Key Insights

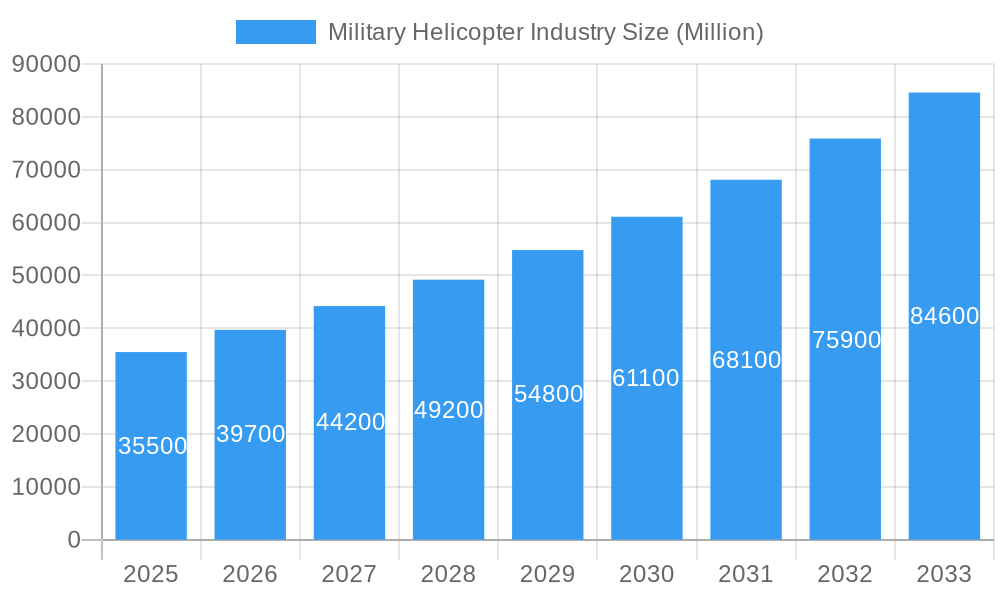

The global Military Helicopter market is projected to reach USD 34.3 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7% through 2033. This expansion is driven by rising geopolitical tensions and the demand for advanced aerial capabilities, including surveillance, troop transport, and combat support. Governments are investing in modernizing fleets to counter emerging threats, enhance operational efficiency, and maintain strategic military advantages. The demand for versatile, multi-mission helicopters is high. The integration of AI, advanced avionics, and stealth technology fuels innovation. Increased defense spending globally and modernization efforts by major powers will further propel market growth.

Military Helicopter Industry Market Size (In Billion)

The market features intense competition from established global players and emerging regional manufacturers. Companies are investing in R&D to develop next-generation helicopters with improved performance, survivability, and reduced operating costs. Key growth drivers include fleet replacement, new model development, and the use of helicopters in disaster relief. Constraints include high acquisition and maintenance costs and stringent regulations. Nevertheless, sustained demand for advanced aerial platforms and the strategic importance of defense capabilities ensure strong growth for the military helicopter industry.

Military Helicopter Industry Company Market Share

This report offers a dynamic, SEO-optimized analysis of the Military Helicopter Industry, covering market size, growth, key players, and future trends from 2019 to 2033, with a base year of 2025.

Military Helicopter Industry Market Structure & Competitive Landscape

The military helicopter market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Key innovation drivers include the relentless pursuit of enhanced combat survivability, increased operational range, advanced sensor integration, and superior payload capacity. Regulatory impacts are substantial, with stringent defense procurement policies, export controls, and national security interests shaping market access and product development. Product substitutes, while limited in the high-end military rotorcraft segment, can emerge in the form of unmanned aerial vehicles (UAVs) for specific mission profiles. End-user segmentation primarily revolves around army aviation, naval aviation, and air force applications, each with distinct operational requirements. Mergers and acquisitions (M&A) trends are influenced by the need for technological synergy, cost optimization, and global market expansion. For instance, recent M&A activities aim to consolidate expertise in areas like advanced avionics and next-generation propulsion systems. The market concentration is estimated to be around a CR5 of 65-70%, with M&A volumes averaging between 2-3 significant deals annually over the historical period.

Military Helicopter Industry Market Trends & Opportunities

The Military Helicopter Industry is poised for significant growth, driven by escalating geopolitical tensions, modernization programs of national defense forces, and continuous technological advancements. The market size is projected to reach over USD 75 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2% from the base year 2025. Technological shifts are paramount, with a strong emphasis on the integration of artificial intelligence (AI) for enhanced decision-making, autonomous flight capabilities, and advanced electronic warfare systems. The development of hybrid-electric and all-electric powertrains is also gaining traction, promising reduced operational costs and environmental impact. Consumer preferences, within the defense sector, are increasingly leaning towards multi-role helicopters that offer versatility and cost-effectiveness, capable of performing a wide array of missions from troop transport and cargo delivery to armed reconnaissance and close air support. Competitive dynamics are intensifying, with established manufacturers investing heavily in R&D to maintain their technological edge and secure lucrative government contracts. The market penetration of advanced rotorcraft technologies is steadily increasing as nations prioritize force modernization. Opportunities abound in emerging markets undergoing substantial defense budget increases and in specialized niche segments requiring unique rotorcraft capabilities. The ongoing demand for advanced attack helicopters, such as the AH-64 Apache, and heavy-lift platforms, like the CH-47 Chinook, continues to shape market trends, with significant contract awards signaling sustained demand. The integration of networked warfare capabilities and advanced sensor fusion further elevates the operational effectiveness of modern military helicopters, creating new avenues for innovation and market expansion.

Dominant Markets & Segments in Military Helicopter Industry

The Multi-Mission Helicopter segment is currently the dominant force within the global Military Helicopter Industry, driven by its inherent versatility and ability to adapt to diverse operational requirements. This segment's dominance is further bolstered by a substantial market share, estimated at over 45% of the total industry value. Key growth drivers within this segment include robust government investments in homeland security, counter-terrorism operations, and disaster relief capabilities, where multi-role platforms excel. The Transport Helicopter segment also represents a significant and consistently growing market, essential for troop deployment, logistics, and humanitarian aid missions. Its growth is underpinned by the persistent need for strategic mobility and the ability to support expeditionary forces across vast distances. The Others segment, encompassing specialized platforms like reconnaissance, training, and attack helicopters, also contributes significantly, though its market share is more fragmented.

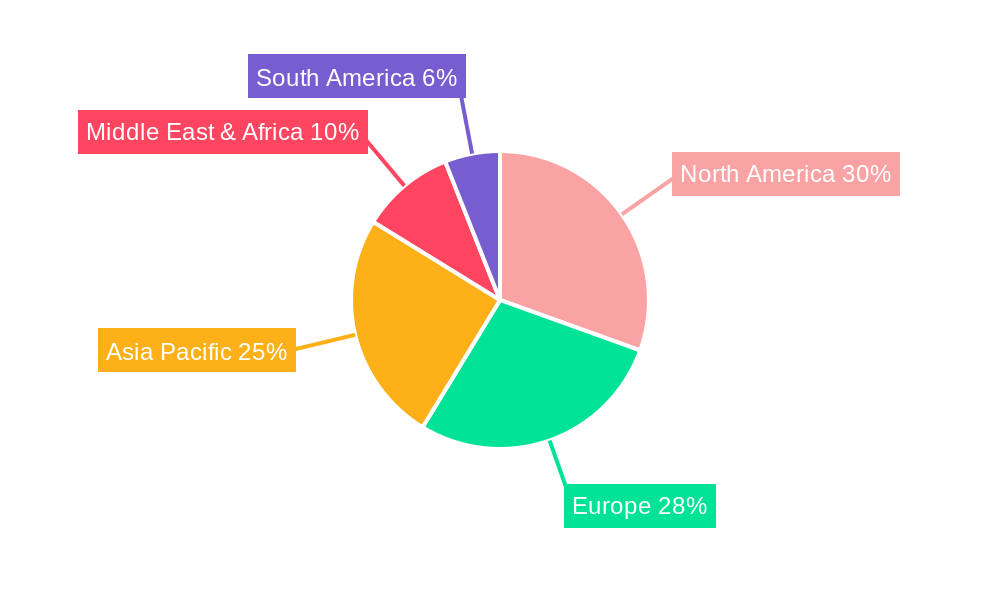

Geographically, North America continues to lead the military helicopter market due to substantial defense spending by the United States, a continuous demand for fleet modernization, and significant ongoing procurement programs. The increasing focus on technological superiority and the development of next-generation rotorcraft by American defense giants fuels this dominance. Asia-Pacific is emerging as a rapidly growing region, propelled by rising defense budgets in countries like China, India, and South Korea, driven by regional security concerns and a desire to enhance their military capabilities. Government policies in these regions are actively supporting domestic defense manufacturing and procurement of advanced military assets, including helicopters. Europe remains a mature yet crucial market, characterized by ongoing modernization efforts, collaborative defense initiatives, and a strong emphasis on interoperability among NATO forces. The demand for advanced platforms capable of supporting joint operations is a key trend. Latin America and the Middle East, while smaller in market size, present burgeoning opportunities, with countries in these regions increasingly investing in upgrading their aging military helicopter fleets to address evolving security challenges.

Military Helicopter Industry Product Analysis

Product innovations in the military helicopter industry are primarily focused on enhancing survivability, operational efficiency, and mission effectiveness. Key advancements include the integration of advanced composite materials for lighter and stronger airframes, sophisticated sensor suites for superior situational awareness, and next-generation avionics for enhanced pilot assistance and autonomous capabilities. Competitive advantages are derived from platforms offering unparalleled multi-role flexibility, robust combat performance, and extended operational ranges. The application of these innovations spans from next-generation attack helicopters to advanced troop transport and heavy-lift solutions, directly addressing the evolving needs of modern armed forces.

Key Drivers, Barriers & Challenges in Military Helicopter Industry

Key Drivers, Barriers & Challenges in Military Helicopter Industry

Key Drivers: The military helicopter industry is propelled by escalating geopolitical tensions, necessitating robust aerial defense capabilities and ongoing fleet modernization programs. Technological advancements in areas like AI, advanced avionics, and next-generation propulsion systems are creating demand for more capable rotorcraft. Government policies supporting defense spending and indigenous manufacturing further stimulate the market.

Barriers & Challenges: The primary restraints include the significant capital investment required for R&D and production, lengthy and complex procurement cycles dictated by government regulations, and stringent export controls. Supply chain vulnerabilities for critical components and specialized materials can lead to production delays. Intense competition among established manufacturers and the emergence of potential disruptive technologies like advanced UAVs also pose challenges.

Growth Drivers in the Military Helicopter Industry Market

The Military Helicopter Industry is experiencing robust growth primarily fueled by escalating geopolitical tensions and the imperative for national defense modernization across various nations. Significant government investments in defense procurement, particularly in North America and the Asia-Pacific regions, are a major catalyst. Technological advancements, such as the integration of artificial intelligence, advanced sensor suites, and the development of next-generation rotorcraft, are driving demand for upgraded and new platforms. Moreover, the growing emphasis on multi-role helicopters offering enhanced versatility and cost-effectiveness for diverse operational needs, including troop transport, attack missions, and humanitarian aid, further stimulates market expansion.

Challenges Impacting Military Helicopter Industry Growth

The Military Helicopter Industry faces several significant challenges that can impact its growth trajectory. Stringent regulatory frameworks and lengthy, complex defense procurement processes can significantly delay program timelines and increase costs. Supply chain complexities and the reliance on specialized components and raw materials can lead to production bottlenecks and price volatility. Intense competition among established global players, vying for lucrative government contracts, intensifies pressure on pricing and innovation. Furthermore, the ongoing development and increasing capabilities of unmanned aerial vehicles (UAVs) present a potential challenge for certain military helicopter roles, requiring manufacturers to continuously innovate and differentiate their manned platforms.

Key Players Shaping the Military Helicopter Industry Market

- Textron Inc.

- Russian Helicopters

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- MD Helicopters LLC

- Leonardo S.p.A.

- Hindustan Aeronautics Limited

Significant Military Helicopter Industry Industry Milestones

- May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 Billion to Germany, significantly boosting the heavy-lift helicopter market.

- March 2023: Boeing secured a contract from the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers, valued at USD 1.95 Million. Delivery to the US military, Australia, and Egypt is planned as part of the Foreign Military Sales (FMS) program, with contract completion anticipated by the end of 2027, underscoring sustained demand for advanced attack rotorcraft.

- December 2022: The US Army awarded a contract to Textron Inc.'s Bell unit for next-generation helicopters under the "Future Vertical Lift" program, aiming to replace over 2,000 medium-class UH-60 Black Hawk utility helicopters, signaling a significant shift towards advanced rotorcraft technology for utility roles.

Future Outlook for Military Helicopter Industry Market

The future outlook for the Military Helicopter Industry remains exceptionally strong, driven by continued global defense spending and the relentless pursuit of technological superiority. Strategic opportunities lie in the development and deployment of autonomous and semi-autonomous rotorcraft, advanced multi-mission platforms, and next-generation attack helicopters with enhanced lethality and survivability. The market potential is further augmented by the growing demand in emerging economies and the ongoing modernization efforts within established defense forces. Innovations in materials science and propulsion systems are expected to yield lighter, more fuel-efficient, and more capable helicopters, ensuring sustained growth and market relevance for key industry players.

Military Helicopter Industry Segmentation

-

1. Body Type

- 1.1. Multi-Mission Helicopter

- 1.2. Transport Helicopter

- 1.3. Others

Military Helicopter Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Helicopter Industry Regional Market Share

Geographic Coverage of Military Helicopter Industry

Military Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Multi-Mission Helicopter

- 5.1.2. Transport Helicopter

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. North America Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Body Type

- 6.1.1. Multi-Mission Helicopter

- 6.1.2. Transport Helicopter

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Body Type

- 7. South America Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Body Type

- 7.1.1. Multi-Mission Helicopter

- 7.1.2. Transport Helicopter

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Body Type

- 8. Europe Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Body Type

- 8.1.1. Multi-Mission Helicopter

- 8.1.2. Transport Helicopter

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Body Type

- 9. Middle East & Africa Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Body Type

- 9.1.1. Multi-Mission Helicopter

- 9.1.2. Transport Helicopter

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Body Type

- 10. Asia Pacific Military Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Body Type

- 10.1.1. Multi-Mission Helicopter

- 10.1.2. Transport Helicopter

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Body Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Russian Helicopters

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MD Helicopters LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leonardo S p A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hindustan Aeronautics Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Military Helicopter Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Military Helicopter Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 3: North America Military Helicopter Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 4: North America Military Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Military Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Military Helicopter Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 7: South America Military Helicopter Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 8: South America Military Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Military Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Military Helicopter Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 11: Europe Military Helicopter Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 12: Europe Military Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Military Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Military Helicopter Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 15: Middle East & Africa Military Helicopter Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 16: Middle East & Africa Military Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Military Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Military Helicopter Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 19: Asia Pacific Military Helicopter Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 20: Asia Pacific Military Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Military Helicopter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: Global Military Helicopter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 4: Global Military Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 9: Global Military Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 14: Global Military Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 25: Global Military Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Military Helicopter Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 33: Global Military Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Military Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Helicopter Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Military Helicopter Industry?

Key companies in the market include Textron Inc, Russian Helicopters, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, MD Helicopters LLC, Leonardo S p A, Hindustan Aeronautics Limited.

3. What are the main segments of the Military Helicopter Industry?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Helicopter Industry?

To stay informed about further developments, trends, and reports in the Military Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence