Key Insights

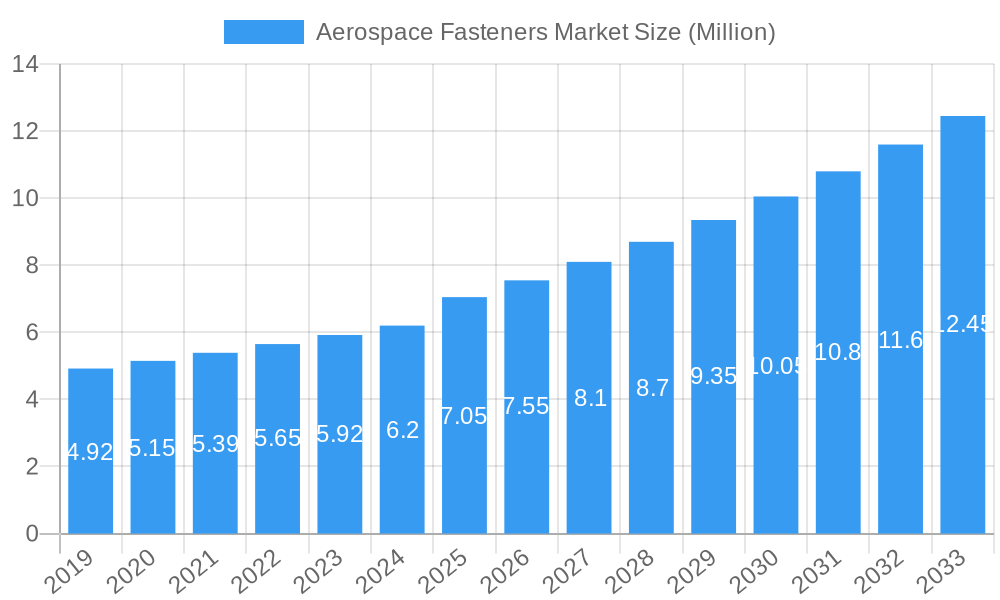

The global Aerospace Fasteners Market is projected for substantial growth, reaching an estimated market size of $6,899.7 million by 2025, with a Compound Annual Growth Rate (CAGR) of 10.3% through 2033. This expansion is driven by increased commercial aircraft demand fueled by population growth and rising disposable incomes, leading to higher air travel. Significant investments in modernizing military fleets, coupled with advancements in general aviation and space exploration, are also key growth catalysts. The market's reliance on advanced materials like aluminum, steel, superalloys, and titanium highlights their crucial role in ensuring aircraft safety, durability, and performance. Leading players are innovating to meet the aerospace industry's stringent demands.

Aerospace Fasteners Market Market Size (In Billion)

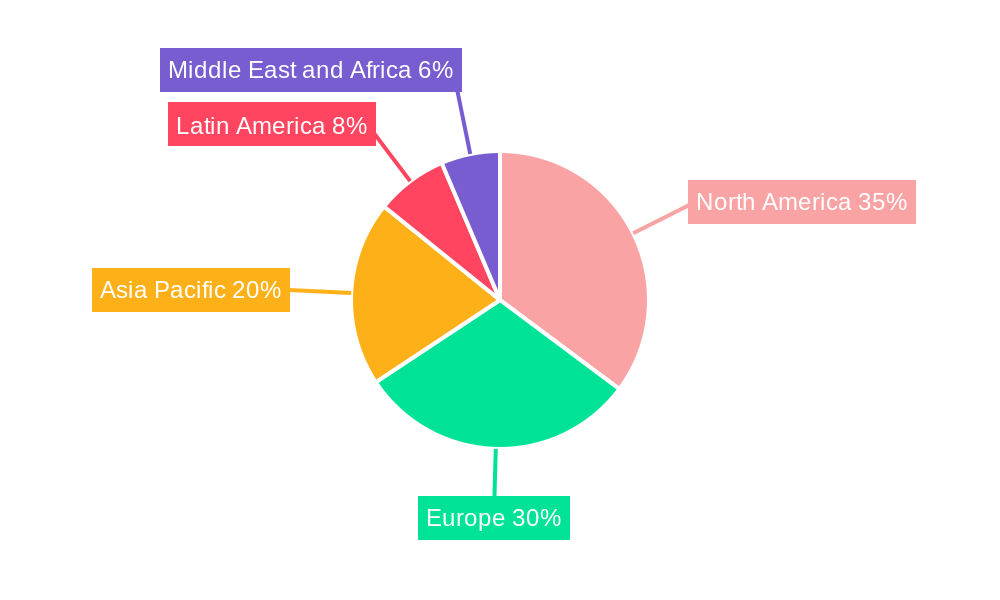

Key market trends include the rising adoption of lightweight, high-strength composite materials, requiring specialized fastening solutions, and a growing emphasis on sustainable manufacturing and eco-friendly fasteners. However, the market faces challenges such as high raw material costs and complex regulatory frameworks. Geographically, North America and Europe lead due to established aerospace ecosystems, while the Asia Pacific region, particularly China and India, is expected to experience the fastest growth driven by expanding domestic aviation industries and increased defense spending. Continuous innovation in fastener technology, material science, and manufacturing processes will be vital for stakeholders to capitalize on opportunities and navigate the competitive landscape.

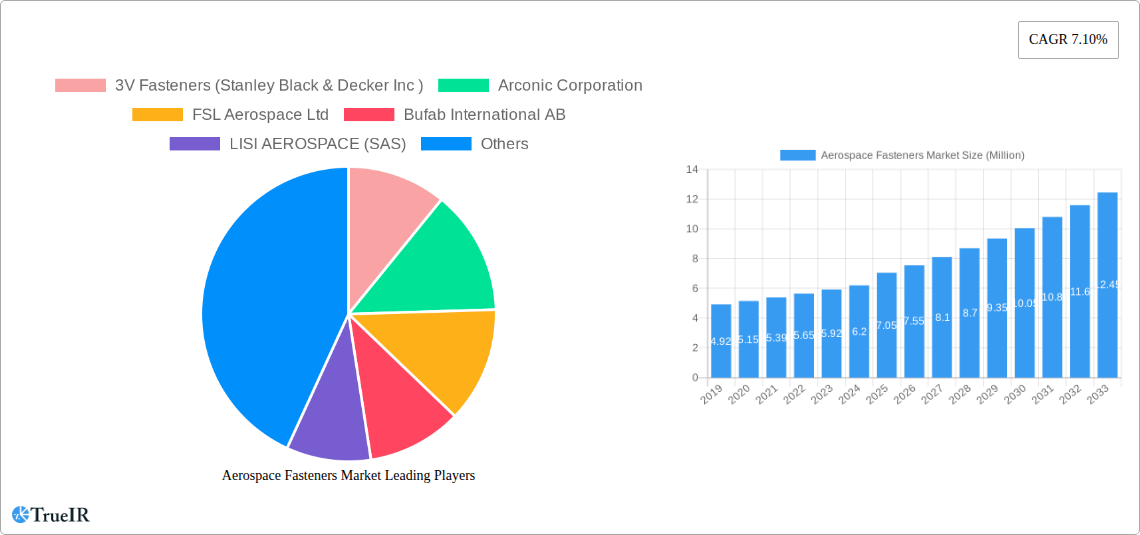

Aerospace Fasteners Market Company Market Share

This report offers a comprehensive analysis of the global Aerospace Fasteners Market, providing in-depth insights into its structure, trends, competitive landscape, and future outlook from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It is an essential resource for stakeholders looking to understand and leverage the evolving aerospace fastener industry.

Aerospace fasteners are critical, often unseen components ensuring aircraft structural integrity and safety across commercial, military, and general aviation sectors. Demand for high-performance, lightweight, and durable fasteners is driven by stringent safety regulations and the continuous pursuit of fuel efficiency and operational reliability in aviation.

This report provides actionable intelligence for manufacturers, suppliers, investors, and regulatory bodies by analyzing the impact of technological advancements, material innovations, and evolving market dynamics on the aerospace fasteners industry.

Aerospace Fasteners Market Market Structure & Competitive Landscape

The Aerospace Fasteners Market exhibits a moderately concentrated structure, with a mix of large, established players and a significant number of specialized, niche manufacturers. The market concentration is influenced by high entry barriers, including stringent regulatory approvals, substantial R&D investment, and long-standing customer relationships. Innovation drivers are primarily focused on lightweight materials, advanced alloys, and intelligent fastener systems that enhance performance and reduce aircraft weight for improved fuel efficiency. Regulatory impacts from bodies like the FAA and EASA are paramount, dictating design, manufacturing, and material standards, thus shaping product development and market access. Product substitutes are limited due to the critical nature of aerospace applications, but advancements in composite materials and adhesive bonding techniques present indirect competitive pressures. End-user segmentation is clearly defined by application (Commercial Aircraft, Military Aircraft, General Aviation) and material (Aluminum, Steel, Superalloys, Titanium), each with distinct performance requirements. M&A trends within the industry are driven by a desire for vertical integration, expanded product portfolios, and increased market share. For instance, over the historical period (2019-2024), there were approximately 5-10 significant M&A activities valued in the hundreds of millions, aimed at consolidating capabilities and securing technological leadership. The competitive landscape is characterized by a blend of global conglomerates and specialized suppliers vying for contracts with major aircraft OEMs.

Aerospace Fasteners Market Market Trends & Opportunities

The global Aerospace Fasteners Market is projected to witness robust growth, driven by escalating air travel demand and increasing aircraft production rates. The market size is expected to expand from an estimated USD xx Million in 2025 to USD xx Million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This significant expansion is fueled by several key trends. Firstly, the aging global aircraft fleet necessitates frequent maintenance, repair, and overhaul (MRO) activities, leading to sustained demand for replacement fasteners. Secondly, the introduction of new aircraft models, particularly in the commercial aviation sector, with advanced designs and lighter composite materials, creates opportunities for manufacturers offering specialized fastening solutions. The shift towards sustainable aviation is also a prominent trend, pushing for fasteners made from lighter, more environmentally friendly materials and contributing to reduced fuel consumption. Technological advancements, such as the development of smart fasteners with integrated sensors for real-time monitoring of structural integrity, represent a major innovation frontier. Consumer preferences are increasingly leaning towards aircraft with higher fuel efficiency and lower operational costs, indirectly boosting the demand for advanced, lightweight fasteners. The competitive dynamics are intensifying, with companies investing heavily in R&D to develop cutting-edge fastening technologies and secure long-term supply agreements with OEMs. Opportunities abound in the development of next-generation fasteners that offer enhanced corrosion resistance, higher tensile strength, and superior fatigue life, particularly for applications in extreme aerospace environments. The increasing outsourcing of manufacturing by major aerospace companies also presents an avenue for specialized fastener suppliers to expand their market penetration. Furthermore, the growth in the general aviation segment, particularly with the rise of personal jet ownership and business aviation, contributes steadily to market expansion. The market penetration rates for advanced materials like titanium and superalloys are expected to rise as aircraft manufacturers prioritize performance and longevity.

Dominant Markets & Segments in Aerospace Fasteners Market

The Commercial Aircraft segment is unequivocally the dominant force within the Aerospace Fasteners Market, driven by the consistent and substantial global demand for passenger and cargo air transport. The sheer volume of commercial aircraft manufactured annually, coupled with their extensive operational lifespan requiring regular MRO, positions this segment as the primary revenue generator. The United States and Europe currently represent the leading regional markets, owing to the presence of major aircraft OEMs like Boeing and Airbus, respectively, and a well-established MRO infrastructure.

Key Growth Drivers in the Commercial Aircraft Segment:

- Increasing Global Air Passenger Traffic: Post-pandemic recovery and sustained economic growth in emerging economies are fueling demand for air travel, translating into higher aircraft production and a constant need for fasteners.

- Fleet Expansion and Modernization: Airlines are continually expanding their fleets to meet rising passenger demand and replacing older, less fuel-efficient aircraft with newer models, necessitating a significant supply of new fasteners.

- Lightweighting Initiatives: The drive for fuel efficiency compels manufacturers to use lighter materials, such as advanced aluminum alloys and titanium, in aircraft construction, thereby increasing the demand for specialized fasteners for these materials.

- Robust MRO Sector: The ongoing maintenance and repair requirements for a vast global fleet of commercial aircraft ensure a continuous demand for replacement fasteners.

In terms of Materials, Aluminum and Steel fasteners continue to hold significant market share due to their cost-effectiveness and widespread application in various aircraft components. However, the trend towards higher performance and weight reduction is significantly boosting the demand for Titanium and Superalloys.

Key Growth Drivers for Titanium and Superalloys:

- High Strength-to-Weight Ratio: These materials offer superior strength at a lower density compared to traditional alloys, critical for aerospace applications where weight reduction directly impacts fuel efficiency and payload capacity.

- Excellent High-Temperature Performance: Superalloys, in particular, are essential for components operating in high-temperature environments, such as engine parts, where their resistance to creep and fatigue is crucial.

- Corrosion and Fatigue Resistance: Titanium and advanced superalloys exhibit exceptional resistance to corrosion and fatigue, enhancing the longevity and reliability of critical aircraft structures.

- Advancements in Manufacturing Processes: Innovations in additive manufacturing and precision machining are making these high-performance materials more accessible and cost-effective for fastener production.

While Military Aircraft and General Aviation also contribute to the market, their demand, though substantial, is generally lower in volume compared to commercial aviation. Military aircraft require highly specialized and robust fasteners for extreme operational conditions, while general aviation, though growing, comprises a smaller fleet size.

Aerospace Fasteners Market Product Analysis

Aerospace fasteners are engineered with precision to meet extreme performance requirements, including high tensile strength, fatigue resistance, and exceptional durability in challenging environments. Key product innovations focus on lightweight materials such as titanium and advanced aluminum alloys, as well as high-performance superalloys for critical applications. The competitive advantage lies in offering fasteners with superior corrosion resistance, enhanced vibration dampening capabilities, and improved sealing properties. Advancements in manufacturing techniques, including precision machining and emerging additive manufacturing, enable the production of complex geometries and customized solutions, further solidifying market position and addressing the evolving needs of aircraft OEMs for weight reduction and increased operational efficiency.

Key Drivers, Barriers & Challenges in Aerospace Fasteners Market

Key Drivers:

The aerospace fasteners market is propelled by sustained growth in global air travel, necessitating increased aircraft production and MRO activities. Technological advancements in lightweight materials like titanium and superalloys are crucial for enhancing fuel efficiency and performance. Stringent safety regulations, while a barrier to entry, also drive innovation towards higher quality and more reliable fastening solutions. Government initiatives supporting defense spending and aerospace research further bolster demand, particularly for military-grade fasteners.

Barriers & Challenges:

The primary challenges include the highly regulated nature of the industry, requiring extensive and costly certifications for new products and manufacturers. Supply chain complexities, exacerbated by geopolitical factors and the specialized nature of raw materials, can lead to lead time extensions and increased costs. Intense competition among established players and the threat of material substitution in non-critical applications present ongoing pressures. Furthermore, the high initial investment required for R&D and specialized manufacturing equipment acts as a significant barrier to entry for new market participants. The cyclical nature of aircraft production can also lead to fluctuations in demand.

Growth Drivers in the Aerospace Fasteners Market Market

The growth of the Aerospace Fasteners Market is significantly influenced by several interconnected factors. The escalating global demand for air travel, driven by economic development and an expanding middle class, directly translates into higher aircraft production volumes and, consequently, a greater need for fasteners. Technological innovation plays a pivotal role; the continuous pursuit of lighter, stronger, and more durable materials such as titanium alloys and advanced superalloys allows manufacturers to meet the stringent weight reduction targets for improved fuel efficiency. Furthermore, significant investments in research and development by aerospace OEMs and fastener manufacturers are leading to the creation of advanced fastening systems, including those with enhanced fatigue life and corrosion resistance, vital for long-term aircraft operational integrity. Government policies supporting the aerospace sector through defense spending and R&D grants also contribute to market expansion.

Challenges Impacting Aerospace Fasteners Market Growth

Several significant challenges can impact the growth trajectory of the Aerospace Fasteners Market. The industry's stringent regulatory environment, encompassing rigorous testing and certification processes, presents a substantial hurdle for new entrants and can prolong product development cycles. Supply chain disruptions, including raw material availability and transportation issues, can lead to production delays and increased costs, particularly for specialized alloys. Intense competition among both established global players and specialized manufacturers can exert downward pressure on pricing and profit margins. Moreover, the high capital investment required for advanced manufacturing technologies and adherence to quality standards acts as a considerable barrier to entry. Fluctuations in global economic conditions and geopolitical uncertainties can also lead to unpredictable demand patterns, posing a challenge for long-term market planning.

Key Players Shaping the Aerospace Fasteners Market Market

- 3V Fasteners (Stanley Black & Decker Inc )

- Arconic Corporation

- FSL Aerospace Ltd

- Bufab International AB

- LISI AEROSPACE (SAS)

- Precision Castparts Corp (Berkshire Hathaway Inc )

- B&B Specialties Inc

- Boeing Distribution Services Inc (The Boeing Company)

- TriMas Corporation

- TFI Aerospace Corporation

- National Aerospace Fasteners Corporation

Significant Aerospace Fasteners Market Industry Milestones

- 2023: Launch of new lightweight titanium fasteners with enhanced fatigue resistance, enabling further weight reduction in next-generation commercial aircraft.

- 2022: Acquisition of a specialized composite fastener manufacturer by a major aerospace components supplier to expand its portfolio in advanced materials.

- 2021: Development of smart fasteners with integrated sensors for real-time structural health monitoring in military aircraft applications.

- 2020: Increased investment in additive manufacturing capabilities by leading fastener manufacturers to produce complex geometries and custom solutions.

- 2019: Introduction of enhanced corrosion-resistant coatings for steel fasteners used in harsh marine and extreme climate operating environments.

Future Outlook for Aerospace Fasteners Market Market

The future outlook for the Aerospace Fasteners Market is exceptionally promising, driven by sustained growth in global air travel and a continuous drive for aircraft modernization and efficiency. The increasing demand for lightweight yet robust fastening solutions, particularly those made from advanced materials like titanium and superalloys, will be a significant growth catalyst. Innovations in smart fasteners and additive manufacturing technologies are expected to create new market opportunities, enabling enhanced aircraft performance and predictive maintenance. Strategic collaborations between fastener manufacturers and aircraft OEMs will be crucial for developing bespoke solutions that meet evolving design requirements. The growing emphasis on sustainable aviation practices will further incentivize the development and adoption of eco-friendly fastening materials and processes. Overall, the market is poised for substantial expansion, fueled by technological advancements, increasing production rates, and the persistent need for safety and performance in the aerospace sector.

Aerospace Fasteners Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation

-

2. Material

- 2.1. Aluminum

- 2.2. Steel

- 2.3. Superalloys

- 2.4. Titanium

Aerospace Fasteners Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Aerospace Fasteners Market Regional Market Share

Geographic Coverage of Aerospace Fasteners Market

Aerospace Fasteners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment is Projected to Showcase the Largest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Aluminum

- 5.2.2. Steel

- 5.2.3. Superalloys

- 5.2.4. Titanium

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Aluminum

- 6.2.2. Steel

- 6.2.3. Superalloys

- 6.2.4. Titanium

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Aluminum

- 7.2.2. Steel

- 7.2.3. Superalloys

- 7.2.4. Titanium

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Aircraft

- 8.1.2. Military Aircraft

- 8.1.3. General Aviation

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Aluminum

- 8.2.2. Steel

- 8.2.3. Superalloys

- 8.2.4. Titanium

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Aircraft

- 9.1.2. Military Aircraft

- 9.1.3. General Aviation

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Aluminum

- 9.2.2. Steel

- 9.2.3. Superalloys

- 9.2.4. Titanium

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Aircraft

- 10.1.2. Military Aircraft

- 10.1.3. General Aviation

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Aluminum

- 10.2.2. Steel

- 10.2.3. Superalloys

- 10.2.4. Titanium

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3V Fasteners (Stanley Black & Decker Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arconic Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FSL Aerospace Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bufab International AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LISI AEROSPACE (SAS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Precision Castparts Corp (Berkshire Hathaway Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B&B Specialties Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boeing Distribution Services Inc (The Boeing Company)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TriMas Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TFI Aerospace Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 National Aerospace Fasteners Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 3V Fasteners (Stanley Black & Decker Inc )

List of Figures

- Figure 1: Global Aerospace Fasteners Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 3: North America Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 5: North America Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 9: Europe Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 11: Europe Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 15: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 17: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 18: Asia Pacific Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 21: Latin America Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 23: Latin America Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Latin America Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 25: Latin America Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 29: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 3: Global Aerospace Fasteners Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 11: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Germany Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: France Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Russia Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 19: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: India Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: China Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Japan Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 26: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 27: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Brazil Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 33: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Egypt Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Israel Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Fasteners Market?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Aerospace Fasteners Market?

Key companies in the market include 3V Fasteners (Stanley Black & Decker Inc ), Arconic Corporation, FSL Aerospace Ltd, Bufab International AB, LISI AEROSPACE (SAS), Precision Castparts Corp (Berkshire Hathaway Inc ), B&B Specialties Inc, Boeing Distribution Services Inc (The Boeing Company), TriMas Corporation, TFI Aerospace Corporation, National Aerospace Fasteners Corporation.

3. What are the main segments of the Aerospace Fasteners Market?

The market segments include Application, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 6899.7 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment is Projected to Showcase the Largest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Fasteners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Fasteners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Fasteners Market?

To stay informed about further developments, trends, and reports in the Aerospace Fasteners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence