thereby expanding market opportunities for data providers and analytics firms.

Dominant Markets & Segments in Remote Sensing Technology Market

The remote sensing technology market is characterized by several dominant markets and segments, each contributing significantly to the overall growth and evolution of the industry.

Dominant Orbit Class: LEO (Low Earth Orbit) LEO constellations are currently dominating the market due to their ability to provide high-resolution imagery with frequent revisit times. The increasing deployment of small satellites in LEO further solidifies its leadership. The ability to capture data with lower latency and higher spatial detail makes LEO ideal for applications requiring near real-time monitoring.

Dominant Satellite Mass Segment: 100-500kg This segment represents a sweet spot for many remote sensing missions, offering a balance between payload capacity for advanced sensors and manageable launch costs. Satellites in this mass class are capable of carrying sophisticated imaging instruments while remaining cost-effective to deploy and operate.

Dominant Satellite Subsystem: Satellite Bus & Subsystems The reliable and efficient functioning of the satellite bus and its integrated subsystems is foundational to any remote sensing mission. Innovations in satellite bus design, power management, and communication systems directly impact the performance and longevity of remote sensing satellites. This segment is crucial for enabling the payload to perform its intended functions.

Dominant End User: Commercial The commercial sector is emerging as the largest and fastest-growing end-user for remote sensing technology. This growth is driven by applications in precision agriculture, infrastructure monitoring, urban planning, insurance, financial services, and environmental compliance. The increasing availability of affordable satellite data and advanced analytics platforms is fueling commercial adoption.

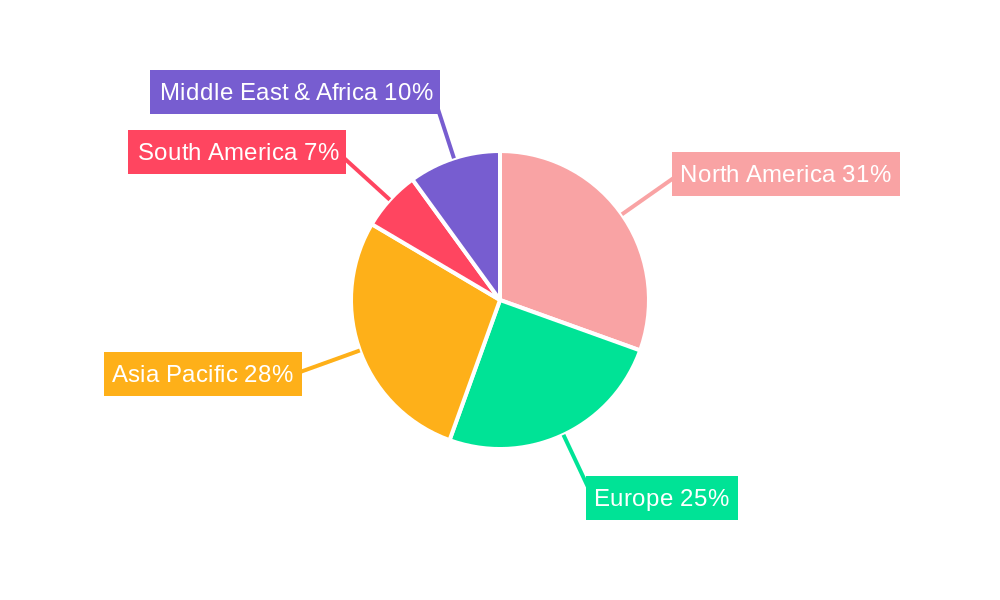

Dominant Region: North America North America, particularly the United States, remains a leading region in the remote sensing market. This dominance is attributed to robust government investment in space programs, a thriving private sector engaged in satellite development and data analytics, and a high adoption rate of geospatial technologies across various industries. Key growth drivers include significant investments in national security, environmental monitoring initiatives, and the development of advanced AI-driven analytics platforms.

- Key Growth Drivers in North America:

- Infrastructure Development: Monitoring of large-scale infrastructure projects, including transportation networks and energy grids.

- Environmental Policies: Increasing focus on climate change mitigation and resource management drives demand for Earth observation data.

- Technological Innovation: Leading role in developing advanced sensors, AI, and big data analytics for geospatial intelligence.

- Defense Spending: Significant allocation for national security and intelligence gathering through satellite imagery.

- Key Growth Drivers in North America:

Remote Sensing Technology Market Product Analysis

Remote sensing products are evolving rapidly, with a focus on delivering higher resolution, multi-spectral, and hyperspectral data. Innovations in sensor technology, such as miniaturized radar and optical instruments, are enabling smaller, more cost-effective satellites to capture richer datasets. The integration of AI and machine learning algorithms allows for automated feature extraction, anomaly detection, and predictive analytics, transforming raw imagery into actionable intelligence. These advancements are crucial for applications ranging from precision agriculture and disaster response to urban planning and resource management, providing unparalleled insights into the Earth's surface and atmosphere.

Key Drivers, Barriers & Challenges in Remote Sensing Technology Market

Key Drivers: The remote sensing technology market is propelled by several key drivers. Technologically, advancements in sensor miniaturization, AI-powered data analytics, and the proliferation of small satellite constellations are reducing costs and increasing accessibility. Economically, the growing demand for geospatial intelligence across various commercial sectors, including agriculture, insurance, and urban planning, fuels market expansion. Policy-driven factors, such as increased government investment in national security, environmental monitoring, and climate change initiatives, also play a significant role. For example, the push for sustainable development goals necessitates accurate Earth observation data.

Barriers & Challenges: Despite robust growth, the market faces challenges. Regulatory complexities, including data privacy concerns and international data sharing agreements, can create hurdles. Supply chain issues, particularly for specialized components and launch services, can lead to delays and increased costs. Competitive pressures, both from established players and emerging startups, necessitate continuous innovation and cost optimization. The high initial investment for satellite development and launch can also be a barrier to entry for smaller organizations.

Growth Drivers in the Remote Sensing Technology Market Market

Key growth drivers in the remote sensing technology market include technological advancements such as the development of higher resolution sensors and sophisticated AI algorithms for data processing. The increasing global emphasis on climate change monitoring, disaster management, and sustainable resource allocation necessitates comprehensive Earth observation capabilities. Economically, the expanding applications of geospatial data in commercial sectors like precision agriculture, smart city development, and insurance are creating significant demand. Regulatory support, including government initiatives and funding for space exploration and Earth science, further stimulates market growth. The continuous innovation in satellite design and manufacturing, leading to more cost-effective solutions, is also a critical factor.

Challenges Impacting Remote Sensing Technology Market Growth

Challenges impacting remote sensing technology market growth include the complex regulatory landscape surrounding data acquisition, processing, and dissemination, particularly concerning privacy and national security. Supply chain vulnerabilities, from rare earth minerals for sensors to launch vehicle availability, can lead to production delays and cost escalations. Intense competitive pressures require companies to constantly innovate and differentiate their offerings. Furthermore, the substantial capital investment required for developing and launching satellite constellations and ground infrastructure remains a significant barrier for new entrants, and the ability to effectively monetize vast amounts of acquired data presents ongoing hurdles.

Key Players Shaping the Remote Sensing Technology Market Market

- GomSpace ApS

- ESRI

- Lockheed Martin Corporation

- Airbus SE

- Ball Corporation

- Japan Aerospace Exploration Agency (JAXA)

- China Aerospace Science and Technology Corporation (CASC)

- Maxar Technologies Inc

- ROSCOSMOS

- Thales

- Planet Labs Inc

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

- IHI Corporation

- Spire Global Inc

Significant Remote Sensing Technology Market Industry Milestones

- March 2023: The Japan Aerospace Exploration Agency (JAXA) scheduled the launch of the first H3 Launch Vehicle with the Advanced Land Observing Satellite "Daichi 3" (ALOS-3) onboard from the Tanegashima Space Center, enhancing Japan's Earth observation capabilities.

- February 2023: NASA and geographic information service provider Esri entered into a Space Act Agreement to grant wider access to NASA's geospatial content for research and exploration, fostering collaboration and data utilization.

- January 2023: Airbus Defence and Space secured a contract with Poland to provide a comprehensive geospatial intelligence system, including the development, manufacture, launch, and delivery of two high-performance optical Earth observation satellites, underscoring European advancements in satellite technology.

Future Outlook for Remote Sensing Technology Market Market

The future outlook for the remote sensing technology market is exceptionally bright, driven by sustained innovation and expanding applications. Strategic opportunities lie in the continued development of AI-driven analytics platforms that can derive deeper insights from complex geospatial datasets. The burgeoning Internet of Things (IoT) ecosystem, coupled with remote sensing, will enable more integrated and intelligent solutions for smart cities, autonomous vehicles, and precision agriculture. Market potential is further amplified by the increasing global focus on climate resilience, sustainable resource management, and precision defense, all of which rely heavily on accurate and timely Earth observation data. The commercialization of space and the growing accessibility of satellite technology are poised to unlock new revenue streams and drive unprecedented growth in the coming years.

Remote Sensing Technology Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Remote Sensing Technology Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Remote Sensing Technology Market Regional Market Share

Geographic Coverage of Remote Sensing Technology Market

Remote Sensing Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. North America Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.1.1. 10-100kg

- 6.1.2. 100-500kg

- 6.1.3. 500-1000kg

- 6.1.4. Below 10 Kg

- 6.1.5. above 1000kg

- 6.2. Market Analysis, Insights and Forecast - by Orbit Class

- 6.2.1. GEO

- 6.2.2. LEO

- 6.2.3. MEO

- 6.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 6.3.1. Propulsion Hardware and Propellant

- 6.3.2. Satellite Bus & Subsystems

- 6.3.3. Solar Array & Power Hardware

- 6.3.4. Structures, Harness & Mechanisms

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Commercial

- 6.4.2. Military & Government

- 6.4.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7. South America Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.1.1. 10-100kg

- 7.1.2. 100-500kg

- 7.1.3. 500-1000kg

- 7.1.4. Below 10 Kg

- 7.1.5. above 1000kg

- 7.2. Market Analysis, Insights and Forecast - by Orbit Class

- 7.2.1. GEO

- 7.2.2. LEO

- 7.2.3. MEO

- 7.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 7.3.1. Propulsion Hardware and Propellant

- 7.3.2. Satellite Bus & Subsystems

- 7.3.3. Solar Array & Power Hardware

- 7.3.4. Structures, Harness & Mechanisms

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Commercial

- 7.4.2. Military & Government

- 7.4.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8. Europe Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.1.1. 10-100kg

- 8.1.2. 100-500kg

- 8.1.3. 500-1000kg

- 8.1.4. Below 10 Kg

- 8.1.5. above 1000kg

- 8.2. Market Analysis, Insights and Forecast - by Orbit Class

- 8.2.1. GEO

- 8.2.2. LEO

- 8.2.3. MEO

- 8.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 8.3.1. Propulsion Hardware and Propellant

- 8.3.2. Satellite Bus & Subsystems

- 8.3.3. Solar Array & Power Hardware

- 8.3.4. Structures, Harness & Mechanisms

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Commercial

- 8.4.2. Military & Government

- 8.4.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9. Middle East & Africa Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.1.1. 10-100kg

- 9.1.2. 100-500kg

- 9.1.3. 500-1000kg

- 9.1.4. Below 10 Kg

- 9.1.5. above 1000kg

- 9.2. Market Analysis, Insights and Forecast - by Orbit Class

- 9.2.1. GEO

- 9.2.2. LEO

- 9.2.3. MEO

- 9.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 9.3.1. Propulsion Hardware and Propellant

- 9.3.2. Satellite Bus & Subsystems

- 9.3.3. Solar Array & Power Hardware

- 9.3.4. Structures, Harness & Mechanisms

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Commercial

- 9.4.2. Military & Government

- 9.4.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10. Asia Pacific Remote Sensing Technology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.1.1. 10-100kg

- 10.1.2. 100-500kg

- 10.1.3. 500-1000kg

- 10.1.4. Below 10 Kg

- 10.1.5. above 1000kg

- 10.2. Market Analysis, Insights and Forecast - by Orbit Class

- 10.2.1. GEO

- 10.2.2. LEO

- 10.2.3. MEO

- 10.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 10.3.1. Propulsion Hardware and Propellant

- 10.3.2. Satellite Bus & Subsystems

- 10.3.3. Solar Array & Power Hardware

- 10.3.4. Structures, Harness & Mechanisms

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Commercial

- 10.4.2. Military & Government

- 10.4.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GomSpaceApS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ESRI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ball Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Aerospace Exploration Agency (JAXA)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Aerospace Science and Technology Corporation (CASC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxar Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ROSCOSMOS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thale

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Planet Labs Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Northrop Grumman Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Indian Space Research Organisation (ISRO)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 IHI Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Spire Global Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 GomSpaceApS

List of Figures

- Figure 1: Global Remote Sensing Technology Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Remote Sensing Technology Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 3: North America Remote Sensing Technology Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 4: North America Remote Sensing Technology Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 5: North America Remote Sensing Technology Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 6: North America Remote Sensing Technology Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 7: North America Remote Sensing Technology Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 8: North America Remote Sensing Technology Market Revenue (billion), by End User 2025 & 2033

- Figure 9: North America Remote Sensing Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Remote Sensing Technology Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Remote Sensing Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Remote Sensing Technology Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 13: South America Remote Sensing Technology Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 14: South America Remote Sensing Technology Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 15: South America Remote Sensing Technology Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: South America Remote Sensing Technology Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 17: South America Remote Sensing Technology Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 18: South America Remote Sensing Technology Market Revenue (billion), by End User 2025 & 2033

- Figure 19: South America Remote Sensing Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America Remote Sensing Technology Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Remote Sensing Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Remote Sensing Technology Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 23: Europe Remote Sensing Technology Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 24: Europe Remote Sensing Technology Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 25: Europe Remote Sensing Technology Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 26: Europe Remote Sensing Technology Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 27: Europe Remote Sensing Technology Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 28: Europe Remote Sensing Technology Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Europe Remote Sensing Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Remote Sensing Technology Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Remote Sensing Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Remote Sensing Technology Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 33: Middle East & Africa Remote Sensing Technology Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 34: Middle East & Africa Remote Sensing Technology Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 35: Middle East & Africa Remote Sensing Technology Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 36: Middle East & Africa Remote Sensing Technology Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 37: Middle East & Africa Remote Sensing Technology Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 38: Middle East & Africa Remote Sensing Technology Market Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East & Africa Remote Sensing Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa Remote Sensing Technology Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Remote Sensing Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Remote Sensing Technology Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 43: Asia Pacific Remote Sensing Technology Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 44: Asia Pacific Remote Sensing Technology Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 45: Asia Pacific Remote Sensing Technology Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 46: Asia Pacific Remote Sensing Technology Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 47: Asia Pacific Remote Sensing Technology Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 48: Asia Pacific Remote Sensing Technology Market Revenue (billion), by End User 2025 & 2033

- Figure 49: Asia Pacific Remote Sensing Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific Remote Sensing Technology Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Remote Sensing Technology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 2: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Global Remote Sensing Technology Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 7: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Remote Sensing Technology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 15: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 16: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 17: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Remote Sensing Technology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 23: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 24: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 25: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Remote Sensing Technology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 37: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 38: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 39: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Remote Sensing Technology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 48: Global Remote Sensing Technology Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 49: Global Remote Sensing Technology Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 50: Global Remote Sensing Technology Market Revenue billion Forecast, by End User 2020 & 2033

- Table 51: Global Remote Sensing Technology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Remote Sensing Technology Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Remote Sensing Technology Market?

The projected CAGR is approximately 11.59%.

2. Which companies are prominent players in the Remote Sensing Technology Market?

Key companies in the market include GomSpaceApS, ESRI, Lockheed Martin Corporation, Airbus SE, Ball Corporation, Japan Aerospace Exploration Agency (JAXA), China Aerospace Science and Technology Corporation (CASC), Maxar Technologies Inc, ROSCOSMOS, Thale, Planet Labs Inc, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO), IHI Corporation, Spire Global Inc.

3. What are the main segments of the Remote Sensing Technology Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.37 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: The Japan Aerospace Exploration Agency (JAXA) had scheduled the launch of the first H3 Launch Vehicle with the Advanced Land Observing Satellite "Daichi 3" (ALOS-3) onboard from the Tanegashima Space Center.February 2023: NASA and geographic information service provider Esri will grant wider access to the space agency's geospatial content for research and exploration purposes through the Space Act Agreement.January 2023: Airbus Defence and Space has signed a contract with Poland to provide a geospatial intelligence system including the development, manufacture, launch and delivery in orbit of two high-performance optical Earth observation satellites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Remote Sensing Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Remote Sensing Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Remote Sensing Technology Market?

To stay informed about further developments, trends, and reports in the Remote Sensing Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence