Key Insights

The global Helicopter Ice Protection Systems (HIPS) market is projected for substantial growth, estimated to reach $9.21 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 15.19% throughout the forecast period (2019-2033). This expansion is driven by increasing helicopter utilization across military operations in challenging weather and the burgeoning civil aviation sector, including transport, emergency services, and tourism. Technological advancements in HIPS, focusing on enhanced efficiency and reduced weight for de-icing and anti-icing systems, are significant market enablers. Ensuring operational safety and reliability in icy conditions, particularly in regions with severe climates, is a key driver for market growth. The integration of advanced sensing and control systems further elevates HIPS effectiveness, making them crucial for modern rotorcraft.

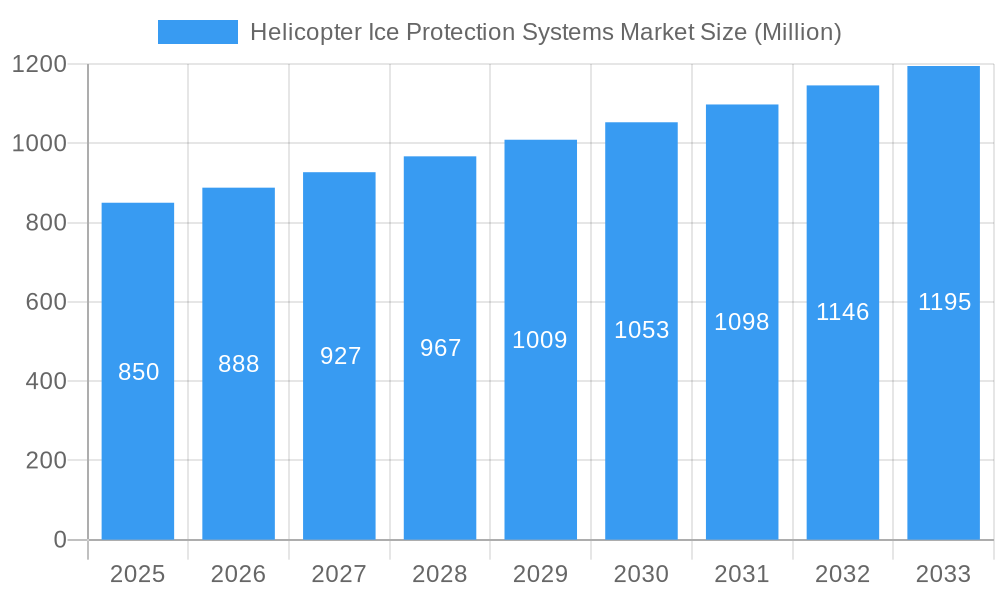

Helicopter Ice Protection Systems Market Market Size (In Billion)

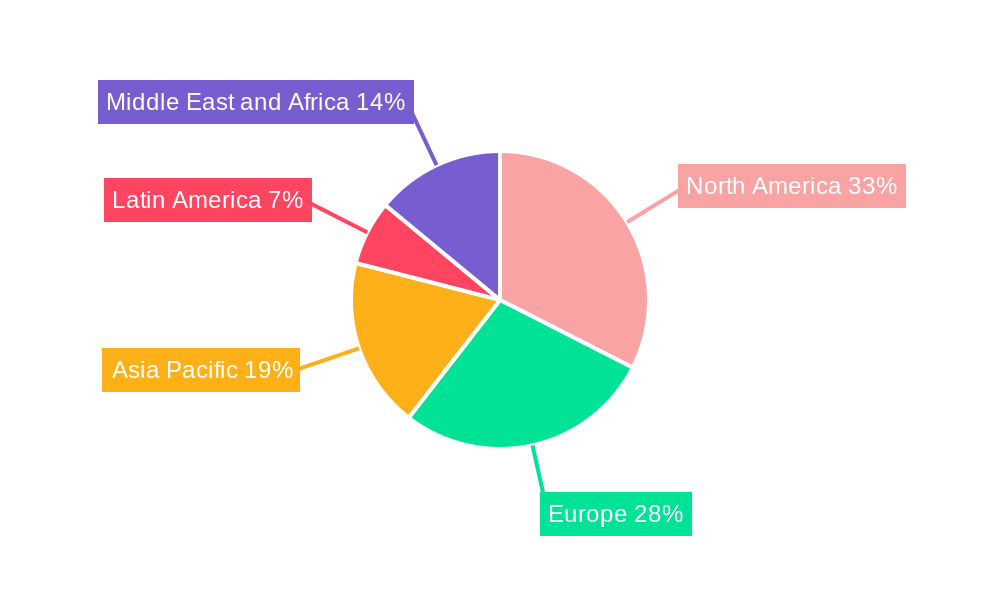

Key market segments include Full Ice-Protection and Limited Ice-Protection, with Full Ice-Protection systems expected to lead due to their comprehensive safety features in severe icing conditions. Both Military Helicopters and Civil Helicopters represent strong end-user segments. Military demand stems from the need for uninterrupted operations in diverse environments, while civil sector growth is fueled by expanding helicopter applications in seasonally icy regions and fleet modernization. North America and Europe are anticipated to dominate the market, supported by advanced aviation industries, stringent safety regulations, and substantial helicopter fleets operating in icing-prone areas. Asia Pacific offers significant growth potential due to its rapidly developing aviation infrastructure and increasing helicopter adoption for commercial and defense purposes. Leading innovators like Honeywell International Inc., Meggitt PLC, and Leonardo S.p.A. are developing next-generation HIPS to meet evolving market needs.

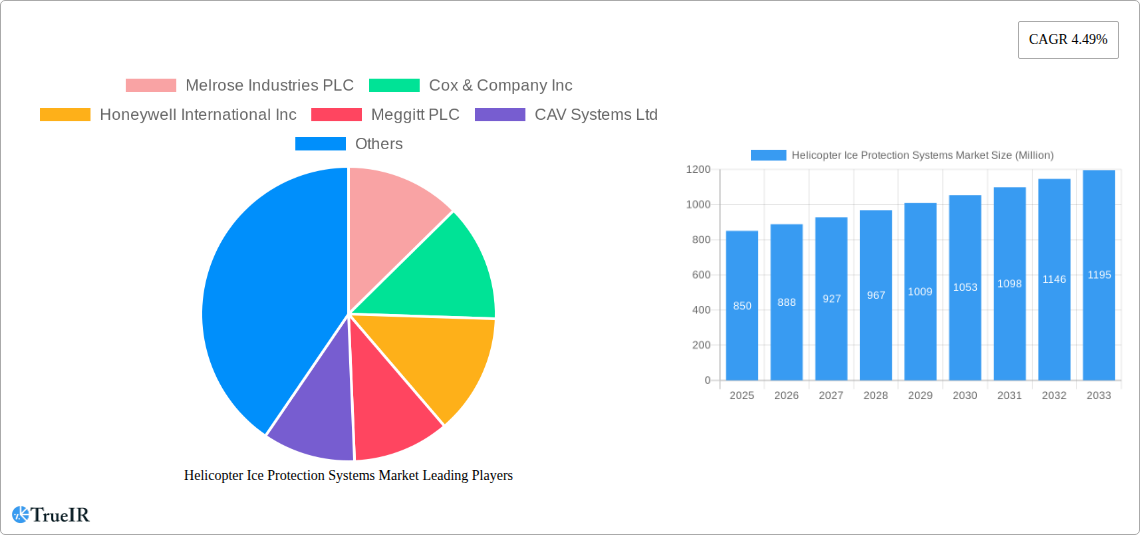

Helicopter Ice Protection Systems Market Company Market Share

This report provides an in-depth analysis of the dynamic Helicopter Ice Protection Systems Market, covering market structure, trends, opportunities, and key players. With a comprehensive study period from 2019 to 2033, including historical data, base year analysis (2025), and a detailed forecast (2025–2033), this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving landscape of helicopter safety and performance.

Helicopter Ice Protection Systems Market Market Structure & Competitive Landscape

The Helicopter Ice Protection Systems Market exhibits a moderately concentrated structure, characterized by the presence of established global players alongside specialized niche providers. Innovation serves as a primary driver, with continuous advancements in material science, sensor technology, and control systems aimed at enhancing system efficiency, weight reduction, and operational reliability. Regulatory impacts are significant, with stringent airworthiness standards and safety mandates from aviation authorities such as the FAA and EASA directly influencing product development and market entry. Product substitutes, while limited in their direct equivalency, can include operational modifications or reliance on advanced weather forecasting.

End-user segmentation is crucial, with military helicopter operators demanding robust and highly reliable systems for extreme operating conditions, while civil helicopter operators prioritize cost-effectiveness, ease of maintenance, and fuel efficiency. Mergers and acquisitions (M&A) trends are observed as key players seek to consolidate market share, acquire innovative technologies, and expand their product portfolios. For instance, the past five years have witnessed an estimated XX number of strategic acquisitions aimed at strengthening competitive positions, with a combined deal value of approximately $XX Million. Concentration ratios, such as the HHI index, are estimated to be around XX, indicating a moderate level of competition.

Helicopter Ice Protection Systems Market Market Trends & Opportunities

The global Helicopter Ice Protection Systems Market is poised for significant expansion, driven by an increasing demand for enhanced aviation safety and operational reliability across both military and civil aviation sectors. The market size is projected to grow from an estimated $XX Million in the base year 2025 to $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This robust growth trajectory is underpinned by several interconnected trends.

Technological advancements are at the forefront, with a notable shift towards electro-thermal de-icing systems, which offer superior performance and energy efficiency compared to traditional pneumatic boots. Advancements in ice detection sensors, real-time data analysis, and adaptive control algorithms are enabling systems to proactively manage ice accumulation, minimizing performance degradation and enhancing pilot situational awareness. The increasing integration of artificial intelligence (AI) and machine learning (ML) in ice prediction and system response optimization further signifies a key technological evolution.

Consumer preferences are evolving, with a heightened focus on reduced maintenance requirements, lower operational costs, and improved fuel efficiency. Operators are actively seeking ice protection solutions that minimize downtime and contribute to overall mission effectiveness. The growing adoption of helicopters in diverse applications, including emergency medical services (EMS), search and rescue (SAR), offshore transportation, and law enforcement, is expanding the addressable market for these systems. Furthermore, the ongoing modernization of military helicopter fleets globally, coupled with the expansion of commercial aviation in developing economies, presents substantial market penetration opportunities. The competitive dynamics are intensifying, with key players investing heavily in R&D to maintain a technological edge and secure market share through product differentiation and strategic partnerships. The development of lighter, more durable, and energy-efficient ice protection solutions will be critical for capturing market opportunities in the coming years.

Dominant Markets & Segments in Helicopter Ice Protection Systems Market

The Military Helicopters segment is a dominant force within the Helicopter Ice Protection Systems Market, driven by the critical need for uninterrupted operational capability in adverse weather conditions. The strategic imperative for national defense ensures consistent investment in advanced aviation technologies, including sophisticated ice protection systems. Countries with extensive air forces and active deployment in diverse climatic regions, such as the United States, China, Russia, and European NATO member states, represent the leading markets.

Full Ice-Protection systems, designed to provide comprehensive protection against ice accumulation on rotor blades, airframes, and critical flight surfaces, are particularly favored in the military domain. This segment's dominance is fueled by the higher risk tolerance and stringent performance requirements associated with combat and reconnaissance missions. The robust infrastructure of military aviation, including dedicated research and development budgets and established procurement processes, further solidifies this segment's leadership.

In the civil aviation sphere, Civil Helicopters are witnessing a steady rise in demand for ice protection systems, particularly in regions experiencing seasonal icing conditions. The expansion of helicopter usage in commercial operations, such as emergency medical services (EMS), offshore oil and gas support, and executive transport, necessitates enhanced safety features. Key growth drivers in this segment include:

- Infrastructure Development: Investments in helipads, air traffic control, and supporting infrastructure for civil aviation operations, especially in remote and challenging terrains.

- Regulatory Mandates: Evolving safety regulations and certifications by aviation authorities that increasingly mandate or strongly recommend ice protection for certain operational categories.

- Technological Accessibility: The development of more cost-effective and user-friendly ice protection solutions is making them more accessible to a wider range of civil helicopter operators.

- Increasing Helicopter Deployments: The growing utilization of helicopters in applications like tourism, firefighting, and logistics in regions with variable weather patterns.

The Full Ice-Protection segment within civil aviation is also gaining traction, driven by the increasing sophistication of civil rotorcraft and the desire to expand operational envelopes. However, Limited Ice-Protection systems, which focus on critical areas like rotor blades and leading edges, continue to hold a significant market share due to their lower cost and complexity, making them a more accessible option for many civil operators. The interplay between these segments and end-users will continue to shape the market's geographical and sectoral distribution.

Helicopter Ice Protection Systems Market Product Analysis

The Helicopter Ice Protection Systems Market is characterized by innovative product development focused on enhancing performance, efficiency, and reliability. Leading players are introducing advanced electro-thermal de-icing systems that utilize heating elements embedded within rotor blades and airframes to prevent ice formation or melt accumulated ice rapidly. These systems offer superior ice shedding capabilities and reduced power consumption compared to older technologies. Furthermore, the integration of intelligent ice detection sensors and sophisticated control algorithms allows for proactive and adaptive operation, optimizing de-icing cycles based on real-time environmental conditions. Competitive advantages are being carved out through products that are lighter, more durable, and require less maintenance, catering to the increasing demand for cost-effective and operational efficiency.

Key Drivers, Barriers & Challenges in Helicopter Ice Protection Systems Market

The Helicopter Ice Protection Systems Market is propelled by several key drivers. Technologically, advancements in materials science and embedded heating elements are enabling more efficient and lightweight systems. Economically, the increasing demand for enhanced flight safety and operational reliability, particularly in regions with challenging weather conditions, fuels market growth. Policy-driven factors, such as stringent aviation safety regulations and the continuous modernization of military and civil helicopter fleets, also play a crucial role.

However, the market faces significant challenges. Supply chain issues, including the availability of specialized components and raw materials, can lead to production delays and increased costs. Regulatory hurdles, such as lengthy certification processes for new technologies, can impede market entry. Competitive pressures from established players and the constant need for R&D investment to stay ahead of technological advancements also present significant restraints. The high initial cost of advanced ice protection systems can also be a barrier for smaller operators.

Growth Drivers in the Helicopter Ice Protection Systems Market Market

Key growth drivers in the Helicopter Ice Protection Systems Market are predominantly technological, economic, and regulatory in nature. Technologically, continuous innovation in electro-thermal heating elements, advanced composite materials for rotor blades, and intelligent ice detection sensors are leading to more efficient, lighter, and more reliable systems. Economically, the increasing demand for enhanced flight safety and expanded operational capabilities in diverse climatic conditions across both military and civil aviation sectors is a primary catalyst. Regulatory bodies like the FAA and EASA are consistently upgrading safety standards, often mandating or strongly recommending robust ice protection measures for specific operational envelopes, thus compelling manufacturers and operators to adopt advanced solutions. The growing utilization of helicopters in critical applications like emergency medical services and offshore transportation further propels market growth by emphasizing the need for dependable performance in all weather.

Challenges Impacting Helicopter Ice Protection Systems Market Growth

Several challenges impact the growth of the Helicopter Ice Protection Systems Market. Regulatory complexities and the time-consuming nature of certification processes for new and advanced ice protection technologies can significantly delay market introduction and adoption. Supply chain vulnerabilities, including the sourcing of specialized materials and components, can lead to production bottlenecks and increased lead times, impacting the timely delivery of systems. Competitive pressures are intense, compelling companies to invest heavily in research and development to maintain technological parity and market share, which can strain resources. The high initial capital expenditure associated with advanced ice protection systems can also act as a barrier for smaller operators or those with budget constraints, limiting widespread adoption, especially in cost-sensitive civil aviation segments.

Key Players Shaping the Helicopter Ice Protection Systems Market Market

- Melrose Industries PLC

- Cox & Company Inc

- Honeywell International Inc

- Meggitt PLC

- CAV Systems Ltd

- ITT Inc

- Leonardo S p A

- Curtiss-Wright Corporation

Significant Helicopter Ice Protection Systems Market Industry Milestones

- 2019: Launch of next-generation electro-thermal de-icing system by [Company Name] for commercial helicopters.

- 2020: Honeywell International Inc. secures major contract for advanced ice protection systems for new military helicopter program.

- 2021: CAV Systems Ltd. introduces a novel lightweight ice detection sensor technology.

- 2022: Meggitt PLC announces acquisition of a specialized ice protection component manufacturer to expand its offerings.

- 2023: Leonardo S.p.A. showcases enhanced rotor blade de-icing capabilities on its latest helicopter model.

- 2024: Curtiss-Wright Corporation enters strategic partnership to develop advanced ice protection control systems.

Future Outlook for Helicopter Ice Protection Systems Market Market

The future outlook for the Helicopter Ice Protection Systems Market is exceptionally positive, driven by continued technological innovation and an unwavering commitment to aviation safety. We anticipate a sustained surge in demand, particularly for integrated and intelligent ice protection solutions that offer predictive capabilities and adaptive performance. The increasing adoption of advanced materials and additive manufacturing techniques will likely lead to lighter, more efficient, and cost-effective systems, further expanding market penetration, especially within the civil helicopter sector. Strategic collaborations and potential further consolidation among key players will shape a competitive yet dynamic market, ensuring continuous advancement in safeguarding rotorcraft operations across diverse climatic conditions and mission profiles.

Helicopter Ice Protection Systems Market Segmentation

-

1. Type

- 1.1. Full Ice-Protection

- 1.2. Limited Ice-Protection

-

2. End-user

- 2.1. Military Helicopters

- 2.2. Civil Helicopters

Helicopter Ice Protection Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Helicopter Ice Protection Systems Market Regional Market Share

Geographic Coverage of Helicopter Ice Protection Systems Market

Helicopter Ice Protection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High-Performance Commercial Helicopters

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Full Ice-Protection

- 5.1.2. Limited Ice-Protection

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Military Helicopters

- 5.2.2. Civil Helicopters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Full Ice-Protection

- 6.1.2. Limited Ice-Protection

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Military Helicopters

- 6.2.2. Civil Helicopters

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Full Ice-Protection

- 7.1.2. Limited Ice-Protection

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Military Helicopters

- 7.2.2. Civil Helicopters

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Full Ice-Protection

- 8.1.2. Limited Ice-Protection

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Military Helicopters

- 8.2.2. Civil Helicopters

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Full Ice-Protection

- 9.1.2. Limited Ice-Protection

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Military Helicopters

- 9.2.2. Civil Helicopters

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Helicopter Ice Protection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Full Ice-Protection

- 10.1.2. Limited Ice-Protection

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Military Helicopters

- 10.2.2. Civil Helicopters

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Melrose Industries PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cox & Company Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meggitt PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CAV Systems Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ITT Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leonardo S p A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Curtiss-Wright Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Melrose Industries PLC

List of Figures

- Figure 1: Global Helicopter Ice Protection Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Helicopter Ice Protection Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Helicopter Ice Protection Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Helicopter Ice Protection Systems Market Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Helicopter Ice Protection Systems Market Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Helicopter Ice Protection Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Helicopter Ice Protection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Helicopter Ice Protection Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Helicopter Ice Protection Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Helicopter Ice Protection Systems Market Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Helicopter Ice Protection Systems Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Helicopter Ice Protection Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Helicopter Ice Protection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Helicopter Ice Protection Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Helicopter Ice Protection Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Helicopter Ice Protection Systems Market Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Helicopter Ice Protection Systems Market Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Helicopter Ice Protection Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Helicopter Ice Protection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Helicopter Ice Protection Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Helicopter Ice Protection Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Helicopter Ice Protection Systems Market Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Helicopter Ice Protection Systems Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Helicopter Ice Protection Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Helicopter Ice Protection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Helicopter Ice Protection Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Helicopter Ice Protection Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Helicopter Ice Protection Systems Market Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Helicopter Ice Protection Systems Market Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Helicopter Ice Protection Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Helicopter Ice Protection Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 11: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 20: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 29: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Mexico Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 35: Global Helicopter Ice Protection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Egypt Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Helicopter Ice Protection Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Helicopter Ice Protection Systems Market?

The projected CAGR is approximately 15.19%.

2. Which companies are prominent players in the Helicopter Ice Protection Systems Market?

Key companies in the market include Melrose Industries PLC, Cox & Company Inc, Honeywell International Inc, Meggitt PLC, CAV Systems Ltd, ITT Inc, Leonardo S p A, Curtiss-Wright Corporation.

3. What are the main segments of the Helicopter Ice Protection Systems Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.21 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Increasing Demand for High-Performance Commercial Helicopters.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Helicopter Ice Protection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Helicopter Ice Protection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Helicopter Ice Protection Systems Market?

To stay informed about further developments, trends, and reports in the Helicopter Ice Protection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence