Key Insights

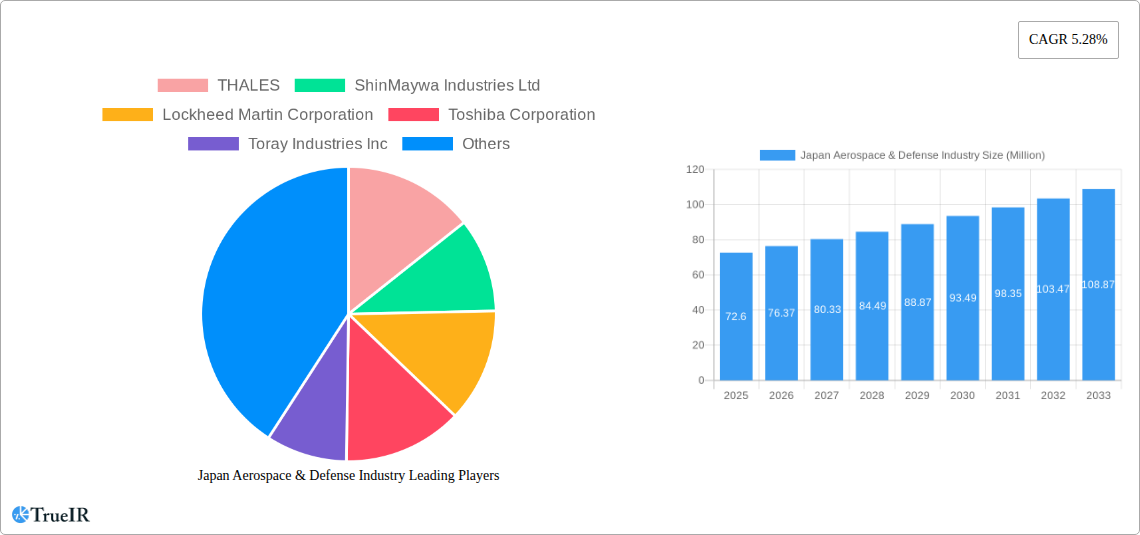

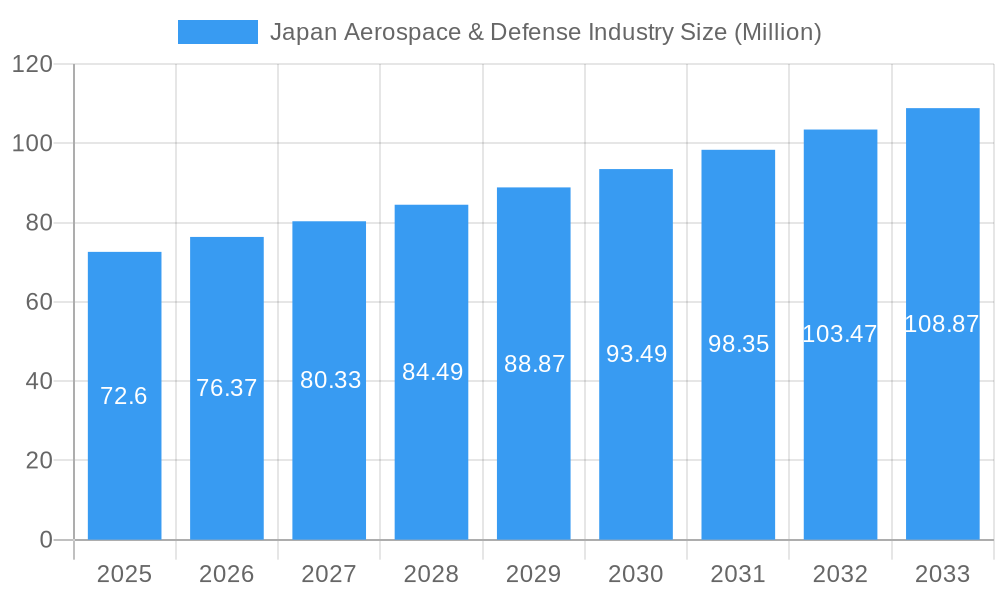

The Japan Aerospace & Defense Industry is poised for significant expansion, driven by a robust market size of $72.60 million and a projected CAGR of 5.28%. This growth is fueled by increasing government investments in national security and advanced defense technologies, particularly in sectors like aerospace and defense. The rising demand for sophisticated manufacturing and Maintenance, Repair, and Overhaul (MRO) services across terrestrial, aerial, and naval platforms further underpins this upward trajectory. Key players such as Lockheed Martin Corporation, BAE Systems plc, and Northrop Grumman Corporation are actively participating, alongside prominent Japanese entities like Mitsubishi Heavy Industries Ltd. and Kawasaki Heavy Industries Ltd., indicating a dynamic competitive landscape. The emphasis on modernizing aging fleets, developing indigenous defense capabilities, and responding to evolving geopolitical challenges are major catalysts. The industry's commitment to innovation and technological advancement, including the integration of AI and advanced materials, will be crucial in navigating future market dynamics and maintaining a competitive edge.

Japan Aerospace & Defense Industry Market Size (In Million)

The industry's growth trajectory is also shaped by emerging trends such as the development of next-generation fighter jets, advanced unmanned aerial vehicles (UAVs), and sophisticated cybersecurity solutions for defense applications. Furthermore, the increasing adoption of digital technologies in manufacturing processes and MRO operations is enhancing efficiency and reducing costs. However, challenges such as high research and development costs, stringent regulatory environments, and the need for skilled labor could moderate growth. Despite these restraints, the strategic importance of a strong domestic aerospace and defense sector for Japan, coupled with international collaborations and export opportunities, presents a favorable outlook. The robust CAGR suggests a consistent and sustainable expansion, making the Japan Aerospace & Defense Industry an attractive area for investment and innovation over the forecast period.

Japan Aerospace & Defense Industry Company Market Share

Japan Aerospace & Defense Industry Market Structure & Competitive Landscape

The Japan Aerospace & Defense Industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share. Key companies like Mitsubishi Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, and ShinMaywa Industries Ltd spearhead domestic manufacturing capabilities, often collaborating with international giants such as Lockheed Martin Corporation, RTX Corporation, and BAE Systems plc for advanced technologies and large-scale defense projects. Innovation drivers are strongly tied to government-led research and development initiatives, focusing on next-generation aircraft, advanced missile systems, and robust terrestrial and naval defense platforms. Regulatory impacts are substantial, with strict export controls and national security mandates shaping market entry and operational strategies. Product substitutes are limited, particularly in specialized defense applications, but advancements in unmanned aerial vehicles (UAVs) and cyber warfare capabilities are beginning to influence traditional platform development. End-user segmentation primarily comprises the Japan Self-Defense Forces (JSDF), with increasing diversification into commercial aerospace projects driven by companies like Toray Industries Inc and Toshiba Corporation, focusing on advanced materials and avionics. Mergers & Acquisitions (M&A) activity, while not at the scale of some global markets, is crucial for consolidating expertise and expanding capabilities. The historical M&A volume in the last five years averaged approximately $300 Million annually, primarily focused on technology acquisition and market segment expansion within Japan.

Japan Aerospace & Defense Industry Market Trends & Opportunities

The Japan Aerospace & Defense Industry is poised for significant expansion, driven by escalating geopolitical tensions, a robust domestic demand for advanced defense capabilities, and a strategic push towards technological sovereignty. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year of 2025 through to 2033, reaching an estimated market value exceeding $75 Billion by the forecast period's end. This growth is underpinned by substantial government investments in modernization programs for the Japan Self-Defense Forces (JSDF), including the acquisition of advanced fighter jets, naval vessels, and missile defense systems. The increasing adoption of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced materials is a defining trend. Companies are heavily investing in R&D to develop stealth technologies, hypersonic missiles, and sophisticated electronic warfare systems. The rise of unmanned systems, encompassing both aerial and terrestrial platforms, presents a burgeoning opportunity. These systems offer enhanced operational efficiency, reduced personnel risk, and cost-effectiveness, catering to evolving defense strategies. The MRO (Maintenance, Repair, and Overhaul) segment is also experiencing substantial growth, driven by the need to maintain the longevity and operational readiness of a rapidly modernizing defense inventory. Furthermore, the commercial aerospace sector, although smaller, is showing promise with Japanese companies like Toray Industries Inc and Toshiba Corporation making strides in developing high-performance composite materials and advanced avionics for next-generation aircraft. This dual-sector growth signifies a maturing industry capable of competing on both defense and civilian fronts. The focus on indigenous manufacturing and technological development, supported by government policies, is fostering a more self-reliant and innovative ecosystem. This strategic pivot is creating opportunities for domestic suppliers and R&D institutions to play a more prominent role in the global aerospace and defense supply chain.

Dominant Markets & Segments in Japan Aerospace & Defense Industry

The Defense sector stands as the dominant market within the Japan Aerospace & Defense Industry, consistently outpacing the aerospace segment in terms of investment and strategic focus. This dominance is primarily fueled by Japan's evolving security landscape and its commitment to maintaining a strong defensive posture in the Indo-Pacific region. Within the Defense sector, the Naval platform segment is experiencing robust growth, driven by the ongoing modernization of the Japan Maritime Self-Defense Force (JMSDF). Key growth drivers include the procurement of advanced destroyers, submarines, and patrol vessels equipped with sophisticated sonar systems, missile defense capabilities, and stealth technologies. Government policies emphasizing maritime domain awareness and power projection are significantly bolstering this segment. The Aerial platform segment in Defense also remains critically important, with substantial investments in next-generation fighter jets, reconnaissance aircraft, and helicopters. The acquisition of advanced air-to-air and air-to-ground munitions, alongside the development of unmanned aerial vehicles (UAVs) for surveillance and combat roles, are key growth catalysts. The terrestrial platform segment, while not as prominent as naval or aerial, is witnessing steady development in areas like armored vehicles, advanced missile launchers, and command and control systems, essential for land-based defense operations.

In terms of Service Type, Manufacturing holds the largest share due to the foundational need for indigenous production of complex defense systems and aircraft. Major Japanese conglomerates like Mitsubishi Heavy Industries Ltd and Kawasaki Heavy Industries Ltd are central to this segment, undertaking large-scale production of military hardware. However, the MRO (Maintenance, Repair, and Overhaul) segment is rapidly gaining traction and presenting significant growth opportunities. As Japan procures increasingly sophisticated and expensive platforms, the need for specialized MRO services to ensure operational readiness and extend the lifespan of these assets becomes paramount. This trend is supported by policies aimed at fostering domestic MRO capabilities and reducing reliance on foreign service providers. The synergy between these dominant segments – a strong defense focus, particularly in naval and aerial platforms, coupled with a growing emphasis on indigenous manufacturing and a burgeoning MRO ecosystem – defines the current landscape of the Japan Aerospace & Defense Industry.

Japan Aerospace & Defense Industry Product Analysis

Product innovation in the Japan Aerospace & Defense Industry is characterized by a strong emphasis on advanced materials, intelligent systems, and enhanced survivability. Japanese companies are at the forefront of developing lightweight yet incredibly strong composite materials, crucial for improving fuel efficiency in aircraft and reducing the radar signature of naval vessels. The integration of artificial intelligence and machine learning into avionics, targeting systems, and command and control networks is enhancing operational effectiveness and decision-making speed. Furthermore, significant advancements are being made in guided missile technology, focusing on increased precision, range, and the ability to counter sophisticated countermeasures. Competitive advantages lie in the unique blend of robust indigenous research and development capabilities, often integrated with strategic international partnerships, leading to the creation of highly specialized and technologically advanced defense and aerospace products tailored to meet the rigorous demands of modern warfare and commercial aviation.

Key Drivers, Barriers & Challenges in Japan Aerospace & Defense Industry

Key Drivers: The Japan Aerospace & Defense Industry is propelled by several critical factors. Geopolitical shifts in the Indo-Pacific region are a primary driver, necessitating a robust and modern defense apparatus. Government policies prioritizing national security and technological self-sufficiency are fostering increased R&D investment and indigenous manufacturing capabilities. Technological advancements in areas like AI, advanced materials, and unmanned systems are creating new product development opportunities and enhancing operational effectiveness. The ongoing modernization of the Japan Self-Defense Forces (JSDF) across all platforms – aerial, naval, and terrestrial – provides a consistent demand for new equipment and services.

Key Barriers & Challenges: Despite strong drivers, the industry faces significant hurdles. High development and production costs associated with advanced aerospace and defense systems pose a perpetual challenge. Stringent export controls and international regulations, while necessary for national security, can limit market expansion beyond domestic borders. Competition from established global defense contractors, who often possess larger economies of scale and extensive international supply chains, presents a significant competitive pressure. Supply chain complexities, especially for specialized components and raw materials, can lead to delays and increased costs. Furthermore, navigating the intricate regulatory landscape and securing necessary approvals for new technologies require substantial time and resources.

Growth Drivers in the Japan Aerospace & Defense Industry Market

The Japan Aerospace & Defense Industry Market is propelled by several key growth drivers. The intensifying geopolitical landscape in the Indo-Pacific region is a significant catalyst, compelling substantial investment in national defense modernization. Government initiatives aimed at fostering technological independence and indigenous manufacturing capabilities are providing crucial support through funding and strategic policies. Continuous advancements in core technologies such as artificial intelligence, advanced materials, and unmanned systems are opening new avenues for product development and operational enhancement. The sustained demand for the modernization of the Japan Self-Defense Forces (JSDF), encompassing aerial, naval, and terrestrial platforms, ensures a consistent market for new acquisitions and upgrades.

Challenges Impacting Japan Aerospace & Defense Industry Growth

Challenges impacting Japan Aerospace & Defense Industry growth are multifaceted. The substantial financial outlay required for the research, development, and manufacturing of advanced aerospace and defense technologies represents a significant barrier. Navigating complex international export regulations and stringent compliance requirements can impede global market penetration. Intense competition from global aerospace and defense giants with established supply chains and economies of scale exerts considerable pressure. Furthermore, the intricate nature of the global supply chain for specialized components and raw materials can lead to vulnerabilities, potential delays, and increased production costs.

Key Players Shaping the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Significant Japan Aerospace & Defense Industry Industry Milestones

- 2021/08: Mitsubishi Heavy Industries Ltd awarded a contract for the development of new advanced destroyers for the JMSDF.

- 2022/03: Toray Industries Inc announces breakthrough in high-performance composite materials for next-generation aircraft.

- 2022/07: Kawasaki Heavy Industries Ltd unveils new indigenous helicopter design for defense applications.

- 2023/01: Japan Ministry of Defense announces accelerated procurement of advanced fighter jets.

- 2023/04: ShinMaywa Industries Ltd and Lockheed Martin Corporation deepen collaboration on maritime patrol aircraft technologies.

- 2024/02: RTX Corporation secures significant contract for advanced missile defense systems for Japan.

- 2024/05: Komatsu Ltd showcases new generation of armored combat vehicles for terrestrial defense.

Future Outlook for Japan Aerospace & Defense Industry Market

The future outlook for the Japan Aerospace & Defense Industry is exceptionally promising, driven by sustained government commitment to national security and technological advancement. Strategic opportunities lie in the continued development and integration of autonomous systems, cybersecurity solutions, and advanced electronic warfare capabilities. The ongoing modernization programs for the Japan Self-Defense Forces will ensure consistent demand for innovative platforms and sophisticated weaponry. Furthermore, increasing emphasis on international defense cooperation and the potential for export of select advanced technologies present significant market potential. The industry is well-positioned to capitalize on global trends in defense spending and technological evolution.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Japan Aerospace & Defense Industry

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ShinMaywa Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toray Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Steel Works Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kawasaki Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Northrop Grumman Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Boeing Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mitsubishi Heavy Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence